The Top 10 Reasons Businesses Choose Complyance for UAE E-Invoicing

Discover the top 10 reasons businesses choose Complyance for UAE e-invoicing. From a single API for global rollout to 100% FTA compliance, see how we save you time & money.

Table of Contents

What if your e-invoicing process is actually slowing down business operations instead of keeping things running smoothly? When invoices stack up, go missing, or get rejected due to non-compliance, day-to-day workflows can freeze, and your progress stops.

For product managers, IT teams, finance pros, and tax experts alike, these challenges can feel overwhelming. There’s also a silver lining. With Complyance, navigating e-invoicing becomes simpler, freeing up time and resources while keeping your business fully compliant.

In the next few minutes, let’s dive into 10 key benefits of choosing Complyance for UAE e-invoicing, plus some extra perks that make it the smart choice. Our goal is to help you understand, trust, and feel confident about making the switch so your business can thrive.

To understand why this change matters, let’s compare traditional invoicing with e-invoicing:

| Aspect | Traditional Invoicing | E-Invoicing |

|---|---|---|

| Format | Paper-based or unstructured digital files (PDF, email attachments) | Structured digital formats (e.g., XML, JSON, EDIFACT) |

| Process | Manual creation, printing, mailing, and manual entry | Automated generation, transmission, and data integration |

| Speed | Slow, delays due to postal delivery and manual approvals | Instant delivery and automated approvals |

| Accuracy | Prone to human errors in manual entry and handling | Automated validation reduces errors |

| Costs | High due to paper, printing, postage, and manual labor | Lower overall costs by eliminating paper |

| Tracking | Limited visibility and manual tracking | Limited visibility and manual tracking |

| Compliance | Difficult to ensure and verify regulatory compliance | Built-in compliance with tax authority standards |

| Security | Vulnerable to fraud and tampering | Enhanced with digital signatures, IRN, and QR codes |

| Amendments | Flexible but prone to errors | Limited amendments, validated changes |

| Integration | Typically, standalone | Integrates with ERP and accounting systems |

| Environmental | High paper waste | Environmentally friendly by eliminating paper |

This switch from paper to digital is a transformation that unlocks new levels of efficiency, security, and control. But to fully realize these benefits, you need a partner that makes the transition seamless. That's where Complyance comes in. Complyance is an Accredited Service Provider, built to meet the UAE’s official framework requirements while making e-invoicing easy, scalable, and secure for growing businesses. Let's explore the top 10 benefits that make it the definitive choice for your UAE e-invoicing journey.

Complyance’s Unique features :

- Go Live in Weeks, Not Months: Pre-built connectors and a developer-friendly API get you operational ahead of the 2026 deadline.

- The Power of a Single API: Manage e-invoicing in the UAE and across 100+ countries through one simple, powerful integration.

- 100% FTA Compliance Guarantee: Over 100 automated validations ensure every invoice is accepted on the first try, avoiding fines.

- Proactive Error Detection: Our platform doesn’t just flag failures; it guides you to the exact error before submission.

- Seamless Multi-ERP Integration: In-house expertise to integrate with any system, from SAP and Oracle to QuickBooks and Zoho.

- Enterprise-Grade Security: ISO 27001 certification and local UAE data storage keep your sensitive information protected.

- Handles Government API Downtime: A smart queuing system automatically sends invoices when FTA systems are back online.

Unique Features that Set Complyance Apart.

You know that feeling of finding the right solution that just works? That’s Complyance. Here’s a rundown of the key benefits that make it the definitive choice:

1. Multi-Country Rollout from a Single API

One Integration, Infinite Compliance. Do you do business in multiple countries? The best providers let you manage global e-invoicing without starting from scratch for every new mandate. Complyance’s powerful single API is your gateway to seamless e-invoicing in the UAE and across 100+ countries. This unified approach saves you from the endless cycle of rebuilding schemas and tax logic.

