ZATCA E-Invoicing Updates 2025: A Detailed Guide for SMEs

ZATCA e-invoicing updates for SMEs in 2025: Learn deadlines, compliance strategies, and how Complyance offers seamless solutions for your business.

Table of Contents

ZATCA E-Invoicing Updates 2025: A Detailed Guide for SMEs

The Zakat, Tax, and Customs Authority (ZATCA) has introduced a structured roadmap to ensure full e-invoicing compliance for businesses across Saudi Arabia. SMEs, generating annual revenues between SAR 2 million and SAR 15 million, are now the center of this initiative, with critical deadlines rolling out throughout 2025.

For SMEs in sectors like retail, manufacturing, services, healthcare, and more, understanding ZATCA’s requirements and integrating a seamless e-invoicing system is vital.

At Complyance, we simplify this transition. With 4 years of expertise in e-invoicing solutions, our systems are tailored to help SMEs integrate effortlessly with ZATCA’s FATOORA platform.

Understanding ZATCA E-Invoicing and Why It Matters

E-invoicing, mandated by ZATCA, aims to:

- Enhance VAT compliance and tax transparency.

- Digitize and modernize business invoicing processes.

- Reduce manual errors and fraud by ensuring real-time validation.

For SMEs, this means a shift from traditional invoicing systems to ZATCA-approved digital invoicing solutions that comply with stringent technical standards.

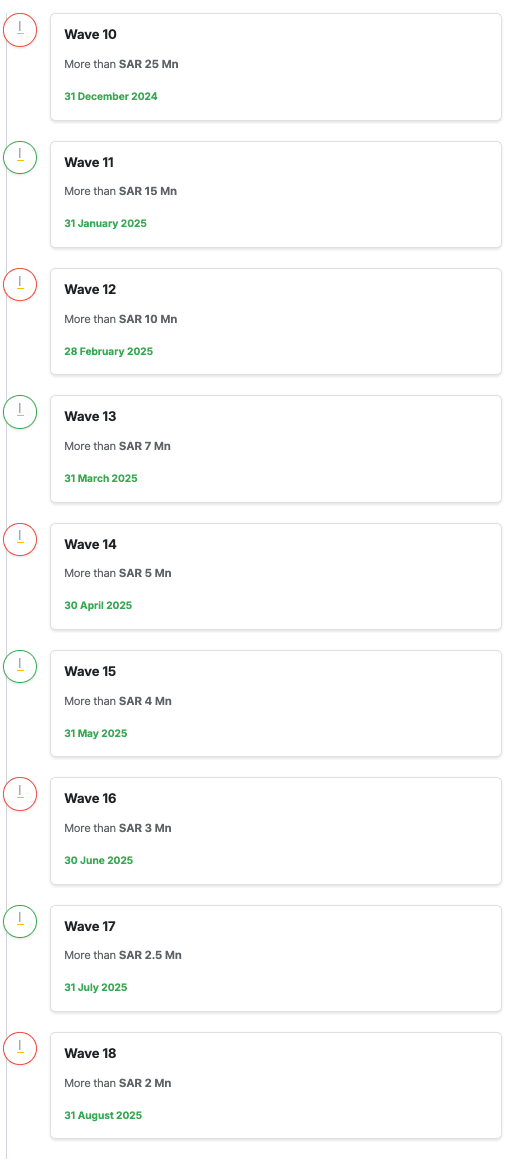

Key Deadlines for SMEs: ZATCA Compliance Timeline

ZATCA is rolling out e-invoicing compliance in phases based on revenue thresholds. SMEs fall under the following deadlines for 2025:

What This Means for SMEs:

SMEs must ensure their invoicing systems are ZATCA-compliant before their designated deadlines to avoid penalties or operational disruptions.

Challenges SMEs Face with ZATCA E-Invoicing

- Understanding Technical Requirements

- E-invoices must include QR codes, cryptographic stamps, and an XML/UBL format.

- Integration with Existing Systems

- Businesses must update or replace outdated systems to integrate seamlessly with ZATCA’s FATOORA platform.

- Compliance Costs

- SMEs may struggle with the upfront costs of adopting new invoicing software.

- Ensuring Data Security

- E-invoicing requires secure systems to protect sensitive financial data.

- Lack of Technical Expertise

- Limited in-house IT resources may delay compliance for SMEs.

How Complyance Simplifies ZATCA E-Invoicing for SMEs

At Complyance, we specialize in delivering reliable, user-friendly, and cost-effective e-invoicing solutions for SMEs across industries.

1. Seamless Integration with Existing Systems

Our solution is compatible with all major ERP, POS, and accounting systems, ensuring minimal disruption to your operations.

2. Full Compliance with ZATCA Standards

- Generates both Tax Invoices (B2B) and Simplified Tax Invoices (B2C).

- Includes mandatory features like QR codes, cryptographic stamps, and XML formats.

- Real-time integration with ZATCA’s FATOORA platform for validation and clearance.

3. Proven Expertise and Customer Support

- 4 years of experience in e-invoicing implementation.

- End-to-end support for onboarding, testing, and compliance audits.

4. Secure and Reliable Systems

We prioritize data security with robust, encrypted systems, ensuring your invoices remain secure and ZATCA-compliant.

Steps to Get ZATCA-Compliant with Complyance

- Request a Demo: See our solution in action and understand its benefits for your business.

- Integration: Our experts ensure smooth system integration with no disruptions.

- Training and Support: Comprehensive training for your team to manage e-invoicing effortlessly.

- Stay Compliant: Generate, validate, and submit invoices in real time.

Conclusion

ZATCA’s e-invoicing compliance is transforming the financial landscape for SMEs in Saudi Arabia. For businesses to meet their 2025 deadlines, adopting a reliable and ZATCA-compliant solution is crucial.

At Complyance, we bring proven expertise, seamless integration, and ongoing support to ensure SMEs across all industries achieve compliance effortlessly.

Get started today with Complyance and experience hassle-free ZATCA e-invoicing solutions tailored for your business needs.

Related posts

Frequently Asked Questions

ZATCA e-invoicing is a mandatory system in Saudi Arabia requiring businesses to issue digital invoices in a structured XML/UBL format to enhance VAT compliance.

SMEs with annual revenues exceeding SAR 2 million must comply with ZATCA e-invoicing deadlines between January and August 2025.

Businesses must generate e-invoices with QR codes, cryptographic stamps, and XML formats. Integration with ZATCA's FATOORA platform is mandatory for real-time validation.

Non-compliance can result in penalties, operational disruptions, and audits. Businesses are urged to prepare early to avoid such risks.

Complyance provides seamless integration, full compliance with ZATCA standards, and end-to-end support for SMEs, ensuring a hassle-free transition.

Subscribe to our Newsletter

Get the latest compliance updates, e-invoicing news, and expert tips delivered to your inbox.

ABOUT COMPLYANCE

Empowering businesses to automate e-invoicing and stay compliant in 100+ countries. Our platform simplifies regulatory complexity for enterprises and fast-growing companies.

Go Live in a Week with Developer-Friendly Global E-Invoicing Platform

Complyance makes it easy for your IT/dev team to integrate once and automate E-Invoicing across 100+ countries. Built for fast deployment, field-level validation, and indirect tax accuracy—no delays, no rework.