What Is E-Invoicing and Why Will it Be Mandatory in the UAE?

Discover what UAE e-invoicing means, why it’s mandatory, and how Complyance keeps your business compliant, audit-ready, and supports you after go-live.

Table of Contents

Imagine a world where every invoice you send is instantly verified, securely delivered, and fully tax-compliant. In today’s business world, invoices still get lost in inboxes, delayed in approvals, or flagged for compliance errors weeks after they’re issued.

That’s exactly what the UAE is changing.

The UAE Ministry of Finance has officially announced that e-invoicing is mandatory for all VAT-registered businesses.

Start Your 14-Day Free Trial of the UAE E-Invoicing Platform

But what exactly is e-invoicing? Why now? And what do businesses need to do to get ready?

Additionally, you’ll discover how Complyance can make e-invoicing easier, faster, and more secure for your business, helping you stay compliant while saving time and costs.

What Is E-Invoicing?

E-invoicing, also known as electronic invoicing, is the process of creating and exchanging invoices in a structured digital format that computers can read and validate automatically. Instead of sending a PDF or printed invoice, businesses submit these digital invoices through ASPs (accredited service providers) like Complyance, where they are validated and shared with both the buyer and the government for compliance and reporting.

Key Objectives of E-Invoicing for Businesses

E-invoicing eliminates uncertainty. It ensures every invoice is delivered, validated, and tracked in real time.

