The 5 Best UAE E-Invoicing Software for SAAS Companies in 2025

The UAE e-invoicing mandate is a hidden churn risk for the SaaS Industry. Protect your revenue & customer trust. Our 2025 guide compares the top solutions to turn the e-invoicing challenge into your competitive advantage.

Table of Contents

While you've been concentrating on feature rollouts, minimizing churn, and company expansion, a subtle yet significant threat to your retention rate has surfaced. The UAE's e-invoicing mandate is now an essential condition for conducting business. Your enterprise clients in the region will not accept invoices that fail to comply.

If your SaaS platform cannot produce invoices that are immediately validated by the government, your customers will face manual workarounds, delayed payments, and their own compliance risks. In a highly competitive market, they will likely switch to a provider that meets these standards.

The consequences of getting this wrong are severe: disrupted billing operations, rejected invoices, and substantial financial penalties. More importantly, you risk lasting damage to customer trust and a direct impact on your retention metrics.

Companies that prioritize this strategically will not only achieve e-invoicing but also develop a more efficient, automated revenue system and a significant edge in a regulated market.

This guide will assist you in navigating these changes by evaluating the best e-invoicing solutions specifically designed for SaaS companies' unique needs.

Why Building In-House E-Invoicing is a Costly Mistake

Many companies consider building an in-house e-invoicing system to maintain control. However, this path is filled with hidden costs, complexities, and strategic drawbacks that can severely challenge your growth. Here’s what you’re up against:

- The Expertise Gap: You lack in-house tax experts who can accurately interpret complex, ever-changing regulations across different countries. A single misinterpretation can lead to rejected invoices, financial penalties, and compliance failures for your customers.

- The Maintenance Burden: E-invoicing mandates are not static. Governments frequently update requirements, forcing you into a continuous cycle of tracking, development, and deployment just to maintain e-invoicing compliance, pulling your development team away from your core product.

- The Support Challenge: Providing support for e-invoicing issues requires deep subject matter expertise. Without a dedicated team of e-invoicing specialists, you risk long resolution times, frustrated customers, and damage to your brand's reputation for reliability.

- The Global Expansion Bottleneck: Scaling to a second or third country becomes a massive project. You'll need to build and maintain separate integrations for each new market's unique API and rules, which takes lots of time and resources.

- The Implementation Drag: Building logic to automatically map your invoice data to each country's specific format is a complex and time-consuming development task that requires significant effort.

- The Accreditation Process: In many jurisdictions, transmitting e-invoices directly to government platforms requires official accreditation. This process is complex and time-consuming, demanding specialized knowledge before you can even begin live operations.

- Lack of Practical Experience: A custom-built solution misses out on the knowledge gained from handling millions of invoices across different industries. Your team may end up spending time solving problems that a specialized provider has already fixed.

Turn E-invoicing into a Competitive Advantage

Future-proof your SaaS platform by automating e-invoicing across regions. Achieve compliance faster and retain customers with confidence.

How E-Invoicing Strengthens Your SaaS Business

While e-invoicing is mandatory, the right e-invoicing solution delivers significant competitive advantages that can transform your business operations and customer relationships.

| Strategic Advantage | Key Benefit |

|---|---|

| Automated Revenue Operations | Eliminates manual billing, reduces administrative overhead, and ensures consistent cash flow through automated, error-free invoicing. |

| Enhanced Customer Stickiness | Turns an e-invoicing feature into a core dependency, significantly increasing switching costs and building stronger, more loyal client relationships. |

| Global Expansion Accelerator | Enables faster entry into new international markets with built-in tax compliance, turning regulatory complexity into a strategic advantage. |

| Trust and Credibility Building | Demonstrates professionalism and regulatory adherence, strengthening your brand's reputation with enterprise clients and financial departments. |

| Operational Intelligence | Provides valuable data insights into payment behaviors and revenue patterns to optimize pricing, identify upsells, and improve forecasting. |

| Competitive Market Differentiation | Positions your platform as more mature and enterprise-ready than competitors, becoming a decisive factor for prospects during evaluations. |

| Increase in Revenue | Enables faster go-live in new markets and frees up developer resources to focus on core product features and new projects, directly accelerating revenue generation. |

By accepting e-invoicing as a strategic capability rather than just a compliance requirement, you transform a regulatory challenge into a sustainable business advantage that drives growth, retention, and market leadership.

