Complyance Webinars

Join our expert-led webinars to learn about e-invoicing compliance, tax regulations, and digital transformation strategies across different countries.

WEBINAR TYPE

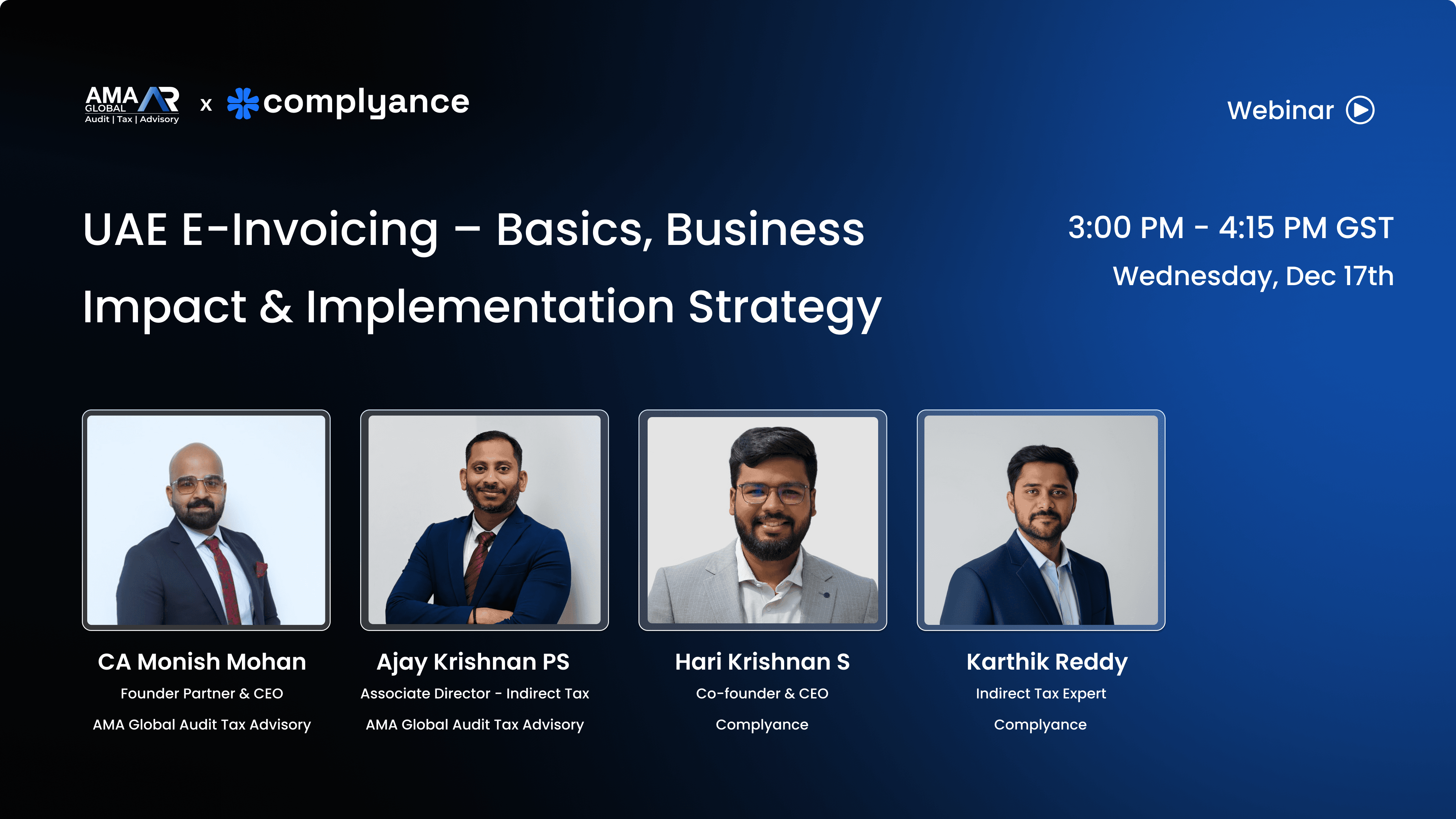

UAE E-Invoicing – Basics, Business Impact and Implementation Strategy

The UAE’s move toward structured E-invoicing is reshaping how businesses operate, from documentation and data flows to ERP integration and audit readiness. This session offers a clear view of the mandate, the business-wide implications, and a strategic pathway to implementation across sectors.

