Top 5 E-Invoicing Solutions for UAE E-invoicing in 2025

Find the right e-invoicing software solutions in the UAE for your business and discover which solution best fits your team so you can go live smoothly without the frustration.

Table of Contents

Top UAE E-Invoicing Solution Providers in 2025

- Complyance: Best for global e-invoicing with a developer-friendly single API

- Pagero: Best for network-based B2B invoice exchange

- EDICOM: Best for enterprises with EDI and complex compliance needs

- Sovos: Best for regulation-driven tax and e-invoicing compliance

- Avalara: Best for ERP-centric tax and e-invoicing workflows

Tired of confusing e-invoicing rules slowing you down? Imagine picking one simple tool that gets your business ready for the UAE’s FTA mandate in just weeks!

The UAE's mandate is a fixed deadline, but how you get there is your choice. Selecting the right partner is critical.

This comparison outlines the core offerings of five key providers to help you make an informed decision. Before diving into their solutions, let’s consider the key factors that define an ideal e-invoicing partner to ensure compliance and operational success.

Seamless Integration for Uninterrupted Operations

In the UAE's five-corner e-invoicing model, robust connectivity is essential to link your systems with the FTA's Peppol framework and trading partners.

The best providers offer reliable API gateways, real-time data exchange, and failover mechanisms to handle network disruptions, ensuring invoices flow without delays or errors.

This connectivity not only meets FTA requirements but also supports hybrid B2B/B2G exchanges for efficient global operations.

The Problem: Challenges in Analyzing Multiple E-Invoicing Vendors

Choosing an e-invoicing provider for UAE FTA compliance can feel overwhelming. Businesses face these common issues when evaluating vendors:

- Too Many Options: With over 100 providers, it’s hard to know which ones are reliable and meet FTA standards.

- Complex Requirements: Understanding the UAE’s Peppol-based, five-corner model and ensuring a provider complies is confusing.

- Time Constraints: The 2026 deadline is approaching, and slow implementation could lead to penalties or delays.

- Technical Jargon: Non-technical teams struggle to evaluate API integrations, security standards, or ERP compatibility.

- Hidden Costs: Some providers have high fees or unclear pricing, making budgeting tricky for small businesses.

- Uncertain Scalability: Businesses worry if a provider can handle future needs, like multi-country compliance or growing invoice volumes.

- Platform Complexity: Some solutions have steep learning curves, requiring extensive technical expertise to navigate and maintain.

- Delays in Go-Live: Lengthy onboarding processes or unclear implementation timelines can push back compliance readiness.

- Inadequate Customer Support: Limited or unresponsive support can leave businesses stuck during critical setup or error resolution phases.

- Team Training Needs: Platforms may require significant training for teams, adding time and cost to adoption.

These challenges make it tough to find a provider that’s fast, secure, and fits your budget and systems.

The Solution: How to Choose the Right E-Invoicing Partner

To overcome these hurdles, focus on these key factors when picking an e-invoicing provider:

- Integration Speed: Can the solution be set up quickly to meet the FTA deadline?

- Technical Ease: Is the platform easy for your team to integrate, with clear API documentation?

- Compliance Guarantee: Does it ensure every invoice meets FTA standards on the first try?

- Security: Is your data stored locally in the UAE with top certifications like ISO 27001?

- Global Support: Are experts available locally and globally to help when needed?

- 24/7 Customer Support & Expert Consultation: Does the provider offer round-the-clock help and tailored advice?

- Gap Analysis & Readiness Assessment: Can they assess your systems and provide a clear compliance plan?

- Handles Government API Downtime: Does the platform keep operations running during FTA system outages?

- Seamless Multi-ERP Integration: Can it connect with multiple ERP systems for smooth workflows?

- Multi-Country Rollout: Does one integration support compliance in other countries?

- Scalability: Can the solution handle your transaction volume, whether you’re a small business or a large company?

By focusing on these, you can narrow down providers and avoid compliance risks. For a more detailed breakdown of each selection criterion, read our comprehensive guide on how to choose the right e-invoicing platform for your business.