What Happens If You Choose the Wrong E-Invoicing Tool?

| Problem | Consequence |

|---|---|

| The Integration Burden:- Your engineering team gets trapped building custom integrations for client legacy systems. | Product development stalls as resources get diverted from your core roadmap to maintenance work. |

| The Revenue Disruption:- Your system fails during high-volume billing periods with slow or failed validations. | Revenue stops completely as invoices get frozen, damaging client relationships through payment delays. |

| The Compliance Gap:- You must manually track and implement frequent government regulation changes. | Inevitable compliance gaps lead to rejected invoices and accumulating financial penalties. |

| The Data Quality Trap:- Error-prone systems generate invoices with data quality issues that get rejected. | Finance teams drown in correction cycles, crippling month-end closing and financial reporting. |

| The Vendor Lock-In:- You become dependent on a vendor with unreliable technology or poor support. | Your business gets trapped in permanent compliance risk with no viable exit path. |

| The Security Compromise:- Inadequate data protection fails to secure sensitive customer financial information. | Data breaches destroy market trust while triggering significant regulatory fines. |

| The Internal Coordination Failure:- Siloed teams struggle with conflicting priorities and poor tool integration. | Implementation deadlines get missed despite costly last-minute scrambles. |

| The Adoption Resistance:- Staff face a complex, non-intuitive system that disrupts their workflow. | Low adoption leads to manual workarounds that defeat the purpose of automation. |

| Accelerated Customer Churn :-Clients face compliance issues, payment delays, and a poor experience directly caused by your platform's failure. | This leads to negative feedback in the market, damaging your reputation and giving competitors a clear advantage when prospects are evaluating solutions. |

What We Looked for in a SaaS-Friendly E-Invoicing Tool

For SaaS companies specifically, an API-first architecture is non-negotiable. It’s the foundation for a seamless integration that becomes a feature within your product, not a complex development project.

Here are the critical technical capabilities to prioritize:

| Key Feature | Why It's Essential for Your SaaS |

|---|---|

| Sandbox Environments | Allows for safe, comprehensive testing of the entire invoicing flow without affecting live data or compliance status. |

| Webhook Support | Enables real-time status updates on invoice validation, letting you automate workflows and keep users informed within your platform. |

| Multi-language SDKs | Accelerates development and reduces integration time by providing tools that match your engineering team's existing tech stack. |

| Pre-built Connectors | Drastically reduces time-to-market and developer overhead by offering ready-made integrations for major billing systems and ERPs. |

| Clear Error Handling & Real-time Updates | Provides immediate, actionable feedback during integration and validation, reducing support overhead and development cycles. |

| Comprehensive Documentation & Developer Resources | Ensures a faster time-to-market and a superior developer experience by providing the clarity and resources your team needs to build confidently. |

| Built-in Security & Compliance | Mitigates risk from day one by handling data protection and regulatory requirements, helping you build and maintain customer trust. |

| Fast Implementation Time | Drastically reduces development effort and costs, allowing your team to focus on core product features instead of compliance infrastructure. |

E-Invoicing Solutions for SaaS Companies in 2025

| Solution | Best For |

|---|---|

| Complyance | Prioritizing developer velocity, rapid integration, and a single API for global scalability. |

| Avalara | Enterprises needing a comprehensive suite that bundles tax calculation, filing, and e-invoicing. |

| Pagero | Seamless digital connectivity and automated document exchange with a vast network of partners. |

| Sovos | Operating in highly regulated industries where audit-proof compliance and security are non-negotiable. |

| OpenText | Large-scale enterprises with complex, high-volume document workflows, especially within SAP ecosystems. |

After evaluating dozens of platforms against SaaS-specific criteria, these five solutions stand out for their unique strengths:

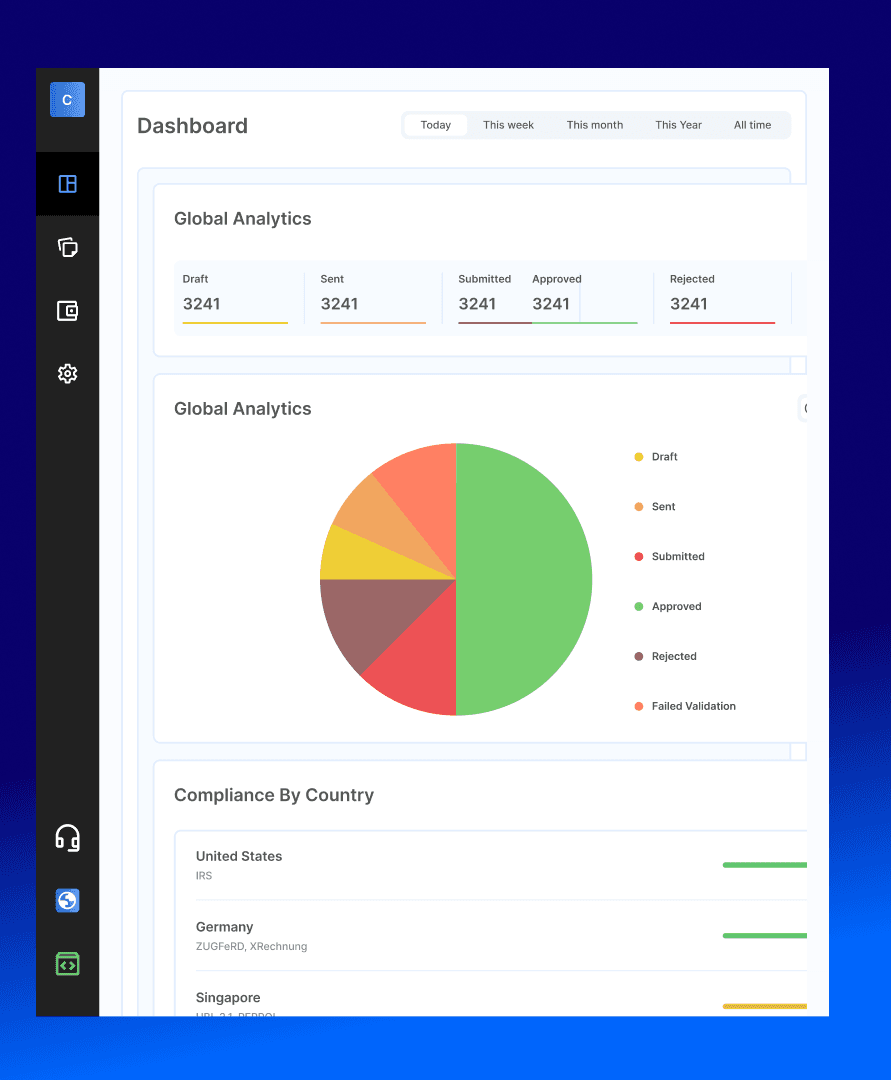

1. Complyance:

For SaaS companies where developer velocity and a simple integration experience are non-negotiable, Complyance positions itself as a specialist. It’s built on the principle that e-invoicing should be a powerful yet simple feature to implement within your product, not a complex, ongoing development project. Complyance is an Accredited Service Provider , aligning its platform with the UAE’s official e-invoicing framework and Peppol-based infrastructure requirements.

Single API for Global E-Invoicing

One integration for 100+ countries eliminates complexity from international expansion without reworking your codebase.

Sandbox Testing Environment

A dedicated sandbox connected to government test systems allows for safe, comprehensive testing of the entire invoicing flow without affecting live data or compliance status.

Pre-built ERP & Billing System Connectors

Accelerates integration with major systems like Oracle, NetSuite, and SAP, reducing time-to-market and developer overhead.

Developer-Centric Resources

Thorough documentation, SDKs, and a focus on a clean API experience enable your engineering team to achieve integration in days, not months.

Multi-Tenant Support

Architecturally designed to serve SaaS platforms that need to manage compliant invoicing for multiple end-clients from a single installation.

Designed for a Seamless User Experience

Complyance understands that SaaS companies need to maintain a seamless user experience. Its API is built to operate completely behind your UI, ensuring your customers never have to leave your platform to benefit from fully compliant e-invoicing. This increases product stickiness and allows you to maintain control over the user journey.

