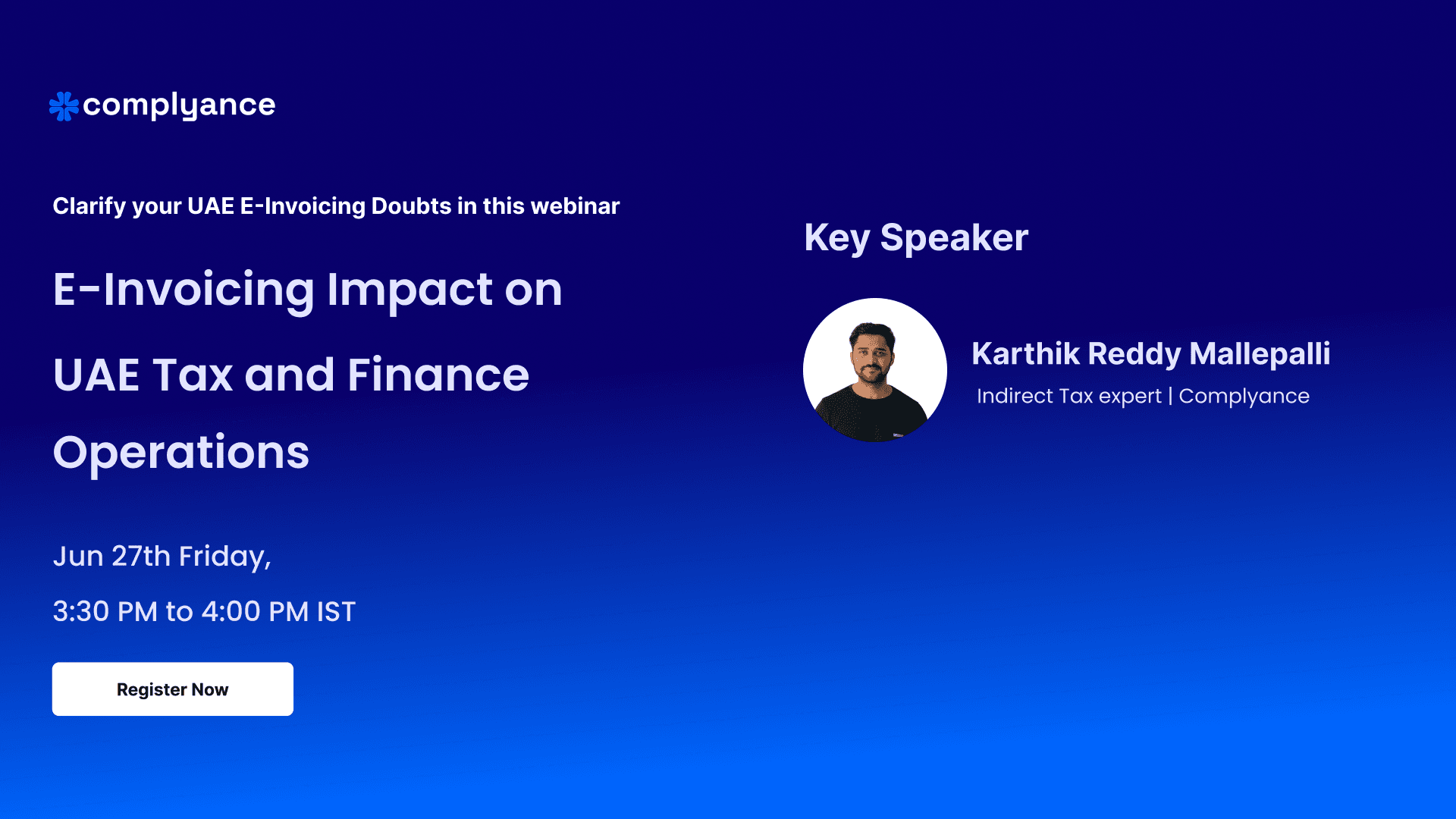

Webinars / E-Invoicing Impact on UAE Tax and Finance Operations

Friday, Jun 27, 2025, 3.30PM IST

E-Invoicing Impact on UAE Tax and Finance Operations

Join our tax expert to learn how UAE’s e-invoicing affects tax and finance operations, from streamlining AR/AP processes to improving tax filing and compliance. Discover benefits of early adoption and how staying updated with Ministry of Finance guidelines ensures a smooth transition.

Trusted by 500+ companies worldwide

Powering the world's leading brands.

From next-gen startups to established enterprises.

Meet Your Speakers

Karthik Reddy Mallepalli

Indirect Tax Domain Expert

COMPLYANCE

Discover how the UAE’s mandatory e-invoicing initiative is transforming tax and finance functions across businesses. In this session, our tax expert will unpack the practical impacts of e-invoicing on accounts receivable and payable processes, tax filing accuracy, and compliance management. Learn from real-world cases how early adopters benefit and how staying aligned with the latest UAE Ministry of Finance updates ensures seamless implementation. This webinar will equip tax and finance professionals with actionable insights to navigate regulatory changes and leverage technology for improved operational efficiency.

Key Takeaways:

- Understand the direct effects of e-invoicing on UAE tax filing and finance operations

- Learn how e-invoicing streamlines AR/AP workflows and reduces manual errors

- Gain insights into common compliance challenges and how to mitigate them

- Discover advantages of early adoption and how it benefits business readiness

- See how Complyance stays closely aligned with UAE MOF updates to support smooth transitions