Top UAE E-Invoicing Implementation Pitfalls and How to Prevent Them

Avoid costly UAE e-invoicing mistakes. Discover the most common compliance mistakes businesses make & learn how to ensure a smooth, penalty-free transition before the 2026 FTA deadline.

Table of Contents

Is your business 99% compliant? That missing 1% could cost you 100% of the fines because in UAE e-invoicing, ‘almost right’ is like missing your flight by one minute: the outcome is exactly the same.

The UAE FTA has zero tolerance for minor technical glitches. Discover the costly misconceptions that could turn your next invoice into an unexpected tax penalty.

As the 2026 deadline approaches, companies that misunderstand the requirements will face:

- costly fines

- operational disruptions

- strained vendor relationships

- damage to their reputation in a highly competitive market.

The good news? These costly mistakes are predictable and entirely avoidable. Based on the most common implementation failures, we break down the six critical missteps every business must avoid to ensure a smooth, penalty-free transition.

Don’t learn the hard way. Bookmark this guide to protect your business from costly fines.

Ignoring the UAE’s Specific Rules

It’s easy to assume that all e-invoicing is the same. This is the first and most expensive mistake a business can make.

The UAE’s system has its own unique set of rules, and using a generic, off-the-shelf solution is a direct path to compliance failure.

The Federal Tax Authority (FTA) requires very specific information on every invoice, in a very specific format.

To get it right, you need to know the complete list of required fields for each type of invoice.

Whether it's a standard tax invoice, a simplified invoice, or a credit note, the best way to do this is to use the official data dictionary. It is the ultimate rulebook that defines every single field, what it means, what format it must be in, and whether it's mandatory or optional.

To make it even simpler, we have a Data Dictionary Guide that breaks down these technical requirements into plain language.

Choosing the Wrong Partner

Many businesses underestimate the complexity of the transition and select a technology provider based on price or promises alone. This is a critical error.

An inexperienced or non-accredited partner can lead to immediate compliance risks and long-term operational difficulties if they lack:

- Deep knowledge of the UAE's specific compliance rules and FTA data requirements, leading to fundamental errors in invoice formatting.

- Expert integration support, resulting in a disconnected system that fails to sync with your existing ERP or accounting software, causing data silos and manual work.

- Robust security measures put your sensitive financial and customer data at risk of breaches and non-compliance with UAE data laws.

- Guidance through future regulatory changes, leaving you on your own to interpret new FTA announcements and implement necessary system updates.

