Top 5 E-Invoicing Solutions for ERP companies

Compare the top global e-invoicing solutions for ERP companies. See how single API helps ERPs manage multi-country compliance, reduce development effort, and unlock new revenue streams.

Table of Contents

For ERP companies that cater to global customers or are expanding internationally, managing e-invoicing can be a nightmare. Different countries, different regulations, and a constant need for updates, it’s an overwhelming task that can stretch your resources thin.

Here’s the good news: you don’t have to build multiple solutions or custom modules for every new market. With the right E-invoicing solution partner, a single integration can handle e-invoicing across multiple countries—saving you time, money, and headaches. Your ERP becomes the one-stop shop for global e-invoicing compliance, reducing the burden on your internal teams while giving you the ability to resell this feature to your customers.

But what does this partnership actually look like in practice? Let's break down exactly how a modern E-invoicing solution partner tackles the specific operational challenges that keep ERP teams up at night.

Note: What is e-invoicing? It is a structured form of invoice data that is issued and exchanged electronically between a supplier and a buyer and reported electronically to the UAE Federal Tax Authority.

The Top 5 Global E-Invoicing Solutions for ERPs

| Solution | Best For |

|---|---|

| Complyance | Best Global E-Invoicing with a single Developer-Friendly API |

| Pagero | Best for Global B2B Network and Peppol Connectivity |

| Avalara | Best Integrated Tax Compliance and E-invoicing Suite |

| EDICOM | Best for EDI Integration and Security-Focused Archiving |

| Sovos | Best for Large Multinationals with Complex Compliance Needs |

The Core Challenges an E-invoicing Partner Solves for Your ERP

Integrating with an E-invoicing partner isn't just about transmitting data; it’s about solving the operational roadblocks that overwhelm your development team. While understanding E-invoicing from a technical perspective is important, navigating its complexities from a tax and compliance standpoint requires expertise that most ERP companies lack.

This often means relying on in-house tax teams or hiring costly experts. Additionally, obtaining accreditation in countries where it’s mandated and meeting the compliance requirements to be recognized as an ASP(Accredited Service Provider) can be time-consuming and expensive. These are all challenges that ERP companies don’t need to worry about. With the right E-invoicing partner, you can focus on your core product development while leaving global e-invoicing, compliance, and accreditation to the experts.

Here’s how a robust E-invoicing partner addresses the specific problems you face:

| Challenge | The ERP Problem | The E-invoicing partner Solution |

|---|---|---|

| Multi-Country Complexity | Your business is growing across borders, but each country has its own e-invocing dialect. Building and maintaining separate integrations for the UAE, Saudi Arabia, and malaysia is a developer's nightmare. | A Global E-Invoicing API provides one unified connection point. Your ERP sends data in a standardized format, and the E-invoicing partner translates it for each country's requirements, simplifying global expansion. |

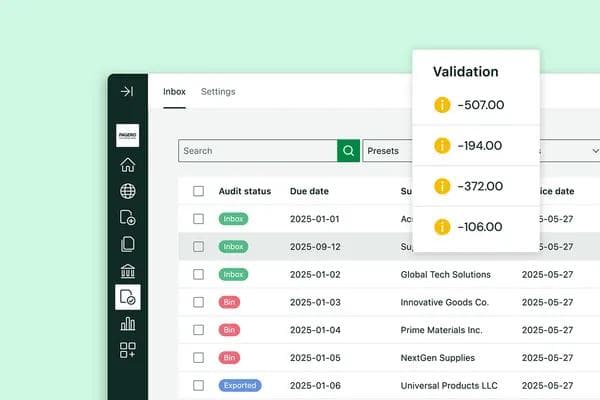

| Costly E-invoicing Errors | An invoice rejected by the FTA due to a tiny error means manual correction, delayed payments, and potential penalties. Your team is left guessing what went wrong. | Advanced E-Invoicing Validation checks every invoice against live FTA rules before it's sent. Combined with E-Invoicing Error Guidance that provides smart tips, it turns a frustrating doubt into a simple fix, ensuring clean submission on the first try. |

| Clunky Integration & Mapping | Mapping your internal ERP data fields (e.g., CUST_CODE) to the mandated government fields (e.g., BuyerReference) is a manual, time-consuming, and error-prone process for developers. | Auto-Field Mapping cutS integration time from weeks to days. A Developer Environment with sandbox testing allows for easy integration without disrupting live operations. |

