Top 5 UAE E-Invoicing Solutions for IT solutions to Implement for Their Clients

Select the ideal e-invoicing partner in the UAE to match your clients' specific requirements, drastically reducing implementation time and facilitating a smooth, hassle-free go-live experience.

Table of Contents

Your core business is delivering exceptional technology services to your clients not interpreting tax law or maintaining government integrations. Yet, that's exactly where you find yourself when you choose to build a custom, in-house e-invoicing solution. What seems like a path to control quickly becomes a costly distraction, pulling your team into a relentless cycle of e-invoicing updates, complex integrations, and technical support for a non-core function.

This diversion has a real cost: slow client onboarding, delayed project go-live dates, and the growing risk of compliance penalties for your clients. With over 60% of countries enforcing real-time e-invoicing in the upcoming years, including the UAE's mandate in July 2026, the burden of building and maintaining your own solution is a direct threat to your growth and reputation.

The strategic alternative is to partner with a dedicated global e-invoicing provider. This approach unlocks seamless compliance not just for the UAE, but across other GCC countries and global markets through a single, unified API.

By leveraging a partner, you can instantly simplify e-invoicing for your clients. This means you can AutoMap invoicing fields, drastically reduce developer workload, and accelerate implementation timelines.

This directly increases your company's revenue potential. By eliminating development bottlenecks, your team can take on more projects faster, turning e-invoicing necessity into a new revenue source

The Best E-Invoicing Solutions for IT Services Partners

- Complyance for Best Global E-Invoicing with a single Developer-Friendly API

- Avalara for global tax compliance and extensive ERP integrations

- Pagero for network-based automation and seamless partner connectivity

- OpenText for enterprise-scale digital document exchange and deep SAP integration

- Sovos for complex regulatory requirements and multi-jurisdiction reporting

Why Building an E-Invoicing Solution Is a Costly Distraction

While building a custom, in-house e-invoicing function might seem like a way to retain control, it often introduces significant challenges that pull your focus away from your core business: serving your clients.

- The Expertise Gap: lack of in-house tax experts who can accurately interpret complex, ever-changing regulations across different countries. A single misinterpretation can lead to rejected invoices, financial penalties, and compliance failures for your customers.

- The Maintenance Burden: E-invoicing mandates are not static. Governments frequently update requirements, forcing you into a continuous cycle of tracking, development, and deployment just to maintain e-invoicing compliance, pulling your development team away from your core product.

- The Support Challenge: Providing support for e-invoicing issues requires deep subject matter expertise. Without a dedicated team of e-invoicing specialists, you risk long resolution times, frustrated customers, and damage to your brand's reputation for reliability.

- The Global Expansion Bottleneck: Scaling to a second or third country becomes a massive project. You'll need to build and maintain separate integrations for each new market's unique API and rules, which takes lots of time and resources. Even if you only support one country, a client with operations in multiple regions will be forced to find other providers elsewhere. This means you miss out on significant revenue from their international business and risk losing the client entirely to a more capable competitor offering multi-country e-invoicing.

- The Implementation Drag: Mapping your invoice data to each country's specific format is a complex and time-consuming development task that requires significant effort.

- The Accreditation Process

In many jurisdictions, transmitting e-invoices directly to government platforms requires official accreditation. This process is expensive and time-consuming, demanding pre-requisites before you can even begin live operations. - Lack of Practical Experience

A custom-built solution misses out on the knowledge gained from handling millions of invoices across different industries. Your team may end up spending time solving problems that a specialized provider has already fixed.

What IT Solutions Partners Should Look For in an E-Invoicing Platform

1. Built-In, Country-Specific E-Invoicing Compliance

Choose a platform that manages e-invoicing compliance out of the box from mandatory invoice formats to transport protocols. It should natively support country-specific rules like PINT-AE, ZATCA Fatoorah, Peppol BIS, and more, so your team doesn’t have to implement country logic manually.

2. Automatic Updates for E-Invoicing Mandates

Select a platform that actively tracks and updates changes to e-invoicing schemas, APIs, and rollout phases without requiring your developers to make last-minute changes. This ensures you're always aligned with the latest government requirements.

