UAE E-Invoicing Compliance Guide: What Your Business Must Know

Get a clear understanding of UAE e-invoicing. what it is, why it’s important, and the steps your business needs to take to stay 100% compliant

Table of Contents

E-invoicing in the UAE is becoming a must for all businesses.

And it’s definitely changing how things work.

Starting in July 2026, all VAT-registered businesses will have to switch to electronic invoicing. This change will affect how invoices are created, sent, and tracked, bringing a new level of efficiency and accuracy to tax compliance.

Let’s dive into what’s changing and how you can get prepared.

Start Your 14-Day Free Trial of the UAE E-Invoicing Platform

Key Takeaways:

- E-invoicing is not optional. All VAT-registered businesses in the UAE must comply by July 2026. The time to prepare is now.

- E-invoicing means generating invoices in a specific, government-standardized XML format (PINT-AE) that can be automatically validated and exchanged between systems, not just sending PDFs via email.

- The UAE is adopting a 5-Corner Model built on the Peppol network, with Accredited Service Providers (ASPs) facilitating secure validation, transmission, and real-time reporting to the Federal Tax Authority (FTA).

- Invoices must include all mandatory fields (like TRN, issue date, tax rates) in the exact PINT-AE format to be accepted. The rules are strict and non-negotiable.

- Beyond compliance, e-invoicing offers real business advantages: faster payments, reduced costs, fewer errors, improved cash flow, and valuable financial insights.

- Getting ready involves more than just software. Businesses must audit their ERP systems, gather accurate tax data (TRNs), train their teams, and choose a certified ASP to ensure a smooth transition.

- The right Accredited Service Provider (ASP) does more than just transmit files. Look for one that offers Peppol certification, robust security, seamless ERP integration, and ongoing support to ensure long-term compliance and efficiency.

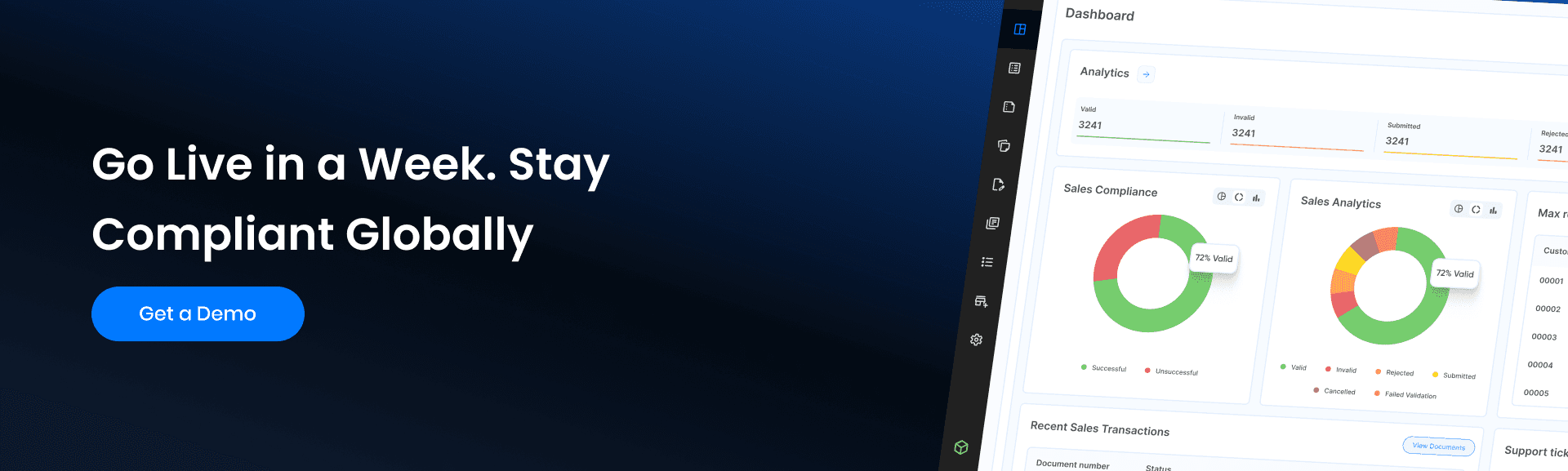

- With the right partner, becoming compliant doesn't need to take months. Businesses can go live successfully in a week, minimizing disruption and ensuring 100% acceptance rates from day one.

What Is E-Invoicing in the UAE?

E-invoicing in the UAE is a government-mandated process that requires businesses to issue, receive, and store invoices electronically in a structured XML format. Regulated by the Federal Tax Authority (FTA), this system ensures real-time tax reporting, reduces invoice fraud, and improves compliance across sectors.

Instead of sending PDF or paper invoices, companies use FTA-approved Access Point providers to generate and transmit machine-readable e-invoices. These invoices are automatically validated and routed to both the buyer and the FTA through a 5-corner model.

The UAE’s e-invoicing rollout will commence in phases, starting in 2025, and will be mandatory for large enterprises by 2027. The system aligns with global digital tax trends and helps businesses streamline financial operations while staying audit-ready.

How B2B, B2G, and B2C Invoicing Works in the UAE

Not every transaction is treated the same way under the UAE’s e-invoicing framework. The rules differ across B2B, B2G, and B2C flows, and it is important to know where your business sits.

- B2B (Business to Business)- From July 2026, invoices between two VAT-registered businesses must be issued in PINT AE XML and transmitted through an Accredited Service Provider over the Peppol network, with real-time reporting to the FTA.

- B2G (Business to Government)- From July 2026, invoices issued for business-to-government transactions must follow the same structured PINT AE format and the same ASP-based transmission flow used for B2B transactions. This ensures full compliance with UAE e-invoicing requirements for real-time validation and reporting to the Federal Tax Authority.

- B2C (Business to Consumer)- For now, B2C e-invoicing is not yet mandatory. Businesses can continue issuing simplified invoices, but the FTA has indicated that consumer transactions may be included in future phases. Smart teams are already modernizing their POS and billing flows so they do not have to rebuild everything later.

For a side-by-side breakdown of requirements, timelines, and what changes by transaction typeRead the full article: B2B vs B2G vs B2C E-Invoicing Requirements in the UAE to see exactly how each type of transaction is treated and how Complyance supports all three.

Why the UAE is Implementing E-Invoicing

The UAE government wants to make business easier and faster with technology. That’s why they are making e-invoicing mandatory by July 2026 for businesses that pay VAT.

E-invoicing will help:

- Modernize the tax system

- Enhance operational efficiency

- Boost transparency in financial dealings

- Prevent VAT loss

For more details on why e-invoicing will be mandatory and how it will impact businesses, check out our detailed guide: “What Is E-Invoicing and Why Will it Be Mandatory in the UAE?