What Makes the Best E-Invoicing Software?

| Capability | What It Means for Your Business |

|---|---|

| Fast to Set Up | Go live in weeks, not months, to meet tight UAE e-invoicing deadlines. |

| Works with Your Systems | Integrates easily with ERPs like SAP, Oracle, NetSuite, and custom or customer ERPs. |

| 100% Compliance | Automatically validates invoices to avoid FTA rejections. |

| Data Protection | Uses top security standards with local UAE data storage. |

| Scalability | Supports growing invoice volumes and future global compliance needs. |

| Expert Support | Provides 24/7 support from teams that understand UAE regulations. |

| Task Automation | Reduces manual work through auto-reconciliation and real-time reporting. |

| Cost and Time Savings | Lowers invoicing costs and effort with efficient, automated processes. |

| Developer-Friendly | Offers interactive API docs, real examples, code snippets, and try-it-now tools. |

| Reduced Implementation Effort | Guided workflows and automation simplify setup and configuration. |

| High Accuracy | Minimizes invoice errors to ensure correct submissions every time. |

| Compliance Assurance | Ensures every invoice meets FTA standards without fail. |

| User-Friendly Interface | Easy-to-use platform that teams can quickly learn and adopt. |

| Real-Time Visibility | Shows invoice status and updates instantly for full transparency. |

| Multi-Channel Support | Works across ERP, POS, accounting, and billing systems. |

| Multi-Country Support | Enables compliance across multiple countries through one solution. |

| Automated Validation | Checks invoices automatically against all rules with no extra effort. |

| Automated Invoice Creation | Creates and sends invoices quickly with minimal manual input. |

A great platform makes e-invoicing easy, cuts costs, boosts efficiency, and reduces your team's efforts.

How We Evaluated These Solutions

To compare Complyance, Pagero, EDICOM, Sovos, and Avalara, we used a thorough process based on:

- FTA Compliance: Checked if each provider meets the UAE’s Peppol-based, five-corner model requirements, including PINT AE XML standards and digital signatures.

- User Feedback: Reviewed sales calls, customer testimonials, and case studies for reliability and ease of use.

- Technical Capabilities: Assessed API documentation, ERP integration options, and setup speed.

- Security Standards: Verified certifications like ISO 27001 and local UAE data storage.

- Scalability: Evaluated support for multi-country compliance and high invoice volumes.

- Support Quality: Looked at the availability of 24/7 support, local expertise, and gap analysis services.

- Industry Reputation: Consider each provider’s experience in global e-invoicing markets.

- Built to Save Your IT/Dev's Time: Evaluated interactive, developer-friendly API documentation with real examples, code snippets, and try-it-now functionality, so developers can build without guessing.

This approach ensures our comparison reflects real-world performance and UAE-specific needs.

Top 5 E-Invoicing Solutions at a Glance

| Solution | Best For | Standout Feature | Key Advantages |

|---|---|---|---|

| Complyance | Global E-Invoicing with Developer-Friendly API | Go-live in a week with developer-friendly API | Single API for 100+ countries, 100+ automated validations, handles FTA downtime, multi-ERP integration, 24/7 support, gap analysis |

| Pagero | Network-based invoice automation | Peppol-certified network for B2B invoice exchange | Automates invoice lifecycle, global buyer-supplier network, Peppol-certified |

| EDICOM | EDI and e-invoicing expertise | Robust security with digital signature support | Strong EDI capabilities, global compliance in EU/LATAM/UAE, secure data handling |

| Sovos | Regulatory-focused e-invoicing | Scalable for global tax compliance | Supports multi-jurisdiction reporting, FTA-compliant invoicing, regulatory expertise |

| Avalara | Global tax and e-invoicing integration | Broad ERP integrations for tax and invoicing | Multi-country tax compliance, supports major ERPs, centralized dashboard |

