How to Prepare Your ERP Systems for the UAE E-Invoicing Requirements

Prepare your SAP, Dynamics, and Oracle ERP for UAE e-invoicing. Our practical guide covers PINT AE compliance, TRN validation, system gap analysis, and integration strategy. See how Complyance ensures 100% FTA compliance for major ERPs.

Table of Contents

If your organization relies on a mix of SAP, Oracle, and other ERPs, the UAE's e-invoicing mandate is not just a rule; it's an integration challenge.

Your ERP generates invoices. But can it generate FTA-compliant ones that won't get rejected? With the UAE's mandate going live in July 2026, you need solid validation, not just a hopeful guess.

For a comprehensive overview of the new system, you can read our guide on everything businesses need to know about UAE e-invoicing compliance.

Bridging the Gap Between Your ERP and the FTA

Your SAP S/4HANA, Oracle Fusion, NetSuite, or even regional ERP system is the core of your financial operations. However, most out-of-the-box installations from major platforms like Microsoft Dynamics 365 and Sage to smaller, custom-built, or legacy accounting systems lack the specific functionality for native FTA e-invoicing compliance.

This gap is most apparent in two critical areas:

- The complex integration layer is required to connect to the FTA's gateway.

- The intricate data validation rules are mandated by the PINT AE standard.

Whether you're running a global ERP or a local accounting package, the compliance burden is the same.

The system must be able to generate, sign, and submit a perfectly formatted invoice that meets every technical requirement.

For businesses managing a hybrid environment with multiple systems, this challenge multiplies, requiring a unified compliance strategy.

