Step-by-step implementation guide to UAE E-Invoicing with Complyance platform

Learn how to implement UAE e-invoicing step by step using the Complyance platform. Covers ERP integration, API setup, testing, and FTA submission for fast go live.

Table of Contents

Introduction: Making E-Invoicing Easy

We get it. Implementing e-invoicing feels harder than it should be. Many teams are preparing for a rollout filled with changing rules, unexpected validation errors, ERP integration hurdles, and limited in-house expertise, all while facing tight e-invoicing timelines. Especially when dealing with the DCTCE’s(Decentralized Continuous Transaction Control and Exchange) complex five-corner model, it’s easy to fall behind.

That’s where Complyance comes in.

We built Complyance e-invoicing for global enterprises managing complex invoicing across multiple countries, diverse ERPs, and varying regulatory formats. Our platform is fast, scalable, and developer-friendly, helping you stay e-invoicing compliant without disrupting your existing systems.

Complyance is an Accredited Service Provider in the UAE.

And now, with the UAE’s upcoming e-invoicing mandate, Complyance makes it simple for any business, whether you're a growing startup or a multinational company, to go live quickly and confidently.

With Complyance, you can:

- Stop worrying about constantly changing government technical requirements.

- Validate and fix errors before you submit your invoices.

- Go live within a week with confidence, knowing everything is set up correctly.

- Stay updated automatically whenever the government rules change.

- Rely on expert guidance and 24/7 support from our e-invoicing compliance specialists.

- Scale effortlessly as your business grows from one entity to multiple countries.

- Expand globally with ease, using the single API for every new market.

- Save time with smart mapping automation.

This guide will walk you through every step of the process. From creating your account to sending your first real invoice, you'll see how simple UAE e-invoicing can be.

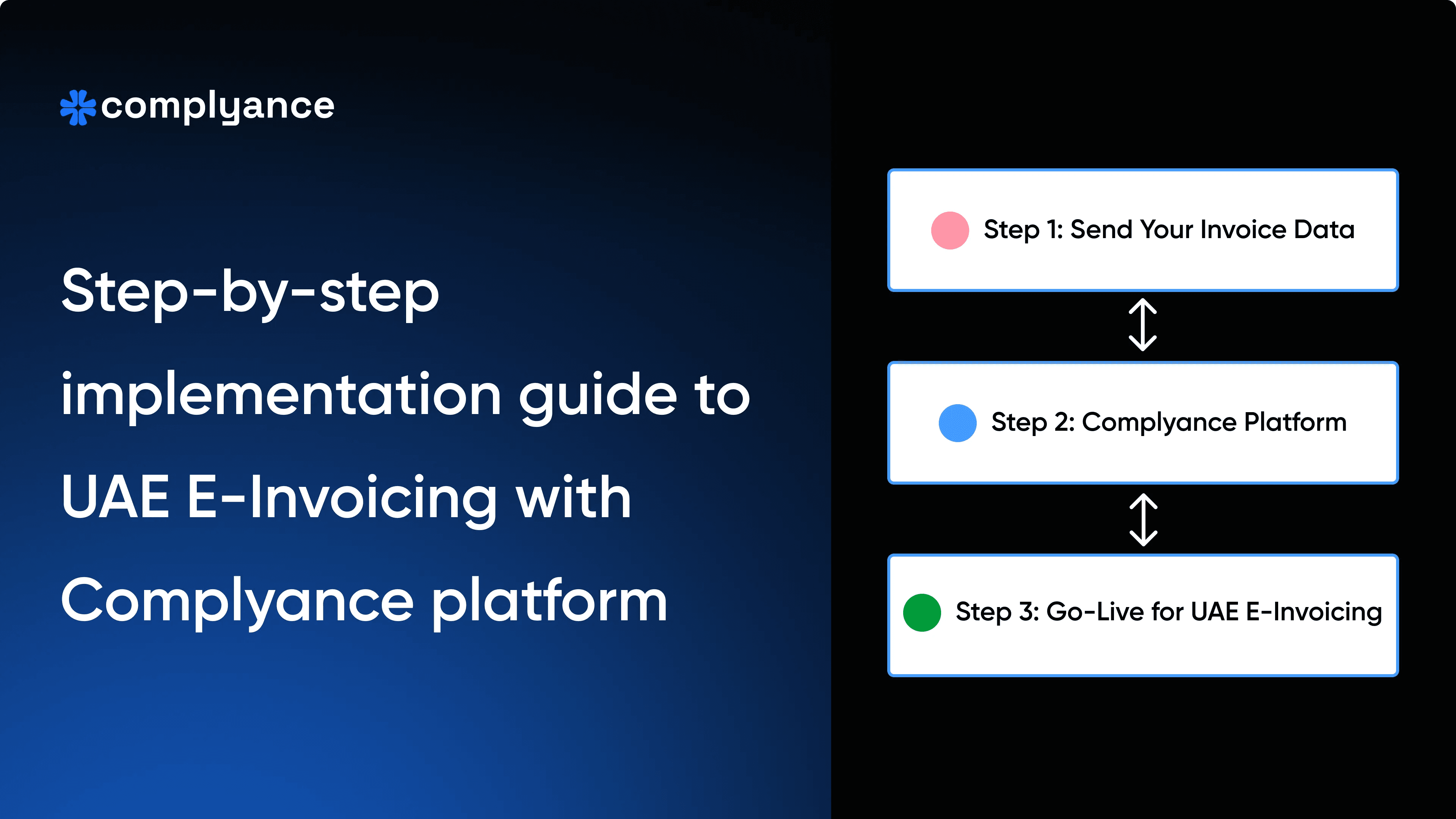

How to implement UAE e-invoicing?

UAE e-invoicing can be implemented by connecting your ERP, POS, accounting, or billing system to an accredited e-invoicing service provider. The provider validates invoice data, converts it into the required XML format, applies digital signatures, and submits it to the Federal Tax Authority through the UAE’s DCTCE model. With a developer-friendly single API like Complyance, most businesses can complete setup, testing, and go-live within a few days, without changing their existing ERP or billing systems.

Understanding the Basics of UAE E-Invoicing

What is e-invoicing?

E-invoicing simply means exchanging invoices in a structured digital format, instead of paper or PDF. It allows businesses and governments to automate tax reporting without fraud.

Now, before we dive into the platform setup, let’s quickly understand what the UAE government’s system requires.

Think of it as a secure, government-monitored digital highway for your invoices, where every invoice must follow specific formats and validation steps. Here are the key things you need to know:

- Digital Format (XML): Your invoices must be created in a specific digital format called XML. You don't have to worry about changing your internal formats each time the standard updates; Complyance handles it all for you.

- Mandatory Fields & Data Mapping: The FTA releases a detailed data dictionary specifying mandatory fields. Complyance's GETS technology automatically maps your data to these country-specific fields, ensuring you never miss a requirement.

- Digital Signature: Every invoice must have a digital stamp to prove it is authentic and has not been tampered with.

- Pre-Approval: Invoices must be sent to the tax authority (FTA) for approval before they are sent to your customer.

- Keep Records: You must keep a clear record of every invoice you submit, including any that were rejected.

- Use an Authorized Provider: You cannot send invoices directly to the FTA. You must use an Accredited Service Provider that acts as a secure bridge between your business and the government with a single API.

What Is Complyance?

Complyance is a global e-invoicing platform that helps businesses meet government e-invoicing mandates without changing their existing systems. It connects ERPs, POS, accounting tools, and custom billing systems to tax authorities through a single, developer-friendly API.

Businesses integrate once with Complyance to handle validation, XML generation, digital signatures, and invoice submission across countries. The platform supports both enterprise-scale automation and simple manual workflows, making it suitable for startups, SMEs, and large organizations.

Before You Start: Setting Up Your Complyance Account

First, let's get your account ready.

Step-by-Step Login & Setup:

1. Sign Up for an Account

- Go to one.complyance.io

- Enter your name, work email, and create a password.

- Click "Create Account.

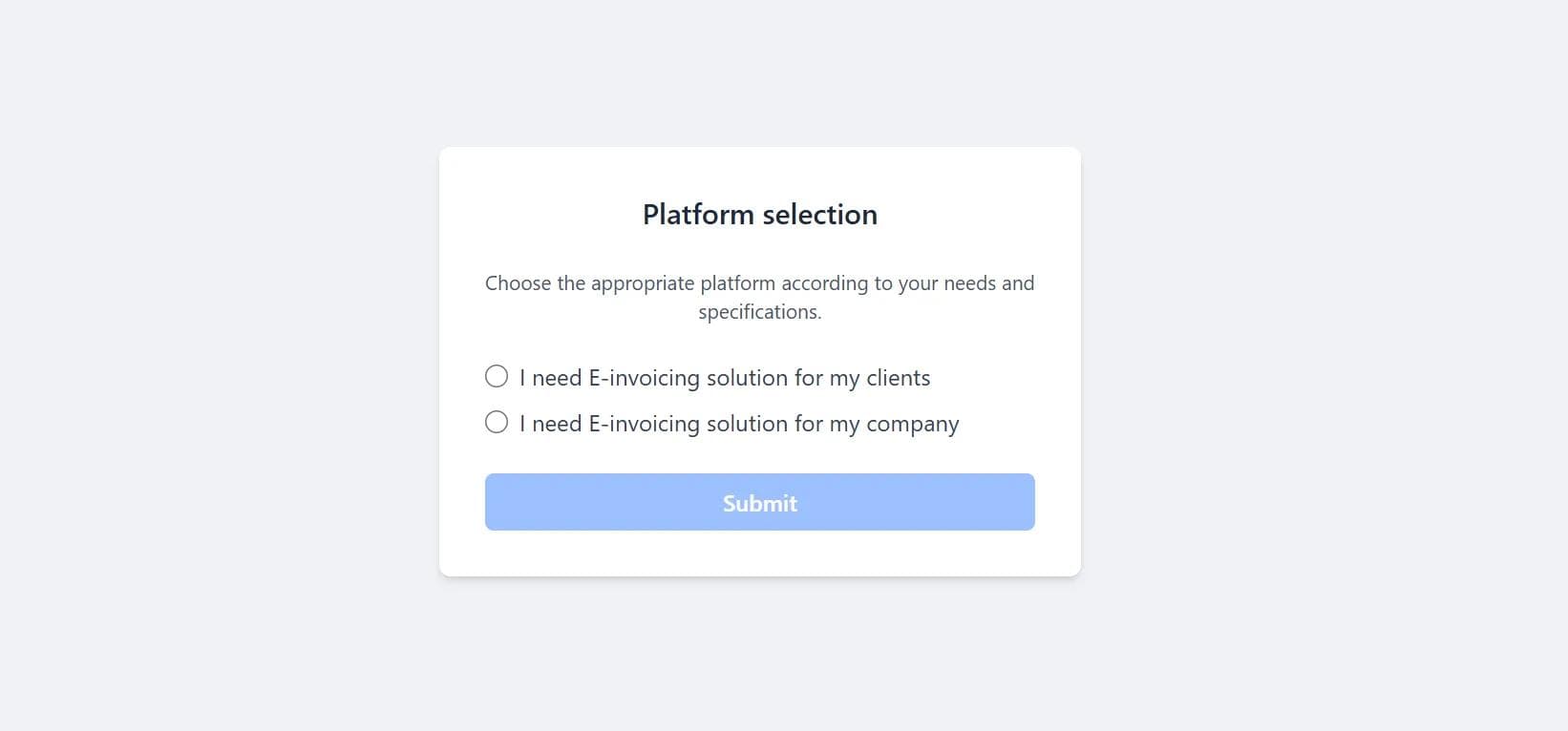

2. Tell Us How You'll Use Complyance

Select one of the following:

- “I need an E-invoicing solution for my company” (If you are a business issuing your own invoices).

