Ajith Kumar

Im a skilled content writer and SEO expert crafting engaging articles that rank. Passionate about making complex topics clear, discoverable, and valuable to readers.Dedicated to driving organic growth through high-quality, search-optimized content

LinkedInUAE E-Invoicing

UAE E-Invoicing 2026: Compliance & Opportunities

Prepare for mandatory UAE e-invoicing starting July 2025. This guide covers compliance, key dates, FTA requirements, and how your business can benefit from digital transformation.

July 15, 2025

UAE E-Invoicing: Your Guide to Compliance and Benefits

Learn UAE's e-invoicing timeline, requirements, and benefits. Find out what businesses need to know for compliance by July 2026.

June 4, 2025

How VAT Affects Individuals and Businesses in the UAE

Discover how VAT impacts UAE individuals & businesses: implementation, benefits, challenges, & compliance essentials. Stay informed & VAT-ready!

June 4, 2025

VAT Late Payment Penalty in the UAE: What Businesses Should Know

Learn about VAT late payment penalties in the UAE, including the fine amounts and how to meet compliance requirements.

June 4, 2025

UAE e-Invoicing Programme Timeline and Milestones

Discover the UAE e-Invoicing timeline, milestones, and its impact on taxpayers and businesses as the nation gears up for a digital tax future by 2026.

June 4, 2025

UAE e-invoicing Framework: 5-Corner DCTCE Model

Understand how UAE’s 5-corner e-invoicing model (DCTCE) works, providing a secure, compliant solution for businesses and government.

June 4, 2025

General Overview UAE

UAE E-Invoicing 2026: Compliance & Opportunities

Prepare for mandatory UAE e-invoicing starting July 2025. This guide covers compliance, key dates, FTA requirements, and how your business can benefit from digital transformation.

July 15, 2025

Smart UAE e-invoicing Initiative

Smart UAE's e-invoicing revolutionizes governance, boosting compliance, efficiency, and sustainability through digital transformation and advanced systems.

June 4, 2025

E-Invoicing in the UAE: What Businesses Need to Know

Discover UAE's B2B e-invoicing system via Peppol, live 2026. Learn implementation timeline, regulatory framework, and business benefits.

June 4, 2025

Malaysia E-Invoicing

Retail Industry E-Invoicing Implementation Solutions in Malaysia

Explore how e-invoicing solutions are transforming Malaysia’s retail industry, ensuring compliance, enhancing efficiency, and boosting economic contributions.

June 30, 2025

Implementing E-Invoicing for Insurance & Takaful in Malaysia

Learn how Malaysia’s insurance and takaful sectors are adapting to the e-invoicing mandate, with insights from IRBM’s guidelines. Understand the challenges and FAQs here.

June 30, 2025

E-Invoicing Implementation in Malaysia’s Aviation Industry

Learn how malaysia aviation sector is adopting e-invoicing. This guide covers IRBM regulations, key revenue streams, compliance challenges, and solutions for aviation stakeholders.

June 30, 2025

Digital Signature for e-invoicing in Malaysia

Learn how digital signatures ensure compliance with Malaysia's e-Invoicing regulations. Discover the role of CAs, the signing process, and validation rules.

June 30, 2025

E-invoice Implementation for Malaysia Financial Services Industry

Learn about the impacts of Malaysian e-invoice on financial services, including important guidelines for consent, cross-border transactions, and brokerage invoicing.

June 27, 2025

Inland Revenue Board of Malaysia (IRBM/LHDN) - New Updates

Discover the role of the Inland Revenue Board of Malaysia (IRBM), also known as LHDN. Learn about its impact and prominence in Malaysia's tax system.

June 27, 2025

Global E-Invoicing

Simplifying Global Trade with Peppol PINT Specifications

Ready to take your business to the next level? Explore Peppol PINT today and see how it can transform your international transactions. Join the global network that's making business easier, faster, and more exciting than ever before. Take the leap, and let Peppol PINT be your guide to new horizons.

June 19, 2025

Guide to Global e-Invoicing Mandates

Learn about the global e-Invoicing mandates, their challenges, benefits, and how "Complyance" helps businesses achieve compliance globally.

June 5, 2025

Peppol BIS Billing

Discover Peppol BIS by OpenPeppol AISBL, enhancing seamless business communication and data exchange with standardized interoperability.

June 5, 2025

Peppol: transforming business transactions across nations

Discover our Peppol E-Invoicing solution designed for ERP systems and major international firms, ensuring seamless global compliance and efficiency.

