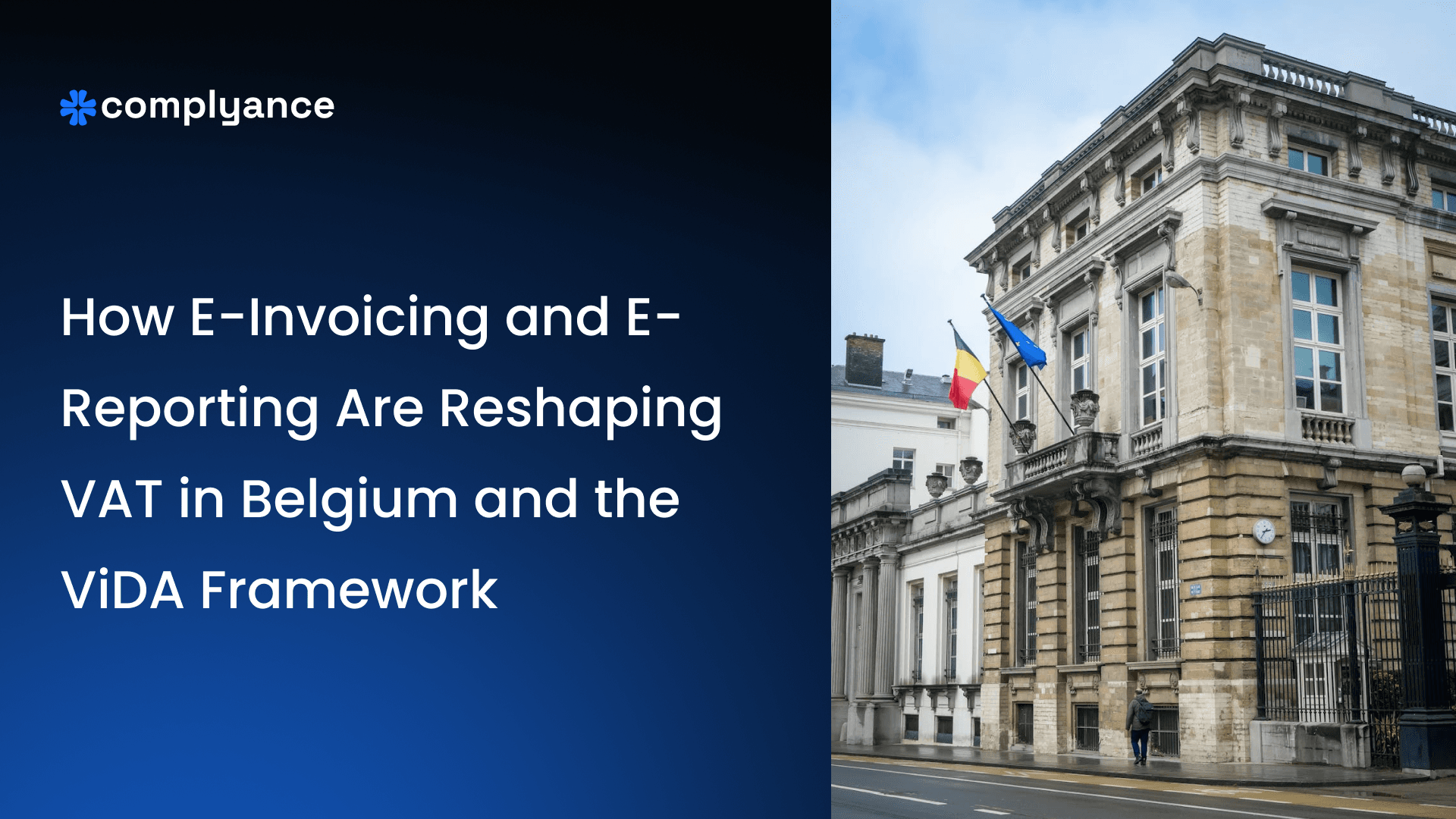

The Complete Guide to PEPPOL E-Invoicing for Businesses

Your complete guide to PEPPOL e-invoicing: standards, the 4-corner model, global country list, implementation steps, and future trends. Learn how to achieve seamless, compliant e-invoicing.

Table of Contents

A single network that unites global trade! Curious how PEPPOL transforms your document exchanges into a seamless global operation?

For businesses navigating international markets, document exchange across borders presents significant challenges. Format inconsistencies, manual processing errors, and communication delays create operational friction that slows transactions, strains cash flow, and adds unnecessary complexity to global trade.