Rapid Implementation and Testing

The promise of a fast go-live is central to its value proposition. With a reported integration timeline of 1-3 days, it drastically reduces the opportunity cost, implementation time and allows your team to stay focused on core product development. The availability of a free testing environment before commitment further de-risks the evaluation process.

Built for Global Ambition

For SaaS companies looking to scale internationally, managing different country mandates via multiple vendors is an operational nightmare. Complyance's "One API" model aims to consolidate this complexity, providing a single, unified interface to handle compliance not just in the UAE, but in over 100 countries, making global growth a more streamlined process.

The Ideal Fit and Considerations

Complyance is purpose-built for global SaaS companies and fast-growing startups that value a modern, API-first development experience and need to move quickly to meet e-invoicing deadlines. It’s especially well-suited for businesses with a global footprint or those expanding into multiple regions.

As with any platform, conducting proper due diligence is essential. For large enterprises with highly complex, legacy-driven workflows, it’s recommended to verify that the solution aligns with specific internal requirements. Additionally, since Complyance uses a transaction-based pricing model, companies should assess projected invoice volumes to ensure the best commercial fit.

How Leading SaaS Companies Achieved Seamless E-Invoicing with Complyance

A growing SaaS company faced a wall. To expand into Saudi Arabia, they needed ZATCA e-invoicing, but their custom ERP system made it a nightmare. Building it themselves would take months, stall their product roadmap, and risk their entire market launch.

They were stuck. Every day of delay meant losing potential customers and falling behind competitors. Their team was staring down a complex, expensive project that had nothing to do with their core product, threatening to derail their growth.

And they chose Complyance's One API. Instead of months of work, their developers used pre-built tools and clear guides to integrate everything seamlessly into their existing system.

The Result?

- Live in 3 Weeks: Achieved full ZATCA compliance in record time.

- Perfect Track Record: 100% of invoices were accepted from day one.

- Total Coverage: Effortlessly handled all invoice types for every customer.

- Smooth Sailing: Zero disruption to their current billing or customers.

They entered the new market faster than they thought possible, leaving the compliance headache entirely to Complyance.

Key Implementation Insights

Single API for Global E-invoicing

Both companies leveraged Complyance's unified API for 100+ countries, enabling rapid deployment without rebuilding their core systems for each new market.

Accelerated Implementation Timeline

The consistent 1-2 week implementation period demonstrates how Complyance's standardized approach creates predictable, reliable deployment cycles for SaaS companies.

Comprehensive Transaction Coverage

Success across all document types highlights Complyance's ability to handle complete business cycles, from standard invoices to complex credit and debit notes.

Perfect Compliance Record

The 100% success rate achieved by both companies showcases Complyance's robust validation and error-handling capabilities in production environments.

Proven Regional Expertise

These implementations are built on years of specialized experience in regional E-invoicing frameworks. The case studies demonstrate that with Complyance's API-first approach, SaaS companies can achieve flawless e-invoicing compliance while accelerating global expansion and maintaining product innovation focus.

