E-Invoicing Error Helper

Complex E-Invoicing Errors Turn Into Human-Readable Messages

No more cryptic codes or government error dumps. Complyance translates technical and country-specific errors into plain language for finance teams and detailed, developer-ready messages with exact fix instructions—so issues get resolved fast

Powering the world's leading brands.

From next-gen startups to established enterprises.

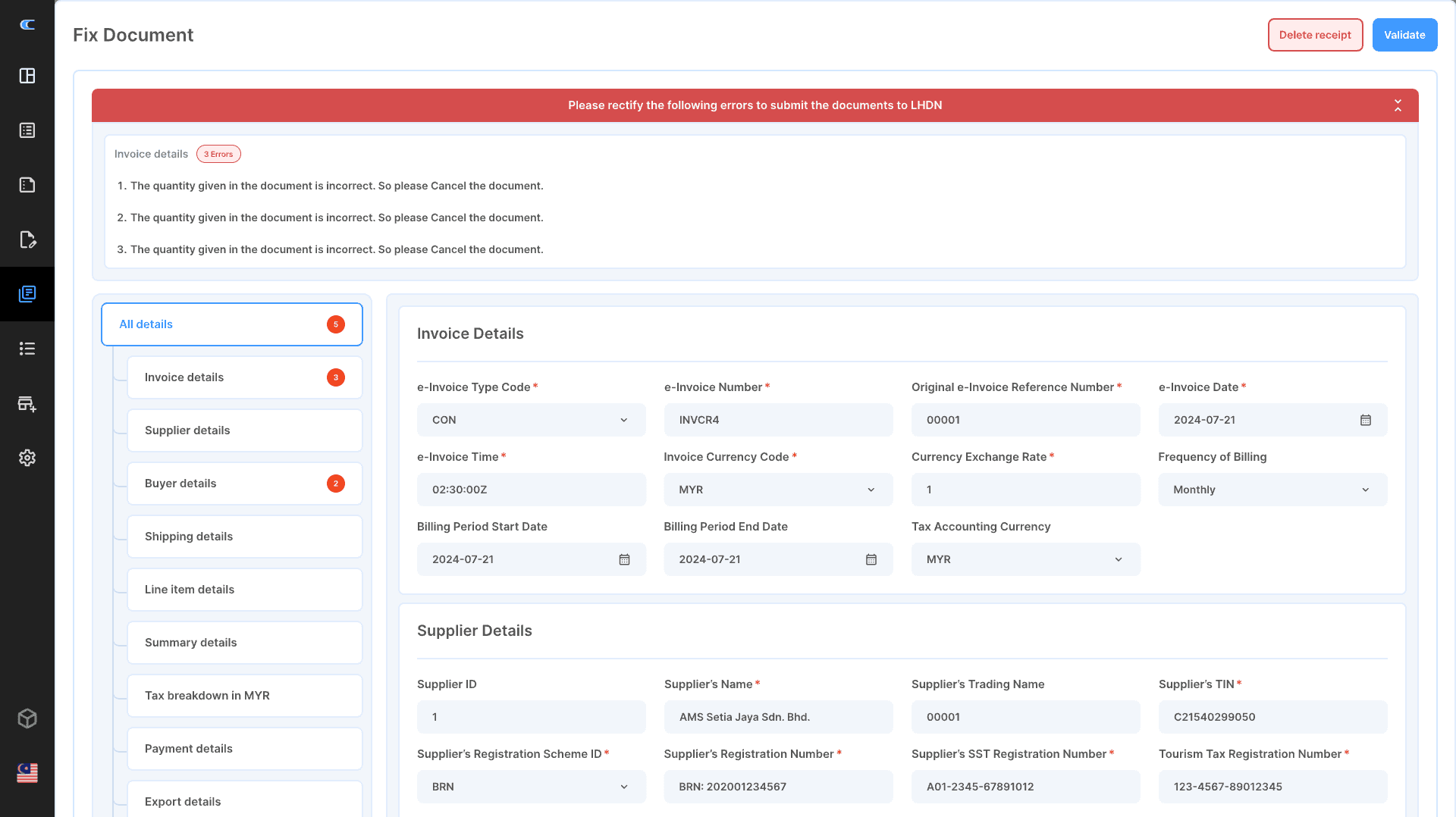

Human-Readable Error Explanations

We convert cryptic tax authority error codes into simple messages that anyone on your team can understand—no technical background needed.