| Brand Dilution & Rigid Systems | The e-invoicing process feels like a disconnected, third-party tool to your customers, missing your brand identity and creating a jarring experience. | Whitelabeling & Customization allow you to embed the entire invoicing journey within your own platform's look and feel, strengthening your brand and providing a seamless customer experience. |

| Peppol Compliance | Your B2B customers and government portals require Peppol e-invoicing, but your ERP lacks native support. Manually ensuring compliance with the Peppol network standards and managing recipient addressing (Peppol IDs) is complex and error-prone. | A Peppol-certified E-invoicing partner acts as your ready-made access point. It automatically formats invoices for the Peppol network, validates Peppol IDs, and ensures seamless, standards-compliant B2B document exchange across the globe. |

Now that we've seen how an E-invoicing partner can transform these challenges, the crucial question becomes: how do you identify the right partner from the many e-invoicing solution providers available?

Choosing Your Partner: What to Look For

With these challenges in mind, how do you choose an E-invoicing partner? Don't just look at the price tag. Evaluate them against these critical criteria.

| Priority Area | Key Questions to Ask | Why It Matters for Your ERP |

|---|---|---|

| Technical Integration | Do you offer pre-built connectors or a well-documented API for my ERP? Do you have an Auto-Field Mapping tool? | Saves months of development time and prevents costly technical debt. |

| Compliance Assurance | Do you offer pre-submission validation and automatic updates for Global mandates and E-invoicing rules?? | Eliminates manual compliance work and reduces the risk of penalties and rejected invoices. |

| Operational Control | Do you provide a customer management dashboard, a partner portal, and whitelabeling options? | Gives your team visibility and control while maintaining a seamless brand experience. |

| Global Scalability | Can your platform handle our expansion into other global markets through a single API? | Prevents the need to re-architect your entire e-invoicing setup for multiple countries. |

| Developer Experience | Do you provide clean API documentation, SDKs, and a full sandbox environment? | Reduces integration effort with structured documentation and clear error messages. |

| Implementation Speed | Can you provide prebuilt adapters and guided onboarding to go live in weeks, not months? | Gets your team operational faster with minimal disruption to existing workflows. |

Maximize Your ERP's Revenue Potential with Global E-Invoicing

Unlock new revenue opportunities by integrating e-invoicing into your ERP, with automatic updates and global compliance.

How Complyance Delivers on Each Solution

| Challenge | How Complyance Provides the Solution |

|---|---|

| Multi-Country Complexity | Our single, unified API connects your ERP to over 100 countries, including the EU, UAE, Saudi Arabia, and Malaysia. You send data once in a standard format, and our platform handles all the country-specific translations and compliance rules, eliminating the need for multiple integrations. |

| Costly E-invoicing Errors | We offer real-time, pre-submission validation that checks every invoice against the latest E-invoicing rules. Combined with our detailed error guidance, which pinpoints the exact field and issue, we ensure invoices are validated and corrected before they are officially submitted, preventing rejections and penalties. |

| Clunky Integration & Mapping | Our AI-powered Auto-Field Mapping Tool automatically suggests correlations between your ERP fields (like CUST_CODE) and government-mandated fields (like BuyerReference). This, combined with our full sandbox Developer Environment, allows your team to test and refine mappings, cutting integration time from weeks to just days. |