This is precisely where PEPPOL (Pan-European Public Procurement Online) creates a transformative impact. It establishes a standardized international framework that eliminates these cross-border document exchange barriers through:

- Universal format standardization (using UBL/CII XML standards)

- Automated digital processing that removes manual intervention

- Secure, encrypted transmission through accredited Access Points

- Real-time status tracking and confirmation

- Compliance with international e-invoicing regulations

By providing a unified network that connects trading partners regardless of their location or internal systems, PEPPOL transforms what was once a complex, error-prone process into a seamless, efficient exchange that accelerates operations, improves accuracy, and enhances cash flow management for international businesses.

What Exactly is PEPPOL?

PEPPOL is first and foremost a standardized method for sending invoices to public sector customers, but its capabilities extend much further. It is a highly secure, international network that enables organizations to exchange business-critical electronic documents with any other registered entity on the network.

Originally developed as an EU standard, PEPPOL now connects hundreds of thousands of public and private organizations worldwide. While most users remain based in Europe, adoption has expanded significantly to countries including Canada, New Zealand, Singapore, and the United States, creating a truly international framework for digital business document exchange.

The Story Behind PEPPOL's Creation and Its E-Invoicing Standard:

For years, European businesses navigated a complicated system of national e-invoicing standards. Systems like Sweden's Svefaktura, Norway's EHF, and Denmark's NemHandel required companies to master different formats for each country's public sector requirements.

This fragmentation ended with a transformative EU regulation. Beginning April 18, 2020, all public institutions and authorities across EU member states became legally mandated to accept invoices exclusively through the PEPPOL network. This major shift established a unified framework that eliminated the need for businesses to navigate different national formats, fundamentally streamlining cross-border trade throughout Europe.

Although some countries maintained transitional periods for their national standards, these are being systematically phased out in favor of the universal PEPPOL standard. For companies engaged with public sector clients, adopting PEPPOL has evolved from a strategic advantage to an operational essential.

Beyond its core e-invoicing function, the PEPPOL standard has expanded to support a comprehensive suite of business documents, including electronic orders, order confirmations, product catalogs, and shipping documents. This evolution positions PEPPOL not merely as a compliance solution but as a complete framework for digital business transformation across international borders.

How PEPPOL Works

As established, PEPPOL represents an EU standard for electronic document exchange, particularly for invoices. But what does this mean in practical terms?

Essentially, the EU has created a specific set of requirements that documents must meet to be transmitted through the PEPPOL network. All public authorities within the EU are required to accept compliant invoices, while an increasing number of private businesses are also adopting the standard for both sending and receiving documents.

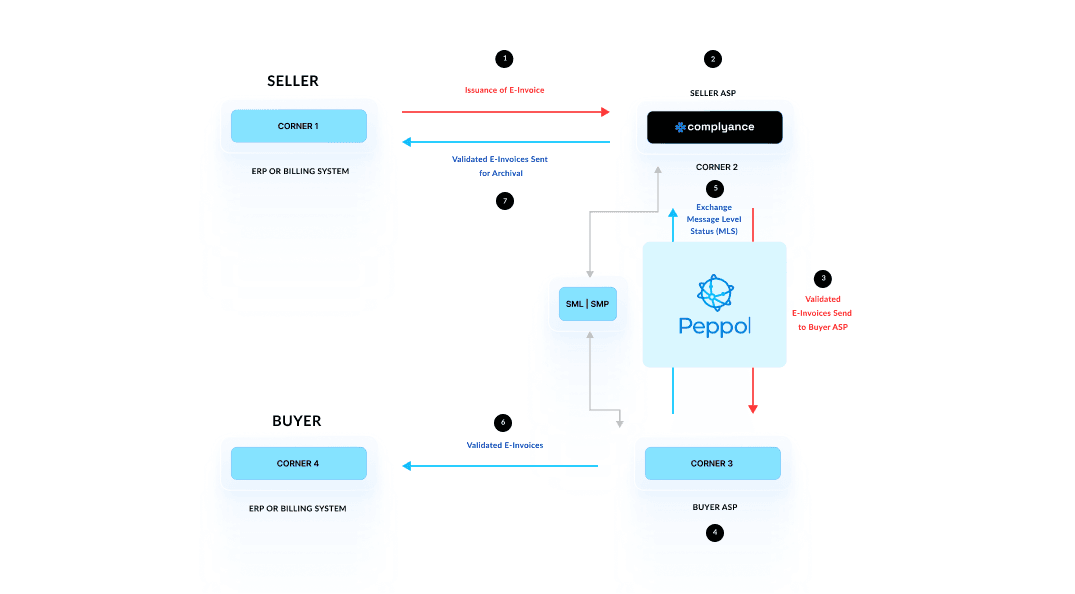

The key to ensuring your documents meet these standards and reach their intended destination lies in working with a PEPPOL Access Point. This process operates on the Four-Corner Model, a robust framework that ensures security and interoperability .