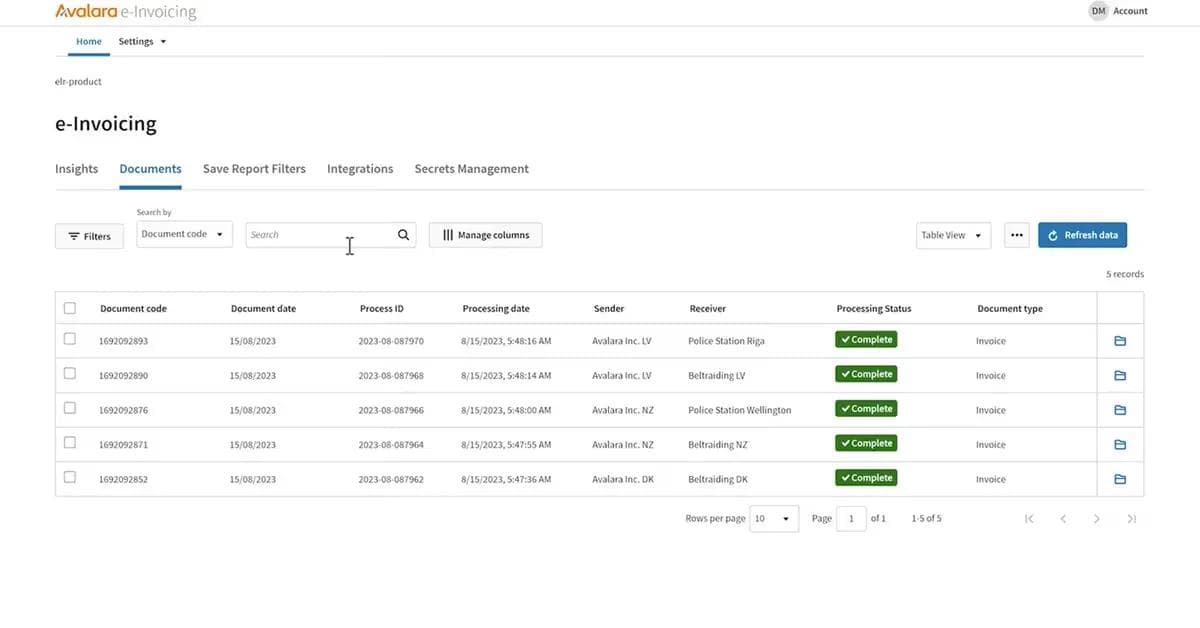

2. Avalara:

For SaaS, supply chain, and manufacturing, Avalara offers specific tools to build a powerful e-invoicing compliance layer into your product.

Simplify Cross-Border Complexity

Avalara's AI automates HS code classification and calculates real-time customs duties, preventing border delays and unexpected costs for international shipments.

Connect Effortlessly to a Global Partner Network

Get certified access to Peppol and other major e-invoicing networks, enabling seamless B2B document exchange with countless partners through a single connection.

Automate High-Risk Tax Scenarios

Avalara automatically tracks and validates tax exemption certificates, embedding compliance directly into billing workflows to significantly reduce audit risks.

Mitigate Audit Risks

The platform creates a secure, audit-ready digital trail by automatically applying the correct, up-to-date tax rules for every multi-jurisdictional transaction.

Pros:

- Comprehensive Global Coverage: Manages tax compliance and e-invoicing across a wide range of international jurisdictions, making it a true one-stop shop for global operations.

- Vast Integration Ecosystem: With over 1,400 pre-built connectors for major ERPs, e-commerce platforms, and billing software, it significantly reduces custom development time.

- End-to-End Automation: Bundles tax calculation, filing, and e-invoicing into a single platform, automating the entire compliance workflow for complex tax situations.

Cons:

- Complex Pricing Structure: Pricing is not transparent and is typically customized based on transaction volume and features, which can lead to high and unpredictable costs.

- Reported Support Challenges: Some users report frustrations with customer support, citing slow response times and difficulties in resolving technical integration issues.

- Potential Overkill for Simple Needs: The extensive feature set can be overwhelming and unnecessarily complex for SaaS companies that only need basic e-invoicing compliance without broader tax automation.

- Less Developer-Friendly API: The API can be complex and less intuitive than modern alternatives, leading to a longer and more difficult implementation process that delays your go-live date.

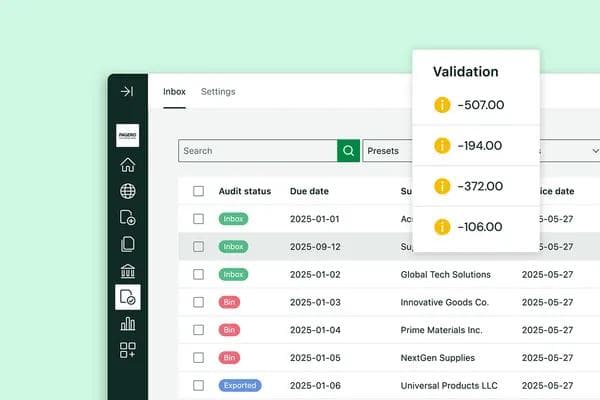

3. Pagero:

The Network Connect Pagero is a platform in logistics, supply chain, or manufacturing because its network directly solves the core challenge of digital connectivity with a vast and diverse ecosystem of partners.

The platform's design and services are tailored to create a seamless experience for your company and your clients. Here’s How It Benefits Your SaaS Platform:

Open & Global Network

Clients connect to all partners through a single integration, regardless of partner size or digital capability.

