Top 5 UAE E-Invoicing Solutions for Accounting Firms Helping Clients Go Live

Discover the 5 best e-invoicing Solutions Partners for UAE accounting firms. Our guide compares latest solutions for fast implementation, scalability, and turning E-Invoicing into a profitable service for accounting firms.

Table of Contents

In the UAE, accounting firms form the backbone of business operations—handling VAT, corporate tax, auditing, legal compliance, and financial advisory services. But their role is rapidly evolving. Beyond traditional finance and compliance, firms are now expected to help clients transition to PINT-AE–compliant e-invoicing, which involves managing structured XML formats, secure government integrations, and real-time validation workflows to ensure full regulatory compliance.

Whether you're managing 20 clients or 2000+, you need a solution that’s not just compliant but scalable, efficient, accountant-friendly, and ensures error-free e-invoicing. You need a platform that is easy to integrate, user-friendly, and guarantees accuracy in every transaction.

We reviewed 20+ Solutions and shortlisted the 5 best e-invoicing partners for accounting firms in the UAE.

In this guide, we’ll explore the top e-invoicing partners and their solutions—examining how each supports UAE accounting firms, the benefits of partnering with them, and how these collaborations can help your firm deliver faster compliance and greater client value.

The Best E-Invoicing Solution Partner for Accounting Firms:

| Solution | Best For |

|---|---|

| Complyance | Smooth Client Onboarding & Scaling Your E-Invoicing Service Profitably |

| Avalara | Global Tax Compliance and Extensive ERP Integrations |

| Pagero | Network-Based Automation and Seamless Partner Connectivity |

| EDICOM | EDI and E-Invoicing Expertise |

| Comarch | Regulatory-Focused E-Invoicing |

What Makes an E-Invoicing Partner the Right Fit for Accounting Firms?

The table below outlines the essential criteria to evaluate potential partners.

| Key Selection Criteria | Why It Matters for Your Accounting Firm |

|---|---|

| Fast Implementation & Go-Live | A partner with a proven, rapid rollout process is crucial for onboarding clients quickly to meet the UAE's phased deadlines, helping you retain clients and build trust through timely compliance. |

| Multiple Industries | A provider with experience across various sectors (retail, manufacturing, logistics, services) understands the unique invoicing workflows and compliance nuances of your diverse client portfolio. |

| Guaranteed & Automated E-Invoicing | The solution must offer automated updates for regulatory changes and handle validation and reporting without manual intervention. A clear compliance guarantee protects your firm's reputation. |

| Scalable, Predictable Pricing Model | The fee structure (per client, per transaction, etc.) must be scalable and predictable. This allows you to confidently build a profitable pricing package for your clients without your own costs spiraling out of control. |

| Ability to Create New Revenue Streams | The solution should enable you to offer new services with a clear one-time payment structure, such as e-invoicing implementation, ongoing compliance management, advisory, and reporting/analytics packages, turning a compliance burden into a profit center. |

| Reduction in Manual Work Hours | The platform should automate manual data entry, validation, and submission tasks. This frees up your highly-billable staff from low-value administrative work, allowing them to focus on high-margin advisory services. |

| Improved Client Retention & Reduced Churn | By providing a seamless, reliable, and valuable compliance service, you become a stickier partner. Clients are less likely to leave a firm that seamlessly manages a complex and critical function for them. |

| Experience | A vendor with a long, proven track record has likely encountered and solved complex challenges, ensuring reliability and reducing risk for your firm and your clients. |

| Enterprise-Grade Security | With sensitive financial data at stake, features like data encryption, access controls, and certifications like ISO 27001 are non-negotiable for protecting your clients and your firm. |

| Proactive Support & Training | Choose vendors that provide excellent support for your team and offer resources to train your clients, easing adoption and positioning your firm as a guide. |

