What Is EN 16931 Format and Peppol BIS 3.0 Standard in Belgium e-invoicing?

Confused about EN 16931 and Peppol BIS 3.0? This simple guide explains the invoice formats used in Belgium, how they work together, and how e-invoices are structured.

Table of Contents

What are EN 16931 and Peppol BIS 3.0?

EN 16931 is the European standard that defines what information an electronic invoice must contain and what each field means.It ensures that all compliant e-invoices across Europe use the same data definitions, tax logic, and calculation rules.

Peppol BIS 3.0 is the technical invoice format used to structure and exchange invoices based on EN 16931 through the Peppol network.It defines how invoice data is organised, validated, and transmitted between systems in a secure and standardised way.

Belgium is changing the way invoices are sent and received.Paper invoices are being phased out. PDF invoices are no longer enough.The goal is simple. Belgium wants invoices that are faster, safer, and easier to control.To achieve this, the country is moving toward structured electronic invoicing, also called e-invoicing.

Why Belgium Is Moving Toward E-Invoicing

For many years, tax authorities received invoice information late.Errors were found only after audits.Fraud was detected too late to prevent losses.At the same time, businesses faced their own problems:

- Manual data entry

- Invoice rejections

- Payment delays

- High administrative effort

Belgium, like many other European countries, wants to fix this. Belgium, in line with guidance and initiatives from the FPS Finance.By using structured e-invoices, the government can receive clean and accurate invoice data in near real time. Businesses can reduce errors and speed up payments.This is why Belgium already requires e-invoicing for public sector transactions and will extend this to B2B transactions from January 1, 2026.But for this to work at scale, invoices must follow common rules. This is where EN 16931 and Peppol BIS 3.0 come in.

How EN 16931 and Peppol BIS 3.0 Fit Into Belgium’s Model

Belgium chose to follow a European e-invoicing model so it can align with other EU countries and support smooth cross-border e-invoicing.

This model works through two connected layers:

- A European standard that defines what invoice data must be included and what each field means

- A standardised invoice format that applies those rules and enables invoices to be exchanged digitally

In Belgium’s e-invoicing setup:

- EN 16931 defines the required invoice data and its meaning

- Peppol BIS 3.0 structures that data and allows invoices to be sent through the Peppol network

Together, these form the foundation of Belgium’s e-invoicing system and support consistent, automated invoice processing.