- “I need an E-invoicing solution for my clients” (If you are managing invoices for

- multiple clients).

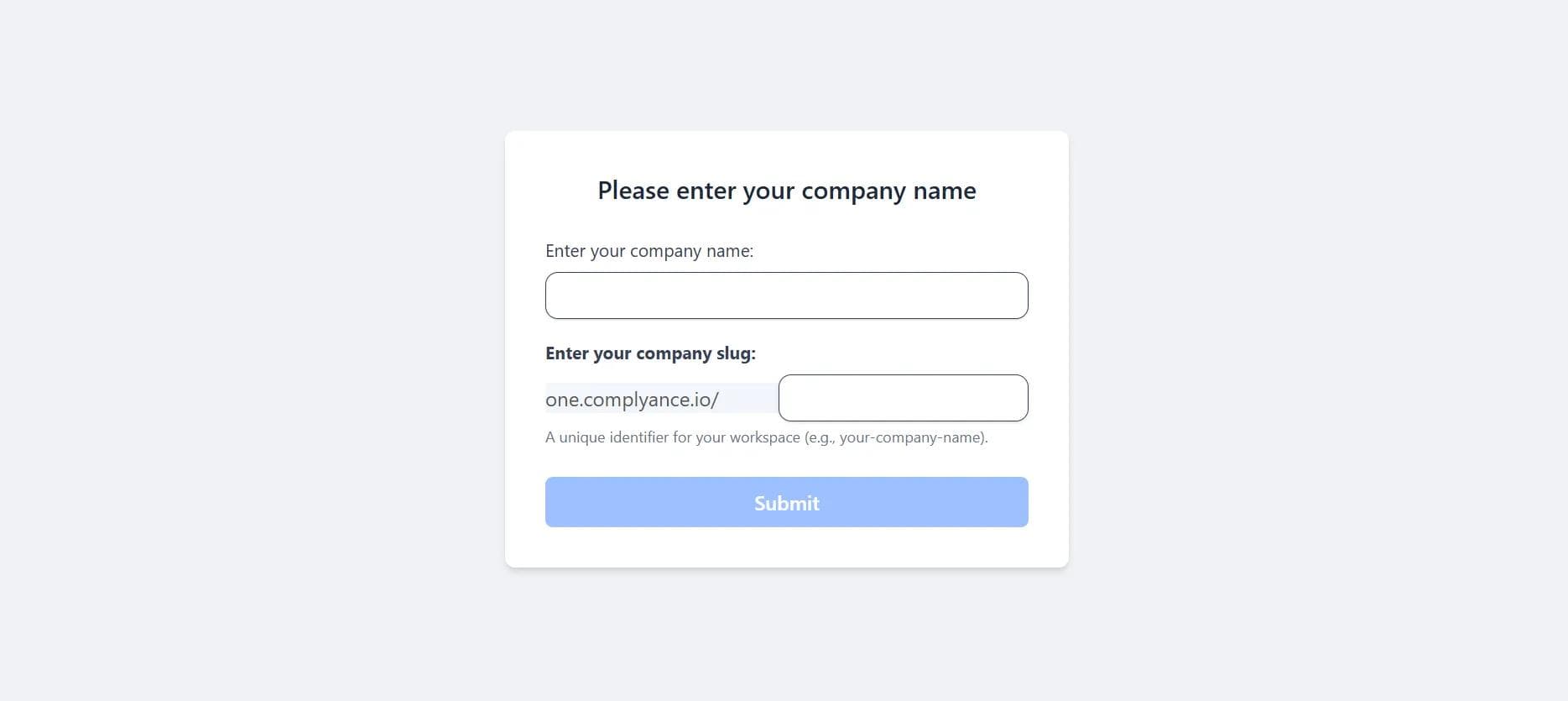

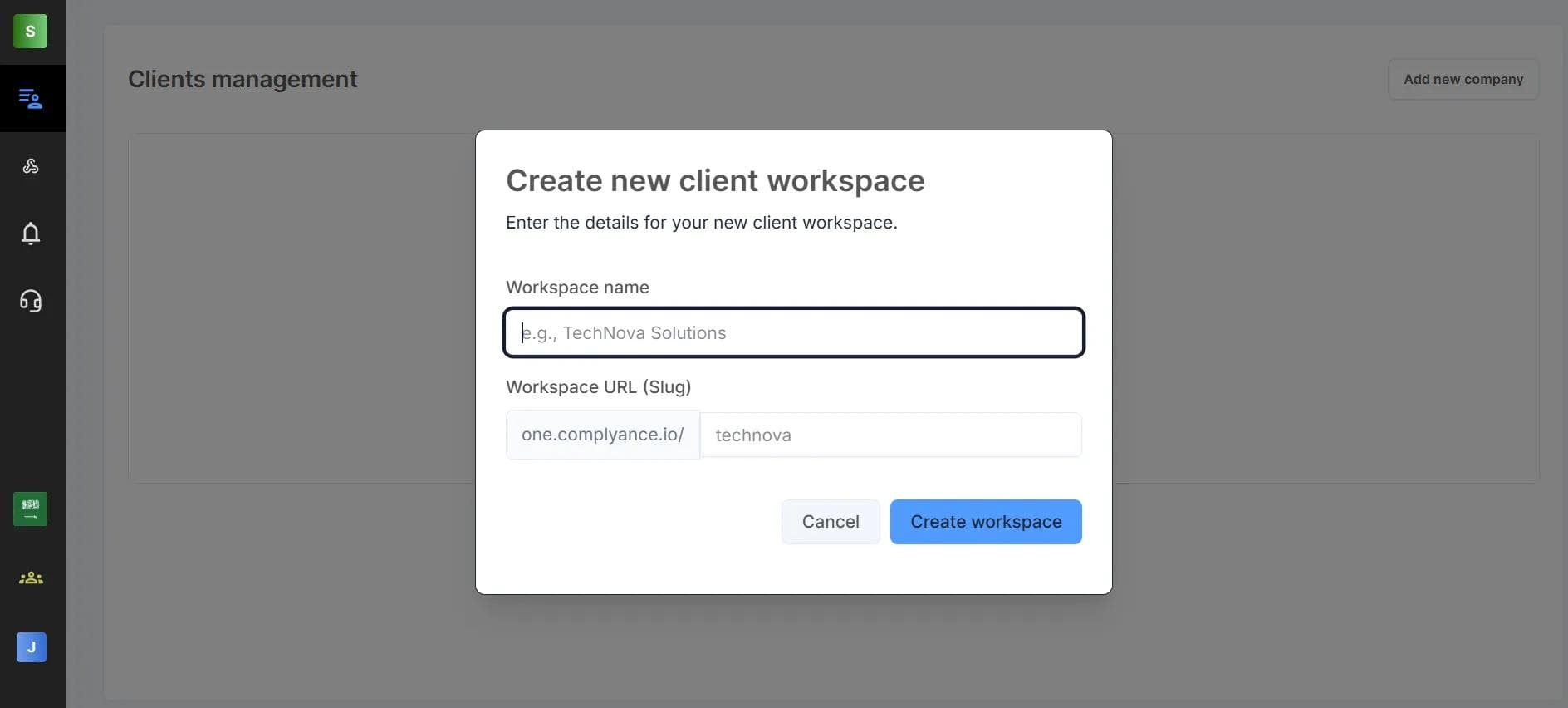

3. Create Your Workspace

- Enter your Company Name (e.g., "TechNova Solutions").

- Choose a unique URL slug for your workspace (e.g., one.complyance.io/technova).

4. Add Company Details

- If you are a business, enter your own company's legal and tax information.

- If you are a service provider, you can add the details for all your clients here

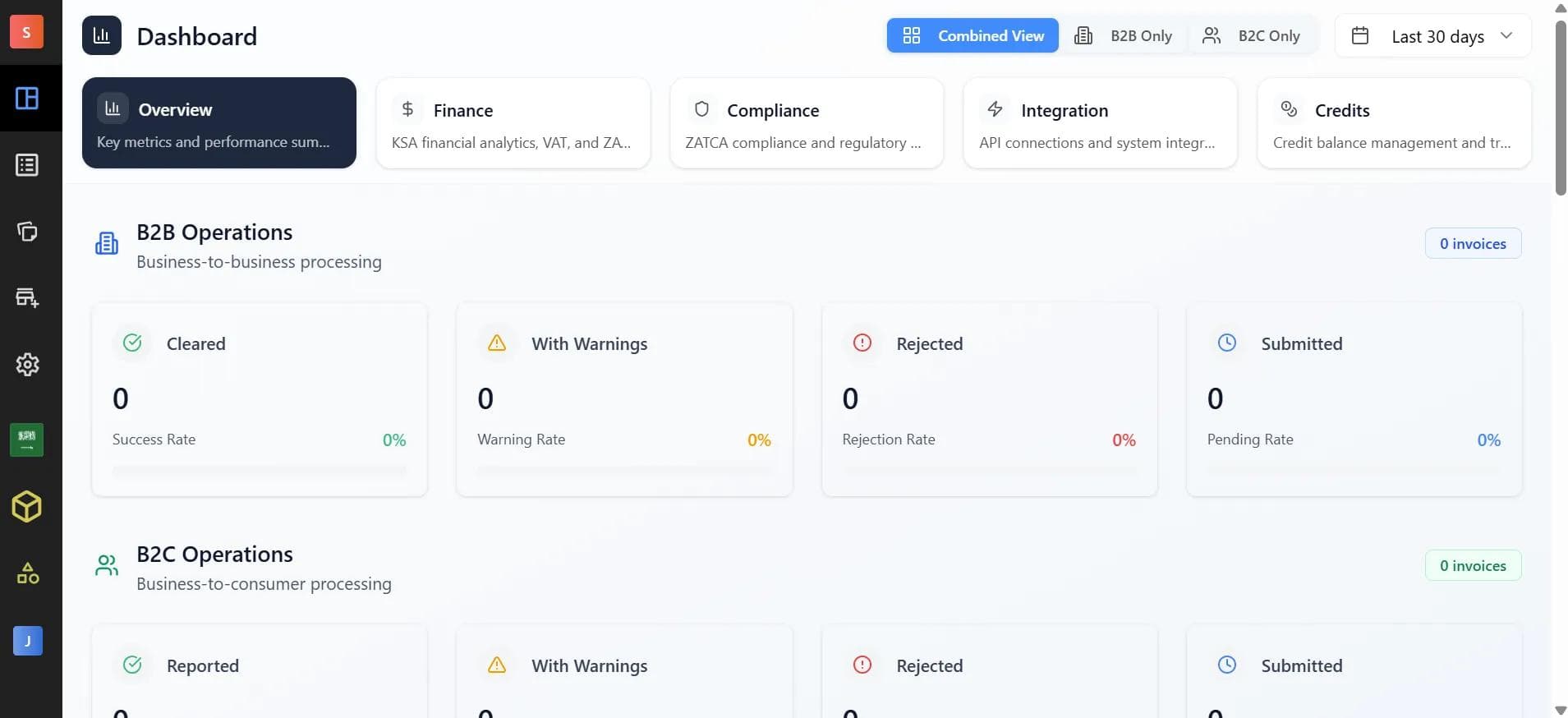

5. Access Your Dashboard

Once setup is complete, you will see your main dashboard. This is your control center where you can:

- See the status of all your invoices (Approved, Waiting, Rejected).