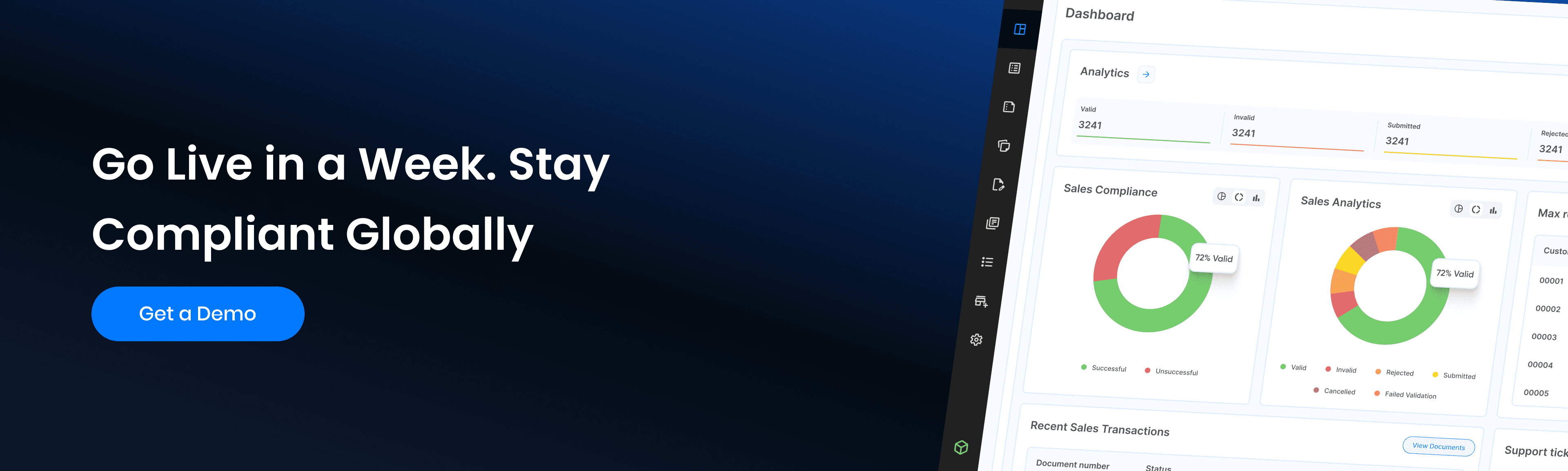

The Right Choice: Partner with an FTA-accredited service provider like Complyance. Look for a partner with proven local expertise, a track record of successful integrations, robust security credentials, and a commitment to ongoing support. The right partner handles the complex, ever-changing technical and regulatory burdens, allowing you to focus on your business with confidence.

Poor Integration with Your Existing Systems

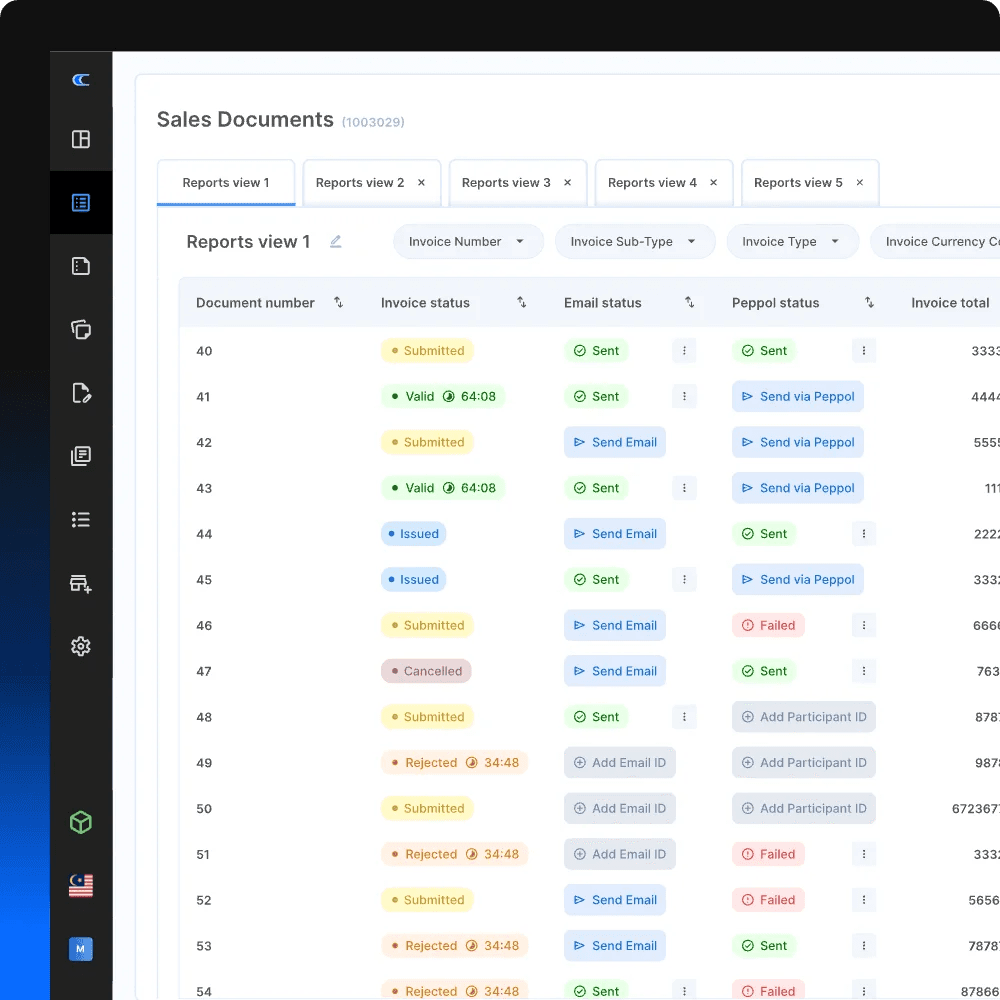

For your IT and operations teams, ensuring seamless integration with your existing ERP system presents a fundamental challenge. If the new e-invoicing solution doesn't connect flawlessly with your current infrastructure, you will face a full-scale operational crisis.

