How UAE Businesses Can Ensure E-Invoicing Compliance: Key Deadlines, Penalties, and Preparation Step

Discover UAE e-invoicing deadlines, penalties, and key preparation steps to stay compliant and avoid costly disruptions.

Table of Contents

The UAE’s e-invoicing rule is a requirement for all VAT-registered companies.

It covers B2B and B2G transactions and follows clear government rules for format and reporting.

Businesses that meet the requirements can avoid fines, payment delays, and workflow problems.

This guide explains the timeline, the rules, the deadline to appoint an ASP and what businesses need to do to stay compliant.

Want to make your e-invoicing go-live smooth and penalty-free?

UAE E-Invoicing Timeline

Here’s the official rollout timeline for UAE e-invoicing. These dates are confirmed by the Ministry of Finance and are critical for your planning.

| Step | What Happens | When |

|---|---|---|

| Accreditation | Federal Tax Authority (FTA) launched the accreditation portal for e-invoicing Service Providers | March 2025 |

| Rules Finalized | The government confirms all laws, formats, and technical details. | Mid-2025 |

| Pilot Program | Selected invite-only companies begin testing with the FTA and ASPs. | July 2026 |

| Voluntary Phase Opens | Any business can join voluntarily to start early integrations and testing. | July 2026 |

| Phase 1 Mandatory | Businesses with annual revenue ≥ AED 50 million must adopt e-invoicing (B2B + B2G). | January 2027 |

| Phase 2 Mandatory | Businesses with revenue < AED 50 million must comply. | July 2027 |

| Phase 3 Mandatory | Government entities required to issue e-invoices. | October 2027 |

E-Invoicing Implementation Schedule

This schedule outlines the mandatory deadlines for businesses and government entities to appoint an Accredited Service Provider (ASP) and fully adopt e-invoicing, ensuring compliance with UAE regulations.

Large Companies (Revenue ≥ AED 50M)

• Jul 31, 2026 – Deadline to appoint an Accredited Service Provider (ASP)

All Businesses (Revenue < AED 50M)

• Mar 31, 2027 – Deadline to appoint an ASP

Government Entities

• Mar 31, 2027 – Deadline to appoint an ASP

UAE E-Invoicing Penalties

The UAE has released the official penalties for non-compliance with the e-invoicing system. Businesses that miss the mandate deadlines or fail to follow system requirements can face the following fines:

• Failure to implement the e-invoicing system or to appoint an Accredited Service Provider: A penalty of 5,000 AED for each month of delay or part of a month.

• Failure to issue and send an e invoice or electronic credit note through the e invoicing system: A penalty of 100 AED per invoice, capped at 5,000 AED per calendar month.

• Failure to notify the Federal Tax Authority when your system is not working: A penalty of 1,000 AED for each day of delay or part of a day.

• Failure to notify the Accredited Service Provider when your registered data changes: A penalty of 1,000 AED for each day of delay or part of a day.

These penalties apply once your go-live date is reached. Missing the deadline can lead to both operational disruptions and cumulative fines.