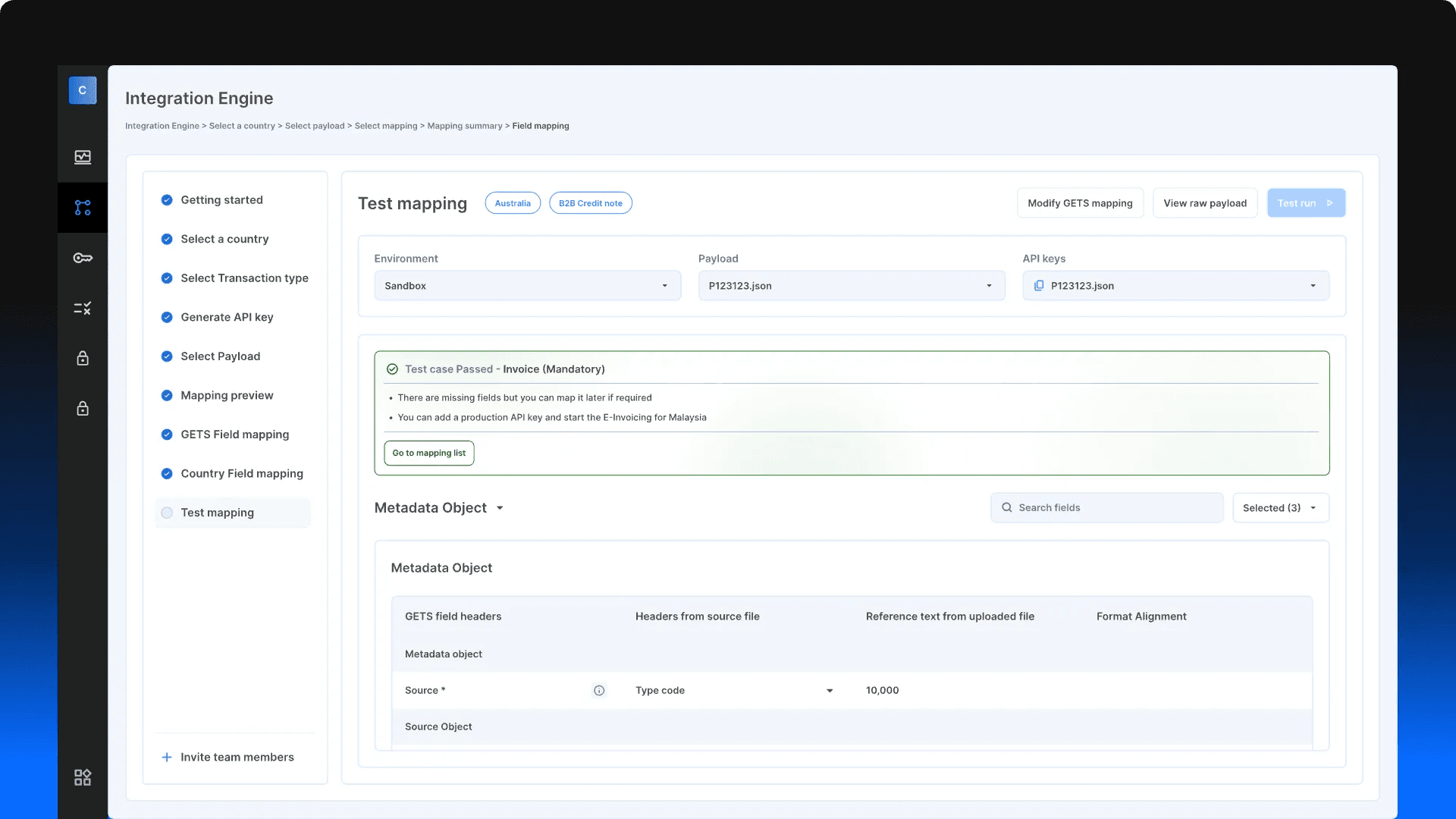

Sandbox Error Simulation

Test how your integration handles different error types by simulating real-world rejection scenarios in our sandbox environment.

