What Is Peppol for Belgium E-Invoicing? A Complete Guide to the Belgium B2B E-Invoicing Mandate 2026

Learn about the Belgium e-invoicing mandate 2026 and how the Peppol interoperability framework ensures secure, structured e-invoice exchange across businesses in Belgium.

Table of Contents

Belgium is preparing for the B2B e-invoicing mandate 2026, which will require all VAT-registered businesses to send and receive structured, machine-readable e-invoices. This shift does not mean switching from paper to PDF; it means generating invoices in a standardised electronic format that systems can read automatically.

To support this change, Belgium is adopting the Peppol interoperability framework as the backbone of its national e-invoicing system. Peppol ensures that every business, regardless of software or provider, can exchange e-invoices securely and consistently across Belgium and the EU.

Introduction to Belgium E-Invoicing and the Peppol Interoperability Framework

The move to mandatory e-invoicing in Belgium aims to modernise financial processes, reduce errors, improve VAT compliance, and strengthen audit capabilities.

Structured electronic invoicing in Belgium requires invoices to follow the EN 16931 e-invoicing format and the Peppol BIS 3.0 standard, ensuring that data is accurate, complete, and machine-readable.

Instead of forcing all businesses into a single government portal, Belgium uses the Peppol interoperability framework. This open network allows companies to connect through any certified service provider and exchange e-invoices easily with all trading partners.

What Is Peppol E-Invoicing and the Peppol Interoperability Framework?

Peppol, short for (Pan-European Public Procurement Online), is not a software platform. It is a global framework of standards, protocols, and a secure network that enables the electronic exchange of business documents across different systems.

The Peppol interoperability framework defines how e-invoices must be formatted, transmitted, validated, and delivered. It ensures electronic invoice interoperability so that any company using Peppol-compliant software can send invoices to any other company or public body on the network.

Two key standards make this possible:

- Electronic invoice standard EN-16931: Defines core invoice requirements across the EU.

- Peppol BIS 3.0: Adds practical rules and XML structures needed to implement EN-16931 in real business systems.

By following these standards, Peppol ensures accuracy, compliance, and consistent processing across industries and countries.

Introduction to Belgium E-Invoicing and the Peppol Interoperability Framework

The move to mandatory e-invoicing in Belgium aims to modernise financial processes, reduce errors, improve VAT compliance, and strengthen audit capabilities.

Structured electronic invoicing in Belgium requires invoices to follow the EN 16931 e-invoicing format and the Peppol BIS 3.0 standard, ensuring that data is accurate, complete, and machine-readable.

Instead of forcing all businesses into a single government portal, Belgium uses the Peppol interoperability framework. This open network allows companies to connect through any certified service provider and exchange e-invoices easily with all trading partners.

What Is Peppol E-Invoicing and the Peppol Interoperability Framework?

Peppol, short for Pan-European Public Procurement Online, is not a software platform. It is a global framework of standards, protocols, and a secure network that enables the electronic exchange of business documents across different systems.

The Peppol interoperability framework defines how e-invoices must be formatted, transmitted, validated, and delivered. It ensures electronic invoice interoperability so that any company using Peppol-compliant software can send invoices to any other company or public body on the network.

Two key standards make this possible:

- Electronic invoice standard EN-16931: Defines core invoice requirements across the EU.

- Peppol BIS 3.0: Adds practical rules and XML structures needed to implement EN-16931 in real business systems.

By following these standards, Peppol ensures accuracy, compliance, and consistent processing across industries and countries.

How Does Belgium's E-Invoicing Work Through the Peppol Network?

The Belgian Peppol interoperability framework creates a simple and secure process for sending and receiving e-invoices. Here is how the workflow operates:

- Invoice Creation: A business creates an invoice in its ERP or accounting system.

- Automatic Formatting: The invoice is converted into the Peppol BIS 3.0 XML format based on EN 16931 rules.

- Submission to Access Point: The invoice is sent to the business’s chosen Peppol Access Point in Belgium.

- Validation: The Access Point checks Belgian e-invoicing regulation and BIS 3.0 rules to ensure all mandatory fields are included.

- Recipient Lookup via SMP: The sender’s Access Point first checks the Service Metadata Locator (SML) to find which Service Metadata Publisher (SMP) stores the recipient’s registration details. The Access Point then uses the SMP to look up the recipient’s Peppol Access Point using the company’s VAT or enterprise number.