Detailed Breakdown: Top 5 E-Invoicing Solutions

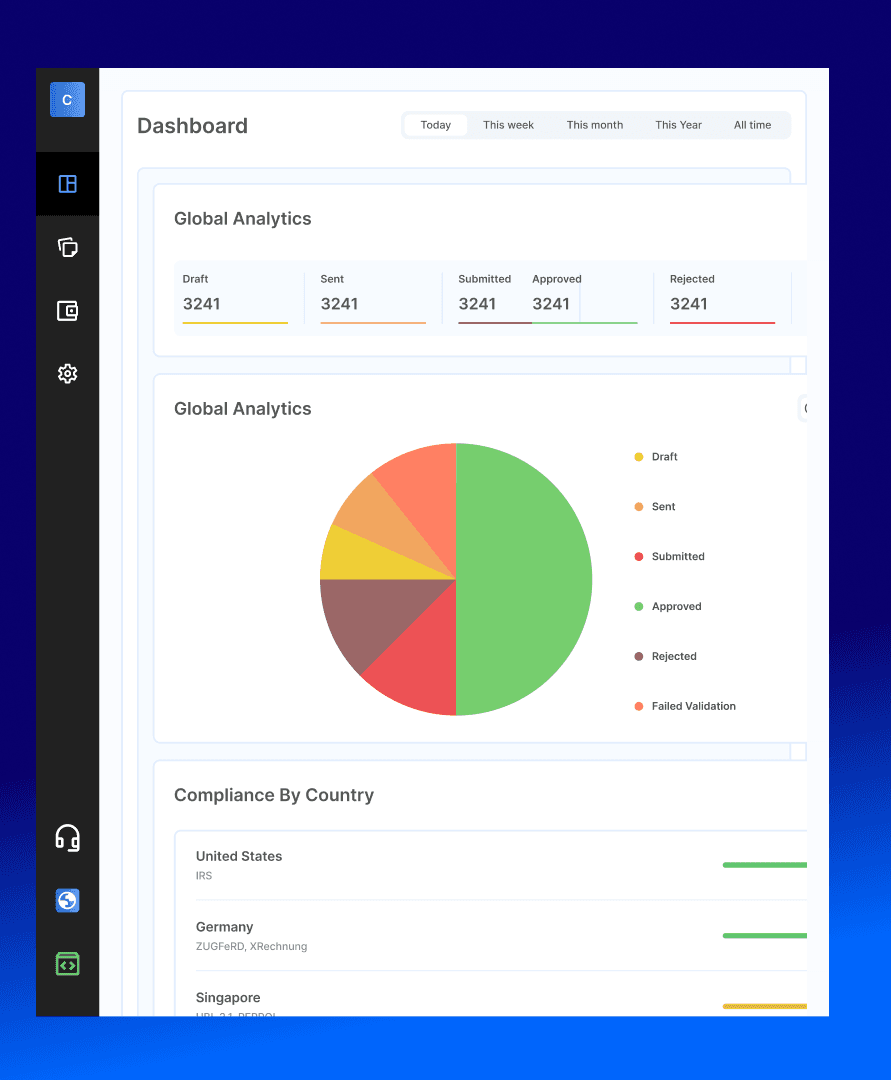

1. Complyance: Best for Smooth Client Onboarding & Scaling Your E-Invoicing Service Profitably

| Key Selection Criteria | Rating | Remarks |

|---|---|---|

| Fast Implementation & Go-Live | ✅ Excellent | Efficient processes for smooth client onboarding and scaling your e-invoicing service profitably, Promises client compliance in under a week. |

| Multiple Industries | ✅ Excellent | Versatile platform designed to handle the needs of a wide range of sectors, from retail and services to more complex trade. |

| Experience | ✅ Excellent | 5+ years of specialized e-invoicing expertise with a strong, proven track record in the UAE and other GCC countries. |

| Guaranteed & Automated Compliance | ✅ Excellent | 100+ automated validations, Explicit compliance guarantee. |

| Scalable, Predictable Pricing Model | ✅ Excellent | Transparent, scalable pricing per client, not per transaction, protects profit margins. |

| Ability to Create New Revenue Streams | ✅ Excellent | Enables firms to offer "Compliance as a Managed Service," a new, high-value revenue stream. |

| Reduction in Manual Work Hours | ✅ Excellent | Automates validation and submission, freeing senior staff for advisory work. |

| Improved Client Retention & Reduced Churn | ✅ Excellent | Fast, reliable onboarding and guaranteed compliance make the firm indispensable. |

| Enterprise-Grade Security | ✅ Excellent | ISO 27001 certified, UAE data storage. |

| Proactive Support & Training | ✅ Excellent | 24/7 support and gap analysis. |

| Use Cases & Adaptability | ✅ Excellent | Successfully implemented across 100+ real-world use cases, ensuring proven solutions for virtually any client scenario. |

Complyance understands that your firm's reputation hinges on accuracy and reliability. Its platform is built to eliminate e-invoicing risk and drastically reduce implementation time across your client portfolio.

