E-Invoicing in UAE: A Complete Guide for Businesses

Understand UAE e-invoicing in simple terms, what it is, why it matters, and how your business can meet the July 2026 compliance deadline.

Table of Contents

E-Invoicing in UAE: A Complete Guide for Businesses

The United Arab Emirates (UAE) is advancing towards full digitalization of its tax system through e-invoicing, with mandatory compliance expected by July 2026.

This e-invoicing mandate aims to Modernize the tax system, Enhance operational efficiency, Boost transparency in financial dealings and VAT loss.

This UAE’s e-invoicing rule is a requirement for all VAT-registered companies.

It covers B2B and B2G transactions and follows clear government rules for format and reporting.

In this comprehensive guide, we will explore all key aspects of e-invoicing, including updates, benefits, and steps to prepare your business.

Key Updates on UAE e-invoicing

| Q3 202 | Development of certification procedures for Accredited Service Providers (ASP) |

|---|---|

| Q2 2025 | Publication of e-invoice legislation |

| December 2025 | Pilot phase begins |

| July 2026 | Phase 1 go-live for B2B and B2G e-invoicing |

- Q3 2024 - Q2 2025: The Ministry of Finance will first set up certification rules for Accredited Service Providers (ASPs) and then publish the official e-invoicing legislation, outlining technical standards, compliance duties, and penalties.

- December 2025: A pilot program will begin with selected businesses and ASPs to test invoice creation, validation, and transmission in a live environment, helping refine the system before launch.

- July 2026: All VAT-registered businesses in the UAE must issue and receive e-invoices for B2B and B2G transactions through accredited ASPs, using structured formats like XML/UBL 2.1.

The intention to introduce e-invoicing in 2026 reaffirms the UAE’s ambition to innovate rapidly and digitalize its economy. Both businesses and government entities will benefit from a new approach to invoicing that emphasizes simplification, standardization, and automation. This will facilitate near real-time invoice exchange and seamless tax reporting to the UAE Federal Tax Authority (FTA).

What is an e-invoice?

E-invoicing, also known as electronic invoicing, is the process of creating and exchanging invoices in a structured digital format that computers can read and validate automatically. Instead of sending a PDF or printed invoice, businesses submit these digital invoices through approved platforms like Complyance, where they are validated and shared with both the buyer and the government for compliance and reporting.

Key Objectives of e-invoicing:

- Digitalization: Allow invoices to be handled completely digitally, from start to finish. This means less manual work in creating, sending, and reporting invoices. It enables automation, creates clarity, and helps connect with other digital tools.

- Efficiency: Make key business and compliance tasks simpler. This is done by cutting down the time it takes to process an invoice, reducing paper forms, and avoiding mistakes from manual entry. It also supports environmental goals by using less paper and needing less physical storage space.

- Support for the Digital Economy: Help a digital environment grow by supporting the creation of safe, standard, and compatible invoicing systems. This helps build a skilled digital workforce and modern business connections.

- Minimize Tax Leakage: Find and stop both deliberate and accidental mistakes in tax reporting. E-invoicing improves tracking and checks data in real-time, which helps lower lost revenue from VAT and other indirect taxes.

- Economic Contribution: Support better economic planning and make businesses more competitive. This is done by creating reliable, well-organized invoice data. This information helps companies improve their operations and helps the government make smarter economic decisions.

- Enhanced Security: Keep invoices genuine and safe through encryption, digital signatures, and secure ways to share data. This helps fight against fraud, changes to documents, and unwanted access.

- Data-Driven Policy Making: Give tax authorities and the government access to immediate and accurate data for every transaction. This helps them make better policies, support specific industries, and improve how public money is managed.