- Check your account balance.

- Access different sections for B2B/C invoices, financial reports, and integration settings.

Now, let's gather the information you'll need to start creating invoices.

6. Getting Ready for Implementation

What You Need :

| Category | Details to Prepare |

|---|---|

| Invoice Details | The unique invoice number, issue date, and type (e.g., Tax Invoice, Credit Note). |

| Buyer Details | Buyer's legal name, address, TRN, etc |

| Seller Details | Seller's legal name, address, TRN, etc |

| Document Totals | The total invoice amount, total discount, and total amount due. |

| Tax Breakdown | The total VAT amount and the taxable value, broken down by tax rate (e.g., 0%, 5%). |

| Invoice Line Items | A list of goods/services sold, including description, quantity, unit price, and line-level tax. |

Complete Breakdown on the Complyance Dashboard

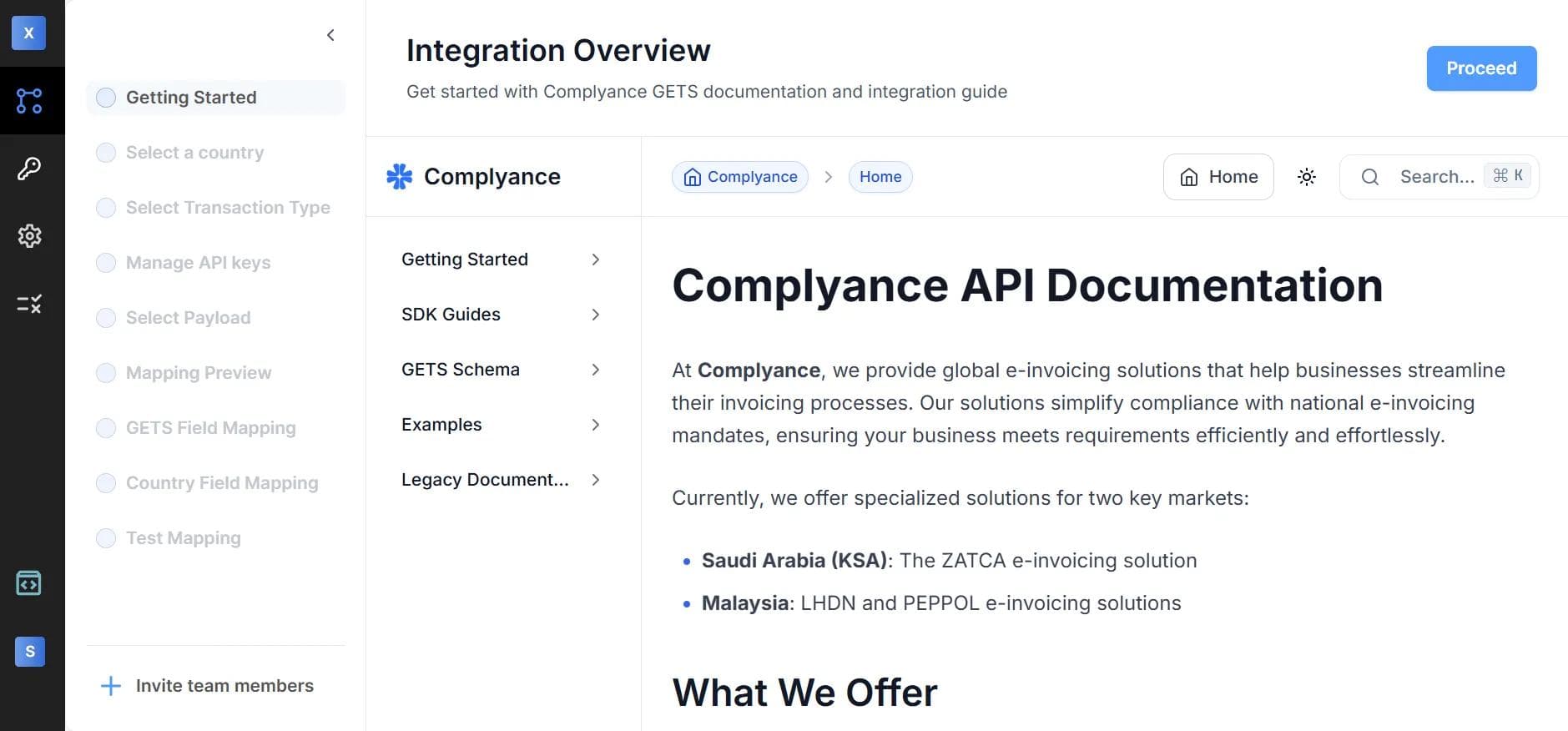

Step 1: Get Started with the Integration Panel

Once you log into the Complyance platform, you’ll see a navigation sidebar on the left.From here:

Expand the “Developer Portal” section at the bottom. You’ll see two options under Portals:

- Invoice Portal

- Developer Portal

Click on Developer Portal to access the Integration Engine, where you’ll land on the Integration Overview screen.

This is your starting point to get access to:

- SDK Guides – Step-by-step instructions for setting up and using Complyance SDKs

- GETS Schema Documentation – Detailed breakdown of standard fields and country-specific mappings

- Example Payloads – Sample JSONs and response structures to help shape your ERP output

- Legacy Docs – Useful if you're migrating from older formats

This section gives your developers everything they need to get started: from understanding GETS to pushing validated data using SDKs.

On the left sidebar, you'll see a progress-driven checklist, starting from country selection and ending with test mapping.

Java SDK Setup (Recommended Path for Developers)

We currently support the Java SDK for production-grade integration with your ERP or billing systems.

In upcoming updates, we’ll add official SDK support for C++, JavaScript (Node.js), and Python to suit broader tech stacks.

For now, if you're using Java, follow the setup below.

Installation: Java SDK Setup

We recommend using the automated setup, which detects your operating system and generates the correct configuration path for you.

macOS & Linux Setup

Install Java (JDK 11 or higher)

brew install openjdk@11Set the JAVA_HOME environment variable

export JAVA_HOME=$(/usr/libexec/java_home -v 11)Verify Java Installation

java -versionWindows

- Download and install OpenJDK 11+

- Set the JAVA_HOME environment variable

- Add Java to PATH

After setting up the Installation, go to the Developer portal and start implementing it

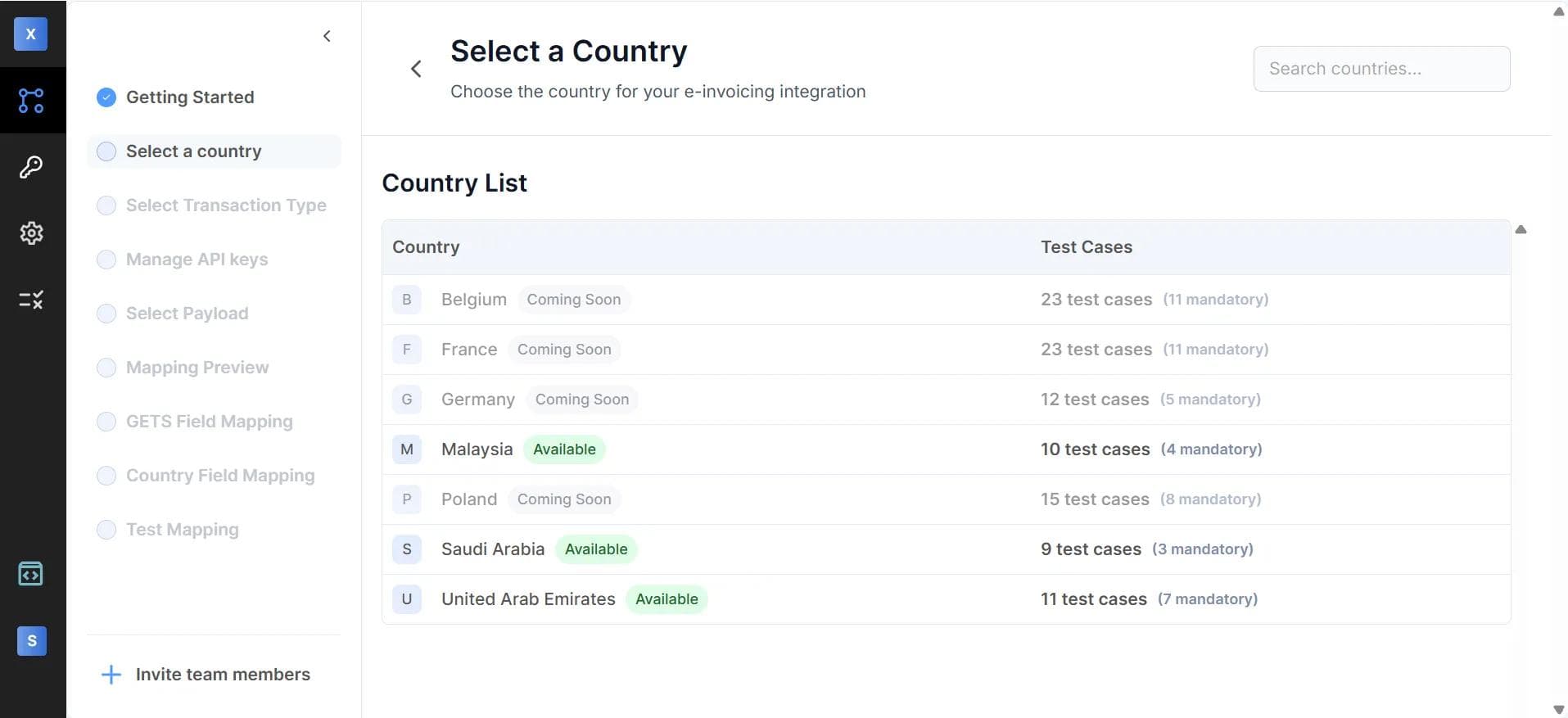

Step 2: Select Your Country

Click on “Select a Country” from the left menu and choose United Arab Emirates (AE).This will load UAE-specific regulatory requirements (e.g., PINT-AE) into your integration flow.