June 5, 2025

Peppol BIS Billing: A Comprehensive Guide to Simplified e-Invoicing

Discover how Peppol BIS Billing simplifies e-invoicing, ensures EU compliance, and benefits businesses. Learn features, processes, and implementation.

June 5, 2025

Peppol International (PINT) model for Billing - The Complete Guide

Peppol PINT is a standardized model for global billing, simplifying invoicing processes with clear rules and specifications.

June 5, 2025

peppol

Simplifying Global Trade with Peppol PINT Specifications

Ready to take your business to the next level? Explore Peppol PINT today and see how it can transform your international transactions. Join the global network that's making business easier, faster, and more exciting than ever before. Take the leap, and let Peppol PINT be your guide to new horizons.

June 19, 2025

Peppol BIS Billing

Discover Peppol BIS by OpenPeppol AISBL, enhancing seamless business communication and data exchange with standardized interoperability.

June 5, 2025

Peppol: transforming business transactions across nations

Discover our Peppol E-Invoicing solution designed for ERP systems and major international firms, ensuring seamless global compliance and efficiency.

June 5, 2025

Peppol BIS Billing: A Comprehensive Guide to Simplified e-Invoicing

Discover how Peppol BIS Billing simplifies e-invoicing, ensures EU compliance, and benefits businesses. Learn features, processes, and implementation.

June 5, 2025

Peppol International (PINT) model for Billing - The Complete Guide

Peppol PINT is a standardized model for global billing, simplifying invoicing processes with clear rules and specifications.

June 5, 2025

Regulatory updates

How to Use E-Invoicing for Foreign Transactions in Malaysia

E-Invoicing Malaysia: Expert tips for compliant profit distribution & foreign income, including domestic & international dividends. Maximize compliance.

June 6, 2025

E-Invoicing in Malaysia

Learn all about LHDN e-invoicing regulations. Get timelines, compliance steps, and choose the best solution for seamless implementation in your business.

June 6, 2025

Credit Notes and Debit Notes in Malaysia E-Invoicing

Learn about credit notes and debit notes in Malaysia's e-Invoicing system, including types of e-Invoices, benefits, and best practices for handling them.

June 6, 2025

Malaysia E-Invoice Penalties: Consequences of Non-Compliance

E-Invoice Malaysia Penalties: Non-compliance can result in fines from RM200 to RM20,000, imprisonment up to 6 months, or both.

June 6, 2025

E-Invoice Rejection and Cancellation Guide for Malaysia

Learn about e-invoice rejection and cancellation in Malaysia. Manage errors within 72 hours and keep accurate records with our comprehensive guide.

June 6, 2025

E-Invoicing for Agents, Dealers & Distributors in Malaysia

Learn about self-billed e-invoices for payments to agents, dealers, and distributors in Malaysia, including essential methods and compliance practices.

June 6, 2025

Complyance update

Do Businesses Need to Submit an E-Invoice the Same Day?

Learn if Malaysian businesses must submit e-invoices the same day. Get details on e-invoicing rules, deadlines, and compliance in this guide.

June 6, 2025

10 Common Mistakes in E-Invoicing for Businesses in Malaysia

Avoid Malaysia's top 10 e-invoicing mistakes! Complyance offers expert tips to stay compliant and efficient, ensuring your business goes live fast.

June 6, 2025

e-invoicing in Malaysia: A Complete Guide for Every Business

Malaysia's e-invoicing, mandated August 1, 2024: Learn regulations, applicability, implementation, and choosing the right solution for your business.

June 6, 2025

Malaysia e-Invoice Software Development Kit (SDK)

Discover Malaysia's Electronic Invoice SDK by IRBM for easy e-invoicing. Automate processes and boost efficiency with this comprehensive toolkit.

June 5, 2025

How to Avoid and Resolve Common E-Invoicing Failures in Saudi Arabia?

Avoid common e-invoicing failures in Saudi Arabia with expert tips. Ensure compliance and avoid mistakes.

June 5, 2025

Industry blogs

E-invoice Implementation for Malaysia Construction Industry

Learn how Malaysia's e-Invoice impacts construction. Get key guidelines for contractors, subcontractors, & material suppliers to stay compliant.

June 6, 2025

E-invoice implementation for Malaysia e-commerce industry

E-commerce guide to Malaysia's e-Invoice system. Learn how platforms and sellers can stay legal and streamline operations.