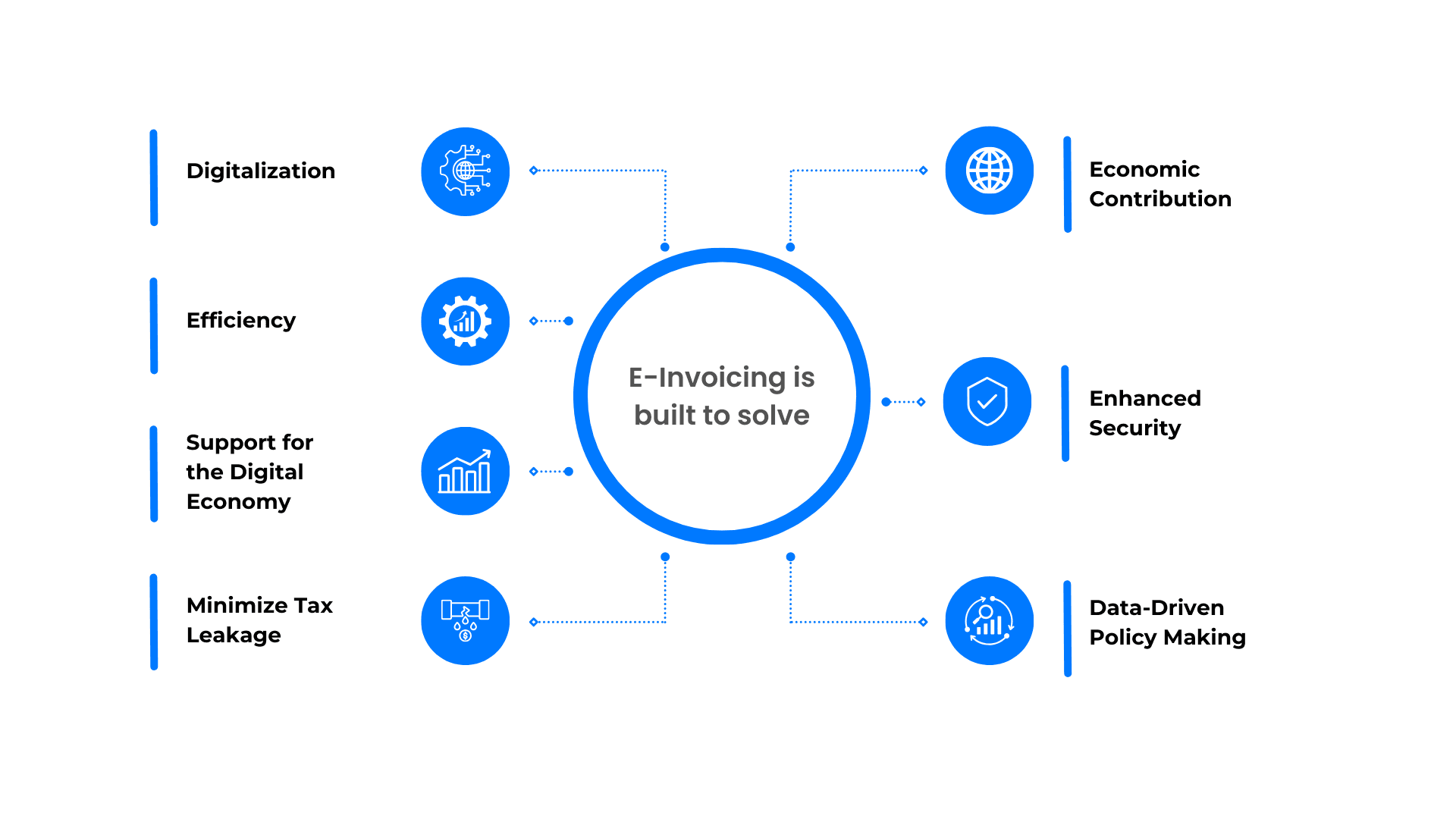

Here’s what e-invoicing is built to solve:

- Digitalization: Enable end-to-end digital processing of invoices by reducing human intervention in invoice issuance, submission, and reporting. This supports automation, transparency, and integration with other digital systems.

- Efficiency: Streamline core operational and compliance processes by reducing invoice processing time, paperwork, and manual errors. This also supports sustainability by cutting down on paper usage and physical storage.

- Support for the Digital Economy: Encourage the growth of a digital ecosystem by fostering the development of secure, standardized, and interoperable invoicing infrastructure. This contributes to building skilled digital talent and modern business networks.

- Minimize Tax Leakage: Detect and prevent both intentional and unintentional tax reporting gaps. E-invoicing improves traceability and real-time validation, helping to reduce revenue leakage in VAT and other indirect tax regimes.

- Economic Contribution: Facilitate smarter economic planning and improved competitiveness by generating high-quality, structured invoice data. This empowers both private sector optimisation and public sector economic insights.

- Enhanced Security: Protect the authenticity and integrity of invoices through encryption, digital signatures, and secure data exchange protocols. This helps mitigate fraud, tampering, and unauthorised access.

- Data-Driven Policy Making: Enable tax authorities and governments to access real-time, accurate transaction-level data. This informs targeted policymaking, sectoral interventions, and improved public financial management.

Key Components of E-Invoicing: What Makes a Valid Digital Invoice?

At its core, an e-invoice is a set of structured data fields. It consists of header, body, and footer elements that must follow a specific format and include all essential information for it to be recognized and validated by tax authorities.

Below are a few of the key components that make up a valid digital invoice:

| Component | Description |

|---|---|

| Invoice Reference Number (IRN) | A unique identifier generated for each e-invoice to ensure traceability and prevent duplication. It proves the invoice has been electronically validated. |

| QR Code | A machine-readable code embedded in the invoice that includes key details. It enables instant verification during audits or buyer-side checks. |

| Digital Signature | A secure digital stamp used to confirm the authenticity of the issuer and protect the integrity of the invoice after issuance. |

| Supplier Information | Includes the supplier’s legal name, TRN (Tax Registration Number), address, country and emirate code, and contact details. |

| Recipient Information | Captures the buyer’s legal name, TRN, billing address, contact details, and applicable country or emirate code. |

| Document Details | Refers to the unique document number assigned to the invoice and the official invoice issue date. |

| Itemized Invoice Lines | Lists each good or service sold, including description, quantity, unit price, applicable tax rate, tax amount, and total per line item. |

| Tax Summary | Summarizes the taxable value, VAT applied, and any exemptions or zero-rated amounts for the entire invoice. |

| Document Total | Displays the full invoice value before and after tax, including discounts, shipping charges, and any final adjustments. |

Why the UAE Is Making E-Invoicing Mandatory

Traditional VAT reporting reveals business transactions only after weeks or months have passed, creating blind spots in compliance and economic oversight.