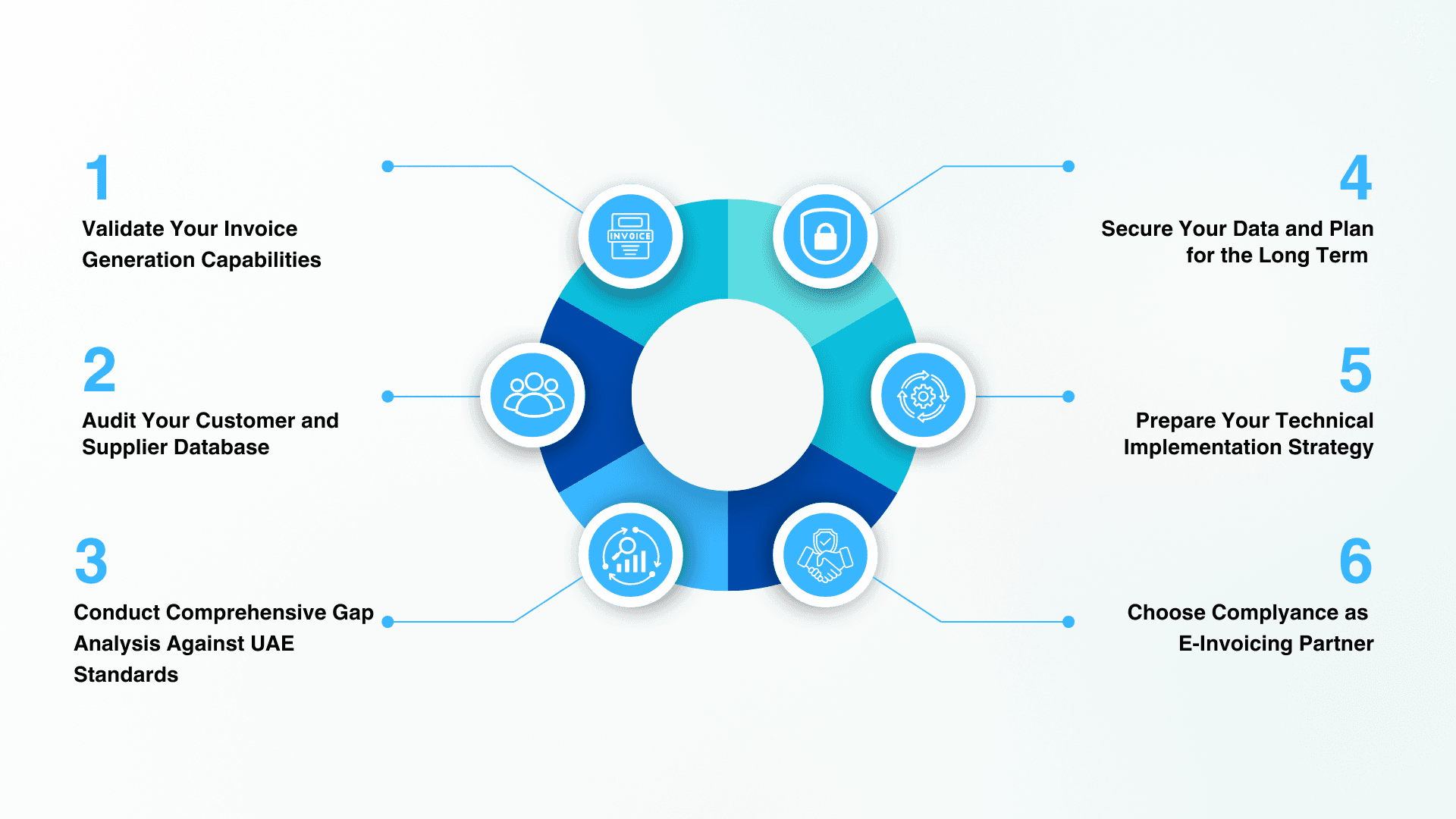

Validate Your Invoice Generation Capabilities

Before any integration, you must verify your ERP's core billing engine can produce invoices data that meet the UAE's 50+ mandatory data fields.

Your system must be configured to handle critical mandatory fields, including:

- Tax Registration Number (TRN) that matches official registration records

- Automatic VAT calculation according to UAE tax regulations

- Unique sequential invoice numbering complying with FTA requirements

- Proper date and currency formatting on all documents

Beyond standard invoices, your system must generate special document types:

- Credit notes with proper referencing to the original invoices

- Exemption certificates with appropriate justification codes

- Reverse charge invoices for B2B transactions with shifted tax liability

Sequential numbering often causes compliance failures. Verify your system can generate invoices in strict chronological order and handle number gaps with proper documentation.

Complyance's platform provides native support for PINT AE requirements, ensuring all mandatory fields from your SAP or Oracle system are accurately mapped and validated before submission.

Plug in your ERP. Get e-invoicing ready in a week with one API

Audit Your Customer and Supplier Database

Having established your system's capability to generate compliant invoices, the next logical step involves ensuring your data foundation is equally robust through comprehensive database auditing.

Incomplete or inaccurate customer data represents a primary cause of e-invoicing rejections. The UAE's e-invoicing framework requires complete business information using legal entity names rather than trading names.

Each customer record must contain:

- Verified TRN from FTA databases

- Complete address details, including emirate and postal codes

- Proper business classification (individual, corporation, government entity)

- Accurate banking information for payment processing

Supplier information requires similar attention to detail. Your vendor master data must contain complete contact and tax information with verified tax status.

Implementing data quality assurance requires:

- Regular validation checks to identify incomplete records

- Mandatory field controls to prevent future incomplete entries

- Systematic processes for ongoing customer data maintenance

Complyance includes automated, real-time validation tools that verify TRN authenticity directly from the FTA gateway and check for data completeness, significantly reducing errors at the source.

Conduct a Comprehensive Gap Analysis Against the UAE Standards

With your data cleansed, you must conduct a technical gap analysis against the UAE standards. This is where the real work for your IT team begins.

Your technical assessment should evaluate:

- Current invoice fields against FTA's mandatory requirements

- System capability to output data in the required XML formats

- Digital signature capacity for Qualified Electronic Signatures

- UUID generation for Global Unique Identifiers

Workflow integration analysis must examine how your current invoice approval processes align with e-invoicing submission requirements. Error handling capabilities require careful evaluation to manage rejection responses and resubmission processes.

The integration readiness review should cover three key areas:

- API capabilities for direct FTA integration

- Third-party connection compatibility with accredited providers

- Data export functionality for manual submission processes

Secure Your Data and Plan for the Long Term

Once you've identified compliance gaps, attention must shift to implementing robust security measures and establishing sustainable maintenance protocols.

E-invoicing involves transmitting highly sensitive fiscal data. The FTA mandates strict security protocols, including encryption and access controls.

Develop a continuous compliance plan that includes:

- Regular audits of your invoicing processes

- Protocols for staying updated on FTA regulation changes

- Clear procedures for applying system updates without disrupting operations

Establishing escalation procedures is crucial for handling submission failures swiftly and avoiding potential FTA penalties.