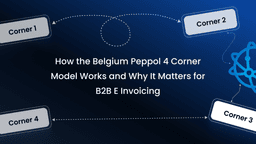

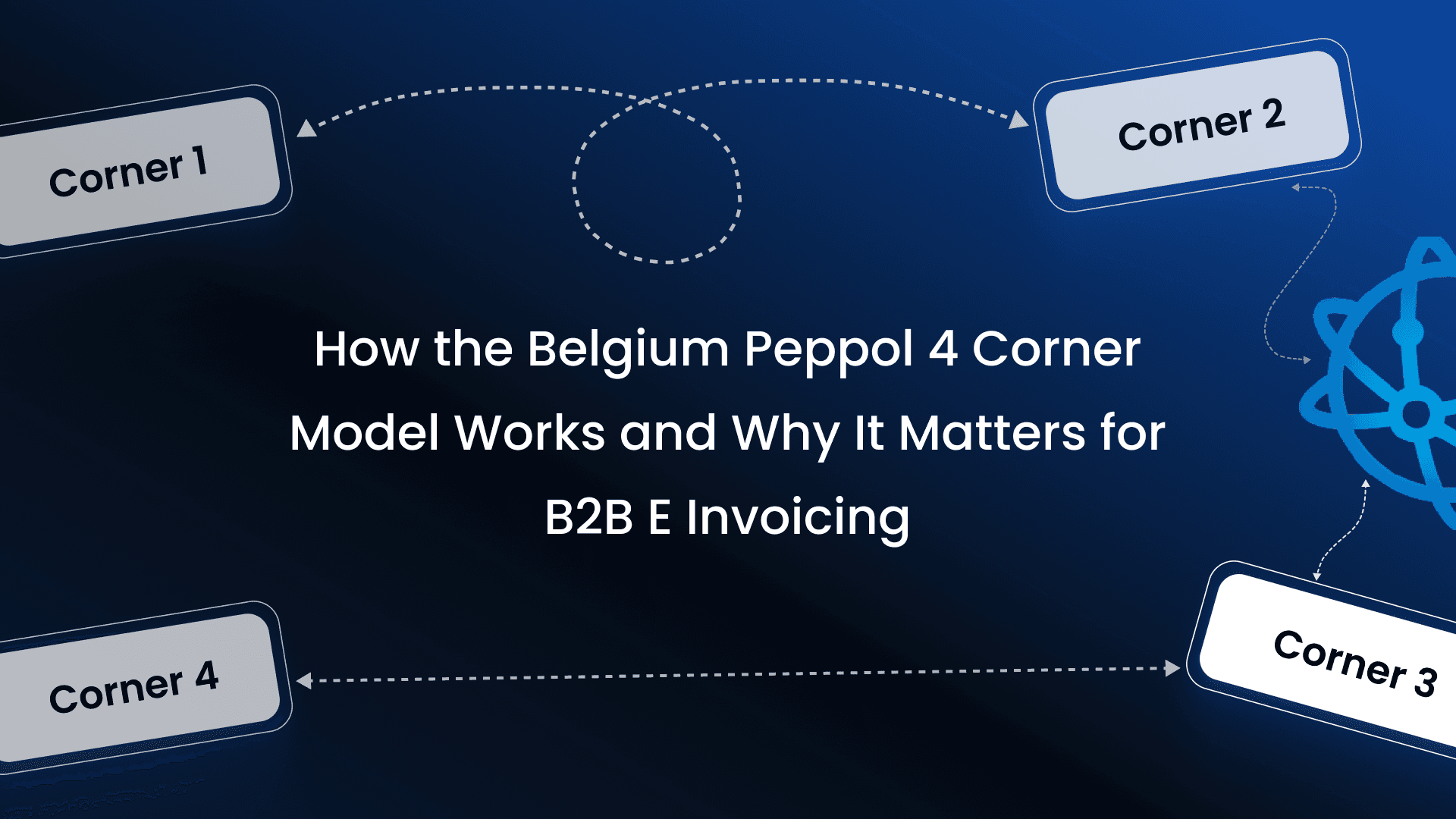

What is Peppol BIS 3.0 in Belgium e-invoicing?

Peppol is a secure network used to exchange electronic business documents. To ensure that different systems can understand each other, documents exchanged on this network must follow strict technical and business rules. These rules are called Peppol BIS, which stands for Business Interoperability Specifications.

Peppol BIS 3.0, also known as Peppol BIS Billing 3.0, is the most widely used e-invoicing specification in Europe. It is not just a transport format. It is a business specification that sits on top of EN 16931 and UBL 2.1 and bridges the gap between invoice rules and technical implementation.

In Belgium, Peppol BIS 3.0 is the core standard businesses use to structure and exchange e‑invoices in a way that aligns with current and upcoming B2G and B2B e‑invoicing requirements.

Peppol BIS 3.0 translates EN 16931 business requirements into a concrete XML structure. It defines which XML elements must be used, how those elements are nested, and what values and code lists are allowed. This ensures that invoice data is structured in a way that machines can read and process consistently.

It also defines which invoice fields are mandatory, conditional, or optional for a compliant e-invoice. This prevents incomplete invoices and ensures that different business scenarios are handled in a standardised way.

In addition, Peppol BIS 3.0 adds validation and interoperability rules so that any Peppol-compliant system can receive, validate, and process the invoice correctly without custom mappings or manual intervention.

In simple terms, EN 16931 says that an invoice must contain supplier and buyer details, VAT information, line items, and totals. Peppol BIS 3.0 explains exactly how those details appear in XML, in which elements, and using which formats and codes. This clear separation between meaning and structure is what enables reliable, automated e-invoicing across Belgium and the wider European ecosystem.

