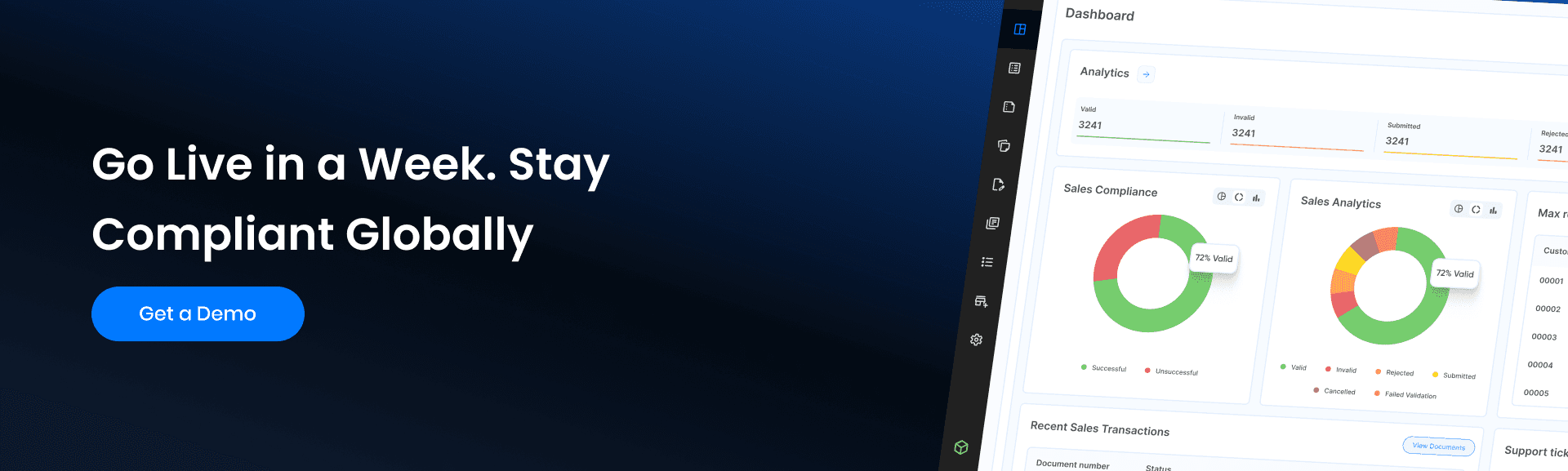

Top 10 Benefits of Choosing a Unified Global E-Invoicing Platform

Managing e-invoicing across countries is hard. See how a unified global e-invoicing platform makes compliance easier, operations smoother, and quick go-live

Table of Contents

Why Is Global Invoicing So Difficult for Businesses?

Sending and receiving e-invoices should be easy. But for businesses working across many countries, e-invoicing can quickly become confusing. Each country has different rules, formats, and systems.

Keeping up with all of them takes time, money, and effort. This is where a unified global e-invoicing platform helps. It brings everything into one place and makes e-invoicing simple, clear, and reliable.

Pro Tip: Use one developer‑first API so your technology team can implement e‑invoicing in weeks, and your tax/finance teams can go live on time and avoid penalties. That’s what Complyance is for

Let us walk through the top ten benefits and see how a unified platform makes e-invoicing simple and efficient.