3. Direct Access to Expert E-Invoicing Support

Ensure your provider offers hands-on support from specialists who understand e-invoicing infrastructure, rejection codes, and country-specific errors. When integrations break or invoices fail, you need fast troubleshooting from a team that’s done it before not a generic help desk.

4. A Unified API for Multi-Country E-Invoicing

If you plan to expand globally, prioritize vendors who offer a single e-invoicing API for multiple countries. This dramatically simplifies onboarding new clients in new markets without rebuilding separate country integrations every time.

5. Easy ERP Integration with Auto E-Invoicing Field Mapping

Choose a platform that offers easy integration with major ERPs and supports automatic mapping of e-invoicing fields to country-specific formats. This removes the need for manual data transformation or complex data mapping, helping your team accelerate implementation across multiple clients and Countries.

6. Government Accreditation & Proven Track Record

Verify that the platform is officially accredited in the regions you operate. A certified provider with a history of processing high invoice volumes across industries is more likely to deliver consistent uptime, accuracy, and audit-ready results.

The Top 5 E-Invoicing Solutions for IT Services partners in 2025:

After evaluating dozens of platforms against IT-specific criteria, these five solutions stand out for technical teams in IT service providers:

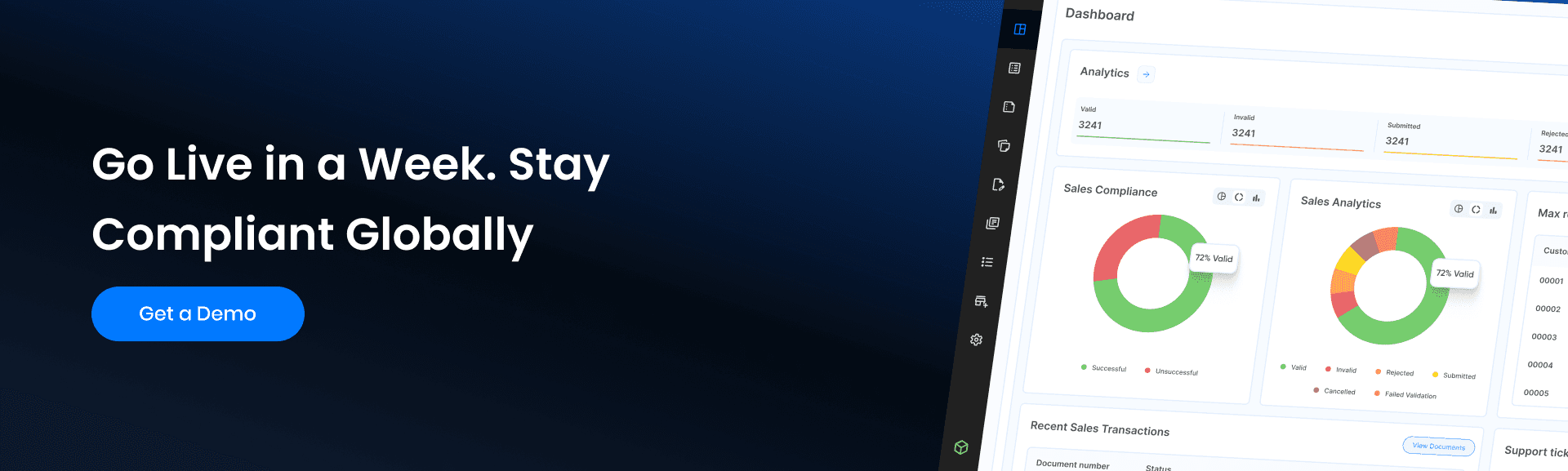

1. Complyance: The Best E-Invoicing Solution Powered by a Single Developer-Friendly API

UAE-focused businesses needing rapid, API-driven integration with a single API, Complyance stands out with its developer-first approach featuring comprehensive API documentation, SDKs, and sandbox environments that accelerate integration. Their platform enables UAE FTA compliance in under a week, with 100+ automated validations that ensure invoice acceptance on the first submission.

