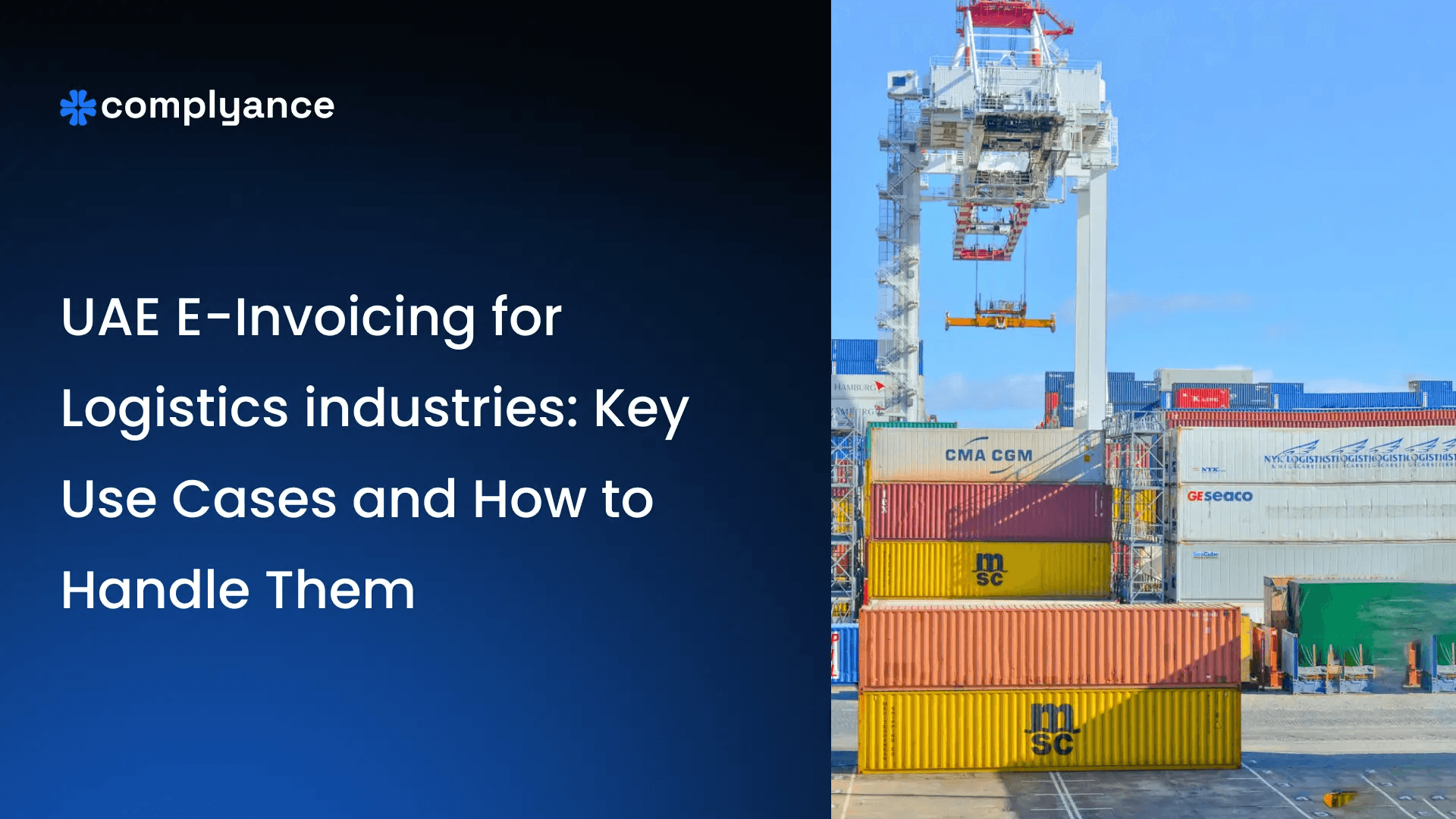

UAE E-Invoicing for Logistics Industries: Key Use Cases and How to Handle Them

A Practical UAE E-Invoicing guide for logistics industries. Understand who must comply, how PINT AE and Peppol apply to freight and import‑export flows, and how to connect your ERP or TMS to an accredited service provider without disrupting operations.

Table of Contents

Overview of UAE E-Invoicing for Logistics Companies

Almost every business in the UAE is aware of the upcoming shift toward e‑invoicing. The country is moving away from paper and PDF invoices toward structured e-invoices issued in a structured digital format that systems can read and process automatically under Federal Tax Authority UAE guidelines.

While e‑invoicing applies to all VAT-registered businesses, implementation differs across industries. Some issue simple invoices for single products or services. Others, like logistics, face far greater complexity with high transaction volumes, cross-border movements, and multiple services bundled into single e‑invoices.

Logistics is a high-priority industry for e‑invoicing due to its combination of volume, cross-border trade, and complex VAT treatment. A single logistics e‑invoice may include domestic transport (standard-rated), international freight (often zero-rated), warehousing, packing, customs clearance, and value-added services, each subject to different VAT rules yet billed together by logistics companies in Dubai.

Go Live with UAE E-Invoicing for Logistics in a Week

E‑invoicing brings greater transparency for government authorities by simplifying how business transactions are captured and reported. At the same time, it requires logistics companies to rethink how e‑invoices are structured, validated, and issued.

Understanding E‑Invoicing Use Cases in Logistics

Before looking at logistics specifically, let's define what a "use case" means in e‑invoicing.

A use case is simply a common business situation where an invoice is issued.For example:

- Selling one product to a customer

- Charging monthly service fees

- Issuing an invoice that includes multiple services together

Different industries have different use cases because they sell different types of goods and services. E-invoicing rules often change based on these use cases. That is why understanding industry-specific use cases is critical for logistics industries, 3PL companies, and third-party logistics providers.

When businesses try to apply generic invoicing logic across all industries, errors start to appear. Logistics is a perfect example of why this approach doesn't work.

How UAE Logistics Services Appear on One E‑Invoice

Logistics companies rarely issue simple invoices. Most logistics transactions involve multiple services delivered together as part of one job.

For example, a single shipment may include local transportation, warehousing for a few days, packing and handling, and customs clearance support. Even though all these services are part of one shipment, they are different services and often follow different VAT rules under FTA UAE guidance. Yet, they usually appear together on one invoice sent by the UAE logistics companies or regional operators.

If e‑invoicing systems aren't designed to handle this complexity:

- VAT may be applied incorrectly

- Important invoice details may be missed

- E‑invoices may fail validation in the future

This is why logistics industries must clearly understand their industry-specific UAE e invoicing use cases before going live.

Regulatory Background and UAE E‑Invoicing Timeline

The FTA e-invoicing framework sits alongside the UAE VAT law. While VAT determines tax rates, zero-rating, and place of supply, UAE e-invoicing regulations define how invoices must be structured, transmitted, and stored through the Peppol network using approved channels.