UAE E-Invoicing Overview

The UAE is preparing for a major shift in tax compliance with the introduction of mandatory e-invoicing. To help businesses understand what’s coming, here’s a breakdown of the key parameters you need to know:

| Parameter | Details |

|---|---|

| Authority | Peppol - Ministry of Finance (MOF) Tax Authority - Federal Tax Authority (FTA) |

| Standard | PINT AE (Peppol International Arab Emirates) – the official e-invoicing format for the UAE. |

| Model | DCTCE (Decentralized Continuous Transaction Control & Exchange), also known as the 5-Corner Model. |

| Government Portal | CDP (Central Data Platform) – the central hub where tax data will be reported and monitored. |

| Mandate For | B2B and B2G transactions. |

| Timeline | July 2026: Mandatory Go-Live for Phase 1. |

| Archival Period | 7 years (businesses must store e-invoices for this duration). |

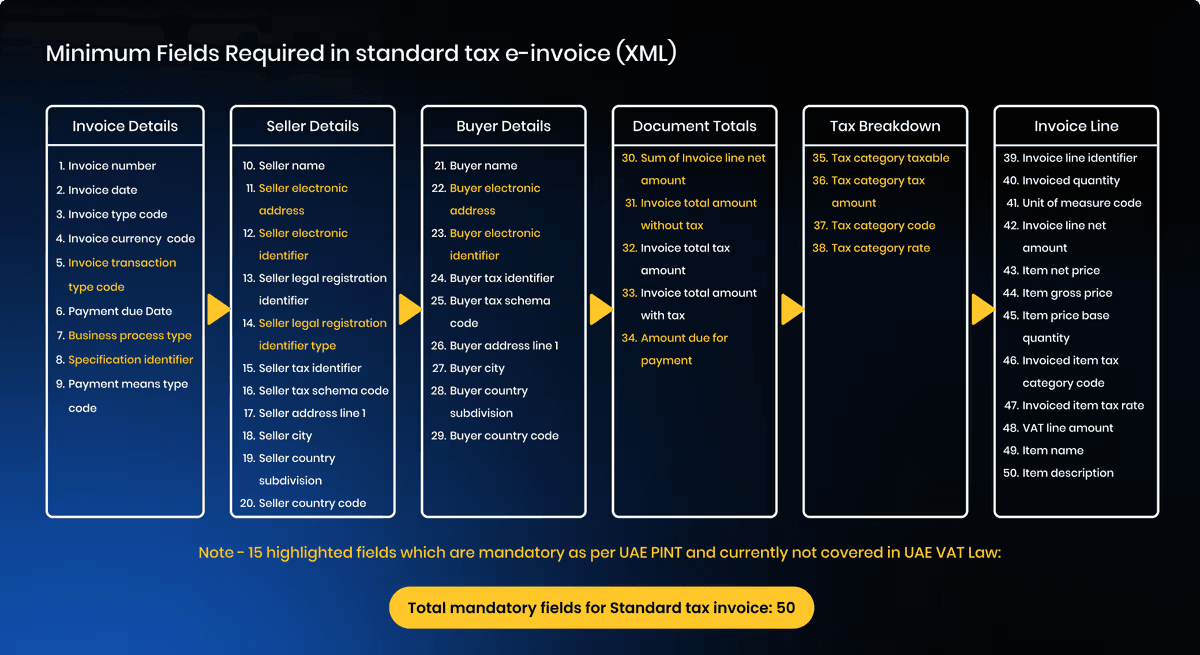

| Mandatory Fields | 50 fields are required to meet the Standard Tax Invoice format. |

| Criteria & Scope | A phased rollout is expected for all VAT-registered businesses in the UAE. |

For the full visual breakdown, check out our LinkedIn post here UAE E-Invoicing Overview.

How UAE E-Invoicing Works

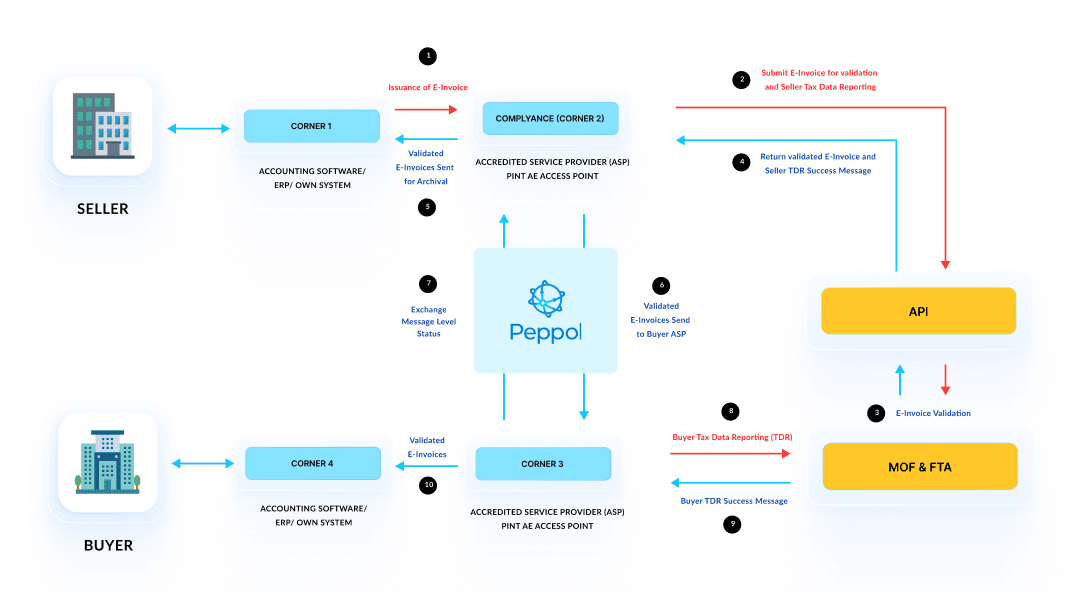

E-invoicing in the UAE operates on a Decentralized Continuous Transaction Control and Exchange model. DCTCE, also referred to as the Peppol CTC model, operates through a decentralized five-corner architecture on the Peppol network.