The UAE e-invoicing Framework

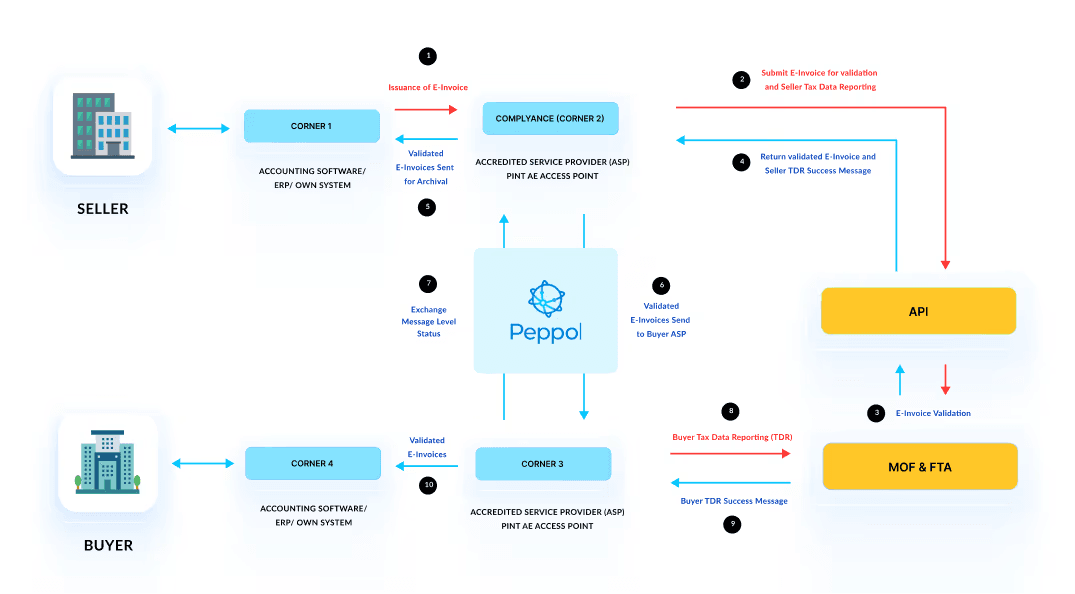

The UAE’s e-invoicing system adopts the Peppol "5-corner" model, which ensures the secure and standardized exchange of invoices between businesses and the FTA.

Want to Know More? Read Our Complete Guide to the UAE Five-Corner Model

1. Supplier Generates the Invoice

The supplier creates an invoice in their ERP or billing system in a standard format (not yet an e-invoice).

2. Supplier’s Accredited Service Provider (ASP) Validates and Converts

The supplier’s ASP checks the invoice against UAE requirements and converts it into the PINT-AE XML format.

At this point, the invoice becomes a valid e-invoice.

3. Service Metadata Publisher (SMP) Routes the Invoice

The SMP manages and publishes metadata about participants (supplier, buyer, ASPs) and their access points. This ensures the e-invoice is routed to the correct destination and that all participants have the necessary information to process it.

4. Transmission to Buyer’s ASP

Using the Peppol network and SMP data, the e-invoice is securely delivered to the buyer’s ASP.

5. Buyer Receives and Processes the Invoice

The buyer’s ASP delivers the e-invoice to the buyer’s ERP/accounting system, where it can be accepted, reconciled, or processed further.

6. Reporting to the Federal Tax Authority (FTA)

Both ASPs generate the Tax Data Document (TDD) and send it to the FTA via the Central Data Platform (CDP).

7. FTA Validates and Accepts the TDD

The FTA validates the TDD in real time. Once accepted, the invoice is officially recorded as compliant and audit-ready.

Benefits of e-invoicing for UAE Businesses

Adopting e-invoicing provides significant advantages for business:

- Cost Savings: E-invoicing cuts down expenses by removing the need for printing, mailing, and storing paper invoices.

- Boost Team Productivity: Automation reduces manual work so Finance and Operations teams can spend more time on important tasks.

- Prevent Lost Documents: Invoices are stored safely online, easy to find, and protected from being lost.

- More Efficiency, Fewer Errors: Automated systems speed up invoicing and lower mistakes, giving bigger savings than just cutting paper costs.

- Always Audit-Ready: Digital records are well-organized and verified automatically, making audits quicker and less stressful.

- Secure Transactions: Encryption and digital signatures keep financial data safe and reduce the risk of fraud or changes.

- Support Global Growth: With the UAE’s PINT-AE format and the Peppol network, businesses can expand across borders while staying compliant.

Challenges in Implementing e-invoicing

While e-invoicing brings many advantages, businesses may face certain challenges during implementation:

Incomplete or Inaccurate Master Data

When customer or supplier information is missing or outdated, invoices can easily get rejected. Common issues include missing TRNs, incorrect VAT details, or inconsistent records. Ensuring master data is complete and regularly updated is essential for smooth submissions.

