Exploring Alternatives to ClearTax for E-Invoicing in the UAE

ClearTax vs. other E-Invoicing software: See how Complyance and other solution providers outperform on speed, support, and cost for UAE e-invoicing. Includes pros, cons, and use cases.

Table of Contents

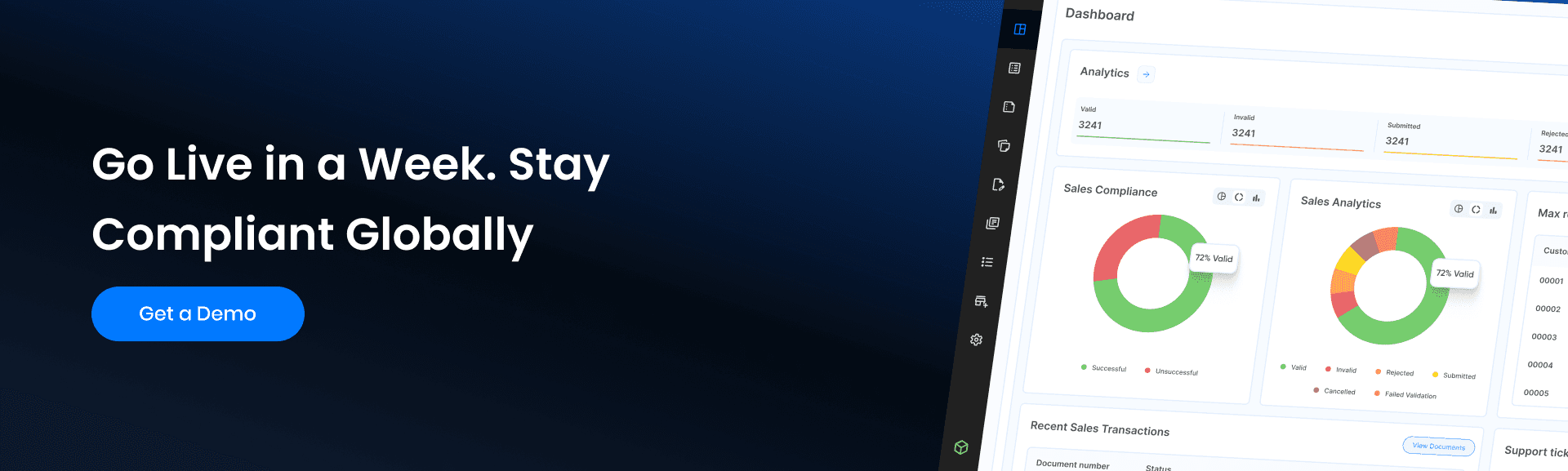

While ClearTax is a popular choice for e-invoicing, what if you could have a solution that integrates 10x faster, guarantees 100% submission success, and cuts developer effort by 85%? For businesses scaling in the UAE and beyond, the right alternative isn’t just about compliance; it’s about strategic advantage.

Many businesses find their growth stalled by recurring e-invoicing challenges: platform slowdowns during critical filing periods, complex and costly API integrations, and support that can't keep up with their global ambitions. These aren't minor inconveniences; they are significant bottlenecks to efficiency and scalability.

This is why many organizations initially turn to a well-known name like ClearTax. It serves as a popular default for navigating the Federal Tax Authority (FTA) mandates, offering a baseline of functionality to handle core tasks:

- Generate and validate compliant invoices

- Integrate with major ERPs like SAP and Oracle

- Manage archives and global compliance

And while it provides these essential benefits, they are frequently tempered by significant complexities. Users commonly encounter performance bottlenecks during high-volume periods, face rigid and lengthy processes for invoice generation, and must navigate API integrations that can demand considerable developer resources to implement and maintain.

Choosing a ClearTax alternative means identifying if you need a dedicated solution for lightning-fast implementation (1-4 weeks), 100% submission success rate with built-in PINT-AE validation, and a developer-first approach that reduces integration effort by 85% while maintaining enterprise-grade security and compliance across 100+ countries, raw API speed, enterprise-scale automation, 24/7 expert support, or deeper customization.

You're not alone in making that determination.

We've explored the landscape of e-invoicing solutions to see how ClearTax's features stack up against more specialized platforms.

The following alternatives each excel in specific areas where ClearTax falls short, helping you find the right tool for seamless, efficient, and future-proof compliance in the UAE.

ClearTax and Its E-Invoicing Offerings

Founded in 2011, ClearTax is a leading fintech platform specializing in tax compliance and e-invoicing, serving over 1,500 enterprises globally.

Its e-invoicing solution is designed to streamline compliance with various regulatory frameworks, including the UAE's FTA mandates, and extends to international markets like Malaysia.

Key features include:

- Invoice Generation and Validation: Generates compliant e-invoices and integrates with tax authority portals for real-time validation.

- ERP Integration: Connects with systems like NetSuite, Oracle, and SAP to automate workflows for e-invoices, amendments, and archiving.

- Global Capabilities: Supports international e-invoicing standards, such as Malaysia's LHDN-compliant software, making it versatile for cross-border operations.

- Bulk Processing Capabilities: Bulk data ingestion supports CSV and Excel formats, which are particularly beneficial for organizations managing high transaction volumes.

- Strong Error Handling: Comprehensive error tracking with advanced data validation (150+ checks) minimizes non-compliance and reduces manual correction effort.

- Multi-User Support: Multi-user support with tailored user roles enhances security and operational efficiency for larger teams.

