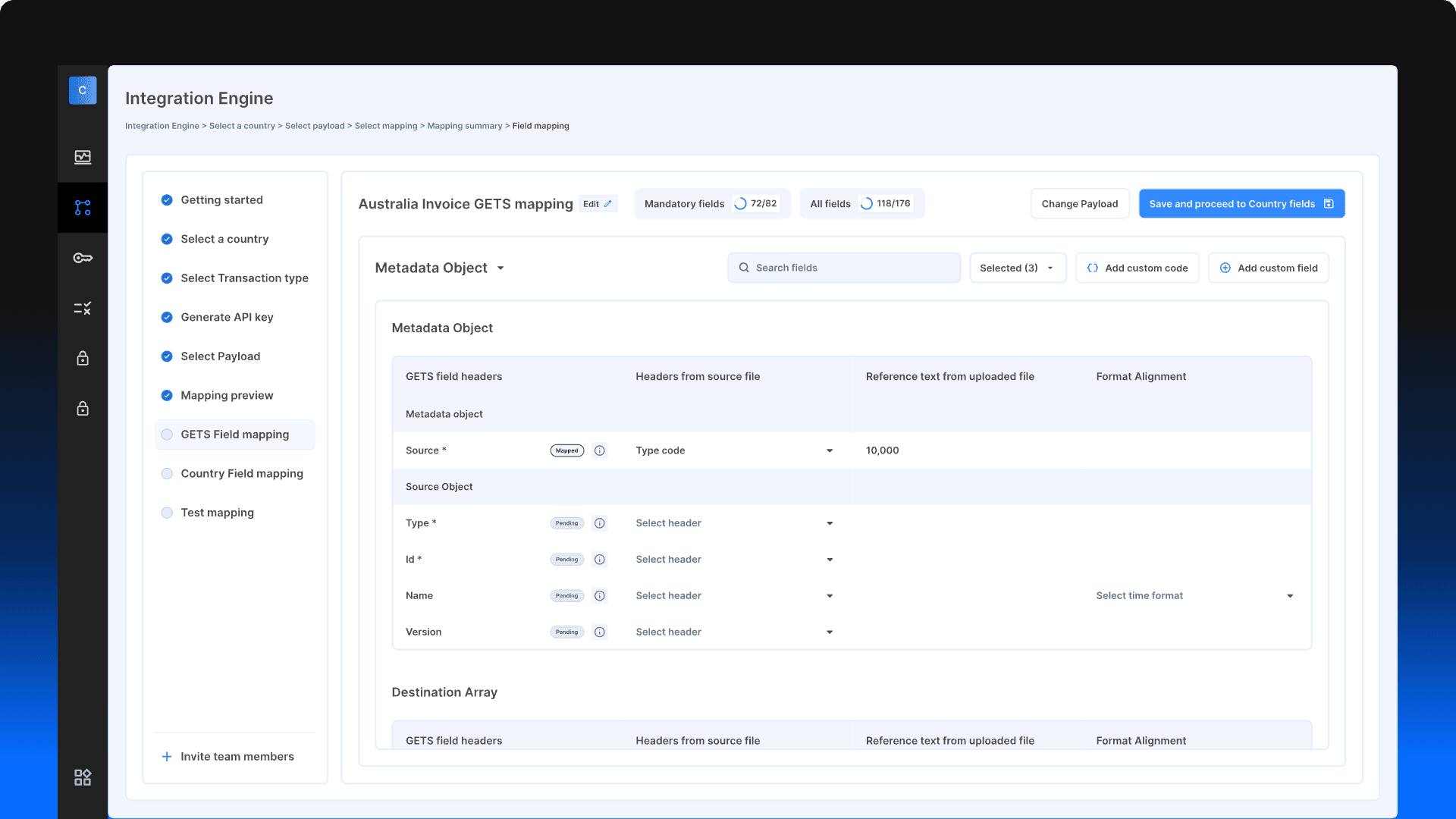

Field Mapping

Map Fields Once. Go Live Everywhere.

Complyance lets you define how your invoice data maps to country-specific schemas using our GETS format. Handle variations across 100+ tax authorities with a visual, developer-friendly tool with no hardcoding required.

Auto-Field Mapping Made for developer to reduce the effort

Integrate once and comply across 100+ countries without dealing with formats, schemas, or local tax rules.

Map Once. Adapt Everywhere.

Your invoice data maps to country-specific schemas using our GETS format. A single visual interface handles local variations without hardcoding or format rewrites.

Built-In Transformations and Defaults

Complyance handles all local transformations, validations, and government routing. This means you can focus on building your business logic, not worrying about the nitty-gritty of e-invoicing compliance.

