How E-Invoicing and E-Reporting Are Reshaping VAT in Belgium and the ViDA Framework

Understand Belgium’s 2028 e-reporting mandate marks a shift to near real-time VAT under the EU’s ViDA vision. Learn how e-invoicing and digital reporting reshape VAT compliance.

Table of Contents

Belgium’s e-invoicing mandate is often described as a 2026 compliance deadline. But that is not the real change.

The real transformation is happening at the European level through VAT in the Digital Age, known as ViDA. ViDA is the plan of the European Union to redesign how VAT data is collected, shared, and checked.

Belgium’s move to structured e-invoicing in 2026 and near real-time e-reporting in 2028 is how the country is aligning itself with this larger vision. These are not isolated rules. They are steps toward a future where VAT works digitally, continuously, and with much better data.

What Is VAT in the Digital Age (ViDA) and E-Reporting?

VAT in the Digital Age (ViDA) is the European Union’s plan to modernise VAT by replacing delayed, periodic reporting with structured, near real-time digital data exchange across member states. E-reporting is the practical mechanism that makes ViDA work. It requires VAT-relevant e-invoice data to be transmitted digitally to tax authorities shortly after a transaction occurs, rather than weeks or months later through VAT returns or summary listings. In Belgium, structured e-invoicing becomes mandatory in 2026 to standardise e-invoice data, while near real-time VAT e-reporting begins in 2028. Together, these measures prepare businesses for the EU-wide ViDA digital reporting requirements that become mandatory for cross-border B2B transactions from 2030.

The problem ViDA is trying to fix

For decades, VAT reporting across the EU followed a delayed and fragmented model. Businesses issued invoices, accumulated transaction data over weeks or months, and submitted VAT returns long after the underlying transactions had taken place

This time lag was not just an administrative inconvenience. It became a structural weakness in the VAT system.

By the time tax authorities received consolidated VAT data, the economic reality had already moved on. Errors were harder to trace back to their source. Fraud schemes had time to operate across borders. Corrective action often came months or years after the damage occurred.

The scale of the issue is significant. In 2021, the estimated EU VAT Gap stood at approximately €94 billion. While this figure has declined from earlier years, it remains a persistent loss of public revenue, and a meaningful share of this gap is linked to delayed or incomplete transaction visibility, particularly in cross-border trade.

One of the most well-known examples is carousel fraud. These schemes exploit timing gaps in intra-EU VAT reporting, where goods and invoices circulate rapidly across borders before tax authorities can connect the full transaction chain. Annual losses from this type of fraud are estimated in the billions of euros.

Fragmentation compounds the problem. With 27 member states applying different VAT reporting rules, formats, and timelines, cross-border businesses face higher compliance costs and inconsistent audit expectations. Errors identified in one country may surface months later in another, increasing remediation effort and operational risk.

ViDA is designed to address these weaknesses at their root.Instead of relying on delayed summaries and periodic listings, VAT data is expected to move digitally and closer to the moment of the transaction. Structured, machine-readable data enables earlier validation, faster cross-checking, and clearer transaction chains across borders.

The objective is not only better enforcement; It is a VAT system that works continuously, reduces uncertainty for compliant businesses, and supports a more predictable and transparent tax environment across the EU.

What ViDA Is Aiming to Achieve

ViDA is built around three strategic objectives. Each goal is tied directly to specific regulatory changes and measurable outcomes across the EU VAT system.

1. Stronger and Earlier Fraud Control

ViDA shifts VAT enforcement from a reactive to a proactive model.

By receiving structured, transaction-level data closer to real time through digital reporting requirements, tax authorities can identify inconsistencies and fraud patterns much earlier. This is particularly important for complex cross-border schemes such as carousel fraud, where delays in reporting have historically allowed abuse to scale before detection.

The reform directly targets the persistent EU VAT Gap, which was estimated at around €94 billion in 2021. By improving transaction chain visibility and replacing delayed summaries with digital reporting, ViDA aims to significantly reduce revenue losses and limit reliance on retrospective audits.

