How the Complyance Platform Simplifies UAE E-Invoicing for Your Business

Learn how Complyance helps you go live with UAE e-invoicing within weeks. Follow 10 simple steps for full FTA compliance with zero errors.

Table of Contents

E-invoicing is now required in the UAE. Starting in 2027, all VAT-registered businesses must send their invoices in a digital format. The rollout will occur in phases: large companies must comply by January 2027, small and medium businesses (SMBs) by July 2027, and B2G transactions by October 2027. Paper and PDF invoices will no longer be accepted.

This may sound difficult, but it doesn’t have to be. With Complyance, your business can get ready quickly, stay compliant, and send e-invoices easily, no matter what ERP system you use.

Key Takeaways

- All VAT-registered companies in the UAE must start e-invoicing by 2027, with a phased rollout: large companies by January 2027, small and medium businesses (SMBs) by July 2027, and B2G transactions by October 2027.

- Invoices must follow a special digital format called PINT AE XML.

- You must send invoices through an approved partner called an Accredited Service Provider (ASP).

- Complyance helps you meet these rules and go live in just a few days.

- You don’t need to change your ERP or billing tools, Complyance connects with what you already have.

What Is Complyance?

Complyance is an e-invoicing platform that helps you send e-invoices the right way in the UAE. It connects your ERP, POS, or billing system with the Federal Tax Authority (FTA) through the Peppol network.

Here’s what it does:

- Checks your invoice data

- Converts it into the PINT AE format

- Sends it to your customer and the FTA

- Tracks the full journey of every invoice

You don’t need to understand XML or PINT AE rules. Complyance does all the work behind the scenes.

Want to see how Complyance helps every team?

Read: Top 10 Benefits of Choosing Complyance for UAE E-Invoicing

Why the UAE Is Moving to E-Invoicing?

The UAE government wants to:

- Make tax reporting easier

- Reduce invoice fraud

- Speed up business transactions

- Help companies follow tax rules better

To do this, all businesses are required to stop using PDFs or paper invoices. Instead, businesses must use structured digital invoices.

By January 2027, all large VAT-registered businesses must follow the e-invoicing rule.

What is the E-invoicing Format in the UAE?

You must send your invoice in PINT AE XML format. This is a special type of file that:

- Uses a fixed structure

- Has strict rules for field names and data types

- Can be read and checked by government systems

- You cannot just send a PDF or an Excel file. You must use this format, or your invoice will be rejected.

For a full explanation of this format, read: UAE E-Invoicing Data Dictionary Explained (Step by Step).

How does UAE E-Invoicing work?

The UAE uses the Peppol-based e-invoicing model called the 5-corner model.

Here's how it works:

- Your system creates the invoice: This can be SAP, Oracle, QuickBooks, or even Excel

- Complyance checks: We look for errors and make sure all fields follow UAE rules. The invoice is converted to PINT AE XML.

- Now, it is ready for official submission: E-invoices are sent to the buyer through the Peppol network. This is a secure way to send e-invoices across systems. It is also sent to the FTA. The FTA checks it, accepts it, and stores it for tax records.

The full process happens quickly and safely.

Who Should Use Complyance?

Complyance is for any company that needs to send e-invoices in the UAE. We support many types of systems:

- ERP Systems: SAP, Oracle, Microsoft Dynamics, Epicor, etc. Complyance connects to your ERP and sends e-invoices directly.

- POS Systems: Retail, F&B, hospitality, and more. Complyance turns your invoice data into digital invoices that follow UAE rules.

- Accounting Tools: Tally, QuickBooks, Xero, etc.. You can upload Excel files with all invoice data.

- Custom Billing Systems: SaaS, marketplaces, platforms.

Developers can use our API and SDK to connect easily.

See the full setup process here: Step-by-Step Guide to Implement UAE E-Invoicing with Complyance Platform

Easy e-invoicing implementation with complyance

How to Set Up the Complyance Platform in 10 Simple Steps?

Getting started with Complyance is easy. Just follow these 10 steps to set up your account, connect your systems, and start sending UAE-compliant e-invoices.

Step 1: Sign Up for an Account

- Go to one.complyance.io.

- Click Create Account.

- Enter your name, work email, and choose a password.

- Once done, your account will be created in seconds.