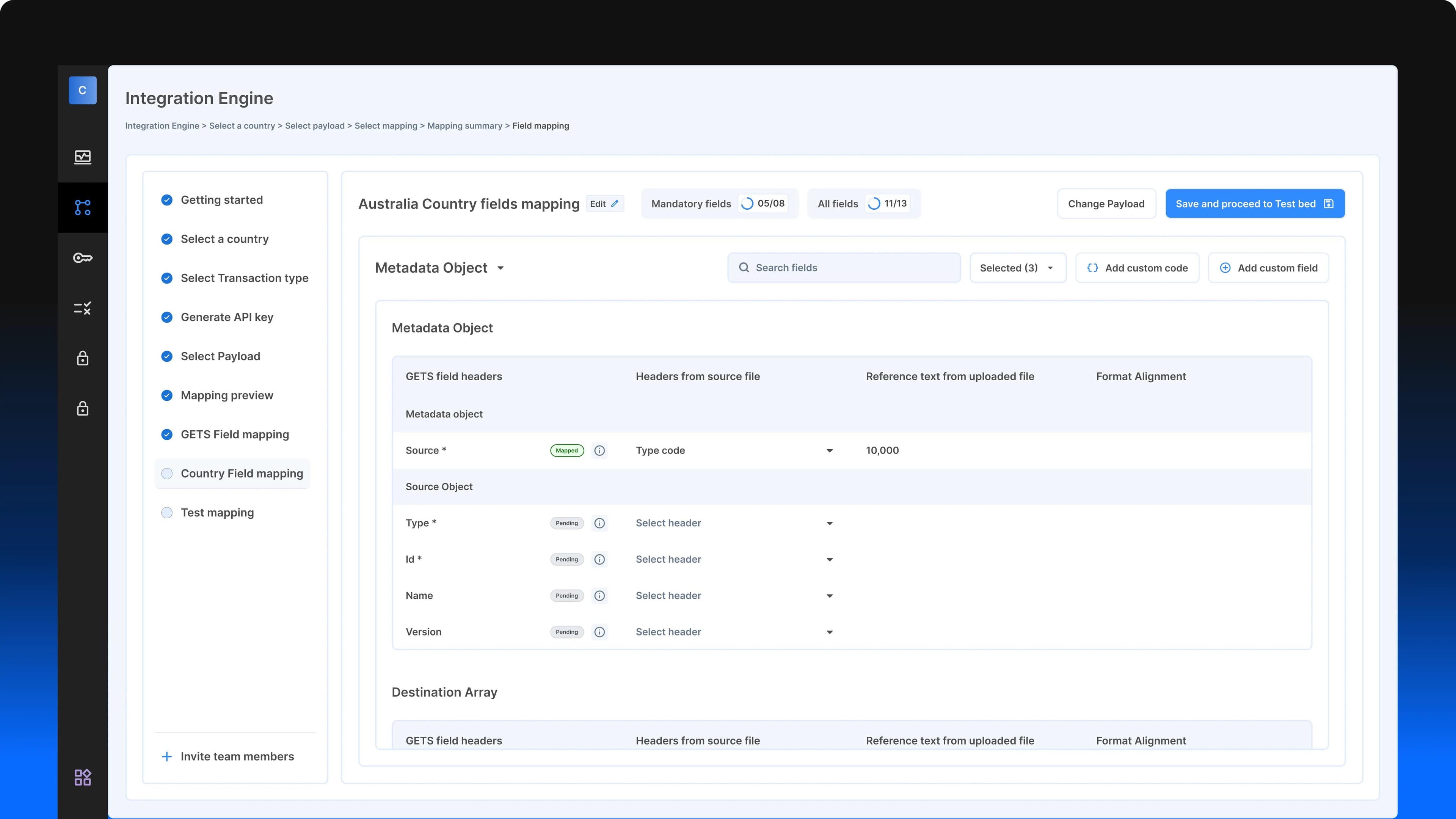

Country-Specific Schema Awareness

Each field adapts dynamically based on the country you select. You'll know exactly which fields are needed for ZATCA, Peppol, IRBM, and more.

Modular Country Extensions Without Breaking Core Logic

Add support for new jurisdictions through GETS extensions that plug into your existing payload—without refactoring your entire integration. This lets your team expand globally with zero changes to your base invoice structure.