Understanding the Four-Corner Model

This model is named for the four key participants involved in every transaction :

- Corner 1 (C1): The Sender (e.g., a supplier).

- Corner 2 (C2): The Sender's Access Point Provider.

- Corner 3 (C3): The Receiver's Access Point Provider.

- Corner 4 (C4): The Receiver (e.g., a buyer or another business).

The process is elegantly simple for the end-users. A user (C1) sends a document through their Access Point (C2), which then transmits it securely via the PEPPOL network to the recipient's Access Point (C3), which finally delivers it to the intended receiver (C4) . This structure means that trading partners do not need to use the same software or Access Point provider; they only need to be connected to the PEPPOL network, much like how email providers interoperate to deliver messages globally.

Key PEPPOL Standards & Formats Explained

PEPPOL's effectiveness lies in its use of common standards. These standards act as a universal language, ensuring that a document created by one system can be automatically read and understood by another, anywhere in the world.

- Core Concept: Standards define the exact structure and data fields for documents (like invoices), ensuring consistency and automatic processing.

- Primary Format: PEPPOL documents are based on XML, a structured data format that computers can read effortlessly, unlike PDFs, which are often just

visual images of documents.

Here are some of the most important specifications you need to know:

- EN 16931 (The European Foundation)

- What it is: The official European Norm (standard) for the core content of an electronic invoice.

- Its Purpose: It defines the minimum mandatory data fields a compliant e-invoice must have (e.g., supplier and buyer IDs, invoice number, tax rates, line item details). This ensures a baseline level of interoperability across Europe.

- BIS (Business Interoperability Specifications)

- What it is: PEPPOL's own set of rules that build upon EN 16931.

- BIS 3.0: This is the most widely used version. It specifies exactly how to implement EN 16931 using the UBL (Universal Business Language) XML format. If you're sending a PEPPOL invoice in Europe, you are likely using the PEPPOL BIS 3.0 format.

- PINT (PEPPOL International Invoice)

- What it is: The next-generation, global standard designed to extend PEPPOL beyond European requirements.

- Its Purpose: PINT addresses international needs that BIS 3.0 doesn't cover, such as specific tax rules for countries outside the EU, additional fields for global trade, and support for different currencies. It is the future-proof standard for global expansion.

- PINT-AE (for the United Arab Emirates)

- What it is: A specific PINT profile tailored for the UAE's FATCA e-invoicing system.

- Its Purpose: It ensures that a PEPPOL invoice sent in the UAE contains all the mandatory fields required by the UAE's Federal Tax Authority (FTA), such as the QR Code, Tax Registration Number (TRN) format, and specific regulatory phrases. It's a perfect example of how PINT is adapted for local law

It's important to note that PEPPOL is designed to interoperate with a wide array of other established national formats, such as Spain's Factura-E, France's Factur-X, and more.

This capability to map between PEPPOL and these various standards is key to its role as a unifying network, effectively connecting a global patchwork of national e-invoicing systems.

Understanding PEPPOL Access Points

A PEPPOL Access Point serves as your gateway to the entire PEPPOL network. Typically offered as a service by accredited providers, these access points function much like telecommunications companies.

Just as your phone provider connects with another provider to complete a call, your Access Point transmits documents through the PEPPOL network to the recipient's Access Point, which then delivers them to the final destination.

With over 300 certified Access Points operating globally, businesses can select the provider that best meets their specific requirements, creating a secure, interconnected network for document exchange.

This process operates on what's known as the "four-corner model," named for the four participants involved, both trading partners and their respective Access Points.

The Role of PEPPOL Authorities

To maintain network integrity and compliance, official PEPPOL Authorities oversee the entire ecosystem. Currently, 17 appointed Authorities ensure that Access Points adhere to the technical and service specifications established by the EU.

These Authorities are responsible for:- Monitoring Access Point compliance- Enforcing technical standards- Establishing additional national requirements for PEPPOL documents.

All PEPPOL Authorities operate under OpenPEPPOL, the international non-profit organization that develops and promotes the PEPPOL standard across Europe and globally, ensuring consistent implementation and ongoing development of the network.