June 6, 2025

How to implement LHDN E-Invoicing for Petroleum Industries

Learn how e-invoicing impacts Malaysia's petroleum sector. Discover the challenges, benefits, and key steps for compliance in this comprehensive guide.

June 6, 2025

E-invoice Implementation for Tourism Industries in Malaysia

Malaysia’s tourism sector is adapting to e-invoicing. Learn about new regulations, common billing scenarios, and the benefits for businesses.

June 6, 2025

E-invoicing Implementation for Healthcare Industries in Malaysia

Learn how Malaysia's e-Invoice implementation impacts healthcare providers, with guidelines for hospitals, consultants, and locum staff.

June 6, 2025

E-invoicing Implementation for Malaysia Telecommunication Industry

Telecommunications e-Invoice implementation: Learn to efficiently manage billing adjustments, prepaid plans, rentals, and add-on services.

June 6, 2025

Complyance API

Malaysia e-Invoice Model via API: Comprehensive Guide

Discover how the Malaysia e-Invoice Model via API boosts efficiency and compliance. Our guide covers step-by-step workflows and key benefits.

June 5, 2025

Oracle Fusion Technical Integration Guide

Need help with Oracle Fusion Technical Integration? This guide is your go-to resource for understanding ERP Fusion, ZATCA, and E-invoicing.

June 5, 2025

Integrating ZATCA with SAP S4 HANA

Looking to integrate ZATCA with SAP B1? This guide will walk you through the process step by step, ensuring a smooth and successful integration.

June 5, 2025

Zatca E-invoicing API

The V2 release introduces the 'Unify API,' a single endpoint consolidating previously disparate functionalities.

June 5, 2025

Simplifying Zatca's API Integration Sandbox with Complyance

Streamline Zatca's API Sandbox integration using Complyance.io for effortless compliance management.

June 5, 2025

Developer Friendly Zatca E-Invoicing API

In our latest V2 version, we have streamlined and consolidated these functionalities into a single, unified API known as the "Unify API"

June 5, 2025

Zatca E-invoicing

Oracle Fusion ERP & ZATCA: Integrating Third-Party APIs for Compliance

Need help with Oracle Fusion Technical Integration? This guide is your go-to resource for ERP Fusion, ZATCA, and E-invoicing. Get started now!

June 5, 2025

Oracle Fusion Technical Integration Guide

Need help with Oracle Fusion Technical Integration? This guide is your go-to resource for understanding ERP Fusion, ZATCA, and E-invoicing.

June 5, 2025

Integrating ZATCA with SAP S4 HANA

Looking to integrate ZATCA with SAP B1? This guide will walk you through the process step by step, ensuring a smooth and successful integration.

June 5, 2025

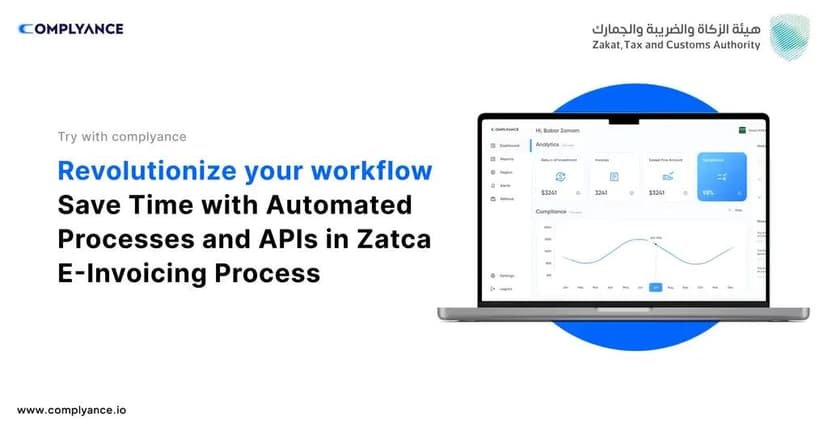

Automate ZATCA E-Invoicing: Revolutionize Workflow and Save Time

Looking to streamline your e-invoicing process? Explore the power of Zatca's API and discover how it can save you time and improve efficiency.

June 5, 2025

EGS Onboarding - ZATCA Phase-2 E-Invoicing

EGS Onboarding: Master the ZATCA Phase-2 E-Invoicing system for seamless, compliant, and efficient invoicing solutions

June 5, 2025

How to Verify a ZATCA e-Invoice by Scanning Its QR Code?

Discover how QR codes are revolutionizing the verification process for tax invoices under the Zatca and E-invoicing systems.

June 5, 2025