The Complete Guide to Choosing a UAE E-Invoicing Partner for Your Business

Learn how to choose a UAE e-invoicing solution provider using the official MoF checklist, industry-specific criteria, and a comparison of the top 5 e-invoicing platforms in the UAE.

Table of Contents

With more than 100+ service providers to choose from, finding one you can trust to keep your UAE e-invoicing safe can be confusing.

The upcoming mandate from the Federal Tax Authority is not just a simple change. It is a fundamental shift in how your business issues, validates, and reports invoices.

One of the most important decisions you will make in this journey is simple: choosing the right solution partner.

Your e-invoicing provider will act as the bridge that connects:

- Your ERP, POS, and billing systems

- The UAE FTA and the Peppol network

The wrong choice can mean delayed implementation, security issues, failed validations, and a constant firefight before every deadline. The right choice means a smooth, fast go-live that keeps your business calm and sets you up for multi-country compliance in the future.

This guide will walk through:

- The official Ministry of Finance (MoF) accreditation checklist

- The advanced capabilities that most providers do not offer, but you will actually need

- Industry-specific checklists for:

- IT services and system integrators

- SaaS companies

- ERP vendors

- Accounting and audit firms

4. A consolidated view of the top 5 UAE e-invoicing platforms and when each one fits

Why Your Choice of E-Invoicing Vendor Matters So Much

Your e-invoicing partner will:

- Handle invoice and tax data

- Communicate directly with the FTA through the Peppol network

They must not break in peak periods, misinterpret rules, or disappear when an update rolls out.

A good provider does more than make you “technically compliant”. They should:

- Help you go live faster, with less internal chaos

- Reduce error rates and rejected invoices

- Scale with you as you add new entities with different ERPs, and move to multiple countries

That is why we start with the non-negotiables from the UAE Ministry of Finance.

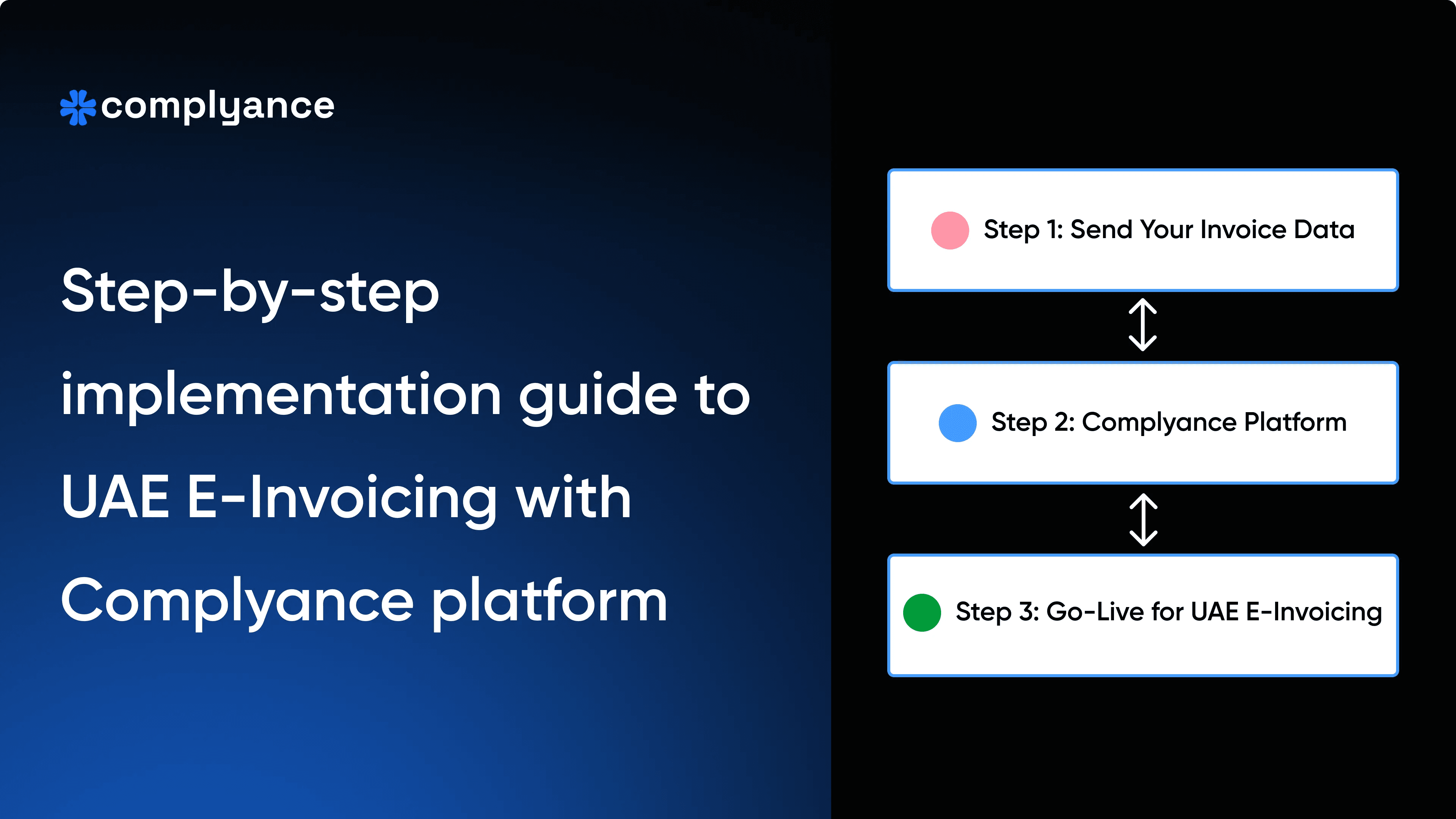

The implementation of e-invoicing in the UAE takes one week.