How Peppol BIS 3.0 Structures the e-invoice

Peppol BIS 3.0 structures an e-invoice by translating the EN 16931 semantic requirements into a precise, machine-readable XML layout based on UBL 2.1. In simple terms, it answers one critical question:Where does each EN 16931 data element go in the e-invoice, and how must it be represented? Peppol BIS 3.0 defines:

1. The Overall Invoice Hierarchy

The invoice is organised into a clear XML hierarchy, including:

- Invoice header information

- Supplier and buyer details

- Tax information

- Line items

- Totals and payment details

This hierarchy ensures that systems always know where to find each piece of data.

2. Mandatory, Conditional, and Optional Elements

Peppol BIS 3.0 specifies:

- Mandatory fields that must always be present

- Conditional fields that are required only when certain business scenarios apply

- Optional fields that can be included for additional detail

This prevents incomplete e-invoices and ensures consistent validation across systems.

3. Standardised Data Types and Codes

To avoid ambiguity, Peppol BIS 3.0 enforces:

- Standard code lists for currencies, countries, tax categories, and units of measure

- Strict data formats for dates, identifiers, and amounts

This allows different ERP and accounting systems to interpret values in the same way.

4. Line-Level and Total-Level Consistency

Peppol BIS 3.0 defines rules that ensure:

- Line totals match quantities and unit prices

- Tax amounts are calculated correctly

- Invoice totals reconcile with line-level data

Invoices that fail these checks are considered invalid.

5. Alignment With EN 16931 Semantics

Every element in a Peppol BIS 3.0 e-invoice maps directly to an EN 16931 business term.This guarantees that the meaning of the data is preserved when e-invoices move between systems, countries, and organisations.

How Peppol BIS 3.0 Works in Practice

Peppol BIS 3.0 is not just a delivery mechanism. It is a highly prescriptive e-invoice specification that defines exactly how invoice data must be structured, validated, and interpreted so every system on the Peppol network processes e-invoices the same way.

In practice, your ERP or billing system is not “sending a file”. It is filling a very specific invoice blueprint defined by Peppol BIS 3.0, which is built on EN 16931 and implemented using UBL 2.1 XML.

1. BIS 3.0 as an invoice blueprint

Peppol BIS 3.0 sits on top of EN 16931 and UBL 2.1 and adds strict business and technical rules.

- Business layer: Defines the e-invoicing process itself. Who sends the invoice, who receives it, and which document types are supported, such as invoices and credit notes.

- Syntax layer: Uses UBL 2.1 XML to represent invoice data. Every concept, such as seller, buyer, VAT totals, invoice lines, or payment terms, maps to a specific XML element.

- Constraint layer (CIUS): Tightens EN 16931 by defining which fields are mandatory, conditional, or optional. It also restricts code lists, formats, and allowed values so invoices behave consistently across Belgium and other Peppol countries. This combination ensures there is only one correct way to represent a compliant Peppol BIS 3.0 invoice.

2. Mapping ERP data to Peppol BIS 3.0

When an e-invoice is prepared, the ERP or billing system sends invoice data to a Peppol-certified Access Point, which maps that data into the Peppol BIS 3.0 structure.

- Header data: Supplier and buyer identifiers, invoice number, issue date, due date, currency, and VAT identifiers are mapped to defined BIS header elements with strict formats and cardinality.

- Tax and totals: VAT is broken down per tax rate and category. BIS requires explicit taxable amounts, tax amounts, rates, and category codes. All totals must reconcile mathematically according to BIS rules.

- Invoice lines: Each line item includes quantity, unit of measure, price, line amount, tax category, and optional product identifiers. Charges and allowances use dedicated structures rather than ad-hoc lines.

- References: Purchase order numbers, contracts, or delivery references are carried in specific reference elements so buyers can automate matching.

This mapping is where most implementation effort happens. Once done correctly, e-invoices become predictable and machine-readable.

3. BIS 3.0 validation rules

Before an e-invoice can travel on the Peppol network, it must pass BIS 3.0 validation.

- Syntactic validation: The XML must be valid UBL 2.1 with correct structure, namespaces, and data types.