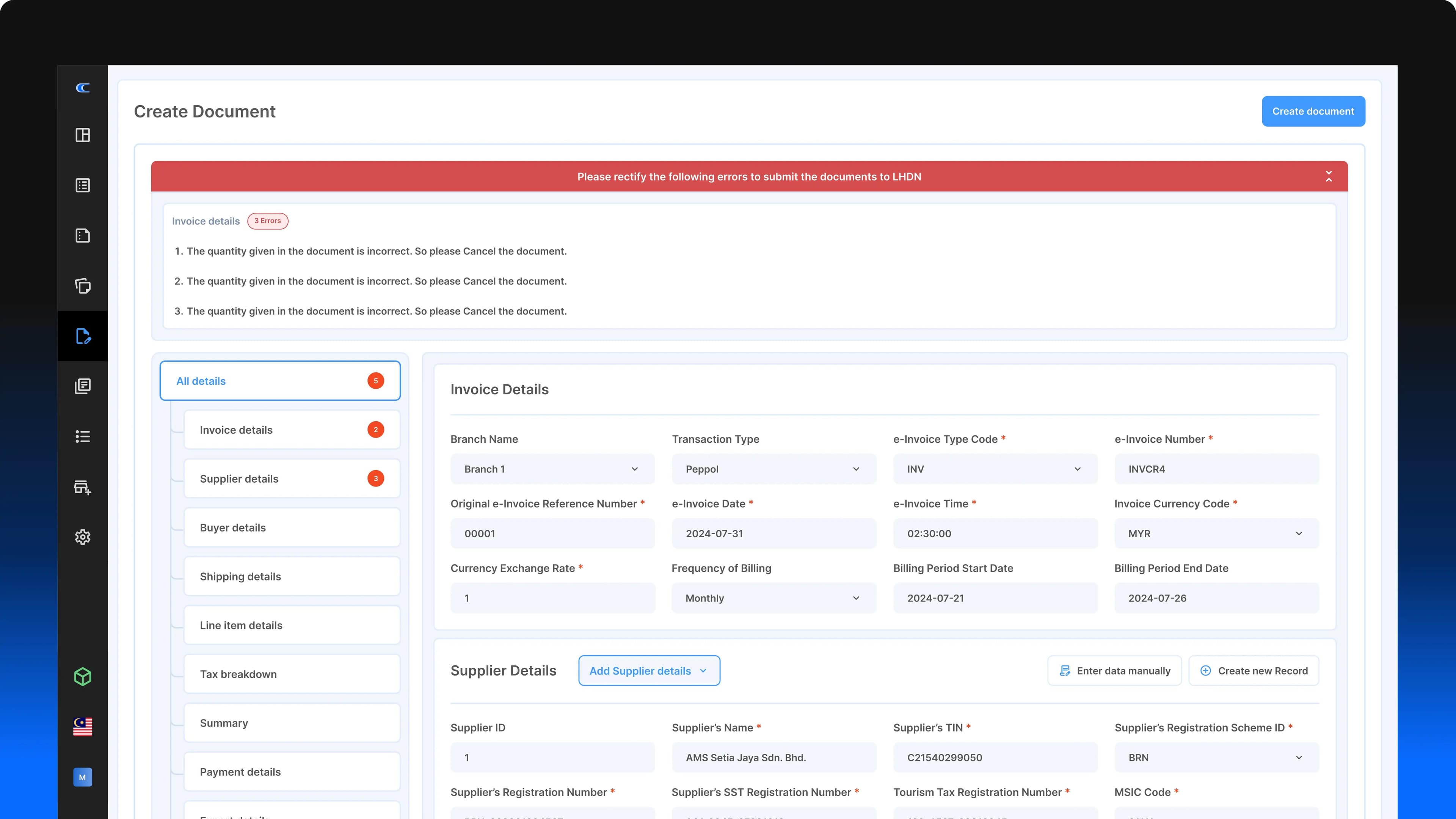

Developer-Friendly Fix Suggestions

Each error comes with actionable, field-level guidance tailored for your JSON payload. Know exactly what went wrong and how to fix it—fast.

Complyance Error Guidance Changes Everything

Complyance helps you move faster and avoid costly mistakes by turning complex e-invoicing errors into simple, actionable guidance—for both developers and finance teams. No confusion. No guesswork. Just fast resolution.

Fix Issues Faster with Clarity

Get clear explanations and field-level tips that help your team resolve errors without relying on engineering or compliance experts.

Reduce Failed Submissions and Delays

Proactively catch and correct errors before they block invoice approvals, saving valuable time and avoiding penalties.

In House Tax Expertise

Our team of tax experts ensures your invoices are always compliant, so you can focus on growth without worrying about penalties.

See how businesses like yours have

simplified global e‑invoicing

View All Customer Success StoriesHow SpeedCast Standardized E‑Invoicing for 15+ Entities Using One API Integration

Read SpeedCast Case Study500M+

E‑Invoices Generated Annually

100+

countries supported worldwide

95%

Reduction in implementation time

Problem

SpeedCast needed a compliant e-invoicing system for over 15+ global entities — all with different formats, languages, and regulatory requirements. Their finance team also struggled with multi-page invoices, currency fluctuations, and integration gaps with Dynamics and ServiceNow.

Solution

Complyance provided a clean, accountant-friendly UI and a well-documented API that worked across SpeedCast's diverse landscape. With support for future Dynamics integration, AI-driven invoice processing, and consolidated USD-based invoicing, the platform became a global backbone for compliance.

Product

Complyance API Platform (GETS + Partner Console)

Scale with enterprise–grade security

Security

Ensure your company's data is completely secure and that you are in compliance with the latest standards.

Say Goodbye to Confusing E-Invoicing Errors

Fix issues faster with human-readable messages and developer-ready suggestions—no more decoding tax portal responses.