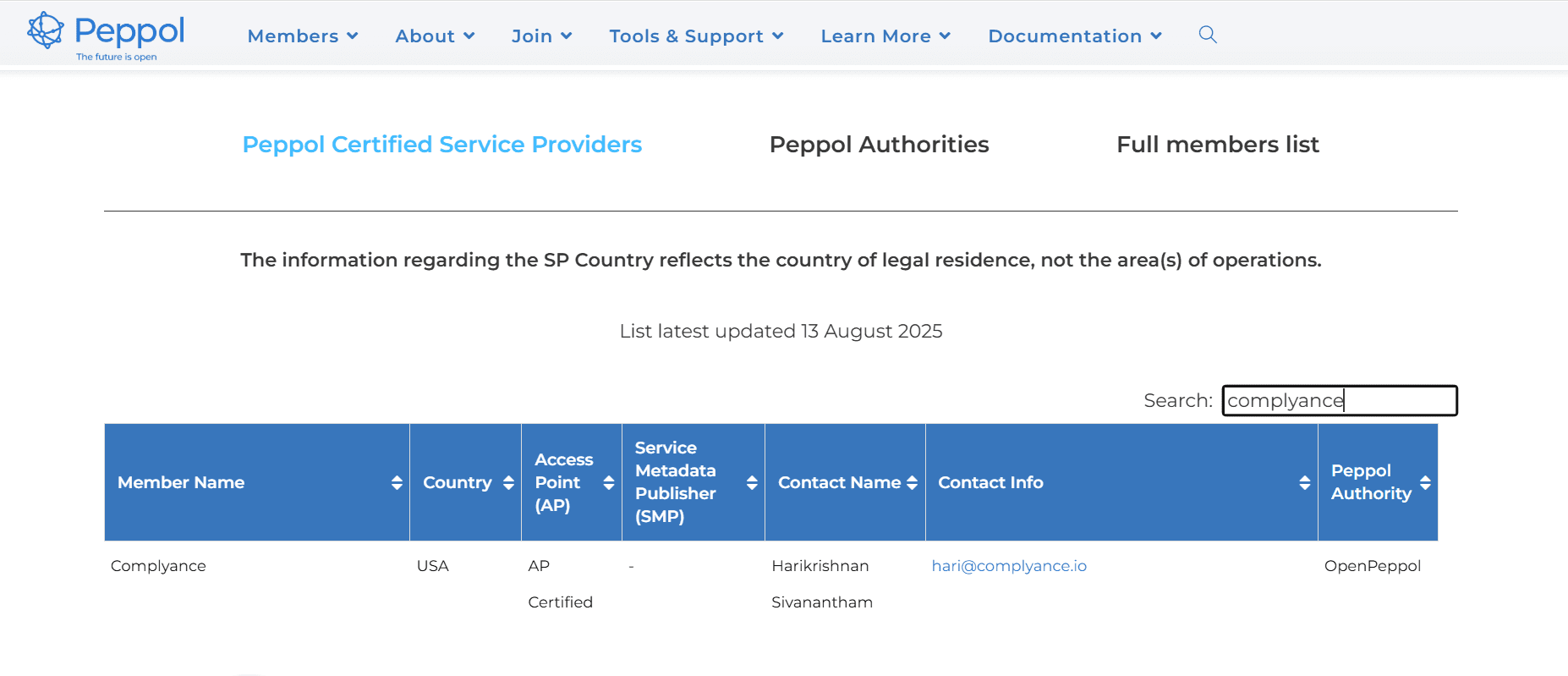

Accredited Service Providers act as intermediaries who validate invoices, convert them into the required PINT AE XML format, and exchange them securely between trading partners while reporting the Tax Data Document to the Federal Tax Authority in real time. As a Peppol certified provider, Complyance is in the final stage of ASP(accredited service provider) accreditation in the UAE, with official confirmation expected in the upcoming phases.

What Is the 5-Corner Model?

Explore our detailed guide on the 5-Corner Model for e-invoicing

For a detailed, step-by-step explanation of the 5 Corner Model, sign up for a free UAE E-Invoicing consultation with one of our tax experts

- Supplier Generates the Invoice: The supplier creates an invoice in their ERP or billing system in a standard format (not yet an e-invoice).

- Supplier’s Accredited Service Provider (ASP) Validates and Converts: The supplier’s ASP checks the invoice against UAE requirements and converts it into the PINT-AE XML format.

At this point, the invoice becomes a valid e-invoice. - Service Metadata Publisher (SMP) Routes the Invoice: The SMP manages and publishes metadata about participants (supplier, buyer, ASPs) and their access points. This ensures the e-invoice is routed to the correct destination and that all participants have the necessary information to process it.

- Transmission to Buyer’s ASP: Using the Peppol network and SMP data, the e-invoice is securely delivered to the buyer’s ASP.

- Buyer Receives and Processes the Invoice: The buyer’s ASP delivers the e-invoice to the buyer’s ERP/accounting system, where it can be accepted, reconciled, or processed further.

- Reporting to the Federal Tax Authority (FTA): Both ASPs generate the Tax Data Document (TDD) and send it to the FTA via the Central Data Platform (CDP).

- FTA Validates and Accepts the TDD: The FTA validates the TDD in real time. Once accepted, the invoice is officially recorded as compliant and audit-ready.

Why the 5-Corner Model Matters in E-Invoicing in the UAE

- Real-Time Validation: You can be confident that your invoice is delivered, validated, and recorded by the government in real time.

- Security: The system is built to ensure your invoices are secure at every step.

- Traceability: Each invoice is tracked, so you can always trace its journey from creation to government submission.

- Fraud Prevention: By following this model, the risk of fraud is significantly reduced, as every step is monitored and verified.

- Error Reduction: The validation process at each corner helps minimize mistakes, ensuring that your invoices are accurate.

- Fewer Delays: With real-time reporting and automatic validation, delays are greatly reduced.

What Is the Required Format of E-Invoices in the UAE?

In the UAE, e-invoices must follow a special format called PINT AE. This format uses XML files, which can be easily read and processed by software systems.

What is the PINT AE Format?

The PINT AE format is the official XML standard for e-invoicing in the UAE. This format ensures that invoices meet the country's e-invoicing compliance requirements, enabling automated processing and reporting of transactions for tax purposes.

Key Points of the PINT AE Format

- The PINT AE format uses a standardized XML structure for invoicing.

- This structure allows easy validation and processing by computers.

- It helps ensure tax reporting accuracy, supports automated compliance checks, and reduces human errors.

Mandatory Fields:

Here are some of the key mandatory fields that must be included in a PINT AE to be compliant with the UAE VAT law:

- Invoice Number

- Issue Date

- Seller and Buyer Information

- Tax Rates

- Payment Terms

These fields must be accurately filled in for the invoice to be validated and accepted by the system.

PINT AE covers various invoice types, including:

- Tax Invoices: For standard transactions.

- Credit Notes: For adjustments to previous invoices.

- Self-Billing Invoices: Issued when the buyer issues an invoice on behalf of the supplier (commonly used in reverse charge transactions).

Different types of invoices require specific fields or formats based on the nature of the transaction (e.g., reverse charge, zero-rated supplies, etc.).

The PINT AE format ensures that invoices are validated before they are sent to the tax authorities, reducing the chances of non-compliance or errors.

If an invoice doesn’t meet the required standards, it is flagged and cannot proceed until the issues are corrected.

Need a deeper technical breakdown of PINT AE and its XML structure?

Check out our detailed guide. What Is PINT AE? The UAE’s Official E-Invoicing Specification Explained, where we explain the main sections, field rules, and common validation errors you should avoid.

The UAE E-Invoicing Data Dictionary: Your Official E-Invoicing Rulebook

Once you understand that UAE e-invoicing uses a structured XML format based on PINT AE, the next step is knowing exactly which information must appear on every invoice.

That is where the UAE E-Invoicing Data Dictionary comes in. Think of it as the official rulebook for every single field on your invoice. It tells you:

- Which fields are mandatory, optional, or conditional

- How each field must be formatted, including dates, codes, and IDs

- Which rules apply to different invoice types and scenarios

For example, something as simple as the Invoice Issue Date cannot appear as 25/04/24 or 04-25-2024. The Data Dictionary forces everyone to use the international YYYY-MM-DD format. So 2024-04-25 is always read correctly by every system and validator.