PEPPOL vs. Traditional Invoicing: A Modern Paradigm Shift

Traditional invoicing methods, whether paper-based, PDF email attachments, or proprietary digital formats, create significant operational friction. These approaches often involve manual data entry, format inconsistencies, and a lack of delivery confirmation, leading to payment delays, errors, and compliance risks.PEPPOL transforms this process through standardized electronic invoicing that offers:

- Automated data processing, eliminating manual intervention

- Real-time delivery confirmation and status tracking

- Built-in compliance with international regulatory requirements

- Reduced processing costs (typically 60-80% lower than manual methods)

- Enhanced security through encrypted transmission

- Immediate validation of document authenticity

The transition from traditional methods to PEPPOL represents not just technological advancement but a fundamental shift toward seamless, automated business communications.

Global Adoption: Who Uses PEPPOL and Where

PEPPOL's adoption has expanded far beyond its European origins to become a truly global standard. The network connects:

Public Sector Entities:

- All EU government agencies and public institutions

- National and local government bodies

- Public healthcare systems

- Educational institutions

Private Sector Organizations:

- Multinational corporations

- Small and medium-sized enterprises

- Suppliers to public sector entities

- Businesses engaged in cross-border trade

Geographic Reach: PEPPOL now operates in over 40 countries, including:

- European Union members (all 27 countries)

- United Kingdom

- Norway, Switzerland, Ukraine

- Singapore, Malaysia, Japan

- Australia, New Zealand

- Canada, United States

- United Arab Emirates, Saudi Arabia

This widespread adoption creates a powerful network effect; each new participant increases the value for all existing members

Peppol E-Invoicing simplified with One Platform

Global Adoption: PEPPOL Country Requirements Overview

| Country | Sector | Status | Key Requirements |

|---|---|---|---|

| Austria | Public | Mandatory | Required for public sector invoicing |

| Belgium | Public | Mandatory | B2G e-invoicing via PEPPOL |

| Bulgaria | Public | Mandatory | Public sector suppliers must use PEPPOL |

| Croatia | Public | Mandatory | Required for government contracts |

| Cyprus | Public | Mandatory | Public sector e-invoicing standard |

| Czech Republic | Public | Mandatory | Mandatory for B2G transactions |

| Denmark | Public | Mandatory | NemHandel being phased out for PEPPOL |

| Estonia | Public | Mandatory | Public sector e-invoicing requirement |

| Finland | Public | Mandatory | Required for government suppliers |

| France | Public | Mandatory | Chorus Pro integration with PEPPOL |

| Germany | Public | Mandatory | XRechnung standard via PEPPOL |

| Greece | Public | Mandatory | Public sector e-invoicing mandatory |

| Hungary | Public | Mandatory | Required for government transactions |

| Ireland | Public | Mandatory | Public sector suppliers must comply |

| Italy | Public | Mandatory | FatturaPA via PEPPOL network |

| Latvia | Public | Mandatory | Mandatory for public sector |

| Lithuania | Public | Mandatory | Required for B2G invoicing |

| Luxembourg | Public | Mandatory | Public sector e-invoicing standard |

| Malta | Public | Mandatory | Government suppliers must use PEPPOL |

| Netherlands | Public | Mandatory | Simpler Invoicing transition to PEPPOL |

| Poland | Public | Mandatory | Required for public sector |

| Portugal | Public | Mandatory | Mandatory for government contracts |

| Romania | Public | Mandatory | Public sector e-invoicing requirement |

| Slovakia | Public | Mandatory | Required for B2G transactions |

| Slovenia | Public | Mandatory | Public sector suppliers must comply |

| Spain | Public | Mandatory | FACeB2G integration with PEPPOL |

| Sweden | Public | Mandatory | Svefaktura being phased out for PEPPOL |

| United Kingdom | Public | Voluntary | Supported post-Brexit |

| Norway | Public | Mandatory | EHF standard via PEPPOL |

| Switzerland | Public | Voluntary | Growing adoption |

| Ukraine | Public | Emerging | Pilot implementation |

| Australia | Public | Mandatory | Required for federal government suppliers |

| New Zealand | Public | Voluntary | Supported by government agencies |

| Singapore | Public | Mandatory | Invoice Now scheme for B2B and B2G |

| Canada | Public | Pilot | Limited implementation at provincial level |

| United States | Mixed | Emerging | Growing adoption in healthcare and manufacturing |

The Future of PEPPOL: Global Expansion and Technological Evolution

Expansion into New Markets:

- PEPPOL is expanding beyond Europe into Africa, Latin America, and Asia, with countries including the Philippines, Botswana, Kenya, Malaysia, Oman, Singapore, and the UAE adopting or planning implementation between 2024 and 2026