Example: Imagine a trading company in Italy buys smartphones VAT‑free from a supplier in Germany, then resells them in Italy, charging VAT but never remitting it and disappears. Another Italian company then claims a large input VAT deduction on those purchases. Under periodic reporting, tax authorities in Italy and Germany might only see this chain months later. With ViDA‑style digital reporting, each intra‑EU sale and purchase between Germany and Italy is reported in structured form within days, so mismatches between who charged VAT and who remitted it can be flagged and investigated before the fraud snowballs

2. Simpler and More Predictable Cross-Border Compliance

Cross-border VAT compliance has long been fragmented, with different reporting formats, timelines, and local rules across 27 member states.

ViDA addresses this by standardising key VAT processes, especially for intra-EU B2B transactions. From 2030, structured e-invoicing and digital reporting become mandatory for cross-border supplies, creating a common compliance baseline across the EU.

For businesses operating in multiple countries, this reduces duplication, lowers administrative overhead, and limits the risk of inconsistent treatment during audits. Over time, it also supports fewer local VAT registrations through expanded One-Stop Shop mechanisms.

Example: A Belgian SaaS company selling to clients in France, Spain, and the Netherlands currently manages separate VAT registrations, country‑specific listings, and differing audit expectations. Under ViDA’s structured e‑invoicing, digital reporting, and expanded One‑Stop Shop, most of these cross‑border B2B sales can be handled through a single EU portal, reducing duplicate filings and making audits more consistent.

What is One-Stop Shop (OSS)

The One‑Stop Shop (OSS) is an EU VAT system that lets you handle VAT for many cross‑border B2C sales through a single registration, single return, and single payment instead of registering in every country you sell into

- Without OSS: If you sell to consumers in 10 EU countries, you may need up to 10 local VAT registrations, 10 sets of returns, and 10 tax office relationships.

- With OSS: You register in just one “member state of identification,” file one OSS return (usually quarterly), and pay all the VAT due on eligible cross‑border B2C sales there; that state then redistributes VAT to the others.

How it relates to ViDA

ViDA plans to expand OSS and Single VAT Registration so that more types of supplies (and some B2B flows) can be covered through one EU‑level registration and portal, further reducing the need for multiple local VAT numbers

3. VAT Rules That Reflect the Digital Economy

Many VAT rules were designed for traditional supply chains and did not account for platform-driven and digital business models.

ViDA updates this framework by introducing deemed supplier rules for certain platform activities, such as short-term accommodation and passenger transport. In these cases, platforms become responsible for charging and remitting VAT instead of individual sellers.

This ensures VAT is collected where economic activity actually occurs and reduces leakage in fast-growing digital sectors that previously fell outside effective enforcement. The result is a VAT system better aligned with how modern commerce operates.

Example: A platform that brokers short‑term apartment rentals in Spain and Portugal currently relies on thousands of individual hosts to charge and remit VAT correctly. Under ViDA’s deemed‑supplier rules, the platform itself becomes responsible for charging and remitting VAT on qualifying stays, so VAT is collected where the accommodation actually takes place and leakage in the platform economy is reduced.

The Three Pillars of ViDA Explained

ViDA is structured around three pillars. Each pillar targets a specific weakness in the current VAT system and introduces concrete operational changes for businesses.

1. Digital Reporting and E-Invoicing

This is the most impactful pillar for most B2B businesses.

Under ViDA, structured electronic invoices become the primary source of VAT data, supported by Digital Reporting Requirements (DRR). Instead of periodic summaries, transaction-level data is reported digitally and closer to the time of supply.

For intra-EU B2B transactions, DRR and structured e-invoicing become mandatory from 1 July 2030. Invoice data must be reported within ten days of the taxable event, including reverse-charge scenarios. Domestic implementation timelines are decided by each member state, which is why Belgium is moving earlier.