2. Go Live in Weeks, Not Months

The 2026 FTA deadline is fast approaching, and speed is critical. Traditional software implementations can drag on for months. Complyance flips the script with rapid go-live features like pre-built connectors and crystal-clear API documentation that enables full integration in days, not months. A growing retail chain recently used these tools to launch its e-invoicing system weeks ahead of schedule, avoiding last-minute stress and potential penalties.

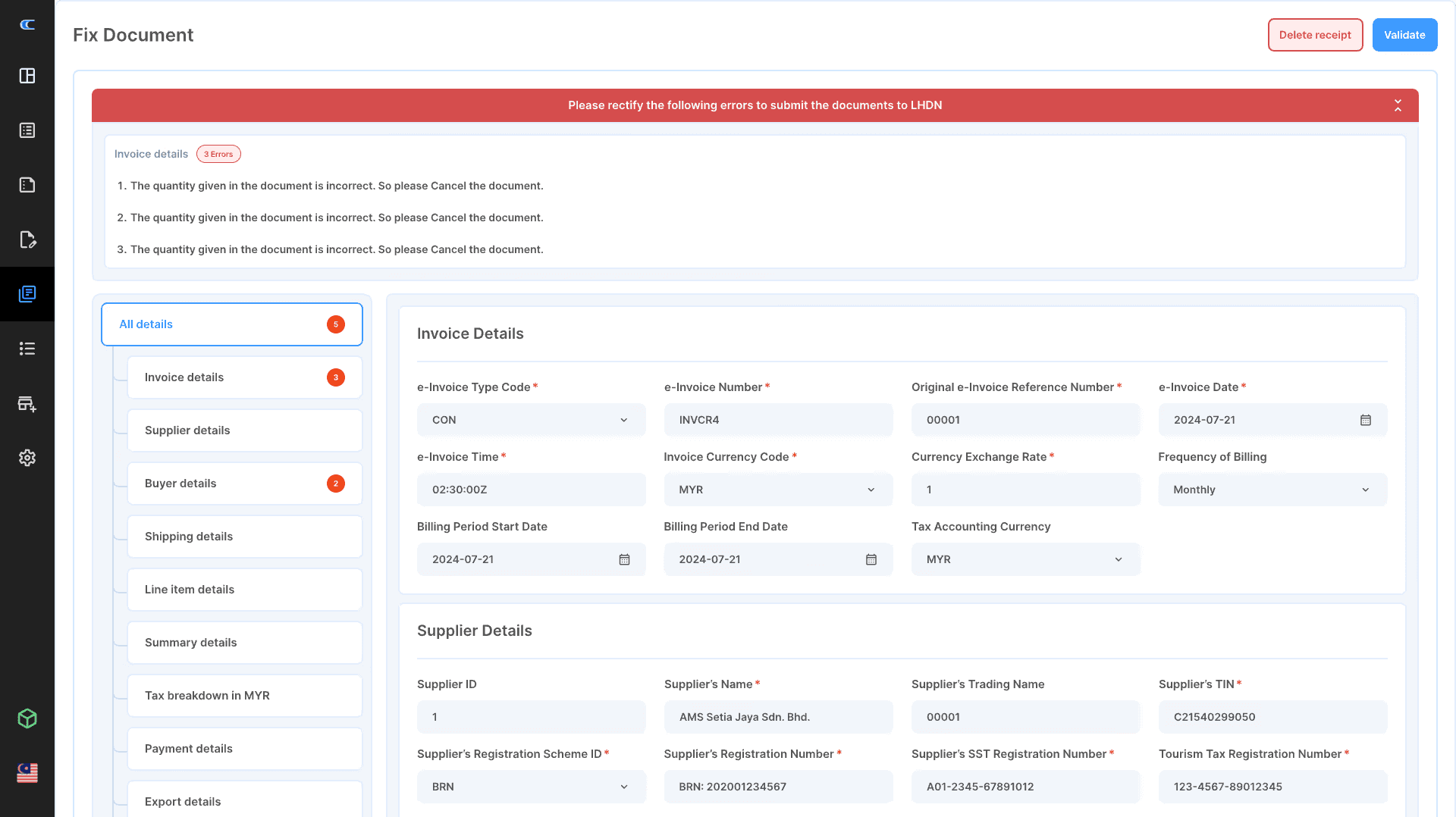

3. Proactive Error Detection & Advanced Pre-Validation

Instead of just telling you an invoice failed FTA validation, our sophisticated engine guides you to the exact error before you even send it. As your team drafts an invoice, Complyance rigorously validates the data against all current business and FTA rules in real-time, highlighting missing fields, incorrect tax calculations, or formatting issues. This proactive approach saves you time, prevents costly compliance rejections, and eliminates the back-and-forth.

With Complyance, you fix errors before they happen, not after they fail.

4. Seamless Multi-ERP Integration & Gap Analysis

Your provider needs in-house expertise to integrate with any system you use. Complyance offers seamless integration with everything from SAP, Oracle, and MS Dynamics to QuickBooks, Xero, and Shopify. But we don't stop there. We begin with a thorough gap analysis of your current systems to align data fields, formats, and workflows with UAE standards, ensuring a perfect fit from day one.

5. 100% FTA Compliance with Automated Updates

FTA rejections lead to penalties, and regulations are constantly evolving. Managing this manually is a full-time job. Complyance guarantees 100% compliance with over 100 automated validations. Even more critically, our platform is automatically updated to reflect any future changes in FTA regulations. This removes the entire compliance burden from your team, ensuring every invoice is accepted on the first try, today and in the future.

"While other solutions make you manually track regulatory changes, our platform updates itself automatically, turning compliance from a constant race into a guaranteed outcome."

6. Handles Government API Downtime with Smart Queuing

Government systems can be slow or go down completely. What happens to your invoices then? Complyance has a smart system that queues your invoices during FTA downtime and automatically sends them once the system is back online. Your operations never skip a beat, and you don’t have to lift a finger.

"our smart queue works around the clock, ensuring your invoices are delivered without any manual intervention."