E-invoicing solves this by giving tax authorities real-time access to transactional data, enabling faster decisions, stronger enforcement, and greater transparency.

Here's what it enables:

- Combat Tax Fraud and Evasion: E-invoicing helps stop fake or duplicate invoices by checking them instantly when they’re created.

- Enable Real-Time VAT Reporting: Invoices are shared with the tax authority as soon as they’re issued—no more delays in VAT reporting.

- Improve Transparency Across Supply Chains: Each invoice is tracked digitally, making it easier to keep records and solve payment or reporting issues.

- Align with Global Standards: Using the Peppol network and the UAE’s PINT-AE format allows smoother trade and tax compliance with other countries.

- Reduce Administrative Burden: Automated invoicing cuts down manual work, saving time and reducing mistakes for businesses and tax teams

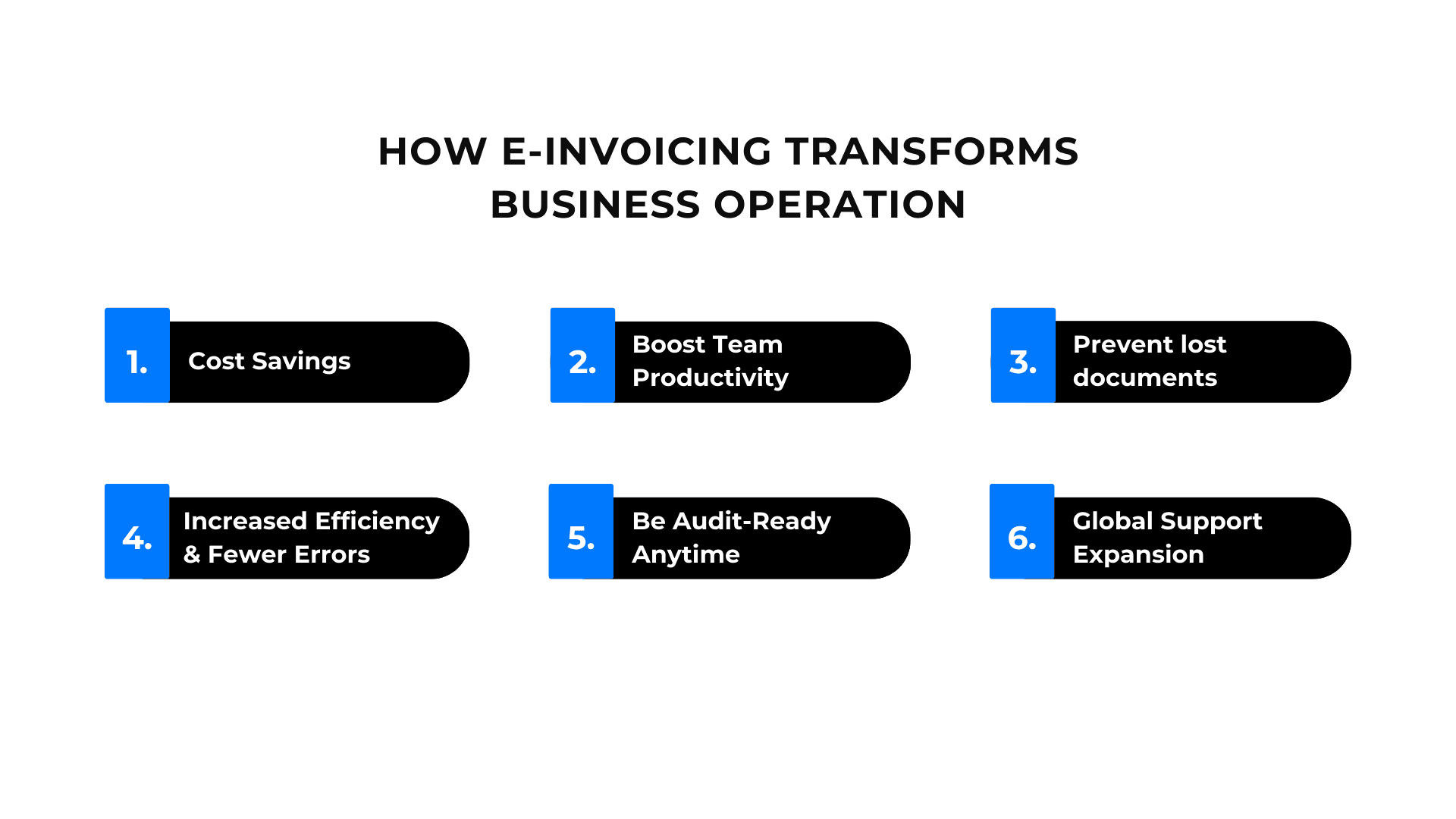

How E-Invoicing Transforms Business Operations

- Cost Savings: E-invoicing reduces costs by eliminating paper expenses tied to printing, posting, and archiving.