Key operational requirements under this pillar include:

- Invoices must follow the European semantic standard EN 16931

- Invoice data must be machine-readable and structured, not PDFs

- Reporting cadence shifts from periodic to near real-time

- DRR replaces delayed EC Sales Lists for cross-border trade

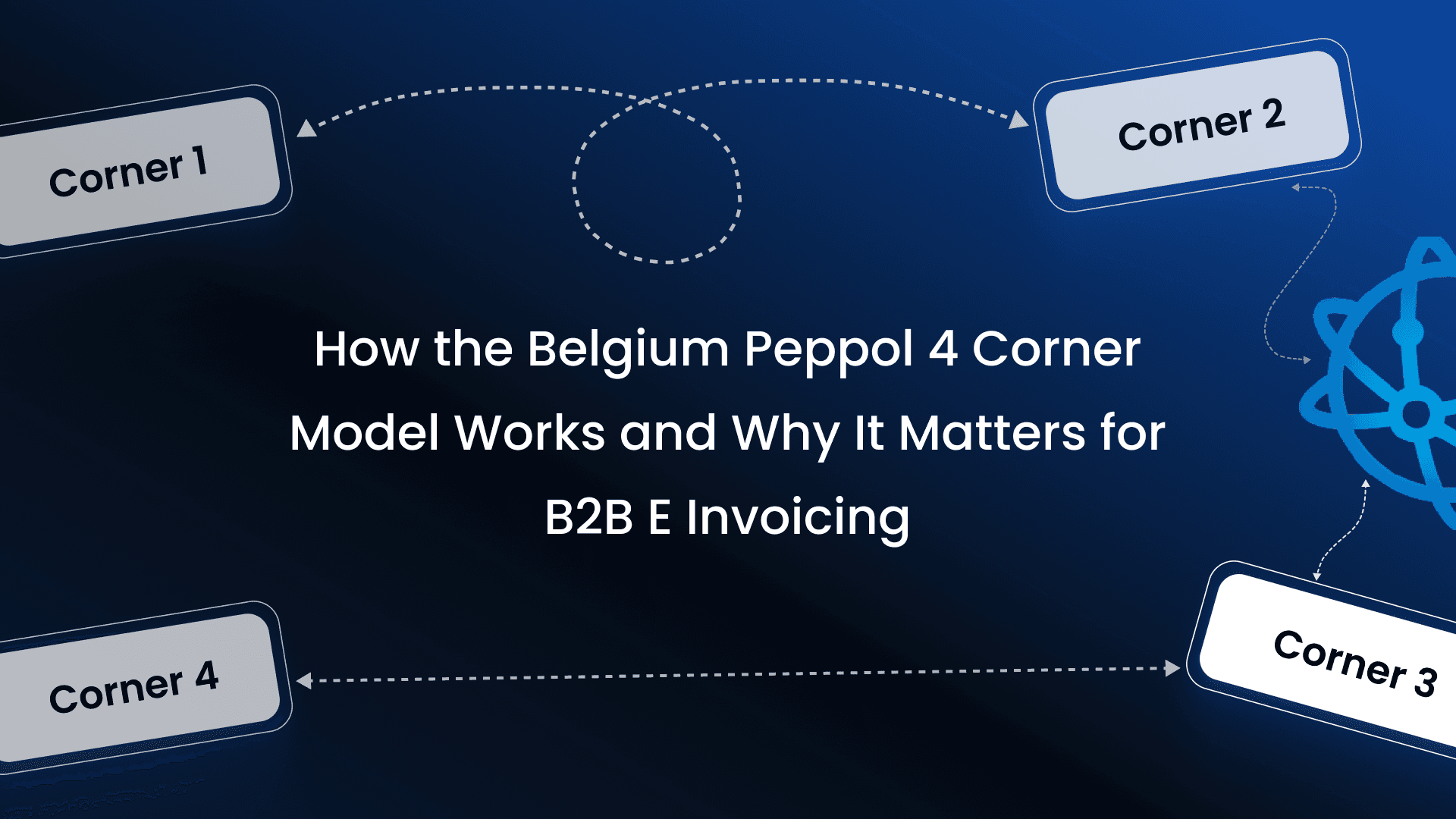

Belgium’s roadmap directly implements this pillar. From 1 January 2026, domestic B2B invoices must be issued in a structured format via the Peppol network.From 1 January 2028, Belgium will introduce near real-time VAT e-reporting using a five-corner Peppol model, where invoice data also flows to the tax authority. In effect, Belgium is implementing the ViDA DRR model at a national level before it becomes mandatory across the EU.