In-Depth Look at Each E-Invoicing Provider

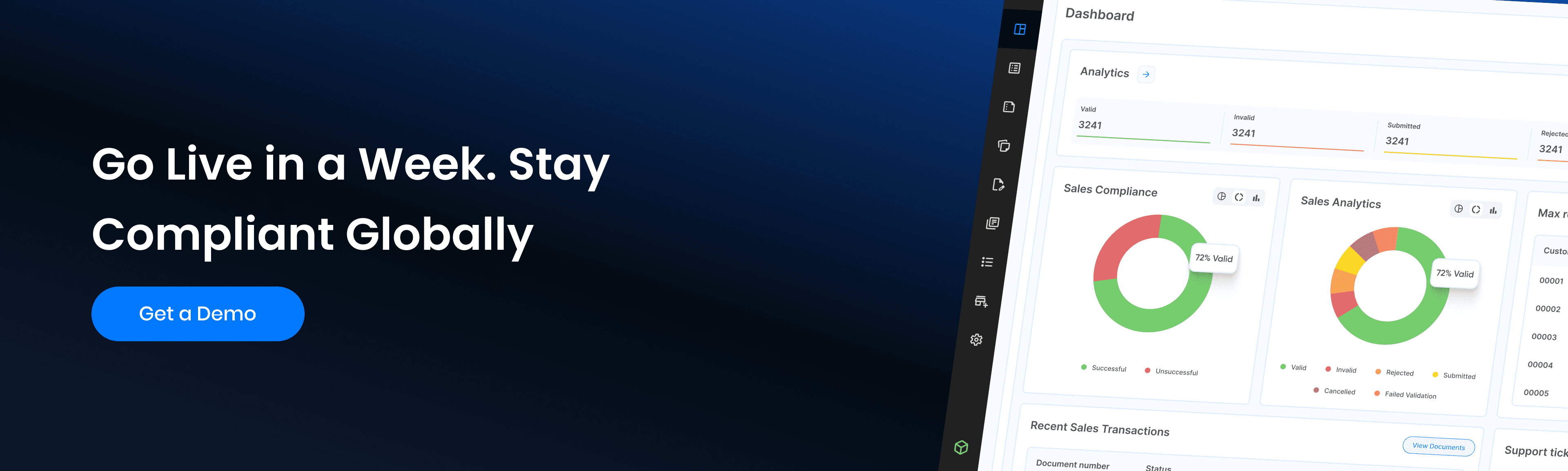

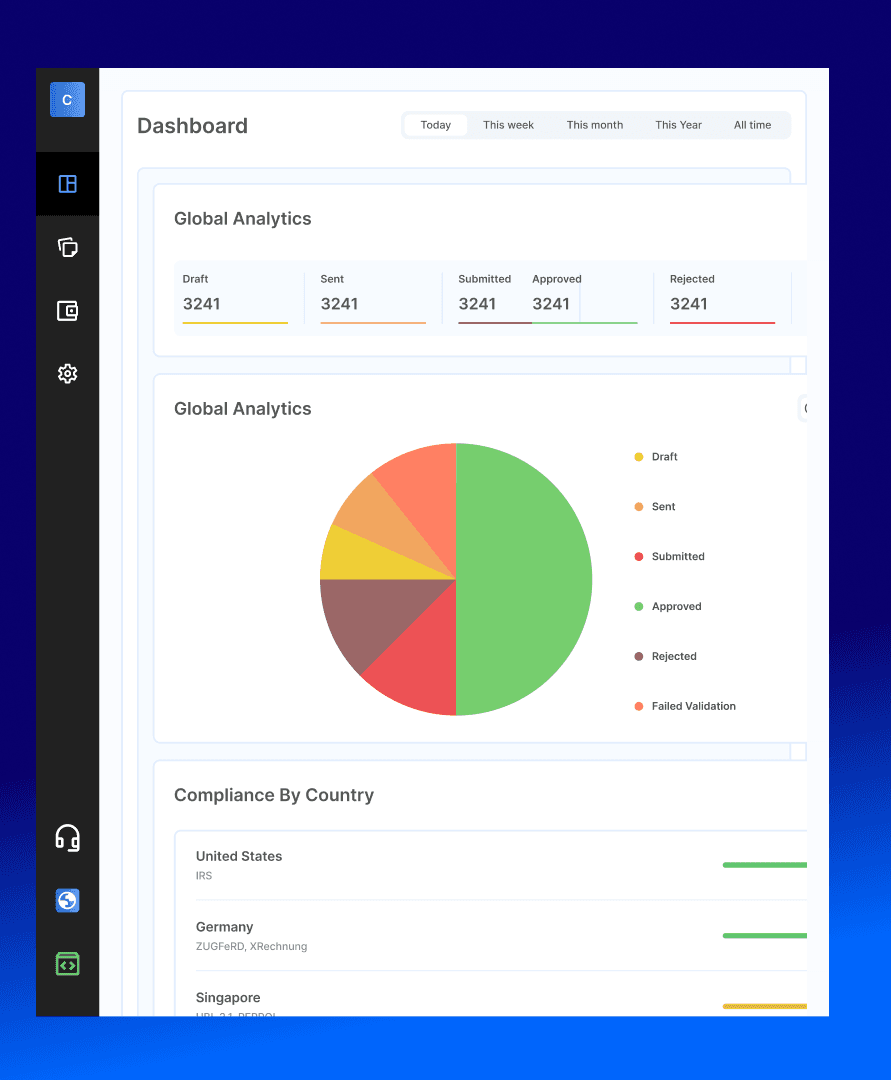

Complyance: Best Global E-Invoicing with a Developer-Friendly One API

Complyance stands out with its developer-first One API platform, enabling UAE FTA compliance in under a week. Complyance is an Accredited Service Provider under the UAE e-invoicing framework, ensuring structured invoice transmission through the Peppol network in alignment with Ministry of Finance requirements. Trusted by over 1,000 businesses globally, it processes 1.5 billion e-invoices annually, backed by five years of e-invoicing expertise. Its GETS proprietary framework allows one integration to cover e-invoicing in 100+ countries, making it ideal for businesses with global ambitions.

