How to Verify a ZATCA e-Invoice by Scanning Its QR Code?

Discover how QR codes are revolutionizing the verification process for tax invoices under the Zatca and E-invoicing systems.

Table of Contents

How to Verify a ZATCA e-Invoice by Scanning Its QR Code?

Introduction

In the digital age, many traditional processes are getting a modern twist, and tax invoicing in Saudi Arabia is no exception. The country's regulatory body, the Zakat, Tax, and Customs Authority (ZATCA), is leading the charge on innovative ways to simplify tax compliance and increase transparency. One such approach is incorporating Quick Response (QR) codes into the electronic invoicing process.

What is a QR Code?

QR codes are two-dimensional barcodes that store information which can be quickly and easily read by a smartphone or QR scanner. Originally developed for tracking automotive parts, QR codes have been adopted across various industries for tasks as varied as event ticketing, interactive marketing, and now, tax invoicing.

QR Codes and E-Invoicing

The use of technologies like QR Code in tax matters is gaining traction worldwide. These cryptographically secure, scannable codes can contain vital information about an invoice, including supplier details, invoice numbers, date, and even line-item specifics.

The introduction of QR codes in e-invoices is advantageous for both businesses and the government. For businesses, QR codes simplify the record-keeping process, improve efficiency, and reduce errors. On the government's side, QR codes make it easier to track transactions, reduce tax evasion, and improve the accuracy of tax collection.

Role of QR Codes in Saudi Arabia's Tax Invoicing

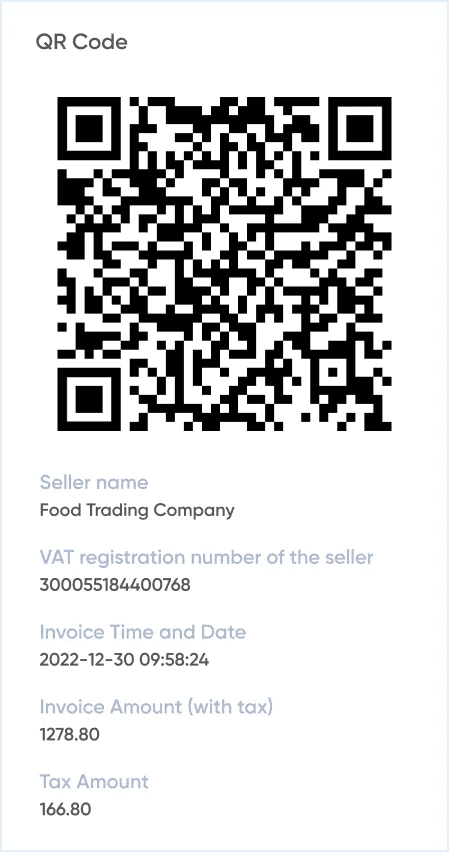

A QR code is used in two distinct ways:

- Data Encoding: An entire invoice's worth of data is encoded within the QR code. This includes essential details like supplier and customer information, description of goods or services, quantity, unit price, VAT amount, total amount, and more.

- Invoice Verification: The QR code serves as a digital signature, confirming the authenticity of the invoice. When scanned using a Zatca’s Fatoora App you can verify the invoice Data against records held by the ZATCA and which ultimately helps you identify if the invoice is valid or not.

Exploring Global Trends

As the world becomes more connected and digital, we are observing a consistent global trend toward the integration of QR codes in e-invoicing systems. In many regions, governments are encouraging or even mandating the use of QR codes to increase transparency, enhance tracking, and simplify the audit process.

This section can provide examples of countries successfully implementing QR code systems, providing a broader perspective on their potential application in Saudi Arabia.

QR Codes – A Tool for Transparency and Compliance

QR codes make it much easier for authorities to track transactions, match payments with their corresponding invoices, and detect fraudulent activities. The digitization and automation of these processes also reduce the workload on tax authorities, making the entire system more efficient and effective.

Ease of Implementation and Use

Here, we could focus on the practicality of QR codes. They are easy to generate, and most smartphones can read them without needing any special equipment. This ease of implementation and use means that businesses of all sizes can easily incorporate QR codes into their existing systems with minimal disruption or cost.

Security Aspects of QR Codes in E-Invoicing

QR codes can be encrypted to protect the information they contain, making them a secure choice for sensitive financial data. However, businesses must be aware of potential risks and ensure they have robust security measures in place to prevent data breaches.

The Future of QR Codes and E-Invoicing

In a world where digital transactions are becoming the norm, it is only logical to expect further integration of technologies like QR codes into everyday business operations. The use of QR codes in e-invoicing could revolutionize the way businesses handle their tax affairs, simplifying the process for everyone involved.

The Required QR Codes and E-Invoicing

Conclusion

The future of tax invoicing in Saudi Arabia, and indeed, around the world, is exciting. The potential inclusion of QR codes in this process is an example of how technology can be leveraged to improve efficiency, transparency, and compliance. As businesses and regulators alike adapt to the digital age, we can look forward to further innovations that will transform the way we handle our financial affairs. For now, we can only watch, wait, and speculate about the possibilities the future may hold.

Related posts

Subscribe to our Newsletter

Get the latest compliance updates, e-invoicing news, and expert tips delivered to your inbox.

ABOUT COMPLYANCE

Empowering businesses to automate e-invoicing and stay compliant in 100+ countries. Our platform simplifies regulatory complexity for enterprises and fast-growing companies.

Go Live in a Week with Developer-Friendly Global E-Invoicing Platform

Complyance makes it easy for your IT/dev team to integrate once and automate E-Invoicing across 100+ countries. Built for fast deployment, field-level validation, and indirect tax accuracy—no delays, no rework.