Choosing an E-Invoicing Provider in the UAE: A Step-by-Step Guide

Follow our step-by-step guide to select your UAE e-invoicing provider. Get the official MoF compliance checklist and discover the 8 advanced features that guarantee a smooth, future-proof transition for your business.

Table of Contents

With over 100+ providers competing for your business, how can you be sure you're choosing the one that won't put your E-Invoicing at risk?

The upcoming e-invoicing mandate from the Federal Tax Authority is a fundamental shift in how businesses operate, designed to bring greater transparency and efficiency to the economy.

One of the biggest steps in adapting to this change is choosing the right e-invoicing solution for your business.

Your provider will be the strategic partner in your compliance journey, handling sensitive data and ensuring seamless integration with your financial operations.

The wrong choice can mean delayed implementation, security risks, and painful compliance headaches. The right choice means a smooth, fast transition that sets your business up for the future.

Let's walk through the exact steps to evaluate an Accredited Service Provider based on the official Ministry of Finance guidelines and analyze how to choose a partner you can truly trust for this transition.

Why Your Choice of E-Invoicing Vendor Matters More

Think of your e-invoicing provider as a new member of your finance team. This team member handles sensitive data, reports to government systems, and must never make a mistake.

A good provider does more than just make you compliant. They make your team's life easier by,

- Helping you go live faster

- Avoid costly errors

- Scale as you grow.