Key Features:

- Rapid Go-Live: Pre-built connectors and clear API documentation enable full integration in days.

- 100% Compliance Guarantee: 100+ automated validations ensure every invoice is FTA-accepted first time, avoiding penalties.

- Global Scalability: Single API supports E-invoicing in the UAE and beyond, perfect for expanding businesses.

- Top Security: ISO 27001-certified with UAE-based data storage, meeting MoF standards.

- Seamless ERP Integration: Connects with SAP, Oracle, NetSuite, and more for smooth workflows.

- Automated Reconciliation: Syncs ERP data with FTA submissions, cutting manual work.

- 24/7 Support: Local UAE experts and global teams provide round-the-clock help.

- Gap Analysis: Assesses your systems and offers a clear compliance roadmap.

- Handles FTA Downtime: Ensures operations continue during government API outages.

How Complyance Can Help Your Developers

Complyance’s API is designed for developers, featuring easy-to-follow API documentation that includes real-world examples, code snippets, and 'try-it-now' options to facilitate quick and simple setup. Install the SDK with:

Prerequisites:

What you'll need before getting started

Development Environment:

- Java 8+

- Maven/Gradle or npm/yarn (Coming Soon)

- IDE (IntelliJ, VSCode, etc.)

Platform Access

- Complyance API account

- API key (sandbox/production)

- Running backend services

Installation

Install the SDK using Java — support for Next.js, Python, Rust, PHP, and more is coming soon.

Java SDK

Maven

<dependency>

<groupId>io.complyance</groupId>

<artifactId>unify-sdk</artifactId>

<version>3.0.0-beta</version>

</dependency>Gradle

implementation 'io.complyance:unify-sdk:3.0.0-beta'Make sure you're using Java 8 or higher. You can verify with: java -version

Our One API key simplifies integration, and our detailed API documentation guides you through every step, whether you’re a developer or a business leader. With clear instructions, sample code, and interactive tools, you can integrate quickly and ensure compliance without guesswork.

At Complyance, we aim to make global e-invoicing easy, safe, and efficient, so you can focus on growing your business. Explore full API documentation or contact our support team to get started today!

Why Businesses Choose Complyance?

Our single API solution simplifies global compliance, lifting the burden from your IT/Dev team. Now you can focus on core business activities while we handle all e-invoicing complexity. Complyance makes FTA rules simple and saves you money, whether you're a small or large business. Ready to start? Schedule a demo to see Complyance in action.

All You Need for UAE E-Invoicing in One Platform.

Connect your ERP, validate invoices, and go live fast, all from one developer-friendly platform.