Try Complyance and see the fast result

The Foundation: UAE Ministry of Finance Compliance Checklist

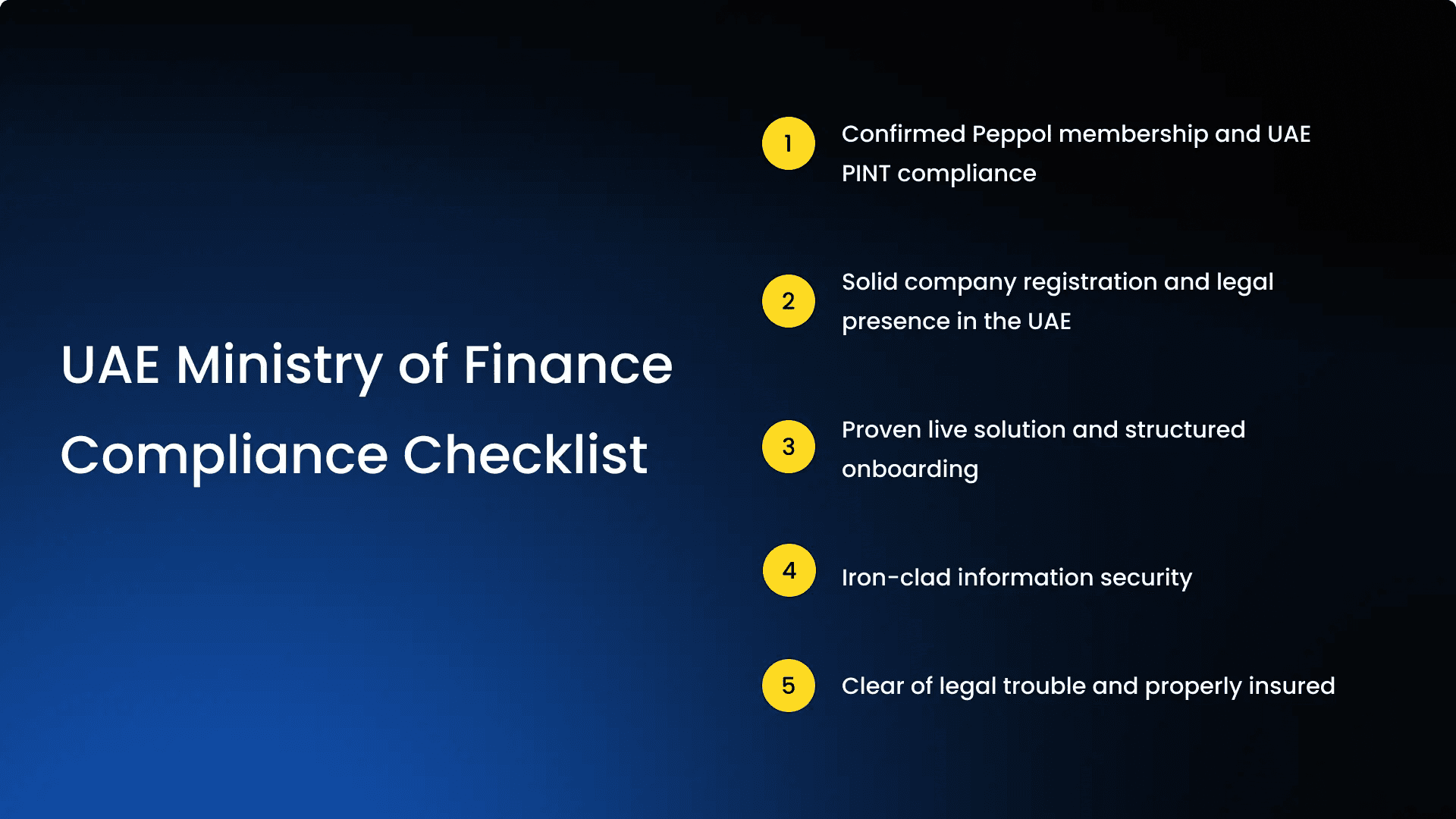

The MoF has a strict accreditation framework so that only stable API providers are allowed to operate. Before you look at features and UI, make sure the provider passes these basics.

- Confirmed Peppol membership and UAE PINT compliance: First, ask for the provider’s Peppol Service Provider ID and confirm their status as a registered Peppol access point or service provider. Next, verify that they support the UAE-specific PINT AE format, not just generic Peppol BIS. If they are not Peppol certified or do not support PINT AE correctly, you risk invoice rejections, downtime, and non-compliance when the FTA tightens enforcement.

- Solid company registration and legal presence in the UAE: Your provider should have a real legal footprint in the UAE, either as a local company or as a foreign entity with a registered office. Check their trade license and confirm that they meet MoF criteria, such as minimum paid-up capital and at least two years of operational history. This proves they are built for the long term and reduces the risk of them disappearing midway through your rollout.

- Proven live solution and structured onboarding:

Look for:

- A live, working demo using real or sample invoice flows

- Customer stories, ideally in your industry or region

- A documented onboarding plan with milestones and responsibilities

You are looking for a partner who can show clear steps from “kickoff” to “first accepted invoice” rather than leaving your team to figure it out after signing. - Iron-clad information security: Your e-invoicing provider will process invoice data, customer details, tax information, and audit trails. Security cannot be an afterthought. Look for:

- ISO 27001 certification as a baseline

- Encryption in transit and at rest for all sensitive data

- Multi-factor authentication for admin access

- Continuous monitoring, logging, and alerting for suspicious access

This is not just about compliance. It is about protecting your customers and your brand. - Clear of legal trouble and properly insured: Ask directly about legal status. The provider should:

- Have no ongoing liquidation or insolvency proceedings

- Not be on any regulatory or banking blacklist in the UAE

- Hold active policies for cyber insurance, professional indemnity, and crime, aligned to MoF expectations

These are boring questions during sales calls, but they protect you from serious risk later.

Beyond the Basics: Capabilities Most Providers Do Not Offer, But You Will Need

Passing the MoF bar means a provider is allowed to operate. It does not mean they will make your life easy. To run e-invoicing smoothly in real life, you will need a partner who can do much more than “generate a PINT AE XML”.

- Multi-country rollout from one integration: If you already operate in KSA, Singapore, or other GCC markets, or you plan to do so, look for a solution that handles multiple countries with a single API or connector. This avoids a situation where your IT team rebuilds integrations every time a new mandate appears. The best platforms give you one unified data model, then handle country-specific mapping and routing behind the scenes. Refer: Top 5 E Invoicing Partners for IT Services Implementing for Clients in 2025

- Proactive error detection: A basic provider will tell you, “Invoice rejected, here is a cryptic error code”.A better provider will show you which field is wrong, why it failed, and how to fix it, ideally before the invoice even leaves your system. This pre-validation approach dramatically reduces rejections, manual rework, and month-end chaos for finance teams.