Why We Recommend It: We recommend Complyance for accounting firms that view the e-invoicing mandate as a critical business risk that must be managed without eroding profitability or client trust. It is the definitive solution for firms that need to move fast, eliminate e-invoicing risk, and turn a regulatory challenge into a structured, profitable, and scalable service.

The Outcome You Will Get: By choosing Complyance, your firm will achieve rapid, worry-free onboarding for your entire client portfolio. You will transform your e-invoicing service from a time-consuming, manual liability into a smooth, profitable, and scalable practice area. The result is stronger client lock-in, protected revenue, and a future-proofed service offering for global expansion.

Top Features offered for Accounting Firms:

- Scalable, Per-Client Pricing: A predictable pricing model that allows you to easily build a profitable, resellable e-invoicing package for each client without your own costs spiraling.

- Rapid, One-Week Client Onboarding: Pre-built connectors and a streamlined process let you onboard a new client in under a week, securing compliance quickly and saving countless work hours on setup.

- "E-invoicing as a Service" Toolkit: Everything you need to launch a new, high-margin managed service, including guaranteed FTA acceptance, client training resources, and audit-ready reporting, turning a e-invoicing burden into a revenue stream.

- Global Compliance from One Platform: The ability to service your clients' international expansion needs from a single dashboard, making your firm the go-to advisor for global growth without multiple complex integrations.

Make UAE E-Invoicing Simple for Your Clients — and Profitable for You

E-invoicing isn’t just another mandate — it’s a business opportunity. Discover how firms are monetizing E-invoicing enablement with Complyance.

Pros:

- Accelerates client onboarding with pre-built ERP connectors, transforming a traditionally time-intensive process into a scalable, profitable service.

- Minimizes e-invoicing penalties through automated validations, protecting the firm's reputation

- Enables firms to offer global e-invoicing as a value-added service, attracting multinational clients

- Reduces manual oversight with audit-ready reporting, freeing staff for advisory roles

- add

Ideal Client Fit:

- Accounting firms with clients planning international expansion

- Practices needing rapid deployment across multiple clients

- Firms serving clients with complex compliance needs

- Firms serving diverse industries with proven use cases across retail, trading, services, and manufacturing sectors.

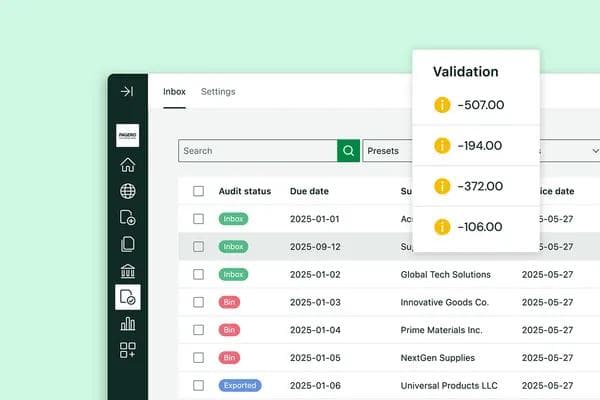

2. Pagero: Best for Network-Based Invoice Automation

| Key Selection Criteria | Rating | Remarks |

|---|---|---|

| Fast Implementation & Go-Live | ⚠️ Moderate | Network model is efficient long-term, Onboarding complex partners can take time. |

| Multiple Industries | ✅ Excellent | Particularly strong in supply-chain, healthcare, and distribution with complex supply chains. |

| Experience | ✅ Excellent | A long-established global network with deep experience in cross-border e-invoicing and compliance. |

| Guaranteed & Automated Compliance | 👍 Good | Automated regulatory updates across its network. |

| Scalable, Predictable Pricing Model | ⚠️ Moderate | Per-transaction fees can become costly for high-volume clients, potentially squeezing firm margins. |

| Ability to Create New Revenue Streams | 👍 Good | Strong for offering supply chain automation services to clients with complex partner networks. |

| Reduction in Manual Work Hours | 👍 Good | Automates partner connectivity and data capture, reducing reconciliation time. |

| Improved Client Retention & Reduced Churn | ⚠️ Moderate | While integration is deep, complex pricing and setup can sometimes become a point of friction with clients. |

| Enterprise-Grade Security | ✅ Excellent | Secure network infrastructure. |

| Proactive Support & Training | 👍 Good | While extensive resources exist, direct, personalized support can vary, and the platform's complexity often requires clients to be more self-reliant. |

Pagero operates a global network for e-invoicing and business communication. This network approach is ideal for firms with clients that have complex supply chains, both domestically and internationally.

