How the UAE Five-Corner E-Invoicing Model Works: Step-by-Step Process Explained

Ready for UAE e-invoicing? If you’re not clear on what the 5-corner model is, or why it matters, you’re already behind.

Table of Contents

Step-by-Step Breakdown of the UAE Five-Corner E-Invoicing Model

This blog gives you the clearest breakdown of the UAE’s five-corner e-invoicing model and shows you how to use it to go live faster, stay compliant, and get paid quicker.

Introduction

Tired of chasing payments and drowning in manual invoice follow-up?

The UAE's new five-corner e-invoicing model turns this manual liability into your greatest automated strength. It’s designed to ensure you get paid faster and stay compliant, effortlessly.

Imagine every invoice you send is instantly validated, logged with the government, and guaranteed to reach your buyer. This level of efficiency and security is the core promise of the UAE's 5-corner model, turning a complex process into an effortless standard.

As the backbone of the national Peppol-based network, this system becomes mandatory for all VAT-registered businesses by July 2026. This isn't just a new rule, it's a complete transformation of your workflow.

The result? Fewer rejections, faster payments, and cleaner audits.

And with platforms like Complyance, it's made simple. Go live in a week and achieve full MoF compliance without the complexity.

What is the UAE Five-Corner E-Invoicing Model?

The UAE 5-corner model is a structured, secure way of processing e-invoices through a chain of five verified parties:

- The supplier (you) – the business that issues the invoice

- Your Accredited Service Provider (ASP) – your technology partner who validates and transmits invoices like Complyance

- The buyer’s ASP – the receiving partner that confirms and forwards the invoice

- The buyer – the customer receiving the validated invoice

- The Federal Tax Authority (FTA) – the regulatory body that logs and verifies tax data in real-time

This model is based on the global Peppol framework, used by countries leading in digital tax systems. That means every invoice follows a unified structure, is transmitted securely, and passes through multiple validation gates before it reaches the FTA and the buyer.

Note: Complyance is an OpenPeppol Global Peppol Accredited Service Provider. We’re not just compliant, we’re certified to help you go live fast and avoid rejections. Whether you're sending one invoice or a million, our infrastructure is built to deliver success, from field validation to final FTA confirmation.

How Does This Differ from Other Global Models?

While many countries have adopted e-invoicing frameworks, their approaches vary significantly. Most follow one of two common models:

- Clearance Models (e.g., India, Chile):

In this system, every invoice must be pre-approved by the tax authority before it can even be sent to the buyer. This adds a layer of compliance but can introduce delays and administrative bottlenecks. - Post-Audit Models (e.g., the United States):

Businesses issue invoices freely without prior validation. Compliance is typically checked retrospectively during an audit. This offers flexibility but carries significant risk, as errors are often caught too late.

The UAE chose a smarter middle ground.

The 5-corner model ensures real-time compliance without slowing down operations. Your ASP handles the technical load validation, transformation to PINT AE XML, digital signatures, and secure routing, while your team stays focused on running the business.

You don’t lose visibility or control. You gain automation, compliance, and speed, all in one move.

With the right ASP like Complyance, you can go live in days, not months.

