Auto-Generate Invoices at Checkout or POS

Trigger compliant invoice creation in real-time—whether it's from your ecommerce checkout, mobile app, or in-store POS terminal.

Simplify Global E‑Invoicing

Complyance helps ecommerce brands and retail chains manage e-invoicing across 100+ countries—from real-time checkout to large-volume reconciliation. Whether you run POS stores, marketplaces, or D2C platforms, our API makes tax compliance simple and scalable.

Whether you're running an omnichannel brand or a global marketplace, Complyance helps you automate invoicing, manage regional compliance, and scale across countries—without disrupting your billing or checkout systems.

Unify your in-store POS and ecommerce invoicing with one integration. Complyance supports real-time invoice generation across all customer touchpoints, including in-store returns, click-and-collect, and online purchases.

Automatically issue country-compliant invoices for each seller and customer, no matter where they operate. Avoid regulatory risk and simplify VAT/GST compliance for multi-region transactions.

Generate compliant invoices from custom-built carts or third-party platforms like Shopify, WooCommerce, or Magento. Our flexible API plugs into any stack and keeps your checkout flow fast and compliant.

E-invoicing shouldn't feel like a specs problem. Our platform simplifies it down to what you already know—API, request, response, done

Retailers and ecommerce platforms move fast—but compliance moves differently. From high-volume transactions and regional tax rules to refunds and fragmented tech stacks, staying compliant across borders isn’t just hard—it’s costly. Here’s where most teams get stuck:

Retail businesses process thousands of orders daily. A single invoice error at scale leads to customer complaints, refund delays, and operational fire-fighting—hurting both margin and brand trust.

Reversing or correcting invoices for refunds and returns varies by country. Without dynamic logic, teams risk sending non-compliant credit notes, causing tax discrepancies and customer service overhead.

VAT thresholds, product-based exemptions, and dynamic GST logic break automation in global flows. Add custom checkout logic or a hybrid POS system, and mapping compliance gets even harder.

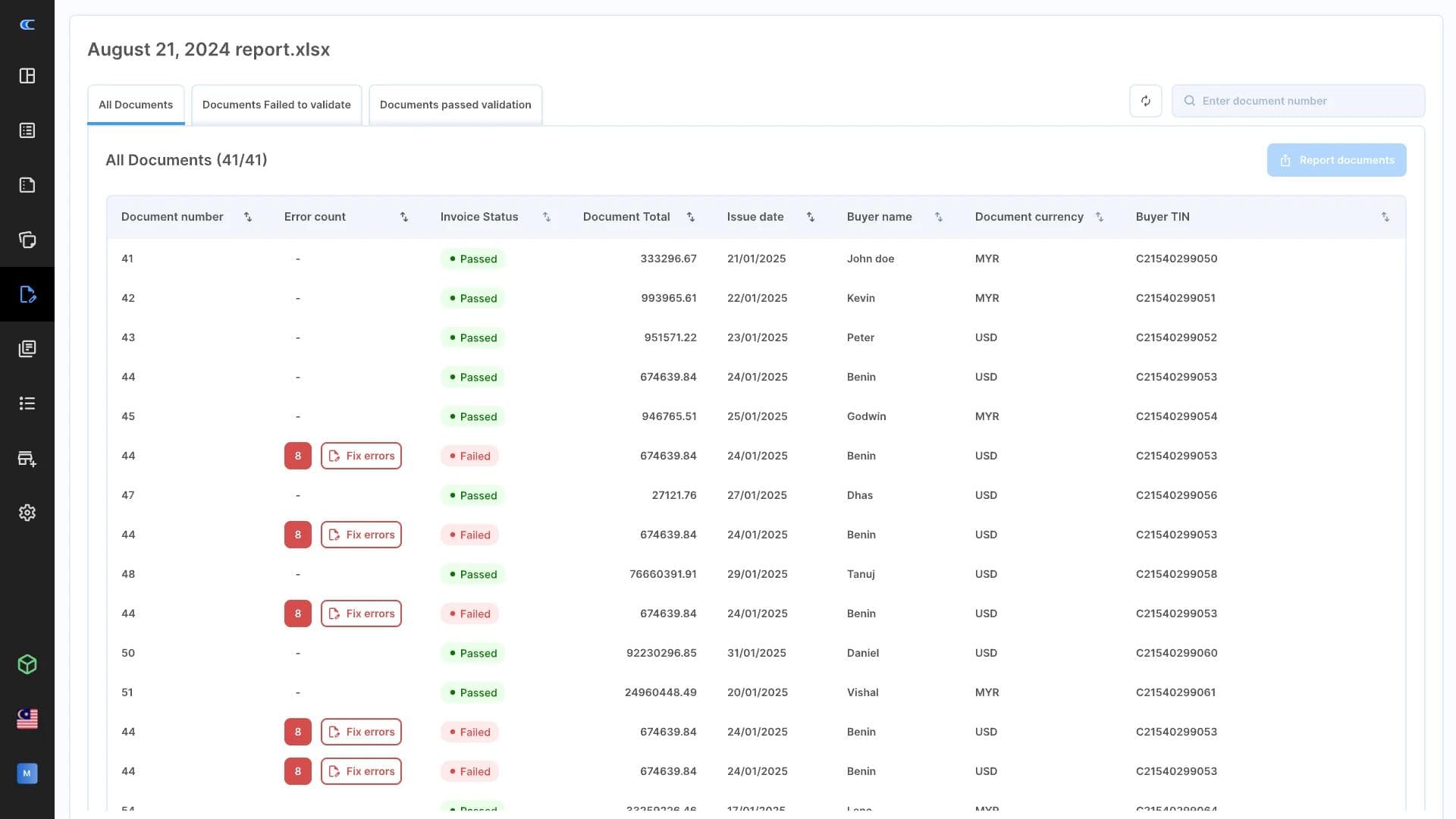

Complyance gives your retail and ecommerce teams full control over invoicing operations—from validation to monitoring. Here's how our interface simplifies compliance across every touchpoint and transaction.

Quickly validate invoices per country schema and preview the final document before submission. Instantly spot and fix missing fields, format mismatches, or compliance issues with field-level guidance.

Monitor invoicing activity across stores, brands, and regions. Filter by country, status, or entity to track errors, submission rates, and ensure full control across your global invoicing footprint.

Complyance connects with your ERP, CRM, or billing systems, making integrations quick and easy.

Internet-first companies scale fast—and your compliance stack should too. Complyance delivers measurable results by reducing integration effort, saving dev time, and enabling multi-country invoicing without complexity.

Whether you're selling across storefronts, platforms, or borders—Complyance integrates effortlessly into your existing tech stack. Automate invoice generation, track performance, and scale across 100+ countries with confidence.

Trigger compliant invoice creation in real-time—whether it's from your ecommerce checkout, mobile app, or in-store POS terminal.

Issue fully compliant reversals and credit notes automatically for returns, exchanges, and refunds—based on local tax rules.

Use GETS, our unified payload format, to support regional invoicing rules without rewriting logic for every market.

Easily map your platform’s data to country-compliant invoice structures—without writing custom code or middleware scripts.

Track which invoices succeed, fail, or need revision. Filter and troubleshoot by store, region, or integration endpoint.

From Peppol to Tax authorities, our in-house tax team keeps Complyance aligned with every local update—so your business doesn’t have to worry about regulation changes.

Ensure your company's data is completely secure and that you are in compliance with the latest standards.

Go live in days, not months. With Complyance, ecommerce and retail brands can automate invoice generation, handle refunds compliantly, and stay ahead of global tax mandates—with help from in-house tax experts.