- Handling government API downtime gracefully: FTA and Peppol endpoints can be slow, especially in early rollout phases. Your provider should queue invoices automatically, retry intelligently, and keep a clear status trail without requiring manual intervention from your team.

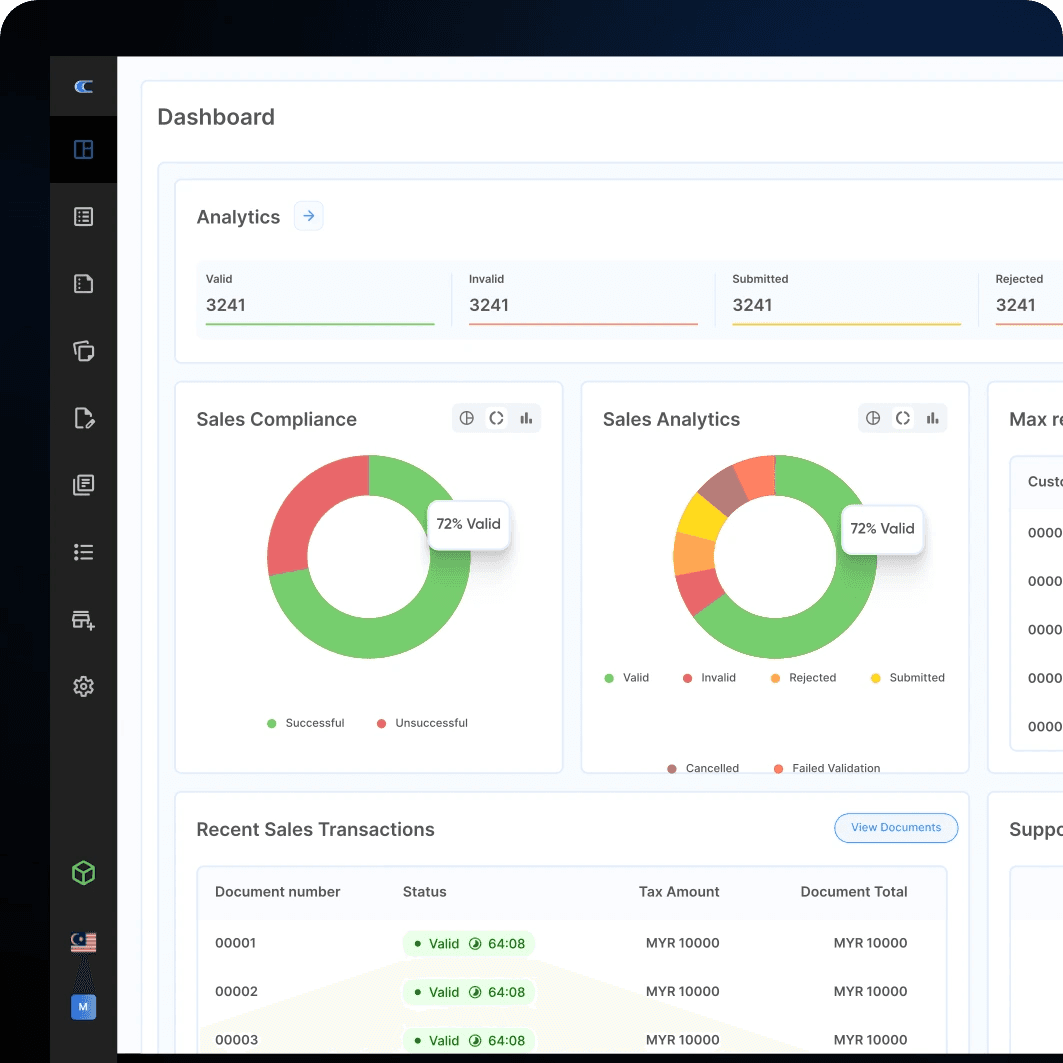

- Transparent usage and performance dashboards: You should be able to answer questions like:

- How many invoices did we send this week by entity or country?

- How many were rejected and why?

- Are we about to cross any limits where our price will jump, or overage charges will start?

A good platform provides clear dashboards with no hidden fees and no surprise overages. This becomes a powerful tool for both finance operations and vendor management. - Gap analysis and readiness assessment: Before your project even starts, your provider should help you understand:

- Which invoice fields are missing or misaligned with PINT AE

- Which ERPs, POS, and billing systems need changes

- Which process gaps will cause rejections or delays

A structured readiness assessment reduces last-minute challenges and gives a clear view of effort and risk.

Read the full blog: UAE E-Invoicing Readiness Assessment: A 6 Step Preparation Plan for Business - 24/7 customer support with real experts: Look for an e-invoicing partner who understands the UAE rules, Peppol flows, and integration details. Ideally, you should be able to reach someone during UAE working hours and have escalation paths for business-critical issues.

- Automated regulatory updates and advanced pre-validation: Your provider should own the job of staying in sync with new rules, schemas, and timelines. They should also maintain a rich pre-validation engine that checks both business rules and FTA rules before submission. This turns UAE e-invoicing from a continuous project into a managed service you can trust.

Industry Specific Checklists:

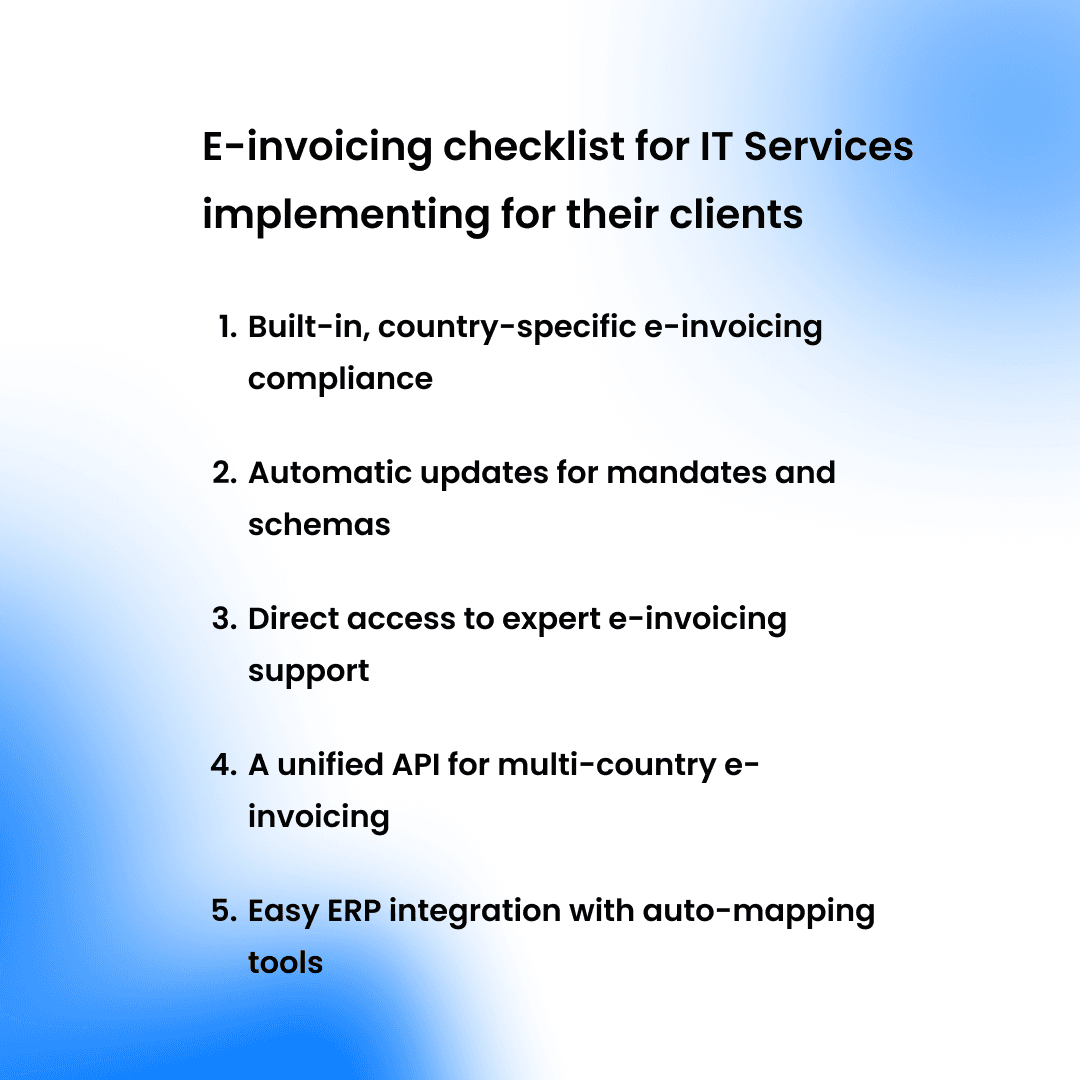

Checklist for IT Services and System Integrators

When you implement e-invoicing for clients, the platform you choose affects your delivery timelines, margins, and support load. Use this checklist as your partner selection filter.

- Built-in, country-specific e-invoicing compliance: Your platform should ship with native support for formats and rules like PINT AE, ZATCA Fatoorah, Peppol BIS, and other e-invoicing formats. This means the vendor handles the full end-to-end chain. When country rules change, your team should not be rewriting code, only updating the configuration or letting the partner handle it entirely.

- Automatic updates for mandates and schemas: Governments frequently update e-invoicing schemas, APIs, and timelines. Choose a provider that tracks these changes, updates their platform proactively, and gives you clear release notes or change logs. Your goal is to protect your development teams from last-minute “all hands on deck” sprints every time a tax authority updates its rules.

- Direct access to expert e-invoicing support: You want support from people who have lived through rejections, Peppol routing issues, and API failures, not just call center agents. When a client invoice fails, your partner should help you identify whether the issue is data, mapping, configuration, or external downtime. Fast, expert guidance lets your team resolve incidents quickly and protects your relationship with the client’s leadership.

- A unified API for multi-country e-invoicing: If you build integrations for multiple markets, a single global API is a huge advantage. This allows you to standardize your own internal data model and reuse patterns across projects, rather than creating separate integrations for each country. In practice, this means faster delivery, less maintenance, and a more scalable “e invoicing accelerator” that you can reuse with many clients.

- Easy ERP integration with auto-mapping tools: Your developers should not spend weeks mapping CUST_CODE to BuyerReference and guessing the right VAT fields. Look for auto-mapping tools and templates that suggest field mappings based on your ERP schema and the PINT AE or local requirements. This significantly reduces integration time, avoids mapping mistakes, and makes delivery more predictable across different clients and ERPs.

- Government accreditation and proven track record: Your partner should be accredited or in the formal accreditation pipeline where required, and have live production volumes to show. Ask for references specifically from IT services or system integrators who use the platform as part of their own offering. This gives you confidence that the platform can handle multi-client, multi-project, multi-ERP environments without falling apart.

Read the full article: Top 5 E Invoicing Partners for IT Services Implementing for Clients in 2025