However, several drawbacks make vendors look for alternatives that better suit UAE-specific and global needs.

Why Vendors Need ClearTax Alternatives

Despite its strengths, user feedback and industry insights reveal recurring pain points with ClearTax that hinder efficiency and scalability, which include:

- Performance and Reliability Issues: Some users experience occasional platform slowness or login issues, notably during high-traffic periods, which disrupt critical workflows.

- Feature Limitations: Certain features, like advanced customizations and reporting (e.g., data downloads for periods over one month), are limited and could be expanded.

- Rigid and Lengthy Processes: Mandatory field checks for invoice generation can make the process feel lengthy or complex for new users, especially those less familiar with e-invoicing compliance.

- Inconsistent Support Responsiveness: Although support is strong in theory, some users report that 24/7 customer care isn't always as responsive during off-peak hours as advertised.

- API Complexity & Integration Challenges: While some users report good experiences with pre-built ERP connectors, others mention that deeper, API-led integrations can be complex to implement and maintain, requiring significant developer resources.

- Gaps for Large Enterprises: Larger enterprises with highly specialized needs may find some feature gaps or wish for deeper customization options in workflows or document templates.

- Limited Error Resolution Guidance: Technical errors or validation failures are often presented as complex codes or generic messages, lacking clear, human-readable explanations that would help users resolve issues quickly without relying heavily on support.

- Extended Implementation Timelines: Businesses frequently face extended setup and configuration periods, delaying their go-live date and potentially putting them at risk of non-compliance as FTA deadlines approach.

These limitations, particularly around performance, advanced features, and enterprise scalability, are what push growing UAE businesses toward alternatives that offer better reliability, deeper customization, and more robust compliance readiness.

Top Alternatives to ClearTax for E-Invoicing in the UAE

To address ClearTax's shortcomings, we've curated four compelling alternatives, starting with Complyance, which excels in speed, scalability, and UAE-specific compliance.

Each alternative is evaluated for its ability to streamline e-invoicing and ensure FTA adherence.

| Solution | Best For | Standout Features | Key Advantages |

|---|---|---|---|

| Complyance | Global businesses needing rapid integration with developer-friendly single API | - 100+ automated validations - Handles FTA downtime - 24/7 support & gap analysis - GETS framework for 100+ countries | - Go-live in 1-4 weeks - Single API for multi-country compliance - ISO 27001, GDPR, SOC 2-certified with UAE data storage |

| Pagero | Businesses prioritizing global B2B network automation | - Peppol-certified access point - Automated invoice lifecycle management - Global buyer-supplier network | - Seamless B2B invoice exchange via Peppol - Minimizes manual work - Supports multi-country compliance |

| Comarch | Robust archiving & EDI integration | - Built-in long-term archiving - Strong EDI compatibility - Global format support | - Addresses data management constraints - Overcomes limited customization options |

| Edicom | Businesses requiring EDI & e-invoicing expertise | - Strong EDI capabilities - Digital signature support - Global compliance (EU/LATAM/UAE) | - Secure data handling - Expertise in international standards - Customizable workflows |

| Avalara | ERP-integrated tax & e-invoicing automation | - Broad ERP integrations (SAP, Oracle, etc.) - Multi-country tax compliance - Centralized dashboard | - Streamlines tax calculations & reporting - Scalable for high-volume businesses - Real-time reporting capabilities |