- Boost Team Productivity: Automation reduces manual work, allowing Finance and Operations teams to focus on higher-value tasks.

- Prevent Lost Documents: Invoices are securely archived online, making them easy to retrieve and safe from loss.

- Increased Efficiency and Fewer Errors: Automation and integration speed up the invoicing process and reduce human errors, delivering the biggest savings beyond paper costs.

- Be Audit-Ready Anytime: Digital records are automatically organized and verified, making audits faster and less stressful.

- Keep Transactions Secure: Encryption and digital signatures protect sensitive financial data, reducing the risk of fraud or tampering.

- Support Global Expansion: With the UAE’s PINT-AE format and the Peppol network, businesses can expand cross-border with smoother compliance.

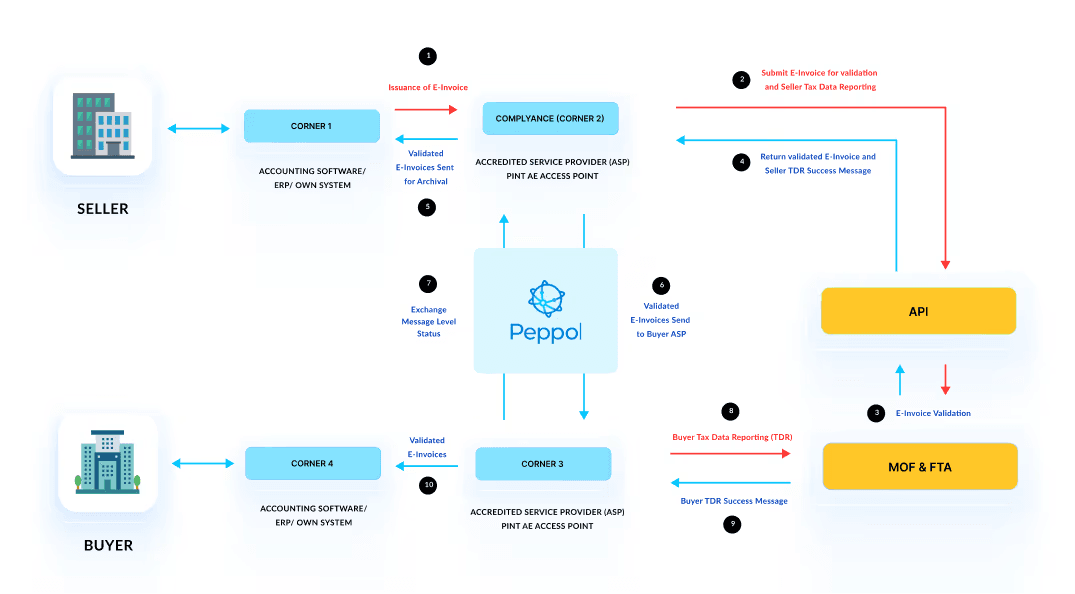

How the 5-corner model works in the UAE E-invoicing

E-invoicing in the UAE operates on a Decentralized Continuous Transaction Control and Exchange (DCTCE) model using a 5-corner architecture built on the Peppol network. Accredited Service Providers (ASPs) act as intermediaries. Learn more about the 5-corner model here.