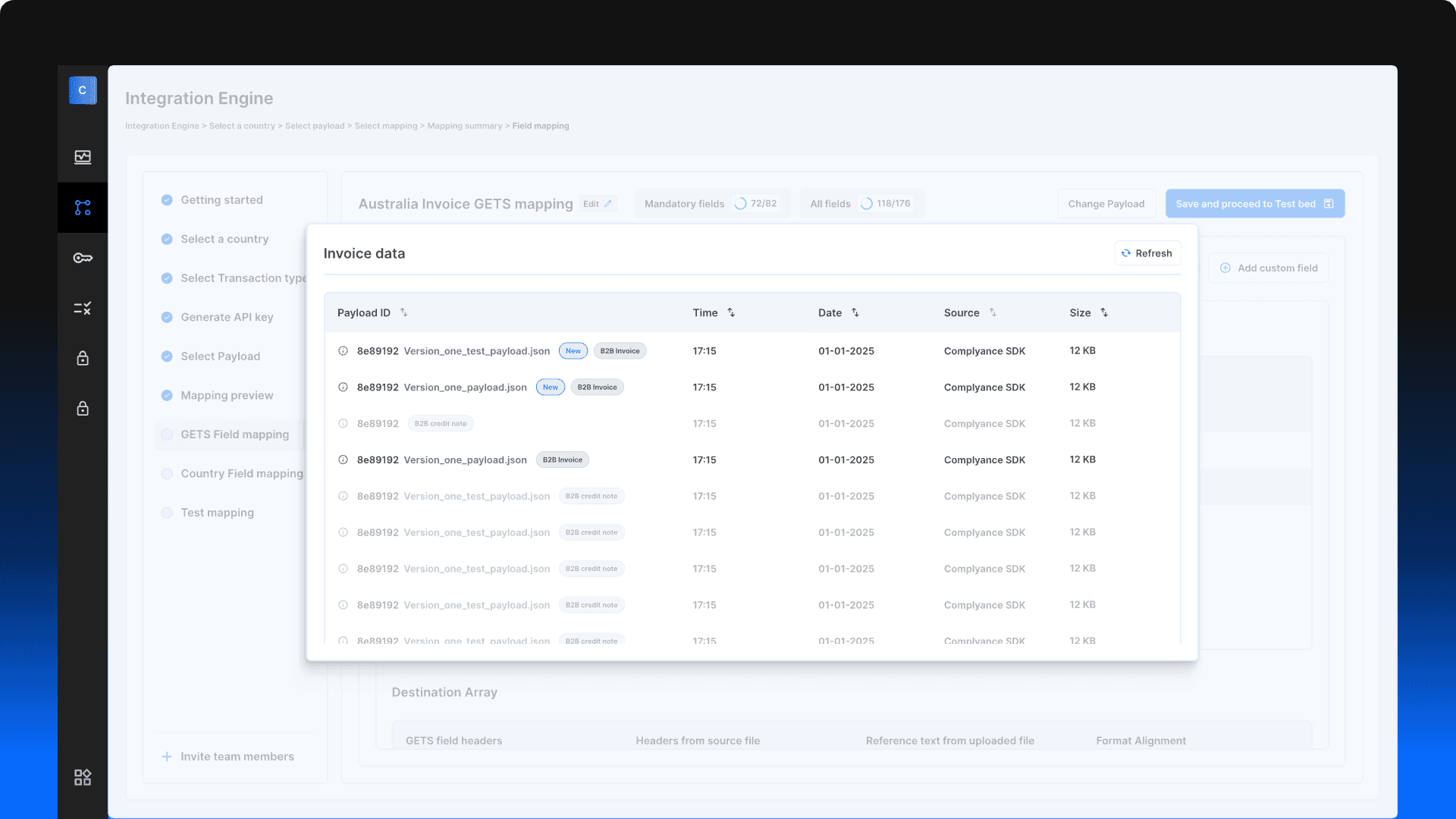

Field-Level AI Diagnostics with Confidence Scoring

Each field in your payload is analyzed by our AI engine to assess mapping accuracy, suggest corrections, and rank reliability—helping you identify risky mappings before they become failed submissions or compliance risks.

Smart Schema Adaptation by Country

Our mapper adjusts automatically based on the country you select—showing only the relevant fields, rules, and validation logic. Stay focused without digging through documentation or switching contexts.

