Is Your Indirect Tax Team Ready for the UAE's E-Invoicing?

Prepare your indirect tax team for UAE e-invoicing. Ensure smooth compliance, reduce errors, and unlock operational benefits with Complyance's 7-step preparation plan.

Table of Contents

Could the UAE’s e-invoicing mandate help your tax team overcome tough challenges? For teams struggling with complex regulations, messy data, and audit pressures, the answer is a definitive yes.

Now is the time to act, transforming this mandate from a compliance task into an opportunity to streamline operations and improve efficiency.

Changes in VAT rules, inconsistent data from various sources, and increased audit pressures are stretching tax and finance teams to their limits.

Many still rely on manual processes, which can lead to errors, penalties, and compliance gaps.

The UAE’s e-invoicing mandate offers a powerful solution. It replaces paper and PDFs with a structured digital format shared instantly with the Federal Tax Authority (FTA). This ensures fewer errors, faster processing, and full compliance.

Forward-thinking teams see this as a chance to improve operations. Let us show you how to prepare your team for success.

The Challenges Holding Your Tax Team Back

Indirect tax teams face constant pressure. VAT regulations keep changing, data from ERP and billing systems is often inconsistent, and audits are tougher than ever. Additionally, manual processes slow you down and increase the risk of costly errors. Here’s what you’re dealing with:

- Complex Regulations: VAT requirements are constantly evolving and vary across jurisdictions.

- Inconsistent Data: ERP and business systems produce non-standardized, error-prone data.

- Growing Workloads: More filings and tighter deadlines strain your team.

- Penalty Risks: Manual mistakes heighten the chances of fines and compliance gaps.

The UAE’s e-invoicing mandate isn’t just another rule to follow; it’s an opportunity to address these challenges directly and improve your team’s operations.

Why E-Invoicing Is Your Team’s Solution

The UAE’s e-invoicing system aims to simplify compliance. Switching from paper and PDFs to a digital format shared instantly with the FTA reduces errors and speeds up processes. Here’s how it supports your tax team:

- Fewer Errors: Systems check invoices for accuracy at the source, so you avoid fixing mistakes later.

- Consistent Data: Standardized XML formats (like PINT AE) provide clean, reliable data without depending on other departments.

- Easier Audits: Digital trails verified by the FTA make audit preparation quick and stress-free.

- More Efficiency: Automation cuts down manual work, allowing your team to focus on more important tasks.

This shift is not just about compliance; it’s about giving your team control, accuracy, and the time to focus on what matters.

Your 7-Step Roadmap to UAE E-Invoicing Success

Ready to make e-invoicing work for you? Follow this simple 7-step plan to prepare your indirect tax team for the UAE’s mandate:

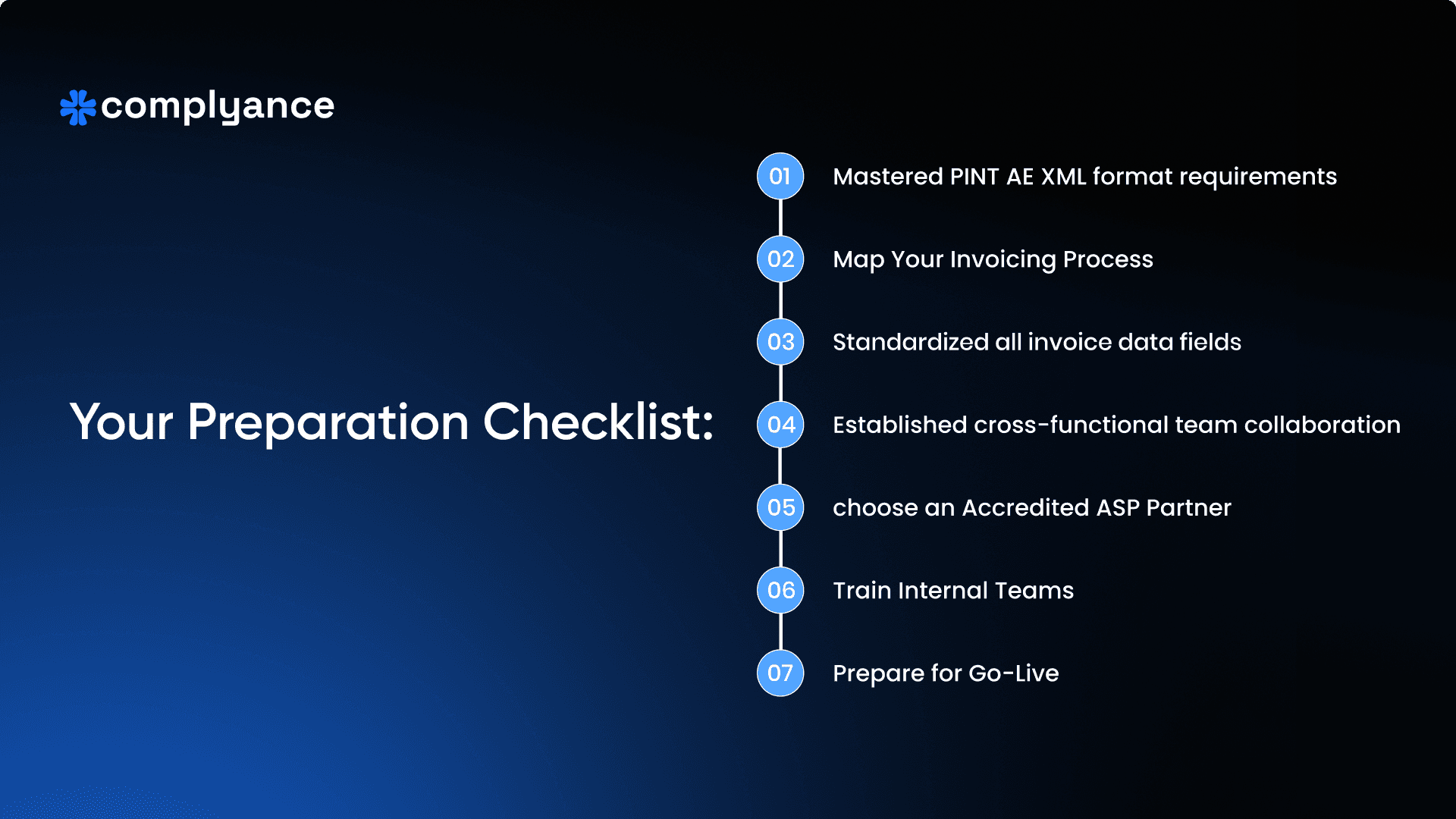

1. Mastered PINT AE XML format requirements:

Familiarize yourself with the UAE’s e-invoicing rules, including the PINT AE XML format. Understand the data dictionary, mandatory fields, and conditional fields to know what is required for compliance. Read our blog for a detailed guide on the UAE e-invoicing data dictionary.

2. Map Your Invoicing Process:

Document how invoices are generated across your ERP, billing platforms, and POS systems. Identify specific data fields (e.g., invoice number, TRN, VAT rate, payment methods) where data originates, who manages them, and how they flow. This helps identify gaps that need fixing to comply with UAE requirements.

3. Standardize All Invoice Data Fields:

Invalid TRNs, inconsistent VAT codes, or missing payment or bank details can lead to invoice rejection by the FTA. Standardize these fields and align them with the PINT AE schema to avoid surprises during implementation.

4. Established cross-functional team collaboration:

Work closely with IT for ERP integration and with finance for accurate reporting. Joint ownership reduces bottlenecks and speeds up problem-solving, ensuring your team is aligned for compliance.

5. Choose an Accredited ASP Partner:

Select an Accredited Service Provider (ASP) that supports your ERP, handles high transaction volumes, integrates smoothly, and scales as mandates change. Complyance meets these needs and more, offering easy integration and regional scalability. Schedule a free consultation to see how we can assist.

6. Train internal Teams:

Conduct workshops for finance, tax, and operations teams to understand the new process, handle errors, and monitor compliance. Well-trained teams ensure technology works efficiently.

7. Prepare for Go-Live:

Set up dashboards to track invoice flows, configure error alerts for quick fixes, and maintain audit-ready logs for compliance. This shifts your team from reactive to proactive, adding value from day one.