The Foundation: What the UAE Ministry of Finance Requires

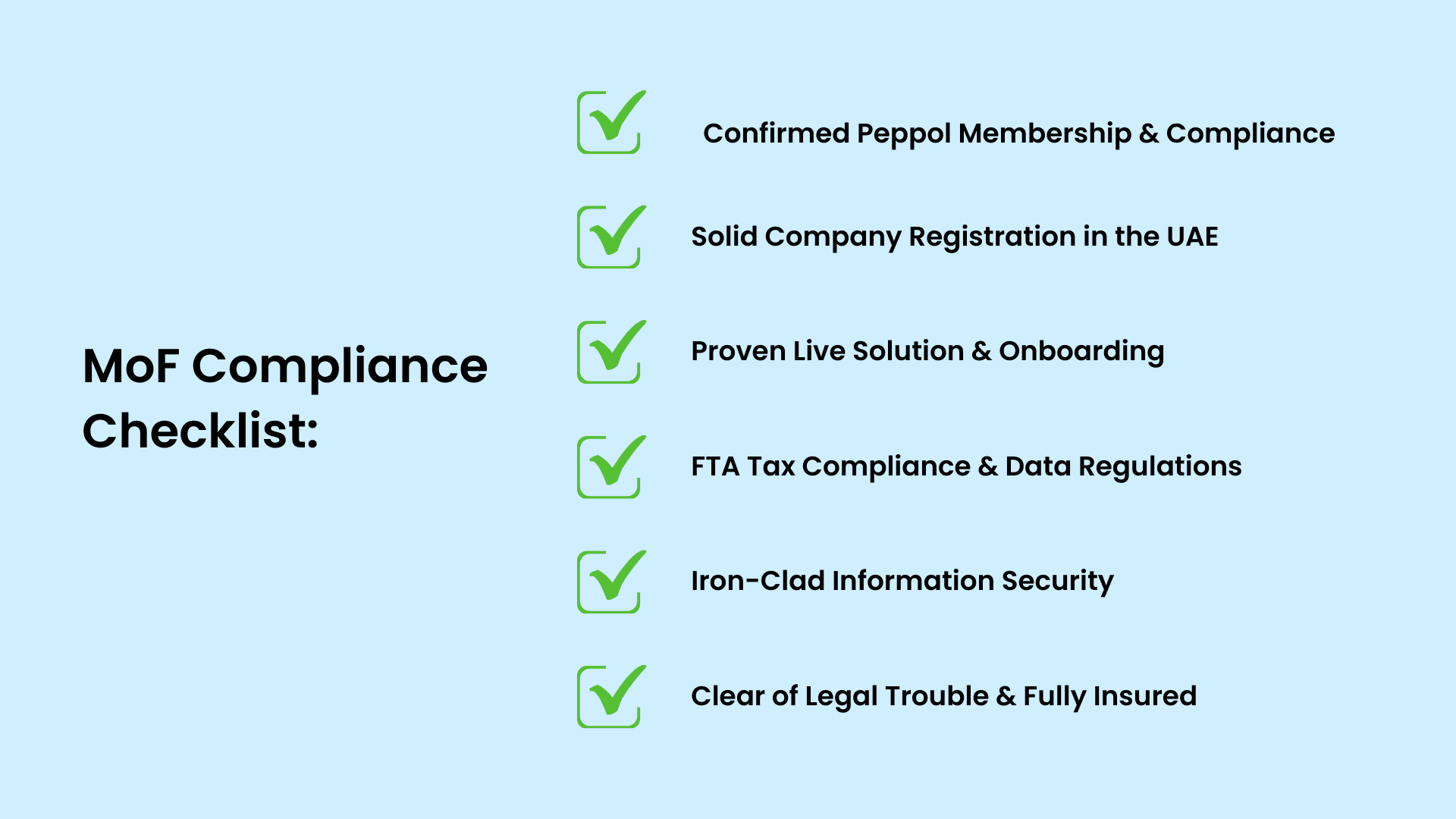

The MoF has a strict checklist for a reason. They need to ensure every accredited provider is stable, secure, and reliable. Here are the non-negotiable basics you must verify.

1. Confirmed Peppol Membership & Compliance

First, ask the provider for their Peppol Service Provider ID. This proves they are a registered member of the global Peppol network. Then, confirm they meet the UAE-specific PINT standards. This ensures your invoices will be accepted across the UAE and in over 40 countries.

2. Solid Company Registration in the UAE

Your provider must have real roots here. Check that they have a legal presence, either as a local UAE company or a foreign company with a registered office. Make sure they have their trade license. The MoF also requires a minimum paid-up capital of AED 50,000 and at least two years of operational history. This proves they’re here for the long run.

3. Proven Live Solution & Onboarding

To confirm a provider has a proven solution, check for these essential things:

A Live, Working Demo: They should be able to show you how their platform works in real-time. This proves the software is functional and not just a concept.

Real Customer Stories: Know their previous customer stories. Understanding their experience with businesses similar to yours provides the strongest validation that their solution performs reliably in real-world scenarios.

Guided Onboarding: Ensure the onboarding process is a smooth, guided experience, not something your team has to struggle through alone. You'll want clear steps and direct support, not just a login and a manual. A well-structured onboarding is crucial for a fast and successful launch.

4. FTA Tax Compliance & Data Regulations

Your provider must be fully compliant with the Federal Tax Authority itself. This includes their own VAT and Corporate Tax registrations. Crucially, they must guarantee that all your taxpayer data is hosted, processed, and stored within the UAE to meet strict data residency laws.

5. Iron-Clad Information Security

This is huge. Your financial data is precious. Your provider must have:

- ISO 27001 Certification: The international gold standard for information security.

- Strong Encryption: Data must be encrypted both when it's being sent and when it's stored.

- Multi-Factor Authentication (MFA): An extra layer of security for all logins.

- Continuous Monitoring: To detect and stop threats before they become problems.

6. Clear of Legal Trouble & Fully Insured

A simple but important check is to ensure the provider has no ongoing liquidation proceedings or blacklist status in the UAE. They must also hold active insurance policies for cybersecurity, professional indemnity, and crime as defined by UAE law.