The risks of poor integration are immediate and severe: Technical glitches can cause invoices to fail transmission to the FTA portal, leading to missed deadlines and automatic fines, even if your invoice data is otherwise perfect.

This makes comprehensive testing against UAE requirements absolutely essential. Simply assuming your current ERP can handle compliance is a dangerous gamble. A thorough, methodical approach is your only safeguard:

- Conduct a Gap Analysis: This is the critical first step. You must answer specific questions: Does your system support all mandatory XML fields? Can it handle the specific digital signature and cryptographic requirements mandated by the FTA?

- Technical Implementation: Here, the software is configured or customized to bridge the gaps identified in your analysis. This phase ensures your system can not only generate fully compliant invoices but also connect reliably to the FTA portal.

- Secure File Transfer: Establishing an encrypted, reliable connection for transmitting sensitive invoice data is the final, non-negotiable layer for ensuring security and compliance.

The ultimate solution lies in achieving seamless, certified integration. This is where expertise matters.

Our in-house specialists provide end-to-end integration for ERP, POS, and Accounting systems, ensuring full compliance across all major platforms, including:

- ERP: SAP, Oracle, MS Dynamics, Infor, Epicor, Sage

- Accounting Software: QuickBooks, Xero, Zoho, Cegid

- POS & E-commerce: Square, Shopify, Lightspeed

Is your SAP, Oracle, or NetSuite environment prepared for PINT AE compliance? Our experts will analyze your setup and provide a personalized roadmap.

Forgetting to Train Your Team

Technology is useless if people don’t know how to use it.

Implementing a new e-invoicing system without comprehensive training leads to errors, delays, and non-compliance. Success requires coordination across your entire organization.

Begin by bringing your Finance, Tax, IT, and Operational teams together from the outset. This ensures everyone understands their role in the process and prevents critical gaps in compliance.

Different teams require targeted training:

- Finance Teams must master issuing compliant invoices, processing credit notes accurately, and reconciling payments with reported data.

- Tax Teams need to understand the FTA’s validation rules, implement proper digital archiving, and maintain audit readiness.

- IT Teams should be equipped to handle ERP field mapping, XML schema updates, and seamless integration with your Accredited Service Provider (ASP).

- Procurement & Sales play a vital role in maintaining accurate master data, including validating TRNs and buyer details.

Without role-specific training, teams are likely to make costly mistakes, applying incorrect VAT rates, omitting mandatory fields, or missing reporting deadlines. This can also lead to internal resistance, slowing down company-wide adoption.

Keep in mind that this change extends beyond your organization. Your vendors and customers will receive your new e-invoices, and any confusion over formatting or processing could strain important business relationships.

Overlooking Data Security

E-invoices contain the most sensitive financial data from bank details and transaction histories to Tax Registration Numbers (TRNs). Simply having a digital system is not enough. You must ensure it is fortified. Common, yet critical, oversights include:

Inadequate Data Encryption: Data must be encrypted both at rest (when stored on servers) and in transit (when being sent to the FTA gateway or your clients). Strong, industry-standard encryption protocols are non-negotiable to prevent unauthorized access.

Poor Access Controls: Failing to set strict user permissions and role-based access is like leaving the vault door open. Not every employee needs access to all data. Principles of least privilege should be enforced to ensure staff can only see and edit the information essential to their role.

Neglecting Security Audits: Cyber threats evolve constantly. Without regular security assessments, vulnerability scans, and penetration testing, hidden weaknesses can go undetected until it's too late.

The FTA explicitly mandates secure digital archiving and clear, tamper-proof audit trails for this reason.

A single data breach could lead to massive fines from regulators, loss of trust from your clients, and serious, long-term damage to your brand's reputation that is far more costly to repair than any fine.

Thinking This is a One-Time Project & Not Staying Updated

The UAE's e-invoicing framework is still evolving. The rules released today will be refined tomorrow. New government announcements will introduce additional requirements or modify existing ones. Your team will require patches and updates to stay compatible.

Treating this as a one-off project leaves you in danger. You need a proactive plan for the future that answers critical questions:

- Who is officially responsible for monitoring the FTA portal and official channels for announcements and updates?

- What is the process for testing and deploying mandatory software updates from your provider?

- How will you handle a system outage to ensure it doesn’t cause missed reporting deadlines?

- When will you schedule annual or bi-annual training refreshers for your finance, tax, and IT teams?