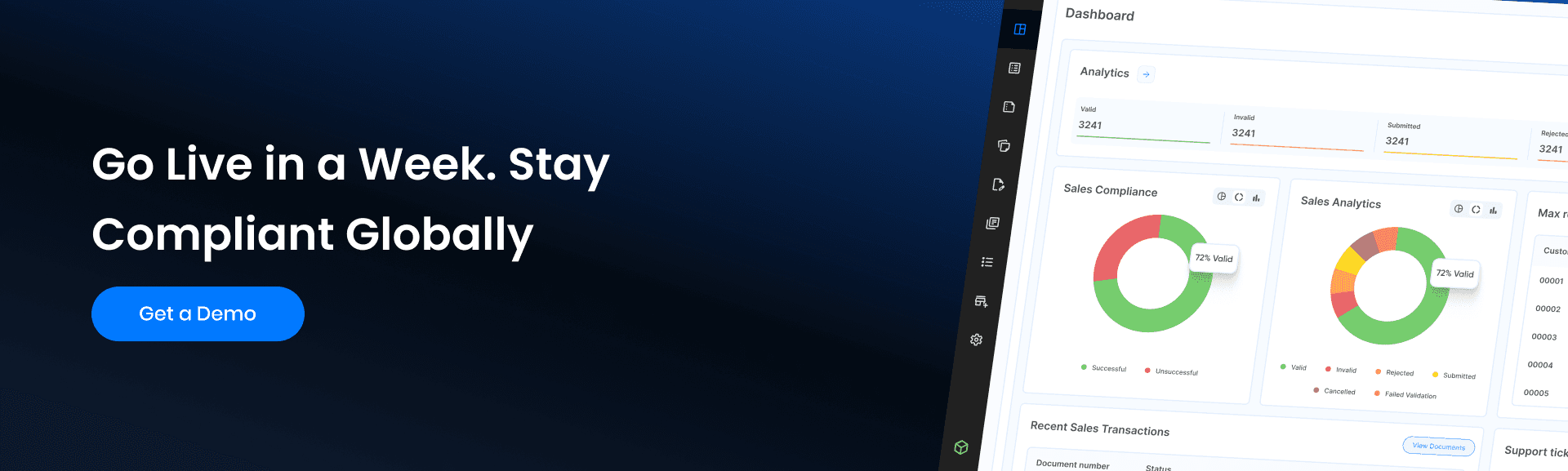

Why Complyance Is Your Ideal Partner

Choosing the right ASP is critical for e-invoicing success. Selecting the Right E-Invoicing Solution Provider ensures you partner with a solution that integrates with your ERP, manages large transaction volumes, and grows with your business across the region. Our platform, Complyance is an Accredited Service Provider, offering user-friendly dashboards and monitoring tools, empowering your tax team to manage compliance independently.

With Complyance, you're not just getting a tool; you’re gaining a partner dedicated to your long-term success. Schedule a free consultation to discover how we can simplify your e-invoicing journey.

Take Control of UAE E-Invoicing Today

The UAE’s e-invoicing mandate is a chance to redefine how your tax team works. By addressing compliance challenges with a clear plan and the right partner, you can reduce errors, streamline processes, and stay audit ready. Don’t let compliance overwhelm you. Follow these seven steps, partner with Complyance, and turn e-invoicing into your team’s greatest strength. Schedule a call to start transforming your operations today.

Related posts

Frequently Asked Questions

All businesses registered for VAT in the UAE are required to prepare e-invoices for B2B and B2G transactions. This obligation extends even to micro businesses with an annual turnover below AED 3 million, meaning size does not exempt a company from compliance. Non-resident businesses that supply taxable goods or services in the UAE are also included under the mandate. The only current exception applies to B2C transactions, which remain out of scope for now but may be brought under the e-invoicing framework in the future.

Key requirements include using the Peppol-based 5-corner model, where invoices must be exchanged through Accredited Service Providers (ASPs) accredited by the Federal Tax Authority (FTA). Invoices must be generated in specific digital formats like XML or JSON using structured standards such as PINT AE (Peppol International Invoice for UAE). Real-time reporting to the FTA is mandatory, and invoices must include mandatory fields like supplier/buyer Tax Identification Numbers (TRNs), VAT breakdowns, and invoice types as per the UAE Data Dictionary.

In the UAE, there is no specific turnover threshold exclusively for e-invoicing. Instead, the e-invoicing mandate applies to all VAT-registered businesses. Businesses with an annual taxable turnover exceeding AED 375,000 are required to register for VAT and must comply with e-invoicing rules. Additionally, businesses with a turnover between AED 187,500 and AED 375,000 can opt for voluntary VAT registration, making them subject to e-invoicing as well.

Complyance is a global e-invoicing platform that works in 100+ countries through one simple API. It takes care of tax rules, formats, and real-time checks, no changes needed in your ERP, Accounting software, or POS. Our GETS framework turns your invoice into the right format for each country automatically. From Peppol to PINT, Complyance helps you stay compliant without the manual work.

Failure to issue an e-invoice within the required timeframe, such as 30 days, may result in penalties under UAE VAT laws, including fines starting at AED 5,000 for the first violation, potential audits by the Federal Tax Authority (FTA), and disruptions in B2B/B2G transactions. Specific guidelines will be clarified closer to the July 2026 e-invoicing mandate. Businesses should ensure timely compliance and monitor FTA updates.

Subscribe to our Newsletter

Get the latest compliance updates, e-invoicing news, and expert tips delivered to your inbox.

ABOUT COMPLYANCE

Empowering businesses to automate e-invoicing and stay compliant in 100+ countries. Our platform simplifies regulatory complexity for enterprises and fast-growing companies.