UAE e-invoicing Framework: 5-Corner DCTCE Model

Understand how UAE’s 5-corner e-invoicing model (DCTCE) works, providing a secure, compliant solution for businesses and government.

Table of Contents

UAE e-invoicing Framework: 5-Corner DCTCE Model

Understanding the UAE's Digital Invoicing Model: Simplifying Compliance Through DCTCE and Peppol Network

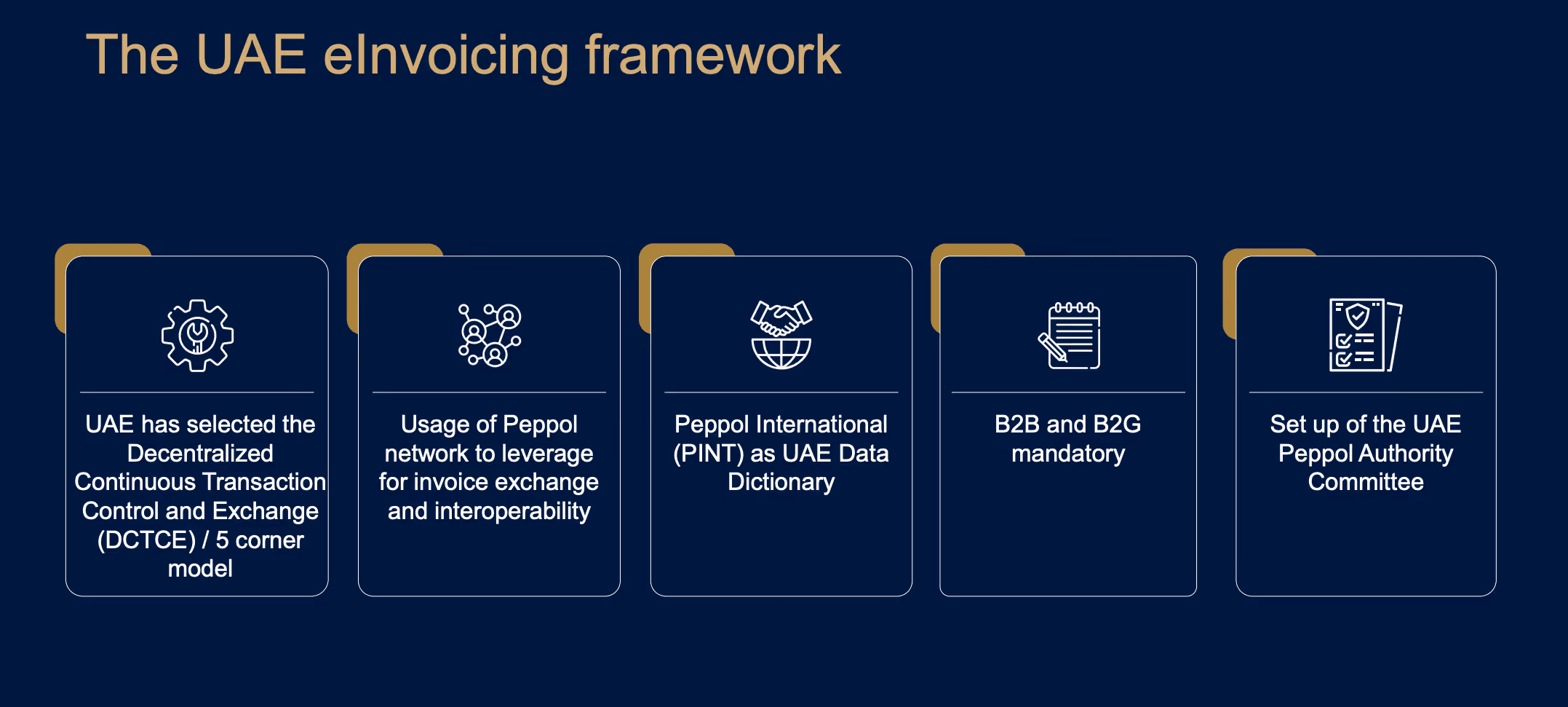

The UAE has introduced a state-of-the-art digital invoicing model known as the Decentralized Continuous Transaction Control and Exchange (DCTCE) or the 5-corner model. This transformative system is designed to modernize business transactions, enhance transparency, and ensure compliance with regulatory requirements. In this blog, we’ll break down the key components of this system and its benefits for businesses in the UAE.

What is the UAE Digital Invoicing Model?

