Use One Platform to Cover 100+ Countries

Single platform for e-invoicing, credit notes, and tax compliance. No more juggling multiple tools or country-specific systems. Manage everything in one place.

Global E‑Invoicing Simplified for Finance Teams

Complyance gives finance and tax teams full control over invoice validation, credit notes, and global tax mandates—across 100+ countries. Automate where needed, track everything in real-time, and stay audit-ready without depending on dev teams.

Managing global e-invoicing across regions is more than just checking a compliance box. Constant rule changes, limited visibility, and error-prone workflows create friction between finance, tax, and IT.

Tax rules evolve across jurisdictions like ZATCA, IRBM, Peppol, and CFDI. Staying up to date without automation leads to risky workarounds and constant revalidation.

Missing fields, invalid formats, and schema mismatches cause submission failures, delaying processing, creating bottlenecks, and impacting cash flow.

Without centralized dashboards or clear logs, finance teams are left guessing why invoices failed—or chasing IT for answers.

Complyance links your existing ERP, CRM, and Accounting systems directly to tax authorities in over 100+ countries — simplifying submissions, automating validations, and giving finance teams full visibility and control without heavy internal changes.

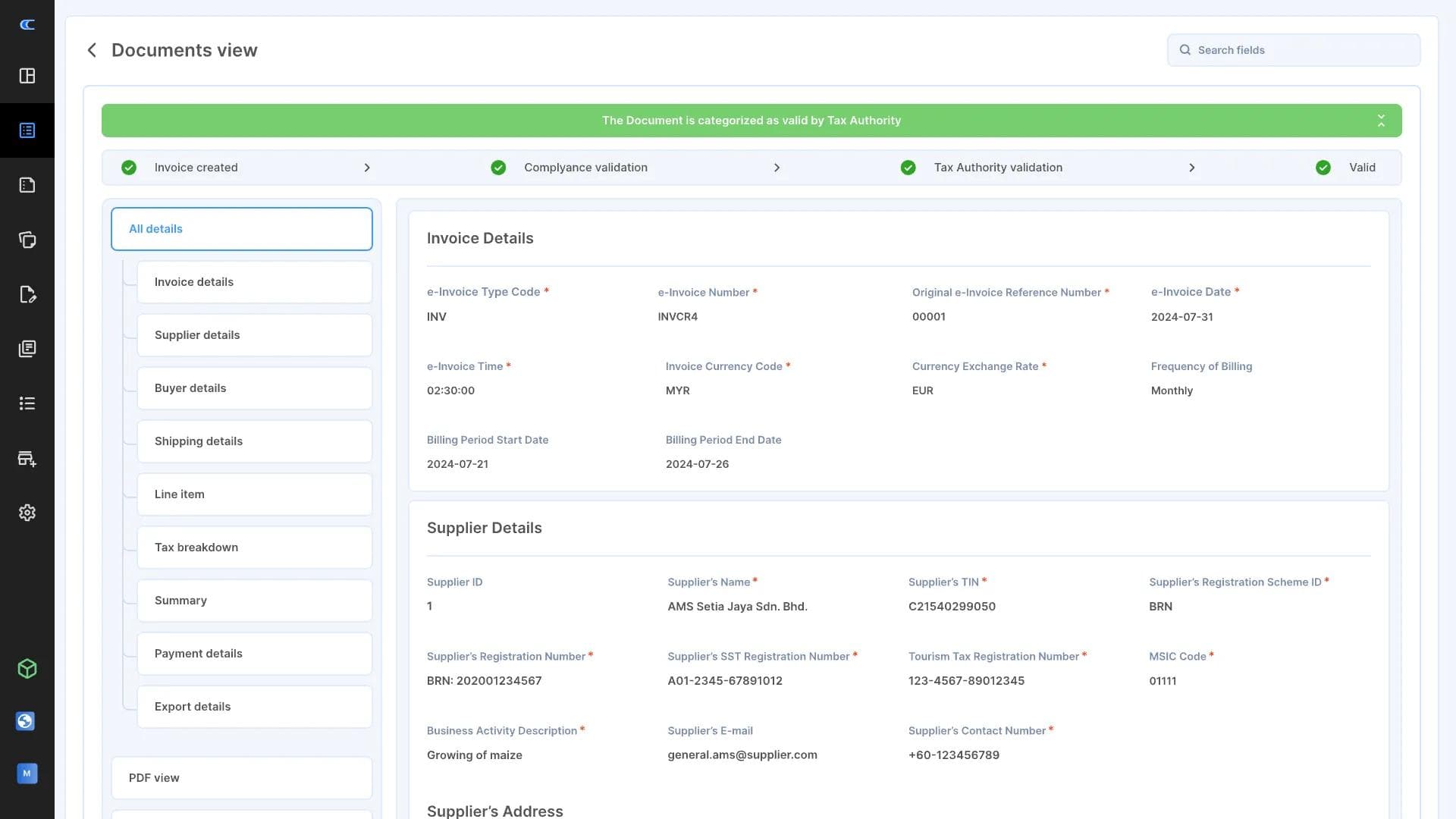

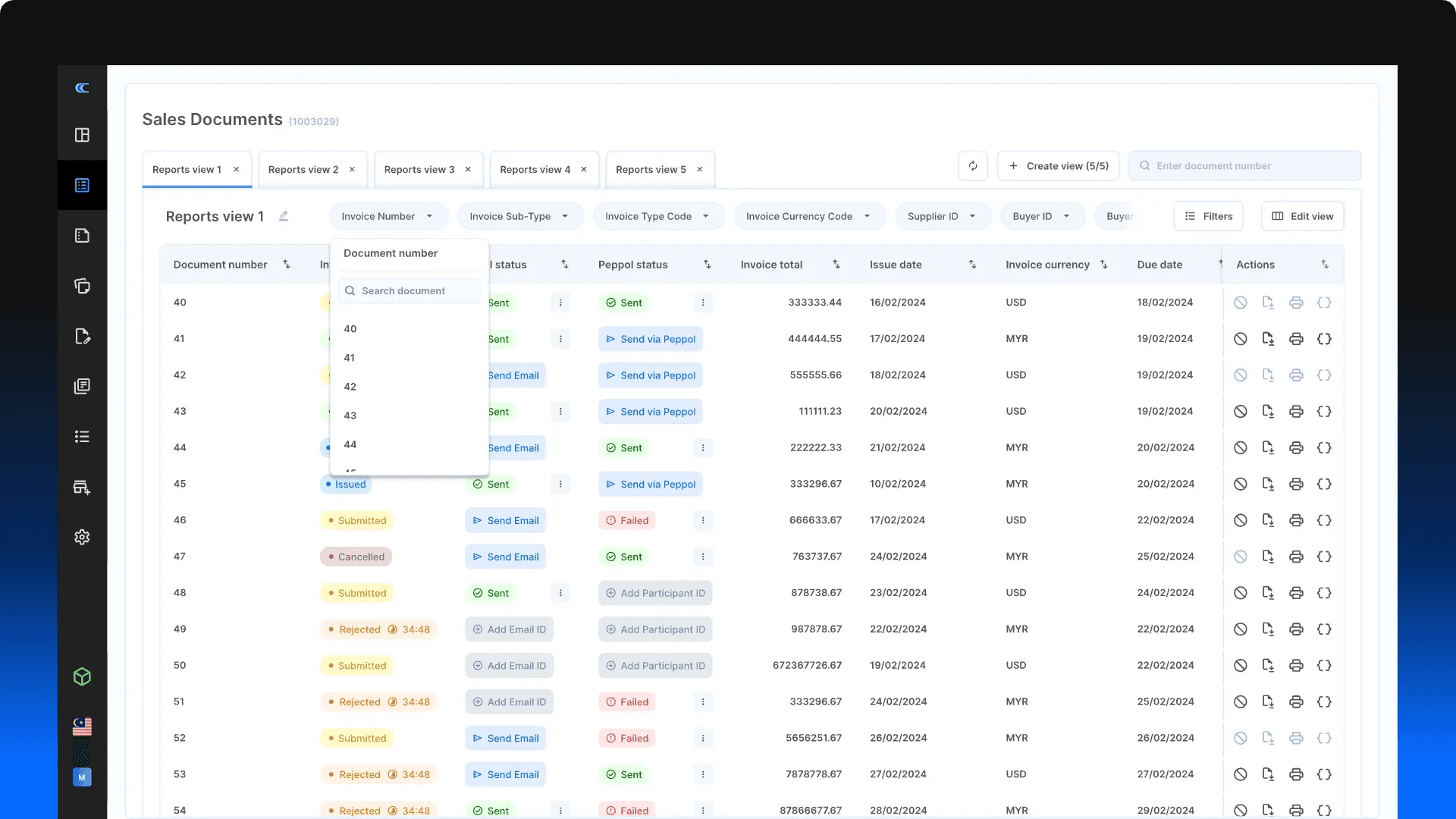

Track every invoice from creation to government acceptance — in every country you operate. With instant status updates, finance teams get the visibility they need to stay compliant and avoid penalties, without relying on IT.