The same level of clarity applies to seller and buyer details, TRN, totals, VAT breakdown, line items, and even specialized fields for exports or reverse charge. Behind the scenes, this is what makes automation, interoperability, and FTA validation possible.

Read the full explainer: UAE E-Invoicing Data Dictionary Explained (Step by Step), where we break down field types, invoice types, and the 16 official use cases in simple language.

Key Dates and Implementation Timeline in the UAE

Here’s the official rollout timeline for UAE e-invoicing. These dates are confirmed by the Ministry of Finance and are critical for your planning.

| Phase | Category | Deadline to Appoint ASP | Mandatory Implementation Date |

|---|---|---|---|

| Pilot Programme | Selected businesses (Taxpayer Working Group) | Not Applicable | 1 July 2026 |

| Voluntary Adoption | Any business (optional) | Flexible | From 1 July 2026 |

| Phase 1 | Large businesses with revenue ≥ AED 50 million | 31 July 2026 | 1 January 2027 |

| Phase 2 | Businesses with revenue < AED 50 million | 31 March 2027 | 1 July 2027 |

| Phase 3 | All UAE Government Entities | 31 March 2027 | 1 October 2027 |

Explore our comprehensive guide on deadlines, penalties, and actionable steps to ensure your business is fully prepared.

Benefits of e-invoicing for your business

Eliminating paper invoices saves money on printing, postage, and storage. Automation also reduces labor costs related to manual invoice handling and error correction.

- Enhanced Accuracy and Reduced Errors: Automated validation in e-invoicing minimizes human errors such as duplicate or incorrect invoices, improving data quality and reducing costly disputes or rework.

- Stronger Regulatory Compliance: E-invoicing platforms automatically align with evolving tax rules and audit requirements, helping businesses stay compliant and avoid penalties.

- Better Business Insights from Invoice Data: Digital invoices provide rich, real-time data that can be analyzed to identify payment trends, optimize working capital, and improve financial forecasting.

- Seamless Global Business Transactions: E-invoicing enables easy integration with international partners and supports multiple tax jurisdictions, simplifying cross-border trade and compliance.

- Improved Customer and Supplier Relationships: Faster, error-free invoicing fosters trust with customers and suppliers, strengthening relationships and facilitating smoother business operations.

- Faster Payments and Improved Cash Flow: E-invoicing streamlines the invoicing cycle by automating approvals and eliminating manual delays, enabling your business to receive payments more quickly and enhance cash flow management.

Common Challenges and How to Overcome Them in the UAE

Even with the right tools, many companies run into obstacles when rolling out e-invoicing. Here are some of the most common:

| Challenge | Description |

|---|---|

| Incomplete or Inaccurate Master Data | Missing TRNs, outdated VAT details, or inconsistent customer/supplier information can cause invoice rejections. |

| Integration Hurdles | APIs or file transfers between ERP, ASP, and Peppol endpoints may fail if not properly mapped and tested. |

| Validation Errors | Incorrect tax rates, wrong document types, or invalid invoice references can halt submissions. |

| Change Management Gaps | Finance, tax, and IT teams often lack clear ownership of compliance steps, leading to delays. |

| Regulatory Updates | Frequent changes to schema, mandatory fields, or reporting requirements can catch teams off-guard if processes aren’t regularly updated. |

| Limited Testing | Skipping thorough sandbox or pilot testing can result in go-live failures and compliance penalties. |

Finding e-invoicing too complex? At Complyance, we make it simple and help you go live in just one week. Talk to our experts today

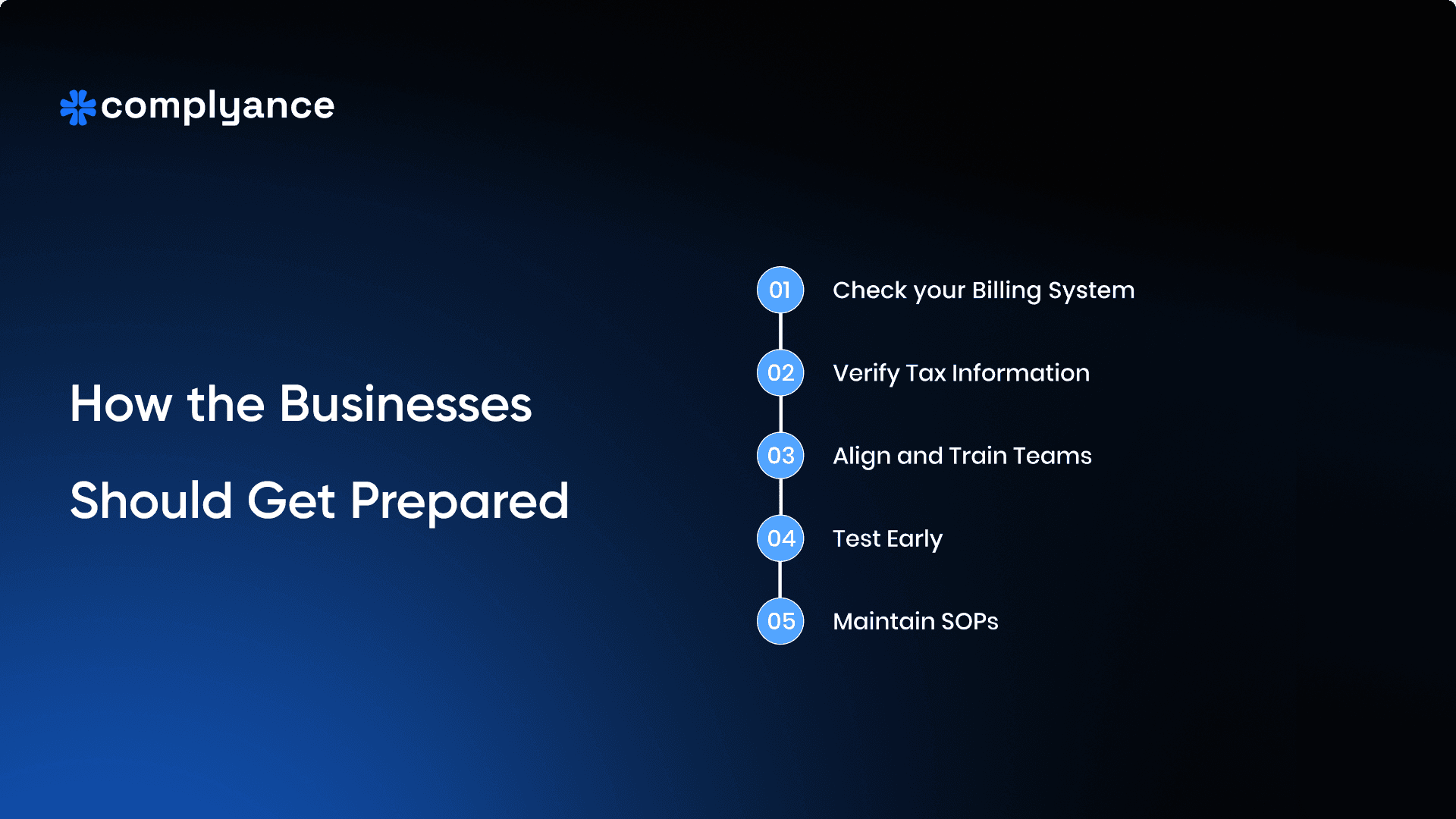

How Businesses Should Get Prepared for UAE E-Invoicing

Every one of these challenges can be avoided with the right preparation. In our E-Invoicing in the UAE: Deadlines, Penalties, and Pro Tips blog, we break down practical steps to align your systems, train your teams, and test your setup for a smooth go-live.