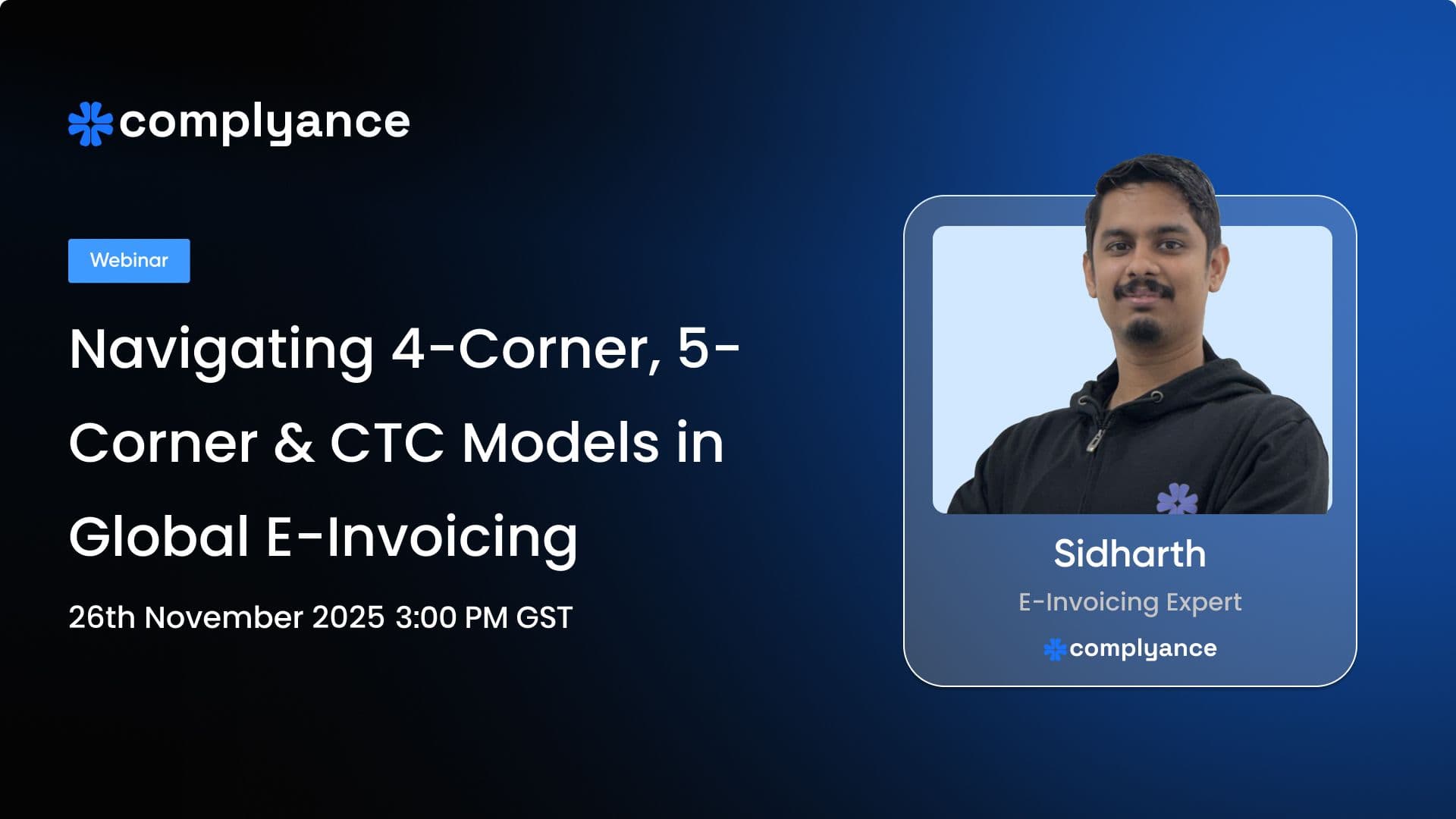

Navigating 4-Corner, 5-Corner & CTC Models in Global E-Invoicing

Global e invoicing is moving toward real time reporting, and countries are using 4 Corner and 5 Corner models to make it happen. This webinar explains these models in simple terms and how CTC and DCTCE fit into them. You will learn what this means for your systems and what to prepare for upcoming mandates.

E-Invoicing Solutions: Should You Build In-House or Buy from a Vendor?

Still unsure whether to build or buy your e-invoicing solution? This webinar reveals the hidden costs, integration hurdles, and faster path to compliance most teams overlook.

2026 UAE E-Invoicing Readiness Checklist: Are You On Track?

Get clarity, cut risk, and get PINT-AE ready—without heavy ERP rework.