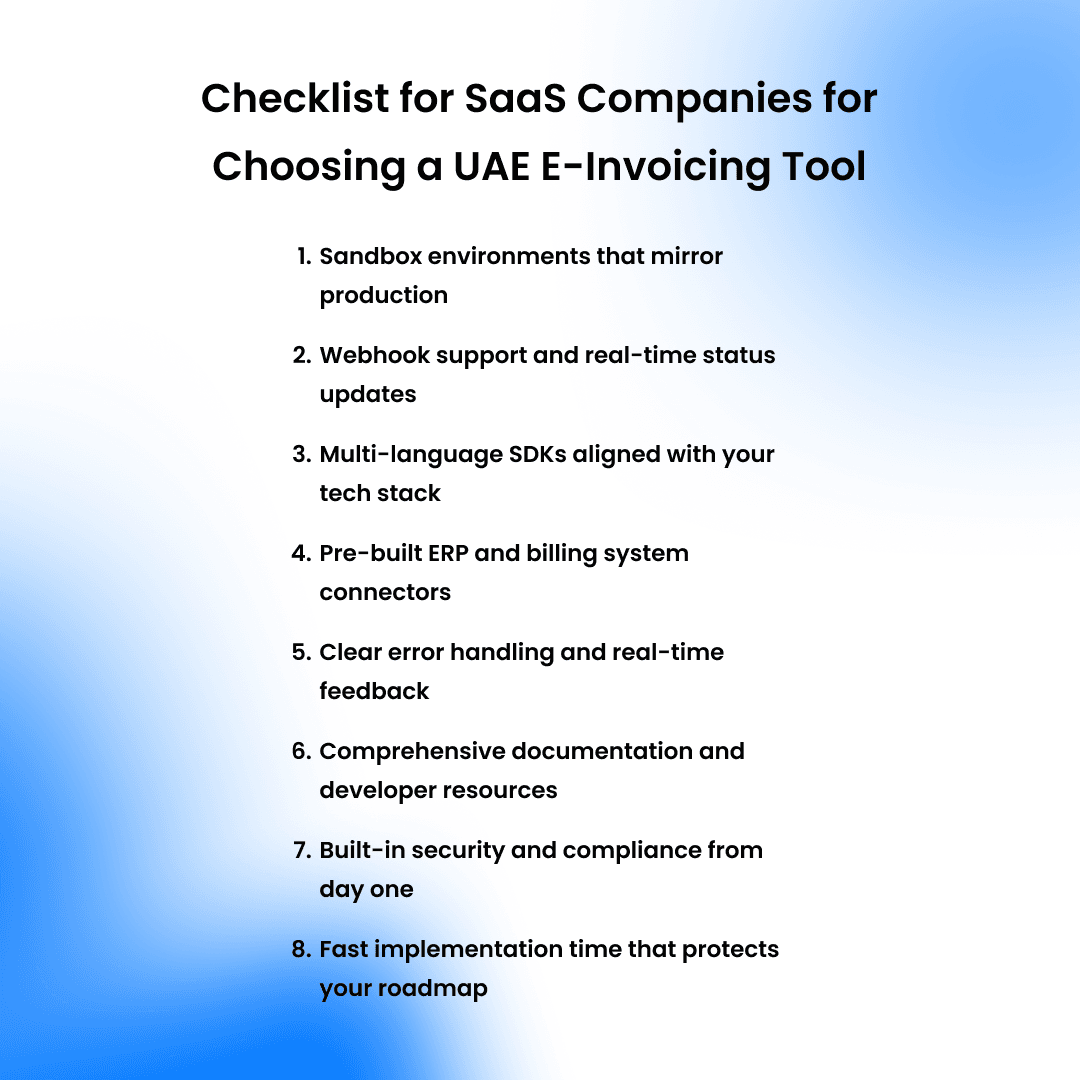

Checklist for SaaS Companies for Choosing a UAE E-Invoicing Tool

- Sandbox environments that mirror production: You need a safe space where your engineers can test the full invoice lifecycle. This includes payload validation, error simulations, status updates, and edge cases without touching live customers or FTA production systems. The closer the sandbox is to real life, the faster you can ship a reliable integration with confidence.

- Webhook support and real-time status updates: Your product should know when an invoice is accepted, rejected, or delayed, and be able to reflect that to users. Webhooks allow you to trigger notifications, retries, and UI updates as soon as the e-invoicing platform receives a status. This is critical for a smooth user experience and for preventing silent failures that show up days later in support tickets.

- Multi-language SDKs aligned with your tech stack: If your team works in Java, Node, Python, or other modern stacks, the provider should offer SDKs and examples in those languages. This reduces bootstrapping time and lets developers focus on their core tasks. Good SDKs also encode best practices around authentication, retries, and error handling for you.

- Pre-built ERP and billing system connectors: Your team should be able to accelerate integration with major systems like Oracle, NetSuite, and SAP, reducing time-to-market and developer overhead.

- Clear error handling and real-time feedback: During development and in production, error messages must be clear, actionable, and tied to the exact field or rule that failed. Avoid providers that only return generic codes with no human-readable explanation. The better the error feedback, the less time your team spends debugging and the fewer “mystery issues” hit your support queue.

- Comprehensive documentation and developer resources: Your engineering team should be able to complete the integration in a matter of days, guided by clear documentation, robust SDKs, and a well-designed, developer-friendly API.

- Built-in security and compliance from day one: Your SaaS customers expect you to protect their data and keep them compliant. Your provider must help you do both. Security features like encryption, fine-grained access control, and audit trails should be part of the core platform, not optional extras. For compliance, automated rule updates and PINT AE validation are critical so your product stays aligned even as legislation evolves.

- Fast implementation time that protects your roadmap: The promise of a fast go-live is central to its value proposition. With a reported integration timeline, it drastically reduces the opportunity cost and implementation time, and allows your team to stay focused on core product development. The availability of a free testing environment before commitment further de-risks the evaluation process.

Read the full breakdown: The 5 Best UAE E-Invoicing Software for SaaS Companies in 2025

Checklist for ERP Companies Choosing an E-Invoicing Partner

- Technical integration that fits your ERP architecture: Your partner should support pre-built connectors or a clean API that works with your main ERP stacks: SAP, Oracle, Dynamics, NetSuite, and custom. Ask about their unique features like Auto Field Mapping, so your team does not hand-map every customer's fields. This saves months of custom work and avoids technical debt that slows future releases.

- Strong compliance assurance, not just “supports UAE.”: You need more than a checkbox that says “PINT AE supported”.Look for robust pre-submission validation, automated rule updates across countries, and clear compliance guarantees. This protects your clients from rejection and protects your product from being blamed for regulatory failures.

- Operational control, dashboards, and whitelabel front ends: Your internal teams should have a single view of all customer entities, invoice volumes, and error patterns. Features like customer management dashboards, partner portals, and whitelabeling allow you to keep control and present everything under your own brand. To your customers, it will be “your” e-invoicing engine, even though a specialist platform is doing the heavy lifting behind the scenes.

- Global scalability through a single API: One global API that supports many countries is far easier to maintain than separate solutions per jurisdiction. This lets your businesses confidently pitch “global e invoicing readiness” while your engineering team maintains a single integration surface.

- Developer experience that does not slow your product roadmap: Clean docs, SDKs, and a full sandbox environment reduce integration effort and help teams avoid guesswork. The easier the DX, the easier it is to make e-invoicing just another module in your product, rather than a constant pain point.