For a full list of deadlines and repercussions, refer to our blog on UAE e-invoicing deadlines, penalties, and pro tips. Your documentation processes must include immutable logs of all invoice lifecycle events as specified by FTA requirements.

Complyance provides ongoing support and documentation to help formalize your e-invoicing workflows, ensuring long-term success beyond implementation.

Prepare Your Technical Implementation Strategy

With security and maintenance frameworks established, we now turn to the practical aspects of technical implementation planning.

Your technical approach determines how smoothly your transition proceeds. You have two primary paths for integration:

1. Direct API Integration (Complex & Resource-Intensive):

- In-House Development: Your IT team must build, test, and maintain the entire integration from scratch, diverting resources from core business projects.

- Specialized Knowledge Required: Requires deep, ongoing expertise in the FTA's specific API protocols and the PINT AE schema, which is outside most teams' standard skill sets.

- Ongoing Maintenance: You are solely responsible for monitoring the integration, handling API updates from the FTA, and troubleshooting any submission failures or errors.

2. Integration via an Accredited Solution Provider (Recommended):

- Leverage a pre-built, FTA-accredited solution provider like Complyance.

- Your ERP only needs to send a simple data payload (e.g., via IDoc in SAP or a REST call to Oracle).

- The external platform handles all XML formatting, signing, UUID generation, API communication, and error handling with the FTA.

- This approach reduces risk, development time, and long-term maintenance overhead.

Complyance offers a full sandbox environment with test data, allowing you to validate payloads from your SAP or Oracle system and simulate errors long before going live.

How Complyance Addresses ERP Integration Challenges

Understanding the technical implementation requirements naturally leads to evaluating specialized solutions that can streamline this complex process.

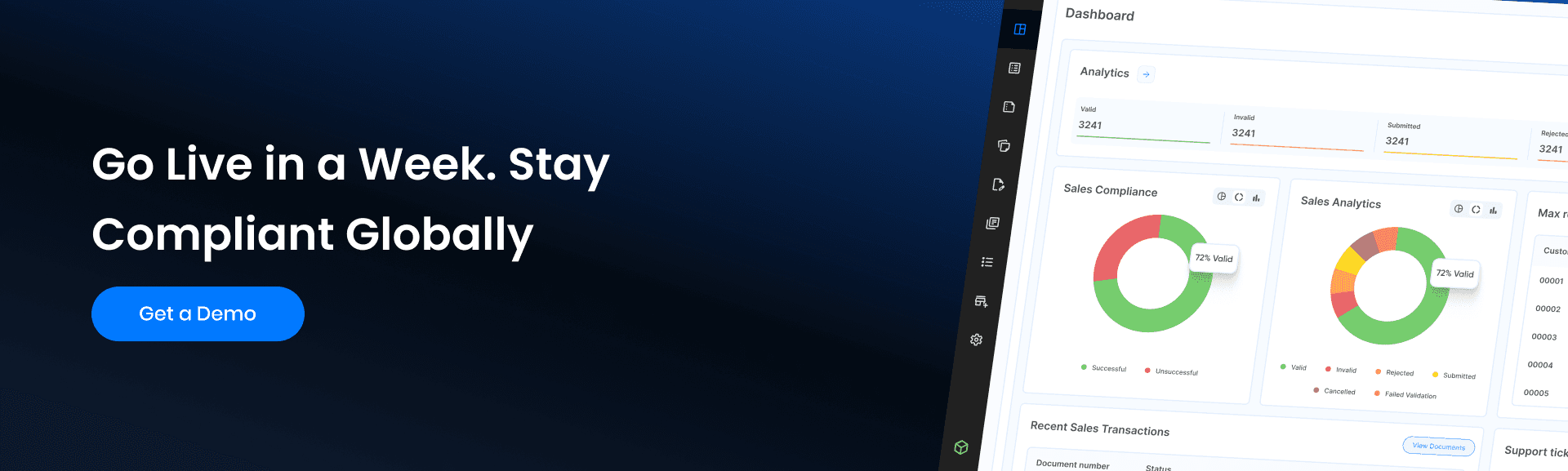

Complyance provides a comprehensive e-invoicing solution that simplifies ERP integration and ensures compliance with UAE requirements.