Step 2: Choose How You'll Use Complyance

You’ll be asked to choose one of these two options:

- “I need an E-invoicing solution for my company.” - If you're sending invoices for your own business.

- “I need an E-invoicing solution for my clients.” - If you're a partner managing e-invoicing for your clients, you can add details for each client separately.

Pick the one that fits your use case.

Step 3: Create Your Workspace

This is where your business will manage invoices.

- Enter your company name (e.g., “TechNova Solutions”).

- Pick a unique workspace link (e.g., one.complyance.io/technova).

You’ll use this link to access your dashboard every day.

Step 4: Add Your Company Details

Next, tell us about your business.

- Add your legal company name

- Add your Tax Registration Number (TRN)

- Add your business address and contact details

If you're a partner managing e-invoicing for your clients, you can add details for each client separately.

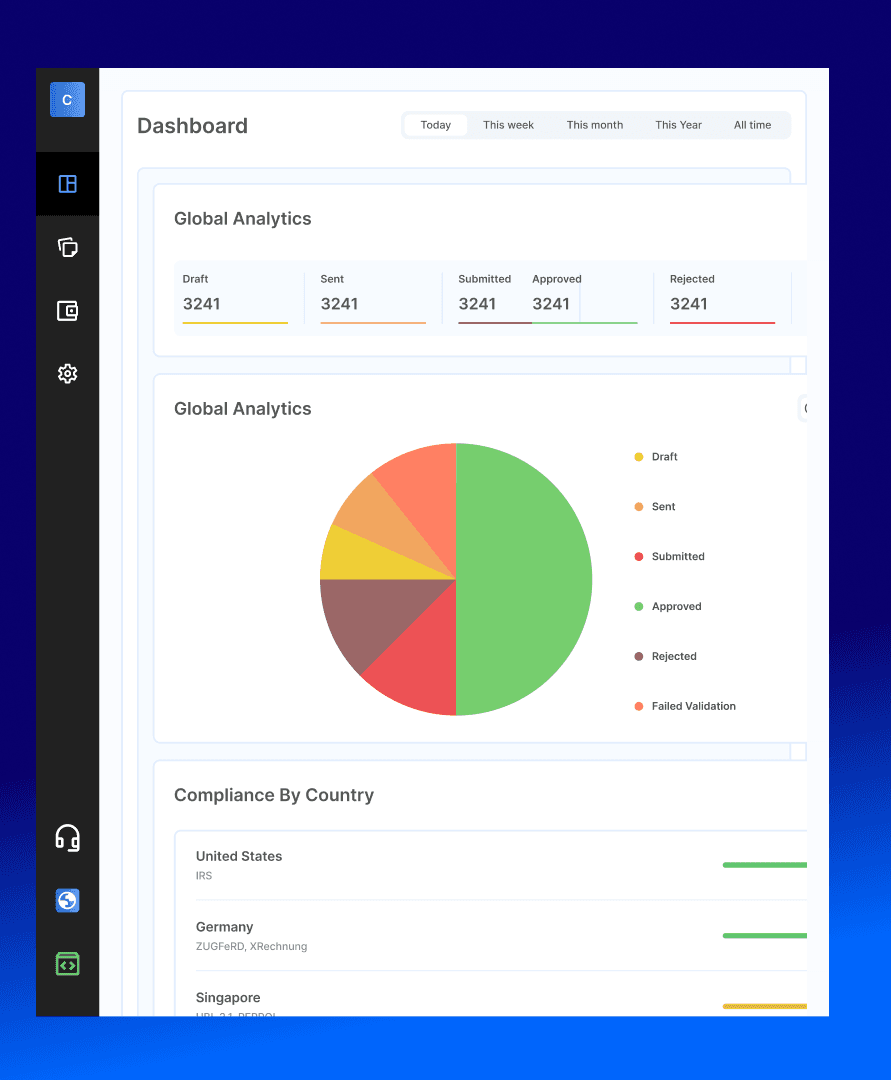

Step 5: Access Your Dashboard

Once setup is done, your main dashboard will open. This is your control center, where you can:

- Track invoice status: Approved, Waiting, Rejected

- View your usage and balance

- Access the integration panel, reports, and settings

Now you’re ready to start sending e-invoices.