Best E-Invoicing Option: What Most Providers Don't Offer But You Really Need

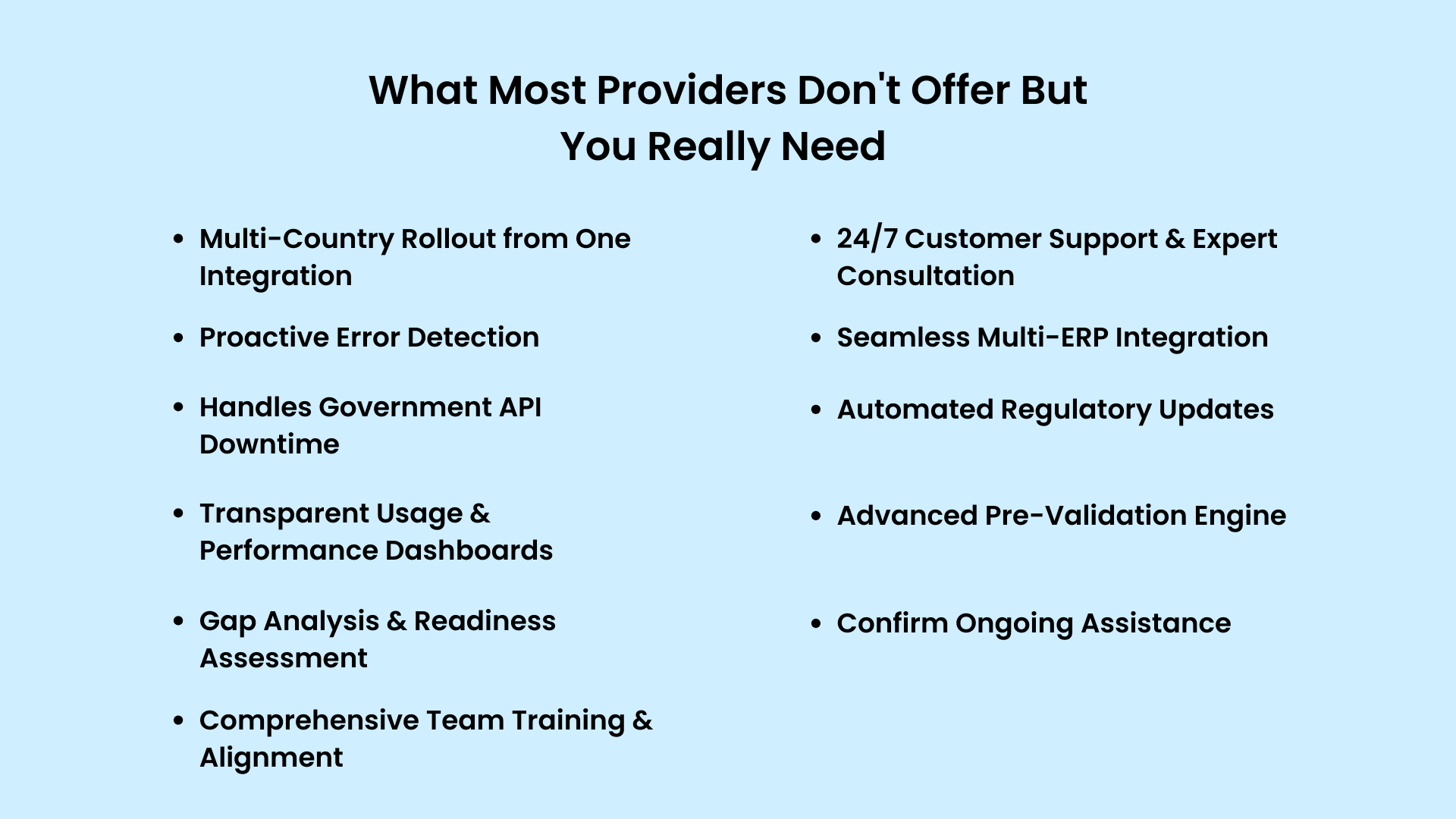

Meeting MoF requirements is the bare minimum for operation, but truly successful e-invoicing implementation requires more. While most providers stop at compliance, you should look for these capabilities that ensure long-term success.

Multi-Country Rollout from One Integration:

Do you do business in Saudi Arabia, Egypt, or Oman? The best providers let you manage e-invoicing across multiple countries through a single, simple integration with your ERP. This saves you from starting from scratch every time a new mandate is announced.