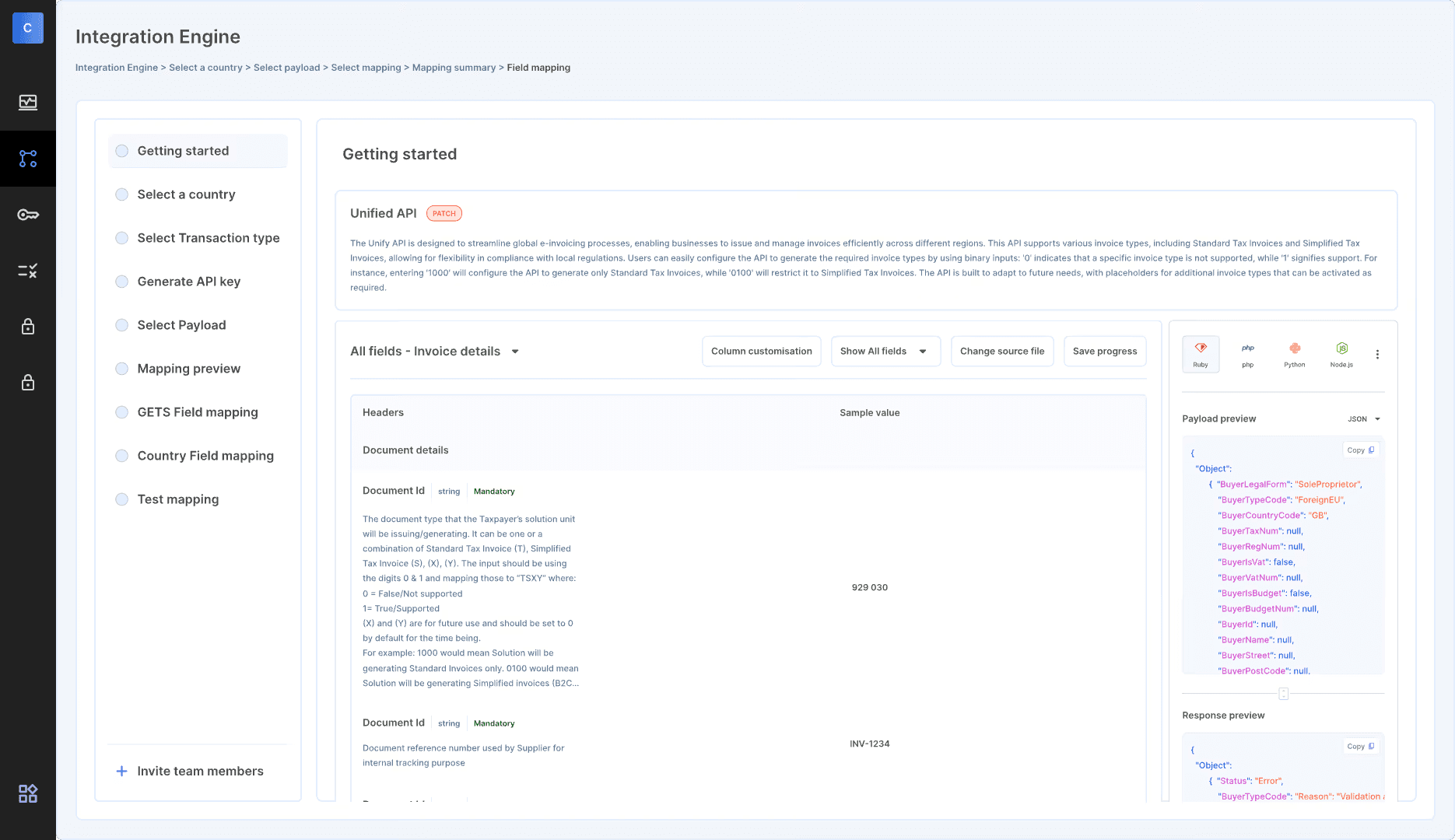

1. Complyance: Best Global E-Invoicing with a Developer-Friendly One API

Complyance is a global e-invoicing platform trusted by over 1,000+ businesses worldwide, offering a developer-first solution tailored for the UAE's FTA requirements and beyond.

With its proprietary GETS framework, Complyance delivers unmatched speed, security, and automation, making it the top choice for vendors seeking a ClearTax alternative.

Key Highlights:

- Single API for Global E-Invoicing: One API integrates with any ERP, POS, or accounting system (e.g., SAP, Oracle, QuickBooks, Zoho), ensuring error-free e-invoicing across 100+ countries, including the UAE.

- Peppol-Certified and UAE-Ready: Fully compliant with Peppol standards (e.g., Malaysia, Belgium) and nearing UAE Ministry of Finance accreditation, Complyance guarantees FTA compliance.

- Robust Security: ISO/IEC 27001, GDPR, and SOC 2 Type 2 certifications ensure data protection, addressing ClearTax's privacy concerns.

- 100+ Automated Validations: Every invoice undergoes rigorous checks before submission to the FTA via Peppol, achieving a 100% success rate in e-invoice generation.

- 24/7 Expert Support: On-site technical teams in the UAE and a global presence in Southeast Asia, Europe, and more provide seamless implementation and training, unlike ClearTax's limited support.

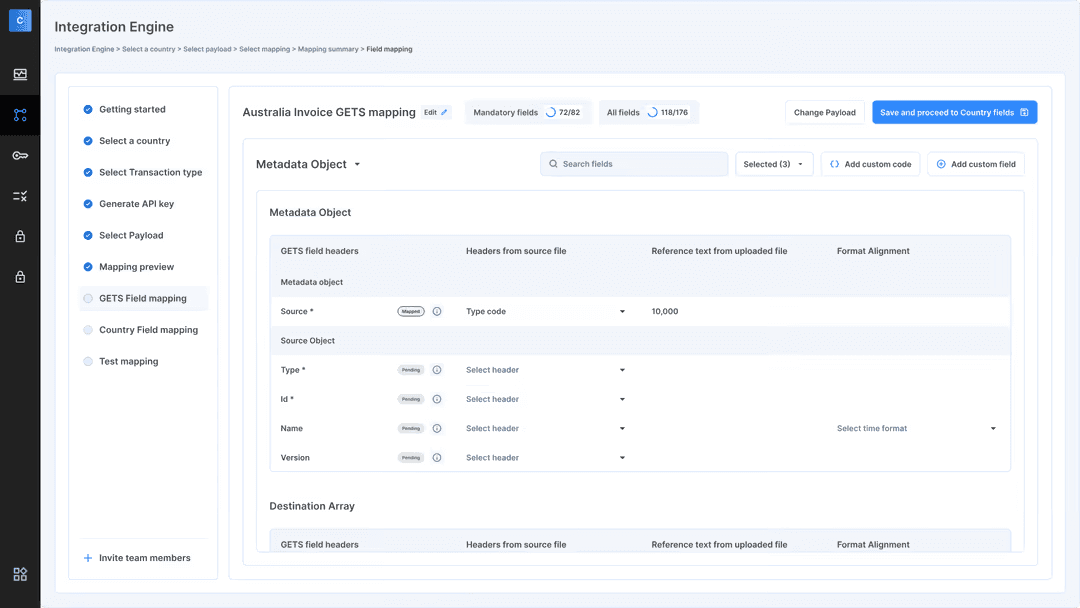

- GETS Framework for Rapid Integration: Complyance's GETS (Global E-Invoicing Transformation Standards) framework unifies multi-country compliance, enabling businesses to go live in 1-4 weeks, up to 10x faster than competitors.