How the UAE Five-Corner Model Works

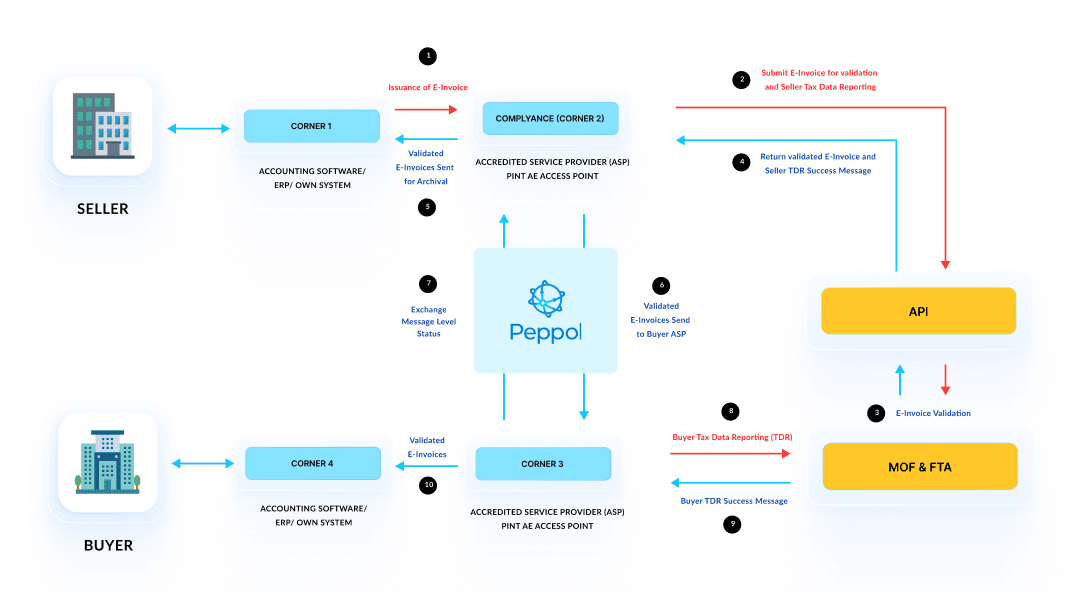

Key Stakeholders and Their Roles

- Supplier (Corner 1): Generates the invoice using PINT AE format.

- Service Provider (Corner 2 & 3): Validates, converts, forwards, and reports invoice data to the FTA.

- Buyer (Corner 4): Receives the invoice and processes it internally.

- FTA (Corner 5): Logs and confirms receipt of every invoice for tax purposes.

Here is a detailed, step-by-step explanation of how an e-invoice is sent and validated through the UAE's five-corner model:

- Supplier Generates the Invoice: The supplier creates an invoice in their ERP or billing system in a standard format (not yet an e-invoice).

- Supplier’s Accredited Service Provider (ASP) Validates and Converts: The supplier’s ASP checks the invoice against UAE requirements and converts it into the PINT-AE XML format.

At this point, the invoice becomes a valid e-invoice. - Service Metadata Publisher (SMP) Routes the Invoice: The SMP manages and publishes metadata about participants (supplier, buyer, ASPs) and their access points. This ensures the e-invoice is routed to the correct destination and that all participants have the necessary information to process it.

- Transmission to Buyer’s ASP: Using the Peppol network and SMP data, the e-invoice is securely delivered to the buyer’s ASP.

- The buyer receives and processes the Invoice: The buyer’s ASP delivers the e-invoice to the buyer’s ERP/accounting system, where it can be accepted, reconciled, or processed further.

- Reporting to the Federal Tax Authority (FTA): Both ASPs generate the Tax Data Document (TDD) and send it to the FTA via the Central Data Platform (CDP).

- FTA Validates and Accepts the TDD: The FTA validates the TDD in real time. Once accepted, the invoice is officially recorded as compliant and audit-ready.

Want zero validation failures?

Use Complyance. Our platform pre-validates invoices, flags missing fields, formats data automatically, and routes everything securely. No silent rejections. No last-minute panic.

Technical and Operational Requirements

To send e-invoices correctly in the UAE, here’s what your system absolutely must support:

- Structured XML files formatted using the PINT AE (Peppol International Invoice for the UAE) standard, containing all required business terms and fields.

- Digital Signatures to ensure the authenticity and integrity of every invoice.

- Peppol Network Integration through an MoF-accredited and OpenPeppol-certified service provider (ASP).

- Real-time status tracking and two-way communication between your ASP, the buyer's ASP, and the FTA to confirm submission, validation, and receipt.

Why the 5-Corner Model Matters in E-Invoicing in the UAE

- Real-Time Validation: You can be confident that your invoice is delivered, validated, and recorded by the government in real time.