Without continuous monitoring and improvement, your systems and processes slowly drift out of alignment with the latest regulations until you are non-compliant without even realizing it, often discovered only when a penalty notice arrives.

This is where partnering with an accredited service provider like Complyance becomes critical. We handle the complex, ever-changing technical and regulatory burdens, so you can focus on your business with the confidence that your e-invoicing is always audit-ready.

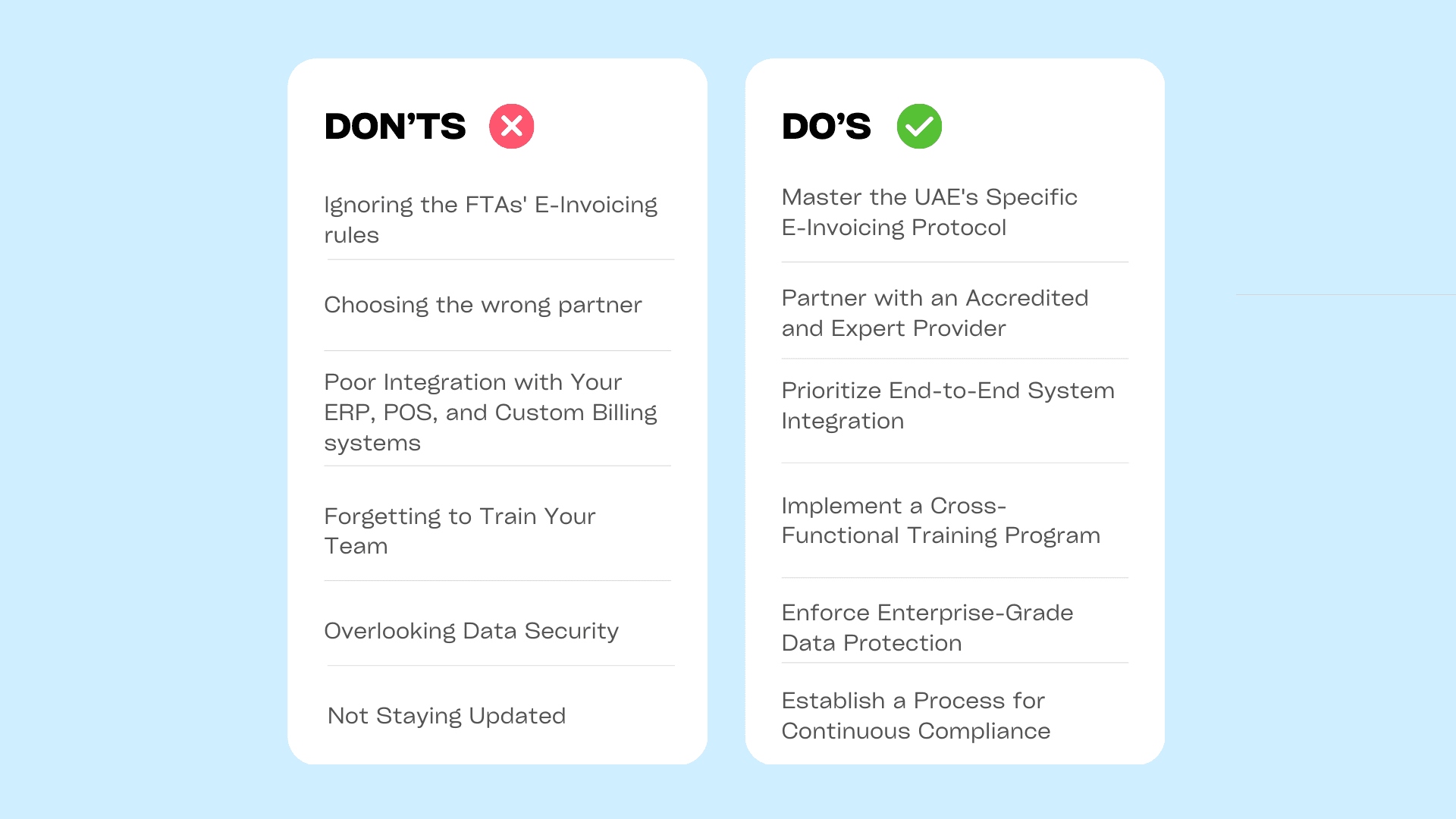

How Can Your Business Avoid These E-Invoicing Pitfalls?

Every one of these mistakes can be avoided with the right preparation, taking proactive steps, and focusing on the right areas. You can avoid the common pitfalls and ensure full compliance.