- Eliminate Data Mapping Complexity: It supports 24+ native e-invoice formats, reducing data mapping time by 98% and developer effort by 85% per country rollout.

- Automated Reconciliation: Real-time tax reconciliation with FTA submissions reduces discrepancies and manual effort, resolving ClearTax's manual process issues.

- Cost-Effective and Scalable: Transparent pricing with no steep renewal hikes, plus a full sandbox with test data for developers to validate workflows.

While ClearTax offers a solid foundation, navigating its limitations can become a chore for growing businesses.

You might find yourself needing more speed, better support, or deeper customization; that's where exploring a specialized alternative like Complyance makes all the difference.

Why are we recommending Complyance? In addition to being a developer-first platform that's built for blistering speed, Complyance directly addresses the most common frustrations users have with ClearTax.

Complyance's single API solution simplifies global E-invoicing, lifting the burden from your IT/Dev team. Now you can focus on core business activities while we handle all e-invoicing complexity. Complyance makes FTA rules simple and saves you money, whether you're a small or large business.Ready to start? Schedule a demo to see Complyance in action.

Where ClearTax can have occasional slow processing and system delays, Complyance's proprietary GETS (Global E-Invoicing Transformation Standards) framework is engineered for real-time, high-volume processing.

- This powerful framework unifies multi-country compliance, enabling businesses to go live in just 1-4 weeks, up to 10x faster than competitors and a fraction of the time ClearTax often requires.

- This is achieved by supporting 24+ native e-invoice formats, which reduces data mapping time by 98% and developer effort by 85% per country rollout.

- Of all its impressive features, the one that stands out is its single API for global compliance.

- This API is built with developers in mind, featuring interactive documentation, SDKs, and a full sandbox environment with test data to validate payloads and simulate errors before going live.

- Furthermore, while ClearTax's lack of 24/7 support can leave you stranded, Complyance offers round-the-clock expert support from a team based in the UAE that deeply understands the FTA's rules, PINT-AE structure, and common ERP pitfalls.

- For businesses concerned with accuracy and compliance, Complyance offers a built-in PINT-AE validator that checks every field against the UAE's official schema, catching format, structure, and business rule errors instantly.

- It also includes Peppol support, allowing you to test end-to-end flows and validate PINT formats within the platform, ensuring a 100% success rate in e-invoice generation and submission.

- Our single, well-documented API for global compliance is built for your technical team. With interactive documentation, SDKs, and a full sandbox environment, development cycles are slashed. Developers can validate payloads and simulate errors before going live, drastically reducing last-minute fire drills.

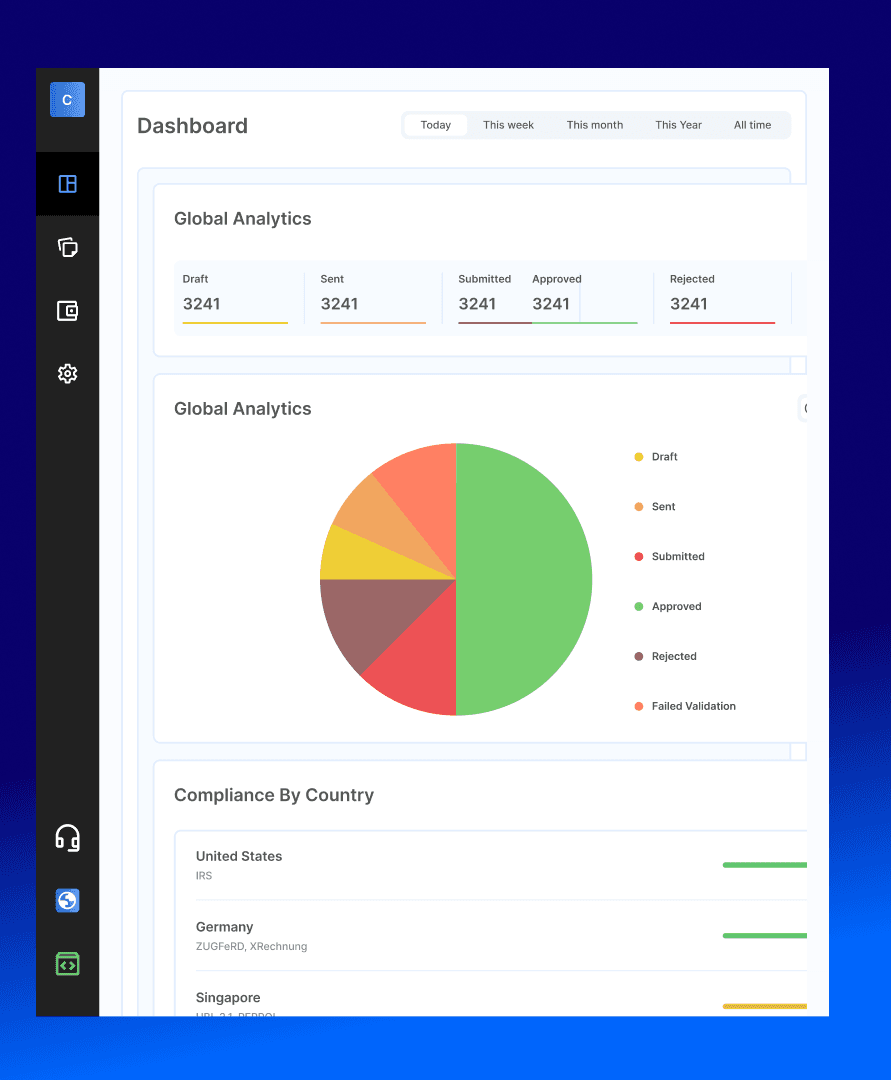

- Gain a single dashboard to manage not just UAE FTA mandates but also e-invoicing in over 100 other countries. A built-in PINT-AE validator checks every field against the UAE's official schema, catching errors instantly and ensuring a 100% success rate in e-invoice generation and submission, virtually eliminating compliance risk and rejected submissions.