- Semantic validation: BIS rules check required and conditional fields, relationships between fields, and arithmetic consistency across totals and tax breakdowns.

- Code lists and identifiers: Only approved codes for currencies, VAT categories, units of measure, payment means, and identifier schemes are allowed. Invalid codes cause immediate rejection. These rules are versioned and maintained by the Peppol community. Access Points enforce the current BIS release to ensure consistency across all participants.

4. Routing on the Peppol network

Once the BIS 3.0 invoice is valid, it can be routed.

- Participant identifiers: Buyer and seller are identified using structured identifiers such as VAT numbers or Belgian enterprise numbers combined with scheme IDs. These identifiers determine where the e-invoice is delivered.

- Document and process identifiers: Each e-invoice is tagged as a Peppol BIS Billing 3.0 document with a specific process ID. This tells Access Points which validation profile and business rules apply.

- Secure transport: The e-invoice content remains BIS 3.0 XML. It is wrapped in Peppol’s secure transport protocol for delivery between Access Points. At this stage, Peppol handles interoperability and secure exchange. BIS 3.0 ensures the content itself is understood everywhere.

5. Receiving and processing the e-invoice

On the buyer side, the same BIS rules apply.

- The receiving Access Point validates the e-invoice again.

- Compliant e-invoices are forwarded to the buyer’s ERP or accounting system.

- Because structure and meaning are standardised, e-invoices can be approved without manual re-entry.

This enables straight-through processing and reduces disputes caused by inconsistent e-invoice data.

Why Peppol BIS 3.0 Is Important for Belgium

Belgium uses Peppol as its main exchange network for e-invoicing. Peppol BIS 3.0 ensures that:

- Invoices are validated before delivery

- Errors are detected early

- Government systems can process invoices automatically

- Cross-border e-invoices follow the same structure

Because Peppol BIS 3.0 is widely adopted across Europe, Belgium can align with other EU countries without building a separate system. Now, Let Us Look at EN 16931. While Peppol BIS 3.0 defines structure and exchange, it is built on a deeper foundation.That foundation is EN 16931.

What Is EN 16931?

EN 16931 is the official European standard for electronic invoicing, published by the European Committee for Standardization (CEN) under a mandate from the European Commission.

It defines the semantic data model of an electronic invoice. In simple terms, EN 16931 specifies:

- What information must an electronic invoice contain

- What each data element means

- How invoice data should be interpreted consistently by different systems

EN 16931 does not define how invoices are transmitted. It does not mandate a specific file format or network. Instead, it focuses purely on the meaning and structure of invoice data, so that invoices can be understood, validated, and processed the same way across countries, industries, and software systems. This semantic foundation is what allows technical formats such as Peppol BIS 3.0 to implement EN 16931 in a consistent and interoperable way across Europe.

Why EN 16931 Exists

Before EN 16931, electronic invoicing across Europe was fragmented.

Each EU country, and often each public authority or large buyer, used its own invoice formats and rules. Even basic elements like invoice dates, VAT categories, taxable bases, or how totals were calculated differed from one system to another. As a result, suppliers had to maintain multiple invoice layouts and mappings just to invoice different customers.

This fragmentation created real operational problems:

- Automation was limited because e-invoices could not be processed consistently.

- Cross-border e-invoicing was slow and expensive.

- Many so-called electronic invoices still require manual checks or re-keying.

- Suppliers faced high integration and maintenance costs to stay compliant with different national or buyer-specific rules.

EN 16931 was created to solve these problems by defining a single European core invoice.

The purpose of EN 16931:

EN 16931 provides a common semantic data model for electronic invoices across the EU. Its goal is to ensure that all compliant e-invoices contain the same essential business and tax information, with the same meaning, regardless of country, software, or service provider.In practical terms, EN 16931 ensures that:

- Every compliant e-invoice includes the same core data, such as seller and buyer identifiers, dates, line items, VAT breakdowns, totals, currency, and payment terms.

- All systems interpret invoice data in the same way because definitions, formats, and validation rules are standardized.

- e-invoices can be generated, sent, received, and processed automatically without custom mappings for each buyer or country.