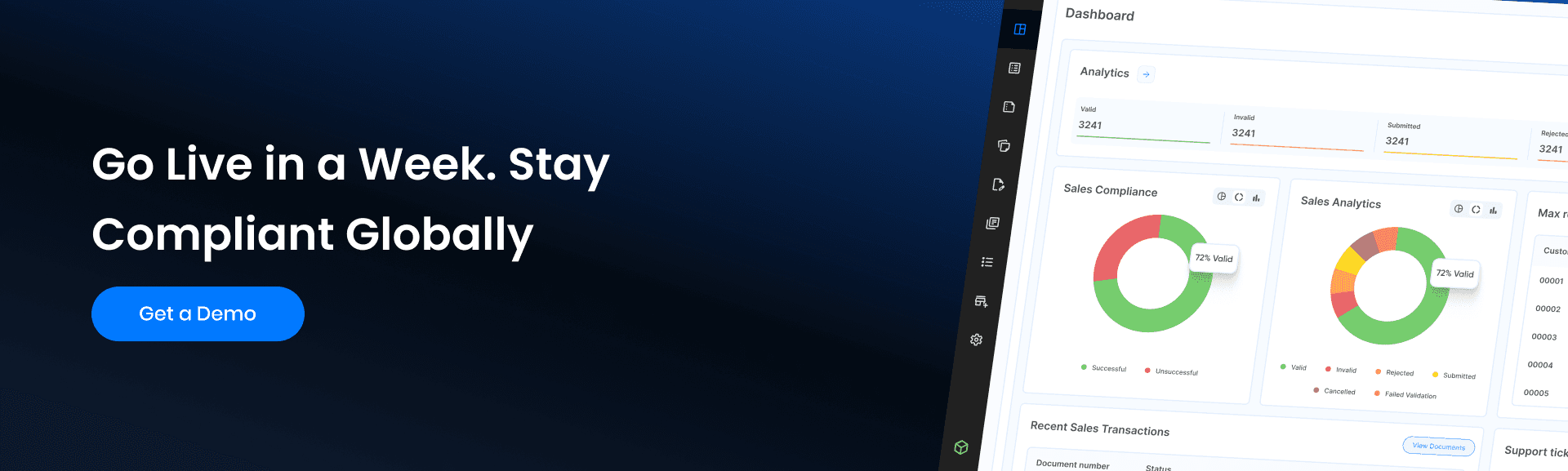

7. Transparent Usage & Performance Dashboards

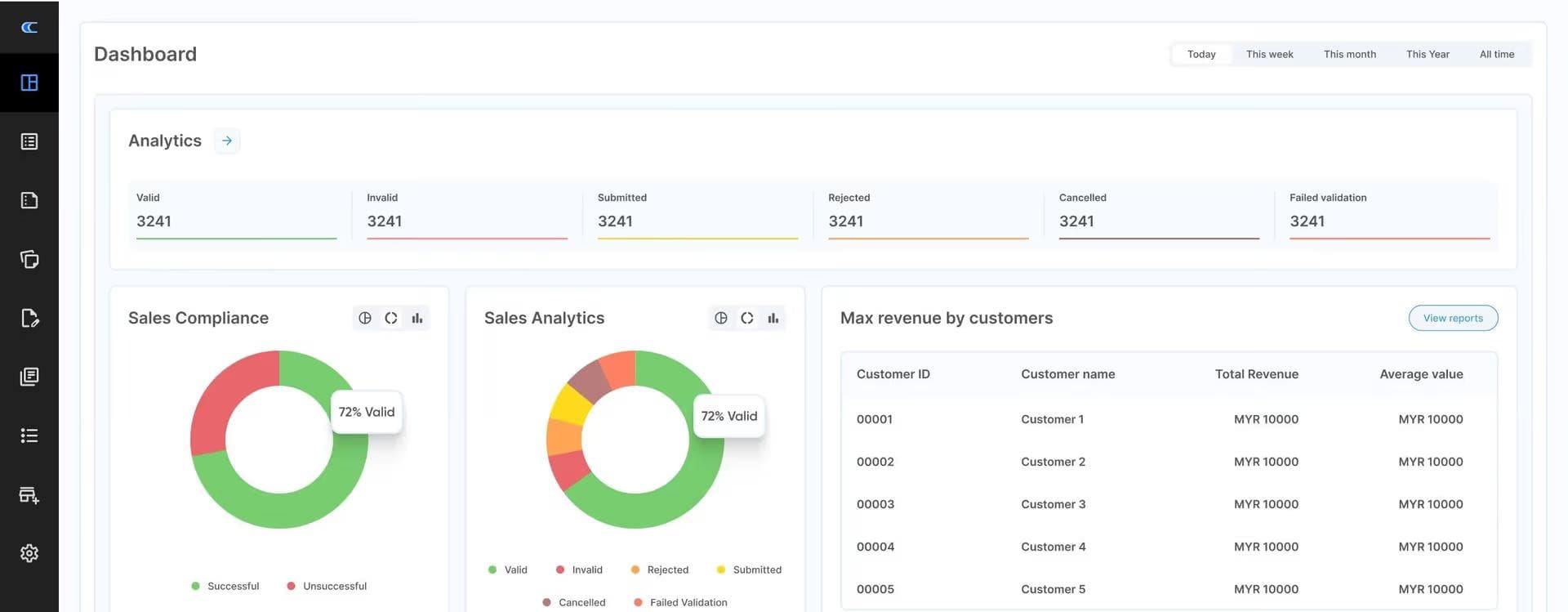

You should never face hidden surprises. You need a clear view of your E-invoicing processes. Complyance provides a centralized real-time dashboard showing your invoice status, usage counts, and system performance. This gives you instant visibility and control over your entire e-invoicing process.