- The platform is backed by enterprise-grade security with ISO/IEC 27001, GDPR, and SOC 2 Type 2 certifications, ensuring every e-invoice and API call remains protected and audit-ready. This mitigates risk and simplifies regulatory audits.

- For product managers, rapid, reliable integration (1-4 weeks) means you can enter new markets faster than your competitors, turning tax compliance from a roadblock into a competitive advantage that accelerates global expansion plans.

- Round-the-clock expert support from a team based in the UAE means no one is ever stranded. This team deeply understands the FTA's rules, PINT-AE structure, and common ERP pitfalls, providing peace of mind and resolving issues before they impact operations.

All you Need for UAE E-invoicing in One platform

Connect your ERP, validate invoices, and go live fast, all from one developer-friendly platform.

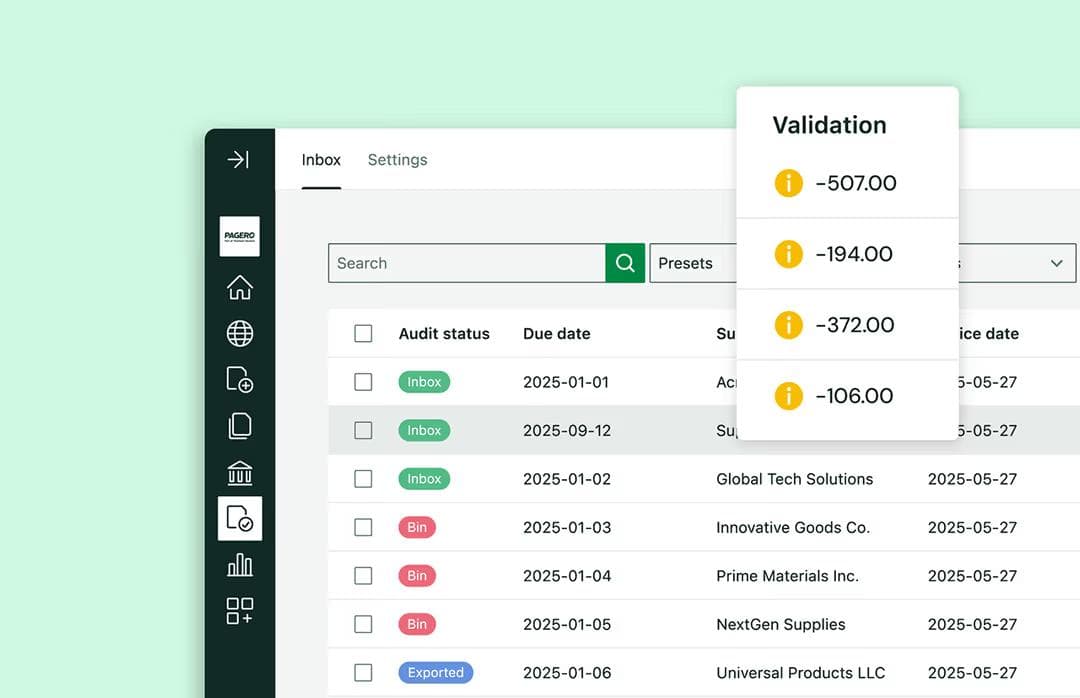

2. Pagero: The Global Network for Seamless B2B Exchange

Pagero is a part of Thomas Reuters that operates as a Peppol-certified Access Point, automating B2B invoice exchanges and ensuring compliance with the UAE FTA's Peppol framework.

Its strength lies in its vast global network, which connects businesses to buyers and suppliers worldwide, facilitating seamless document exchange without the need for direct integrations with each partner.

Key Highlights:

- Peppol Network Access: Provides direct connectivity to the FTA via the Peppol network for instant and compliant invoice delivery.

- Global Trading Network: Connects you to a vast ecosystem of buyers and suppliers, simplifying B2B transactions and partner onboarding.

- Automated Workflow: Handles the entire invoice lifecycle, including validation, transmission, and archiving in line with UAE standards.

- Document Mapping: Converts various invoice formats into the required PINT AE XML standard for FTA compatibility.

- Monitoring & Tracking: Offers real-time tools to track invoice status and receive delivery confirmations.

Cons:

- Less effective if your partners aren’t on Pagero’s network.

- Implementation can be slow and complex.

If your biggest challenge is automating exchanges within a vast supply chain, Pagero solves this perfectly.

Why are we recommending Pagero? As a Peppol-certified Access Point, Pagero automates B2B invoice exchanges and ensures compliance with the UAE FTA's Peppol framework.

Where you'd normally need to build custom integrations with each supplier, Pagero connects you instantly to thousands of trading partners already on its network, turning a complex, manual chore into a completely automated process.