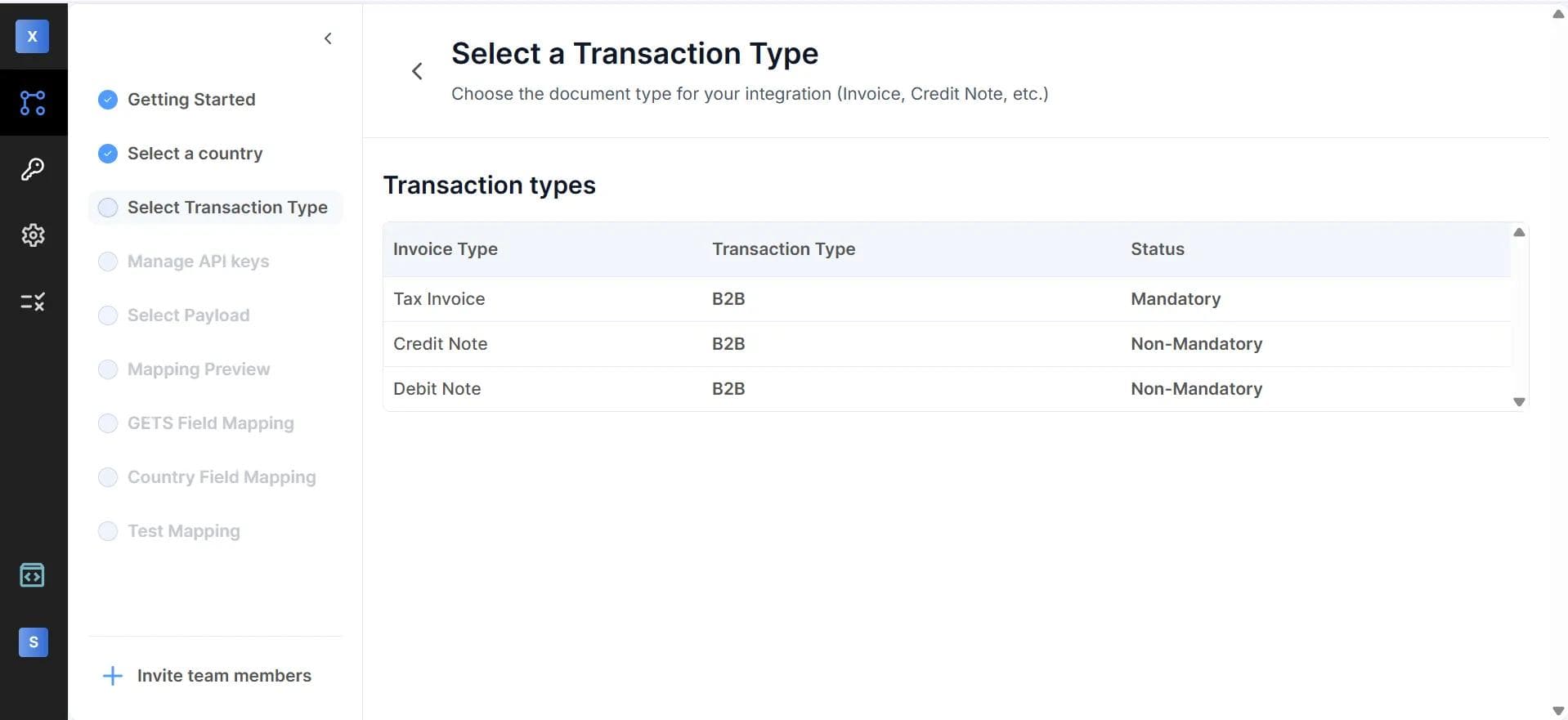

Step 3: Choose Transaction Type

In the next step, “Select Transaction Type”, you’ll choose the type of invoice you want to send.

Options include:

| Invoice Type | Transaction Type | Status |

|---|---|---|

| Tax Invoice | B2B | Mandatory |

| Credit Note | B2B | Non-Mandatory |

| Debit Note | B2B | Non-Mandatory |

You can select one or multiple types based on your use case.

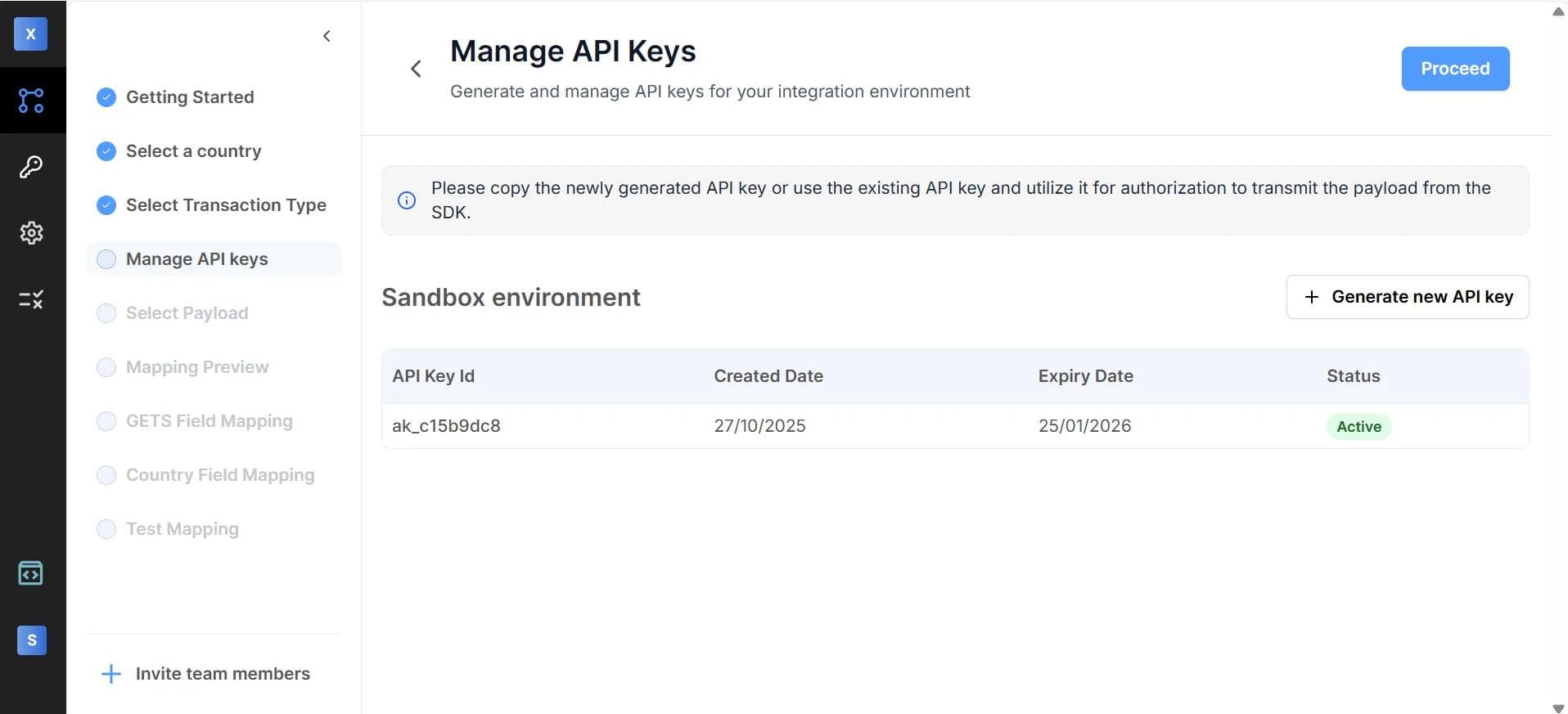

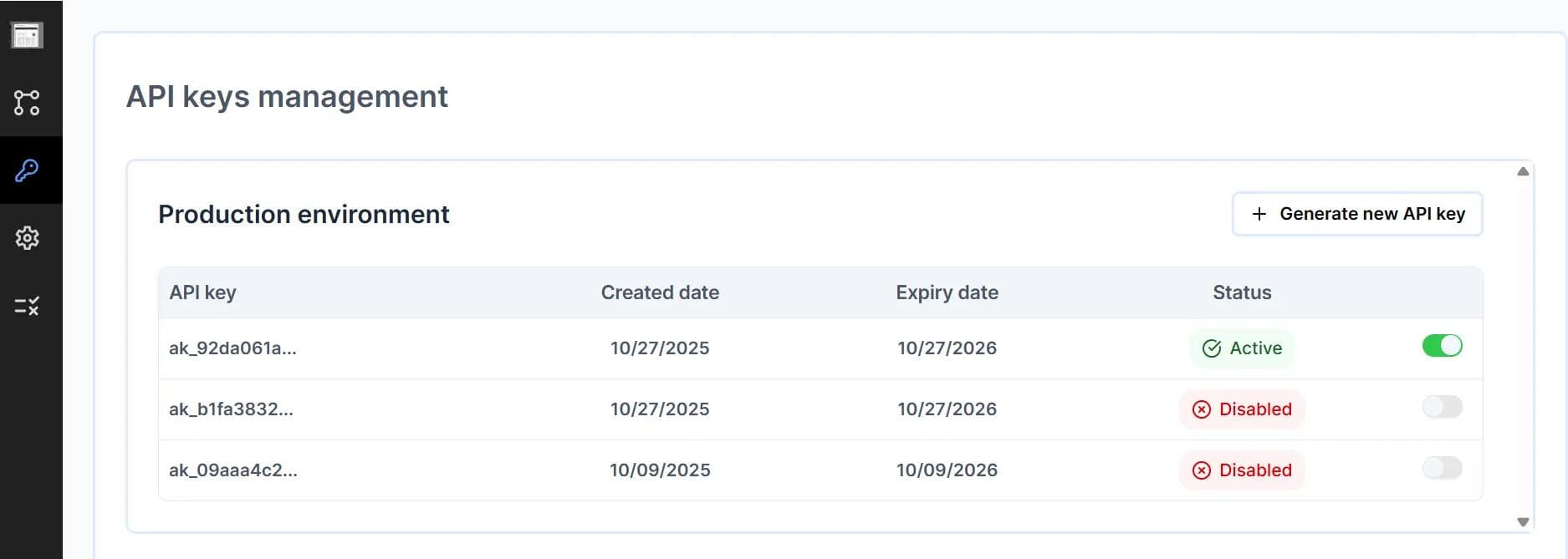

Step 4: Generate API Keys (Sandbox)

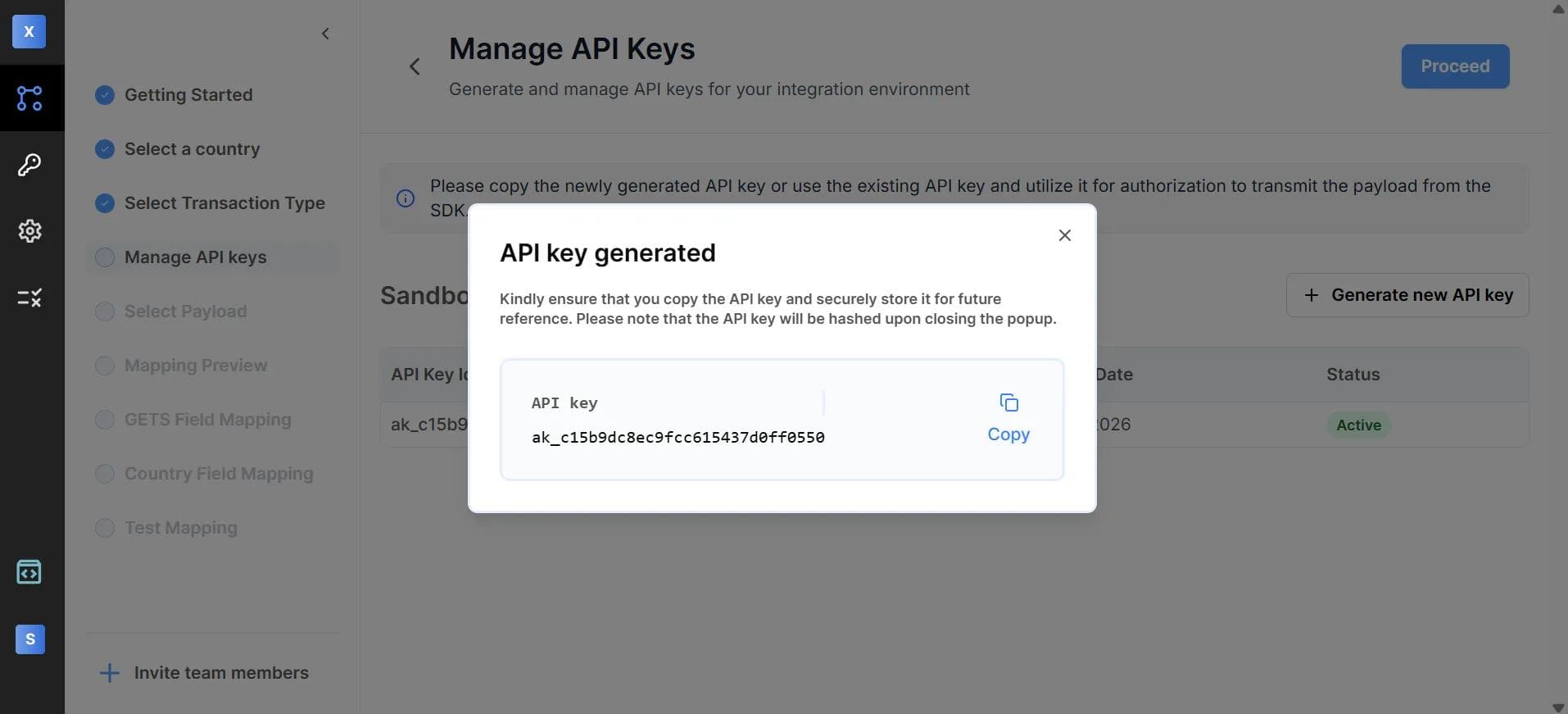

Now head to “Manage API Keys” and click Generate new API key under the Sandbox Environment.