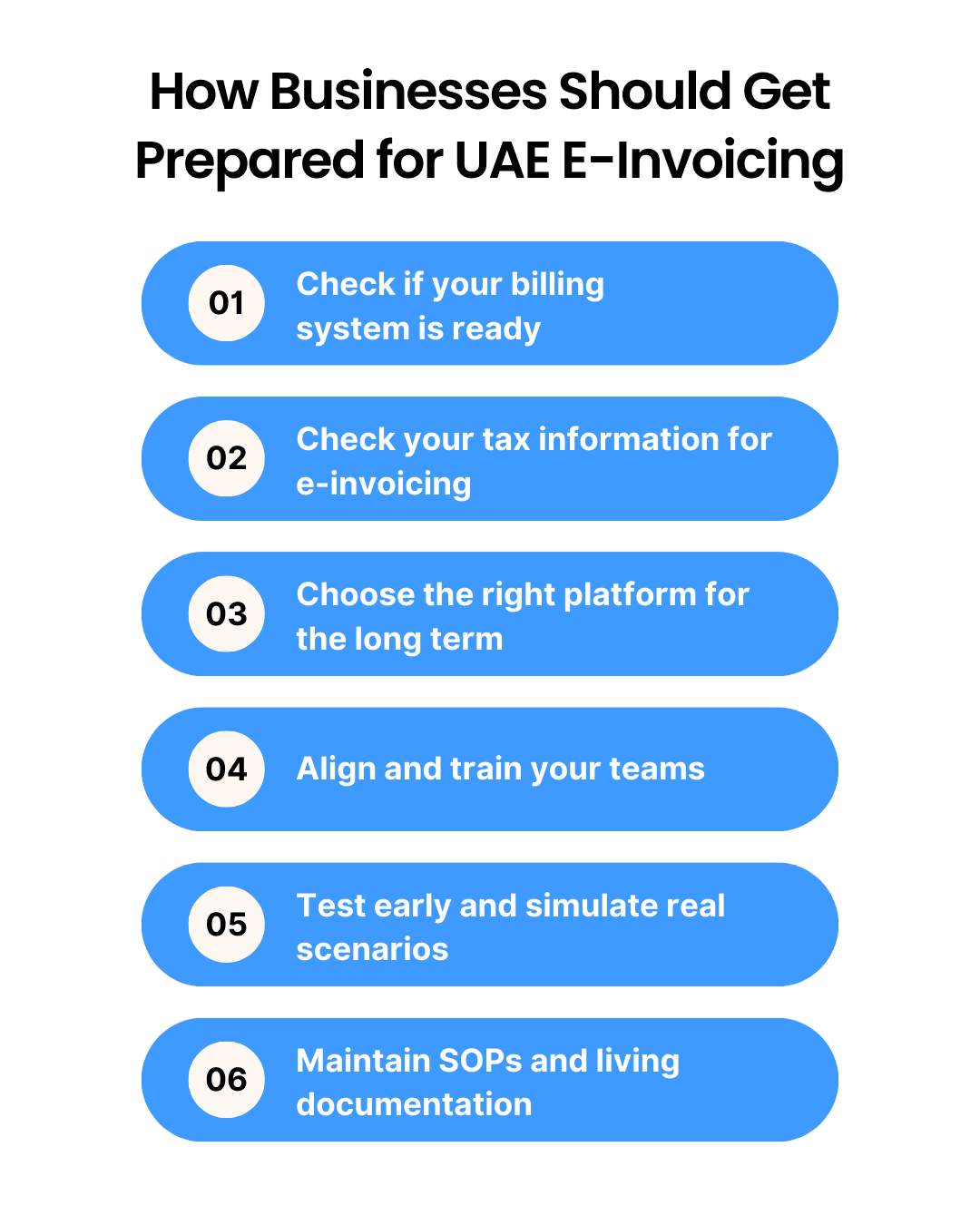

How Businesses Should Get Prepared for UAE E-Invoicing

Note: Your essential guide to preparing for the UAE e-invoicing mandate. Offers team checklists, pitfalls to avoid, and automation insights for a smooth, compliant transition. Download now.

1. Check if your billing system is ready

- Make sure your ERP can generate invoices with all mandatory fields, including TRN, VAT details, and invoice references, correctly filled.

- Ensure you have the required documents for cases like credit notes, exemptions, or reverse charges.

- Check that your invoice references and numbering are in the correct order.

- Verify that customer and supplier records are complete and accurate.

- Conduct a gap analysis to ensure your ERP system matches the UAE’s e-invoicing requirements, including fields, data formats, and workflows, in alignment with government standards for smooth integration.

- Prepare your IT/Dev team to handle the API integration setup and ensure ongoing maintenance is in place.

- If you're not using the API approach, prepare to upload your data in the correct Excel format.

2. Check your tax information for e-invoicing

Before your Accredited Service Provider (ASP) can set up e-invoicing, your business needs to have all the right information ready.

Make sure you have:

- Correct TRNs for your business and all customers.

- Updated VAT details and registration numbers.

- Peppol ID, signature, and other documents for proper onboarding.

3. Choose the right platform for the long term

- Select a platform that works now and can be adjusted as UAE regulations change.

- Make sure it can handle all invoice types, including credit notes and reverse charge flows.

- Check that it integrates with your ERP or accounting system through APIs or secure file transfers.

- Ensure it can automate validation checks before submission to catch errors early.

- Confirm it connects with partner systems and the Peppol network.

- Look for real-time error messages and dashboards to track invoice status.

- Check if it offers post-go-live support, including tax expert assistance.

- Ensure the platform is regularly updated to stay aligned with evolving regulations.

4. Align and train your teams

- Bring Finance, Tax, IT, and operational teams together so everyone understands their role in e-invoicing.

- Train Finance teams to issue compliant invoices, handle credit notes, and match invoices to payments.

- Teach Tax teams to master validation rules, archiving, and audit readiness.

- Guide IT teams on ERP field mapping, XML schema updates, and ASP integrations.