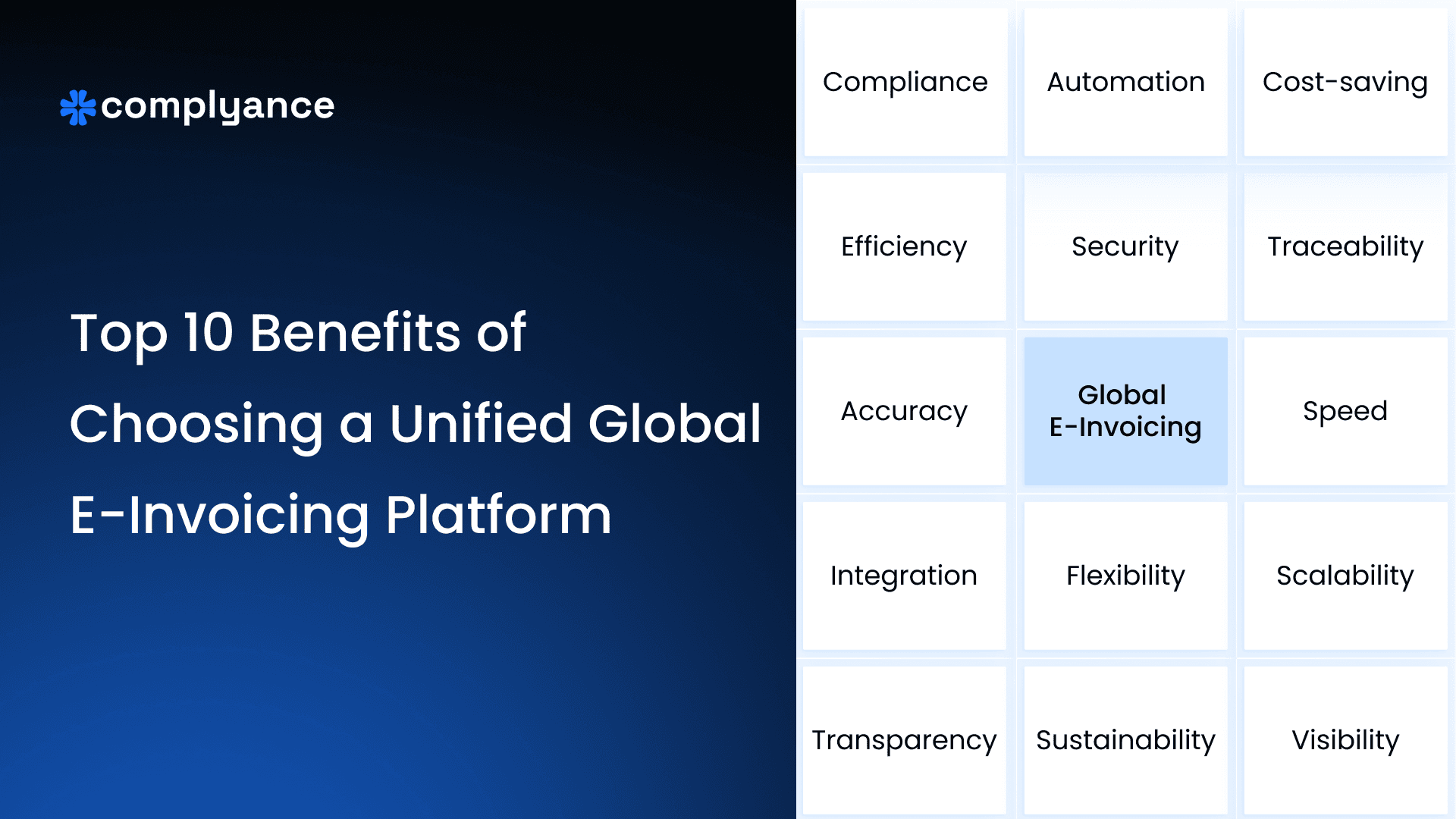

What are the benefits of a unified global e-invoicing platform?

- Guaranteed Global E-Invoicing Compliance

- A Single Workflow That Everyone Follows

- Lower Costs Across Regions

- Better Data and a Clear Financial View

- Centralized Invoice Tracking and Status Visibility

- Easy Scalability for New Country Rollouts

- Support for Multiple ERP and Accounting Systems

- Helping Developers Move Faster

- Centralized Security and Audit Control Across Regions

- Clear Value for Every Team

1. Guaranteed Global e-invoicing Compliance

Every country has its own e-invoicing rules, which often vary. A unified platform follows these rules for you. It supports e-invoicing networks like Peppol and all invoice formats such as UBL, XML-based standards, Factur-X, and many others. The platform updates when regulations change. This means you stay compliant without having to track every local rule. Your team can focus on work instead of worrying about penalties.

2. A Single Workflow That Everyone Follows

Using many e-invoicing systems can be confusing. A unified platform gives one clear and consistent process for all countries. This helps reduce mistakes and saves time. Teams follow the same steps without any confusion. This also makes training easier and keeps businesses aligned across regions.

3. Lower Costs

Using different e-invoicing platforms for each country increases costs. Each system needs its own setup, support, and maintenance. A unified global e-invoicing platform replaces all of this with one solution. Businesses manage integrations, updates, and support in one place. This reduces IT effort and operational overhead. Over time, these cost savings become significant.

4. Better Data and Clear View

When data is spread across systems, it is hard to see the full picture. A unified platform keeps all e-invoice data in one place. Finance teams can see numbers in real time. Reports become easier to create and understand. This helps leaders plan budgets and forecast future growth.