Invoices must flow through an Accredited Service Provider (ASP) like Complyance in the UAE, ensuring secure transmission to the Federal Tax Authority in the UAE in near real time.

How UAE VAT Law and E‑Invoicing Rules Work Together

In simple terms:

- VAT rules decide what tax applies

- E-invoicing rules decide how the e-invoice must be issued and reported

Both must work together for compliance.

UAE E‑Invoicing Phases and Key Deadlines for Logistics Companies

The UAE is expected to implement e-invoicing in phases to allow businesses time to prepare.

Key Dates and Implementation Timeline in the UAE

| Step | What Happens | When |

|---|---|---|

| Rules Finalized | The government confirms all laws, formats, and technical details. | Mid-2025 |

| Pilot Program | Selected invite-only companies begin testing with the FTA and ASPs. | July 2026 |

| Voluntary Phase Opens | Any business can join voluntarily to start early integrations and testing. | July 2026 |

| Phase 1 Mandatory | Businesses with annual revenue ≥ AED 50 million must adopt e-invoicing (B2B + B2G). | January 2027 |

| Phase 2 Mandatory | Businesses with revenue < AED 50 million must comply. | July 2027 |

| Phase 3 Mandatory | Government entities required to issue e-invoices. | October 2027 |

For logistics companies, early preparation is critical because e‑invoicing affects billing, VAT treatment, ERP/TMS integrations, and customer workflows.

Core UAE E‑Invoicing Requirements for Logistics Industries

Structured E‑Invoice Format (PINT AE, Peppol, XML/JSON)

E-Invoices must be generated in a structured digital format aligned with PINT AE, which is aligned with Peppol ID and Peppol network interoperability rules. These are machine-readable formats such as XML or JSON, not PDFs or scanned documents.

Narrative descriptions that worked in paper invoices are no longer sufficient for logistics companies or third-party logistics providers.

This means:

- No PDFs or scanned invoices

- Only structured e-invoices in XML or JSON

- Mandatory submission via an Accredited Service Provider (ASP) in the UAE

- Use of FTA-approved e-invoicing software

Mandatory Fields on a UAE Logistics E‑Invoice (Header, Parties, Lines, Tax)

A logistics e-invoice must clearly include:

| Section | Field | Description / Purpose |

|---|---|---|

| Invoice Header | Invoice number | Unique and sequential invoice identifier |

| Invoice Header | Issue date | Date the invoice is issued |

| Invoice Header | Tax point (time of supply) | Determines when VAT becomes chargeable |

| Invoice Header | Payment terms / due date | Required if invoice is issued on credit |

| Seller Information | Legal name | Registered legal name of the seller |

| Seller Information | Legal name | Registered legal name of the seller |

| Seller Information | Full address | Complete registered business address |

| Seller Information | VAT registration number | Seller’s VAT TRN |

| Seller Information | Contact details | Email or phone number (recommended) |

| Buyer Information | Legal name | Registered legal name of the buyer |

| Buyer Information | Full address | Buyer’s registered address |

| Buyer Information | VAT registration number | Buyer’s VAT TRN |

| Buyer Information | PO / reference number | Purchase order or reference number, if provided |

| Line Item Details | Description | Clear description of goods or services provided |

| Line Item Details | Quantity | Quantity of goods or services per line |

| Line Item Details | Unit of measure | Unit used (e.g., shipment, kg, service) |

| Line Item Details | Unit price | Price per unit |

| Line Item Details | Taxable value | Amount subject to VAT |

| Line Item Details | HSN / SAC / commodity code | Classification code for goods or services |

| Line Item Details | Transport / shipment reference | AWB, B/L, shipment ID, or job reference |

| Line Item Details | Incoterms | Required for cross-border services, if applicable |

| Tax Information | VAT category code | VAT classification per line (e.g., S, AE, Z) |

| Tax Information | VAT rate | Applicable VAT rate per service line |

| Tax Information | VAT amount | VAT charged per line |

| Tax Information | Total taxable amount | Total value before VAT |

| Tax Information | Total VAT amount | Sum of VAT across all lines |

| Tax Information | Grand total | Invoice total including VAT |

| Tax Information | Place of supply | Determines VAT applicability |

| Tax Information | Zero-rating / exemption reference | Supporting reference where VAT is 0% or exempt |

| Additional Elements | Currency code | ISO currency code used in the invoice |

| Additional Elements | QR code / digital signature | Used for verification and integrity checks |

| Additional Elements | Notes / legal references | Optional legal or contractual notes |

Storage, Archiving, and Real‑Time Transmission to the FTA

E-invoices must be:

- Transmitted electronically through approved ASPs (Accredited Service Providers)

- Stored securely for audit and compliance purposes

- Retained in structured format (PINT AE XML) for the required period (typically 5 years)

- Available for real-time/near-real-time FTA checks

How Logistics Flows Map to VAT and E‑Invoicing Rules

Logistics operations directly determine VAT treatment and e-invoicing behavior.

VAT Treatment for International Freight, Domestic Transport, and Warehousing

- International Freight (Into/Out of the UAE)Often zero-rated when conditions are met. E‑invoicing requires structured references (AWB, B/L) and evidence in PINT AE fields.

- Domestic Transport Within the UAE5% standard VAT. Must be clearly separated from zero-rated services on the e‑invoice

- Warehousing and StorageTypically standard-rated (5%). Billed periodically or alongside transport services.

- Customs Clearance and DocumentationMust be classified correctly and linked to relevant shipment references.

- Value-Added ServicesPacking, handling, insurance, and pass-through charges may carry different VAT treatments (standard, zero-rated, or exempt).

When an E‑Invoice Is Required and What Changes from Paper/PDF Invoices

Compared to paper or PDF invoices:

- VAT must be applied at the service line level (not invoice level)

- Supporting details must be structured, not narrative/free-text

- Errors cannot be corrected later through manual explanations

- Validation happens automatically, not manually

Impact of UAE E‑Invoicing on Different Logistics Players

Freight Forwarders and NVOCCs

- High invoice volumes

- Multi-leg routing

- Multiple VAT treatments in one invoice

- Multi-currency billing

3PL and 4PL Warehousing Providers

- Recurring billing cycles

- Integration between WMS and finance systems

- Service-based pricing and storage charges

Courier, Express, and Last-Mile Providers

- Very high transaction volumes

- Automated billing requirements

- Tight validation timelines

Shipping Lines and Airlines Acting as Carriers

- Documentation-heavy invoices

- Zero-rated international services

- Strong evidence and reference requirements

Despite differences, all face the same core challenge. Handling composite service e-invoices correctly.

Critical Logistics Use Case: Composite Service E‑Invoices

Logistics companies must issue Composite Service E-Invoices when billing multiple services under one document.

Example: Domestic transport (5% VAT) + export documentation (0% VAT) = one e-invoice, two VAT rates.

Key Requirements:

- Single e-invoice document

- Each service = separate line item

- VAT applied per line (not invoice-level)

- Wrong VAT = FTA validation failure

Why it matters: 80% of logistics firms fail here because ERPs apply single VAT rate across the invoice.