Key Benefits for Accounting Firms:

- Simplified connectivity between businesses, suppliers, and tax authorities

- Seamless cross-border compliance for clients with international operations

- Reduced point-to-point integration complexity through a network approach

Pros:

- Streamlines e-invoicing for clients with complex supply chains, reducing manual reconciliation time

- Enhances client retention by offering cross-border compliance expertise

- Automates regulatory updates, saving accounting staff from manual compliance checks

- Supports diverse supply chain documents, allowing firms to expand service offerings

- Network effect creates natural client stickiness as more trading partners join the platform

- Peppol certification ensures future-proof compliance with emerging global standards

Cons:

- Per-transaction fees may reduce profitability for high-volume client accounts

- Network models may limit flexibility for clients needing bespoke invoicing workflows

- Onboarding clients with outdated systems could increase setup time and costs

- Initial implementation can be time-consuming when complex partner networks are involved

- Pricing structure may become unpredictable during high-transaction periods

- May require significant change management for clients unfamiliar with network-based systems

- The interface is not as intuitive or user-friendly for staff without technical training.

Ideal Client Fit:

- Manufacturing, logistics, Healthcare, and distribution companies with complex global supplier networks.

- Multi-jurisdictional businesses requiring automated cross-border compliance across 80+ markets.

- Accounting and tax advisory practices that need scalable, system-agnostic solutions for their international clients.

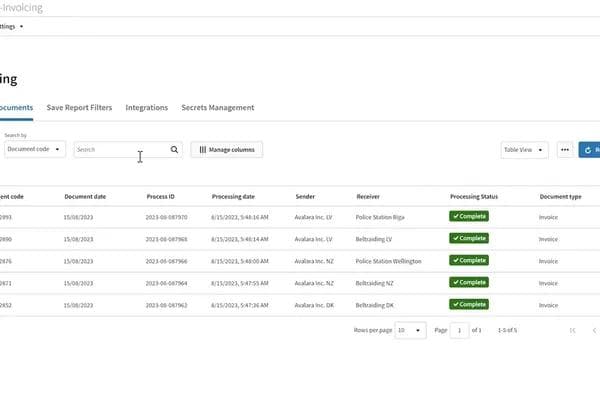

3. Avalara: Best for Global Tax Compliance

| Key Selection Criteria | Rating | Remarks |

|---|---|---|

| Fast Implementation & Go-Live | ⚠️ Moderate | API-first approach enables flexibility, Pre-built connectors speed up integration. |

| Multiple Industries | ✅ Excellent | Extensive experience across e-commerce, retail, SaaS, and numerous other sectors due to its vast integration library. |

| Experience | ✅ Excellent | A global leader in tax compliance with a long history and deep expertise in thousands of tax jurisdictions. |

| Guaranteed & Automated Compliance | 👍 Good | Strong automated tax compliance, Broad global coverage. |

| Scalable, Predictable Pricing Model | ⚠️ Moderate | Complex subscription tiers and potential for add-on costs require careful planning to maintain profitability. |

| Ability to Create New Revenue Streams | 👍 Good | Allows bundling of e-invoicing with existing Avalara tax compliance services. |

| Reduction in Manual Work Hours | 👍 Good | Automates complex global tax calculations and submissions. |

| Improved Client Retention & Reduced Churn | 👍 Good | Deep integration into client workflows makes the firm's service integral to their operations. |

| Enterprise-Grade Security | 👍 Good | Cloud-based security standards. |

| Proactive Support & Training | ⚠️ Moderate | Extensive resources and support. |

Avalara is a leader in cloud-based tax compliance, with pre-built connectors and integrations that make it highly adaptable for a wide range of client ERPs and accounting systems.