Pagero provides robust solutions for large enterprises, especially in manufacturing, automotive, healthcare, and public sector organizations, where complex supply chains and compliance needs are common.

Their open network architecture is often adopted by Fortune 500 companies and global leaders seeking scalable, automated document exchange and transaction controls.

Choose Pagero if: Your business operates a complex global supply chain and you need to automate B2B document exchange (like orders, dispatch advices, and invoices) across thousands of partners on a single network.

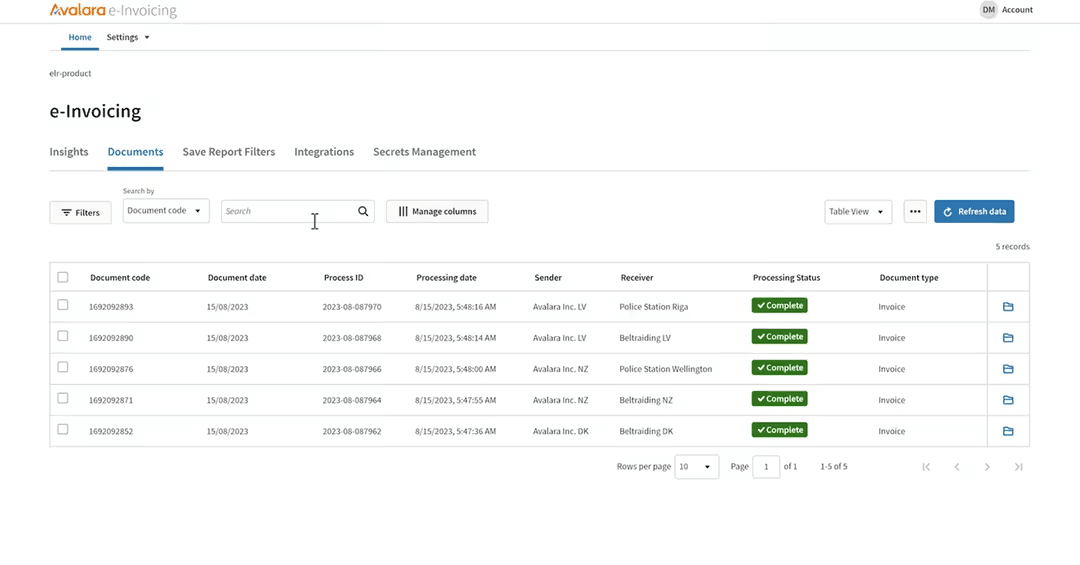

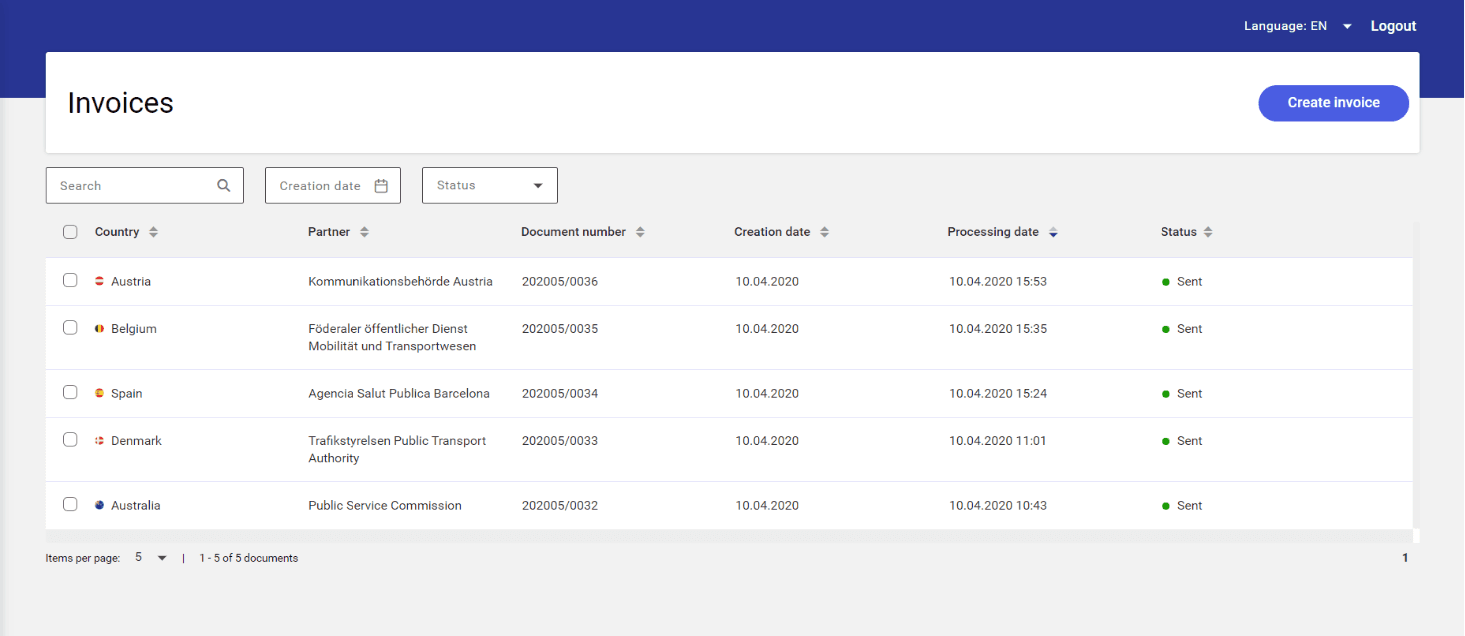

3. Avalara: Enterprise-Grade Global Compliance

Avalara is a leading tax automation platform with a robust e-invoicing solution, ideal for large UAE enterprises operating globally.