8. Comprehensive Team Training & 24/7 Expert Support

We help you train and align your Finance, Tax, IT, and Sales teams on their specific roles through role-based training. This ensures company-wide readiness and smooth adoption. Plus, you get access to 24/7 customer support from local UAE experts and global tax specialists, ensuring you’re never alone, whether it's a technical glitch or a complex compliance query.

"Complyance provide role-specific training and 24/7 access to local UAE experts, ensuring your team is equipped and never left waiting for a solution."

9. Automates Repetitive Tasks to Save Time & Money

Manual invoicing tasks like reconciliation and reporting are a massive drain. Complyance automates these processes, cutting manual effort by up to 70%. This streamlines your entire operation, reduces costs associated with errors and paperwork, and delivers measurable savings.

"our platform automates the entire workflow from creation to reconciliation freeing your team to focus on the core work, not data entry."

10. Confirms Ongoing Assistance & Partnership

Your partnership shouldn’t end at go-live. Complyance offers continuous support, including proactive platform updates, responsive issue resolution, and expert guidance to navigate evolving requirements.

| Feature | Complyance | Generic E-Invoicing Software | In-House Development |

|---|---|---|---|

| Implementation Time | Weeks | Months | 6+ Months |

| Multi-Country Support | Single API for 100+ countries | Separate setups per country | Requires rebuilding for each country |

| FTA Compliance | 100% Guarantee with auto-updates | Manual updates and checks | High risk of errors and oversights |

| Error Handling | Proactive detection before submission | Post-submission rejection reports | Reactive debugging |

| ERP Integration | Pre-built, seamless connectors for major ERPs | Limited or custom integration required | Built-in, but maintenance-heavy |

| Data Security | ISO 27001 certified, local UAE data storage | Varies; often non-transparent | Your responsibility to build and certify |

| Support | 24/7 local UAE experts & tax consultants | Standard ticketing system | Internal IT team burden |

| Total Cost of Ownership | Predictable subscription | Subscription + hidden customization costs | Very high (salaries, maintenance, risk) |

These additional advantages, such as a user-friendly interface and real-time tracking, are what make platforms like Complyance stand out among the best uae e-invoicing software in 2025.

How Complyance transforms E-Invoicing for Every Team

By addressing the specific pains and goals of each department, Complyance ensures a smooth transition, company-wide adoption, and unlocks new levels of efficiency across your entire business.

Finance Teams: From Manual Chaos to Real-Time Control

A leading Malaysian enterprise was struggling with multi-ERP consolidation. Their finance team had to manually pull data from Oracle, SAP, and custom systems just to generate a single compliant report. Invoices were often duplicated, mismatched, or delayed, creating major bottlenecks in monthly closings.

After adopting Complyance, the finance team gained a unified data layer that consolidated inputs from all ERPs. Proactive error detection and built-in LHDN (IRBM) compliance meant invoices were validated automatically before submission, eliminating back-and-forth fixes.

The results:

- 70% faster consolidation across multiple ERPs

- Zero penalties from missed LHDN validations

- Finance teams are now focused on forecasting and insights instead of reconciliation firefighting

Tax Teams: Compliance Without the Burnout

A multinational distributor in Saudi Arabia struggled with rapidly evolving ZATCA Phase 1 and Phase 2 regulations. Each update required hours of manual adjustments, and the risk of penalties for missed compliance was high.

By switching to Complyance, the tax team gained 100+ automated validations and continuous platform updates aligned with ZATCA’s latest rules.

The impact:

- 100% compliance guarantee with zero missed ZATCA updates

- No sleepless nights over real-time clearance errors

- A confident tax team reporting with complete accuracy

Product Managers: Launching Faster with One API

A SaaS product team faced delays in integrating e-invoicing across multiple geographies. Each rollout meant building new connectors and adjusting schemas from scratch.

With Complyance’s single API for 100+ countries, their team deployed ZATCA e-invoicing in weeks, not months. Pre-built connectors removed technical blockers and freed up their roadmap.