Auto Field Mapping Saves Time and Reduces Rework

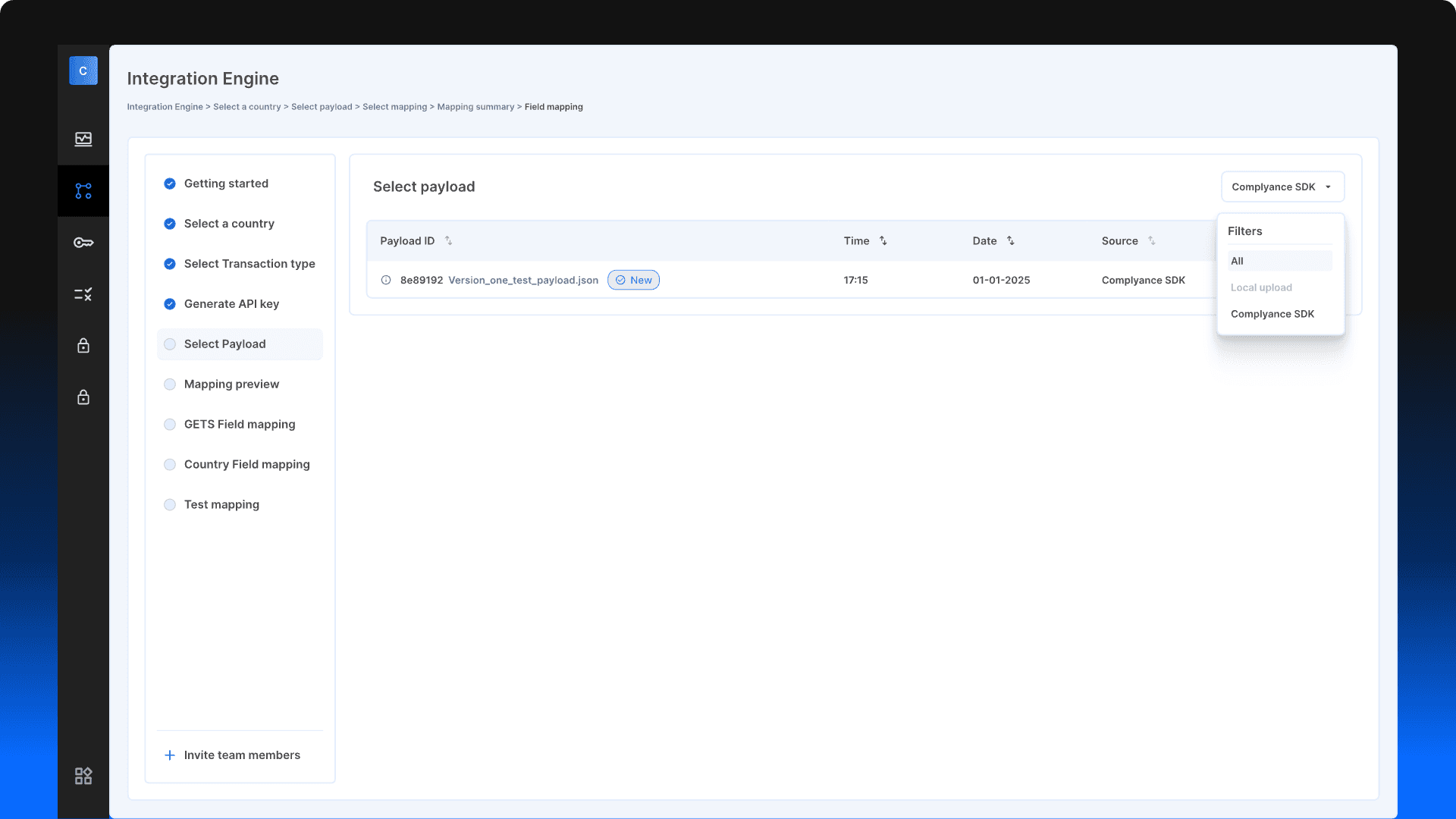

Manually rewriting invoice payloads for every country is error-prone and painful. Complyance’s auto field mapping simplifies global e-invoicing by letting developers work with one clean structure while we handle the rest behind the scenes.

One Format, Global Coverage

Use our unified GETS structure and let the platform map your fields to each country’s schema—no more maintaining region-specific formats.

Eliminate Repetitive Schema Work

Stop duplicating logic for every market. Auto mapping handles differences in field names, tax rules, and formats so you can scale faster with fewer bugs.

Ship Faster With Less Debugging

With built-in logic and validation feedback, you’ll catch field-level issues before they reach production—reducing failed submissions and time spent troubleshooting.

See how businesses like yours have

simplified global e‑invoicing

Read the full storyHow SpeedCast Standardized E‑Invoicing for 15+ Entities Using One API Integration

Read Story30K+

Number of e‑invoices transactions happen per year

100+

countries supported worldwide

95%

Reduction in implementation time across regions

Problem

SpeedCast needed a compliant e-invoicing system for over 15+ global entities — all with different formats, languages, and regulatory requirements. Their finance team also struggled with multi-page invoices, currency fluctuations, and integration gaps with Dynamics and ServiceNow.

Solution

Complyance provided a clean, accountant-friendly UI and a well-documented API that worked across SpeedCast's diverse landscape. With support for future Dynamics integration, AI-driven invoice processing, and consolidated USD-based invoicing, the platform became a global backbone for compliance

Product

Complyance API Platform (GETS + Partner Console)

Scale with enterprise–grade security

Security

Ensure your company's data is completely secure and that you are in compliance with the latest standards.

Ready to Stop Rewriting Schema Logic for Every Country?

Use Complyance’s auto field mapping to build once, map visually, and deploy globally—without duplicate effort.