Next-Level API Capabilities:

Complyance's API is engineered specifically for technical teams, featuring:

- Interactive Documentation: Real-world examples, code snippets, and "try-it-now" functionality that eliminates guesswork for developers

- Multi-Language SDK Support: Native support for Java, with upcoming support for Next.js, Python, Rust, and PHP

- Sandbox Environment: A full testing environment that mirrors production systems, allowing teams to validate integrations before going live

- Single API Architecture: One integration handles compliance across 100+ countries, significantly reducing development overhead

- Automated PINT AE Validation: 100+ validation checks ensure every invoice meets UAE FTA standards before submission

- FTA Downtime Handling: Intelligent queueing mechanisms maintain operations during government system outages

- Real-Time Status Tracking: Message Level Status (MLS) tracking provides immediate feedback on submission success or failure

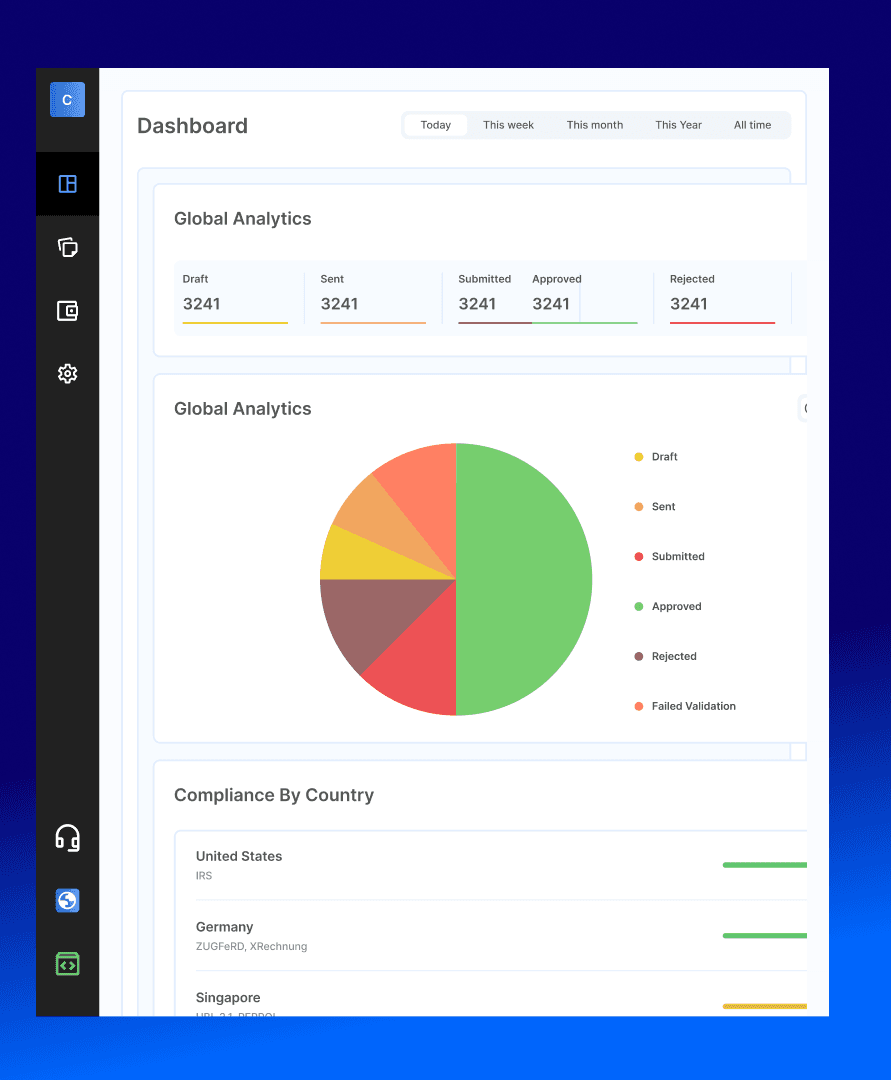

Enterprise-Grade Features for IT Services

For development teams, integration becomes straightforward:

- Multi-ERP Integration: Pre-built connectors for SAP, Oracle, NetSuite, and Microsoft Dynamics

- Automated Reconciliation: Real-time synchronization between ERP data and FTA submissions

- Multi-Tenant Support: Manage multiple clients or entities through a single interface with role-based access control

- White-Label Options: Resell compliance capabilities under your own branding

Why Technical Teams Choose Complyance

- Reduced Development Time: Pre-built validation rules and API endpoints cut integration time from months to weeks

- Ongoing Compliance Assurance: Automatic updates to handle regulatory changes without code modifications

- Local Data Residency: UAE-based data storage meeting MoF security requirements

- 24/7 Technical Support: Direct access to engineering support for critical implementation issues

All you need for UAE E-Invoicing in one API

Connect your ERP, validate invoices, and go live fast, all from one developer-friendly platform.

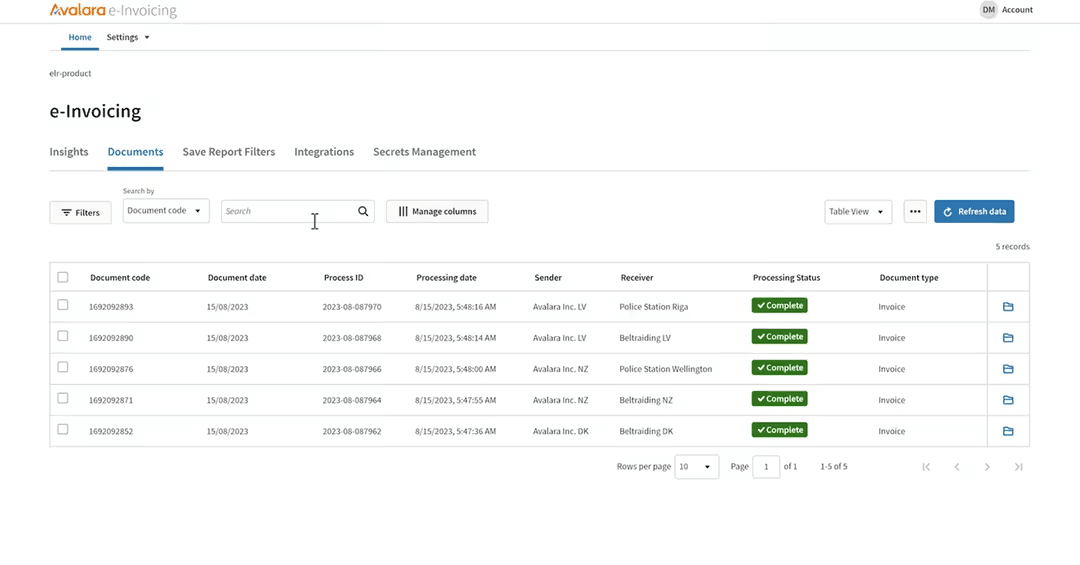

2. Avalara: Best for Global Tax Compliance

Enterprises with complex international tax requirements. Avalara offers e-invoicing within its tax compliance platform, integrating with ERPs like Oracle NetSuite for seamless workflows. It’s ideal for businesses needing multi-country tax and invoicing solutions.

With a strong focus on automated tax calculations and compliance, Avalara helps companies manage VAT, sales tax, and e-invoicing requirements across various jurisdictions, including the UAE's FTA mandate.

The platform's robust ecosystem ensures that tax and invoicing processes are handled in one place, reducing errors and improving efficiency for international operations.

Key IT Advantages:

- Broad integration ecosystem reduces custom development needs

- Real-time compliance monitoring minimizes manual oversight

- Extensive developer resources and support communities

- Highly scalable architecture for enterprise deployments.

Pros:

- Integrates seamlessly with major ERPs like Oracle NetSuite.

- Supports global tax and e-invoicing compliance from a centralized platform.

- An extensive ecosystem of pre-built connectors reduces custom development.

Cons:

- Full implementation can take months, depending on business complexity.