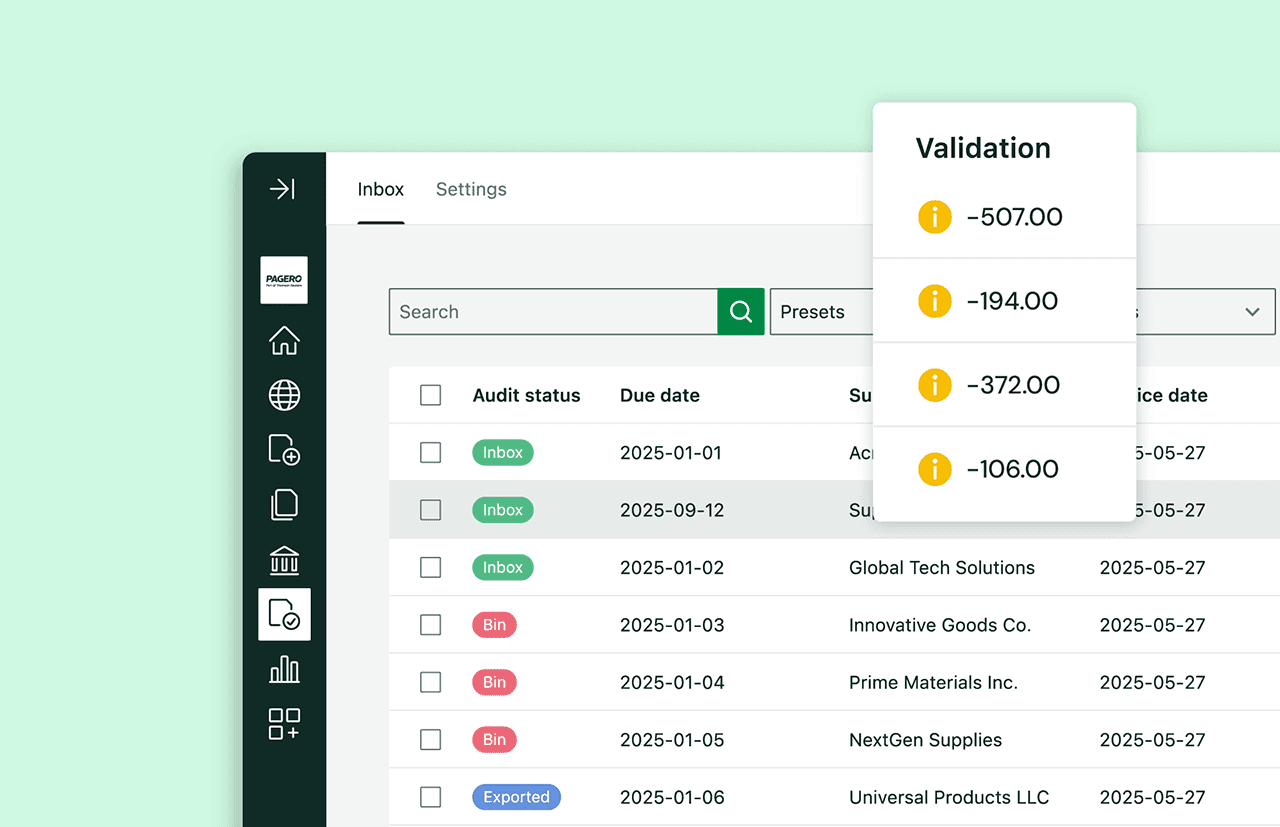

Pagero: Best for Network-Based Invoice Automation

Pagero, a Peppol-certified Access Point, automates B2B invoice exchanges and ensures UAE FTA compliance.

Its global network connects businesses to buyers and suppliers, facilitating seamless document exchange without the need for direct integrations with each partner.

As a leader in Peppol services, Pagero simplifies the transition to digital invoicing by handling the complexities of the five-corner model, making it a strong choice for companies with extensive supply chains in the UAE and beyond.

Key Features:

- Peppol Network Access: Direct connectivity to the FTA's Peppol framework for instant invoice delivery.

- Automated Workflow: Handles validation, transmission, and archiving of invoices in compliance with UAE standards.

- Partner Onboarding: Easy connection to thousands of trading partners worldwide via the Pagero network.

- Document Mapping: Converts various formats to PINT AE XML for FTA compatibility.

- Monitoring Tools: Real-time tracking of invoice status and delivery confirmations.

Pros:

- Peppol-certified for reliable B2B invoice exchange.

- Automates the entire invoice lifecycle.

- Connects to a global network of trading partners.

Cons:

- Less effective if your partners aren’t on Pagero’s network.

- Implementation can be slow and complex.

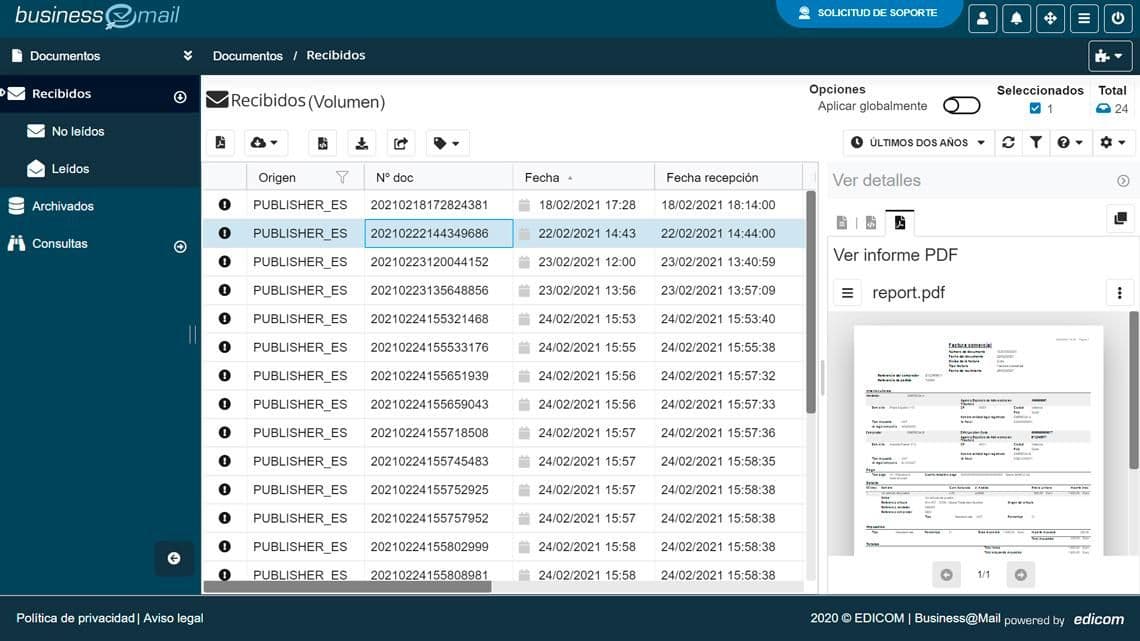

EDICOM: Best for EDI and E-Invoicing Expertise

EDICOM specializes in EDI and e-invoicing, offering FTA-compliant invoices with strong security, including digital signatures.