Key Benefits for Accounting Firms:

- Extensive global coverage for sales tax, VAT, and e-invoicing compliance

- Powerful API for custom integrations with diverse client systems

- Robust platform built for scalability and evolving regulatory needs

Pros:

- Supports diverse client tech stacks, broadening the firm’s addressable market

- Automates tax and compliance tasks, allowing accountants to focus on advisory services

- Scalable platform supports growing client portfolios without additional overhead

- Strong brand recognition helps firms build credibility when pitching compliance services

Cons:

- API setup may require hiring external developers, increasing implementation costs

- Lack of explicit FTA compliance guarantee may raise concerns for risk-averse firms

- Variable costs from subscription tiers could impact budgeting for smaller practices

- A complex pricing structure with multiple add-ons can make cost forecasting challenging

- Learning curve for full platform utilization may require significant training investment

- May be over-featured for firms with simple, UAE-only compliance needs

Ideal Client Fit:

- Companies with diverse ERP and e-commerce platforms require seamless integrations through APIs and prebuilt connectors.

- Practices require robust API capabilities to build custom e-invoicing and reporting solutions.

- Accounting firms already using Avalara for tax compliance who want to extend its benefits to e-invoicing.

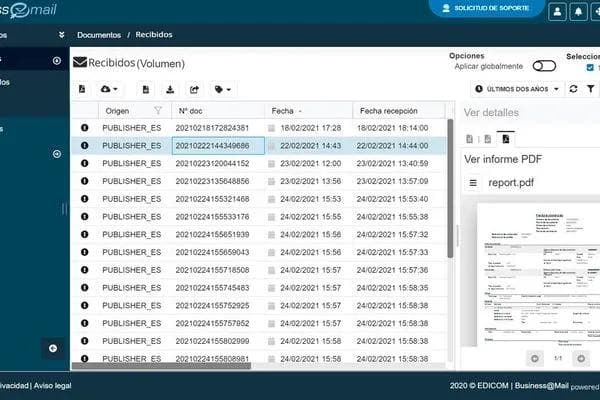

4. EDICOM: Secure EDI and E-Invoicing Expertise

| Key Selection Criteria | Rating | Remarks |

|---|---|---|

| Fast Implementation & Go-Live | ⚠️ Moderate | Robust platform may require longer setup, Customization can extend timelines. |

| Multiple Industries | ✅ Excellent | Deep expertise in highly regulated sectors like pharmaceuticals, automotive, and finance. |

| Experience | ✅ Excellent | A long-standing, certified service provider with a proven track record in EU, LATAM, and global compliance. |

| Guaranteed & Automated Compliance | 👍 Good | Certified service provider; automated updates. |

| Scalable, Predictable Pricing Model | ⚠️ Moderate | Enterprise-tier pricing and potential for high customization costs can impact ROI for smaller firms. |

| Ability to Create New Revenue Streams | 👍 Good | The all-in-one platform allows firms to offer premium, fully-managed EDI and e-invoicing packages. |

| Reduction in Manual Work Hours | 👍 Good | Automates complex B2B data exchanges, reducing manual handling for large clients. |

| Improved Client Retention & Reduced Churn | 👍 Good | High level of security and certification builds deep trust with clients in regulated industries. |

| Enterprise-Grade Security | ✅ Excellent | Strong emphasis on security and long-term archival. |

| Proactive Support & Training | 👍 Good | Dedicated support and training resources. |

EDICOM offers a comprehensive e-invoicing platform that includes integration, compliance, and Electronic Data Interchange (EDI) capabilities. They have a long track record and are a certified service provider for tax authorities worldwide.Key Benefits for Accounting Firms:

- All-in-one platform for e-invoicing, tax compliance, and EDI with a strong emphasis on data security

- Long-term archival ensuring full audit readiness

- Certified provider status with tax authorities globally

Pros:

- Reduces risk of audit penalties with secure, long-term archiving, critical for regulated clients

- Simplifies vendor management with an all-in-one platform, lowering administrative overhead

- Certified provider status builds client trust in compliance processes

- Automated compliance updates save time on regulatory research for accountants

- Comprehensive EDI capabilities enable firms to serve clients with complex B2B requirements

- Strong track record in highly regulated sectors (pharmaceuticals, automotive, finance)

Cons:

- A complex platform may require extensive staff training, increasing implementation overhead

- Higher costs for unused features could strain budgets for smaller firms

- Customization for unique client needs may extend implementation timelines

- Enterprise focus may make it overkill for SME-focused accounting practices

- Potentially longer onboarding period compared to more streamlined solutions

- Premium pricing structure may limit profitability when serving mid-market clients