Legal and policy foundation:

EN 16931 is rooted in EU law. Under EU Directive 2014/55/EU, all public sector bodies in the EU are required to accept electronic invoices that comply with EN 16931 for public procurement. This is why EN 16931 is often referred to as the European core invoice for B2G transactions. Once this common foundation was established for public procurement, many EU countries began extending the same standard into domestic B2B e-invoicing mandates. Using EN 16931 for both B2G and B2B reduces implementation costs, avoids parallel standards, and accelerates adoption.

Strategic impact:

By standardising e-invoice semantics at a European level, EN 16931 enables:

- Reuse of the same e-invoice structure across multiple countries and exchange networks, such as Peppol.

- Faster and more reliable automation for accounts payable and receivable processes.

- A consistent, high-quality data set for tax authorities, which supports e-reporting and future VAT control models.

This is why EN 16931 is not just a technical standard. It is a foundational building block for Europe’s wider digital invoicing and digital tax strategy, including national mandates like Belgium’s move toward structured B2B e-invoicing.

What Information Does EN 16931 Require?

EN 16931 defines a European “core invoice”. It is not limited to basic header and line data. Instead, it specifies a full semantic data model with clearly defined business groups, fields, and validation rules that every compliant e-invoice must follow.

An EN 16931-compliant e-invoice standardises and may require the following categories of information.

Parties involved (seller, buyer, and related parties)

- Seller and buyer legal name, address, country, and VAT or tax identifier

- Support for additional parties when required by the business scenario, such as:

- Payee

- Delivery party

- Tax representative

Each party role has a defined meaning and structure, so systems can reliably identify who is invoicing whom.

Invoice identification and dates

- Invoice number with a unique identifier

- Invoice issue date

- Tax point date, where applicable

- Document type (invoice or credit note)

- Invoice currency using standardised currency codes

Dates and identifiers follow strict formats so they are interpreted consistently across systems.

Delivery and reference information

- Delivery date and delivery location, separate from billing address

- Commercial references such as:

- Purchase order number

- Contract reference

- Project reference

- Preceding invoice reference (for corrections or credit notes)

These references allow automated matching and reconciliation in buyer systems.

Line-level details

For each invoice line, EN 16931 defines:

- Item or service description

- Quantity and unit of measure

- Unit price and line net amount

- VAT category and VAT rate at the line level

- Optional product identifiers (such as buyer or seller item IDs)

Line-level allowances or charges, such as discounts or surcharges, are handled using dedicated structures rather than adjusting prices or quantities informally.

Taxes and VAT breakdown

- Clear separation between net amounts, tax amounts, and gross amounts

- VAT categories (standard, reduced, exempt, reverse charge) using standard codes

- VAT breakdown per rate and category, including:

- Taxable amount

- Tax amount

This structure aligns with EU VAT law and supports automated tax validation.

Totals and currency

- Invoice total without tax

- Total VAT amount

- Invoice total including tax

- Additional totals, such as total allowances or total charges, where applicable

- All amounts are explicitly linked to a defined currency

Totals must reconcile mathematically according to EN 16931 calculation rules.

Payment terms and payment instructions

- Payment due date

- Payment terms (for example, net 30 days or early payment discount)

- Structured payment instructions, such as:

- IBAN

- BIC

- Other payment means

This enables automated payment processing and treasury integration.

Allowances, charges, and discounts

- Invoice-level allowances or charges with:

- Reason

- Amount or percentage

- Correct tax treatment

Business rules ensure these amounts are included correctly in taxable bases and totals.

Attachments and supporting documents

- References to supporting documents such as contracts, delivery notes, or timesheets

- Ability to link or attach additional documentation in a structured, traceable way

Business rules and validation

Beyond listing fields, EN 16931 enforces strict rules such as:

- Mandatory, optional, and conditional fields depending on the business scenario

- Arithmetic checks to ensure totals and tax calculations reconcile correctly

- Standardized code lists and formats for currencies, countries, VAT categories, units of measure, and dates

Each data element has a precise definition, format, and validation rule.This removes ambiguity, prevents inconsistent interpretations, and allows e-invoices to be reliably processed by any compliant ERP, Access Point, or tax authority system across Europe.