- Secure Network Delivery: The invoice is transmitted using AS4 protocols to the recipient’s Access Point.

- Receiving Access Point Checks: The recipient’s Access Point verifies the invoice and forwards it to the accounting or ERP system.

- Processing by the Receiver: The receiver processes the invoice with minimal manual effort.

- Status Tracking: Both parties can track delivery and validation status.

This streamlined flow ensures reliability, accuracy, and end-to-end compliance.

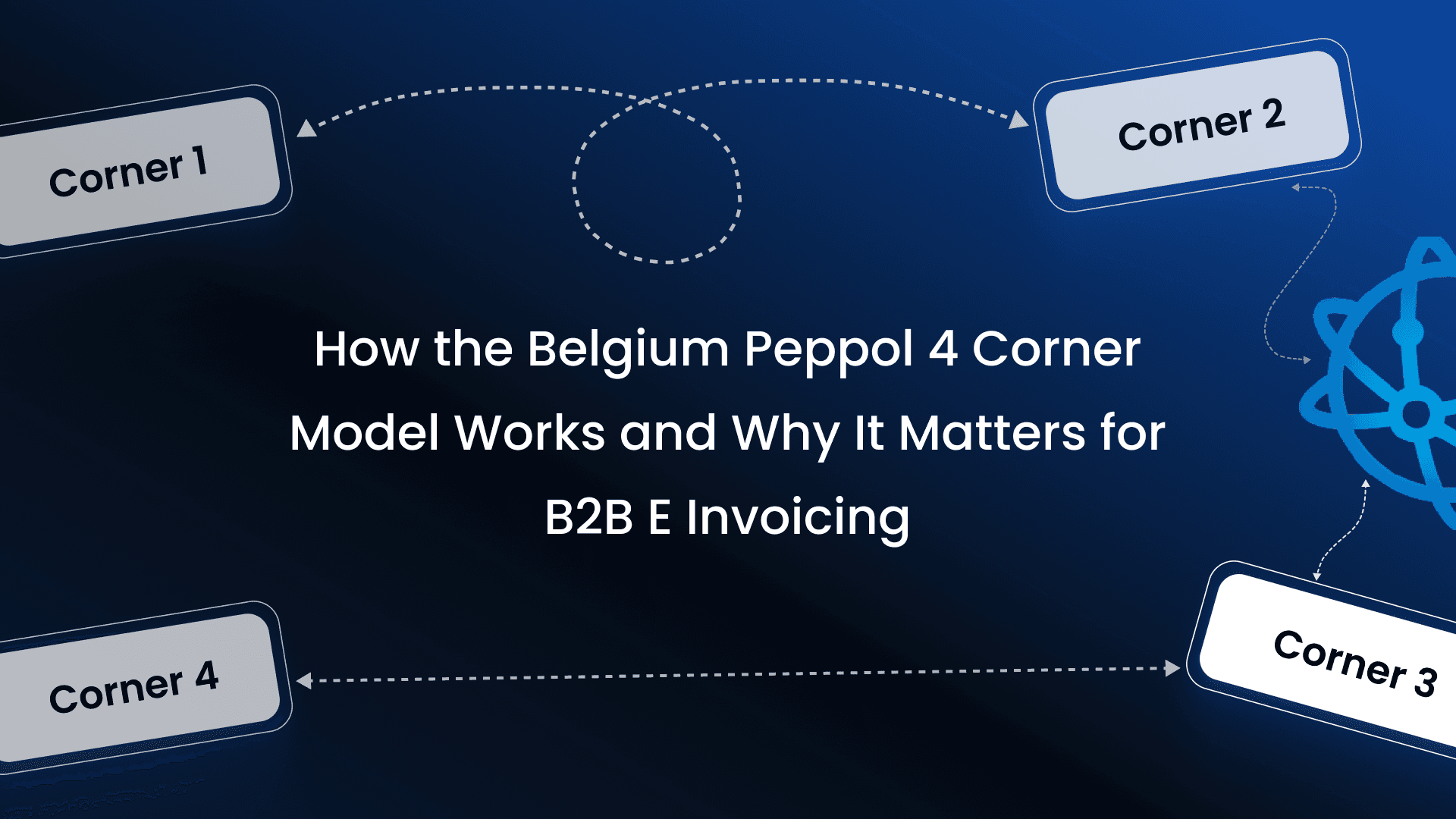

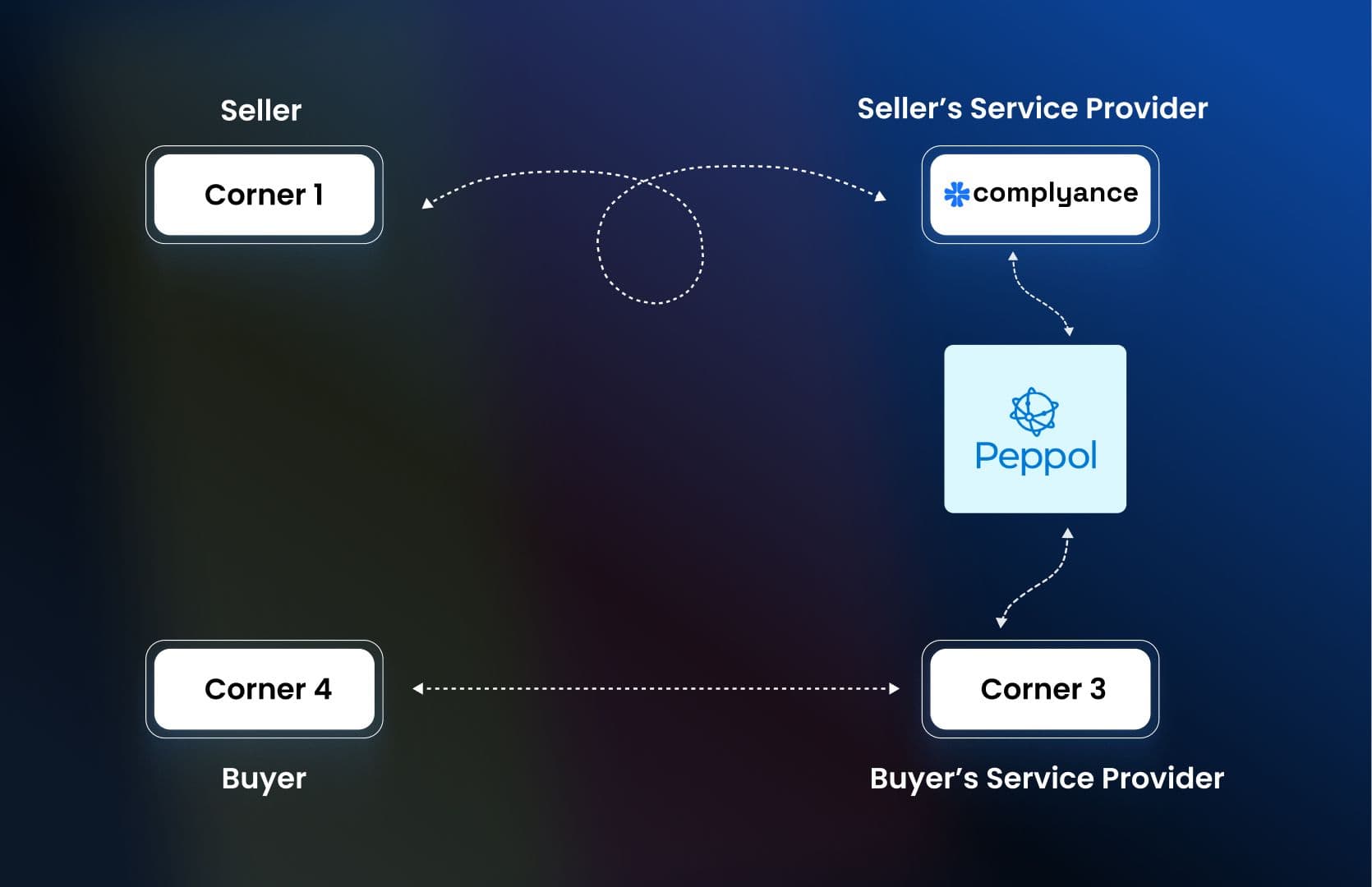

Understanding the Belgian Peppol 4 Corner Model

At the center of the Peppol interoperability framework is the Peppol 4 corner model. This model connects senders and receivers through their chosen Access Points rather than forcing them onto the same platform.