Step 6: Prepare the Invoice Information

Before starting the integration, ensure you have all the necessary invoice details aligned in your ERP system.

| What You’ll Need |

|---|

| Invoice Details |

| Buyer Info |

| Seller Info |

| Invoice Totals |

| Line Items |

| Tax Breakdown |

Need a full breakdown? See: UAE E-Invoicing Data Dictionary Explained (Step by Step)

Step 7: Use the Developer Portal for Integration

Click Developer Portal in the left sidebar. Here you’ll find everything technical teams need:

- SDK guides for easy setup

- GETS schema documents

- Sample payloads (JSON examples)

- Legacy docs (for older formats)

A checklist will guide you from start to finish.

We currently support the Java SDK.SDKs for C++, Python, and Node.js are coming soon.

Step 8: Map, Test, and Validate

Follow this flow to make sure everything works:

- Select Country: Choose United Arab Emirates (AE). This loads UAE-specific rules (PINT AE format).

- Choose Transaction Type: Tax Invoice (B2B) – Mandatory. Credit Note or Debit Note – Optional

- Generate Sandbox API Key: This connects your ERP for testing. Copy it and paste it into your backend

- Upload or Select Payload: Upload a test invoice (JSON) or choose a sample provided by Complyance

- Preview Mapping: See how your data maps to UAE fieldsMake sure names, TRNs, totals, and items match

- GETS Field Mapping: Our engine auto-maps your dataYou can correct fields using suggestions

- Country-Specific Mapping: Apply UAE rules (TRN format, VAT codes, string formats)Complyance ensures every rule is followed

- Test Mapping: Choose “Test” modeRun your payload through FTA-style validation’ll get instant feedback if anything is wrong

Step 9: Go Live in Production

When all tests are successful:

- Switch to Production Environment

- Generate a live API key

- Start submitting real invoices to the FTA

Complyance will digitally sign, format, validate, and send each invoice.

Step 10: Monitor in Real-Time

Once live, your dashboard will show live statuses:

- Pending – Waiting for FTA response

- Validated – Passed GETS checks

- Cleared – Approved by the FTA

- Rejected – Issues found (with reasons)

You can download:

- Audit logs

- Full history of all submissions

Bonus: No-Code Options for Small Teams

Don’t have developers or ERPs? You can still use Complyance

Option A: Manual Invoice Creation (Best for Small Teams)

- Log in to your workspace

- Click Create Invoice

- Enter invoice fields like TRN, items, and tax

- Click Validate and Submit

Simple and fast. No coding required.

Option B: Excel Upload (Best for Growing Teams)

- Download our smart Excel template

- Fill in invoice rows

- Upload to Complyance

- We check and send them to FTA

Smart dropdowns reduce manual errors. Works well for teams not ready for API yet

What Makes Complyance Special?

Here are 10 things that make Complyance the best choice for UAE e-invoicing:

- One API for the UAE and 100+ countries

- Go live in days, not months

- 100+ checks before submitting each invoice

- No need to update manually when rules change

- Works with any system you use

- Secure and certified (ISO 27001, SOC 2)

- Handles FTA downtime with smart queuing

- Easy-to-use dashboard

- 24/7 expert support

- Saves time and money with automation

Read the full list: [Top 10 Benefits of Choosing Complyance for UAE E-Invoicing]

Common Problems and How Complyance Solves Them

| Challenges You Might Face | How Complyance Helps You |

|---|---|

| Making mistakes when typing in Excel. | Pre-filled dropdowns and instant validation catch errors before you upload. |

| Most invoice data is structured differently across ERPs or Excel files, making manual mapping time consuming and error prone. | GETS automatically maps your existing invoice fields (like TRN, tax amounts, line items) to the correct government-required structure, reducing friction and mistakes. |

| Invoices get rejected for unclear reasons. | Our dashboard gives you detailed error messages with tips on how to fix them. |

| The government changes its technical requirements. | GETS is updated automatically, so your invoices are always compliant. |

| You need to manage invoices in multiple countries. | One Complyance integration works for over 100 countries. |

How Complyance transforms E-Invoicing for Every Team

By addressing the specific challenges and goals of each department, Complyance ensures a smooth transition, company-wide adoption, and unlocks new levels of efficiency across your entire business.

Finance Teams: From Manual Chaos to Real-Time Control

A leading Malaysian enterprise was struggling with multi-ERP consolidation. Their finance team had to manually pull data from Oracle, SAP, and custom systems just to generate a single compliant report. Invoices were often duplicated, mismatched, or delayed, creating major bottlenecks in monthly closings.