Why Logistics Companies Often Struggle with UAE E‑Invoicing

Logistics invoices are rarely simple. Most are composite service invoices with mixed VAT treatments, and many existing systems were not built for this level of detail.

- Multi-Entity Operations: Invoices may span multiple legal entities, making VAT treatment and reporting harder to align.

- Multiple ERP Systems: Different systems capture service data differently, complicating structured invoice generation.

- Mixed VAT Workflows: Standard-rated, zero-rated, and exempt services often coexist in one invoice.

- Data Readiness Challenges: Missing service classifications or incorrect VAT codes cause validation failures.

- Continuous Regulatory Updates: Changing rules requires ongoing updates to the invoice structure and validation logic.

System and Data Readiness Checklist for UAE Logistics E‑Invoicing

To support structured e-invoices, logistics companies must ensure their ERP, TMS, or WMS can push data via an API to an FTA-approved e-invoicing software platform.This is especially critical for logistics companies in the UAE handling composite service invoices across multiple entities.

Systems

- ERP, TMS, and WMS integration capability

- Ability to generate structured invoice data

- Support for high transaction volumes

Master Data

- Customer VAT IDs and TRNs

- Accurate addresses and place of supply

- Consistent service codes and descriptions

Event-to-Invoice Mapping

- Pickup, delivery, export, and import events

- Clear tax point identification

- Correct invoice trigger logic

Validation and Rejections

- Pre-submission validation checks

- Handling FTA rejections

- Audit and reconciliation workflows

Operational Benefits of E‑Invoicing for Logistics Firms

When implemented correctly, e-invoicing goes beyond compliance and delivers tangible operational improvements for logistics companies across finance, operations, and management teams.

Faster E-invoicing and Improved Cash Flow

With e-invoicing, e-invoices are generated in a structured format and validated automatically before being issued. This removes delays caused by manual checks, rework, or incomplete information. Customers receive accurate e-invoices faster, which shortens approval cycles and accelerates payments. For logistics companies handling high daily invoice volumes, this directly improves cash flow predictability.

Fewer Disputes and Credit Notes

Disputes in logistics often arise from unclear service descriptions, incorrect VAT treatment, or missing references. E-invoicing enforces service-level clarity by clearly itemizing each service and applying the correct VAT treatment per line. This reduces misunderstandings with customers and minimizes the need for credit notes, reissued invoices, and follow-up communication.

Stronger Audit Trails

Each e-invoice and its underlying service lines are stored digitally in a structured and consistent format. This creates a clear audit trail that links services, VAT treatment, and supporting references together. During audits or internal reviews, logistics companies can quickly retrieve invoice data, reducing audit effort and lowering compliance risk.

Reduced Manual Reconciliation Work

Automated validation ensures e-invoice data aligns with accounting records, logistics events, and VAT rules from the start. Finance teams spend less time manually reconciling e-invoices with transport records, warehouse data, or customs documentation. This frees up resources to focus on higher-value tasks such as analysis and exception handling.

Better Visibility Into Margins by Route, Service, and Customer

E-invoicing captures detailed, service-level data that can be analyzed across routes, customers, and service types. Logistics companies gain clearer insight into which routes are profitable, which services carry higher costs, and where pricing adjustments may be needed. This visibility supports better decision-making and long-term operational planning.

Common UAE E‑Invoicing Pitfalls in Logistics and How to Avoid Them

- Treating e-invoicing as only an IT project: E-invoicing is not just a system change. It directly affects VAT treatment, invoice structure, and operational workflows. Successful implementation requires early involvement from tax, finance, IT, and operations teams to ensure services are classified and reported correctly.

- Ignoring tax and operations input: Without alignment between tax and operations, logistics services can be misclassified, leading to incorrect VAT application. This is especially risky for composite service invoices that include multiple VAT treatments.

- Missing zero-rating evidence for international transport: Zero-rated international transport services require proper supporting documentation. If evidence is missing or not captured in a structured way, e-invoices may fail validation or create audit risk later.

- Building country-specific solutions that do not scale: Point solutions built only for the UAE often break when expanding to KSA, the EU, or other regions. A scalable approach avoids repeated rework and inconsistent compliance across countries.

- Overlooking testing and validation phases: Skipping sandbox testing or pilot validation increases the risk of e-invoice rejections once live. Logistics companies should test e-invoice flows, composite service scenarios, and edge cases before full rollout.

- Poor data mapping from ERP, TMS, or WMS systems: Unstructured or inconsistent legacy data often fails during XML or structured e-invoice conversion. Early data mapping and cleanup across systems helps prevent validation failures and last-minute rework.

Refer to our detailed guide on How Logistics Companies in the UAE Can Simplify E-Invoicing with Complyance, which breaks down real-world approaches and solutions step by step.

Implementation Roadmap for UAE Logistics E‑Invoicing

A phased implementation approach helps logistics companies adopt e-invoicing with minimal disruption while addressing the most complex risks early.

Step-1: Gap Analysis and Data Mapping

Before any technical integration begins, logistics companies should conduct a gap analysis across invoices, systems, and data.

This involves reviewing current invoice formats, service descriptions, VAT treatment, and supporting documents, and comparing them against UAE e-invoicing requirements such as PINT AE. ERP, TMS, and WMS data should be checked to ensure required fields like service codes, VAT categories, place of supply, and shipment references are consistently available.

This phase helps identify data gaps early, avoiding costly rework later.

Step-2: Start With Top Customers and High-Volume Routes

The first live implementation should focus on:

- Top customers by invoice volume or revenue

- High-frequency routes or services

This approach delivers quick business value and exposes real-world issues early, such as missing data, incorrect VAT mapping, or customer-specific billing requirements. Fixing issues at this stage is easier than addressing them across the entire organization later.

Step-3: Focus First on Composite Service Invoices

Composite service invoices should be prioritized early because they are both the most common and the most complex use case in logistics.

This phase ensures:

- VAT is applied correctly at the service line level

- Standard-rated, zero-rated, and exempt services coexist correctly

- Validation rules work for mixed VAT scenarios

If composite invoices work correctly, simpler invoice types will follow naturally.

Step-4: Pilot Testing and Validation

Before full rollout, logistics companies should run pilot testing in a controlled environment. This includes:

- Sandbox or test submissions

- Structured e‑invoice validation

- Testing edge cases such as exports, reversals, and corrections

Pilot testing helps catch validation errors, formatting issues, and workflow gaps before live submission, reducing the risk of e-invoice rejection and billing delays.

Step-5: Training and Change Management

E-invoicing affects more than just IT systems. Finance, tax, and operations teams must understand how e-invoices are structured and validated.

Training should focus on:

- Reading structured e-invoices

- Understanding service-level VAT logic

- Handling rejections and corrections

- Operational changes to billing workflows

Clear ownership and communication across teams ensure smooth adoption.