- Supplier Generates the Invoice: The supplier creates an electronic invoice using their ERP or billing system.

- Supplier's Accredited Service Provider (ASP) Validates and Converts: The supplier's ASP validates the invoice against UAE standards and converts it into the required PINT-AE XML format.

- Transmission to Buyer's ASP: The validated and formatted invoice is transmitted via the Peppol network to the buyer's Accredited Service Provider (ASP).

- Buyer Receives and Processes the Invoice: The buyer's ASP delivers the invoice to the buyer's system, where it can be accepted, reconciled, or further processed.

- Reporting to the Federal Tax Authority (FTA): Both ASPs report the tax-related data of the e-invoice to the FTA's Control Data Platform (CDP) for real-time compliance and auditing purposes.

Why do you need to choose Complyance?

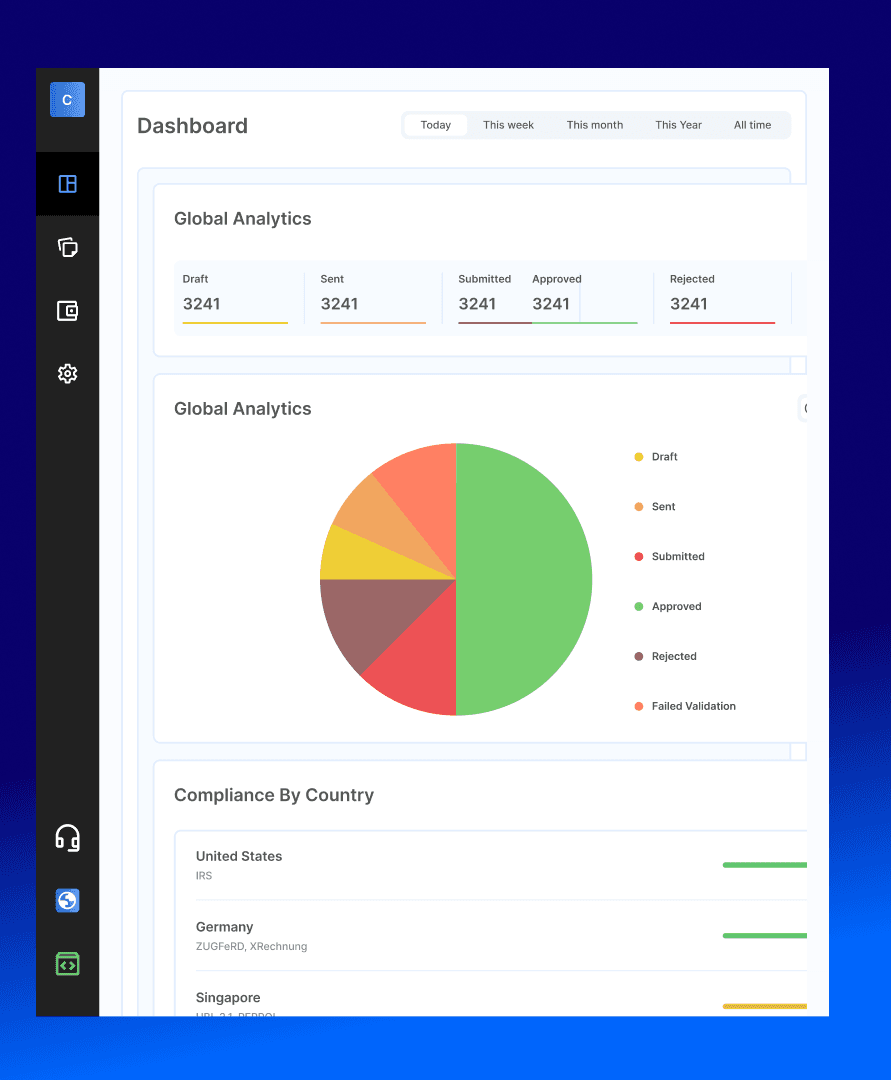

Complyance makes it simple for businesses to start e-invoicing in the UAE. It connects directly with the Federal Tax Authority (FTA), fully complies with Peppol and UAE standards, and is easy for both developers and finance teams to manage.

- Faster Go-Live with Less Effort: Skip long setups; businesses can become e-invoicing ready in days, not months, thanks to our pre-built integrations and sandbox testing.

- A Truly Developer-Friendly Platform: Complyance offers clear APIs, sandbox testing, and real-time validation tools, making integration faster and reducing trial-and-error. Developers can focus on building instead of troubleshooting compliance.

- Seamless Integration and Ongoing Updates: IT teams get a scalable, secure platform that integrates smoothly with ERPs and accounting systems. With regular updates to match evolving UAE regulations, IT teams can be confident that systems stay compliant without constant rework.

- Compliance Without Complexity: Finance teams benefit from automated validations, error detection, and audit-ready records. Tax expert assistance ensures smooth handling of complex scenarios like reverse charge, exemptions, and credit notes.

- Gap Analysis and Easy Uploads: Complyance conducts a full gap analysis to ensure ERP systems align with UAE e-invoicing requirements (fields, data formats, and workflows). For businesses not using APIs, Complyance provides ready-to-use Excel templates for compliant uploads.