- Markets like Australia, New Zealand, South Korea, India, and Japan are embracing PEPPOL, particularly for government procurement

Integration with Emerging Technologies:

- Exploration of blockchain and AI integration to enhance network security, automate processes, and improve data analytics

- Technical improvements, including dynamic discovery, next-generation eDelivery protocols, and sophisticated message-level status updates

Expanded Use Cases:

- Extension beyond e-invoicing to include order management, shipping notices, credit notes, and hybrid message formats

- Support for increasingly complex business processes, enhancing the digitization of procurement and sales cycles

Regulatory and Mandate Growth:

- More governments worldwide are mandating PEPPOL-based e-invoicing due to interoperability and compliance benefits

- Projects like the PEPPOL ViDA pilot integrate tax reporting and electronic invoicing, linking PEPPOL with tax administrations

Technical Maturity and Community Growth:

- Over 40 participating countries and nearly 400 stakeholders in the growing PEPPOL community

- Continued standard revisions, support for multiple corner models, and improved directory services for scalability

PEPPOL's future is geared toward global expansion, enhanced interoperability, deeper regulatory integration, and evolving technological frameworks, ensuring it remains the leading network for secure, standardized business document exchange worldwide.

PEPPOL Implementation: Challenges and Strategic Considerations

While PEPPOL offers significant benefits, successful implementation requires careful planning to address several key challenges that businesses may encounter:

- Technical Errors and Misconfigurations: Improper setup can cause invoice delivery failures, delays, or compliance penalties. Common issues include misunderstanding message formats, test requirements, or document validations. For example, incorrect handling of discounts as separate invoice lines or oversized PDF attachments can violate PEPPOL specifications and cause processing failures.

- Legacy System Integration: Many organizations struggle with outdated ERP and accounting systems that lack automation capabilities, making compliance with PEPPOL's structured document requirements and real-time validation challenging without significant upgrades.

- High Initial Investment: Implementing PEPPOL-compliant solutions and upgrading IT infrastructure involves substantial upfront costs, particularly when businesses must work with certified Access Points or solution providers.

- Process Transformation Requirements: Transitioning from manual or PDF-based invoicing to fully digital, structured e-invoicing necessitates redesigning internal financial processes, which can temporarily disrupt operations and require comprehensive staff training.

- Interoperability Gaps: Uneven adoption among trading partners creates operational challenges, as businesses must maintain parallel processes for partners not yet on the PEPPOL network, reducing efficiency gains.

- Cybersecurity and Data Privacy: Increased digitization expands exposure to cyber threats, requiring robust security measures for Access Points, data encryption, and compliance with evolving privacy regulations across jurisdictions.

- Regulatory Complexity: Varying international requirements and evolving continuous transaction controls (CTC) mandate ongoing compliance monitoring for data retention, tax reporting, and invoice validation standards.

These challenges highlight the importance of technical expertise, strategic planning, and ongoing support. This is particularly relevant in regions with specific mandates, such as the UAE, where selecting the right implementation partner is crucial. For guidance on this specific scenario, see our previous analysis: How to Choose the Right E-Invoicing Provider in the UAE.