Step-6: Expand Gradually Across Entities and Systems

Once the initial rollout is stable, e-invoicing can be expanded across:

- Additional customers

- More routes and services

- Multiple legal entities

- Other ERP, TMS, or WMS systems

A gradual expansion minimizes disruption and allows teams to apply lessons learned from earlier phases.

Step-7: Vendor and Partner Enablement

Logistics companies operate in interconnected ecosystems. Key customers, suppliers, and partners should be onboarded early to ensure two-way compliance. Aligning formats, references, and data expectations reduces disputes and ensures smooth e-invoice exchange across the supply chain.

Using Complyance to Simplify UAE E‑Invoicing for Logistics

Complyance is an FTA-approved e-invoicing software that is built to handle logistics-specific complexity from day one. The Complyance e-invoicing platform supports composite service invoices, mixed VAT treatments, and multi-ERP environments without requiring changes to existing systems.

At the core of the platform is the Complyance e-invoicing API, a developer-friendly e-invoicing API designed specifically for high-volume logistics workflows. Using a single UAE e-invoicing API, logistics companies can push invoice data directly from their ERP, TMS, or WMS systems, while Complyance handles schema mapping, validation, Peppol routing, and compliance with UAE PINT AE requirements, pre-submission checks, and ongoing regulatory updates in the background.

The Complyance e-invoicing solutions use a single API to:

- Convert invoice data into UAE PINT AE format

- Validate invoices before submission

- Route invoices through the Peppol network

- Support B2B and B2G transactions UAE

- Operate as an Accredited Service Provider (ASP) in the UAE

Step‑by‑Step: Setting Up Complyance for UAE Logistics E‑Invoicing

Getting started with Complyance is easy. Just follow these 10 steps to set up your account, connect your systems, and start sending UAE-compliant e-invoices.

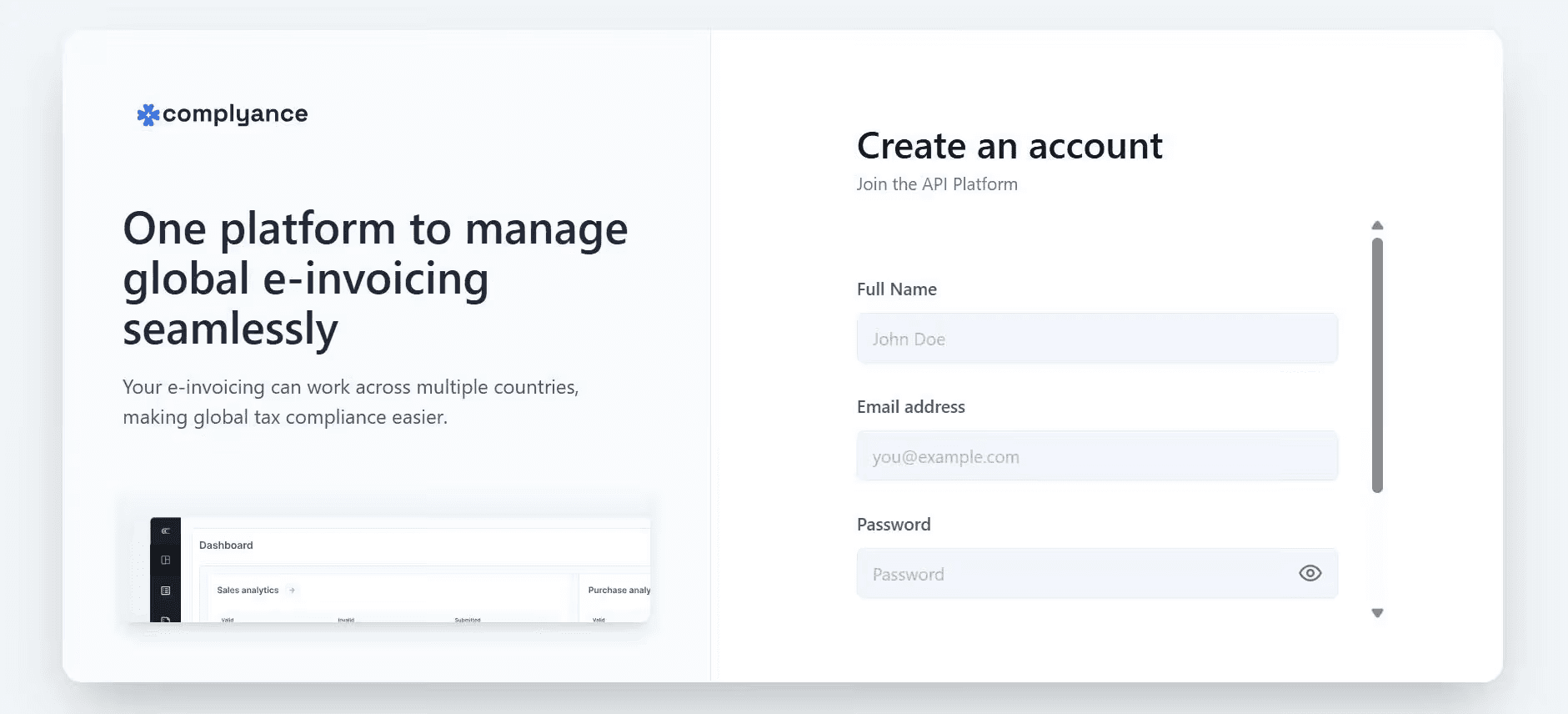

Step 1: Sign Up for an Account

- Go to one.complyance.io.

- Click Create Account.

- Enter your name, work email, and choose a password.

- Once done, your account will be created in seconds.