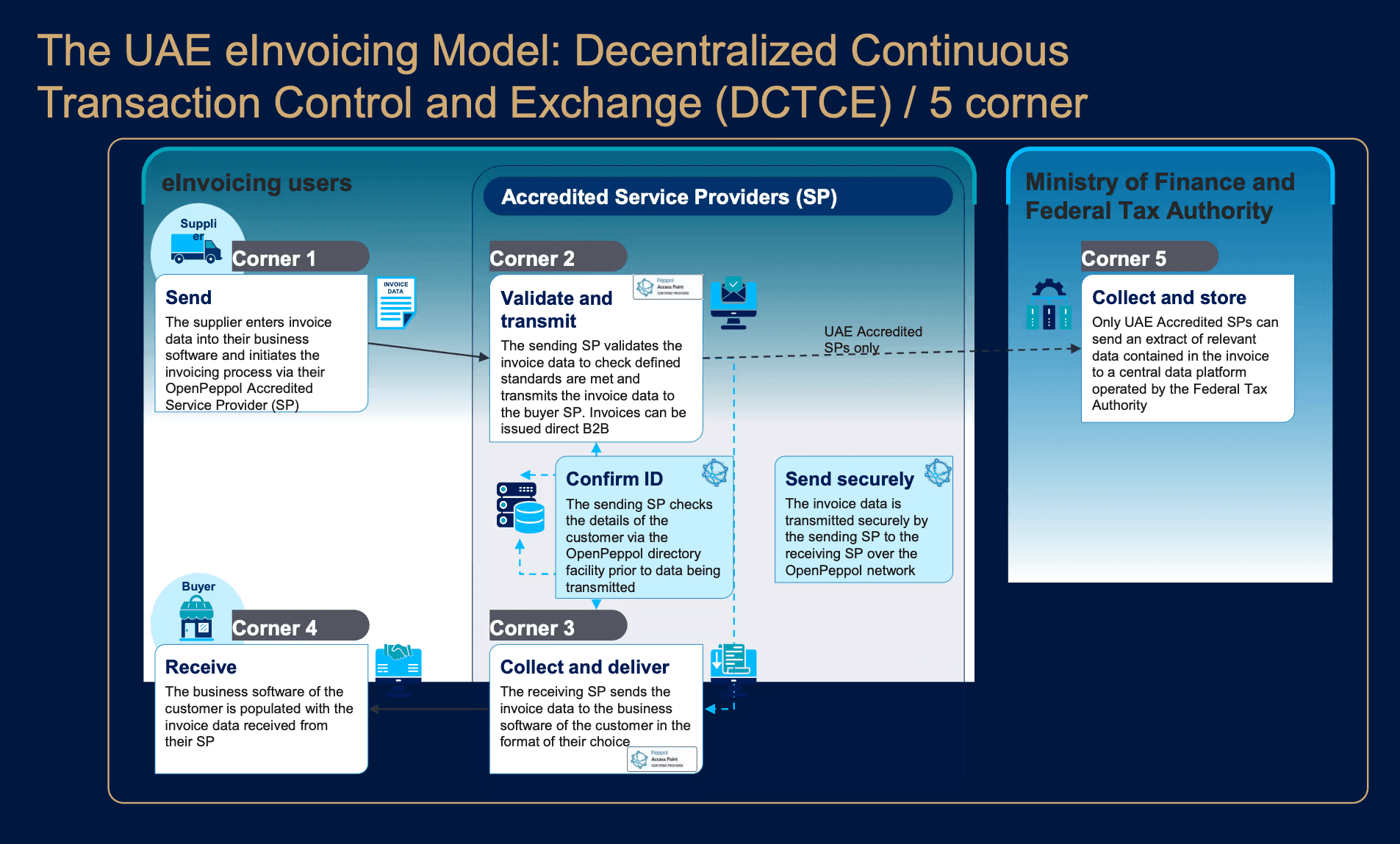

The DCTCE/5-corner model revolutionizes the way businesses handle digital invoicing by leveraging the Peppol network, an international standard for invoicing interoperability. The framework ensures secure, streamlined invoice exchanges between suppliers, buyers, service providers, and the Federal Tax Authority. Here’s how it works step by step:

1. Corner 1: Invoice Creation

- The supplier inputs the invoice data into their business software.

- This data is processed through their accredited OpenPeppol Service Provider (SP), initiating the digital invoicing process.

2. Corner 2: Validation and Transmission

- The sending SP validates the invoice to ensure it adheres to the UAE’s compliance standards.

- After validation, the SP transmits the invoice to the recipient’s service provider securely.

3. Corner 3: Secure Data Transmission

- Using OpenPeppol's trusted network, the sending SP verifies the recipient's identity via a directory service.

- The data is securely transmitted to the recipient’s SP.

4. Corner 4: Invoice Receipt

- The receiving SP delivers the invoice to the buyer’s business system in a compatible format.