- Security: The system is built to ensure your invoices are secure at every step.

- Traceability: Each invoice is tracked, so you can always trace its journey from creation to government submission.

- Fraud Prevention: By following this model, the risk of fraud is significantly reduced, as every step is monitored and verified.

- Error Reduction: The validation process at each corner helps minimize mistakes, ensuring that your invoices are accurate.

- Fewer Delays: With real-time reporting and automatic validation, delays are greatly reduced.

Challenges and Considerations

While the UAE's five-corner model offers immense benefits, its effectiveness depends on your preparedness. Here are key challenges businesses may face:

| Challenge | Description |

|---|---|

| Incomplete or Inaccurate Master Data | Missing TRNs, outdated VAT details, or inconsistent customer/supplier information can cause invoice rejections. |

| Integration Hurdles | APIs or file transfers between ERP, ASP, and Peppol endpoints may fail if not properly mapped and tested. |

| Validation Errors | Incorrect tax rates, wrong document types, or invalid invoice references can halt submissions. |

| Change Management Gaps | Finance, tax, and IT teams often lack clear ownership of compliance steps, leading to delays. |

| Regulatory Updates | Frequent changes to schema, mandatory fields, or reporting requirements can catch teams off-guard if processes aren’t regularly updated. |

| Limited Testing | Skipping thorough sandbox or pilot testing can result in go-live failures and compliance penalties. |

Every one of these challenges can be avoided with the right preparation. In our E-Invoicing in the UAE: Deadlines, Penalties, and Pro Tips blog, we break down practical steps to align your systems, train your teams, and test your setup for a smooth go-live.

Key Dates and Implementation Timeline in the UAE

Here’s the official rollout timeline for UAE e-invoicing. These dates are confirmed by the Ministry of Finance and are critical for your planning.

| Step | What Happens | When |

|---|---|---|

| Accreditation | Federal Tax Authority (FTA) launched the accreditation portal for e-invoicing Service Providers | March 2025 |

| Rules Finalized | The government confirms all laws, formats, and technical details. | Mid-2025 |

| Pilot Program | Some businesses try the new e-invoicing system with the FTA to make sure it works well. | Late 2025 |

| Mandatory Start | All VAT-registered businesses in the UAE must adopt e-invoicing for their B2B and B2G transactions. | July 2026 |

Conclusion and Next Steps

The UAE 5-corner model is already here, and every VAT-registered business will need to adopt it. While compliance is mandatory, true advantage comes from being prepared with a partner who delivers both expertise and reliability.

With Complyance, you gain a proven partner backed by:

- With 5 years of specialized e-invoicing expertise, we ensure seamless implementation and deep domain knowledge.

- Our single API supports both UAE and global compliance, simplifying your tech stack through one integration.

- We guarantee a 100% success rate in e-invoice generation, eliminating submission failures with built-in validation.

- Processing 1.5 billion e-invoices annually, our scale-tested infrastructure delivers reliability you can trust.

- Trusted by over 1,000 companies worldwide, we invite you to join our global community of satisfied users.

Go live in a week with simple, stress-free onboarding. Talk to an expert to get started.

Related posts

Frequently Asked Questions

Yes. Only Accredited Service Providers can validate and submit to the FTA.

You can, but it won’t count. Only XML invoices exchanged through Peppol are valid.

No. It speeds them up. Invoices are validated in real time and delivered instantly.

Yes. Complyance offers a live sandbox so your team can simulate real invoice flows and integrations.

Complyance prevents that. We check every field before submission and catch errors before they hit the FTA.

Subscribe to our Newsletter

Get the latest compliance updates, e-invoicing news, and expert tips delivered to your inbox.

ABOUT COMPLYANCE

Empowering businesses to automate e-invoicing and stay compliant in 100+ countries. Our platform simplifies regulatory complexity for enterprises and fast-growing companies.