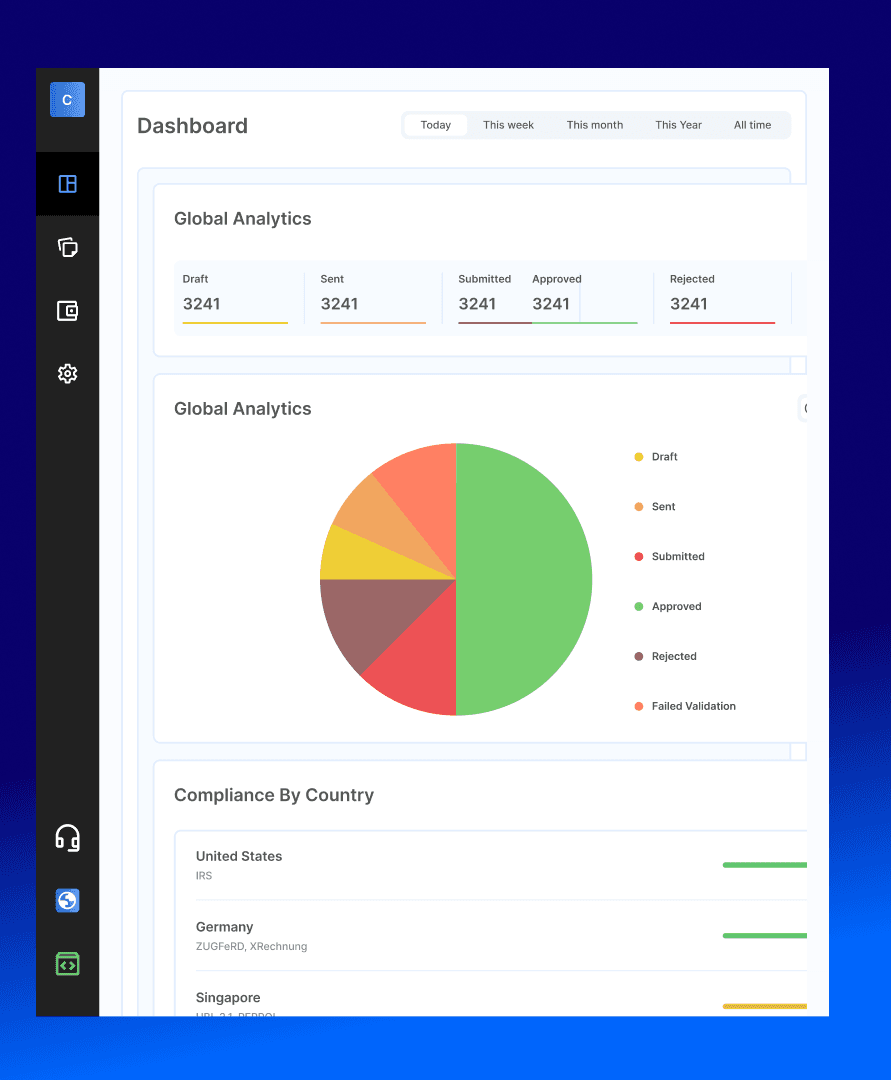

| Lack of Control & Visibility | The Complyance API Platform provides your team with real-time visibility into all your customers' e-invoicing activity, while ensuring customer data security and reliability, ensuring status updates are clear, immediate, and easily accessible. |

Armed with this evaluation framework, let's examine how the top players in the market actually measure up against these critical criteria.

Here is a detailed analysis of the leading providers, highlighting their specific value for ERP environments.

1. Complyance: for Best Global E-Invoicing with a single Developer-Friendly API

It focuses on a single, developer-first API for global e-invoicing compliance designed for rapid integration and scalability. Complyance is an Accredited Service Provider under the UAE e-invoicing framework. It features a single API for 100+ countries, a robust sandbox for testing, automated pre-submission validation, and tools to handle E-invoicing downtime, making it the best e-invoicing software for growing businesses.

Pros:

- Rapid Implementation: Known for fast go-live times, often within weeks.

- Developer-Centric: Excellent documentation, SDKs, and tools that significantly reduce integration effort.

- Built-in Resilience: Platform designed to handle external system outages without disrupting your operations.

- Cost-Effective for Global Needs: One API for multiple countries can reduce long-term development costs.

- 10x Faster Integration: Go live in days, not months, using the GETS framework with minimal rework across countries.

- Developer-Centric Excellence: Interactive docs with try-it-now functionality, SDKs, and a full sandbox environment.

- Unique Auto-Mapping Advantage: The platform features an AI-powered Auto-Field Mapping Tool, exclusive to Complyance, which eliminates the manual and error-prone process of connecting ERP data to government fields, a capability that sets us apart from all other e-invoicing partners.

- Proven ERP Success: Trusted by major companies including Zenoti, Softlink Global, and Newage for seamless ERP integration.

- Enterprise-Grade Security: SOC 2 Type 2, ISO 27001, and GDPR certified with robust data protection.

- Volume Handling: Send thousands of invoices in one go with instant error fixing and consolidation.