It supports compliance in Europe, Latin America, and the UAE, making it a go-to solution for enterprises with complex EDI needs. EDICOM's platform combines traditional EDI with modern e-invoicing, providing a hybrid approach that ensures secure, real-time exchanges while adhering to the Peppol-based model required by the FTA.

Key Features:

- EDI Translation: Converts legacy EDI formats to FTA-compliant e-invoices seamlessly.

- Digital Signing: Built-in certificate management for authenticating invoices per UAE regulations.

- Cloud-Based Platform: Scalable infrastructure for high-volume transactions with 99.99% uptime.

- Multi-Region Compliance: Pre-configured rules for UAE, EU, and LATAM e-invoicing mandates.

- Integration APIs: Connects with ERPs and custom systems for automated data flow.

Pros:

- Robust security with digital signatures.

- Global compliance across multiple regions.

- Strong EDI expertise for complex needs.

Cons:

- Setup requires significant technical expertise.

- Deployment is slower compared to API-driven solutions.

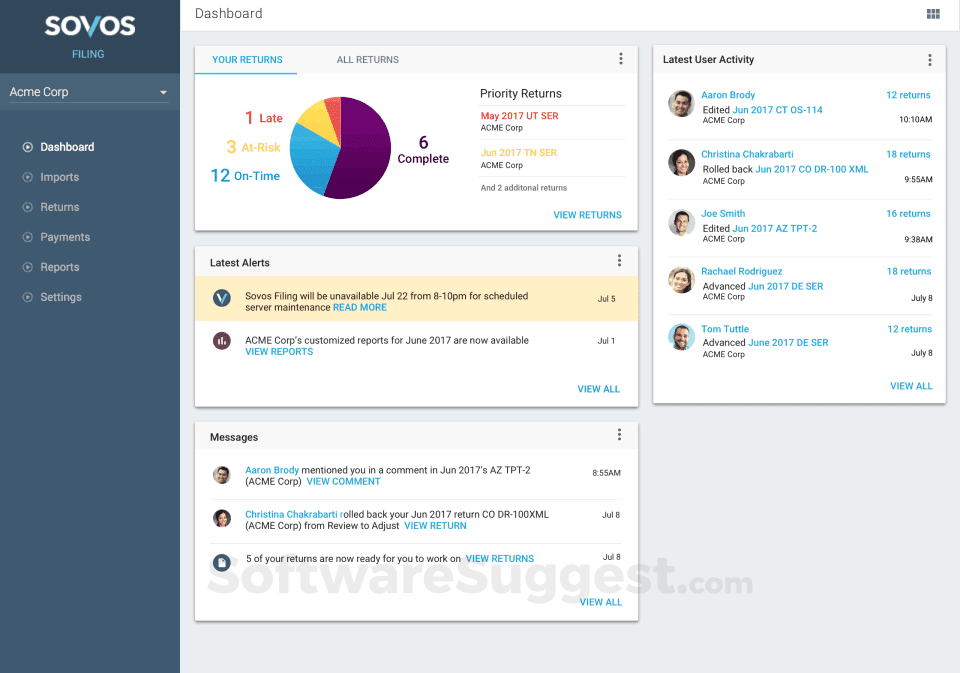

Sovos: Best for Regulatory-Focused E-Invoicing

Sovos provides e-invoicing within its tax compliance platform, supporting FTA-compliant invoices and multi-jurisdiction reporting.

It’s suited for businesses preparing for global mandates, with a deep emphasis on regulatory intelligence and continuous monitoring of changes in tax laws.

Sovos helps organizations stay ahead of evolving requirements like the UAE's 2026 deadline by offering proactive compliance tools and expert guidance.

Key Features:

- Regulatory Intelligence: Real-time updates on FTA rules and global tax changes.

- Continuous Transaction Controls: Validates invoices against FTA standards before submission.

- Cross-Border Reporting: Handles VAT and e-invoicing reporting for multiple countries.

- Data Archiving: Secure, long-term storage compliant with UAE retention policies.

- Consulting Services: Expert advice on implementing e-invoicing strategies.

Pros:

- Strong focus on regulatory compliance.

- Scalable for global e-invoicing needs.

- Supports FTA-compliant invoice generation.

Cons:

- The UAE-specific solution is still developing, with potential functionality gaps.

- Pricing is often too high for smaller businesses.