- Custom pricing is often expensive for startups or mid-sized firms.

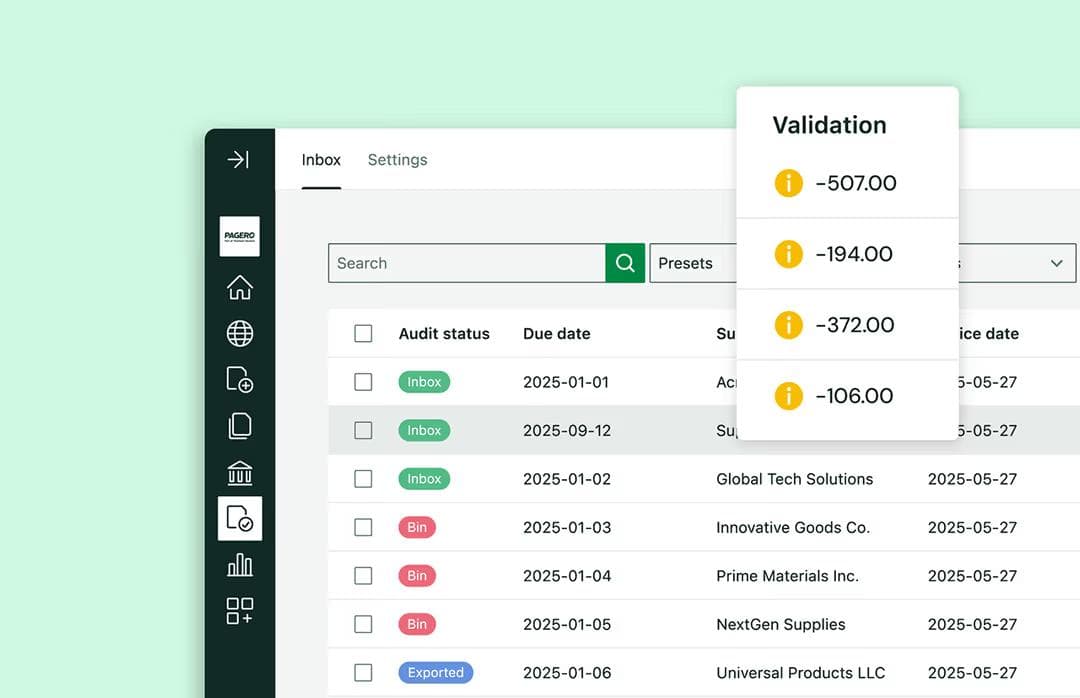

3. Pagero: Best for Network-Based Invoice Automation

Pagero, a Peppol-certified Access Point, automates B2B invoice exchanges and ensures UAE FTA compliance.

Its global network connects businesses to buyers and suppliers, facilitating seamless document exchange without the need for direct integrations with each partner.

As a leader in Peppol services, Pagero simplifies the transition to digital invoicing by handling the complexities of the five-corner model, making it a strong choice for companies with extensive supply chains in the UAE and beyond.

Key Features:

- Peppol Network Access: Direct connectivity to the FTA's Peppol framework for instant invoice delivery.

- Automated Workflow: Handles validation, transmission, and archiving of invoices in compliance with UAE standards.

- Partner Onboarding: Easy connection to thousands of trading partners worldwide via the Pagero network.

- Document Mapping: Converts various formats to PINT AE XML for FTA compatibility.

- Monitoring Tools: Real-time tracking of invoice status and delivery confirmations.

Pros:

- Peppol-certified for reliable, automated B2B invoice exchange.

- Connects to a vast global network of trading partners.

- Automates the entire invoice lifecycle from validation to archiving.

Cons:

- Value is diminished if your key partners aren’t on Pagero’s network.

- A network-based model can lead to slower, more complex implementation.