- One Global E-invoicing Platform: Single API integration eliminates the need for multiple country-specific connections.

2. Pagero

Operates as a powerful, Peppol-certified network, automating document exchange across a global web of buyers and suppliers. Excels in seamless B2B connectivity and is a leading provider of Peppol e-invoicing services.

Pros:

- Superior Network Effects: Ideal for businesses with complex and extensive B2B supplier and customer networks.

- Peppol Expertise: Ensures seamless and standard-compliant data exchange globally.

- Lifecycle Automation: Manages the process from issuance to payment, reducing manual tasks.

- Strong Intercompany Solutions: Ideal for large enterprises with complex transaction flows between subsidiaries and partners.

- Scalable for High-Volume B2B: Handles massive volumes of transactional document exchange reliably.

Cons:

- Limited customization options for specific ERP workflow requirements

- Higher total cost of ownership due to network access fees

- Less flexible for businesses needing deep ERP integration beyond basic document exchange

- Can be slow to adapt to specific country regulatory changes outside their core markets

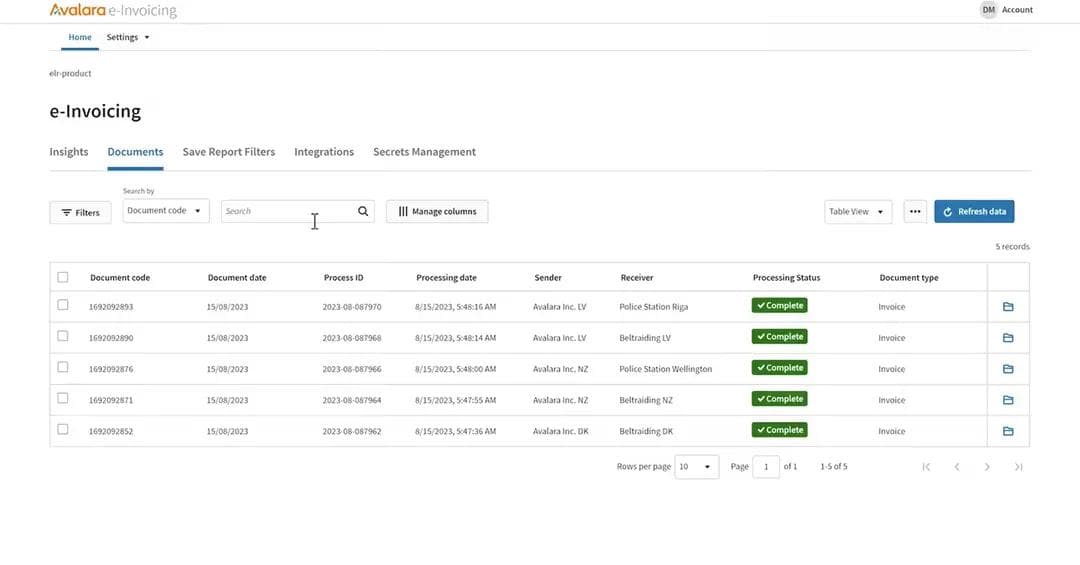

3. Avalara: The Integrated Tax Compliance Leader

Provides e-invoicing as part of a broader, world-class automated tax compliance suite. Boasts deep, pre-built connectors for major ERPs like NetSuite and SAP, unifying tax calculation and e-invoicing.

Pros:

- Unified Platform: Combines tax calculation and e-invoicing in one system, reducing data silos.

- Deep ERP Integration: Wide array of certified connectors simplifies the initial technical setup.

- Comprehensive Reporting: A centralized dashboard provides excellent visibility for both tax and invoicing data.

- Strong Brand Recognition: A well-known and established player in the broader compliance space.

Cons:

- Complex pricing structure with hidden fees for additional features

- It can be overwhelming for businesses that only need e-invoicing without a full tax suite

- Slower implementation timelines due to complex system architecture

- Its broad focus can sometimes make it less nimble for rapidly evolving local mandates.