Live Demo: UAE E-Invoicing with One API, One Template and Zero Rebuilds

Choosing an e-invoicing vendor? Don’t decide yet. See Complyance in action—AI-driven integration, multi-country compliance, and gap analysis that can shift your priorities. Live demo included.

Preparing for UAE and Oman E-Invoicing - Your Questions Answered

Join our exclusive webinar on the 2nd of July, 2025 to gain insights from e-invoicing and ERP specialists.

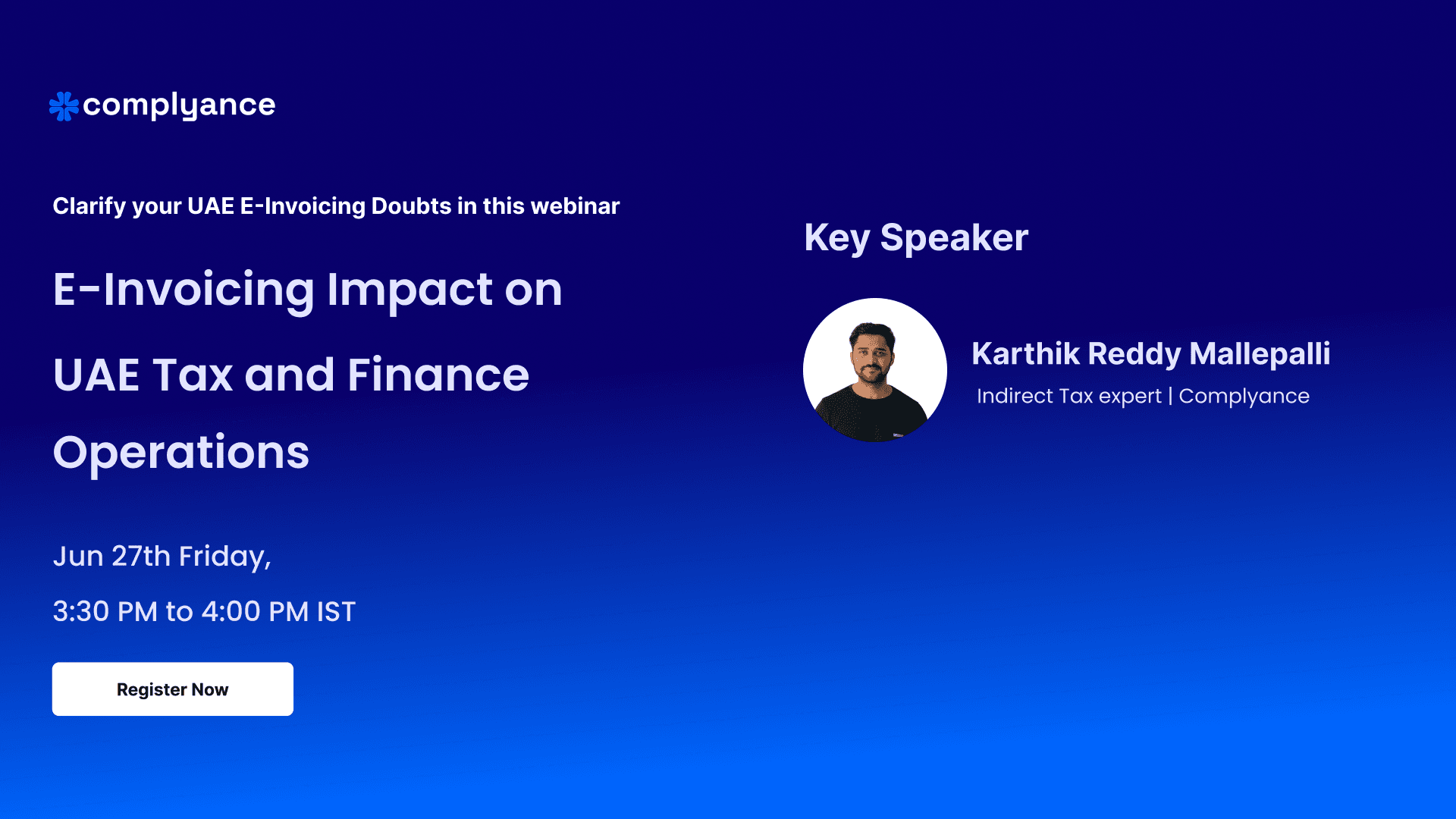

E-Invoicing Impact on UAE Tax and Finance Operations

Join our tax expert to learn how UAE’s e-invoicing affects tax and finance operations, from streamlining AR/AP processes to improving tax filing and compliance. Discover benefits of early adoption and how staying updated with Ministry of Finance guidelines ensures a smooth transition.