Its E-Invoicing and Live Reporting platform simplifies compliance through a single API.

Standout Features:

- Global Tax Compliance: Supports e-invoicing and tax calculations in 75+ countries, including real-time VAT, GST, and customs duties automation

- Real-Time Reporting: Automates transaction reporting to tax authorities like the FTA, ensuring accuracy.

- Scalable Automation: Streamlines VAT calculations, filings, and e-invoicing for high-volume businesses.

- Offline Tax Calculations: Provides downloadable tax content for POS systems in retail and hospitality sectors, ensuring compliance even without internet access

- ERP Integrations: Offers 1000+ pre-built connectors for major systems like SAP, Oracle, NetSuite, and Shopify, reducing manual setup efforts

Cons:

- Setup can take months, especially for all businesses.

- Custom pricing is often expensive for startups or mid-sized firms.

- Limited customization for niche industries and occasional tax calculation inaccuracies requiring manual checks

While ClearTax handles basic tax compliance adequately for straightforward operations, growing enterprises often reach a point where they require more sophisticated automation, deeper system integrations, and scalable architecture. This is where Avalara presents itself as a compelling alternative for businesses with complex needs.

Why consider Avalara alongside ClearTax? As an established tax automation platform with strong global compliance capabilities, Avalara offers enterprise-grade features that may better suit scaling organizations.

Where ClearTax might experience performance challenges with high transaction volumes, Avalara's infrastructure is designed to handle substantial scale efficiently.

The platform maintains an extensive database of global tax rules that receives regular updates, enabling accurate calculations across multiple jurisdictions simultaneously.

The platform automates complete tax compliance workflows, ranging from real-time calculations during transactions to automated filing and reporting.

Its rules engine can be customized to address complex business scenarios that may challenge more basic systems.

Avalara specializes in serving accounting firms, ecommerce platforms, and enterprises with complex indirect tax compliance needs, spanning manufacturing, retail, and distribution.

Their SaaS tax automation products (like AvaTax) are widely used by mid-sized and large businesses for real-time calculation, filing, and cross-border compliance in sales tax, VAT, and GST environments.

Choose Avalara if: your top priority is automating highly complex, multi-jurisdiction tax calculations (VAT, GST, sales tax) and you need deep, pre-built integrations with ERPs and e-commerce platforms, but their e-invoicing integration may require more technical effort and resources compared to specialized solutions.

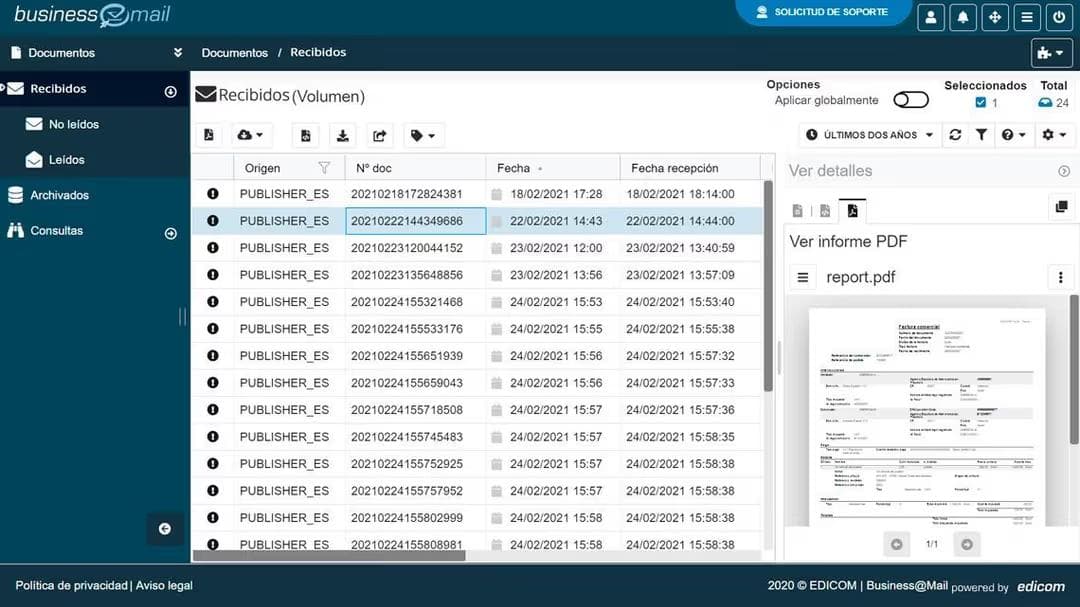

4. Edicom: Secure EDI and E-Invoicing Expertise

Edicom specializes in electronic data interchange (EDI) and e-invoicing, offering a SaaS-based platform for secure B2B document management in the UAE and beyond.

Key Strengths:

- Comprehensive Document Management: Handles issuing, sending, and archiving e-invoices with full FTA compliance.

- Global Compliance Support: Covers e-invoicing and VAT mandates worldwide, with user-friendly resources like webinars.

- Quick Setup: SaaS model enables rapid deployment without heavy IT investment.

Cons:

- Setup requires significant technical expertise.

- Deployment is slower compared to API-driven solutions.