Check Your Billing System

- Ensure your ERP generates invoices with all mandatory fields (TRN, VAT, references)

- Keep customer/supplier records complete and accurate

- Conduct a gap analysis to align fields, formats, and workflows with UAE standards

- Prepare IT teams for API setup or Excel uploads. (Complyance offers ready Excel templates.)

Verify Tax Information

- Have correct TRNs ready for ASP onboarding

- Prepare VAT details accurately

- Set up Peppol ID for electronic document exchange

- Ready signature for the ASP onboarding process

Choose Future-Proof Platform

- Supports all invoice types and integrates via API or secure transfers

- Automates validation, connects to Peppol, and provides dashboards

- Offers post-go-live support and regular regulatory updates

- Provides comprehensive reporting and analytics

Align and Train Teams

- Finance, Tax, IT, Procurement, and Sales should understand their roles

- Use targeted training and internal champions to maintain readiness

- Establish clear communication channels between departments

- Regular training updates as regulations evolve

Test Early

- Use pilot programs to run real-world scenarios

- Validate B2B, B2G, exempt supplies, and rejection handling against UAE Peppol standards

- Test integration points and data flow processes

- Validate error handling and exception management

Maintain SOPs

- Document processes, error fixes, and contact points

- Keep versions updated as rules change

- Establish regular review cycles for procedures

- Maintain audit trails and compliance documentation

Choosing the Right Accredited Service Provider for UAE E-Invoicing

Selecting the right Accredited Service Provider (ASP) goes beyond basic compliance and significantly impacts your team's efficiency and success. When evaluating providers and platforms, look for:

- Peppol Certification & Compliance – Ensure the ASP is Peppol-certified and fully aligned with OpenPeppol and UAE-PINT standards.

- Security & Data Protection – Verify robust security certifications (e.g., ISO/IEC 27001), adherence to UAE data laws, strong encryption, and multifactor authentication.

- Support for All Invoice Types – The platform should handle tax invoices, credit notes, reverse charge flows, and other formats required by UAE regulations.

- ERP & System Integration – Choose a solution that connects seamlessly with your ERP or accounting system via APIs or secure file transfers, and integrates with partner systems on the Peppol network.

- Advanced Capabilities – Look for guided onboarding, automated validation before submission, proactive error detection, real-time compliance monitoring, and detailed analytics.

- Post-Go-Live Support – Confirm ongoing assistance, including tax expert consultation, platform updates to match evolving regulations, and responsive issue resolution.

- Multi-Country Readiness – Opt for a platform that supports global rollouts through a single integration, simplifying expansion beyond the UAE.

- Proven Track Record – Check operational history, financial stability, and absence of legal or compliance issues.