Built-in Global Compliance

Ensures regulatory compliance in over 80 countries, reducing a major burden for your international clients.

Seamless ERP Integration

Offers pre-built integrations for all major ERP systems, simplifying your platform's technical integration.

Supplier Onboarding Services

Pagero's multi-lingual team actively helps onboard your clients' partners, speeding up network activation.

Pros:

- Powerful Network Effects: Operating a vast global network connects you to millions of businesses, simplifying B2B document exchange and reducing point-to-point integration complexity.

- Reduces IT Burden: The "two-step" process and single connection to the network free your IT team from tracking regulatory changes and building country-specific templates.

- Future-Proofed Compliance: The platform automatically adapts to new and evolving e-invoicing mandates across its global network, ensuring ongoing compliance.

Cons:

- Network-Dependent: The primary benefit is the network itself. If your clients don't need to connect with a wide ecosystem of partners, the value proposition may be diminished.

- Potential for Variable Costs: Pricing models may be based on transaction volume, which could become costly for high-volume businesses and requires careful evaluation.

- Onboarding Complexity for Legacy Systems: While the network is efficient, onboarding clients with particularly outdated or non-standard systems could still require additional effort and time.

4. Sovos:

Some industries live under constant regulatory scrutiny. Sovos has built its reputation on navigating the most complex compliance landscapes with a focus on multi-jurisdictional reporting and audit-ready security.

Automated Regulatory Updates

Sovos provides continuous monitoring of global tax laws with automatic platform updates. This ensures ongoing compliance without requiring constant internal oversight from your team.

Audit-Ready Archiving

The platform offers tamper-proof archiving with detailed transaction histories. This creates comprehensive audit trails that withstand rigorous regulatory examinations.

Enterprise-Grade Security

Bank-level security protocols with end-to-end encryption protect sensitive financial and health data. This helps meet stringent data protection requirements in regulated industries.

Multi-Jurisdictional Expertise

Manage compliance across 60+ countries through a single integration. This eliminates building separate compliance frameworks for each new market you enter.

Pros:

- Reduces Compliance Burden: Automatic updates free your team from manually tracking regulatory changes

- Mitigates Legal Risk: Robust audit trails and security features minimize exposure to compliance violations

- Simplifies Global Expansion: A Single platform approach to multi-country compliance accelerates international growth

Cons:

- Premium Pricing: The specialized compliance features come at a higher cost compared to basic e-invoicing solutions

- Feature Overkill: Companies operating in single jurisdictions with simple compliance needs may find the extensive features unnecessary

- Implementation Complexity: The comprehensive nature of the platform may require longer setup times and specialized configuration.

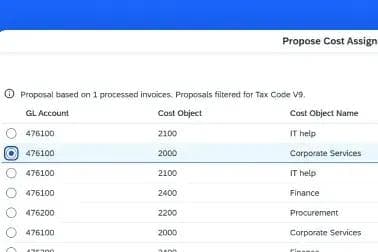

5. OpenText:

When your SaaS platform operates at massive scale with complex document workflows, you need industrial-strength solutions. OpenText brings decades of enterprise document management experience with particularly deep SAP integration.

Deep Integration with SAP and Other Critical Systems

OpenText embeds content management directly into daily applications like SAP, ensuring documents and data flow seamlessly across finance, HR, and supply chain for a unified operational view.

Enterprise-Grade Compliance and Security Built-In

The platform meets strict global compliance standards for regulated industries, featuring pre-configured certifications that provide a secure foundation for data privacy and governance.

AI-Powered Productivity for Complex Workflows

OpenText's AI content assistant uses natural language to quickly find and summarize information from vast document repositories, accelerating decision-making and information discovery.

Pros:

- Proven at Scale: The platform is built to handle the content management needs of the largest organizations, with a track record of helping businesses manage high-volume, complex document workflows reliably.

- Comprehensive Feature Set: It offers a wide range of capabilities out of the box, including workflow automation, document generation, and advanced records management, reducing the need for multiple point solutions.

Cons:

- Enterprise Complexity: The very power and comprehensiveness of the platform mean it can be complex to implement and may require specialized expertise or professional services for optimal setup and customization.