2. VAT Rules for the Platform Economy

The second pillar focuses on VAT leakage in platform-driven business models.

ViDA introduces a deemed-supplier regime for certain digital platforms, particularly in short-term accommodation and passenger transport. In these cases, the platform becomes responsible for charging and remitting VAT, rather than individual underlying sellers.

Key characteristics of this pillar include:

- Applies to platforms facilitating services such as rentals and transport

- Targets platforms exceeding defined turnover thresholds

- Optional deemed supplier status from 2028, mandatory from 2030

- Designed to capture VAT previously lost due to fragmented enforcement

This reform addresses VAT leakage estimated in the billions of euros annually across platform-based services. It primarily affects platform operators and marketplaces, not traditional B2B suppliers, but it has downstream implications for invoicing, settlement, and reporting flows.

3. Single VAT Registration Across the EU

The third pillar tackles administrative fragmentation.

Today, businesses operating cross-border often require multiple VAT registrations, filings, and local compliance processes. ViDA expands the One-Stop Shop framework into a Single VAT Registration model.

From July 2028, businesses will be able to manage a wider set of VAT obligations through a single EU registration and portal, including:

- Cross-border B2C supplies

- Intra-EU stock movements

- Certain domestic transactions

- Reverse-charge reporting scenarios

This significantly reduces the need for multiple local VAT registrations. For SMEs and mid-market businesses, this is expected to cut administrative effort by up to 40–60% over time, while also reducing audit inconsistency across member states.

How the Pillars Connect to Belgium’s Timeline

| Year / phase | Measure in Belgium | ViDA / EU linkage |

|---|---|---|

| 2026 | Mandatory structured B2B e‑invoicing; invoices issued in a standardized format (via Peppol, EN 16931). | Creates the structured invoice data layer ViDA needs for Digital Reporting Requirements. |

| 2028 | Near‑real‑time VAT e‑reporting; invoice data also sent to the tax authority. | Anticipates ViDA’s digital reporting model and continuous VAT controls at EU level. |

| 2030 (EU level) | Later ViDA phases extend digital reporting and Single VAT Registration across intra‑EU trade. | Belgium’s earlier mandates act as building blocks for the ViDA end state by 2030. |

Belgium’s implementation closely mirrors the structure and sequencing of ViDA.The 2026 e-invoicing mandate establishes structured, standardised invoice data at the point of issuance.

The 2028 e-reporting mandate activates near-real-time VAT data flows to the tax authority.Later ViDA phases extend the same logic to intra-EU trade and EU-wide VAT registration models.

Rather than isolated compliance steps, Belgium’s mandates are early building blocks of the ViDA end state. They prepare businesses for the same data standards, reporting logic, and operating model that will apply across the EU by 2030.

Why Belgium Started with E-Invoicing in 2026

From 1 January 2026, all domestic B2B invoices must be issued in a structured electronic format. Paper invoices and unstructured PDFs will no longer be considered VAT-compliant for these transactions. This is not a format preference; It is a structural change in how VAT data enters the system.

The obligation is defined through a Royal Decree and applies broadly. All VAT-registered businesses in Belgium fall within scope, including non-resident businesses that operate through a fixed establishment in the country. In practical terms, any entity issuing domestic B2B invoices must comply.

To avoid fragmented local formats, Belgium mandates invoice exchange through the Peppol network, using the Peppol BIS 3.0 specification. Invoice content must follow the European semantic standard EN 16931, ensuring that VAT-relevant data is structured, consistent, and machine-readable across systems.