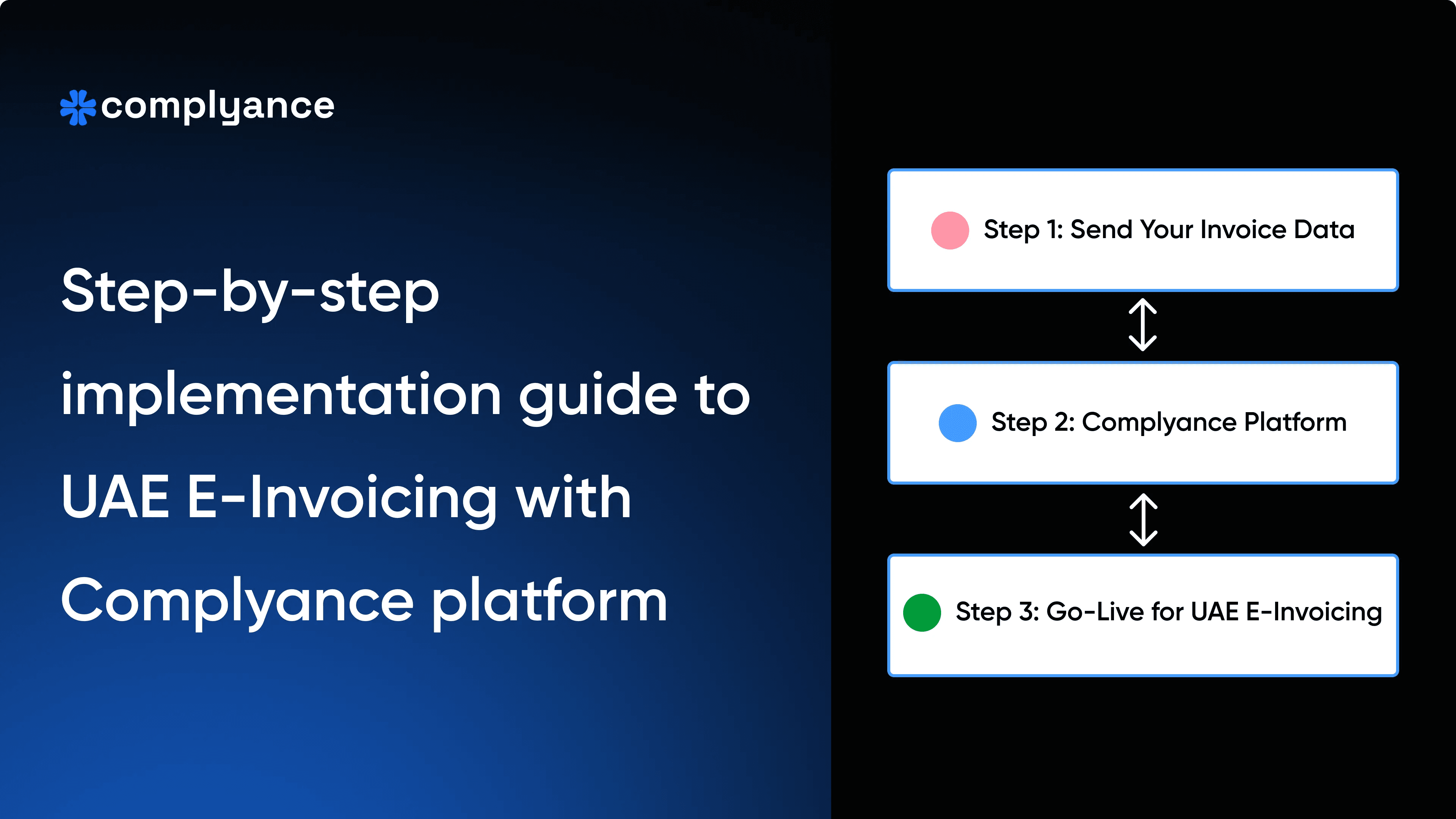

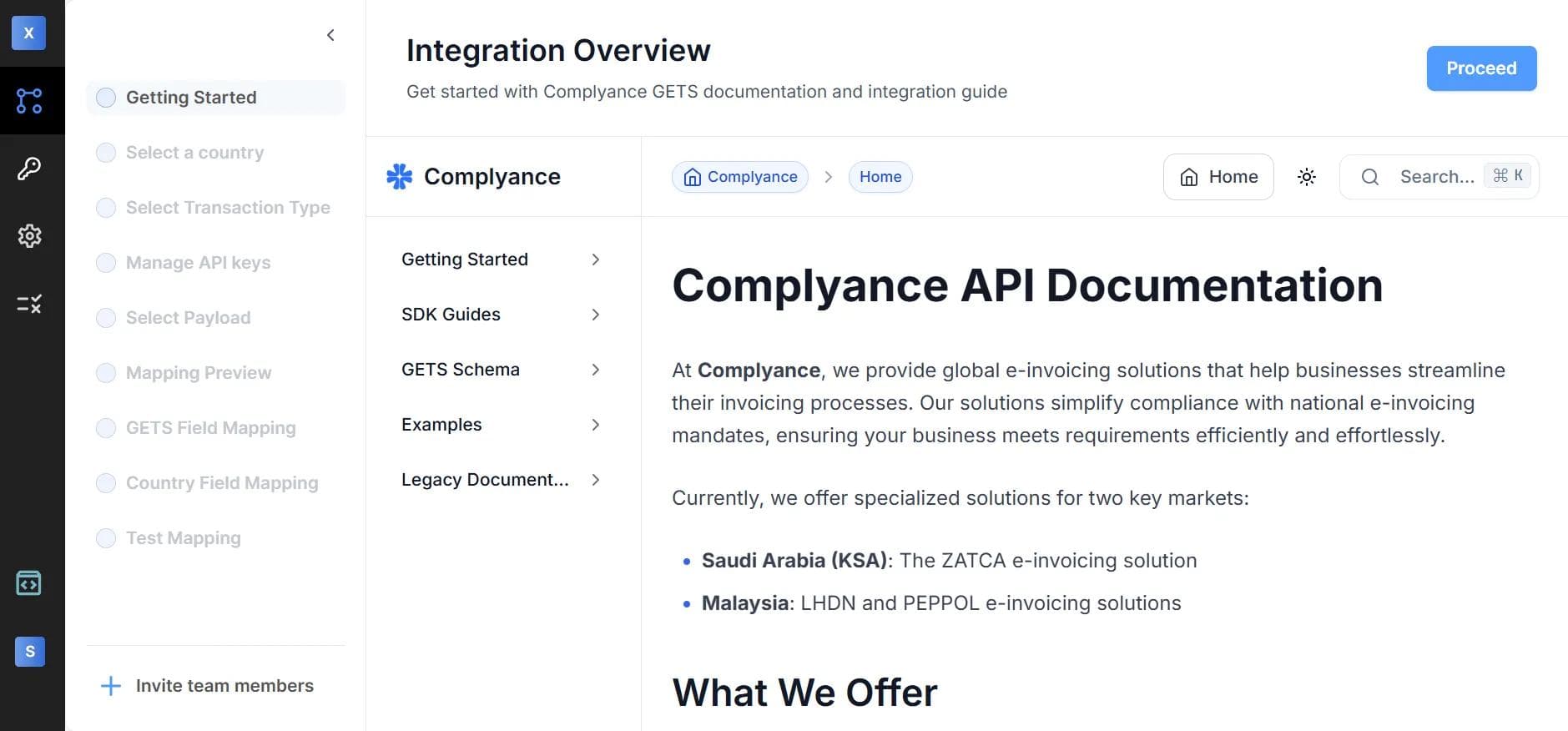

Implementation: How Business Can Integrate Their ERP with the Complyance API

Once businesses finalize their preferred integration model, the next step is to connect their ERP or POS systems with the Complyance API. The setup is simple, developer-friendly, and designed to help large retail environments go live quickly without requiring extensive technical work.

Step 1: Get Started with the Integration Panel

Once you log into the Complyance platform, you’ll see a navigation sidebar on the left. From here: Expand the Developer Portal section at the bottom. You’ll find two options under Portals:

- Invoice Portal

- Developer Portal

Click on Developer Portal to access the Integration Engine, where you’ll land on the Integration Overview screen. This is your starting point to access:

- SDK Guides – Step-by-step instructions for setting up and using Complyance SDKs.

- GETS Schema Documentation – Detailed breakdown of standard fields and country-specific mappings.

- Example Payloads – Sample JSON structures and response formats to help align your ERP output.

- Legacy Docs – Useful for teams migrating from older invoice formats or systems.

This section gives your developers everything they need to get started, from understanding GETS to pushing validated data using SDKs. On the left sidebar, you’ll also find a progress-driven checklist, starting from country selection and ending with test mapping, making it easy to track integration progress from start to finish.

To understand more about the E-invoicing integration, visit Complyance API documentation

Java SDK Setup (Recommended Path for Developers)

Complyance currently supports a Java SDK for production-grade integration with ERP or billing systems. In upcoming updates, SDKs for C++, JavaScript (Node.js), and Python will also be available to support a wider range of technology stacks. For now, if you’re using Java, follow the steps below:

Installation: Java SDK Setup. We recommend using the automated setup, which detects your operating system and generates the correct configuration path for you.

macOS & Linux Setup

Install Java (JDK 11 or higher)

brew install openjdk@11Set the JAVA_HOME environment variable

export JAVA_HOME=$(/usr/libexec/java_home -v 11) Verify Java Installation

java –version- pic Windows:

- Download and install OpenJDK 11+

- Set the JAVA_HOME environment variable

- Add Java to PATH

After setting up the Installation, go to the Developer portal and start implementing it

Step 2: Mapping and Testing

Once your SDK is connected, proceed through the Integration Checklist:

- Select Country – Choose the country (for example, UAE).

- Select Transaction/Invoice Type – Choose the invoice type (Tax Invoice, Credit Note, or Debit Note) and define whether the transaction is B2B, B2C, or B2G.

- Manage API Keys – Securely generate API credentials.

- Select Payload – Configure the data structure for your ERP invoices.

- Mapping Preview – Match your ERP field headers with Complyance’s GETS schema.

- Country Field Mapping – Apply country-specific validation rules (for example, PINT AE for UAE).

- Test Mapping – Run validation tests before going live.

Once testing is complete, you can move to live mode, where invoices are processed, validated, and submitted in real time through Complyance platform.

Step 3: Go Live

After successful testing, your integration is ready for production. Businesses can begin submitting live invoices from their ERP or POS systems to the FTA via Complyance. The platform monitors each transaction in real time and provides status visibility for every invoice submitted, ensuring no data is lost or delayed.

