UAE E-Invoicing Readiness Assessment: A 6-Step Preparation Plan

Is your business ready for the UAE e-invoicing mandate? Discover what VAT-registered companies must do, the roles of finance, IT, product, and tax teams, and a 6-step plan to ensure seamless compliance.

Table of Contents

If your business is preparing for the UAE's 2026 e-invoicing mandate, you might think the solution is to task your IT team with a last-minute software update or have finance manually validate every invoice before sending.

But that approach is fragmented, risky, and unnecessarily complex.

A mandate of this scale requires a coordinated, strategic effort across your entire organization.

That's where a clear framework comes in. This guide provides a cross-functional readiness assessment and a definitive action plan, designed for the teams who will own this change.

What Exactly is the UAE E-Invoicing Mandate?

In simple terms, the Federal Tax Authority (FTA) is moving from a world of static invoice documents like PDFs to a dynamic, integrated system of structured data.

This means every VAT-registered business will need to generate invoices in a specific, machine-readable digital format like XML and report them directly to the FTA's platform in real-time.

Why does this matter?

This UAE e-invoice mandate is designed to bring more transparency, reduce errors, and automate tax compliance. For your business, it means the processes for creating, sending, and storing invoices are about to change forever.

Relying on manual checks or disconnected systems will no longer be an option.

Who Needs to Pay Attention?

Every company that is registered for VAT in the UAE will need to follow the new e-invoicing rules. That means if your business makes:

- Tax invoices

- Debit notes

- Credit notes

…you will need to use the new e-invoicing system like Complyance

This change is a big deal, and it’s not just for one team. Everyone has to work together!

Think of it like a sports team:

- The tax experts know the rules

- The IT team sets up the tech

- The finance team checks the numbers

- The product team updates customer tools

When all teams play their part, your company wins!

Does your company create invoices?

Then it’s time to get everyone talking and working together!

Every team has a special role to play, just like players in a game. When everyone works together, your company can score a win!

Here’s how each group helps:

Finance Teams: The Guardians of the Numbers.

E-invoicing doesn’t work unless the numbers are right, and that’s your specialty.

Here’s what you’ll need to focus on:

Are your systems applying tax correctly? What about discounts, rounding, or credit notes?

The system will be automated, but someone needs to set the logic behind it. That’s on you.

- Make sure customer and supplier details (like TRNs) are complete and accurate.

- Set up checks and validations so mistakes don’t slip through before invoices are sent to the FTA.

- Once invoices are live in the new system, matching what you sent vs. what was accepted will be a daily task.

IT Teams: The Architects of the System.

Your job is to connect all the dots and make sure the tech behind invoicing is bulletproof

Can your current ERP or billing tool generate the correct e-invoice file (usually XML/UBL 2.1)?

- You’ll need to build or configure API connections to the FTA’s portal.

- Think digital signatures, encrypted data, and secure channels for transmission.

What happens if the FTA rejects an invoice?

- Your system should catch and report issues fast.

- You’ll need to plug this into current operations without breaking sales, accounting, or finance workflows.

Product Managers: If Your Product Has Billing Features, This is a Core Update.

If your product or service generates invoices, it’s required.

Here’s what you need to think about:

- This is a regulatory must. You’ll need a clear release plan before the 2026 deadline.

- Work closely with finance and tax to understand the rules. Then partner with IT to scope the build.

What about refunds, discounts, or credit notes? Your product must handle them correctly.

If your customers generate invoices through your platform, you’ll need to explain what’s changing and when.

The rules may evolve. Your product should be able to adapt without major rework.

Tax Professionals: The Navigators Guiding the Ship.

You understand the regulations. Your guidance is what keeps everyone pointed in the right direction.

Here’s where you come in:

- Stay up to date with official announcements, deadlines, and technical specs.

- Turn complex rules into clear steps that finance, IT, and product teams can follow.

What needs to be checked before an invoice is sent? Who owns what part of the process?

You’ll answer a lot of questions and help teams adjust their workflows to follow the rules.

Help the company avoid penalties by catching non-compliance issues before they happen.

What Happens When?

The Big Rollout (By 2026): By 2026, all VAT-registered businesses in the UAE must be fully compliant with the e-invoicing mandate.

2026 might feel far away, but for a project this big, it’s just around the corner.

Getting your systems ready is a big task.

Mastering Your E-Invoicing Preparation: A Strategic Guide

Getting ready for the new e-invoicing rules is like following a recipe. With the right steps, you can make sure your business is prepared without any stress.