This design choice is intentional. By enforcing a single network and a common semantic model, Belgium eliminates bilateral integrations and country-specific formats. Invoices can move directly between ERP systems without custom mappings, while still producing data that can later be reused for reporting and control purposes.

The mandate is also backed by enforcement. Administrative penalties apply for non-compliance, starting at €1,500 for a first offence and increasing to €3,000 and €5,000 for repeated violations within a short period. These penalties signal that structured issuance is not optional, even before reporting obligations begin.

This first phase lays the foundation for everything that follows. Without standardised, machine-readable invoice data at the point of issuance, near real-time reporting, automated validation, and scalable VAT control are not possible. Belgium’s 2026 mandate is therefore not an isolated rule. It is the data layer on which the 2028 e-reporting model and the wider ViDA framework depend.

What Changes in 2028 with VAT E-Reporting

In 2026, the focus is on how invoices are issued and exchanged. In 2028, the focus shifts to what happens to the data inside those invoices.

From 1 January 2028, Belgium plans to introduce near real-time VAT e-reporting through a five-corner Peppol model. In addition to flowing between seller and buyer, invoice data is transmitted to the Belgian tax authority, FPS Finance.

Key characteristics of the 2028 model include:

- No invoice clearance or pre-approval

- Data transmission close to real time, expected within hours, not months

- Replacement of delayed VAT summaries and annual customer listings

- Early detection of inconsistencies and missing VAT

This reform directly targets Belgium’s estimated multi-billion-euro VAT gap by giving tax authorities visibility into transaction chains far earlier than traditional reporting cycles allow.

For non-resident businesses without a fixed establishment, obligations are more limited. These entities are generally required to receive structured invoices, but may not be required to submit domestic e-reporting data themselves.

The model is best described as continuous visibility, not real-time control.

Why Belgium Is Rolling This Out in Phases

Belgium confirmed this roadmap in its Federal Coalition Agreement for 2025 to 2029, placing digital modernisation at the centre of its VAT strategy while committing to proportional and pragmatic enforcement.

The phased rollout serves a clear operational purpose. Belgium first focuses on standardising how invoices are issued and on improving data quality at the source. Only once this foundation is in place does the country activate near real-time VAT reporting using that same structured data.

This sequencing is designed to reduce systemic risk. By separating invoice issuance from reporting, businesses are given time to adapt ERP systems, integrations, and validation rules before reporting obligations become more demanding and visible.

The coalition agreement also reflects a more balanced enforcement philosophy during the transition. Rather than penalising purely technical non-compliance, the focus shifts toward intent and actual financial impact, especially in the early stages of adoption. This approach is intended to support compliance through stabilisation, not disruption.

What This Means for Businesses

This transformation affects far more than VAT filings.

In a near-real-time reporting environment:

- Data quality becomes non-negotiable

- Errors surface immediately rather than months later

- Late corrections become harder and more visible

- Manual workarounds stop scaling

- ERP validation and master data accuracy become audit-critical

For many organisations, ERP and integration costs are expected to rise in the short term. At the same time, audit frequency and retrospective corrections are expected to fall significantly once systems stabilise.

Most importantly, ownership shifts.E-invoicing and e-reporting are no longer tax-only initiatives. Finance, tax, IT, and data teams must operate with shared accountability from day one.