A secure key will be created and shown in a pop-up.

Important: Copy this key immediately, as it won’t be shown again.

You’ll use this key to authenticate all API calls from your ERP or backend system during testing.

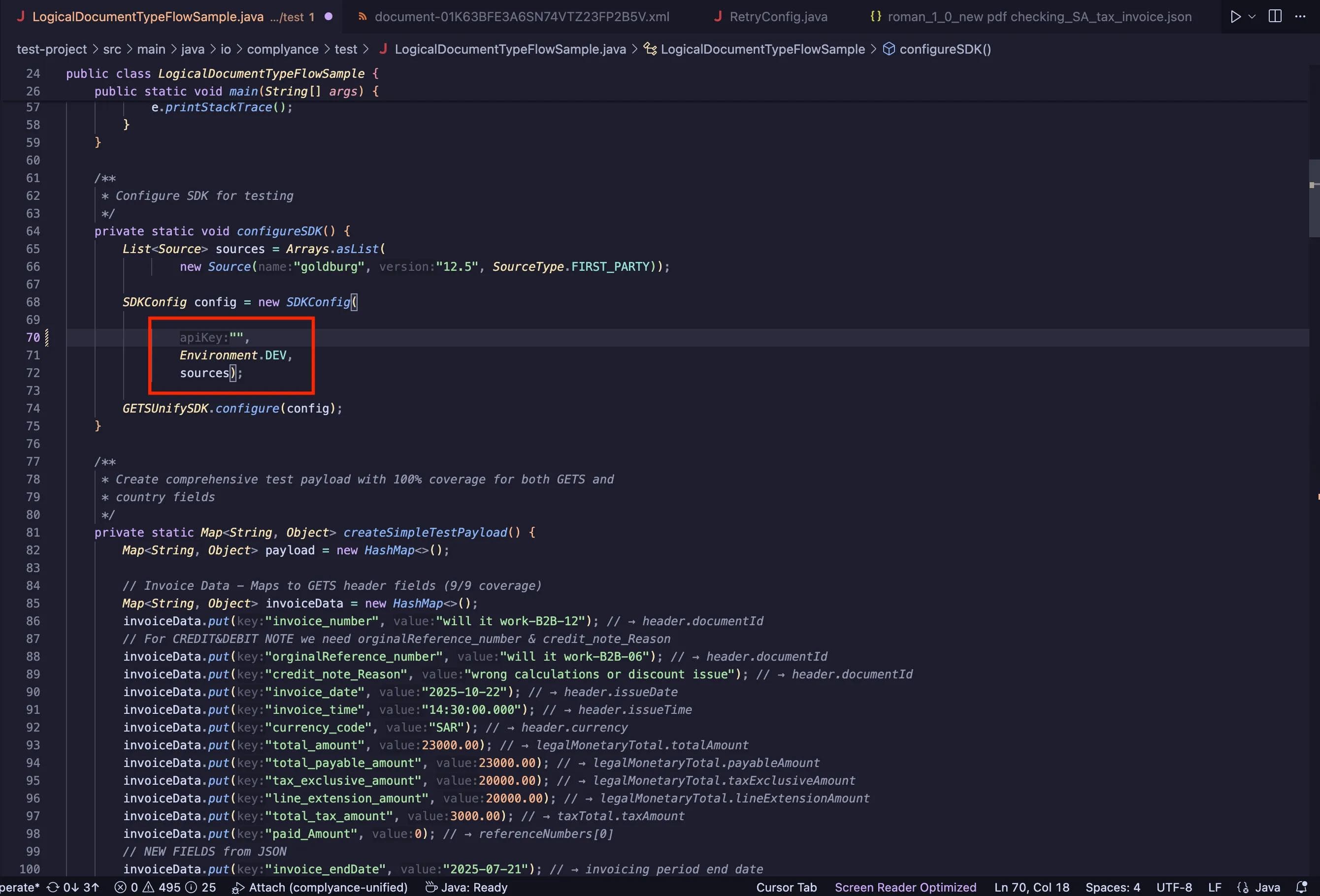

Once you generate your sandbox API key from the Complyance dashboard:

Paste the API key here and then run it.

After that, you can see the payload in the “Select Payload” screen.

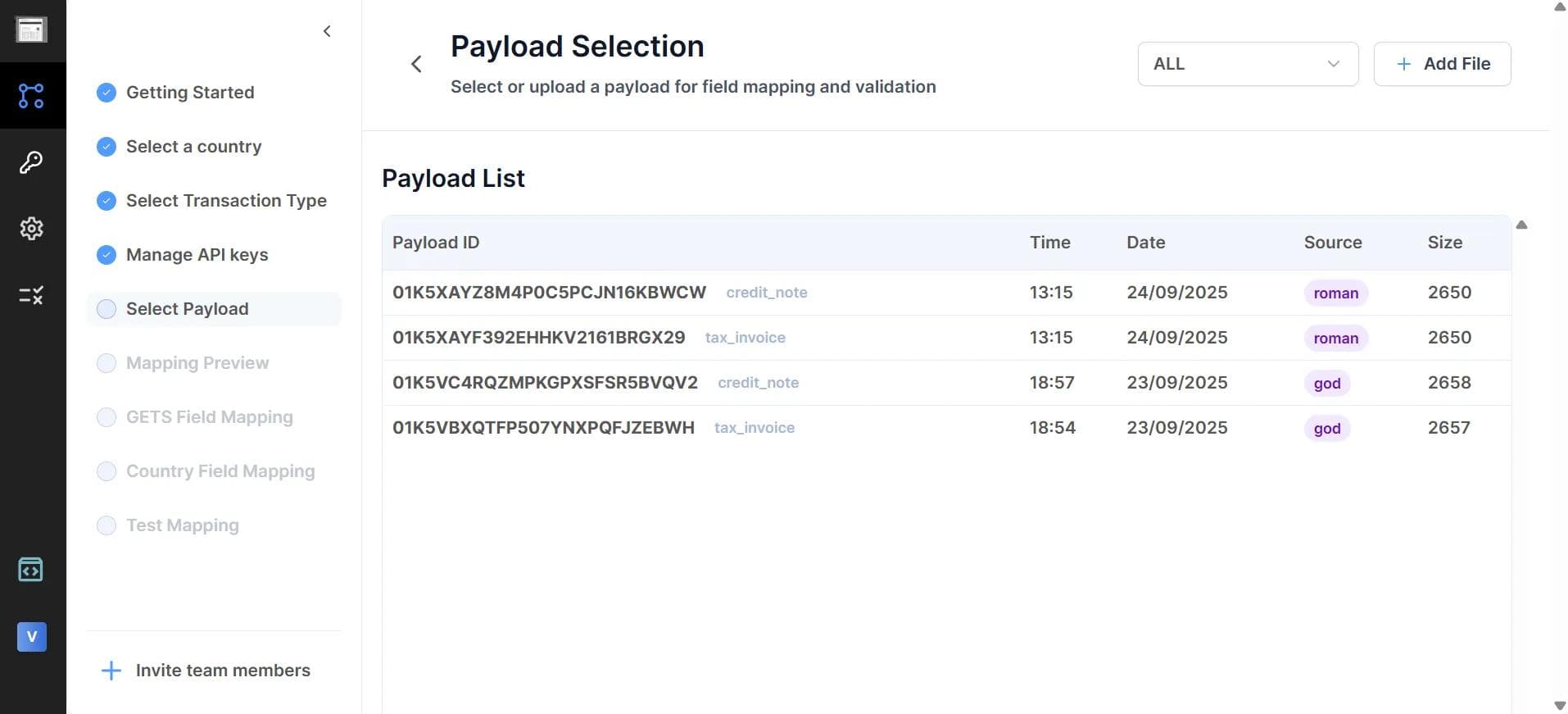

Step 5: Upload or Select Payload

In the Payload Selection screen:

- Choose an existing test payload or upload your own

.json - Each payload is tied to a document type like

tax_invoiceorcredit_note - Payloads are used to map fields during GETS integration

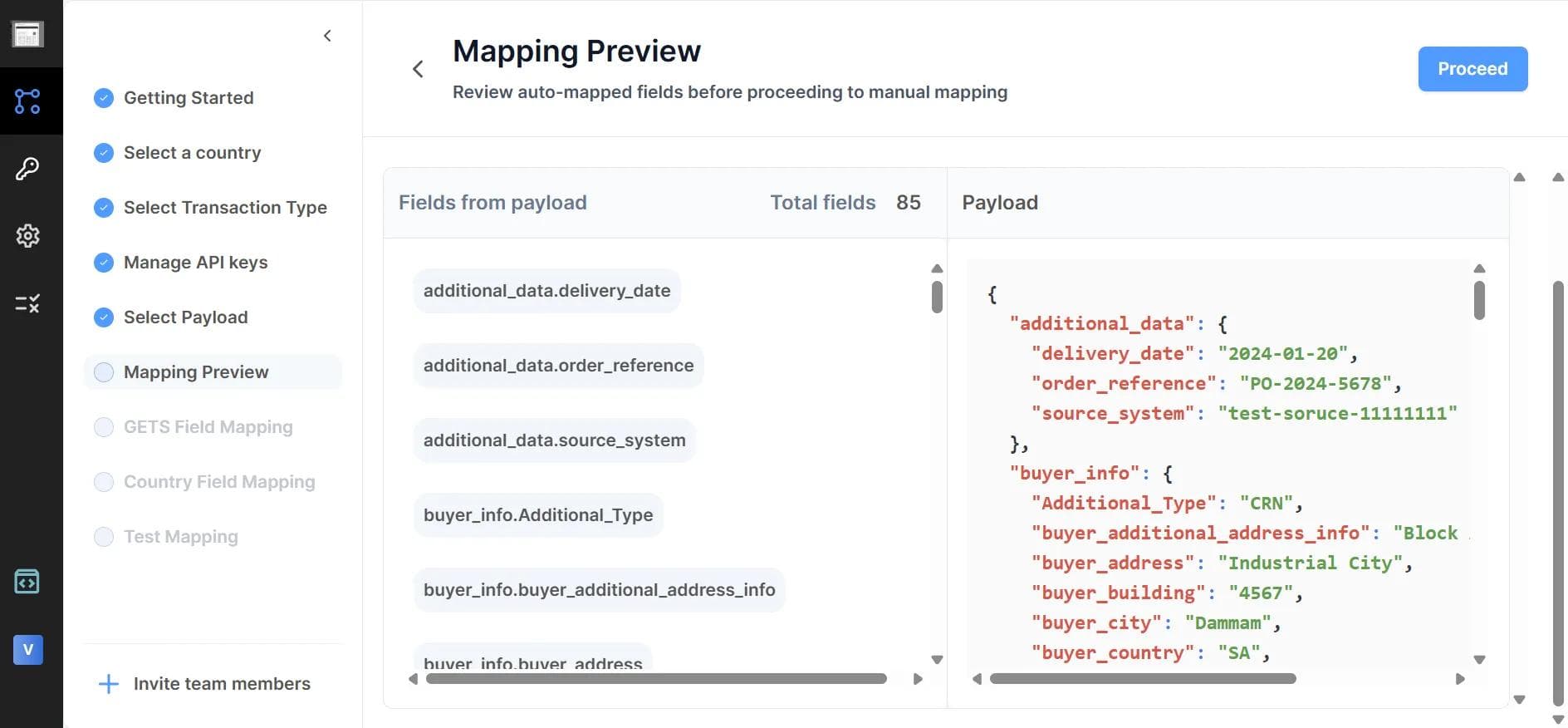

Step 6: Preview Mapping

The Mapping Preview screen auto-detects the structure of your uploaded payload.