After adopting Complyance, the finance team gained a unified data layer that consolidated inputs from all ERPs. Proactive error detection and built-in LHDN (IRBM) compliance meant invoices were validated automatically before submission, eliminating back-and-forth fixes.

The results:

- 70% faster consolidation across multiple ERPs

- Zero penalties from missed LHDN validations

- Finance teams are now focused on forecasting and insights instead of reconciliation firefighting

Tax Teams: Compliance Without the Burnout

A multinational distributor in Saudi Arabia struggled with rapidly evolving ZATCA Phase 1 and Phase 2 regulations. Each update required hours of manual adjustments, and the risk of penalties for missed compliance was high.

By switching to Complyance, the tax team gained 100+ automated validations and continuous platform updates aligned with ZATCA’s latest rules.

The impact:

- 100% compliance guarantee with zero missed ZATCA updates

- No sleepless nights over real-time clearance errors

- A confident tax team reporting with complete accuracy

Product Managers: Launching Faster with One API

A SaaS product team faced delays in integrating e-invoicing across multiple geographies. Each rollout meant building new connectors and adjusting schemas from scratch.

With Complyance’s single API for 100+ countries, their team deployed ZATCA e-invoicing in weeks, not months. Pre-built connectors removed technical blockers and freed up their roadmap.

The outcome:

- 40% faster go-live

- Multi-country expansion without extra dev cycles

- A product roadmap that stayed focused on innovation

Developers: Simplicity That Scales

A developer team in Saudi Arabia working with SAP and Oracle ERPs faced constant schema mismatches, ZATCA XML validation errors, and failed submissions when handling invoice files. The complexity of Phase 1 and Phase 2 rules meant endless debugging cycles.

By using Complyance’s developer-first APIs and proactive error detection, developers identified field-level issues before submission. Instead of reworking rejections, they caught errors in real time, ensuring every invoice cleared ZATCA systems on the first try.

Developer wins:

- Zero post-submission rejections with pre-validation

- Go-live in just 3 weeks, ahead of ZATCA deadlines

- Faster integration using clear API docs and pre-built connectors

- Developers focused on core ERP projects, not compliance fire drill.

The Result for Every Team

No matter the role, Finance, Tax, Product Managers, or Developers, Complyance transforms how teams work.

- Finance saves time.

- Tax ensures accuracy.

- Product launches faster.

- Developers simplify integration.

- Leaders scale with confidence.

That’s the power of Complyance: One API, 100+ countries, 100% compliant.

Why Complyance Is the Right Partner

Complyance is an Accredited Service Provider under the UAE e-invoicing framework.

- 5 years of e-invoicing experience

- 1.5 billion invoices processed every year

- Trusted by 1000+ companies

- Peppol-certified

- Full UAE compliance

- Secure and future-ready

You don’t just get software. You get a long-term partner.

What Should You Do Now?

E-invoicing in the UAE is not optional. The rules are clear. The timeline is fixed. Here’s what you should do:

- Sign up at one.complyance.io

- Choose how you want to connect (manual, Excel, or API)

- Get help from our team

- Start sending e-invoices the right way

You can be 100% ready in just a few days.

Related posts

Frequently Asked Questions

Yes. Complyance not only provides a developer-friendly e-invoicing API platform but also offers expert consultation for businesses preparing for UAE e-invoicing. This includes ERP gap analysis, sandbox testing, team training, and go-live support.

Yes. Complyance offers a live sandbox so your team can simulate real invoice flows and integrations.

Yes, you can fully automate your e-invoicing process with Complyance. Our API seamlessly integrates with your ERP or accounting system to validate, submit, and retrieve government-issued IRNs and QR codes, all without manual intervention.

API Integration: This is the preferred method for UAE e-invoicing. It connects your ERP, accounting, or billing system directly to the e-invoicing platform, enabling real-time submission of invoices and instant receipt of status updates (accepted, rejected, or flagged for correction).

Subscribe to our Newsletter

Get the latest compliance updates, e-invoicing news, and expert tips delivered to your inbox.

ABOUT COMPLYANCE

Empowering businesses to automate e-invoicing and stay compliant in 100+ countries. Our platform simplifies regulatory complexity for enterprises and fast-growing companies.