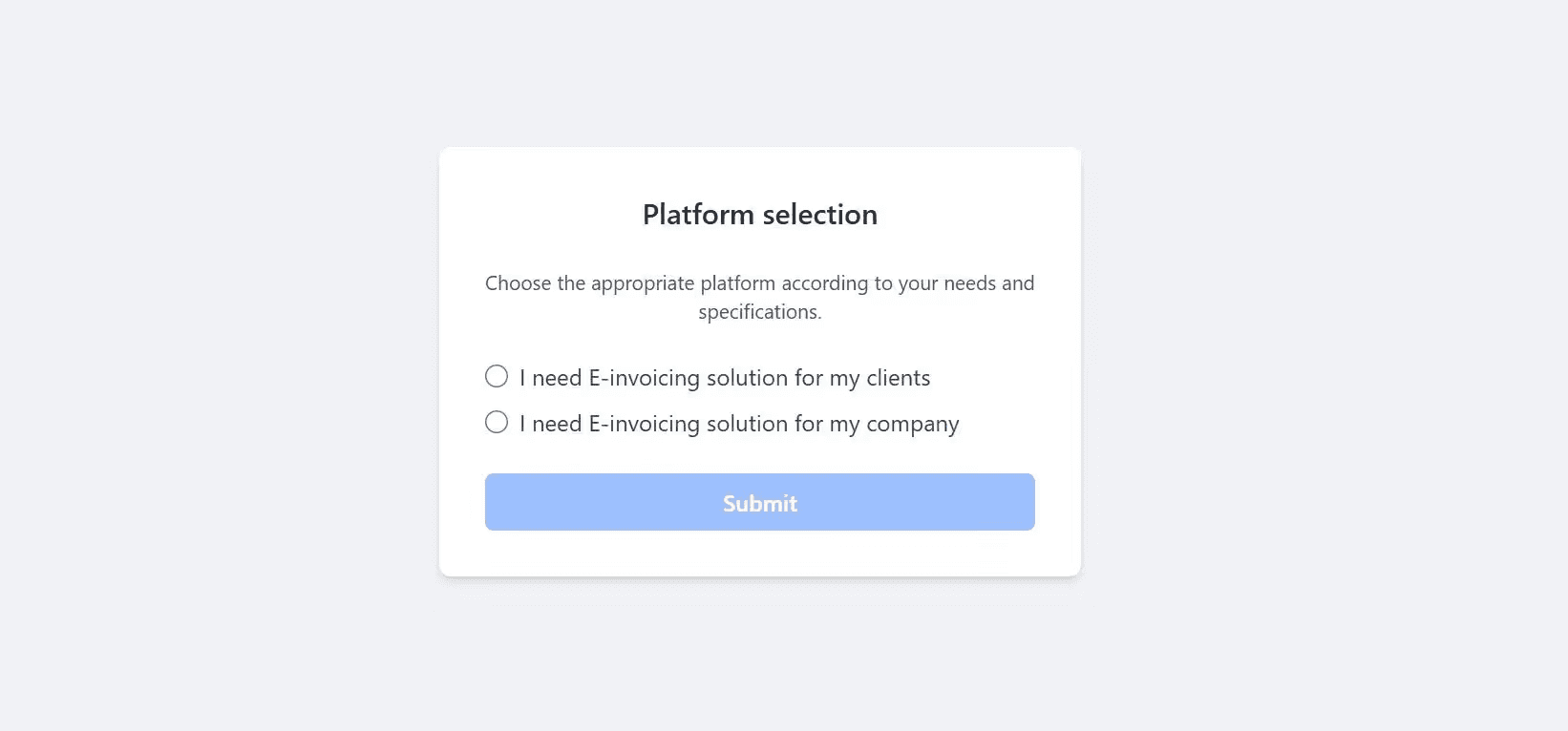

Step 2: Choose How You'll Use Complyance

You’ll be asked to choose one of these two options:

- “I need an E-invoicing solution for my company.” - If you're sending e-invoices for your own business.

- “I need an E-invoicing solution for my clients.” - If you're a partner managing e-invoicing for your clients, you can add details for each client separately.

Pick the one that fits your use case.