Master the UAE's Specific Compliance Protocol

The Mistake: Assuming all e-invoicing is the same and using a generic, off-the-shelf solution. The UAE’s FTA has a unique, non-negotiable set of rules for data fields, formatting, and sequencing.

How to Avoid It: A Detailed Protocol

- Leverage the Official Data Dictionary: Consider the FTA's data dictionary your ultimate rulebook. It defines every single field (e.g., InvoiceIssueDate, PayableAmount), its format (e.g., date format YYYY-MM-DD), its length, and whether it's mandatory or conditional.

- Conduct a Field-Level Gap Analysis: Audit your current invoice templates against the data dictionary. Create a spreadsheet listing every UAE-mandatory field and check if your current system can populate it correctly. Pay special attention to:

- TRN Placement: It must be in the exact designated section.

- VAT Calculation & Display: The breakdown of standard vs. zero-rated vs. exempt VAT must be clearly displayed as per FTA guidelines.

- Sequential Numbering: Invoice numbers must be sequential and unique without any gaps.

- Mandate the Correct Format for Reporting: Understand that the human-readable PDF you send to a customer is different from the machine-readable file (likely XML) you must report to the FTA. Your system must be capable of generating and transmitting the approved technical format.

Download our simplified Data Dictionary Guide that translates these technical requirements into plain language for your team.

6 essential steps to a 100% Seamless UAE E-Invoicing Implementation

Choose the Right Implementation Partner

The Mistake: Underestimating the complexity of the transition and selecting a technology provider based on price or promises alone. An inexperienced or non-accredited partner is a single point of failure that can lead to immediate compliance risks and long-term operational difficulties.

How to Avoid It: By choosing the right partner

The right partner is your greatest asset for a smooth transition:

- Peppol Certification & Compliance – Ensure the ASP is Peppol-certified and fully aligned with OpenPeppol and UAE-PINT standards.

- Security & Data Protection – Verify robust security certifications (e.g., ISO/IEC 27001), adherence to UAE data laws, strong encryption, and multifactor authentication.

- Support for All Invoice Types – The platform should handle tax invoices, credit notes, reverse charge flows, and other formats required by UAE regulations.

- ERP & System Integration – Choose a solution that connects seamlessly with your ERP or accounting system via APIs or secure file transfers, and integrates with partner systems on the Peppol network.

- Advanced Capabilities – Look for guided onboarding, automated validation before submission, proactive error detection, real-time compliance monitoring, and detailed analytics.

- Post-Go-Live Support – Confirm ongoing assistance, including tax expert consultation, platform updates to match evolving regulations, and responsive issue resolution.

- Multi-Country Readiness – Opt for a platform that supports global rollouts through a single integration, simplifying expansion beyond the UAE.

- Proven Track Record – Check operational history, financial stability, and absence of legal or compliance issues.

Partner with an FTA-accredited service provider like Complyance. The right partner handles the complex, ever-changing technical and regulatory burdens, allowing you to focus on your business with the confidence that your e-invoicing is always audit-ready.

Prioritize End-to-End System Integration

The Mistake: Treating the e-invoicing solution as a standalone tool, leading to an operational breakdown where invoices fail to transmit, causing automatic fines.

How to Avoid It: The Integration Blueprint

Seamless integration with your existing ERP, POS, and accounting systems is the foundation. Follow this blueprint:

- Make sure your ERP can generate invoices with all mandatory fields, including TRN, VAT details, and invoice references, correctly filled.

- Ensure you have the required documents for cases like credit notes, exemptions, or reverse charges.

- Check that your invoice references and numbering are in the correct order.

- Verify that customer and supplier records are complete and accurate.

- Conduct a gap analysis to ensure your ERP system matches the UAE’s e-invoicing requirements, including fields, data formats, and workflows, in alignment with government standards for smooth integration.

- Prepare your IT/Dev team to handle the API integration setup and ensure ongoing maintenance is in place.

- If you're not using the API approach, prepare to upload your data in the correct Excel format.

Our Expertise: Our in-house specialists provide certified, end-to-end integration for all major platforms, including:

- ERP: SAP, Oracle, MS Dynamics, Infor, Epicor, Sage

- Accounting Software: QuickBooks, Xero, Zoho, Cegid

- POS & E-commerce: Square, Shopify, Lightspeed

Implement a Cross-Functional Training Program

The Mistake: Rolling out a complex new system without targeted training, leading to human errors, internal resistance, and strained vendor relationships.