With over five years of global e-invoicing experience, Complyance offers proven expertise that reduces implementation risk.

The platform's GETS framework simplifies multi-country compliance by unifying global and local requirements. This approach reduces implementation time by 85% per country rollout, according to customer data.

Technical advantages include:

- Pre-built connectors for major ERP systems (SAP, Oracle, MS Dynamics)

- Real-time validation against 100+ business rules before submission

- Automated tax reconciliation between ERP data and FTA submissions

- End-to-end encryption meets international security standards

- The platform's developer-friendly API includes interactive documentation and code snippets that reduce integration time from months to weeks.

Conclusion and Action Plan

The UAE's e-invoicing mandate represents a significant transformation in tax compliance requirements. Businesses that begin preparation now will transition smoothly while competitors scramble as deadlines approach.

Your action plan should include:

- Immediate technical assessment of current ERP capabilities

- Data quality initiative for customer and supplier records

- Vendor evaluation for accredited service provider partnership

- Implementation timeline with testing milestones

- Staff training program for new processes and systems

In our E-Invoicing in the UAE: Deadlines, Penalties, and Pro Tips blog, we break down practical steps to align your systems, train your teams, and test your setup for a smooth go-live.

Get a Free, ERP-Specific Readiness Assessment

Is your SAP, Oracle, or NetSuite environment prepared for PINT AE compliance? Our experts will analyze your setup and provide a personalized roadmap.

Related posts

Frequently Asked Questions

It typically involves using a dedicated transaction or report to create a standard invoice. However, for compliance, the critical next step is transforming that internal invoice file into the government-mandated format (like XML or JSON in the UAE) and then securely transmitting it to the tax authority's platform. Many ERPs need an added integration solution to handle this compliance step automatically.

You should configure SAP's native output settings for invoices, often using tools like SAP Document Compliance, and most importantly, you integrate SAP with a certified third-party compliance solution or middleware like Complyance. Their system takes the invoice data from SAP, ensures it meets all local regulatory rules (like the UAE's FTA requirements), converts it into the correct format, and submits it to the government portal. This end-to-end managed process is what ensures your SAP-generated invoices are fully compliant.

Your ERP is the central software that manages your core processes like finance, sales, and inventory. An API (Application Programming Interface), on the other hand, allows your ERP to communicate seamlessly with other external systems. For e-invoicing compliance, an API is what allows your ERP to safely send invoice data to the government's tax authority system and receive a compliance approval back without any manual work.

- Create the Invoice in Your ERP: You generate the invoice in your existing ERP or billing system; no changes needed.

- Send to Complyance API: Complyance (your Accredited Service Provider) validates the data and converts it into the UAE-compliant PINT-AE XML format.

- We handle Peppol Routing: Using official Peppol directories, Complyance ensures the invoice is routed securely to the buyer’s ASP.

- Buyer Receives the Invoice Automatically: The buyer’s ASP receives and delivers the e-invoice into their ERP or accounting system.

- We Report to the FTA for You: Complyance generates and submits the Tax Data Document (TDD) to the Federal Tax Authority via the UAE Central Data Platform.

- FTA Validates the Invoice in Real Time: The FTA reviews and accepts the invoice instantly. Your transaction is now fully compliant and audit-ready.

Yes, Complyance is an ASP provider and is in the process of being accredited by the FTA in the UAE.

Complyance is the best e-invoicing solution for UAE businesses looking for speed, scale, and simplicity.

Unlike rigid systems that require ERP changes or manual formatting, Complyance offers:

- One API to go live with the UAE's PINT-AE format

- Real-time validation & delivery via Peppol with FTA-compliant reporting

- No ERP rewrites, no local middleware required

- Powered by our GETS framework that auto-adapts your invoice to each country’s format

Complyance helps businesses stay compliant across 100+ countries, without the complexity.

Yes, e-invoicing will become mandatory in the UAE starting July 2026.

It will apply to all B2B and B2G transactions. VAT-registered businesses will soon be required to issue structured electronic invoices to stay compliant.

Subscribe to our Newsletter

Get the latest compliance updates, e-invoicing news, and expert tips delivered to your inbox.

ABOUT COMPLYANCE

Empowering businesses to automate e-invoicing and stay compliant in 100+ countries. Our platform simplifies regulatory complexity for enterprises and fast-growing companies.