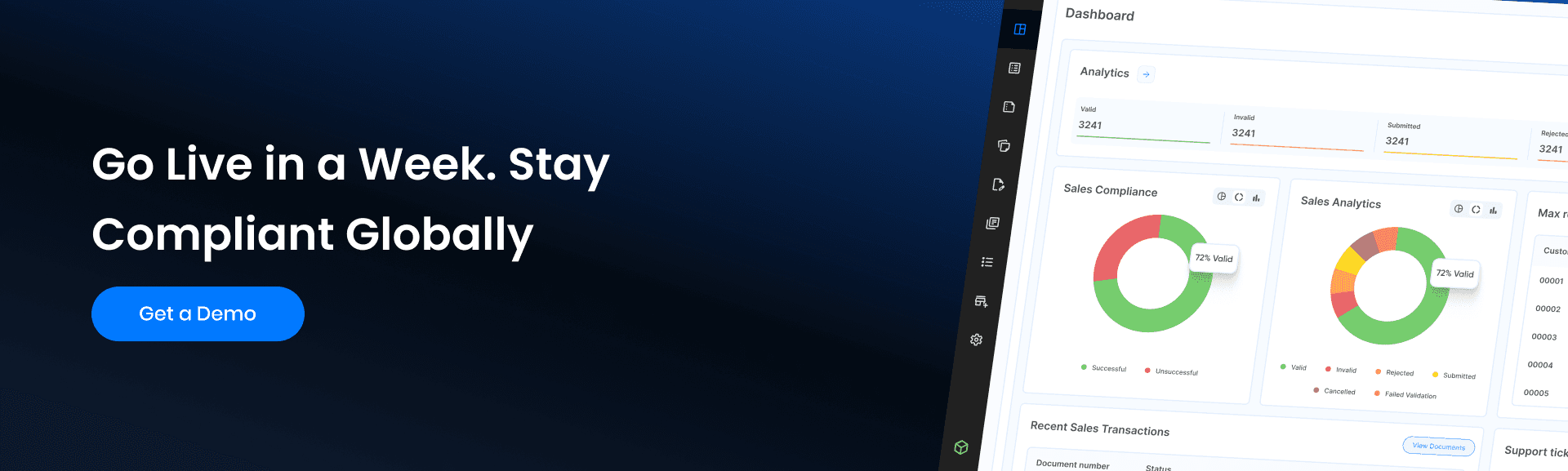

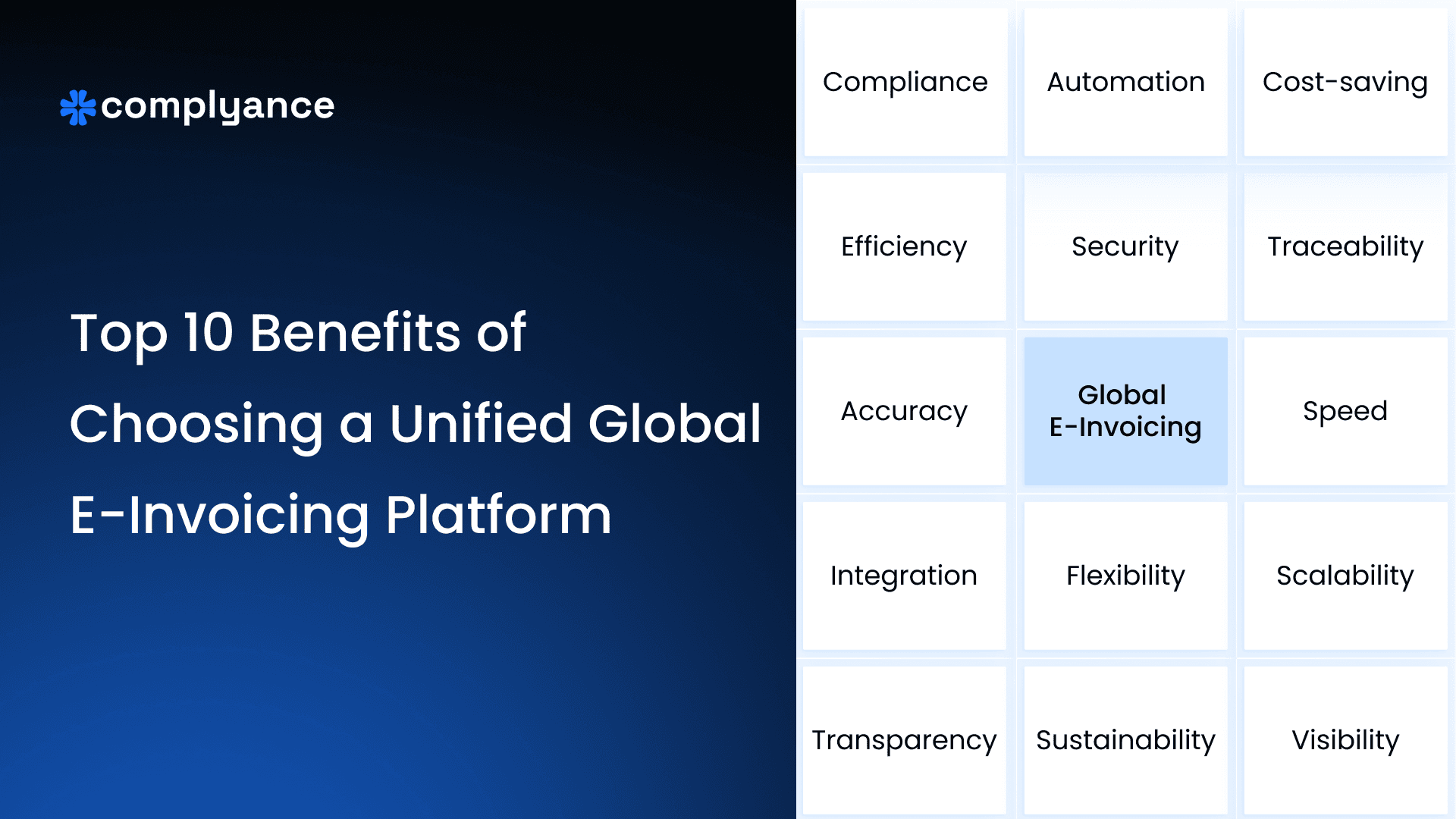

How Complyance Simplifies Your PEPPOL Journey

Complyance serves as your comprehensive PEPPOL solution provider, offering end-to-end services that streamline your transition to a standardized e-invoicing exchange. As an Access Point provider, Complyance handles the technical complexities while ensuring full compliance with international standards.

Complyance's PEPPOL Services Include:

- PEPPOL ID registration and management

- Document formatting and validation against PEPPOL specifications