How EN 16931 and Peppol BIS 3.0 Work Together

EN 16931 and Peppol BIS 3.0 are not competing standards. They are designed to work together in layers. EN 16931 defines what a compliant European electronic invoice must contain. Peppol BIS 3.0 defines how the e-invoice is implemented, validated, and exchanged in real systems. Any invoice that is valid under Peppol BIS Billing 3.0 is, by design, an EN 16931-compliant e-invoice. This is why Peppol BIS 3.0 is suitable for Belgium’s e-invoicing mandate and other EU-aligned e-invoicing systems.

1. What EN 16931 provides

EN 16931 is the European semantic standard for electronic invoicing. It defines:

- The semantic data model of an invoice includes parties, invoice identifiers, dates, line items, VAT breakdowns, totals, and references.

- The meaning of each data element, such as what qualifies as an invoice issue date, tax amount, or taxable base.

- The relationships and calculation logic between elements, especially for VAT and totals.

EN 16931 is technology-neutral. It does not mandate XML, UBL, or any transport network. Instead, it defines business concepts and rules that can later be bound to technical formats. Because of this, EN 16931 acts as the legal and interoperability baseline for e-invoicing across the EU. Any compliant implementation must respect its core semantics.

2. What Peppol BIS 3.0 adds

Peppol BIS Billing 3.0 is a Core Invoice Usage Specification (CIUS) based on EN 16931.It adds the operational detail needed to use EN 16931 in practice:

- Syntax binding to UBL 2.1: Peppol BIS 3.0 selects UBL 2.1 as the XML syntax and maps each EN 16931 data element to a specific UBL element and structure.

- Stricter business rules: BIS defines which fields are mandatory, conditional, or optional, tightens cardinalities, restricts allowed code lists, and specifies conditional logic between fields.

- Peppol-specific identifiers and profiles: Fields such as CustomizationID and ProfileID explicitly declare that the invoice follows the Peppol BIS Billing 3.0 ruleset, allowing Access Points and receivers to apply the correct validation automatically.In short, BIS 3.0 takes EN 16931’s abstract model and turns it into a precise, enforceable, machine-processable invoice specification.

3. How they fit together in a real invoice

In practice, EN 16931 and Peppol BIS 3.0 apply sequentially.

- Step 1. EN 16931 layer: The invoice must contain all required semantic elements. Seller and buyer identifiers, invoice dates, VAT categories, tax totals, line-level tax information, and payment data must all follow EN 16931 definitions.

- Step 2. Peppol BIS 3.0 layer: Peppol BIS 3.0 specifies exactly how those semantic elements are represented in UBL XML.It defines which XML tags to use, how values are formatted, which codes are allowed, and which combinations are valid.The result is a Peppol BIS 3.0 UBL invoice that is:

- Semantically correct under EN 16931

- Technically interoperable across the Peppol network

- Ready for automated processing in Belgium and other EU countries

4. Compliance and validation coupling

Compliance is enforced in two tightly linked layers.

- EN 16931 compliance: Ensures the invoice respects the European semantic model. Mandatory data must be present, tax logic must be correct, and totals must reconcile logically.

- Peppol BIS 3.0 validation: Adds additional checks through XML schema and business rules. These include code list validation, conditional field checks, arithmetic validation, and Peppol routing requirements. Because BIS 3.0 explicitly identifies itself as an EN 16931 CIUS, receiving systems and Access Points know exactly which semantic and technical ruleset to apply.

Why This Matters for Businesses in Belgium

Belgium’s move to structured B2B e-invoicing is a mandatory operational change that directly affects how invoices are created, validated, exchanged, and paid. Understanding EN 16931 and Peppol BIS 3.0 early helps businesses control costs, reduce risk, and improve financial performance instead of reacting under deadline pressure.

Mandatory, not optional

From the start of the mandate, structured e-invoicing has become a legal requirement for domestic B2B transactions in Belgium. Invoices that do not comply with EN 16931 semantics and Peppol BIS 3.0 structure will not be considered valid VAT invoices. This makes e-invoicing a core compliance obligation, not a best practice or optional digital upgrade.