How to Avoid It: A Structured Training Framework

Technology is only as good as the people using it. Your training program must be ongoing and role-specific.

- Bring Finance, Tax, IT, and operational teams together so everyone understands their role in e-invoicing.

- Train Finance teams to issue compliant invoices, handle credit notes, and match invoices to payments.

- Teach Tax teams to master validation rules, archiving, and audit readiness.

- Guide IT teams on ERP field mapping, XML schema updates, and ASP integrations.

- Help Procurement and Sales maintain accurate master data like TRNs and buyer details.

- Use role-based training, microlearning, and internal champions to keep skills fresh and reduce confusion.

Enforce Enterprise-Grade Data Protection

The Mistake: Underestimating the sensitivity of e-invoice data and failing to implement robust security measures, risking massive fines and irreparable brand damage.

How to Avoid It: E-invoices contain financial data, TRNs, and bank details. Protecting this is mandated by the FTA and UAE Data Law.

To build genuine trust and ensure compliance, your business must verify that its chosen solution and practices adhere to the highest standards:

Look for Robust Certifications: Prefer providers and systems certified under international standards like ISO/IEC 27001, which specifies requirements for establishing, implementing, and maintaining an information security management system.

Ensure Adherence to UAE Data Laws: Your security framework must comply with UAE data protection regulations, including the UAE Data Law and any sector-specific requirements, which govern how personal and financial data must be handled and stored.

Implement Multi-Factor Authentication (MFA): A strong password is no longer sufficient. MFA adds a critical layer of security by requiring a second form of verification, drastically reducing the risk of unauthorized access from compromised credentials.

Establish a Process for Continuous Compliance

The Mistake: Treating e-invoicing as a one-time project. The UAE's framework is evolving. Without continuous monitoring, your system will drift into non-compliance.

How to Avoid It: Build a Continuous Compliance Framework

- Assign Regulatory Monitoring: Designate a person or team to officially monitor the FTA portal, official circulars, and news for updates and announcements.

- Create an Update Management Process: Establish a clear protocol for testing and deploying mandatory software updates from your provider or ASP to ensure ongoing compatibility.

- Develop a Business Continuity Plan: Plan for system outages. How will you generate and store invoices if your primary system is down to avoid missing reporting deadlines?

- Schedule Annual Refresher Training: Plan bi-annual or annual training sessions to refresh existing staff and onboard new hires on compliance protocols.

Conclusion

The shift to e-invoicing is a strategic upgrade to your financial operations. Success is about building a foundation on

- Master the UAE's Specific Compliance Protocol

- Prioritize End-to-End System Integration

- Implement a Cross-Functional Training Program

- Enforce Enterprise-Grade Data Protection

- Establish a Process for Continuous Compliance

- Partner with an Accredited and Expert Provider

The businesses that will thrive are the ones that start now, prepare thoroughly, and choose the right partners.

Related posts

Frequently Asked Questions

E-invoicing is the mandatory digital creation and exchange of invoices in a structured format that can be automatically validated by computers. Instead of sending PDF or paper invoices, VAT-registered businesses must submit digital invoices through approved Accredited Service Providers (ASPs) that validate and share them with buyers and the Federal Tax Authority.

The official format is PINT AE, a structured XML format based on Peppol BIS 3.0, customized to meet the UAE’s specific tax requirements.

Yes, Complyance offers expert guidance on the UAE e-invoicing public consultation process. Our team helps businesses understand regulatory updates, implementation requirements, and compliance strategies aligned with the latest government guidelines.

Yes. The UAE Ministry of Finance has announced that all VAT-registered businesses must adopt e-invoicing by July 2026. This applies across sectors and requires invoices to be generated in the PINT-AE XML format and transmitted via Accredited Service Providers (ASPs).

Yes. You need an Accredited Service Provider like Complyance to validate and submit invoices to the FTA.

Yes, Complyance is an ASP provider and is in the process of being accredited by the FTA in the UAE.

Subscribe to our Newsletter

Get the latest compliance updates, e-invoicing news, and expert tips delivered to your inbox.

ABOUT COMPLYANCE

Empowering businesses to automate e-invoicing and stay compliant in 100+ countries. Our platform simplifies regulatory complexity for enterprises and fast-growing companies.