For a more detailed and full implementation process, read our blog: How to Implement UAE E-Invoicing with the Complyance API Platform: A Step-by-Step Guide

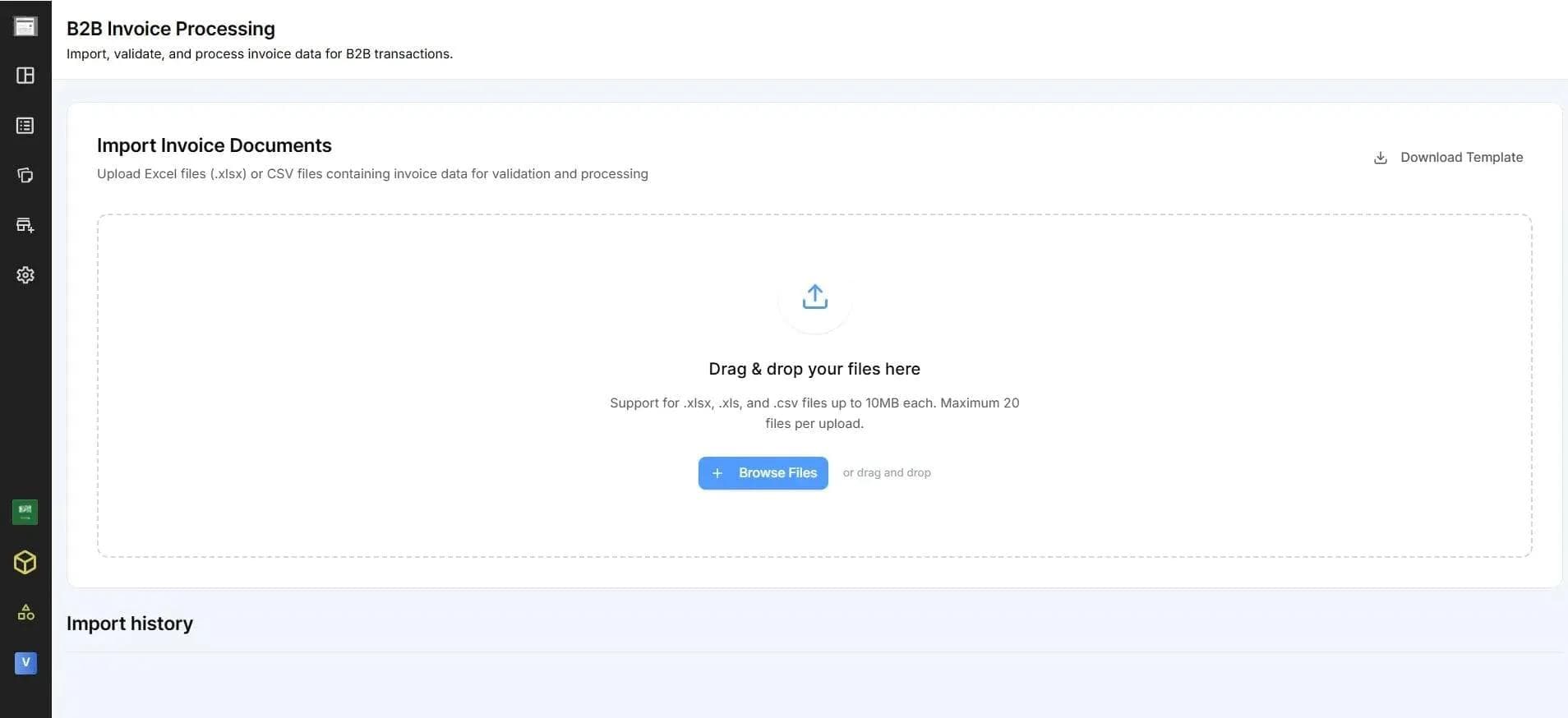

Option B: Excel Upload (Easiest way for doing E-Invoicing)

For the teams that already manage invoices in spreadsheets, the Excel Upload option offers a convenient way to process many invoices at once. Here’s the process:

- Download the pre-formatted Excel template from your Complyance dashboard

- Fill in all invoice rows with the required details

- Upload the completed sheet back to the platform

- Complyance auto-validates each entry, showing clear errors (like missing TRNs or VAT mismatches)

Bonus: Smart dropdowns and data validation in the template help reduce manual mistakes while preparing the sheet.

How Complyance Helps Businesses Stay 100% UAE E-Invoicing Compliant

Complyance is the preferred e-invoicing solution for 1000+ businesses worldwide, helping companies achieve fast, reliable, and fully compliant e-invoicing in the UAE. With over 5 years of global e-invoicing experience, our platform enables businesses to go live within a week, avoiding errors, penalties, and delays, while simplifying compliance with the Federal Tax Authority (FTA).

Whether you are an IT/developer, finance team, or Tax Leader, Complyance makes managing invoices easy, secure, and fully automated.

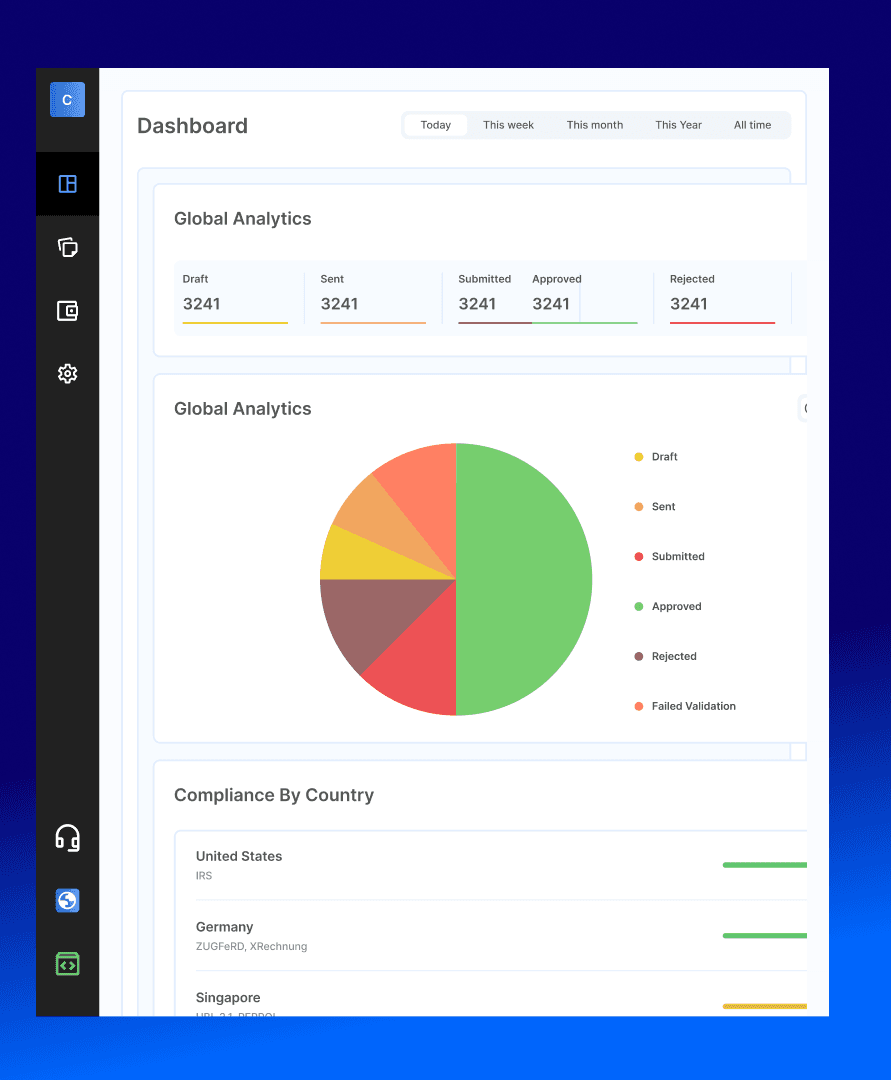

Note: These images show real results from our customers. Every business using Complyance went live with e-invoicing in just 1 to 4 weeks. Compared to other e-invoicing providers, Complyance helps companies get started up to 10× faster, saving time and making e-invoicing quick and easy.