- Secure transmission through certified Access Points

- Real-time delivery tracking and status updates

- Automated compliance checks across multiple jurisdictions

- Seamless integration with existing ERP and accounting systems

- Ongoing monitoring of regulatory changes and updates

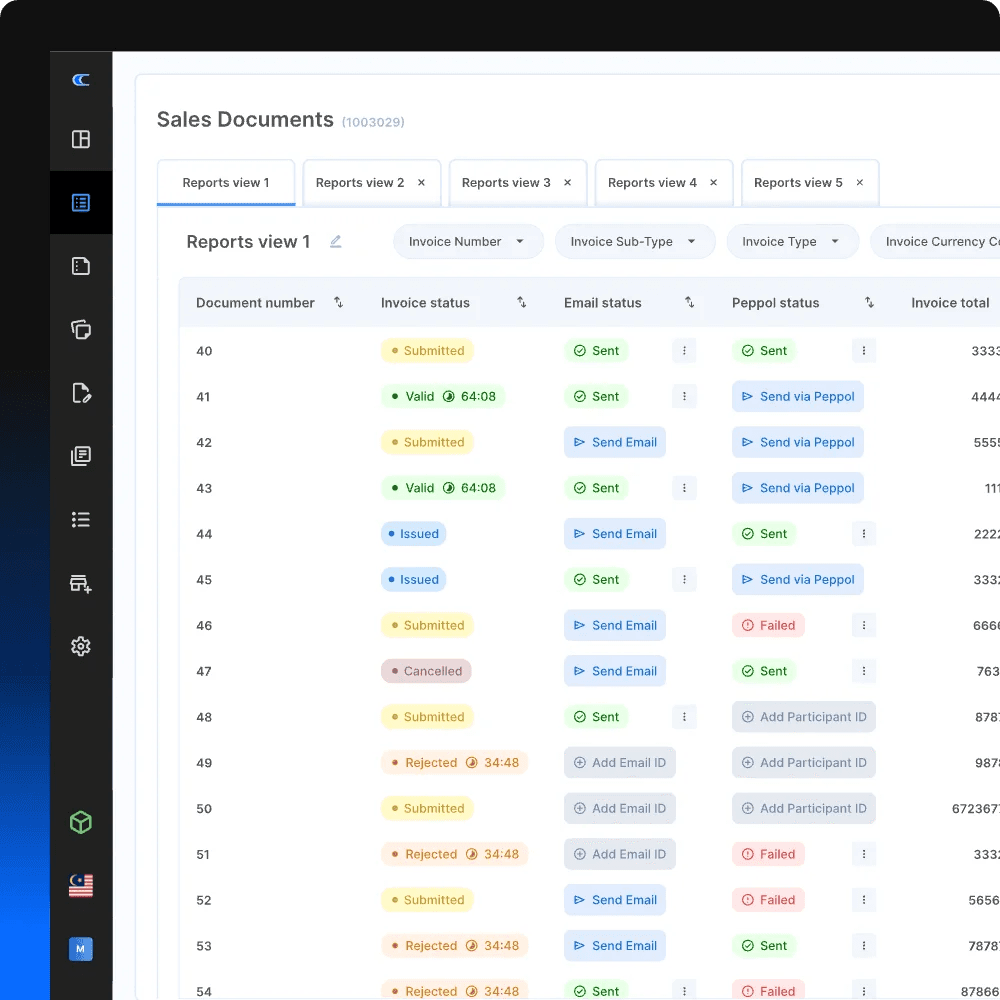

Their platform transforms complex technical requirements into a user-friendly interface, allowing businesses to focus on their core operations while maintaining confidence in their document exchange processes.