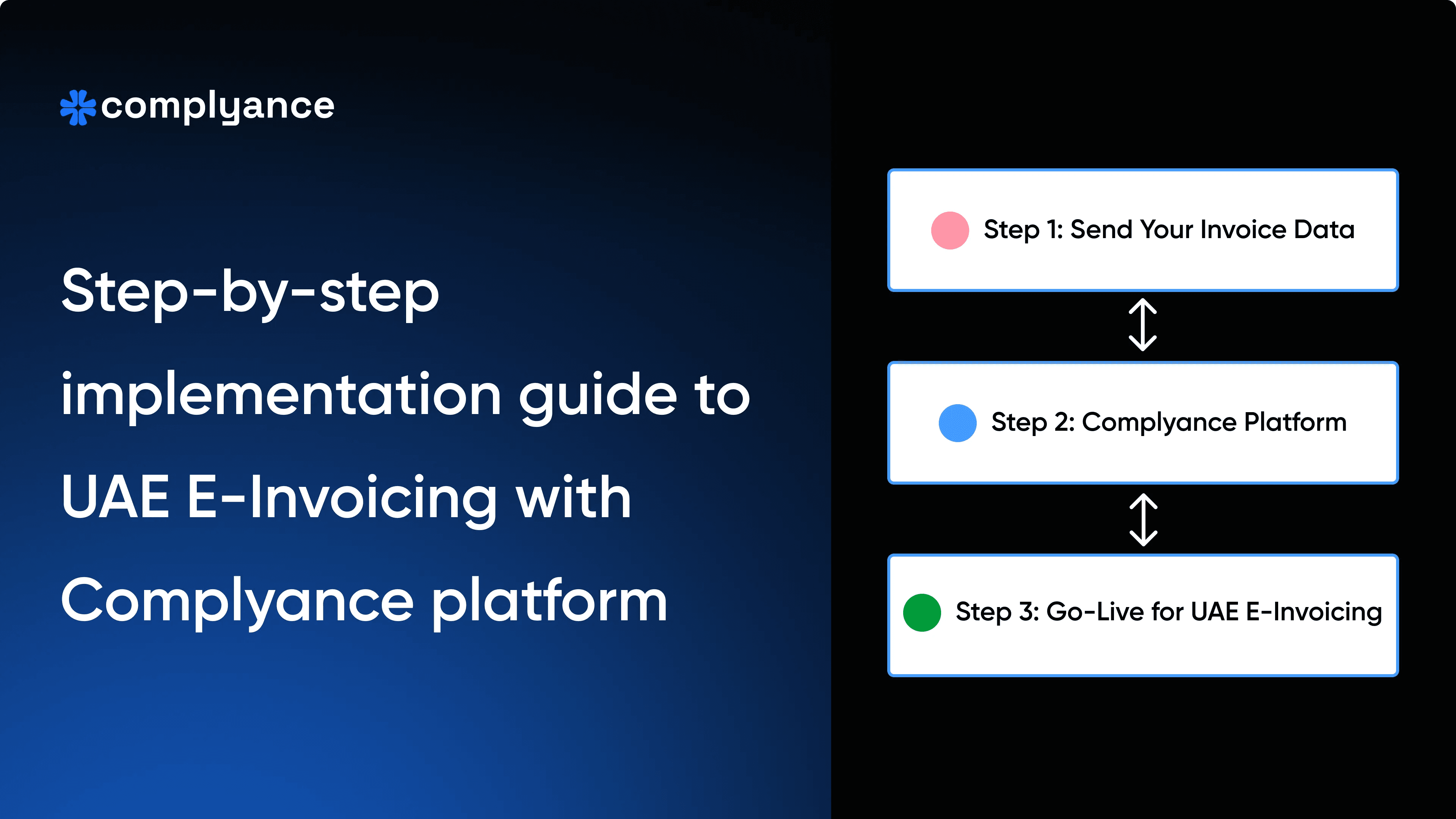

How Businesses Should Prepare Smartly

Preparing for Belgium’s mandates does not mean reacting to each deadline in isolation. Businesses that treat 2026 and 2028 as separate compliance events will end up rebuilding the same systems twice.

The smarter approach is to prepare with ViDA as the end state in mind.

The first step is understanding direction, not just dates. Belgium’s 2026 e-invoicing mandate and its 2028 e-reporting requirement are stepping stones toward the EU-wide Digital Reporting Requirements that become mandatory for intra-EU B2B transactions in 2030. Businesses should already be mapping their Belgian setup to future cross-border flows, reporting cadences, and data reuse scenarios. If a solution works only for Belgium, it will not survive the next phase.