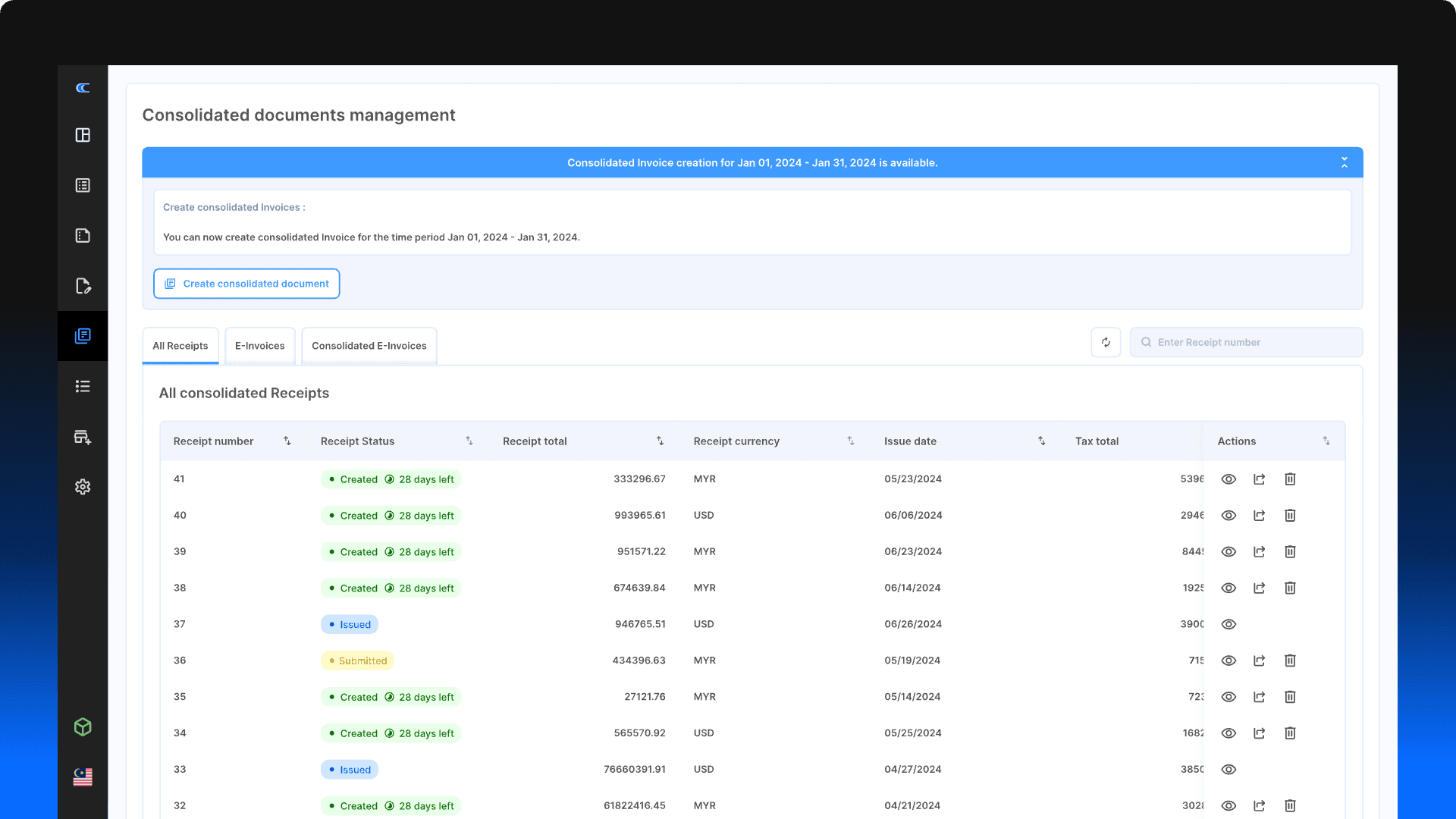

Combine invoice data from multiple branches, brands, or systems into a unified compliance flow. Simplify reconciliation and group-level reporting for multi-entity enterprises.

Use GETS templates to define field mappings, tax rules, and compliance logic by country—without hardcoding. Maintain consistency and control with reusable templates.

Complyance equips finance and tax professionals to take charge of e-invoicing—without relying on engineering teams. From real-time validations to audit-ready exports, manage compliance confidently across regions, partners, and formats.

Single platform for e-invoicing, credit notes, and tax compliance. No more juggling multiple tools or country-specific systems. Manage everything in one place.

With visual field mapping, prebuilt country logic, and interactive docs, most teams go live in days—not months.

Seamlessly handle returns, refunds, and post-sale adjustments in formats that meet country-specific regulations.

Generate detailed, timestamped invoice trails and export compliant documentation for audits, reconciliations, or internal reviews.

Our platform stays in sync with evolving tax regulations like -UAE, IRAS, and Peppol—so you stay compliant without manual updates.

View invoice outcomes, rejections, and retry history across all your regions, entities, or partner accounts—in one place.

Delightful interactions, attention to detail, and genuine concern make Complyance stand out. A+ customer satisfaction!BharatCEO, Tadweer

Early delivery, exceptional quality, and top-notch customer support! Exceeded expectations in every aspect.GlaptonERP Manager, ICR Arabia

Complyance expertly managed our transition to ensure full E-Invoicing compliance. Their meticulous attention to detail resolved issues swiftly, ensuring our invoices were fully compliant.Zakir HussianERP Manager, Kindasa Water Services

We cannot express enough gratitude for the invaluable support during implementation. We appreciate the timely resolution of challenges, showcasing your professionalism and dedication.Tariq BuzaidCEO, I-Energy

We approached Complyance at the last minute, facing a critical deadline. The team went above and beyond helping us integrate with tax authorities, and we've entrusted them with our entire group's e-invoicing.RamasamyProject Manager, Algosaibi

Complyance gives finance and tax teams full control over invoice validation, credit notes, and global tax mandates—across 100+ countries. Automate where needed, track everything in real-time, and stay audit-ready without depending on dev teams.

With Complyance, your finance and tax teams get automation, real-time insight, and country-compliant tools—all without the engineering bottlenecks.