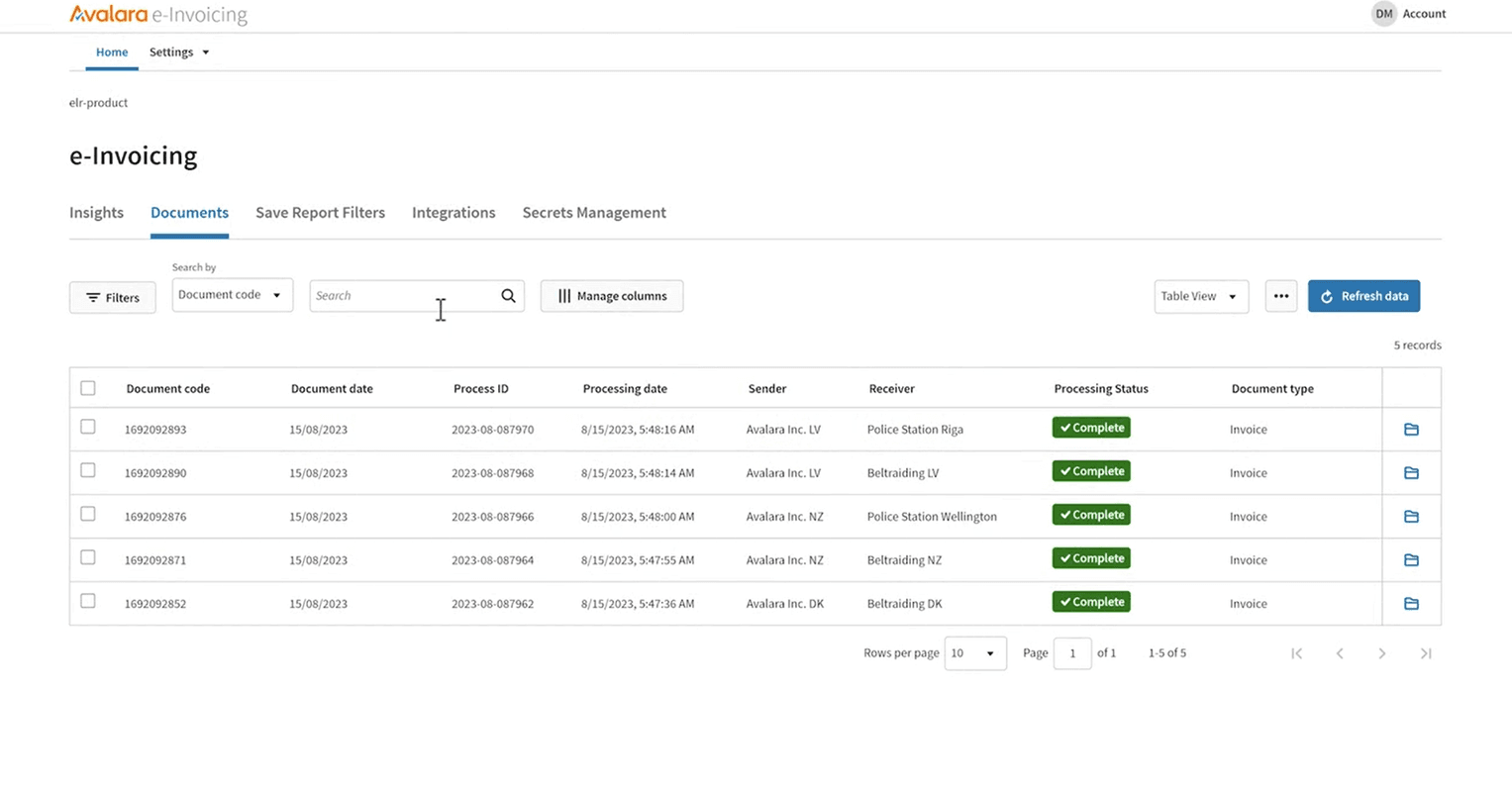

Avalara: Best for Global Tax and E-Invoicing Integration

Avalara offers e-invoicing within its tax compliance platform, integrating with ERPs like Oracle NetSuite for seamless workflows.

It’s ideal for businesses needing multi-country tax and invoicing solutions. With a strong focus on automated tax calculations and compliance, Avalara helps companies manage VAT, sales tax, and e-invoicing requirements across various jurisdictions, including the UAE's FTA mandate.

The platform's robust ecosystem ensures that tax and invoicing processes are handled in one place, reducing errors and improving efficiency for international operations.

Key Features:

- Comprehensive Tax Automation: Automatically calculates taxes and generates compliant invoices for UAE FTA and global requirements.

- ERP Integrations: Deep connections with systems like SAP, Microsoft Dynamics, and NetSuite for real-time data sync.