- Help Procurement and Sales maintain accurate master data like TRNs and buyer details.

- Use role-based training, microlearning, and internal champions to keep skills fresh and reduce confusion.

NOTE: Need expert guidance for your team?

Book a consultation with our experts today and ensure your teams are fully prepared.

5. Test early and simulate real scenarios

- Use the pilot program period as a gap to prepare and test your e-invoicing setup in a real-world environment before going live.

- Check that your systems, data formats, and workflows meet UAE requirements.

- Test standard and special invoice types, including B2B, B2G, and exempt supplies. Run tests for credit notes linked to original invoices and rejection scenarios for missing or incorrect data.

- Validate against UAE Peppol standards and confirm that logs, acknowledgements, and error handling are working.

Ready to test your e-invoicing setup? Access our free testing toolkit to simulate real-world scenarios with confidence.

6. Maintain SOPs and living documentation

- Document every process from invoice creation to error escalation and keep it updated as rules or systems change.

- Include contact points, common error fixes, and clear step-by-step guides.

- Use version control so everyone is always working from the latest instructions.

- Review and update documents regularly to match new compliance requirements.

By taking these proactive steps, your business can achieve a smooth e-invoicing go-live, avoiding costly errors and penalties while ensuring compliance with UAE regulations. Act now to align your systems, train your teams, and leverage the right tools for success.

Conclusion

The UAE’s e-invoicing timeline is moving fast, with the mandate going live in July 2026. The preparation window is short, and penalties for non-compliance can be steep.

That’s why Complyance exists, to make this shift smoother and faster Complyance is an Accredited Service Provider under the UAE e-invoicing framework, helping businesses meet appointment deadlines and transmit compliant invoices through the Peppol network.