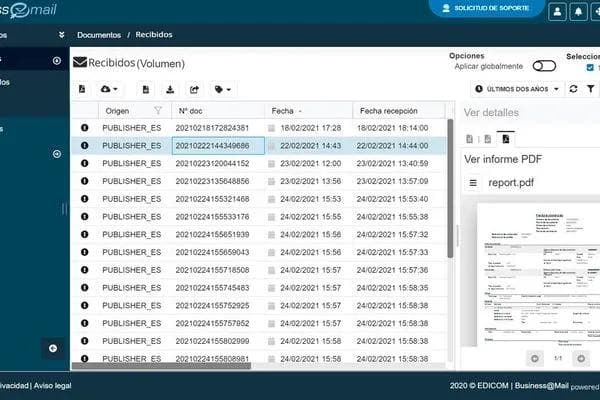

4. EDICOM: The EDI and Security Specialist

Brings robust EDI capabilities and a strong security focus to the e-invoicing space.Strong in industries with established EDI needs, offering whitelabeling, digital signatures, and secure long-term data archiving.

Pros:

- Strong EDI Foundation: Ideal for bridging traditional EDI with modern e-invoicing requirements.

- Enhanced Security: Places a high emphasis on security protocols and data integrity.

- Reliable Archiving: Offers robust long-term data archiving solutions for audit trails.

- Proven Track Record: An established player with a long history in the digital document exchange space.

Cons:

- Outdated API architecture compared to other platforms

- Limited real-time processing capabilities for high-volume transactions

- Poor developer experience with inadequate documentation and support

- Limited global coverage outside European markets

5. Sovos:

Built for large multinationals dealing with complex, multi-jurisdictional regulatory landscapes. Designed to integrate with complex global ERP environments, with a scalable architecture and a regulatory-first approach.

Pros:

- Deep Regulatory Knowledge: Expertise in handling complex compliance across many countries.

- Scalable Architecture: Supports large, decentralized enterprises with high transaction volumes.

- Future-Proof: Actively monitors and adapts to the global regulatory landscape.

- Comprehensive for Specific Industries: Offers specialized solutions for highly regulated industries.

Cons:

- Its comprehensive nature can be cost-prohibitive for mid-sized businesses or those with simpler needs.

- Poor customer support responsiveness for non-enterprise clients

- Over-engineered for businesses with simple e-invoicing requirements

Conclusion:

As global e-invoicing mandates become a fixed requirement in more countries, ERP companies have a unique opportunity to reshape the compliance landscape. Rather than seeing e-invoicing as a burden, it can become a strategic revenue driver for your business. By integrating a seamless e-invoicing solution, you not only simplify compliance but also unlock the potential to offer a high-demand service to your customers with minimal effort.

The right e-invoicing partner empowers your ERP platform to automatically handle global mandates, cutting down development time and freeing your team to focus on core business growth. It also offers an easy way for you to monetize this service, reselling e-invoicing functionality to your customers without additional overhead or tax expertise. Additionally, a strong partner provides continuous support, post-go-live updates, and ensures compliance with evolving regulations.

Choosing the right partner means investing in a solution that handles the complexities of e-invoicing across multiple countries, driving efficiency, maximizing ROI, and enhancing your ERP's value proposition. This is your chance to transform compliance into a competitive advantage, providing a future-proof, scalable solution that not only meets regulatory requirements but also boosts your bottom line.

Related posts

Frequently Asked Questions

All businesses registered for VAT in the UAE are required to prepare e-invoices for B2B and B2G transactions. This obligation extends even to micro businesses with an annual turnover below AED 3 million, meaning size does not exempt a company from compliance. Non-resident businesses that supply taxable goods or services in the UAE are also included under the mandate. The only current exception applies to B2C transactions, which remain out of scope for now but may be brought under the e-invoicing framework in the future.

It typically involves using a dedicated transaction or report to create a standard invoice. However, for compliance, the critical next step is transforming that internal invoice file into the government-mandated format (like XML or JSON in the UAE) and then securely transmitting it to the tax authority's platform. Many ERPs need an added integration solution to handle this compliance step automatically.

The top five solutions, known for their expertise in global e-invoicing and UAE-specific compliance, are:

- Complyance

- Pagero

- EDICOM

- Sovos

- Avalara

Subscribe to our Newsletter

Get the latest compliance updates, e-invoicing news, and expert tips delivered to your inbox.

ABOUT COMPLYANCE

Empowering businesses to automate e-invoicing and stay compliant in 100+ countries. Our platform simplifies regulatory complexity for enterprises and fast-growing companies.