- On the left: Field names from your JSON

- On the right: Raw payload content for verification

This allows you to verify that your ERP export is structured correctly before proceeding.

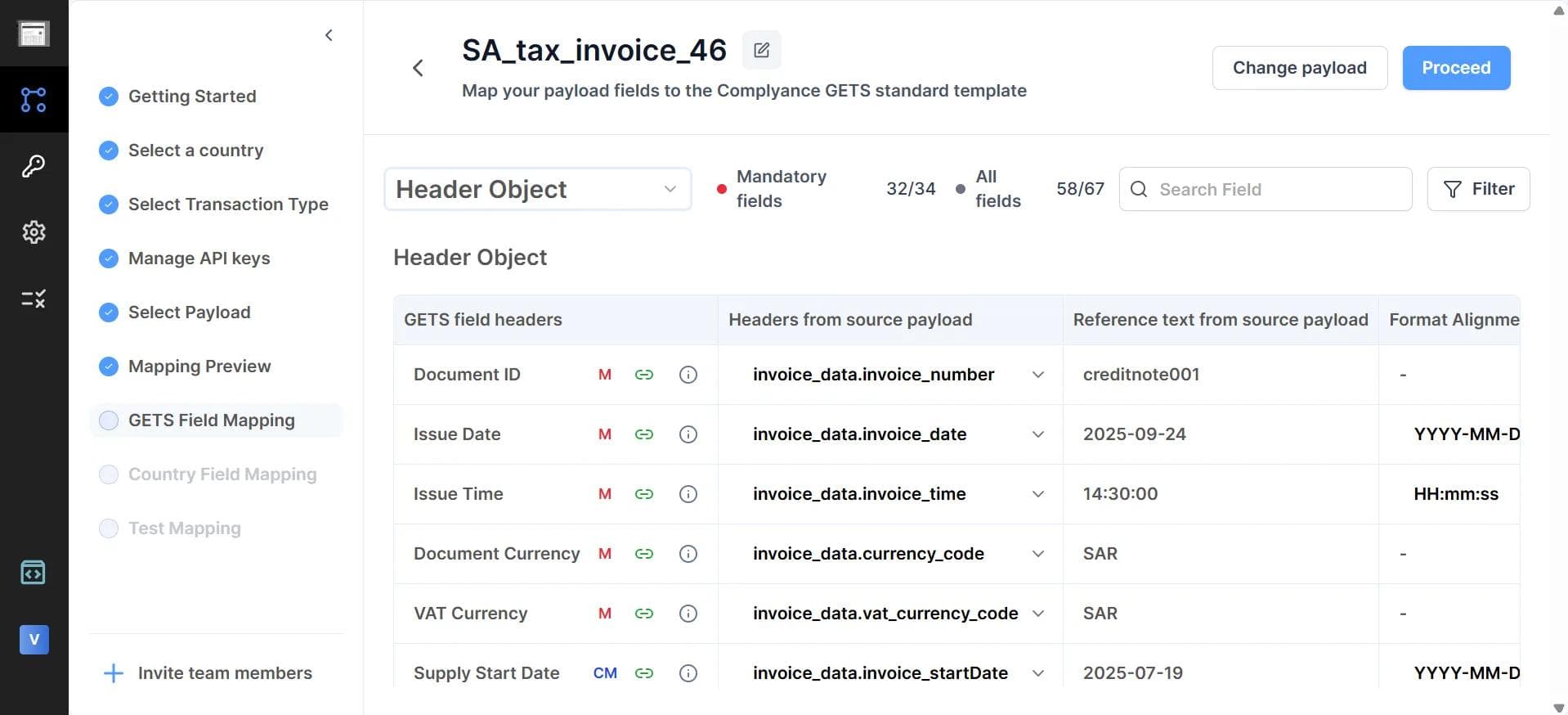

Step 7: GETS Field Mapping

GETS (Global E-Invoicing Transformation Standard) will auto-map your payload fields to the UAE's PINT-AE schema.

Here, you can:

- Review each source field (like

buyerTRN,invoiceAmount, etc.) - Confirm how it maps to the FTA-required XML structure

- Use auto suggestions to auto-correct mismatches

This step ensures your data is always formatted correctly for validation.

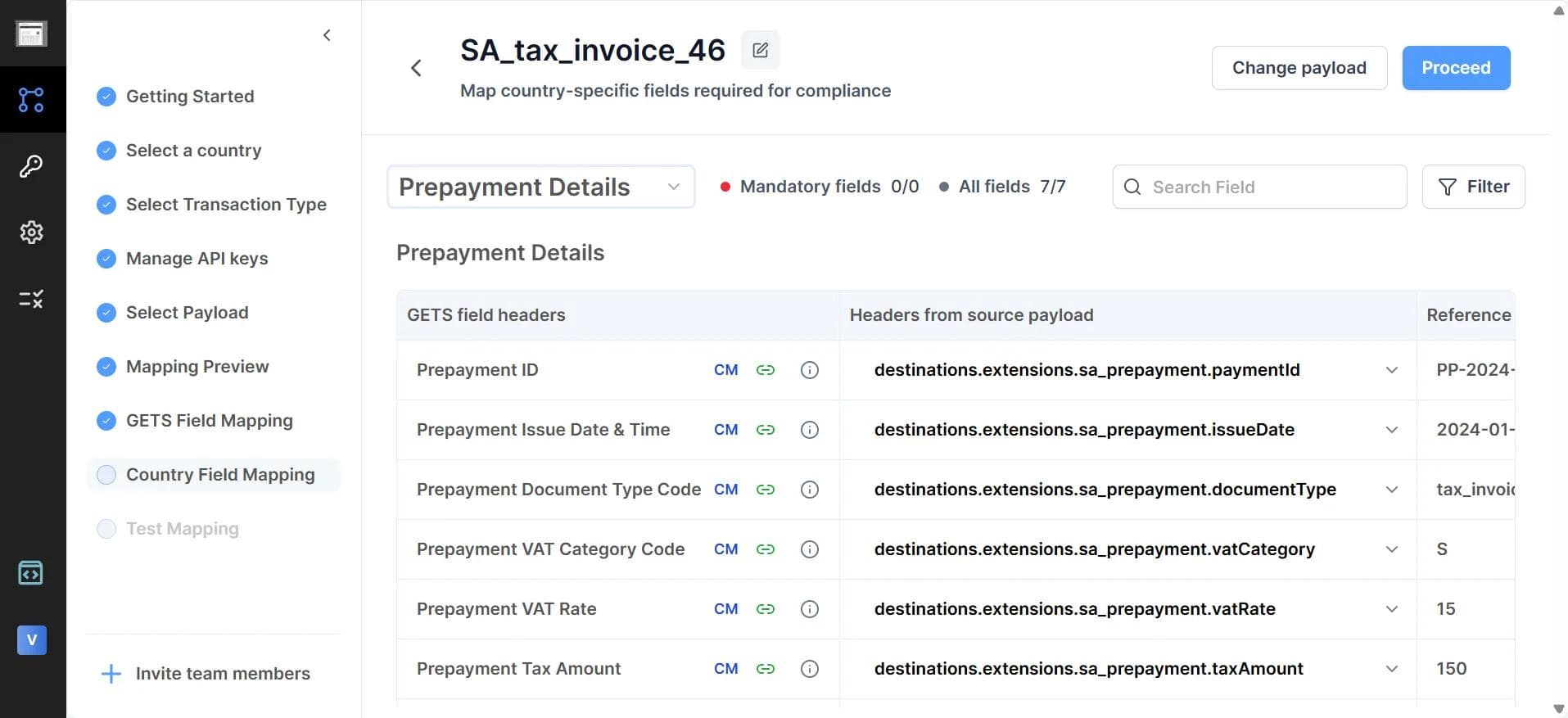

Step 8: Country-Specific Field Mapping

In Country Field Mapping, you’ll handle additional UAE-specific rules, such as:

- Mandatory tax classifications

- Required string formats (e.g., 15-digit TRNs)

- Field validations (e.g., decimal formats, VAT code matching)

Complyance ensures your invoice meets PINT-AE specs automatically.

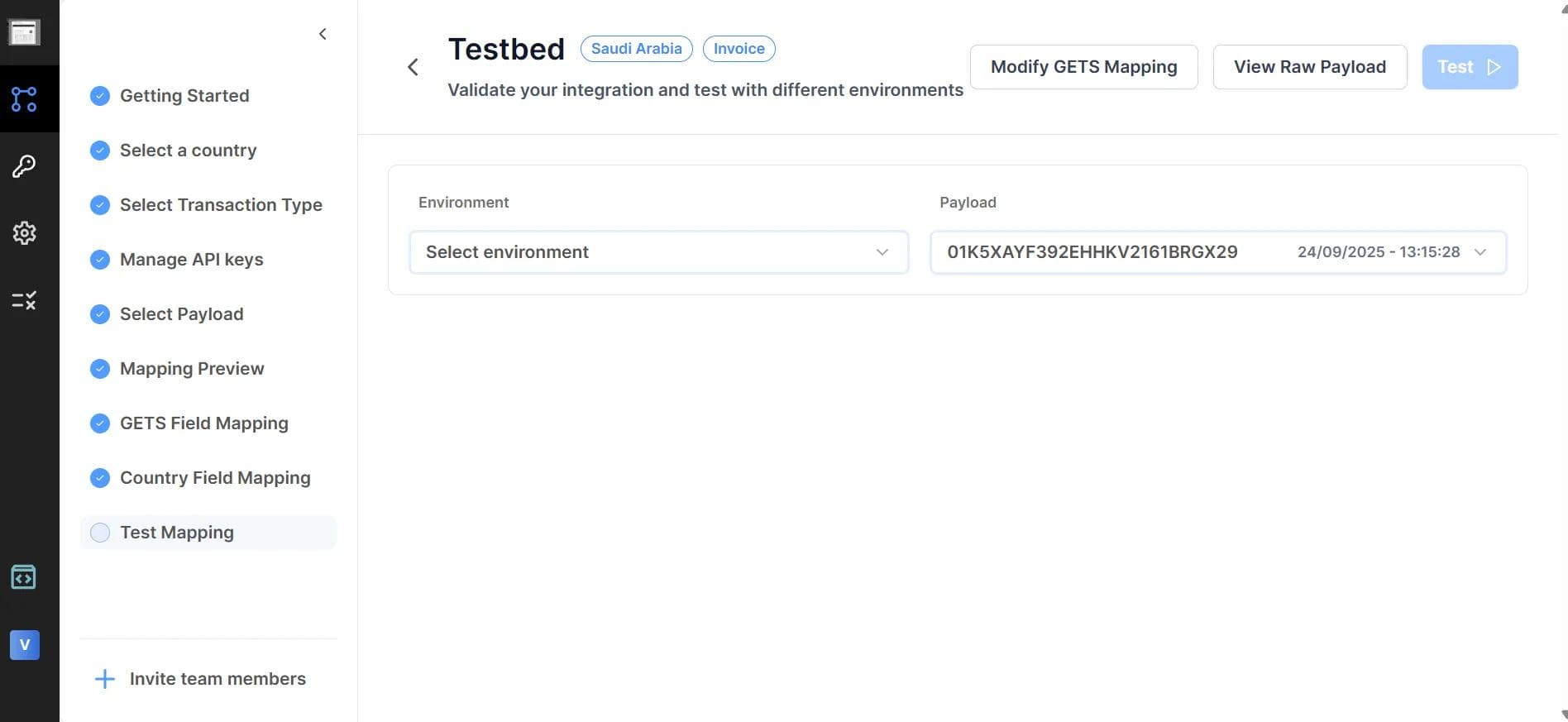

Step 9: Test Your Mapping

This is your final stop before production.