How to Send Your E-Invoice Through PEPPOL

- Prepare Your Document: Convert your invoice to PEPPOL-approved UBL or CII format

- Validate Compliance: Ensure all required fields meet destination country specifications

- Transmit Through Access Point: Submit through your chosen provider, like Complyance

- Network Routing: The document is securely routed through the PEPPOL network

- Delivery Confirmation: Receive instant delivery confirmation and tracking

- Automated Processing: The Recipient's system automatically processes the invoice

The entire process typically occurs within minutes, compared to days or weeks with traditional methods.

Implementing PEPPOL: A Step-by-Step Guide

Assessment Phase:- Evaluate current document processes and systems- Identify trading partners already on PEPPOL network- Determine compliance requirements for target countries- Select an accredited Access Point provider

Setup Phase:- Register for PEPPOL ID- Configure system integration (API or middleware)- Map existing data to PEPPOL standards- Conduct initial testing with partner organizations

Deployment Phase:- Begin with pilot transactions- Train relevant staff on new processes- Establish monitoring and support procedures- Gradually expand to full operational use

Optimization Phase:- Monitor performance metrics and cost savings- Expand to additional document types- Add new trading partners to the network- Stay updated on regulatory changes

Complyance supports each implementation phase with expert guidance, technical resources, and dedicated support, ensuring a smooth transition and maximum return on investment.

Conclusion

In an era where global trade demands speed, security, and simplicity, PEPPOL stands as a revolutionary force, bridging borders and uniting businesses through a single, standardized network.

From its roots in European e-invoicing regulations to its expansive role in facilitating seamless exchanges of orders, catalogs, and shipping documents worldwide, PEPPOL has evolved into an indispensable tool for modern commerce.

By eliminating format inconsistencies, automating processes, and ensuring regulatory compliance, it not only resolves the pain points of traditional methods but also unlocks new opportunities for efficiency, cost savings, and growth.

As adoption continues to accelerate across continents, from the EU's public sectors to emerging markets in Asia and North America, PEPPOL is reshaping the future of international business. Whether you're a small enterprise venturing into cross-border trade or a multinational corporation optimizing your supply chain, embracing this framework positions your organization at the forefront of digital transformation.

Related posts

Frequently Asked Questions

PEPPOL (Pan-European Public Procurement Online) is a standardized, international network that lets businesses and governments exchange electronic documents like invoices, orders, and shipping notices, seamlessly and securely, regardless of their location or internal software.

Complyance acts as your Access Point and implementation partner, handling PEPPOL ID, schema validation, secure routing, tracking, ERP integration, multi-country rules, and ongoing updates.

Highlights

- Developer-first single API + SDKs + sandbox

- Built-in validators to prevent rejects

- 24/7 expert support (UAE-based with global coverage)

- Multi-country readiness for rapid rollout

It uses a secure Four-Corner Model:

- Corner 1 (Sender): You create a PEPPOL-compliant document.

- Corner 2 (Your Access Point): You send the document via a certified PEPPOL Access Point provider (like Complyance).

- Corner 3 (Recipient's Access Point): The network routes the document to your trading partner’s Access Point.

- Corner 4 (Receiver): The document is delivered directly into their system.

You don’t need the same software as your partner; you just both need to be connected to the PEPPOL network.

Complyance goes beyond being just an accredited Access Point. It’s a developer-first platform designed for speed, scalability, and multi-country compliance.

Key Features

- PEPPOL Access Point + UAE PINT-AE validator

- Single API for 100+ countries

- SDKs, sandbox, and interactive docs for developers

- Real-time validation + delivery tracking

- 24/7 expert support (Local + global coverage)

- ISO 27001, GDPR, SOC 2 certified

Best For: Businesses needing rapid PEPPOL go-live in 1–4 weeks, with minimal developer effort and maximum compliance.

Yes, for public sector invoicing in the European Union. All EU government agencies must accept invoices via PEPPOL. Many private companies worldwide also adopt it voluntarily for its efficiency. Adoption is growing rapidly in countries like Singapore, Australia, New Zealand, Canada and the UAE.

- Prepare the invoice in UBL/CII

- Validate required fields/PEPPOL rules

- Submit via your Access Point (e.g., Complyance)

- Route across the PEPPOL network

- Confirm delivery & status in real time

- Auto-process in the recipient ERP

Subscribe to our Newsletter

Get the latest compliance updates, e-invoicing news, and expert tips delivered to your inbox.

ABOUT COMPLYANCE

Empowering businesses to automate e-invoicing and stay compliant in 100+ countries. Our platform simplifies regulatory complexity for enterprises and fast-growing companies.