- Cost Structure: As an enterprise-grade solution, OpenText is a significant investment. The pricing model is likely geared towards large enterprises with substantial budgets and may not be suitable for smaller companies.

How to Choose the Right E-Invoicing Tool for Your SaaS Product

| If you... | Choose... | Why? |

|---|---|---|

| prioritize a seamless developer experience, rapid integration, and a scalable solution for global markets. | Complyance | It’s built API-first for exceptional ease of integration, featuring comprehensive documentation, sandbox environments, and a single, scalable API for 100+ countries. This ensures a smooth, user-friendly experience for your development team and a future-proof foundation for growth. |

| are an enterprise-scale SaaS with complex, international tax obligations. | Avalara | It offers a comprehensive suite that bundles tax calculation, filing, and e-invoicing into one platform, backed by over 1,400 pre-built integrations for massive ERP ecosystems. |

| need seamless digital connectivity with your clients' partners. | Pagero | Its powerful global network automatically connects you to a vast ecosystem of businesses, solving the core challenge of B2B document exchange and partner onboarding. |

| are a multinational SaaS in a highly regulated industry (finance, healthcare) where audit-proof compliance is non-negotiable. | Sovos | It provides unparalleled regulatory depth, with managed services from compliance experts and robust, tamper-proof audit trails designed to withstand the strictest examinations. |

| are a large enterprise with complex, high-volume document workflows. | OpenText | It delivers industrial-strength, enterprise-grade scalability and powerful, customizable workflow automation deeply embedded within the SAP ecosystem. |

The UAE's e-invoicing mandate is more than a compliance hurdle; it's a strategic turning point. The right partner transforms this requirement from a legal burden into a streamlined revenue engine.

Choose based on your primary need:

- Complyance: Best for Global E-Invoicing with a Developer-Friendly One API

- Avalara: Best for global tax compliance and extensive ERP integrations

- Pagero: Best for network-based automation and seamless partner connectivity

- EDICOM: Best for EDI and E-Invoicing Expertise

- Comarch: Best for Regulatory-Focused E-Invoicing

Don't just adapt to the new rules. Use them to build a stronger, more automated platform. The companies that get this right won't just be compliant; they'll be ahead.

Related posts

Frequently Asked Questions

It directly impacts customer retention. Enterprise clients will churn if your platform generates non-compliant invoices that cause them penalties and payment delays. Compliance is no longer optional; it's a core feature.

- Increase Stickiness: Clients rely on your platform to solve a complex regulatory problem.

- Automate Operations: Eliminate manual billing processes for consistent cash flow.

- Accelerate Global Expansion: Use the system as a compliance engine for entering new markets faster.

Complyance is built API-first for developers, offering a sandbox, clear documentation, and a single API for global compliance, enabling integration in days, not months.

- API-First Architecture: For seamless integration into your product.

- Sandbox Environment: For safe testing without affecting live data.

- Global Compliance Coverage: A single solution for multiple countries.

- Pre-built Connectors: For popular billing systems and ERPs.

- Comprehensive Documentation: For a fast, smooth developer experience.

Key requirements include using the Peppol-based 5-corner model, where invoices must be exchanged through Accredited Service Providers (ASPs) accredited by the Federal Tax Authority (FTA). Invoices must be generated in specific digital formats like XML or JSON using structured standards such as PINT AE (Peppol International Invoice for UAE). Real-time reporting to the FTA is mandatory, and invoices must include mandatory fields like supplier/buyer Tax Identification Numbers (TRNs), VAT breakdowns, and invoice types as per the UAE Data Dictionary.

- Complyance: Best for Global E-Invoicing with a Developer-Friendly One API

- Avalara: Best for global tax compliance and extensive ERP integrations

- Pagero: Best for network-based automation and seamless partner connectivit

- EDICOM: Best for EDI and E-Invoicing Expertise

- Comarch: Best for Regulatory-Focused E-Invoicing

Subscribe to our Newsletter

Get the latest compliance updates, e-invoicing news, and expert tips delivered to your inbox.

ABOUT COMPLYANCE

Empowering businesses to automate e-invoicing and stay compliant in 100+ countries. Our platform simplifies regulatory complexity for enterprises and fast-growing companies.