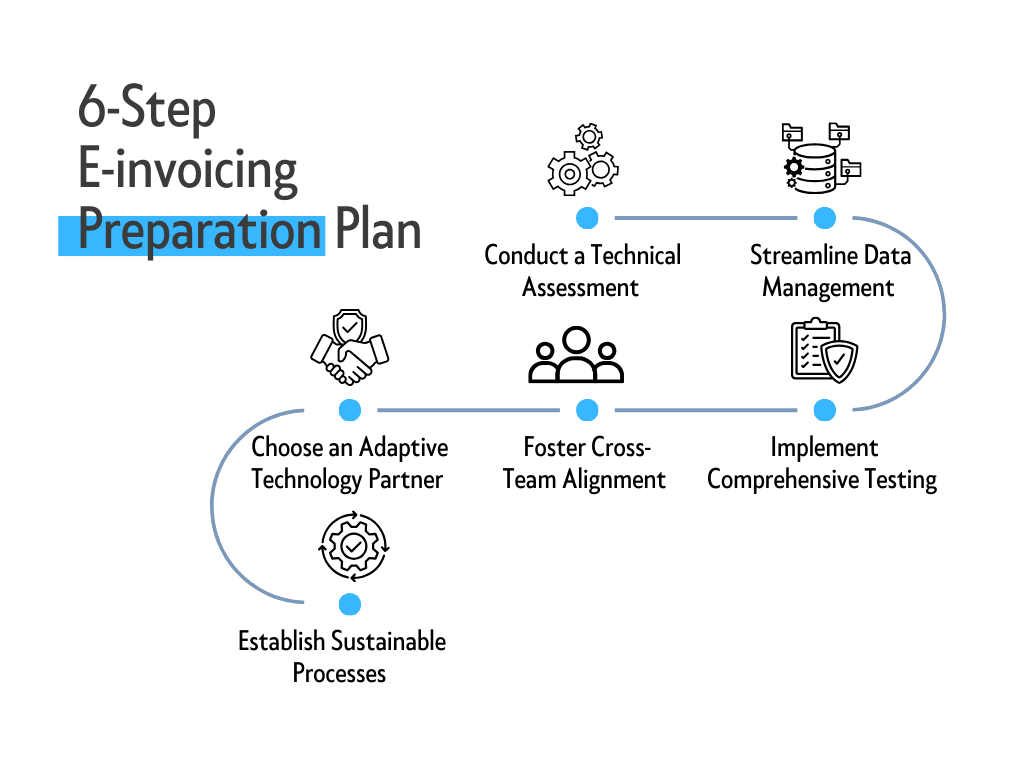

This Complyance Preparation Plan breaks everything down into six easy steps. Let's get started!

Before that, start by asking yourself and your team these six critical questions to honestly gauge your readiness:

- Can our current systems talk to the FTA?

- Is our customer data audit-ready?

- Do we have a tax technology partner or just a tax tool?

- Are our teams speaking the same language?

- Have we tested for real-world scenarios?

- Do we have a clear support plan for go-live?

If these questions reveal any uncertainty, your clear path forward is outlined in our six-step Preparation Plan, powered by Complyance's integrated ASP solution.

To understand how the UAE E-Invoicing 5 Corner Model works, check out

our blog on How the UAE Five-Corner E-Invoicing Model Works: A Step-by-Step Guide.

Here’s our 6-Step UAE E-invoicing Preparation Plan with Complayance:

- Conduct a Technical Assessment: Begin by evaluating your current billing software's capability to generate FTA-compliant invoices. Complyance's ASP solution integrates seamlessly with your existing systems, ensuring automatic generation of compliant XML files without requiring system replacements or major overhauls.

- Streamline Data Management: Data accuracy is fundamental to successful implementation. Our platform includes automated validation tools that verify TRN authenticity and data completeness in real-time, significantly reducing errors before submission and ensuring smooth data transmission to the FTA.

- Choose an Adaptive Technology Partner: As your dedicated ASP, Complyance provides more than just software; we offer a partnership built on continuous regulatory adaptation. Our cloud-based solution automatically updates to meet evolving FTA requirements, ensuring ongoing compliance without additional development costs or efforts.

- Foster Cross-Team Alignment: Successful preparation requires organizational alignment. Complyance supports this through customized training programs and clear documentation tailored for finance, IT, and tax teams. We ensure all stakeholders understand their roles within the new e-invoicing framework.