Key Highlights

- 5 Years of E-Invoicing Expertise

- One API for UAE & Global E-Invoicing

- 100% Success Rate in E-Invoice Generation

- 1.5 Billion E-Invoices Processed Annually

- Trusted by 1,000+ Companies Worldwide

What Businesses Gain with Complyance

- Global E-Invoicing API: Complyance provides a single API for global e-invoicing via our proprietary GETS framework. With one-time integration, enterprises can achieve compliance in multiple countries within a week. No matter which ERP, POS, or accounting software you use, Complyance ensures fast, error-free, and fully compliant e-invoicing across borders.

- Peppol-Certified & UAE-Ready: Complyance is a Peppol-certified solution provider and is currently completing the UAE Ministry of Finance accreditation process. Our platform already supports Peppol integration in Malaysia, Belgium, and more, giving you confidence in reliable global compliance.

- Security & Compliance You Can Trust: Your e-invoicing data is fully secure, ISO/IEC 27001 Certified, GDPR Compliant, and SOC 2 Standards. Complyance meets all UAE MoF requirements, ensuring that your invoices and data are 100% secure.

- End-to-End ERP/POS Integration: Our in-house experts provide any ERP/POS/Accounting system integration with all major systems, including SAP, Oracle, MS Dynamics, Infor, Epicor, Xero, QuickBooks, Cegid, Square, Shopify, Lightspeed, Zoho, Sage, and more.

- Automated Tax Reconciliation: Complyance reconciles ERP invoice data with FTA submissions automatically, reducing discrepancies, saving time, and minimizing human error for finance teams

- UAE & Global Local Presence: Complyance has on-site technical teams in the UAE to support integration and training. Globally, our teams are present in Southeast Asia, Europe, the USA, India, and now across the Middle East, ensuring seamless implementation anywhere your business operates.

- 100+ Invoice Validations Before Submission: Every invoice undergoes 100+ automated validations before submission via Peppol to the FTA. This ensures first-time acceptance and eliminates errors, giving your business complete peace of mind.

Can a business go live in one to three weeks with a 100% success rate?

Absolutely. Redbus achieved 100% E-invoice acceptance with Complyance, going live in just three weeks and processing over 10 million E-invoices without disruption. This real-world success highlights how businesses can quickly meet UAE e-invoicing compliance without extensive IT/Dev resources.

Want to see how? Read the full Redbus case study here.

Conclusion: Make the Smart Move Now!

E-invoicing in the UAE will be mandatory by July 2026.

Businesses should not wait until the final date to act.

Now is the time to prepare your ERP and billing systems for the PINT AE format and real-time invoice transmission.

That means setting up secure connections with Accredited Service Providers, enabling digital signatures, and planning for ongoing compliance costs.

Being prepared early is the smarter move.

Still have questions about UAE e-invoicing?

Talk to our team. We’ll walk you through sandbox access, XML validation, onboarding plans, and integration timelines. Whether you're a finance head or a developer, we’ve got answers. Reach out here.

Related posts

Frequently Asked Questions

The UAE e-invoicing timeline will take place in four key phases:

- Pilot Phase: Begins in July 2026 for a select group of invite-only companies chosen by the Federal Tax Authority (FTA) to test and validate the system.

- Phase 1: From January 2027, e-invoicing becomes mandatory for businesses with annual revenue equal to or above AED 50 million.

- Phase 2: From July 2027, all remaining VAT-registered businesses with revenue below AED 50 million must comply.

- Phase 3: From October 2027, government entities are required to issue and process e-invoices under the same framework.

A regular invoice is typically a PDF or paper document. An e-invoice is a structured XML file that follows UAE’s PINT AE format and is submitted digitally through Accredited Service Providers.

The UAE Ministry of Finance will publish a list of approved Accredited Service Providers (ASPs). Make sure your provider is on this list and meets all OpenPeppol and UAE-specific requirements.

It depends on your current systems. But with Complyance, you can go live in under one week. Our developer-first API and ready-to-use sandbox make integration fast, smooth, and testable from day one. Starting early gives you a big edge—and using Complyance gets you there faster.

Complyance offers a developer-first e-invoicing API platform that lets you integrate UAE e-invoicing into your existing systems in under a week. We provide detailed API docs, a fully functional sandbox, quick-start guides, and real-time support so your engineering team can ship confidently and fast.

At the same time, it’s built for finance and Developer teams, offering Auto Mapping, validation logs, compliance tracking, and smart alerts that make managing e-invoicing easy even for non-technical users.

You can send a PDF copy to your customer for their records—but it won’t count for compliance. Only structured XML files exchanged via the Peppol network fulfill the mandate.

If your invoice doesn’t meet the required standards, your ASP will receive a negative Message Level Status (MLS) from the FTA or the buyer’s ASP. It won’t be delivered or reported. You'll need to fix the issue and resubmit.

But here’s the good news: if you’re using Complyance, we handle all of this for you. Our platform pre-validates every invoice before it’s sent, catching issues in real-time so failed submissions never happen. From formatting to field mapping, from TDD generation to MLS tracking, we take care of the entire lifecycle.

You send the invoice. We do the rest. No rejections. No surprises. Just compliance that works.

No. Your invoicing system or ERP should automatically generate PINT AE-compliant XMLs. If not, you need a platform or middleware that handles this for you.

E-invoicing in the UAE is a government-mandated system requiring businesses to issue, receive, and report invoices in a structured XML format through FTA-approved platforms. Regulated by the Federal Tax Authority (FTA), it aims to improve tax compliance, reduce fraud, and enable real-time reporting. The rollout begins in phases starting 2025, and will be fully mandatory for all businesses by 2027.

Businesses must select an FTA-approved Access Point or ASP provider, map their ERP invoice data to the required schema, run tests, and go live before their mandatory phase. Platforms like Complyance simplify this by offering end-to-end support and fast onboarding.

Subscribe to our Newsletter

Get the latest compliance updates, e-invoicing news, and expert tips delivered to your inbox.

ABOUT COMPLYANCE

Empowering businesses to automate e-invoicing and stay compliant in 100+ countries. Our platform simplifies regulatory complexity for enterprises and fast-growing companies.