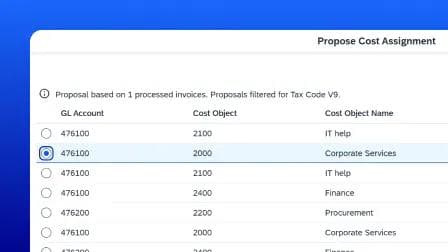

4. OpenText: Best for Enterprise-Scale Digital Document Exchange. Ideal for

Large, complex organizations with deep ERP integrations. OpenText delivers robust e-invoicing solutions built on decades of enterprise content management expertise.

Their platform specializes in handling complex digital document workflows at scale, particularly for organizations with sophisticated integration requirements.

The solution brings enterprise-grade reliability to e-invoicing processes while adapting to evolving global standards like the UAE's Peppol framework.

Key IT Advantages:

- Deep SAP and enterprise ERP integration reduces implementation complexity

- Scalable architecture designed for high-volume transaction environments

- Strong B2B/B2G document exchange capabilities across global markets

- Enterprise-grade security and reliability for mission-critical operations

The overview now maintains a general tone while highlighting OpenText's enterprise focus and scalability, matching the style of your other solution descriptions.

Pros:

- Enterprise-grade reliability and deep integration with SAP and other major ERPs.

- Highly scalable architecture designed for high-volume, global B2B/B2G document exchange.

- Strong security and compliance features for mission-critical operations.

Cons:

- It can be overly complex and costly for small to mid-sized businesses.

- Implementation often requires significant internal IT resources or consultant involvement.

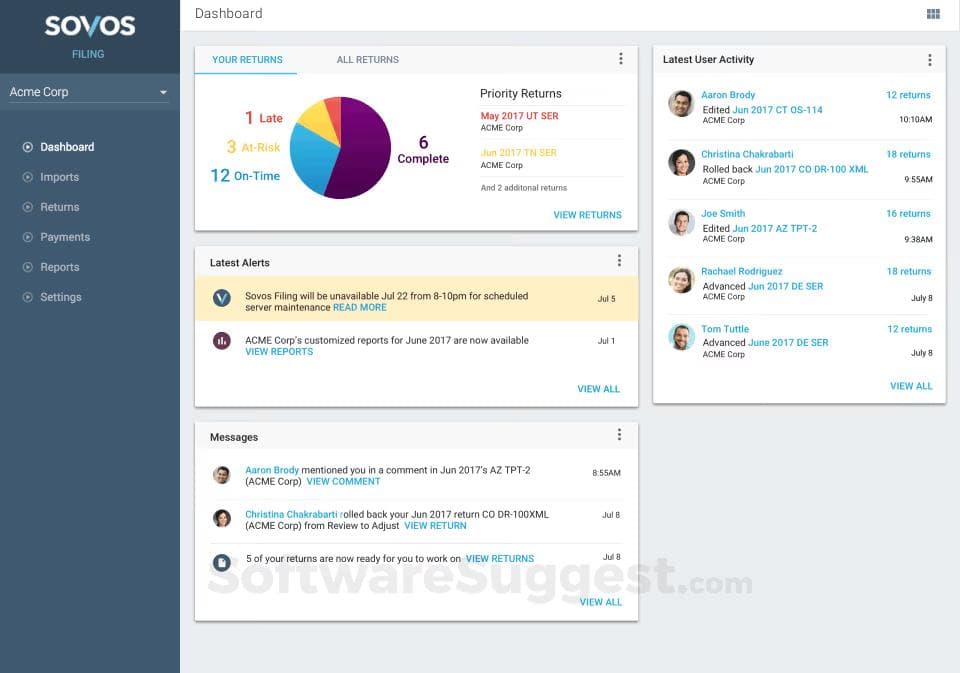

5. Sovos: Best for Complex Regulatory Requirements for

Highly regulated industries and multinational corporations provide e-invoicing within their tax compliance platform, supporting FTA-compliant invoices and multi-jurisdiction reporting.

It’s suited for businesses preparing for global mandates, with a deep emphasis on regulatory intelligence and continuous monitoring of changes in tax laws.

Sovos helps organizations stay ahead of evolving requirements like the UAE's 2026 deadline by offering proactive compliance tools and expert guidance.