- Implement Comprehensive Testing: Utilize Complyance's testing environment to simulate the complete invoice lifecycle, from creation to submission and exception handling. This sandbox environment allows you to identify and resolve issues before going live, ensuring a confident transition to the new system.

- Establish Sustainable Processes: Complyance provides ongoing support and documentation to help formalize your e-invoicing workflows. We help you develop clear procedures for daily operations, error resolution, and compliance maintenance, ensuring long-term success beyond implementation.

Conclusion: Your Readiness UAE E-Invoicing Journey Begins Today

The UAE's e-invoicing mandate presents a pivotal opportunity to modernize your financial operations and enhance your compliance framework. While the 2026 deadline may seem distant, the complexity of implementation demands proactive planning and cross-functional collaboration today.

Don't wait for 2026 to become a challenge. Transform it into your opportunity.

Your journey toward confident, stress-free E-Invoicing starts with a single step.

Schedule your free readiness assessment with Complyance today and position your business at the forefront of e-invoicing excellence.

Related posts

Frequently Asked Questions

All businesses registered for VAT in the UAE are required to prepare e-invoices for B2B and B2G transactions. This obligation extends even to micro businesses with an annual turnover below AED 3 million, meaning size does not exempt a company from compliance. Non-resident businesses that supply taxable goods or services in the UAE are also included under the mandate. The only current exception applies to B2C transactions, which remain out of scope for now but may be brought under the e-invoicing framework in the future.

Step 1: Assess Systems: Ensure your ERP/billing software supports PINT AE XML/JSON generation.

Step 2: Partner with an ASP: Select an FTA-accredited ASP (e.g., ClearTax, SpendConsole) for validation and transmission.

Step 3: Data Validation: Validate TRNs, VAT rates, and mandatory fields in real-time to avoid rejections.

Step 4: Transmit via Peppol: Use your ASP to send invoices through the Peppol network to the buyer’s ASP and FTA.

Step 5: Archive: Store e-invoices securely for 5 years as per FTA requirements

Structured Digital Format: E-invoices must be generated in XML or JSON using the PINT AE standard (a UAE-specific adaptation of Peppol BIS Billing 3.0).

Data Dictionary as the official rulebook that every business in the UAE must follow when creating e-invoices. It's like the instruction manual for the entire country that ensures every invoice speaks the same digital language.

This master guide tells businesses exactly what information to include, how to format it, and when it'srequired.

- All e-invoices follow the same clear structure

- Invoices can be exchanged between different companies seamlessly

- The tax authority's systems can process and verify them automatically

Key requirements include using the Peppol-based 5-corner model, where invoices must be exchanged through Accredited Service Providers (ASPs) accredited by the Federal Tax Authority (FTA). Invoices must be generated in specific digital formats like XML or JSON using structured standards such as PINT AE (Peppol International Invoice for UAE). Real-time reporting to the FTA is mandatory, and invoices must include mandatory fields like supplier/buyer Tax Identification Numbers (TRNs), VAT breakdowns, and invoice types as per the UAE Data Dictionary.

Complyance is a global e-invoicing platform that works in 100+ countries through one simple API. It takes care of tax rules, formats, and real-time checks, no changes needed in your ERP, Accounting software, or POS. Our GETS framework turns your invoice into the right format for each country automatically. From Peppol to PINT, Complyance helps you stay compliant without the manual work.

- Create the Invoice in Your ERP: You generate the invoice in your existing ERP or billing system; no changes needed.

- Send to Complyance API: Complyance (your Accredited Service Provider) validates the data and converts it into the UAE-compliant PINT-AE XML format.

- We handle Peppol Routing: Using official Peppol directories, Complyance ensures the invoice is routed securely to the buyer’s ASP.

- Buyer Receives the Invoice Automatically: The buyer’s ASP receives and delivers the e-invoice into their ERP or accounting system.

- We Report to the FTA for You: Complyance generates and submits the Tax Data Document (TDD) to the Federal Tax Authority via the UAE Central Data Platform.

- FTA Validates the Invoice in Real Time: The FTA reviews and accepts the invoice instantly. Your transaction is now fully compliant and audit-ready.

Subscribe to our Newsletter

Get the latest compliance updates, e-invoicing news, and expert tips delivered to your inbox.

ABOUT COMPLYANCE

Empowering businesses to automate e-invoicing and stay compliant in 100+ countries. Our platform simplifies regulatory complexity for enterprises and fast-growing companies.