Ideal Client Fit:

- Multinational corporations in highly regulated sectors require guaranteed compliance across 80+ countries

- Enterprises needing certified, long-term e-invoice archiving that meets strict legal audit requirements

- Large businesses seeking seamless ERP integration for fully automated, compliant data exchange

5. Comarch: Robust Archiving and EDI Integration

| Key Selection Criteria | Rating | Remarks |

|---|---|---|

| Fast Implementation & Go-Live | ⚠️ Moderate | Managed services can accelerate the process for clients. |

| Multiple Industries | ✅ Good | Strong presence in manufacturing, wholesale, and other sectors with complex EDI and high-volume transaction needs. |

| Experience | ✅ Excellent | Decades of experience providing enterprise-grade IT and EDI solutions for large, complex organizations. |

| Guaranteed & Automated Compliance | ✅ Excellent | Regulatory-focused with strong compliance mandates. |

| Scalable, Predictable Pricing Model | ⚠️ Moderate | Premium pricing is best suited for serving large enterprise clients, limiting use for SME-focused firms. |

| Ability to Create New Revenue Streams | ✅ Excellent | Ideal for creating high-value, enterprise-grade service offerings for multinational corporations. |

| Reduction in Manual Work Hours | ✅ Good | Handles high-volume, complex transactions efficiently, automating major workflows. |

| Improved Client Retention & Reduced Churn | ✅ Good | Enterprise-grade solution deeply embeds the firm as a strategic partner for top-tier clients. |

| Enterprise-Grade Security | ✅ Good | Meets enterprise security requirements. |

| Proactive Support & Training | ⚠️ Moderate | Managed services are available but may involve longer response times for standard support tiers. |

Comarch provides enterprise-grade IT solutions, including a robust e-invoicing and EDI (Electronic Data Interchange) platform. For accounting firms serving large or multinational corporations, Comarch offers the scalability required for complex business environments.

Key Benefits for Accounting Firms:

- Strong EDI heritage and ability to handle high-volume, complex B2B data exchange

- Deep integration capabilities for enterprise ERP systems

- Scalable architecture for a multinational corporation needs

Pros:

- Handles high-volume invoicing, ideal for firms with large corporate clients

- Enhance service offerings with EDI capabilities, attracting premium clients

- Ensures audit compliance with secure archiving, reducing risk for high-stakes accounts

- Scalable platform supports firm growth without needing multiple vendors

- Strong regulatory focus provides confidence for clients in heavily regulated industries

Cons:

- Complex integrations with legacy systems may increase setup costs and time

- Premium pricing may not suit firms with smaller or mid-sized clients

- Advanced features may require specialized training, impacting staff productivity

- Enterprise focus means limited flexibility for clients with simpler needs

- Higher total cost of ownership compared to solutions designed for smaller deployments

Ideal Client Fit:

- Firms serving large enterprises and multinational corporations

- Organizations with complex supply chains that require automation, validation, and secure transaction management.

- Accounting firms with clients requiring high-volume processing

| Your Firm's Primary Need / Goal | Recommended Tool | Key Reason |

|---|---|---|

| If you want to onboard clients fast and increase your revenue and avoid E-Invoicing risks." | Complyance | Delivers the fastest client onboarding with a guaranteed compliant outcome, allowing your firm to offer e-invoicing as a streamlined, profitable managed service rather than a costly administrative burden. The platform's ability to scale across multiple countries enables your firm to provide global e-invoicing compliance from a single, unified platform. |

| If you want to automate invoicing for clients with complex global supply chains. | Pagero | The network-based approach automates document exchange across entire supplier and customer ecosystems, making it ideal for logistics, manufacturing, and distribution clients. |

| If you want to manage global tax and e-invoicing under one roof for diverse tech stacks. | Avalara | With an extensive library of over 1,400 pre-built integrations, it seamlessly adds e-invoicing to a best-in-class global tax automation platform. |

| If you want to serve clients in regulated sectors with maximum security and archival. | EDICOM | With a focus on long-term, tamper-proof archiving and robust EDI, it is built for audit-heavy, high-risk sectors. |

| If you want to support large enterprises with high-volume EDI and global compliance. | Comarch | Its enterprise-grade platform is designed for scalability and complex integrations, perfect for serving multinational corporations with sophisticated needs. |

Implementation Guide: Selecting Your E-Invoicing Partner

Conduct a Technical Audit

- Map Client Systems: Identify primary ERPs (SAP, Oracle, Microsoft Dynamics, NetSuite) and accounting platforms (QuickBooks, Xero) your clients use.