- This seamless integration eliminates manual data entry and ensures accuracy.

5. Corner 5: Regulatory Submission

- UAE-accredited SPs send extracts of relevant invoice data to a centralized data platform managed by the Federal Tax Authority (FTA).

- This ensures compliance with tax regulations and provides real-time oversight for the government.

Key Features of the UAE Digital Invoicing Framework

The framework introduces several important elements to support businesses and enhance compliance:

Decentralized Model:

- The UAE’s selection of the DCTCE model ensures a decentralized approach, where transactions are securely managed without a central intermediary controlling the process.

Peppol Network Integration:

- By leveraging the Peppol network, businesses benefit from global interoperability, making cross-border transactions more efficient.

Standardized Data Dictionary:

- The UAE has adopted the Peppol International (PINT) data dictionary, ensuring consistency and clarity in invoice formatting.

Mandatory Compliance:

- The framework mandates digital invoicing for both Business-to-Business (B2B) and Business-to-Government (B2G) transactions, leaving no room for ambiguity.

UAE Peppol Authority:

- A dedicated authority oversees the implementation and operation of the Peppol network, ensuring adherence to global and local standards.

Benefits for Businesses

Adopting the UAE digital invoicing model provides numerous benefits for businesses:

- Improved Compliance: The centralized submission of invoice data to the FTA ensures businesses remain tax-compliant.

- Enhanced Efficiency: Automating invoice exchanges reduces manual processing errors and saves time.

- Global Compatibility: Peppol's international standards make UAE businesses compatible with global trade partners.

- Data Security: The secure transmission of invoice data prevents unauthorized access and fraud.

- Real-Time Monitoring: The FTA’s ability to monitor transactions in real time enhances transparency across industries.

Why is the UAE Leading in Digital Invoicing?

The UAE’s decision to implement this robust framework stems from its vision to be at the forefront of digital transformation. By adopting Peppol standards, the UAE ensures interoperability across borders while enabling seamless compliance with local regulations.

This initiative reflects a commitment to fostering a business-friendly environment while leveraging cutting-edge technology for transparency and efficiency.

Conclusion

The UAE’s digital invoicing framework is more than just a compliance requirement—it’s a gateway to the future of digital business. By adopting the DCTCE/5-corner model, businesses can streamline operations, enhance accuracy, and stay ahead in an increasingly digitalized economy.

As the system becomes mandatory for all B2B and B2G transactions, now is the perfect time for businesses to adapt. Start exploring accredited service providers and ensure your systems are ready to embrace this innovative change.

This guide provides all the insights you need to understand the UAE digital invoicing model. Stay tuned for more updates as we delve deeper into how businesses can effectively implement and benefit from this system!

Related posts

Frequently Asked Questions

The UAE digital invoicing model is a system based on the Decentralized Continuous Transaction Control and Exchange (DCTCE) framework, leveraging Peppol standards to ensure seamless and secure invoice exchanges.

The digital invoicing system enhances transparency, reduces fraud, ensures tax compliance, and streamlines business operations across the UAE.

Digital invoicing reduces manual processes, enhances tax compliance, speeds up payments, and integrates seamlessly with global systems through Peppol standards.

Accredited service providers validate and securely transmit invoice data between suppliers, buyers, and the Federal Tax Authority (FTA). They ensure compliance with UAE’s digital invoicing requirements.

Yes, digital invoicing is mandatory for Business-to-Business (B2B) and Business-to-Government (B2G) transactions, as per the phased implementation plan in the UAE.

The Peppol network is an international eInvoicing standard that ensures interoperability and secure data exchange. It plays a critical role in enabling the UAE’s seamless cross-border invoicing.

The system ensures data security by leveraging the Peppol network's encrypted channels and identity verification protocols for transmitting invoice data.

Yes, businesses that fail to comply with the UAE’s digital invoicing requirements may face fines and penalties as per the Federal Tax Authority’s guidelines.

Absolutely. Small businesses benefit from cost savings, improved efficiency, and tax compliance through the streamlined invoicing system.

Businesses can access a list of accredited service providers through the UAE’s Federal Tax Authority or OpenPeppol directory.

Subscribe to our Newsletter

Get the latest compliance updates, e-invoicing news, and expert tips delivered to your inbox.

ABOUT COMPLYANCE

Empowering businesses to automate e-invoicing and stay compliant in 100+ countries. Our platform simplifies regulatory complexity for enterprises and fast-growing companies.

Go Live in a Week with Developer-Friendly Global E-Invoicing Platform

Complyance makes it easy for your IT/dev team to integrate once and automate E-Invoicing across 100+ countries. Built for fast deployment, field-level validation, and indirect tax accuracy—no delays, no rework.