- Business Continuity Without Downtime: Even if government systems go offline, your invoices are safely queued and sent when services resume, so, your operations never stop.

Ready to go live with UAE e-invoicing?

Complyance equips your developers, IT, finance, and operations teams with the tools and expert support to ensure a smooth launch.

Conclusion: The Time to Prepare UAE E-Invoicing Is Now

To help your business get ready for UAE e-invoicing, here’s a simple checklist of the key steps you should take now:

- Review your invoicing system.

- Align your ERP with the PINT-AE format.

- Choose a certified ASP

- Test in the sandbox

- Train your teams

- Build your go-live plan.

The UAE’s tax system is going digital. The sooner you adapt, the better positioned you’ll be to lead.

Related posts

Frequently Asked Questions

E-invoicing is the mandatory digital creation and exchange of invoices in a structured format that can be automatically validated by computers. Instead of sending PDF or paper invoices, VAT-registered businesses must submit digital invoices through approved Accredited Service Providers (ASPs) that validate and share them with buyers and the Federal Tax Authority.

Yes. The UAE Ministry of Finance has announced that all VAT-registered businesses must adopt e-invoicing by July 2026. This applies across sectors and requires invoices to be generated in the PINT-AE XML format and transmitted via Accredited Service Providers (ASPs).

The Data Dictionary is the official rulebook issued by the FTA. It defines all required data fields, formats, and validation rules for creating compliant e-invoices. Businesses must align their ERP or billing systems with these specifications.

Yes. Complyance not only provides a developer-friendly e-invoicing API platform but also offers expert consultation for businesses preparing for UAE e-invoicing. This includes ERP gap analysis, sandbox testing, team training, and go-live support.

Non-compliance may result in invoice rejections, penalties, and disruptions in VAT reporting. Delays in compliance can also affect your ability to trade with partners who are already on the Peppol network.

Subscribe to our Newsletter

Get the latest compliance updates, e-invoicing news, and expert tips delivered to your inbox.

ABOUT COMPLYANCE

Empowering businesses to automate e-invoicing and stay compliant in 100+ countries. Our platform simplifies regulatory complexity for enterprises and fast-growing companies.