- Pre-built Connectors: Shortlist providers with the strongest pre-built connectors to these systems to minimize custom development.

- Assess Complexity: Evaluate integration for your most challenging client environments (e.g., legacy systems, complex workflows).

- Calculate Efficiency Gains: Prioritize solutions that automate data entry and validation, directly saving your team countless administrative hours and reducing operational costs.

Evaluate E-invoicing Breadth

- Global Coverage: Confirm the solution's compliance track record in all countries where your clients operate or plan to expand.

- UAE FTA Expertise: Verify specific accreditation and a proven track record with the UAE's FTA requirements and its five-corner model.

- Regulatory Roadmap: Assess the provider's proactive plan for adapting to future regulatory changes and new mandates.

Scrutinize Service and Support

- Dedicated Management: Inquire about dedicated account management tailored for accounting firms.

- Support SLAs: Review Service Level Agreements for guaranteed response and resolution times.

- Training Resources: Evaluate the quality of training materials for both your internal team and your clients to ensure smooth adoption.

Analyzing Total Cost of Ownership

- Look Beyond Sticker Price: Account for all implementation costs, including setup, customization, and data migration.

- Understand Fee Models: Consider per-invoice or transaction fees and project how they will scale with your client volume.

- Calculate True ROI: Factor in the value of saved manual hours, reduced compliance risk, and the ability to offer new advisory services.

Conclusion: Turning E-Invoicing into Competitive Advantage

The UAE's e-invoicing mandate presents more than a regulatory hurdle; it's an opportunity to streamline operations, enhance client value, and position your firm as a leader in the digital accounting landscape.The most forward-thinking accounting firms aren't just seeking compliance; they're selecting partners that will help them transform their delivery service. By choosing a solution that scales with your practice and integrates seamlessly across your client portfolio, you're investing in more than compliance; you're investing in your firm's future.Don't just adapt to the future, define it. Start your e-invoicing partner evaluation today and turn the UAE's mandate into your firm's strategic advantage.

Related reading:

- Top 5 E-Invoicing Partners for IT Services Implementing for Clients in 2025

- The 5 Best UAE E-Invoicing Software in 2025

- How to Choose the Right E-Invoicing Provider in the UAE

Related posts

Frequently Asked Questions

Complyance is the best solution for fast client onboarding. It offers developer-friendly APIs and pre-built connectors designed to make a client compliant in under one week. This speed allows your firm to onboard clients quickly to meet deadlines, retain them, and build trust.

It's a regulatory requirement where accounting firms must help clients generate and report invoices in a specific, structured XML format (PINT-AE) that integrates directly with the government's system (the "5-corner model") for real-time validation.

VAT was primarily about accurate reporting on returns. E-invoicing is about the invoice creation itself. You're now responsible for ensuring the client's invoicing system is compliant in real-time, not just the final numbers on a form.

The UAE 5-corner model is a structured, secure way of processing e-invoices through a chain of five verified parties:

- The supplier (you) – the business that issues the invoice

- Your Accredited Service Provider (ASP) – your technology partner who validates and transmits invoices like Complyance

- The buyer’s ASP – the receiving partner that confirms and forwards the invoice

- The buyer – the customer receiving the validated invoice

- The Federal Tax Authority (FTA) – the regulatory body that logs and verifies tax data in real-time

This model is based on the global Peppol framework, used by countries leading in digital tax systems. That means every invoice follows a unified structure, is transmitted securely, and passes through multiple validation gates before it reaches the FTA and the buyer

- Strong Experience

- Scalability

- Multiple Industry Coverage

- Proactive Support

- Enterprise Security

- Predictable Cost Structure

- Fast Implementation Time

Subscribe to our Newsletter

Get the latest compliance updates, e-invoicing news, and expert tips delivered to your inbox.

ABOUT COMPLYANCE

Empowering businesses to automate e-invoicing and stay compliant in 100+ countries. Our platform simplifies regulatory complexity for enterprises and fast-growing companies.