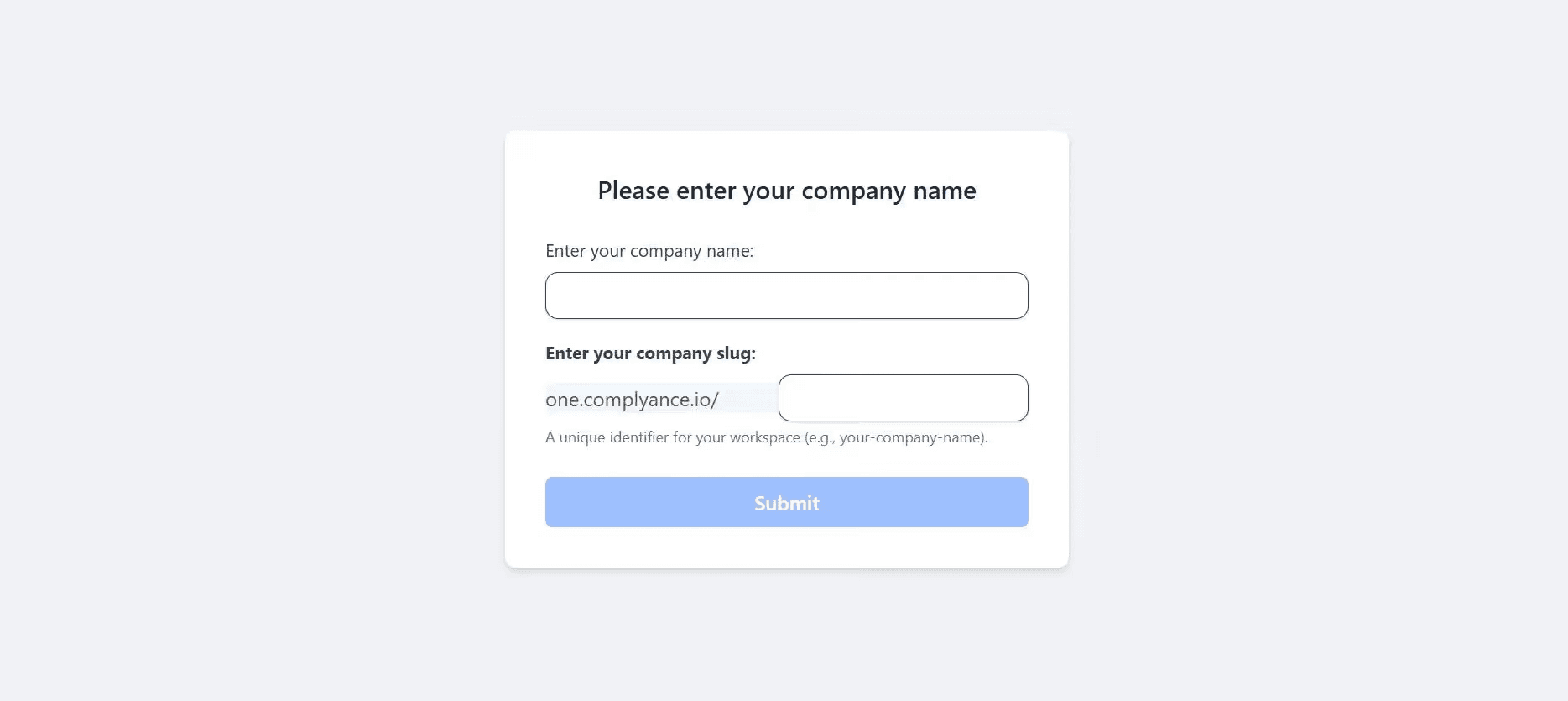

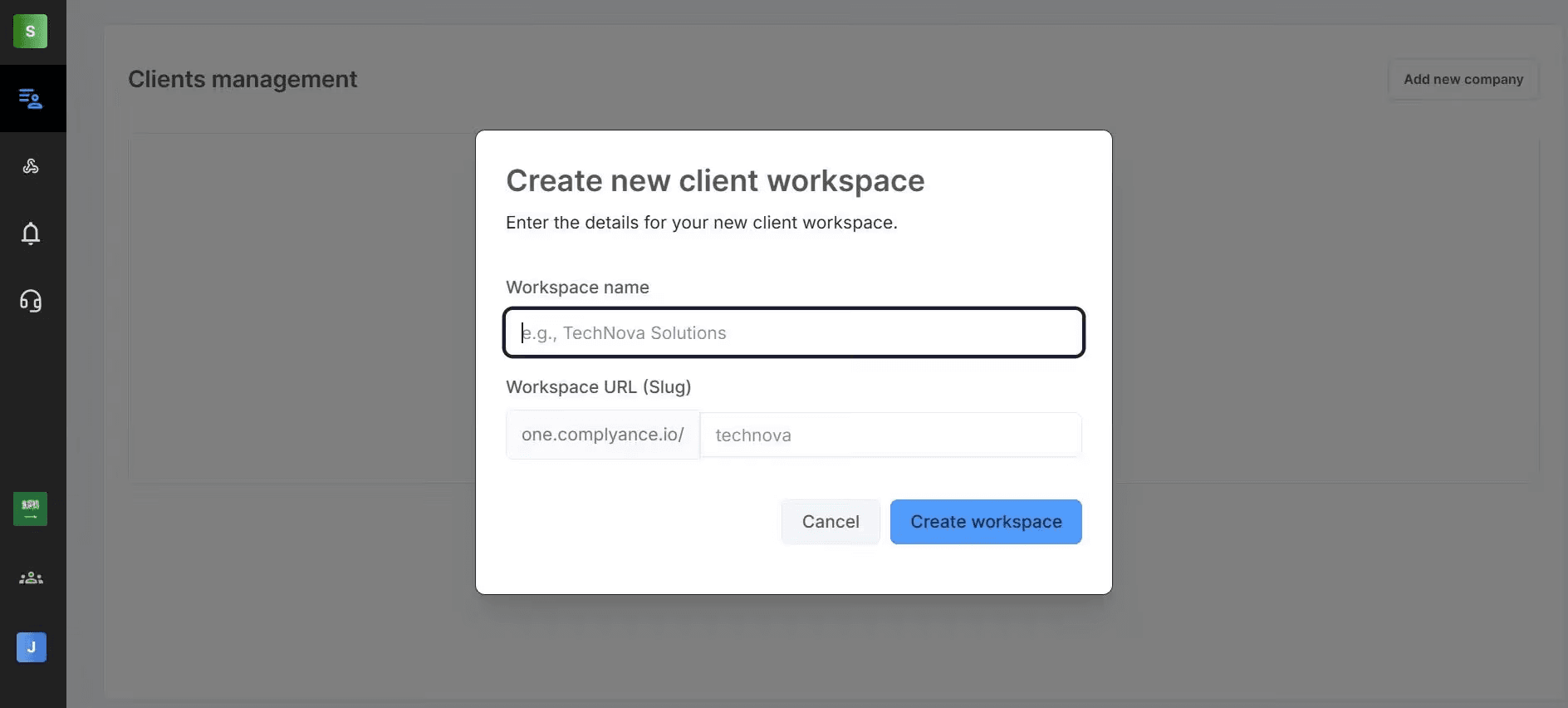

Step 3: Create Your Workspace

This is where your business will manage invoices.

- Enter your company name (e.g., “TechNova Solutions”).

- Pick a unique workspace link (e.g., one.complyance.io/technova).

You’ll use this link to access your dashboard every day.

Step 4: Add Your Company Details

Next, tell us about your business.

- Add your legal company name

- Add your Tax Registration Number (TRN)

- Add your business address and contact details

If you're a partner managing e-invoicing for your clients, you can add details for each client separately.

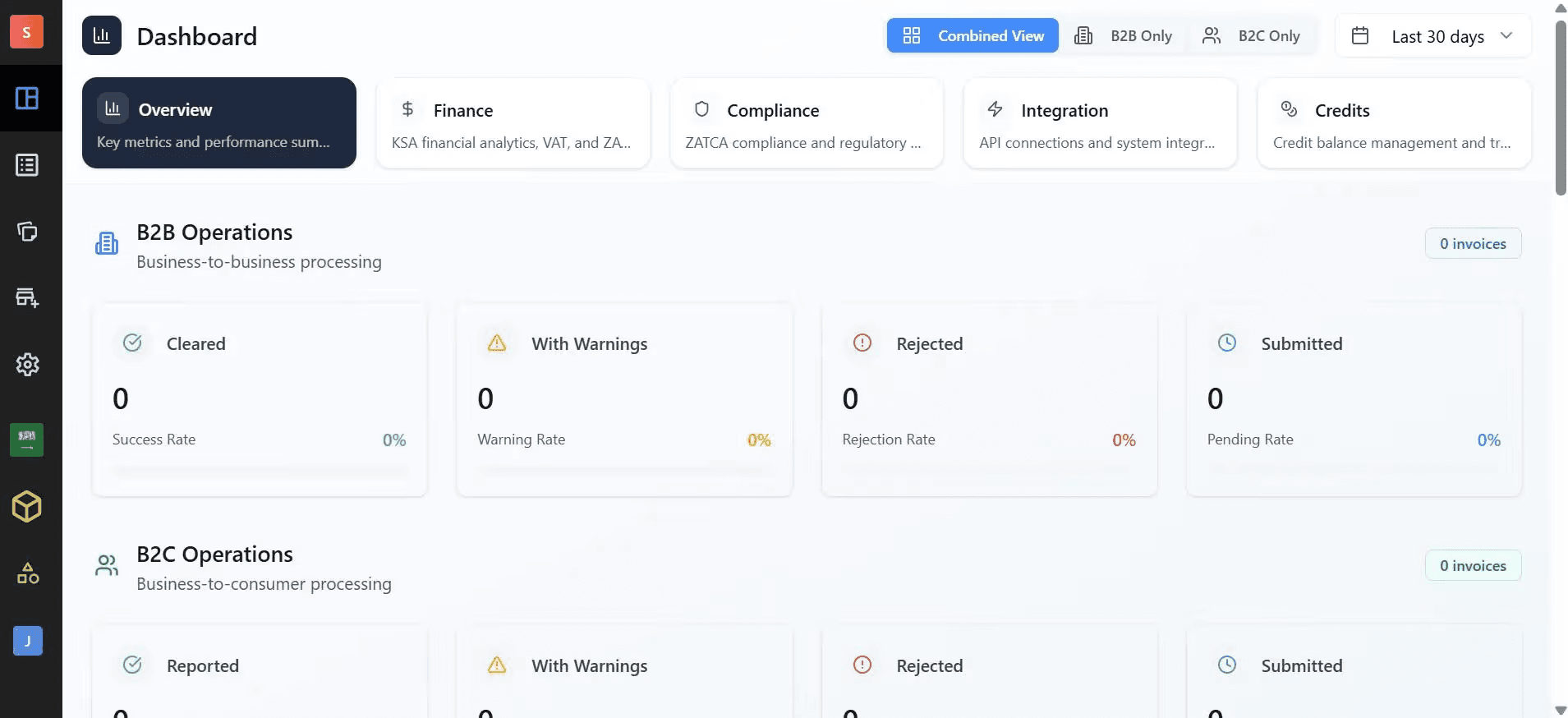

Step 5: Access Your Dashboard

Once setup is done, your main dashboard will open. This is your control center, where you can:

- Track invoice status: Approved, Waiting, Rejected

- View your usage and balance

- Access the integration panel, reports, and settings

Now you’re ready to start sending e-invoices.