Direct impact on finance and accounting operations

Structured e-invoices change how finance teams work day to day.

- Manual data entry is reduced or eliminated

- Invoice validation happens automatically before sending

- Rejections due to missing or incorrect data are detected early

- Invoice matching, posting, and approval become faster and more reliable

For accounts payable and receivable teams, this means fewer exceptions, less rework, and more predictable processing.

Cost, speed, and cash-flow benefits

Because structured invoices are machine-readable and validated upfront, they move faster through both seller and buyer systems.

- Fewer invoice disputes and clarifications

- Shorter approval cycles

- Faster payment timelines

- Lower operational and administrative costs

Over time, this improves cash flow and reduces the hidden cost of e-invoicing errors and delays.

Stronger VAT control and audit readiness

EN 16931 standardises how VAT data is captured and structured at the line and invoice levels. This gives businesses:

- Clear, auditable VAT breakdowns

- Consistent tax calculations across systems

- Easier reconciliation between invoices, payments, and VAT returns

When audits occur, structured e-invoices provide cleaner, more traceable data, reducing audit effort and risk.

Strategic and cross-border advantages

Because EN 16931 and Peppol BIS 3.0 are European standards, the same invoice structure can be reused beyond Belgium.

This allows businesses to:

- Scale e-invoicing operations across multiple EU countries

- Reduce the need for country-specific invoice formats

- Prepare more easily for future mandates, e-reporting, and real-time VAT controls

What starts as a Belgian compliance requirement becomes a foundation for wider digital finance and tax transformation.

Conclusion

Belgium’s move to e-invoicing is part of a larger European shift toward digital tax control and automation.EN 16931 provides a common invoice language across Europe. Peppol BIS 3.0 turns that language into a practical, exchange-ready format. Together, they create a system where invoices move faster, errors are reduced, and compliance becomes part of the process rather than an afterthought. For businesses operating in Belgium, understanding this foundation is the first step toward a smooth transition into structured e-invoicing.

Related posts

Frequently Asked Questions

EN 16931 is the official European standard that defines the semantic data model of an electronic invoice. It specifies what information an e‑invoice must contain, what each field means, and how invoice data should be interpreted consistently by different systems. It does not define file formats or networks; instead, it provides the common invoice “language” that Belgium and other EU countries use as the foundation for structured e‑invoicing

Peppol BIS 3.0 (Peppol BIS Billing 3.0) is a business specification that implements EN 16931 using UBL 2.1 XML and adds strict rules for how e‑invoices are structured, validated, and exchanged on the Peppol network. In Belgium, Peppol BIS 3.0 is the core standard businesses use to send and receive structured B2G and B2B e‑invoices through accredited Peppol Access Points

EN 16931 defines what a compliant European electronic invoice must contain, including parties, VAT breakdowns, totals, and references. Peppol BIS 3.0 then binds these requirements to UBL 2.1 XML and adds validation, code lists, and routing rules so the e‑invoice can be exchanged reliably over the Peppol network. Any invoice that is valid under Peppol BIS Billing 3.0 is, by design, EN 16931‑compliant.

Belgium is phasing out paper and simple PDF invoices because they are hard to automate, slow to validate, and prone to errors and fraud. With structured e‑invoices based on EN 16931 and Peppol BIS 3.0, tax authorities receive accurate data in near real time, while businesses reduce manual data entry, invoice rejections, and payment delays

For Belgian businesses, Peppol BIS 3.0 ensures that e‑invoices are validated before sending, routed correctly via standard identifiers, and processed consistently by customers and government platforms. This reduces exceptions, speeds up approvals and payments, improves VAT audit readiness, and provides a reusable invoice format for other Peppol‑enabled EU markets.

Subscribe to our Newsletter

Get the latest compliance updates, e-invoicing news, and expert tips delivered to your inbox.

ABOUT COMPLYANCE

Empowering businesses to automate e-invoicing and stay compliant in 100+ countries. Our platform simplifies regulatory complexity for enterprises and fast-growing companies.