5. Centralized e-invoice Tracking and Status Visibility

When e-invoices are handled across different platforms, tracking their status becomes difficult. A unified e-invoicing platform shows all e-invoices in one place, across all countries. Finance teams can easily see whether an invoice is sent, approved, rejected, or paid. This removes follow-ups, confusion, and manual tracking. With clear visibility, teams can act faster and manage cash flow more confidently.

6. Easy Scalability for New Country Rollouts

When businesses use a unified e-invoicing platform, scaling to new countries becomes simple. As more countries introduce e-invoicing mandates, the platform adds support without requiring new systems or major changes. Businesses do not need separate integrations for each rollout. The same setup works as regulations expand. This allows companies to grow and stay compliant without slowing down operations.

7. Support for Multiple ERP and Accounting Systems

Many businesses use more than one ERP or accounting system across regions. A unified e-invoicing platform connects with multiple ERPs through a single setup. Invoice data flows smoothly between systems without custom work for each country. There is no need to build separate integrations for every ERP and market. This reduces IT complexity and makes system management more reliable.

8. Helping Developers Move Faster

A unified platform gives developers one API that works across many countries, so they do not have to think about local rules or formats. All compliance checks run quietly in the background, which removes repeated testing and ongoing fixes. This saves developer time and reduces rework across markets. Teams can expand globally without changing their code. As a result, developers move faster and focus on building real product value instead of managing e-invoices.

9. Centralized Security and Audit Control Across Regions

When e-invoice data is spread across many regional platforms, security becomes harder to manage. A unified e-invoicing platform keeps all invoice data secure in a single system, even when operating across many regions. Consistent security controls are applied everywhere. Every action is logged with clear audit trails. This makes audits, tax reviews, and compliance checks easier while reducing the risk of fraud and data loss.

10. Clear Value for Every Team

A unified e-invoicing platform changes how teams work across the business. Finance teams spend less time on manual tasks and more time reviewing clean data. Tax teams stay accurate because rules and checks are applied automatically. Product managers can launch in new countries without long delays or complex setup. Developers work with simple integrations and fewer code changes. Leaders gain confidence knowing every team is aligned and ready to grow globally.