Step 6: Prepare the Invoice Information

Before starting the integration, ensure you have all the necessary invoice details aligned in your ERP system.

What You'll Need

- Invoice Details

- Buyer Info

- Seller Info

- Invoice Totals

- Line Items

- Tax Breakdown

Need a full breakdown? See: UAE E-Invoicing Data Dictionary Explained (Step by Step)

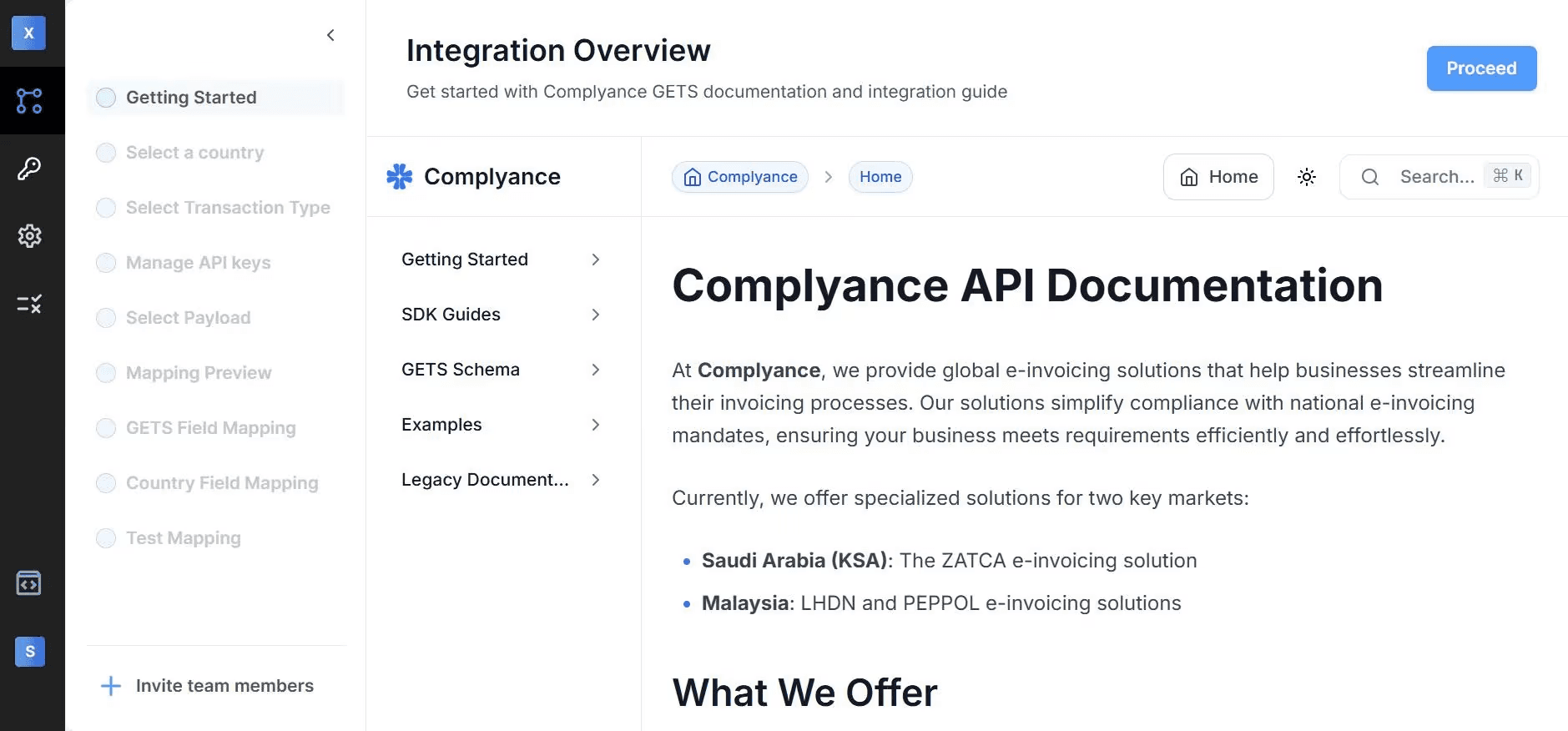

Step 7: Use the Developer Portal for Integration

Click Developer Portal in the left sidebar. Here you’ll find everything technical teams need:

- SDK guides for easy setup

- GETS schema documents

- Sample payloads (JSON examples)

- Legacy docs (for older formats)

A checklist will guide you from start to finish. We currently support the Java SDK; SDKs for C++, Python, and Node.js are coming soon.

Step 8: Map, Test, and Validate

Follow this flow to make sure everything works:

- Select Country: Choose United Arab Emirates (AE). This loads UAE-specific rules (PINT AE format).

- Choose Transaction Type: Tax Invoice (B2B) – Mandatory. Credit Note or Debit Note – Optional

- Generate Sandbox API Key: This connects your ERP for testing. Copy it and paste it into your backend

- Upload or Select Payload: Upload a test invoice (JSON) or choose a sample provided by Complyance

- Preview Mapping: See how your data maps to UAE fields. Make sure names, TRNs, totals, and items match

- GETS Field Mapping: Our engine auto-maps your data. You can correct fields using suggestions

- Country-Specific Mapping: Apply UAE rules (TRN format, VAT codes, string formats)Complyance ensures every rule is followed

- Test Mapping: Choose “Test” mode. Run your payload through FTA-style validation’ll get instant feedback if anything is wrong