The four corners include:

- Corner 1: Sender: The business issuing the e-invoice.

- Corner 2: Sender’s Peppol Access Point: Converts the invoice into BIS 3.0 format, validates it, and sends it securely.

- Corner 3: Receiver’s Peppol Access Point: Receives the e-invoice, verifies it, and forwards it to the receiver.

- Corner 4: Receiver: The business receives and processes the e-invoice.

This architecture provides flexibility, security, and interoperability for all participants.

A Look Ahead: Belgium’s Future 5 Corner Model (2028)

From 2028, Belgium will introduce real-time electronic reporting. This will add the government as a “fifth corner” in a model known as Decentralized Continuous Transaction Controls (DCTCE). All e-invoice data will be transmitted to authorities in real time.

Key Components of the Peppol Interoperability Framework for Belgium2

The framework relies on several technical and operational components:

- Peppol Access Points (APs): Certified providers that convert, validate, and securely deliver invoices on behalf of businesses.

- Peppol BIS Standard Belgium: Defines the XML invoice structure used for all B2B and B2G e-invoicing in Belgium.

- EN 16931 E-Invoicing Format: Sets the EU-wide rules for invoice content and structure.

- Service Metadata Publisher (SMP): A directory that stores participant identifiers and their Access Points for routing purposes.

- Service Metadata Locator (SML): A central lookup mechanism that points to the correct SMP. The SML helps the Peppol network identify where a participant’s metadata is stored, enabling accurate and efficient routing of invoices.

- Interoperability and Security Rules: Protocols like AS4 ensure encrypted, reliable, and traceable document exchange.

- Validation and Error Handling: Access Points reject invalid invoices immediately, reducing compliance risk.

- MERCURIUS Platform for B2G: Belgium’s public sector uses MERCURIUS, which operates within the Peppol framework.

Format and Compliance Requirements for Structured Electronic Invoicing in Belgium

One of the most frequent questions for businesses implementing Belgium e-invoicing is, “What is the format required in Belgium?”The answer is:

- Peppol BIS 3.0

- EN 16931 XML structure

- UBL 2.1 (the underlying XML language)

These rules ensure invoices contain mandatory identifiers, VAT fields, line item details, and payment information. They support automated validation and seamless processing in any Belgian or EU-compliant ERP system.

Why Belgium Chose the Peppol BIS Standard for Its E-Invoicing Mandate

Belgium selected the Peppol interoperability framework for several important reasons:

Universal interoperability across all software and providers

Peppol ensures that any business can exchange e-invoices regardless of the software, ERP, or service provider they use. This removes compatibility issues and allows smooth data exchange between companies of all sizes.

Open and competitive market with no vendor lock-in

Since Peppol is an open network, businesses can choose any certified Access Point without being forced into one platform. This encourages innovation and competitive pricing among providers.

No central government portal, reducing dependency and complexity

Belgium does not rely on a single government-run system for e-invoicing. Instead, the Peppol network distributes responsibilities across certified providers, reducing bottlenecks, technical risks, and operating costs.

High security and fraud protection

Peppol uses strong encryption, identity verification, and delivery tracking. This prevents invoice fraud, tampering, and unauthorised access while ensuring secure end-to-end delivery.

International alignment with the EU and global e-invoicing systems

Many European countries and global markets use Peppol. By adopting the same standard, Belgium ensures seamless cross-border invoicing and avoids building isolated systems that limit international trade.

Automatic compliance through Access Point validation

Peppol Access Points validate invoice structure, mandatory fields, and legal rules before sending the document. This ensures every e-invoice follows Belgian and EU compliance requirements without extra manual checks.

Future readiness for the 2028 real-time e-reporting model

Peppol’s structured format and secure delivery make it easier to expand into real-time or near-real-time VAT reporting. Adding the government as the fifth corner becomes straightforward due to the network’s existing architecture.

Benefits of Using the Peppol Network for E-Invoicing in Belgium

Adopting Peppol provides several strong advantages for Belgian businesses:

Seamless interoperability across Belgium and Europe

Peppol is used in many EU countries, allowing Belgian businesses to exchange invoices effortlessly with suppliers or customers across borders using the same standard.

“Connect once, reach all” connection to trading partners

Once a business connects to a Peppol Access Point, it can send invoices to any other participant on the network without needing custom integrations for each partner.