Key IT Advantages:

- Advanced regulatory automation reduces compliance burden

- Multi-jurisdiction support simplifies global operations

- Audit-ready archival meets compliance requirements

- Strong security protocols protect sensitive financial data

Pros:

- Strong focus on multi-jurisdiction regulatory compliance and reporting.

- Scalable platform capable of handling complex, global e-invoicing needs.

- Supports FTA-compliant invoice generation and audit-ready archival.

Cons:

- The UAE-specific solution is still developing, with potential functionality gaps.

- Pricing structure is often prohibitive for smaller businesses.

| Vendor | API First | Global Coverage | Sandbox & Docs | ERP Integrations | Pricing Transparency | Best For |

|---|---|---|---|---|---|---|

| Complyance | ✅ | 🌍 100+ | ✅ Excellent | SAP, Oracle, MS Dynamics | ✅ Clear (credit-based) | Developer-first IT services |

| Avalara | ✅ | 🌍 Broad | ✅ Excellent | 1200+ pre-built connectors | ⚠️ Custom Quote | Global tax compliance for enterprises |

| Pagero | ❌ | 🌍 Broad | ⚠️ Mid-tier | Enterprise ERPs (via network) | ❌ Expensive | Network-based B2B automation |

| Sovos | ❌ | 🌍 Broad | ⚠️ Regulatory Focus | ERP, workflow APIs | ❌ Opaque | Complex, multi-jurisdiction compliance |

| OpenText | ❌ | 🌍 Broad | ⚠️ Enterprise Focus | Deep SAP/ERP integration | ❌ Expensive | Large-scale enterprise document exchange |

How the Right E-Invoicing Platform Simplifies Your Work as a Partner

Implementing a well-designed right e-invoicing solution a complex, custom project into a standardized, streamlined service you can offer.

Accelerated Client Onboarding:

Pre-built connectors and APIs mean you can deploy e-invoicing for new clients in weeks, not months.

Automated Compliance Management:

You can assure your clients that their invoicing is always compliant, without your team constantly monitoring regulatory changes.

New Revenue Streams:

With white-label options, you can resell the e-invoicing service directly, creating a recurring revenue stream.

Reduced Operational Overhead:

By using a dedicated platform, you avoid the cost and effort of building, maintaining, and supporting a custom invoicing solution.

Choosing the Right E-Invoicing Solution for Your IT Service Business

- If you need one API for multiple countries with a dev-first approach → Complyance

- If you serve global enterprises and supply-chain clients → Pagero

- If your focus is on global tax compliance and extensive ERP integrations → Avalara

- If you need to meet complex regulatory requirements across multiple jurisdictions → Sovos

- If your organization is SAP-heavy and requires enterprise-scale integration → OpenText

Implementation Strategy: A Technical Blueprint for Partners

For IT service providers, a structured, repeatable implementation methodology is key to delivering e-invoicing solutions efficiently and successfully for your clients. This blueprint ensures a smooth rollout that minimizes disruption and maximizes value from day one.

Phase 1: Client Discovery & Solution Scoping

- Conduct a comprehensive analysis of the client's current invoicing workflow and financial systems.

- Identify all critical touchpoints between their invoicing data and other systems (ERPs, CRMs, accounting software) to define integration requirements.

- Document the specific compliance mandates for the client's regions of operation to establish the project's scope.

Phase 2: Solution Design & Vendor Configuration

- Design the integration architecture, selecting pre-built connectors or custom endpoints to bridge the client's systems with the e-invoicing platform.

- Configure the vendor platform to match the client's business rules, tax settings, and compliance needs.

- Develop a project plan with clear milestones, from initial development to go-live and handover.

Phase 3: Integration & Development

- Utilize the vendor's sandbox environment to build and test the integration using the client's data schemas.

- Implement connections to the client's key systems, prioritizing the most critical data flows first to demonstrate early progress.

- Set up automated monitoring and alerting to provide your team and the client with real-time visibility into invoice status and system health.

Phase 4: Client Testing & Validation

- Lead the client through User Acceptance Testing (UAT) to ensure the solution meets their operational needs and is intuitive for their team.