Read the complete blog: Top 5 E Invoicing Solutions for ERP Companies

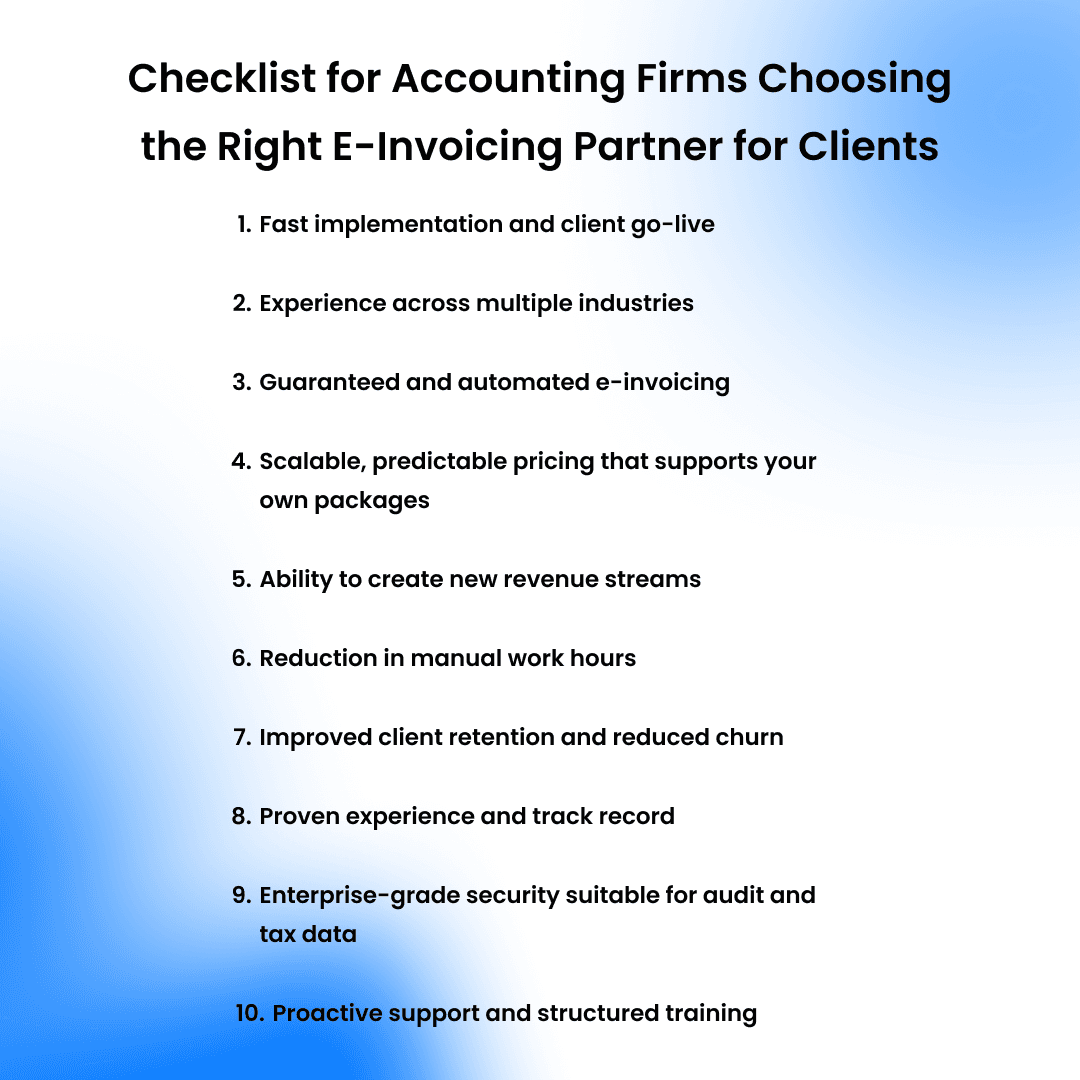

Checklist for Accounting Firms Choosing the Right E-Invoicing Partner for Clients

- Fast implementation and client go-live: Your partner should have a clear track record of onboarding clients in days or weeks, not quarters. This is crucial to help your clients meet phased UAE deadlines without panic or firefighting. The faster you get them live, the more they trust your firm and the easier it becomes to roll out e-invoicing as a standard service.

- Experience across multiple industries: Your portfolio may include retail, manufacturing, logistics, trading, professional services, and more. Choose a provider that has already seen and solved e-invoicing issues across these varied sectors. This reduces surprises on complex clients and allows you to standardize on one platform for most of your book.

- Guaranteed and automated e-invoicing: The solution should handle validation, XML generation, submission, and archiving with minimal manual work from your team. Automated rule updates and clear acceptance guarantees give you confidence when you sign engagement letters. If something breaks, you want the provider to be accountable for fixing it, not your staff burning nights on technical debugging.

- Scalable, predictable pricing that supports your own packages: Look for pricing that is predictable by client, entity, or tier, rather than volatile per-transaction bills that eat into your margins. This helps you design profitable service offerings while keeping costs under control as client volumes grow.

- Ability to create new revenue streams: The right partner should make it easy for you to package e-invoicing as a repeatable, billable offering for your clients. You can charge setup fees, ongoing retainers, and premium reporting for clients that want deeper visibility and support. This shifts e invoicing from a cost and headache into a clear, structured profit center for your firm.

- Reduction in manual work hours: A strong platform automates repetitive tasks like manual XML creation, resubmissions, and data entry. Over time, you improve realization rates and can serve more clients with the same headcount.

- Improved client retention and reduced churn: When you make e-invoicing smooth and low stress, clients mentally tag your firm as “the partner who kept us safe.That makes them far less likely to switch providers once you are embedded in their compliance processes. Higher stickiness translates into recurring revenue, referrals, and a stronger competitive position in your market.

- Proven experience and track record: Select partners with real implementations, case studies, and live volumes in the UAE and similar markets. Ask specifically about other accounting firms they work with and what results they have achieved. This lowers your risk and reassures your partners that you are not betting the firm on an untested tool.

- Enterprise-grade security suitable for audit and tax data: Your clients trust you with complete financial data, so your vendor must meet that bar. Expect encryption, access controls, audit trails, and certifications such as ISO 27001 as standard. This helps you pass security reviews with larger clients and keeps regulators comfortable during inspections.

- Proactive support and structured training: Choose vendors that provide excellent support for your team and offer resources to train your clients, easing adoption and positioning your firm as a guide.