- Choose your payload

- Select the environment (e.g., UAE Sandbox)

- Click Test to run validation

The system will check:

- If all required fields are mapped

- If the data matches the correct formats

- If the output structure matches the UAE PINT-AE specification

You’ll get real-time feedback to fix any last-mile issues.

Step 10: Go Live in Production

Once testing is successful:

- Switch your environment from Sandbox to Production

- Generate a new Production API Key

- Start submitting real, compliant invoices directly to the UAE tax authority

Your invoices are now digitally signed, validated, and submitted in real-time.

Real-Time Monitoring

Your dashboard shows:

🟡 Pending — Waiting for FTA response

✅ Validated — Passed GETS checks, ready to send

🟢 Cleared — Approved by FTA

❌ Rejected — Issues flagged (with clear reasons shown)

You can also export signed XMLs or PDFs, view audit logs, and track submission stats.

Summary: What You’ve Set Up

| Step | Purpose |

|---|---|

| Country Selection | Load UAE-specific schema & rules |

| Transaction Type | Choose invoice type (B2B, Credit, Debit) |

| API Key Generation | Authenticate ERP-to-Complyance connection |

| Payload Selection | Upload ERP sample for mapping |

| GETS Mapping | Auto-map your fields to UAE’s PINT-AE format |

| Country Mapping | Apply local rules and validations |

| Test Mapping | Simulate end-to-end invoice flow |

| Go Live | Activate live submissions to FTA |

While API integration is the most robust and scalable method, especially for businesses with multiple ERP systems, we also offer two additional options for teams who prefer a simpler, more manual approach.

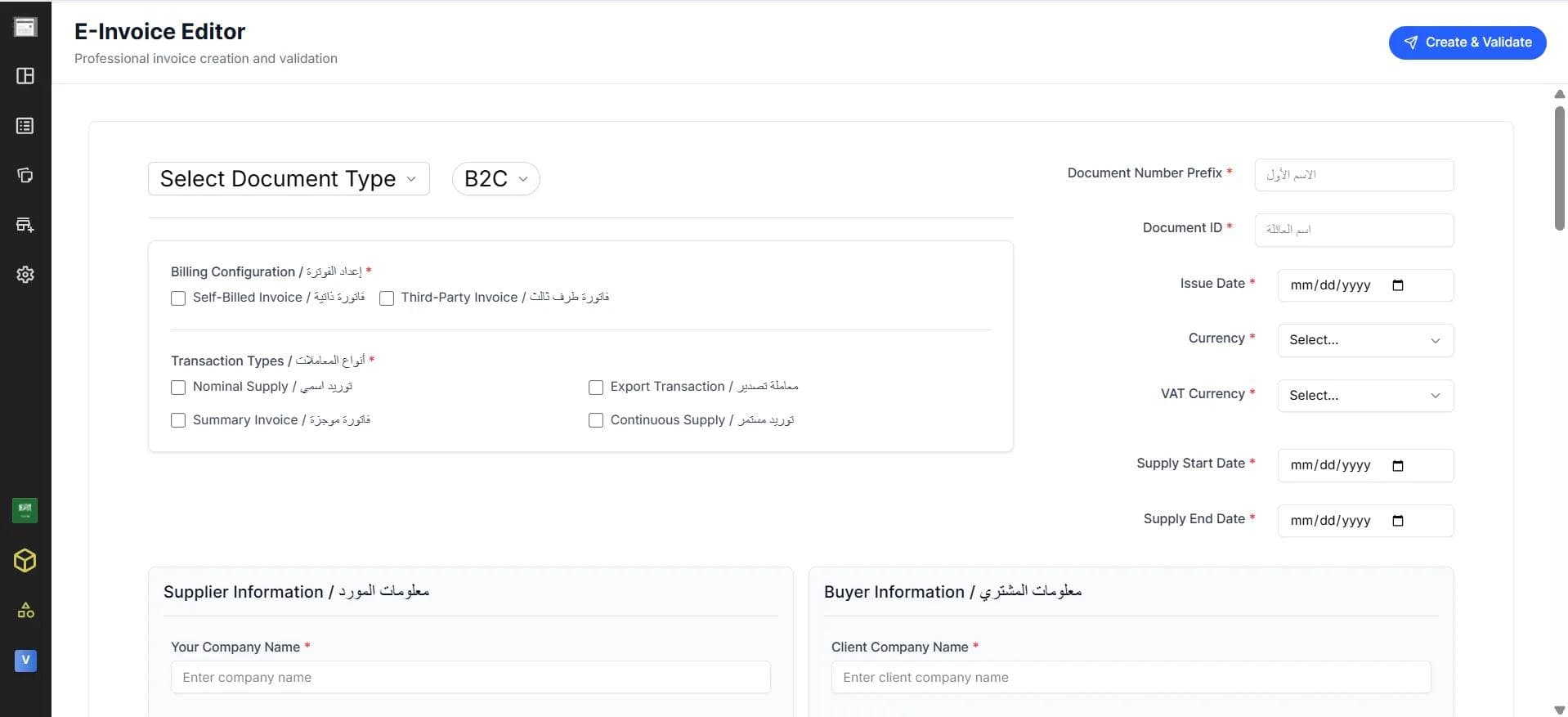

Option A: Manual Input (Best for Small Businesses)

If you're a small business issuing only a few invoices each week, you can create invoices directly in the Complyance platform without any technical setup.

Here’s how it works:

- Log in to your Complyance workspace

- Click the "Create Invoice" button

- Fill in key fields such as TRN, customer name, item details, VAT, and total amount

- Click "Validate" to check for errors, then hit "Submit" to send

This method is ideal for testing or businesses without any ERP systems in place.

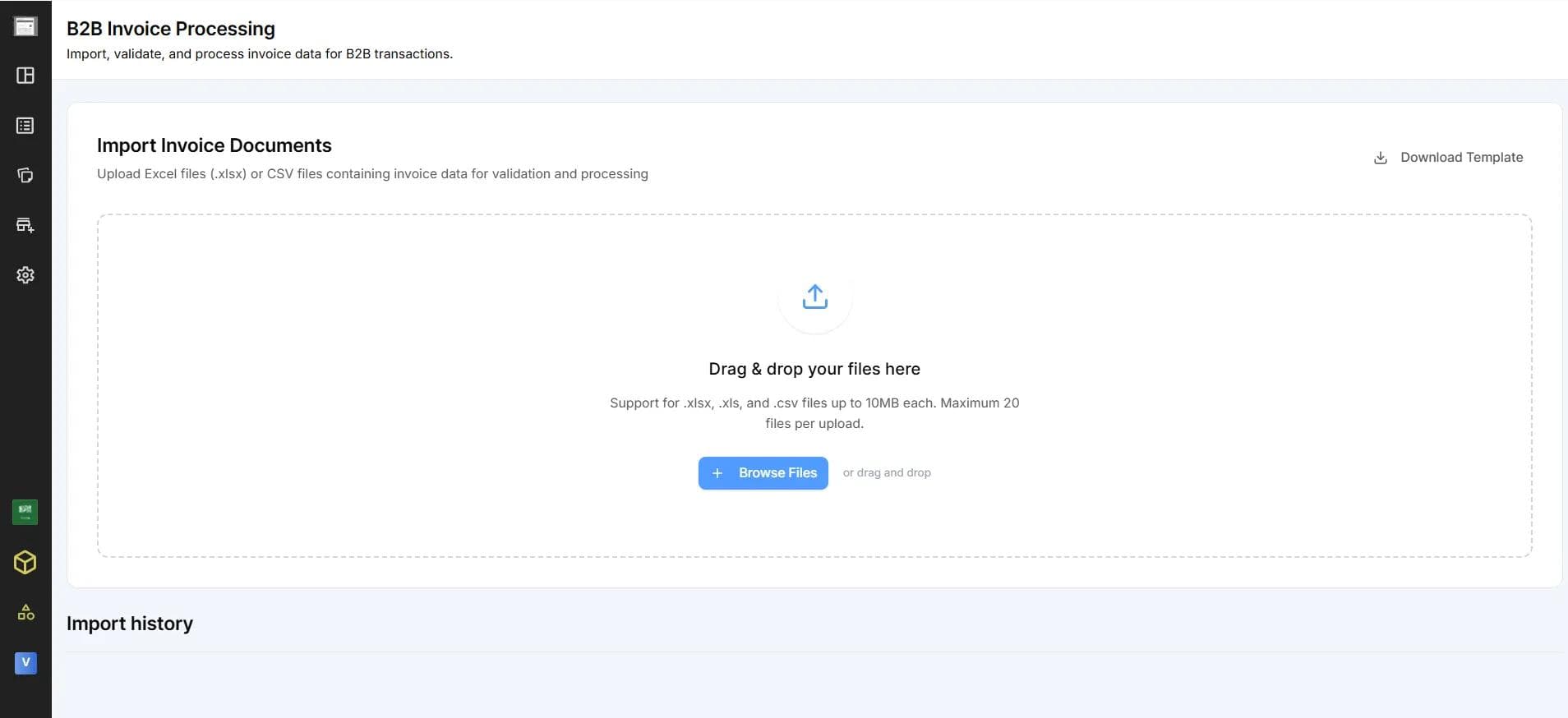

Option B: Excel Upload (Best for Growing Teams)

For the teams that already manage invoices in spreadsheets, the Excel Upload option offers a convenient way to process many invoices at once.

Here’s the process:

- Download the pre-formatted Excel template from your Complyance dashboard

- Fill in all invoice rows with the required details

- Upload the completed sheet back to the platform

- Complyance auto-validates each entry, showing clear errors (like missing TRNs or VAT mismatches)

Bonus: Smart dropdowns and data validation in the template help reduce manual mistakes while preparing the sheet.