Integration Hurdles

E-invoicing depends on seamless communication between ERP systems, ASPs, and Peppol endpoints. If APIs or file transfers are not properly mapped and tested, data may not flow correctly, leading to failed submissions and operational delays.

Validation Errors

Errors in tax rates, document types, or invoice references can cause invoices to be blocked before reaching the Federal Tax Authority. Without strong validation checks, even small mistakes can halt the invoicing process and slow down compliance.

Change Management Gaps

E-invoicing is a cross-team effort, but many businesses lack clear ownership between finance, tax, and IT teams. Without defined responsibilities, compliance tasks may slip through the cracks, leading to delays and confusion.

Regulatory Updates

The UAE’s e-invoicing framework will evolve over time with new schema versions, mandatory fields, or reporting rules. Companies that don’t keep their systems and processes updated risk sudden non-compliance when changes take effect.

Limited Testing

Skipping sandbox or pilot testing is one of the biggest mistakes businesses can make. Without thorough testing, issues often appear during go-live, causing disruptions, rejected invoices, or even compliance penalties.

Steps to Prepare Your Business for e-invoicing Compliance

1. Check Your Billing System

Start by making sure your ERP or billing software can generate invoices with all mandatory fields such as TRN, VAT details, and references. Keep customer and supplier records complete and accurate to avoid rejections. Conduct a gap analysis to see if your fields, formats, and workflows align with UAE e-invoicing standards. Also, prepare your IT team for API connections or Excel uploads

Complyance even provides ready-made Excel templates to simplify this step.

2. Verify Tax Information

Before onboarding with an Accredited Service Provider (ASP), ensure that your TRNs are correct and VAT details are prepared accurately. You’ll also need a Peppol ID to exchange documents electronically, along with a valid digital signature for the ASP onboarding process.

3. Choose a Future-Proof Platform

Select a platform that supports all invoice types and integrates seamlessly via API or secure file transfers. The right solution should automate validation, connect directly to Peppol, and provide dashboards for real-time monitoring. Post-go-live support, regular regulatory updates, and detailed reporting and analytics are also critical to long-term success.

4. Align and Train Teams

Compliance is not just an IT job. Finance, Tax, IT, Procurement, and Sales teams must all understand their roles. Use targeted training sessions and appoint internal champions to maintain readiness. Establish clear communication channels between departments and provide regular updates as regulations evolve.

5. Test Early

Don’t wait until the last minute, use pilot programs to run real-world scenarios in advance. Validate B2B, B2G, exempt supplies, and rejection handling against UAE Peppol standards. Test integration points and data flows thoroughly, and make sure error handling and exception management are in place before go-live.

6. Maintain SOPs

Document your standard operating procedures (SOPs), including error fixes and contact points, so your teams know exactly what to do. Keep versions updated as rules change and establish regular review cycles. Maintaining audit trails and compliance documentation will keep your business always ready for inspections.

How Complyance Can Help Your Business with e-Invoicing in UAE

Complyance helps businesses in the UAE adopt e-invoicing without complexity. Our platform connects directly with the Federal Tax Authority (FTA), follows all Peppol and UAE standards, and is designed to be simple for both developers and finance teams to use.

1. Faster Go-Live with Less Effort

Instead of spending months on setup, businesses can become e-invoicing ready in just days. With pre-built integrations and a sandbox environment for testing, you save time and reduce implementation stress.

2. Always Stay Compliant

Regulations keep changing, but you won’t have to track them manually. Complyance automatically updates your invoicing process to match the latest Peppol and UAE requirements, so you stay compliant without extra effort.

3. Secure and Reliable Operations

Every invoice is protected with strong encryption and processed through ISO-certified systems. With local UAE data storage, your financial data stays safe from fraud and unauthorized access.

4. No More Costly Errors or Rejections

Smart validation checks happen before submission, ensuring invoices meet all FTA rules. This reduces the risk of rejections, delays, penalties, and disputes.

5. Business Continuity Without Downtime

If government systems go offline, Complyance automatically queues invoices and resends them when services resume. Your business keeps moving without interruptions.

6. Confidence Through Expert Support

From setup to go-live, our tax and technical specialists provide hands-on guidance. This gives your finance and IT teams confidence that compliance is under control from day one.