Proactive Error Detection:

Instead of just telling you an invoice failed, a great platform guides you to the exact error before you even send it, saving you time and preventing compliance rejections.

Handles Government API Downtime:

Government systems can sometimes be slow or go down. Your provider should have a smart system that queues your invoices and automatically sends them once the system is back, so you don’t have to lift a finger.

Transparent Usage & Performance Dashboards:

You should have a clear dashboard showing your invoice status, usage counts, and compliance health. No hidden fees or surprises.

Gap Analysis & Readiness Assessment:

They should conduct a thorough gap analysis of your current systems to align data fields, formats, and workflows with UAE standards and provide a clear Peppol integration assessment.

For a detailed, step-by-step plan to conduct your own internal readiness check, read our guide: How to Prepare for UAE E-Invoicing in 6 Simple Steps.

Comprehensive Team Training & Alignment:

The provider should help you train and align your Finance, Tax, IT, Procurement, and Sales teams on their specific roles, ensuring company-wide readiness through role-based training and microlearning.

24/7 Customer Support & Expert Consultation:

Ensure access to round-the-clock support, including consultation with tax experts for complex queries, not just technical help.

Seamless Multi-ERP Integration:

In-house expertise to integrate with any ERP, POS, or accounting system you use, from SAP, Oracle, and MS Dynamics to QuickBooks, Xero, Zoho, and Shopify.

For a detailed, technical guide on preparing your specific ERP system for this integration, including PINT AE compliance and TRN validation, read our comprehensive article: Preparing ERP Systems for E-Invoicing in the UAE.

Automated Regulatory Updates:

A guarantee that their platform will be automatically updated to reflect any future changes in FTA regulations, removing the compliance burden from your team.

Advanced Pre-Validation Engine:

Beyond basic error checking, a sophisticated engine that rigorously validates invoice data against all current business and FTA rules before submission.

Confirm Ongoing Assistance:

Your partnership shouldn’t end at go-live. Ensure they offer continuous support, including proactive platform updates, responsive issue resolution, and expert guidance to navigate evolving requirements.

Conclusion: Best E-Invoicing Platform for Your Business Needs

Choosing your e-invoicing partner is a strategic decision. By carefully verifying a provider against the MoF's requirements and ensuring they offer the advanced capabilities for future growth, you're selecting a strategic partner that will make your team more efficient and your business more resilient. The right provider will transform a mandatory change into a competitive advantage.