Read the full guide: Top 5 UAE E-Invoicing Solutions for Accounting Firms Helping Clients Go Live

Bringing It All Together: Top 5 UAE E-Invoicing Solutions Compared

| Solution | Best For | Standout Feature | Key Advantages |

|---|---|---|---|

| Complyance | Global E-Invoicing with Developer-Friendly API | Go-live in a week with developer-friendly API | Single API for 100+ countries, 100+ automated validations, handles FTA downtime, multi-ERP integration, 24/7 support, gap analysis |

| Pagero | Network-based invoice automation | Peppol-certified network for B2B invoice exchange | Automates invoice lifecycle, global buyer-supplier network, Peppol-certified |

| EDICOM | EDI and e-invoicing expertise | Robust security with digital signature support | Strong EDI capabilities, global compliance in EU/LATAM/UAE, secure data handling |

| Sovos | Regulatory-focused e-invoicing | Scalable for global tax compliance | Supports multi-jurisdiction reporting, FTA-compliant invoicing, regulatory expertise |

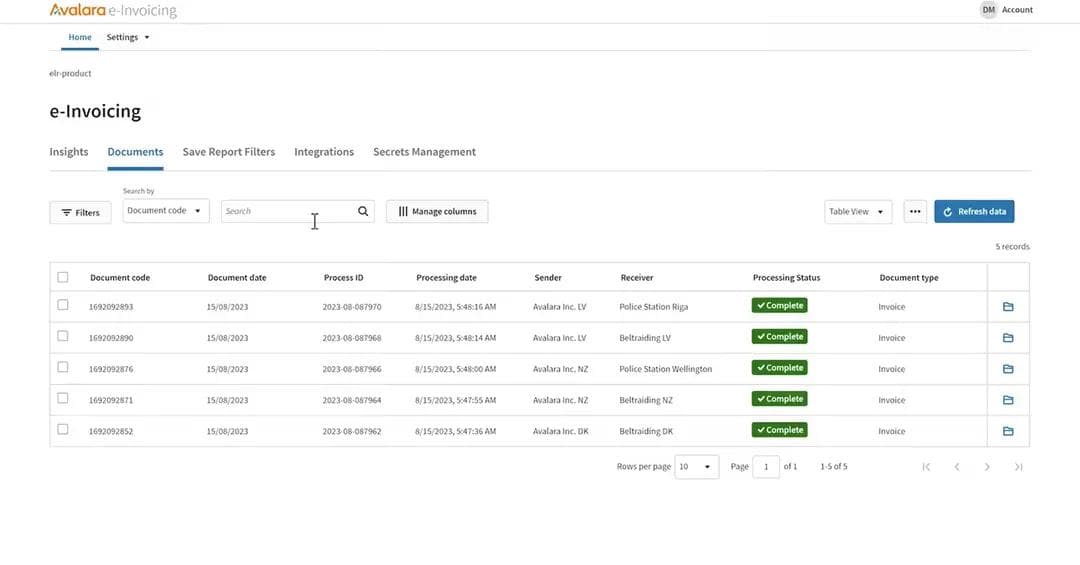

| Avalara | Global tax and e-invoicing integration | Broad ERP integrations for tax and invoicing | Multi-country tax compliance, supports major ERPs, centralized dashboard |

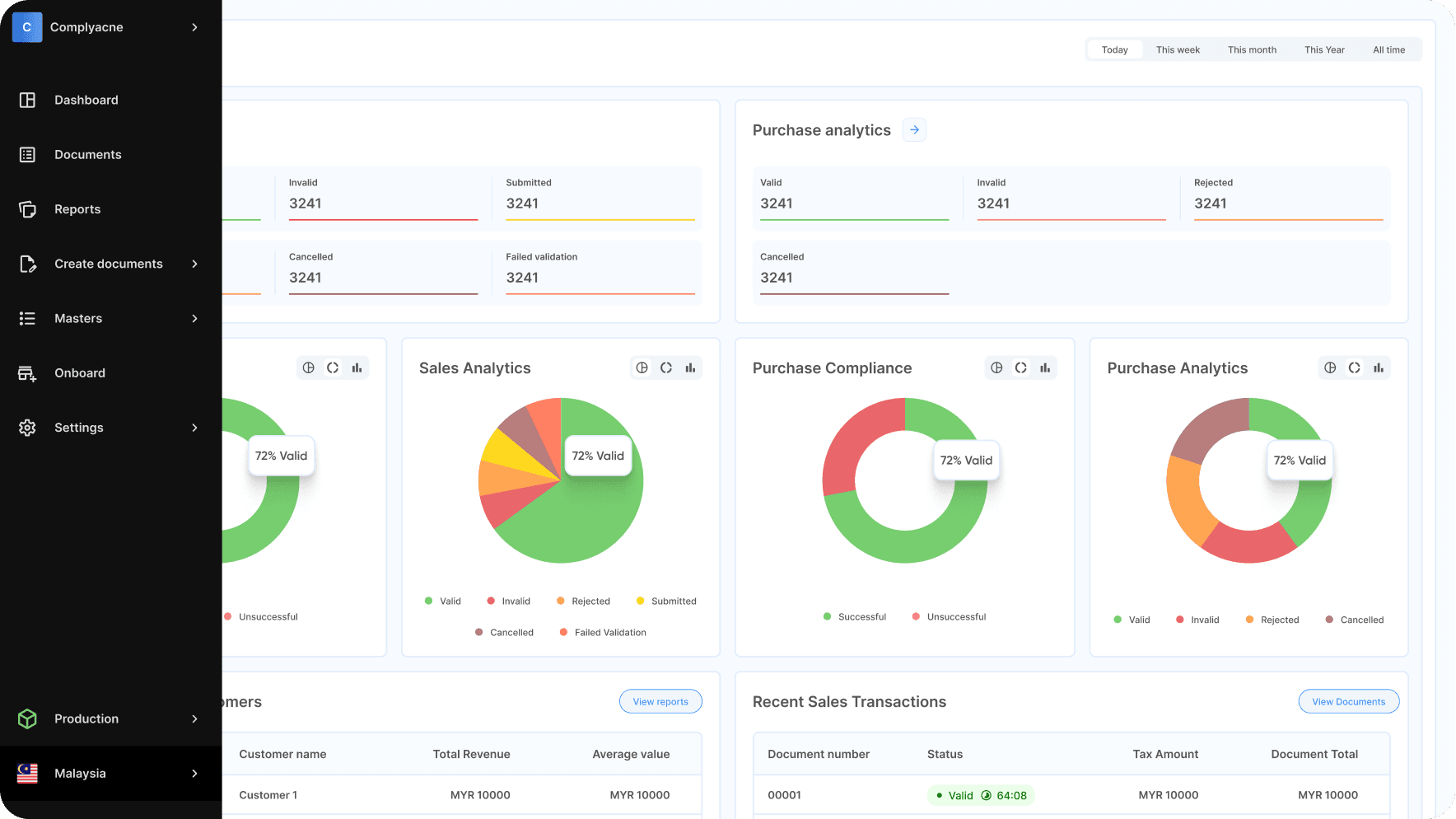

Complyance

Accredited Service Provider under the UAE e-invoicing framework, delivering rapid implementation, global scalability, and a developer-first integration model.