- Conduct end-to-end compliance testing, generating sample invoices and validating them against government standards to ensure acceptance.

- Perform load testing to verify system stability under the client's expected transaction volumes.

Phase 5: Go-Live & Managed Services

- Manage the go-live process, starting with a pilot group of users or transaction types before a full-scale rollout.

- Provide comprehensive training and documentation for the client's technical and business users.

- Transition to a managed services model, offering ongoing support, monitoring compliance updates, and optimizing the system for peak performance.

Ready to start testing? Request sandbox access to test our API with your client's data model and see how quickly you can achieve e-invoicing compliance.

Real-World Implementation: How Complyance Simplified E-Invoicing for Rheinbrücke

Rheinbrücke, an Epicor partner, turned to Complyance to achieve seamless API integration and ensure 100% compliance for their e-invoicing process. By leveraging Complyance’s platform, Rheinbrücke’s customer was able to go live immediately without any errors.

Key Results:

- Go-Live Date: 40 days

- API Integration: 100% compliant for B2B, B2C, Credit Notes, Debit Notes

- Partner: Epicor

Watch this video to hear about Rheinbrücke’s experience and how Complyance helped them streamline their e-invoicing solution:

Partner Testimonial Video

Conclusion: Transforming E-invoicing from Burden to Advantage

For IT Solutions Partners, the transition to a modern e-invoicing platform is a strategic decision. It's an opportunity to transform a complex client challenge into a standardized, profitable service offering.

By selecting a platform with strong technical capabilities and a partner-friendly model, you can:

- Reduce project overhead through faster, repeatable implementations.

- Minimize your clients' compliance risks with automated regulatory updates.

- Create new revenue streams through reselling and value-added services.

- Strengthen client relationships by solving a critical business problem for them.

With the UAE's e-invoicing mandate taking effect in July 2026, your clients will be looking for guidance. The right platform will not only ensure their compliance but will position your firm as a strategic, forward-thinking partner.

Related posts

Frequently Asked Questions

- Complyance – Best for rapid global implementation with one developer-friendly API.

- Avalara – Ideal for global tax compliance and ERP integrations.

- Pagero – Best for network-based invoice automation and global partner connectivity.

- OpenText – Enterprise-scale digital document exchange with deep SAP integration.

- Sovos – Best for complex regulatory requirements and multi-jurisdiction reporting

Complyance is developer-first, offering a single API for rapid global deployment and UAE FTA compliance. It automates 100+ validation checks, reduces integration time by 85%, and provides 24/7 technical support, ensuring seamless e-invoicing with no friction.

- Robust API with SDKs, sandboxes, and real-time tracking

- ERP and accounting system integration

- Automated compliance management for real-time validation

- Security and encryption for data protection

- Scalability to handle growing transaction volumes

Complyance offers a developer-first platform with a single API for multi-country compliance. It ensures fast integration (1-4 weeks), real-time invoice validation, 100+ automated checks, and 24/7 expert support, minimizing development time and guaranteeing compliance.

Through Seamless Integration and Automation:

- Pre-built connectors for major ERPs (SAP, NetSuite, Dynamics).

- Automated workflows that eliminate manual data entry.

- Automated compliance updates that handle regulatory changes without code modifications.

Yes, Complyance offers pre-built ERP integrations with systems like SAP, Oracle, NetSuite, and more. This ensures seamless data flow from your existing infrastructure to the e-invoicing platform without the need for extensive customizations.

Subscribe to our Newsletter

Get the latest compliance updates, e-invoicing news, and expert tips delivered to your inbox.

ABOUT COMPLYANCE

Empowering businesses to automate e-invoicing and stay compliant in 100+ countries. Our platform simplifies regulatory complexity for enterprises and fast-growing companies.

Go Live in a Week with Developer-Friendly Global E-Invoicing Platform

Complyance makes it easy for your IT/dev team to integrate once and automate E-Invoicing across 100+ countries. Built for fast deployment, field-level validation, and indirect tax accuracy—no delays, no rework.