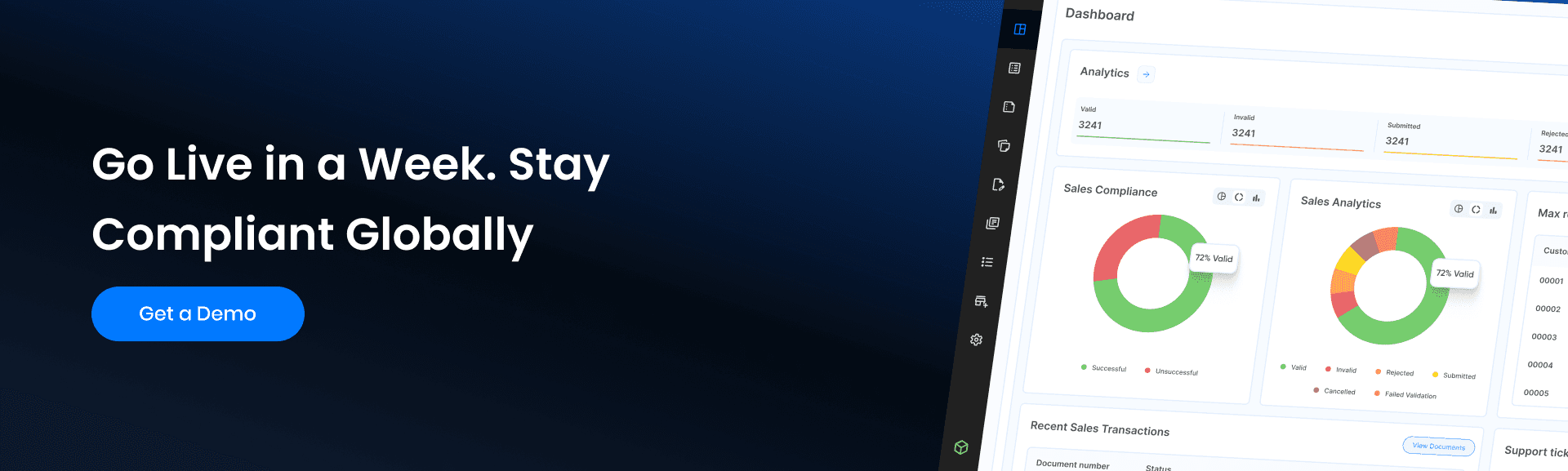

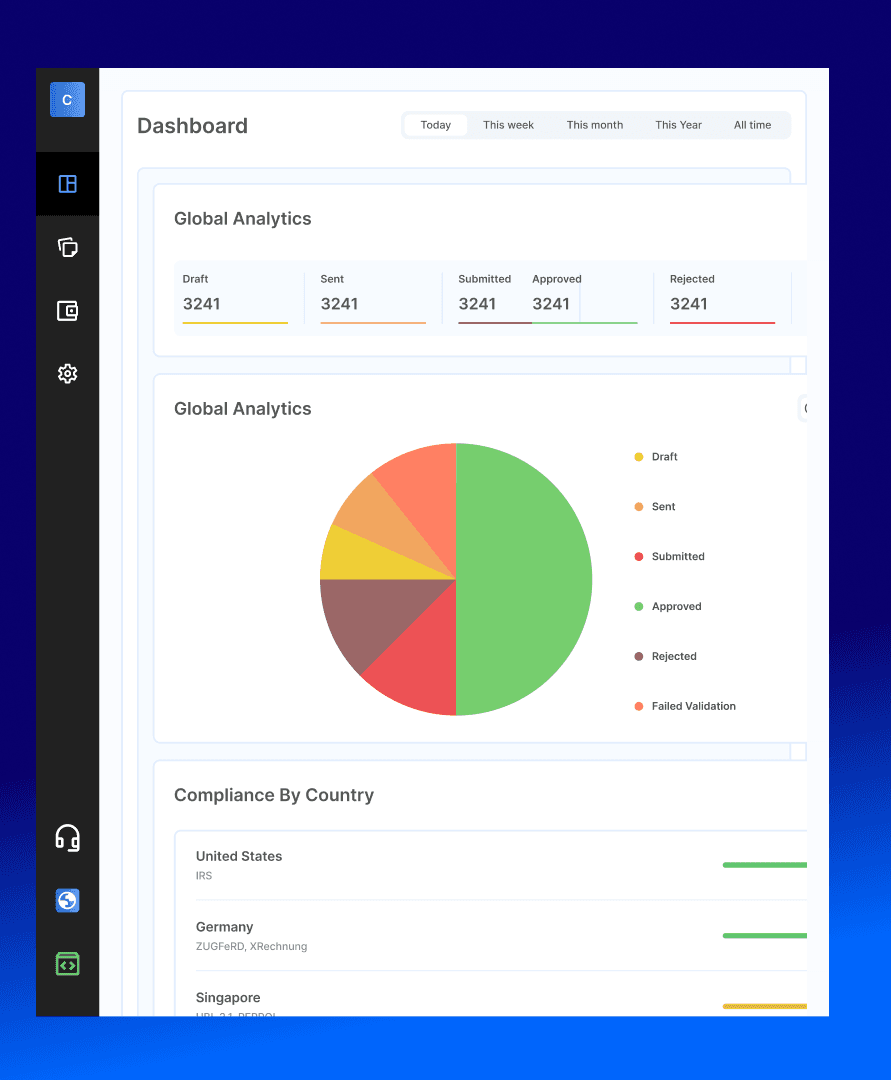

With Complyance, you can:

- Go live in weeks, not months.

- Real-time validation to prevent errors before invoices are sent.

- Seamless UAE integration without changing your ERP.

- Trusted by leading enterprise brands for global compliance.

The right preparation today ensures a disruption-free, penalty-free tomorrow.

Related posts

Frequently Asked Questions

• Failure to implement the e-invoicing system or to appoint an Accredited Service Provider:

A penalty of 5,000 AED for each month of delay or part of a month.

• Failure to issue and send an e invoice or electronic credit note through the e invoicing system:

A penalty of 100 AED per invoice, capped at 5,000 AED per calendar month.

• Failure to notify the Federal Tax Authority when your system is not working:

A penalty of 1,000 AED for each day of delay or part of a day.

• Failure to notify the Accredited Service Provider when your registered data changes:

A penalty of 1,000 AED for each day of delay or part of a day.

The first go-live phase of mandatory e-invoicing is set to begin in July 2026. Businesses should now start actively preparing by choosing certified service providers and testing their e-invoicing systems to meet the expected requirements.

Zero-rated goods are not taxed during sale, but producers can claim a credit for the value-added tax paid on inputs. On the other hand, exempt goods are not taxed either, but producers cannot get a credit for the VAT paid on inputs.

The main objective of a standard invoice is to request payment for the goods or services that were processed during the transaction. The main objective of a tax invoice is to avail tax credit or a form of tax relief.

Subscribe to our Newsletter

Get the latest compliance updates, e-invoicing news, and expert tips delivered to your inbox.

ABOUT COMPLYANCE

Empowering businesses to automate e-invoicing and stay compliant in 100+ countries. Our platform simplifies regulatory complexity for enterprises and fast-growing companies.