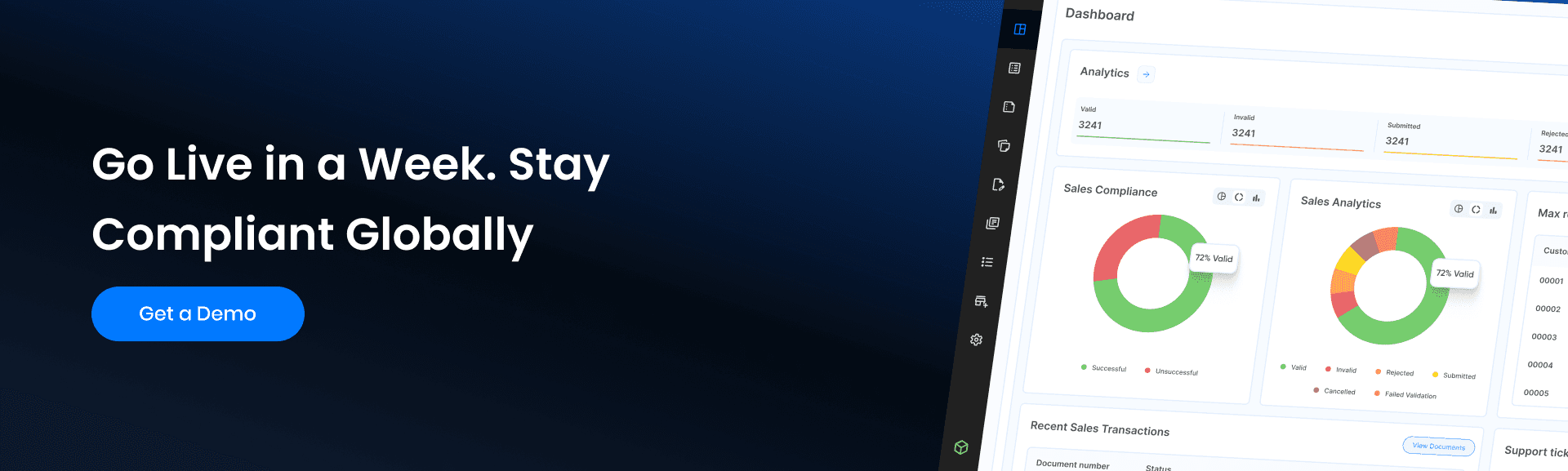

Your Next Step: Experience Free

E-invoicing. Instead of just reading about features, gain firsthand experience to understand how it will actually work for your business. Complyance is an Accredited Service Provider under the UAE e-invoicing framework. With 5 years of deep domain expertise, we’ve built a platform that doesn’t just meet standards, it exceeds them.

We invite you to try our exclusive Free UAE E-Invoicing Experience with a 14-day trial. It’s designed to let you:

- Explore the platform firsthand.

- Test your own invoice files.

- See how easy a fast, smooth go-live can be.

Related posts

Frequently Asked Questions

Key requirements include using the Peppol-based 5-corner model, where invoices must be exchanged through Accredited Service Providers (ASPs) accredited by the Federal Tax Authority (FTA). Invoices must be generated in specific digital formats like XML or JSON using structured standards such as PINT AE (Peppol International Invoice for UAE). Real-time reporting to the FTA is mandatory, and invoices must include mandatory fields like supplier/buyer Tax Identification Numbers (TRNs), VAT breakdowns, and invoice types as per the UAE Data Dictionary.

- Complyance for a global e-invoicing developer-friendly API

- Avalara for global tax and e-invoicing integration

- Pagero for network-based invoice automation

- EDICOM for EDI and e-invoicing expertise

- Sovos for regulatory-focused e-invoicing

E-invoicing is the mandatory digital creation and exchange of invoices in a structured format that can be automatically validated by computers. Instead of sending PDF or paper invoices, VAT-registered businesses must submit digital invoices through approved Accredited Service Providers (ASPs) that validate and share them with buyers and the Federal Tax Authority.

The UAE 5-corner model is a structured, secure way of processing e-invoices through a chain of five verified parties:

- The supplier (you) – the business that issues the invoice

- Your Accredited Service Provider (ASP) – your technology partner who validates and transmits invoices like Complyance

- The buyer’s ASP – the receiving partner that confirms and forwards the invoice

- The buyer – the customer receiving the validated invoice

- The Federal Tax Authority (FTA) – the regulatory body that logs and verifies tax data in real-time

Complyance is a global e-invoicing platform that works in 100+ countries through one simple API. It takes care of tax rules, formats, and real-time checks, no changes needed in your ERP, Accounting software, or POS. Our GETS framework turns your invoice into the right format for each country automatically. From Peppol to PINT, Complyance helps you stay compliant without the manual work.

Mandatory fields are essential for every invoice and must be included without exception. They form the foundation of a compliant e-invoice, and omitting any of these will result in rejection by the tax authority.

Examples include:

- Invoice number (BT-1)

- Invoice issue date (BT-2)

- Seller's Tax Registration Number (TRN)

- Total amount with tax

For a complete breakdown of all 50 mandatory fields and conditional scenarios, refer to our detailed blog: UAE E-Invoicing Data Dictionary: A Comprehensive Guide.

Subscribe to our Newsletter

Get the latest compliance updates, e-invoicing news, and expert tips delivered to your inbox.

ABOUT COMPLYANCE

Empowering businesses to automate e-invoicing and stay compliant in 100+ countries. Our platform simplifies regulatory complexity for enterprises and fast-growing companies.