Reduced errors and manual data entry

Since invoices follow a strict, structured format, ERP and accounting systems can read the data automatically. This significantly reduces human error and manual rework.

Faster payment cycles through structured workflows

Structured invoices move smoothly through automated review and approval steps. This speeds up payment processing and improves cash flow for suppliers.

Strong compliance with Belgian e-invoicing regulation

Using Peppol BIS 3.0 ensures that every invoice includes the mandatory data fields and follows EN-16931 rules. This protects businesses from compliance issues and penalties.

Secure, auditable, and tamper-proof document exchange

Every e-invoice is transmitted through encrypted channels and validated at multiple points. This creates a clear audit trail and prevents fraud, duplicate invoices, or manipulation.

Future-ready infrastructure for real-time reporting

Peppol’s structured and validated format makes it easier for Belgium to introduce real-time VAT reporting in 2028. Businesses using Peppol today will be better prepared for upcoming compliance changes.

Conclusion: Preparing for the Belgium B2B E-Invoicing Mandate 2026

Belgium’s e-invoicing mandate marks a major shift toward digital, structured, and interoperable financial processes. Peppol sits at the center of this transformation, ensuring every VAT-registered business can exchange e-invoices securely and consistently through certified Peppol Access Points.

By adopting the Belgium Peppol interoperability framework, companies gain compliance, efficiency, and long-term readiness for future reporting and international trade. Connecting to Peppol is now essential for every business operating in Belgium.

Related posts

Frequently Asked Questions

No. Businesses do not need to replace their ERP or accounting system. Most companies integrate their existing systems with a certified Peppol Access Point, which handles format conversion, validation, and transmission while the ERP continues to generate invoice data as usual.

Peppol uses a directory-based lookup process. When an invoice is sent, the sender’s Access Point automatically checks the Peppol directory through the SML and SMP to confirm whether the recipient is registered and to identify the correct receiving Access Point. No manual verification is required.

Yes. Complyance is a Peppol-certified Access Point and supports Belgium’s e-invoicing requirements. Businesses can use Complyance to send and receive Peppol BIS 3.0 compliant e-invoices, meet EN 16931 standards, and exchange e-invoices securely with all trading partners on the Belgian and European Peppol network.

Yes. Peppol is widely used across Europe and other regions. Belgian businesses can send structured e-invoices to international trading partners on the Peppol network using the same standards, as long as the recipient country and partner support Peppol.

If an e-invoice does not meet Peppol BIS 3.0 or Belgian regulatory rules, it is rejected by the Access Point before delivery. The sender receives an error message explaining what needs to be corrected, allowing issues to be fixed immediately and preventing non-compliant e-invoices from reaching customers

Belgium’s B2B e-invoicing mandate is scheduled to start on 1 January 2026 for domestic B2B transactions. From this date, all Belgian VAT-registered businesses established in Belgium will be required to issue and receive structured e-invoices for local B2B transactions taxable in Belgium

Non-established VAT-registered taxpayers in Belgium are generally not required to receive e-invoices under the initial 2026 scope, according to current government announcements

Belgium requires structured electronic invoices that comply with:

- The European e-invoicing standard EN 16931

- Peppol BIS Billing 3.0, based on UBL 2.1 XML

Unstructured formats like PDF, Word, or paper will no longer be sufficient for compliance once the mandate takes effect, because they cannot be automatically validated and processed. Peppol BIS 3.0 ensures each e-invoice includes mandatory data such as supplier and buyer details, VAT information, totals, and line-level details, and invoices missing required fields are rejected.

Belgian businesses connect to the Peppol network through a Peppol Access Point, typically provided by an e-invoicing or billing service provider.

- The business integrates its ERP/accounting system with the chosen Access Point, usually via API.

- Once connected, the Access Point converts invoices into Peppol BIS 3.0 format, validates them, and routes them securely to trading partners’ Access Points using the Peppol network.

This “connect once, reach all” approach means companies only need one connection to exchange compliant e-invoices with any participant on the Belgian and EU Peppol network

Subscribe to our Newsletter

Get the latest compliance updates, e-invoicing news, and expert tips delivered to your inbox.

ABOUT COMPLYANCE

Empowering businesses to automate e-invoicing and stay compliant in 100+ countries. Our platform simplifies regulatory complexity for enterprises and fast-growing companies.