While ClearTax covers the essential bases, businesses in highly regulated industries often find its security and customization options lacking.

If your operations demand military-grade data encryption and seamless EDI integration, that's where EDICOM steps in.

Why are we recommending EDICOM? In addition to being a Peppol-certified solution, EDICOM is built on a foundation of robust EDI and security protocols.

Where ClearTax's generalized approach can raise data privacy worries, EDICOM provides a secure, fortress-like environment with advanced encryption, making it a trusted choice for sectors like healthcare, manufacturing, and logistics.

EDICOM is especially strong in the enterprise segment, offering EDI and e-invoicing solutions for industries like healthcare, retail, automotive, and logistics, where global connectivity and multi-standard document exchange are critical.

Their platform is trusted by large corporations and government entities requiring compliance, secure communications, and customized B2B/B2G automation across international markets.

Choose EDICOM if: You are in a highly regulated industry like healthcare or automotive where robust EDI capabilities, advanced digital signatures, and guaranteed data security are non-negotiable requirements.

5. Comarch: Robust Archiving and EDI Integration

Comarch provides a comprehensive e-invoicing solution with strong archiving and EDI capabilities, ideal for UAE businesses needing long-term compliance and data management.

Notable Features:

- Built-In Archiving: Stores invoices for FTA-required periods, ensuring audit readiness.

- EDI Compatibility: Integrates with broader EDI platforms for end-to-end automation.

- Global Adaptability: Supports various international e-invoicing formats.

Cons:

- Outdated Interface: The UI feels less intuitive compared to modern cloud-based platforms.

- Performance Issues: Handles large datasets more slowly than competitors, impacting efficiency

While ClearTax provides basic functionality, businesses that rely on deep Electronic Data Interchange (EDI) and require long-term, secure archiving for audit purposes often find ClearTax's capabilities limiting.

If your business needs to ensure seamless EDI communication and bulletproof data retention aligned with UAE FTA mandates, Comarch offers the specialized robustness you need.

Why are we recommending Comarch? Comarch goes beyond standard e-invoicing by offering deeply integrated EDI capabilities and built-in archiving solutions that automatically comply with regulatory storage requirements.

Where ClearTax might present constraints in data management and long-term retrieval, Comarch provides a structured, secure environment for managing your entire document lifecycle.

This makes it an ideal solution for businesses with complex supply chains that require both e-invoicing and robust EDI integration in a single platform.

Comarch is strongest among enterprise clients in retail, telecommunications, manufacturing, logistics, pharmaceutical, and oil & gas sectors, with a notable presence in helping large organizations modernize ERP and invoicing systems.

Their solutions are frequently chosen by multinational enterprises, global retailers, and leading telcos for advanced data exchange, compliance, and B2B procure-to-pay automation.

Choose Comarch if: You are a large enterprise seeking deep ERP integration and modernization, particularly for end-to-end procure-to-pay automation that unifies EDI and e-invoicing.

Conclusion

ClearTax offers a solid e-invoicing foundation, but its high costs, limited support, and performance issues make alternatives like Complyance, Avalara, Edicom, and Comarch compelling choices for UAE businesses.

Complyance is an Accredited Service Provider and stands out with 24/7 expert support, its GETS framework enabling 10x faster integration with one API, and FTA-compliant automation, all backed by enterprise-grade security.

Whether you're a developer seeking seamless APIs or a finance team needing error-free compliance, Complyance delivers where ClearTax falls short.

Related posts

Frequently Asked Questions

Complyance offers a developer-friendly API for seamless integration, ensures UAE FTA compliance with PINT AE standards, and supports global e-invoicing through a single API platform.

Complyance offers a developer-first e-invoicing API platform that lets you integrate UAE e-invoicing into your existing systems in under a week. We provide detailed API docs, a fully functional sandbox, quick-start guides, and real-time support so your engineering team can ship confidently and fast.

At the same time, it’s built for finance and Developer teams, offering Auto Mapping, validation logs, compliance tracking, and smart alerts that make managing e-invoicing easy even for non-technical users.

Key requirements include using the Peppol-based 5-corner model, where invoices must be exchanged through Accredited Service Providers (ASPs) accredited by the Federal Tax Authority (FTA). Invoices must be generated in specific digital formats like XML or JSON using structured standards such as PINT AE (Peppol International Invoice for UAE). Real-time reporting to the FTA is mandatory, and invoices must include mandatory fields like supplier/buyer Tax Identification Numbers (TRNs), VAT breakdowns, and invoice types as per the UAE Data Dictionary.

Yes, Complyance is an ASP provider and is in the process of being accredited by the FTA in the UAE.

Step 1: Assess Systems: Ensure your ERP/billing software supports PINT AE XML/JSON generation.

Step 2: Partner with an ASP: Select an FTA-accredited ASP (e.g., ClearTax, SpendConsole) for validation and transmission.

Step 3: Data Validation: Validate TRNs, VAT rates, and mandatory fields in real-time to avoid rejections.

Step 4: Transmit via Peppol: Use your ASP to send invoices through the Peppol network to the buyer’s ASP and FTA.

Step 5: Archive: Store e-invoices securely for 5 years as per FTA requirements

Subscribe to our Newsletter

Get the latest compliance updates, e-invoicing news, and expert tips delivered to your inbox.

ABOUT COMPLYANCE

Empowering businesses to automate e-invoicing and stay compliant in 100+ countries. Our platform simplifies regulatory complexity for enterprises and fast-growing companies.