7. Long-Term Efficiency and Cost Savings

By automating validations, reporting, and regulatory updates, your teams spend less time on manual tasks and more time focusing on business growth and strategy.

Trusted by Leading Global Businesses

Complyance has established itself as a reliable provider, trusted by leading global businesses across various industries. Our comprehensive e-invoicing solutions have been implemented for businesses in diverse sectors, helping them stay compliant and efficient.

Experience in KSA and Malaysia

We bring a wealth of expertise, having successfully implemented KSA ZATCA e-invoicing and Malaysia LHDN Peppol e-invoicing solutions. Our experience in these regions allows us to deliver top-tier solutions tailored to your business’s unique needs.

Conclusion

The UAE’s adoption of e-invoicing marks a significant step toward digital transformation, enhancing efficiency, transparency, and competitiveness.

By 2026, all businesses must comply with e-invoicing regulations. Start preparing now to ensure a smooth transition by updating your systems, partnering with accredited service providers, and training your teams.

Early adoption will help businesses capitalize on the benefits of faster processing, reduced costs, and better compliance.

Related posts

Frequently Asked Questions

Yes. According to the UAE Federal Tax Authority (FTA), the e-invoicing mandate will be mandatory for all businesses registered for VAT in the UAE. The rollout will happen in phases, with the first phase for larger businesses expected in mid-2025, and full implementation for all VAT-registered businesses by mid-2026.

The UAE has mandated the use of a structured digital format based on the PINT AE (Peppol International Invoice for the Arab Emirates) standard. This is a UAE-specific adaptation of the global Peppol BIS Billing 3.0 standard. The required technical format is XML (Extensible Markup Language), which is machine-readable and allows for seamless data exchange through the Peppol network.

The new e-invoice rule announced by the UAE FTA requires all VAT-registered businesses to generate tax invoices and credit/debit notes in a structured digital format (XML based on PINT AE), transmit these e-invoices directly to the FTA’s system in near real-time through an accredited Application Service Provider (ASP), and comply with the technical and data standards defined in the UAE e-invoicing data dictionary.

This is a common rule in other countries but has not been officially stated by the UAE FTA for its e-invoicing system. The UAE model is based on real-time or near-real-time reporting at the time of issuance. Always refer to the latest FTA guidelines for official deadlines.

The mandate applies to all businesses and individuals registered for VAT in the UAE, including large corporations, small and medium-sized enterprises (SMEs), and free zone companies that fall under VAT registration. While there may be exceptions for certain specific sectors, these have not yet been widely announced.

This is an important distinction: the UAE has not introduced an e-way bill system alongside its e-invoicing mandate. An e-invoice is a structured digital document for the supply of goods or services that must be reported to the tax authority for compliance and data collection. In contrast, an e-way bill is an electronic document used to track and verify the physical movement of goods above a certain value across state or country borders, and it is usually linked to an e-invoice. Since the UAE operates as a single tax jurisdiction, the introduction of an e-way bill system is currently unnecessary.

Failure to comply with the e-invoicing rules will be considered a violation of the tax law. The FTA has the authority to impose administrative penalties. While the exact penalties for the new system are being finalized, they are expected to be significant and could include fines for each non-compliant invoice, similar to existing VAT penalty structures.

The UAE e-invoicing data dictionary, published by the FTA, serves as the official rulebook for compliance. It specifies the exact structure and format of the XML file, outlines all mandatory, conditional, and optional fields such as seller TRN, invoice date, line item details, and tax amounts, and sets the technical rules and validation checks that must be applied to each field. It also provides the framework for handling different invoice scenarios. Both businesses and software developers must follow this data dictionary to ensure their systems generate fully compliant e-invoices.

Subscribe to our Newsletter

Get the latest compliance updates, e-invoicing news, and expert tips delivered to your inbox.

ABOUT COMPLYANCE

Empowering businesses to automate e-invoicing and stay compliant in 100+ countries. Our platform simplifies regulatory complexity for enterprises and fast-growing companies.

Go Live in a Week with Developer-Friendly Global E-Invoicing Platform

Complyance makes it easy for your IT/dev team to integrate once and automate E-Invoicing across 100+ countries. Built for fast deployment, field-level validation, and indirect tax accuracy—no delays, no rework.