The second priority is fixing data at the source. Near real-time reporting exposes data issues immediately. VAT codes, buyer and seller identifiers, addresses, tax point logic, and master data consistency all become audit-visible much earlier. Leading organisations are already running structured data audits inside ERP and billing systems, with clear targets such as achieving high validation pass rates before 2026 rather than correcting errors after go-live.

The third focus area is scalability of the technical approach. Country-by-country fixes, custom mappings, or local invoice formats may meet short-term deadlines but will break as ViDA expands. Businesses should favour architectures that natively support EN 16931 semantics, Peppol-based exchange, and multi-country rollout, so that adding a new jurisdiction does not require a full redesign.

Finally, alignment across teams is no longer optional. E-invoicing and e-reporting sit at the intersection of finance, tax, IT, and data governance. Organisations that treat this as a tax-only initiative typically struggle with integration delays, unclear ownership, and late error discovery. The most successful implementations establish shared accountability early, often through a cross-functional task force with clear ownership of data quality, system changes, and ongoing monitoring.

Conclusion: The Bigger Picture

Belgium’s 2028 e-reporting mandate is not a standalone national rule. It is part of a broader European shift toward digital, continuous VAT compliance under the ViDA framework.

What Belgium is effectively offering businesses is an early proving ground. The same principles apply in 2026 and 2028. Structured data at issuance, standardised exchange, near real-time reporting, and reduced reliance on periodic summaries. These are the principles that will govern VAT compliance across the EU in the coming decade.

Businesses that approach e-invoicing and e-reporting as one connected journey, rather than as separate compliance projects, gain a structural advantage. They stabilise data earlier. They reduce rework as new countries come into scope. They are better positioned for automation, analytics, and lower audit friction over time.

The objective, ultimately, is not just to comply with Belgium’s rules; the objective is to be prepared for how VAT will operate in Europe going forward.

Glossary for How E-Invoicing and E-Reporting Are Reshaping VAT in Belgium Under ViDA

- What is ViDA (VAT in the Digital Age) The EU’s legislative package to modernise VAT reporting, platform rules, and Single VAT Registration across member states.

- What is OSS (One‑Stop Shop) – An EU VAT scheme that lets businesses report certain cross‑border B2C supplies through a single VAT registration and return instead of multiple country registrations.

- What is Peppol – A network and set of specifications that enables the standardised, secure exchange of structured e‑invoices and other documents between businesses and public bodies

Related posts

Frequently Asked Questions

Belgium’s VAT e-reporting mandate requires VAT-relevant invoice data to be transmitted digitally to the tax authority shortly after a transaction occurs. From 2028, this reporting happens near real time through a five-corner Peppol model, replacing delayed VAT summaries and annual listings.

E-invoicing governs how invoices are issued and exchanged between businesses using structured formats. E-reporting governs how invoice data is shared with the tax authority. In Belgium, e-invoicing becomes mandatory in 2026, while e-reporting begins in 2028.

ViDA, or VAT in the Digital Age, is the EU’s plan to modernise VAT by moving from periodic reporting to structured, digital, near real-time data exchange. Belgium’s e-invoicing and e-reporting mandates are early implementations of this EU-wide strategy.

Under ViDA, structured e-invoicing and digital reporting become mandatory for intra-EU B2B transactions from 2030. This standardises reporting across member states and replaces delayed EC Sales Lists with digital reporting requirements.

Near real-time access to structured transaction data allows tax authorities to detect inconsistencies and fraud patterns earlier. This is particularly effective against carousel fraud, which relies on timing gaps in traditional VAT reporting.

Subscribe to our Newsletter

Get the latest compliance updates, e-invoicing news, and expert tips delivered to your inbox.

ABOUT COMPLYANCE

Empowering businesses to automate e-invoicing and stay compliant in 100+ countries. Our platform simplifies regulatory complexity for enterprises and fast-growing companies.