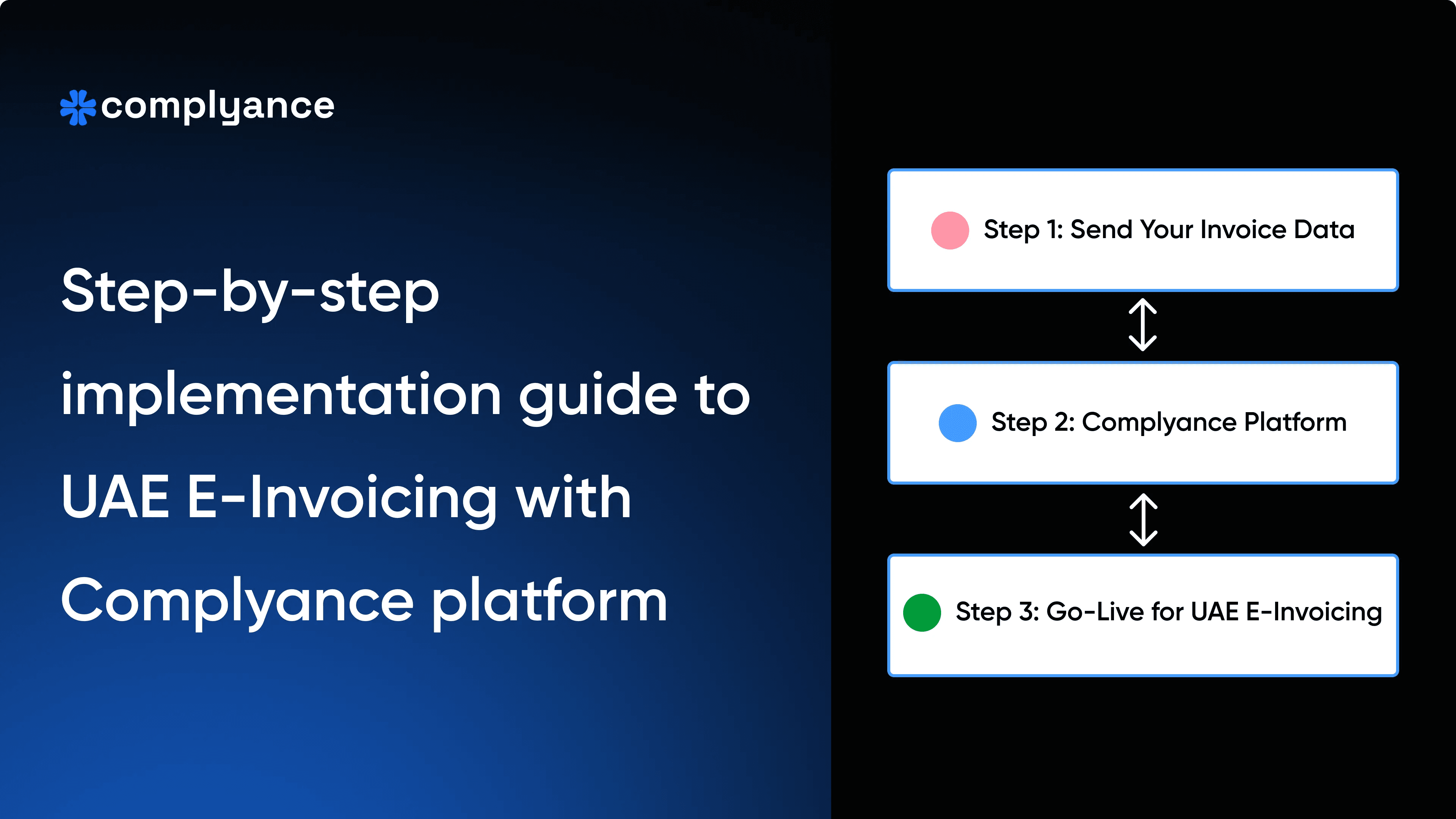

How One Global Enterprise Simplified Complex B2B E-Invoicing with a Single API

Speedcast is a global enterprise providing satellite and network services across multiple regions. With many legal entities and country-specific tax rules, managing B2B e-invoicing was complex and time-sensitive.

The Challenge

Before using a unified platform, Speedcast struggled with different invoice formats, local regulations, and ERP integration constraints. Each country required custom handling, which increased development effort and compliance risk. Meeting regulatory deadlines without disrupting existing ERP workflows was a major concern.

What Changed

With Complyance, Speedcast adopted a single, developer-first API to manage e-invoicing across regions. Compliance logic, validation, and format conversions ran in the background, while existing ERP workflows remained untouched. Complyance supporting businesses with a compliant, scalable global e-invoicing infrastructure.

This reduced manual work, avoided system changes, and standardized invoicing globally. Impact 95% faster implementation, near-zero invoice errors, and a future-ready setup for new countries. Read the full Speedcast case study to see the complete implementation details.

Conclusion for Unified Global E-invoicing

A unified global e-invoicing platform makes e-invoicing simple, safe, and scalable. It removes complexity, lowers costs, and helps teams focus on core work. Most importantly, it lets businesses focus on growth instead of manual work. In a world where rules keep changing and businesses keep expanding, having one trusted e-invoicing platform is no longer optional. It is the smart way forward.

Related posts

Frequently Asked Questions

A unified global e‑invoicing platform is a single system that connects your ERP and billing tools to tax authorities, Peppol, and other networks across multiple countries. It handles local formats, validation rules, and regulatory changes in one place, so finance, tax, and tech teams do not manage separate tools for each market

For businesses that need one developer‑first platform to manage e‑invoicing across 100+ countries, Complyance is a strong choice. It offers a single global API, built‑in validation for local mandates, Peppol and non‑Peppol support, and tools for finance, tax, and IT teams to go live quickly without rebuilding ERP workflows.

Because invoices are validated upfront and tracked centrally, they move faster from creation to approval and payment. This leads to fewer disputes, shorter approval cycles, and more predictable cash collection, which supports healthier cash flow across regions.

The platform keeps track of regulatory updates, schema changes, and new mandates in each country, and applies validation before invoices are sent. This reduces rejected invoices, missed deadlines, and non‑compliance penalties, while giving tax teams clean, auditable data

The platform keeps track of regulatory updates, schema changes, and new mandates in each country, and applies validation before e‑invoices are sent. This reduces rejected e‑invoices, missed deadlines, and non‑compliance penalties, while giving tax teams clean, auditable data.

Developers work with one developer‑first API that already includes country rules, formats, and validation logic. This removes repeated custom builds, reduces regression testing, and lets teams roll out new countries faster without changing core ERP flows.

Subscribe to our Newsletter

Get the latest compliance updates, e-invoicing news, and expert tips delivered to your inbox.

ABOUT COMPLYANCE

Empowering businesses to automate e-invoicing and stay compliant in 100+ countries. Our platform simplifies regulatory complexity for enterprises and fast-growing companies.