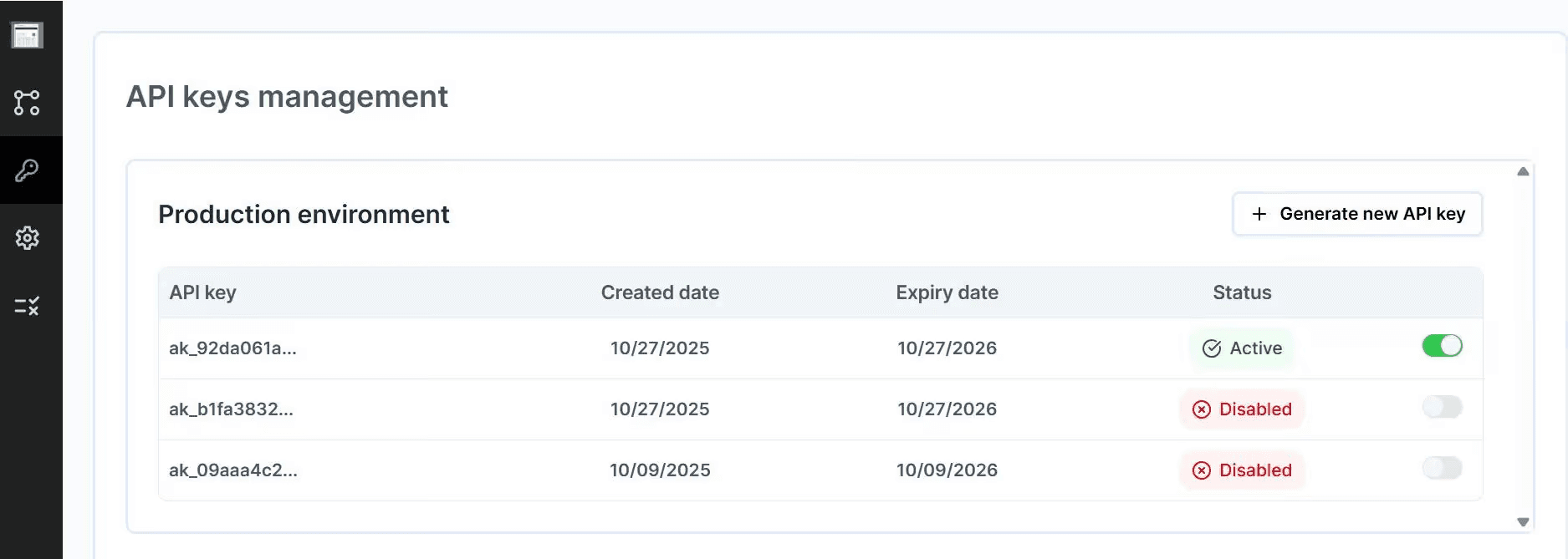

Step 9: Go Live in Production

When all tests are successful:

- Switch to Production Environment

- Generate a live API key

- Start submitting real e-invoices to the FTA

Complyance will digitally sign, format, validate, and send each e-invoice.

Step 10: Monitor in Real-Time

Once live, your dashboard will show live statuses:

- Pending – Waiting for FTA response

- Validated – Passed GETS checks

- Cleared – Approved by the FTA

- Rejected – Issues found (with reasons)

You can download:

- Audit logs

- Full history of all submissions

Bonus: No-Code Options for Small Teams

Don’t have developers or ERPs? You can still use Complyance

Option A: Manual Invoice Creation (Best for Small Teams)

- Log in to your workspace

- Click Create Invoice

- Enter invoice fields like TRN, items, and tax

- Click Validate and Submit

Simple and fast, no coding required.

Option B: Excel Upload (Best for Growing Teams)

- Download our smart Excel template

- Fill in invoice rows

- Upload to Complyance

- We check and send them to FTA

Smart dropdowns reduce manual errors. Works well for teams not ready for API yet.

For a detailed walkthrough of integration steps, validation flows, and go-live timelines, refer to How to Implement UAE E-Invoicing with Complyance API Platform: A Step-by-Step Guide, where the full implementation process is explained step by step.

Case Study: How a Logistics Company Achieved 99.7% E‑Invoice Accuracy

HAACO Shipping, a major logistics operator in Saudi Arabia, faced a challenge common to large logistics enterprises. They needed to comply with ZATCA’s e-invoicing mandates while continuing to process high daily transaction volumes through a custom ERP system, without disrupting critical logistics workflows.

For HAACO, e-invoicing was not just a regulatory requirement. It was mission-critical. Their operations demanded near-perfect clearance rates, stable system performance, and zero tolerance for downtime or manual rework.

Complyance enabled HAACO to meet these requirements through a simple but enterprise-grade approach:

- A single, unified API that converted invoices from their custom ERP into ZATCA-approved XML, including QR codes and security stamps

- Custom mapping aligned with logistics-specific data fields and complex charge structures

- Pre-submission validation that caught errors before e-invoices reached ZATCA

- Hands-on support that enabled a rapid, low-risk rollout

The results were clear:

- 99.7% e-invoice accuracy rate

- 83% reduction in developer effort

- Implementation completed in just one week

By automating validation and compliance while leaving core systems untouched, Complyance helped HAACO achieve high-volume e-invoicing accuracy without slowing down its logistics operations.

Conclusion: Getting UAE Logistics E‑Invoicing Right

E-invoicing in the logistics industry is not just about switching to a digital format. It is about correctly handling composite service invoices, applying the right VAT treatment at the service line level, and ensuring every transaction is structured and compliant.

For logistics companies, this complexity can quickly become overwhelming without the right foundation. With Complyance e-invoicing solutions, logistics businesses can simplify e-invoicing, reduce errors, and stay compliant without changing their existing systems or workflows.

If you are preparing for UAE e-invoicing and want a smooth, scalable approach built for real logistics use cases, Complyance helps you go live with confidence. Get started with Complyance and make logistics e-invoicing simple.

Related posts

Frequently Asked Questions

Yes—Complyance is an FTA-accredited ASP with Peppol certification. It simplifies logistics via single API for PINT-AE conversion, validation, routing, and real-time monitoring. Go live in days with pre-built ERP integrations, gap analysis, and no-downtime queuing. Ideal for 3PL, freight forwarders, and high-volume providers.

Follow this roadmap:

- Gap analysis (invoices, data, VAT mapping).

- Pilot top routes/composite invoices.

- Sandbox test via ASP.

- Train teams on workflows.

- Roll out gradually.

Download Complyance's Excel templates or API docs for quick start.

Map systems to output structured data (TRN, lines, VAT per service). Use developer-friendly APIs like Complyance's: sign up, generate sandbox key, test payloads, go live. No-code options: Excel uploads or manual creation. Supports multi-entity ops and 99.7% accuracy, as in the HAACO case study.

Composite e-invoices bundle multiple logistics services (e.g., domestic transport at 5% VAT + zero-rated export freight) into one document. Each service must be a separate line item with line-level VAT in PINT-AE XML format. Use ERP/TMS APIs to map data accurately, failure here causes 80% of validation rejections. Complyance automates this for mixed VAT scenarios.

- International freight (import/export): Often zero-rated; include structured references like AWB/BL in PINT-AE fields.

- Domestic transport: 5% standard VAT, separated by line.

- Warehousing/storage: 5% standard-rated.

- Customs, packing, handling: Varies (standard, zero, or exempt)—apply per line, not invoice total.

E-invoices transmit via ASPs to FTA in real-time for validation. See the UAE E-Invoicing Data Dictionary.

UAE uses a decentralized 5-corner DCTCE model on Peppol:

- Supplier (logistics firm) generates invoice in ERP/TMS.

- Supplier's ASP validates/converts to PINT-AE.

- Transmits via Peppol to buyer's ASP.

- Buyer processes/reconciles.

- Both ASPs report to FTA's CDP.

This ensures real-time FTA visibility for high-volume logistics transactions.

Subscribe to our Newsletter

Get the latest compliance updates, e-invoicing news, and expert tips delivered to your inbox.

ABOUT COMPLYANCE

Empowering businesses to automate e-invoicing and stay compliant in 100+ countries. Our platform simplifies regulatory complexity for enterprises and fast-growing companies.