- Global Coverage: Supports e-invoicing in multiple countries, with built-in updates for changing regulations.

- Analytics Dashboard: Provides insights into tax liabilities, invoice status, and compliance metrics.

- Audit-Ready Reporting: Generates detailed reports for FTA audits and regulatory submissions.

Pros:

- Integrates with major ERPs (e.g., Oracle NetSuite).

- Supports global tax and e-invoicing compliance.

- Centralized dashboard for tax and invoicing data.

Cons:

- Setup can take months, especially for all businesses.

- Custom pricing is often expensive for startups or mid-sized firms.

Conclusion: Choose the Right E-Invoicing Partner with Confidence

Selecting the best e-invoicing software depends on your business needs, speed, scalability, and regulatory expertise.

Proven Success with Real-World Impact :

Over 100 companies, including global enterprises, have leveraged Complyance’s API-driven platform to achieve seamless e-invoicing compliance and operational excellence.

One standout case study involves LC Waikiki, a leading Turkish fashion retailer with a significant presence in Malaysia. Facing the challenge of managing separate systems for B2B (ERP-generated) and B2C (POS-based) invoicing, LC Waikiki needed a unified solution to comply with mandates without disrupting their high-volume retail operations. By integrating Complyance’s API, they achieved:

- Unified E-Invoicing: A single API streamlined both B2B and B2C invoicing, ensuring FTA compliance for both channels.

- Automated Workflows: POS receipts were automatically consolidated into daily invoices, reducing manual effort and errors.

- Real-Time Visibility: A centralized dashboard provided full visibility into submission status, rejections, and audit trails.

LC Waikiki now handles high-volume transactions effortlessly, with a scalable model ready for expansion into new markets. As their Regional IT Lead noted, "Managing B2B and B2C compliance together is complex, but with Complyance, it’s a single view, a single partner, and zero friction".

This case study exemplifies how Complyance’s API-centric approach drives tangible benefits:

1. Rapid Implementation: Go-live in weeks, not months, critical for meeting the UAE’s 2026 deadline.

2. Scalability: Effortlessly handle high-volume transactions and multi-country compliance through a single API.

3. Automation: Reduce manual processing by up to 70%, cut errors by 90%, and capture early payment discounts.

4. Strategic Advantage: Transform accounts payable from a cost center into a profit driver through intelligent automation and real-time analytics.

For businesses seeking a partner that combines technical excellence with proven results, Complyance offers a future-proof path to compliance and growth. The UAE’s mandate is not just a regulatory hurdle; it’s an opportunity to optimize your financial operations and unlock new efficiencies. Start your free trial with Complyance today and get compliant with confidence.

Related posts

Frequently Asked Questions

Complyance offers a developer-first e-invoicing API platform that lets you integrate UAE e-invoicing into your existing systems in under a week. We provide detailed API docs, a fully functional sandbox, quick-start guides, and real-time support so your engineering team can ship confidently and fast.

At the same time, it’s built for finance and Developer teams, offering Auto Mapping, validation logs, compliance tracking, and smart alerts that make managing e-invoicing easy even for non-technical users.

Yes. Complyance not only provides a developer-friendly e-invoicing API platform but also offers expert consultation for businesses preparing for UAE e-invoicing. This includes ERP gap analysis, sandbox testing, team training, and go-live support.

An ASP is a private entity approved by the Ministry of Finance that connects businesses to the UAE’s E-Billing System. It ensures invoices are converted into PINT AE format and securely exchanged with the Federal Tax Authority (FTA) via the Peppol network.

The UAE 5-corner model is a structured, secure way of processing e-invoices through a chain of five verified parties:

- The supplier (you) – the business that issues the invoice

- Your Accredited Service Provider (ASP) – your technology partner who validates and transmits invoices like Complyance

- The buyer’s ASP – the receiving partner that confirms and forwards the invoice

- The buyer – the customer receiving the validated invoice

- The Federal Tax Authority (FTA) – the regulatory body that logs and verifies tax data in real-time

This model is based on the global Peppol framework, used by countries leading in digital tax systems. That means every invoice follows a unified structure, is transmitted securely, and passes through multiple validation gates before it reaches the FTA and the buyer.

Complyance offers the most developer-friendly API, enabling fast and seamless integration. It's clear documentation and pre-built connectors ensure rapid FTA compliance. This makes it the top choice for technical teams.

Subscribe to our Newsletter

Get the latest compliance updates, e-invoicing news, and expert tips delivered to your inbox.

ABOUT COMPLYANCE

Empowering businesses to automate e-invoicing and stay compliant in 100+ countries. Our platform simplifies regulatory complexity for enterprises and fast-growing companies.