The outcome:

- 40% faster go-live

- Multi-country expansion without extra dev cycles

- A product roadmap that stayed focused on innovation

Developers: Simplicity That Scales

A developer team in Saudi Arabia working with SAP and Oracle ERPs faced constant schema mismatches, ZATCA XML validation errors, and failed submissions when handling invoice files. The complexity of Phase 1 and Phase 2 rules meant endless debugging cycles.

By using Complyance’s developer-first APIs and proactive error detection, developers identified field-level issues before submission. Instead of reworking rejections, they caught errors in real time, ensuring every invoice cleared ZATCA systems on the first try.

Developer wins:

- Zero post-submission rejections with pre-validation

- Go-live in just 3 weeks, ahead of ZATCA deadlines

- Faster integration using clear API docs and pre-built connectors

- Developers focused on core ERP projects, not compliance fire drill.

The Result for Every Team

No matter the role, Finance, Tax, Product Managers, or Developers, Complyance transforms how teams work.

- Finance saves time.

- Tax ensures accuracy.

- Product launches faster.

- Developers simplify integration.

- Leaders scale with confidence.

That’s the power of Complyance: One API, 100+ countries, 100% compliant.

Conclusion: Why Complyance Matters for You

The FTA’s e-invoicing mandate isn’t just a rule; it’s a chance to modernize and grow. Complyance turns compliance into a strength, letting you scale faster, sell smarter, and build less. Whether you’re a product manager streamlining offerings, an IT pro simplifying integration, a finance lead cutting costs, or a tax expert ensuring accuracy, Complyance has you covered. Don’t wait for the 2026 deadline to catch you off guard. Join complyance today for a free consultation and start building your e-invoicing future with confidence.

Related posts

Frequently Asked Questions

It's the standardized e-invoicing model the UAE is adopting. The five "corners" are: the Supplier, the Supplier's ASP, the Buyer's ASP, the Buyer, and the FTA. ASPs validate, convert, and report invoice data on behalf of buyers and suppliers through the Peppol network.

• Failure to implement the e-invoicing system or to appoint an Accredited Service Provider: A penalty of 5,000 AED for each month of delay or part of a month.

• Failure to issue and send an e-invoice or electronic credit note through the e-invoicing system: A penalty of 100 AED per e-invoice, capped at 5,000 AED per calendar month.

• Failure to notify the Federal Tax Authority when your system is not working:

A penalty of 1,000 AED for each day of delay or part of a day.

• Failure to notify the Accredited Service Provider when your registered data changes: A penalty of 1,000 AED for each day of delay or part of a day.

These penalties apply once your go-live date is reached. Missing the deadline can lead to both operational disruptions and cumulative fines.

Start by ensuring your data can be structured and transferred in XML format. You should also plan to partner with an ASP once the FTA accredits them. Regularly check the UAE Ministry of Finance's e-invoicing portal for official updates

Complyance is the best e-invoicing solution for UAE businesses looking for speed, scale, and simplicity.

Unlike rigid systems that require ERP changes or manual formatting, Complyance offers:

- One API to go live with the UAE's PINT-AE format

- Real-time validation & delivery via Peppol with FTA-compliant reporting

- No ERP rewrites, no local middleware required

- Powered by our GETS framework that auto-adapts your invoice to each country’s format

Complyance helps businesses stay compliant across 100+ countries, without the complexity.

Yes. Complyance not only provides a developer-friendly e-invoicing API platform but also offers expert consultation for businesses preparing for UAE e-invoicing. This includes ERP gap analysis, sandbox testing, team training, and go-live support.

Subscribe to our Newsletter

Get the latest compliance updates, e-invoicing news, and expert tips delivered to your inbox.

ABOUT COMPLYANCE

Empowering businesses to automate e-invoicing and stay compliant in 100+ countries. Our platform simplifies regulatory complexity for enterprises and fast-growing companies.