Common Challenges That Businesses Face and How Complyance Solves Them

| Challenges You Might Face | How Complyance Helps You |

|---|---|

| Making mistakes when typing in Excel. | Pre-filled dropdowns and instant validation catch errors before you upload. |

| Most invoice data is structured differently across ERPs or Excel files, making manual mapping time consuming and error prone. | GETS automatically maps your existing invoice fields (like TRN, tax amounts, line items) to the correct government-required structure, reducing friction and mistakes. |

| Invoices get rejected for unclear reasons. | Our dashboard gives you detailed error messages with tips on how to fix them. |

| The government changes its technical requirements. | GETS is updated automatically, so your invoices are always compliant. |

| You need to manage invoices in multiple countries. | One Complyance integration works for over 100 countries. |

Final Tips for a Smooth Rollout

Follow these best practices for a stress-free experience:

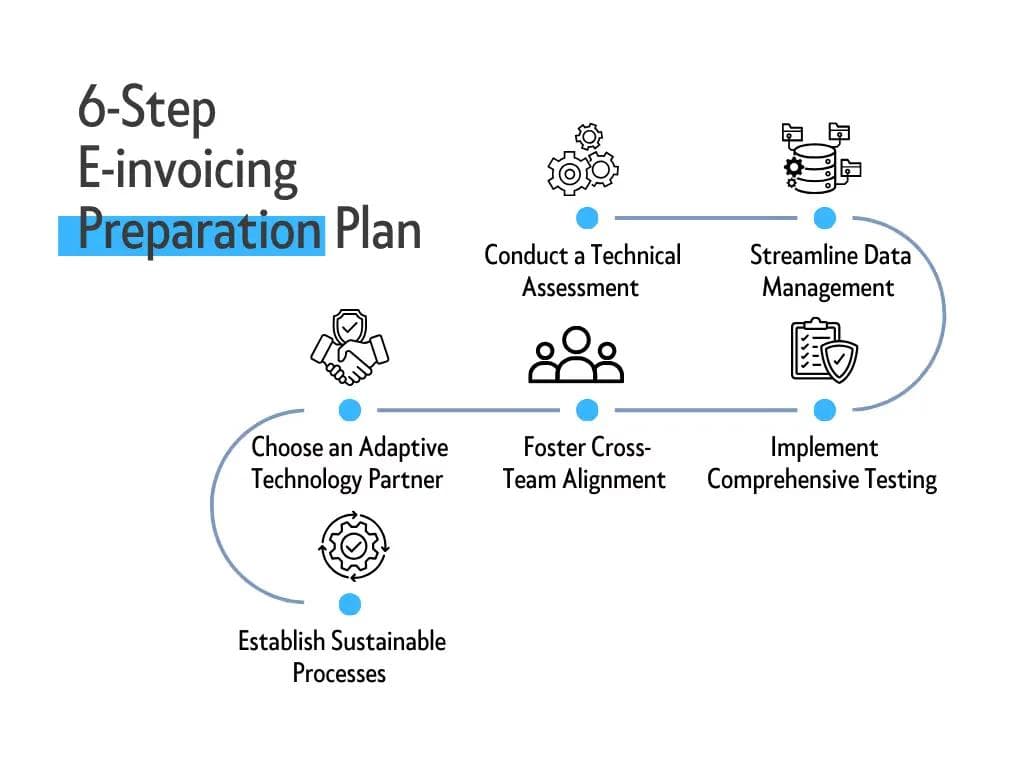

- Conduct a Technical Assessment: Begin by evaluating your current billing software's capability to generate FTA-compliant invoices. Complyance's API solution integrates seamlessly with your existing systems, ensuring automatic generation of compliant XML files without requiring system replacements or major overhauls.

- Streamline Data Management: Data accuracy is fundamental to successful implementation. Our platform includes automated validation tools that verify TRN authenticity and data completeness in real-time, significantly reducing errors before submission and ensuring smooth data transmission to the FTA.

- Choose an Adaptive Technology Partner: As your dedicated ASP, Complyance provides more than just software; we offer a partnership built on continuous regulatory adaptation. Our cloud-based solution automatically updates to meet evolving FTA requirements, ensuring ongoing compliance without additional development costs or efforts.

- Foster Cross-Team Alignment: Successful preparation requires organizational alignment. Complyance supports this through customized training programs and clear documentation tailored for finance, IT, and tax teams. We ensure all stakeholders understand their roles within the new e-invoicing framework.

- Implement Comprehensive Testing: Utilize Complyance's testing environment to simulate the complete invoice lifecycle, from creation to submission and exception handling. This sandbox environment allows you to identify and resolve issues before going live, ensuring a confident transition to the new system.

- Establish Sustainable Processes: Complyance provides ongoing support and documentation to help formalize your e-invoicing workflows. We help you develop clear procedures for daily operations, error resolution, and compliance maintenance, ensuring long-term success beyond implementation.

How ERP, POS, Accounting, and Billing Systems Use Complyance, The Flexible UAE E-Invoicing Platform

Whether you're managing a multi-entity ERP setup or running retail operations with a POS system, Complyance is the e-invoicing software built to meet you where you are. As one of the best e-invoicing providers in the UAE, we offer multiple integration options, through our e-invoicing API, Excel upload, or manual portal, so any business can go live fast.

ERP Platforms (SAP, Oracle, Microsoft Dynamics, Epicor, etc.)

For enterprises using advanced ERP systems, Complyance acts as a plug-and-play e-invoicing platform with SDKs and a unified e-invoicing API that connects all invoice flows across your business units and countries.

Who it's for:

- Multinational companies with group-level ERP setups

- Enterprises managing multiple VAT registrations

- Organizations using multiple ERP systems (SAP + Oracle + custom) under one umbrella

- Internal finance, tax, and IT teams handling invoice compliance

How it works:

- Connect each ERP to Complyance through our developer-first e-invoicing API

- Our GETS engine auto-converts invoice data into the PINT-AE XML format

- The platform validates, signs, and submits invoices to the FTA from one central point

- Each ERP environment gets its own workspace for audit control and compliance tracking

- Real-time dashboards consolidate status from all ERPs in one place

Industries:

- Manufacturing

- Logistics & Shipping

- Retail & E-commerce

- Healthcare

- Consumer Industries

Bonus: Hybrid ERP environments (e.g., SAP + custom billing) can still manage UAE e-invoicing centrally through one API and dashboard.

POS Systems (Retail, F&B, Hospitality)

Complyance is also the ideal e-invoicing software for retailers and restaurants using POS systems. We help you convert printed POS receipts into structured XML invoices ready for real-time submission to the FTA.

Who it's for:

- Supermarkets and retail chains

- Cafés and food delivery platforms

- Hotel front desks and hospitality billing

How it works:

- Connect POS invoice exports to Complyance via Excel or our e-invoicing API

- Auto-generate XML invoices with digital signatures

- Send them directly to the FTA using our accredited e-invoicing provider network

Industries:

- Electronics and apparel chains

- Quick service restaurants (QSRs)

- Hotels and resorts

Bonus: Supports real-time and batch-mode invoice submissions across outlets.

Accounting Software (Tally, QuickBooks, Xero, FreshBooks, Refrens)

Complyance helps businesses using accounting tools meet UAE e-invoicing rules easily, without replacing their existing setup. It’s the best e-invoicing software for small and medium teams that want simplicity and accuracy.

Who it's for:

- SMEs using cloud or desktop accounting tools

- Service firms with minimal IT involvement

- Internal accountants managing invoice compliance

How it works:

- Export invoice data from your accounting tool

- Upload via our smart Excel template or connect via API

- Validate and submit to FTA instantly through our e-invoicing platform

Industries:

- Professional services

- Law firms

- Creative and marketing agencies

Bonus: Downloadable Excel templates include smart validations for TRNs and VAT.

Custom Billing Systems (SaaS, Marketplaces, Aggregators)

If you’ve built your own billing logic, Complyance gives you the flexibility to connect via our SDKs and powerful e-invoicing API. It’s the go-to solution for platforms issuing thousands of invoices every day.

Who it's for:

- Product-led SaaS companies

- Marketplaces and aggregators handling vendor billing

- Logistics or fintech platforms scaling fast

How it works:

- Use our Java SDK (with Python/JavaScript coming soon)

- GETS maps your invoice structure into the UAE’s PINT-AE XML

- Invoices are validated, signed, and submitted automatically

- Track every submission with full logs and API responses

Industries:

- SaaS platforms

- Gig and delivery platforms

- ERP-lite and vertical SaaS tools

Bonus: Built-in staging and testing dashboard to simulate full e-invoicing flows.

Whether you use an accounting tool, POS system, ERP, or custom billing stack, Complyance is the e-invoicing platform that fits right into your workflow. You don’t need to change how you operate. Our flexible e-invoicing software connects with any system through a single API or Excel upload. With real-time dashboards, validation tools, and automated compliance checks, Complyance gives every business unit one place to manage its invoices. If you're looking for the best e-invoicing provider to simplify UAE compliance, you've found it.

Conclusion: Simple, Fast, and Ready for the Future

UAE e-invoicing doesn't have to be a complicated task.

With Complyance, you get a single, powerful platform that handles creation, validation, and submission for you. Our tools are designed for everyone, from someone typing in a single invoice to a developer building a fully automated system.

You can track your invoices in real-time and rest easy knowing the platform updates itself with the latest regulations.

No matter the size of your business, Complyance is built to support you. And if you ever need help, our friendly support team is just a message away.

[Start your e-invoicing compliance journey today at one.complyance.io]

Related posts

Frequently Asked Questions

E-invoicing is the digital exchange of invoices in a machine-readable format like XML instead of PDFs or paper, which allows businesses to send automated, real-time tax reporting to government authorities like Federal Tax Authority (FTA).

The UAE FTA requires invoices in PINT-AE XML format, based on the Peppol BIS 3.0 standard with UAE-specific extensions.

Complyance’s API automatically converts your internal data into this approved structure without manual effort.

Yes, all invoices must include a certified digital signature.

No. You must use an accredited service provider (ASP)

Most teams go live within one week using the Java SDK and sandbox environment. Smaller teams using manual or Excel upload can start issuing compliant invoices on the same day.

Yes. Complyance is a global e-invoicing API platform, already supporting mandates in KSA, Malaysia, Belgium, Singapore, and other regions.

You can manage all countries under a single workspace, with GETS handling local schema differences automatically.

You can start by signing up at one.complyance.io.

Create your workspace, choose “United Arab Emirates” as your country, and begin testing in the sandbox environment immediately.

Our team will assist you throughout your setup and go-live process.

Yes. You can create and manage multiple entities within one account.

Each entity can have its own TRN, invoice series, and data mapping, perfect for groups or holding companies operating across regions.

Complyance uses end-to-end encryption (AES-256), digital signatures, and secure hosting to protect your invoice data.

All submissions are logged, signed, and auditable, meeting enterprise-grade security and compliance standards.

GETS (Global E-Invoicing Transformation Standard) is Complyance’s unified mapping layer. It standardizes invoice data from any ERP, automatically adapting it to country-specific schemas like PINT-AE, MyInvois (Malaysia), or BIS (Belgium). This means one API integration can handle multiple countries effortlessly.

Integration is simple through the Complyance Java SDK (with Python, JavaScript, and C++ support coming soon).

You can connect your ERP, send test payloads, and go live in less than a week. Developers can access all guides and schema documentation directly from the Developer Portal inside the Complyance dashboard.

Yes. Complyance offers Manual Invoice Entry and Excel Upload options for small and medium businesses that don’t use ERP systems. You can create, validate, and submit invoices directly from the Complyance dashboard — no coding required.

Complyance is designed for both developers and finance teams. It offers:

- AI-powered auto-mapping and validation

- Real-time error correction

- Sandbox testing and audit logs

- Multi-country support via a single API

- Always-up-to-date compliance with FTA rule changes

Subscribe to our Newsletter

Get the latest compliance updates, e-invoicing news, and expert tips delivered to your inbox.

ABOUT COMPLYANCE

Empowering businesses to automate e-invoicing and stay compliant in 100+ countries. Our platform simplifies regulatory complexity for enterprises and fast-growing companies.