- Rapid implementation for businesses: Known for fast go-live times, often within weeks, so finance and IT teams see value quickly instead of waiting through long projects.

- 10x faster integration for partners: Go live in days, not months, using the GETS framework, with minimal rework needed as you add new countries over time.

- Developer first experience: Excellent documentation, SDKs, interactive “try it now” docs, and a full sandbox give engineers a clean API experience and sharply reduce integration effort.

- Resilient by design: The platform is built to handle external system outages without disrupting your operations, so FTA or network issues do not stop your billing.

- Cost-effective global rollout: One API covering multiple countries reduces long-term development, testing, and maintenance costs compared to building separate flows per mandate.

- Unique auto mapping engine: An AI-powered Auto Field Mapping Tool eliminates the manual, error-prone task of mapping ERP fields to government schemas, which is usually one of the slowest parts of implementation.

- Proven ERP track record: Trusted by companies such as Zenoti, Softlink Global, and Newage for seamless ERP integration across complex, multi-entity environments.

- Enterprise-grade security: SOC 2 Type 2, ISO 27001, and GDPR certifications, along with robust data protection controls, support strict internal security and audit requirements.

- High volume processing: Handles thousands of invoices in a single run, with instant error identification and consolidation, so large batches can move safely at scale.

- Single global platform: One integration replaces multiple country-specific connections, giving you a unified e-invoicing layer for 100-plus jurisdictions.

- Faster client onboarding for firms: Pre-built ERP connectors help partners, accounting, or IT service firms onboard their own clients faster and more predictably.

- Lower penalty risk: Automated validations reduce e-invoicing errors before submission, helping to minimise rejections and protect your brand.

- New revenue lines for partners: Global e-invoicing can be packaged and resold as a value-added service, attracting multinational clients who value one consolidated provider.

- Audit-ready reporting: Built-in reporting and history reduce manual oversight, freeing senior staff for advisory roles rather than chasing invoice status.

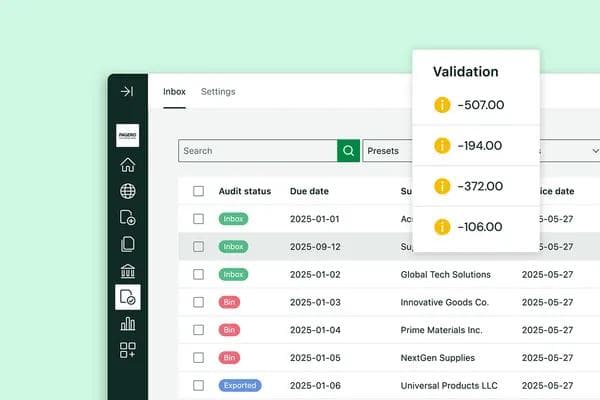

Pagero (Part of Thomson Reuters)

- Supply chain-focused automation: Streamlines e-invoicing for clients with complex supply chains, cutting manual reconciliation time across buyers, suppliers, and intermediaries.

- Network-driven stickiness: Superior network effects and a large trading community create natural client stickiness as more partners connect through the same rail.

- Peppol certified connectivity: Deep Peppol expertise ensures seamless, standards-compliant data exchange with the UAE FTA and other Peppol authorities worldwide.

- End-to-end lifecycle automation: Manages the process from invoice issuance through delivery, acknowledgements, and payment confirmations, reducing repetitive manual work.

- Cross-border compliance strength: Automated regulatory updates and global coverage help firms support international clients that operate in many jurisdictions.

- Broader document coverage: Supports a wide range of supply chain documents, allowing firms to extend services beyond invoices into orders, despatch advice, and more.

- Intercompany transaction support: Strong intercompany capabilities make it suitable for large enterprises with complex flows between subsidiaries and group entities.

- High volume scalability: Designed to handle very large B2B volumes reliably, which suits enterprises with heavy transaction traffic.

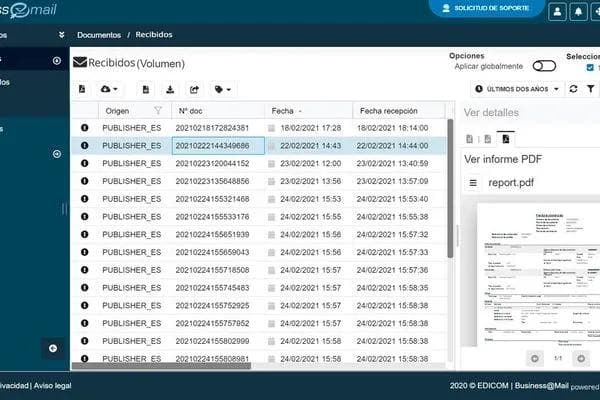

EDICOM

- EDI first foundation: Bridges traditional EDI with modern e-invoicing, ideal for organisations that already rely on EDI and need to add regulatory compliance.

- Security-focused design: Emphasises strong security protocols and data integrity, which is critical when handling sensitive financial and operational messages.

- Long-term compliant archiving: Provides robust, long-term data archiving that supports detailed audit trails and reduces the risk of penalties during inspections.

- All-in-one vendor platform: Combines EDI, e-invoicing, and related services in a single platform, simplifying vendor management and lowering administrative overhead.

- Certified and trusted provider: Certified status with multiple authorities and a long operating history builds confidence that the solution will stand up under regulatory scrutiny.

- Automated regulatory updates: Automatically apply changes in rules and formats, saving time on research and manual configuration for your teams.

- Support for complex B2B requirements: Comprehensive EDI capabilities help firms serve clients with sophisticated partner networks and intricate process flows.

- Strength in regulated sectors: Particularly strong in highly regulated industries such as pharmaceuticals, automotive, and finance, where compliance expectations are high.

Sovos

- Regulation first approach: Built around deep regulatory knowledge, covering complex VAT and e-invoicing rules across many countries.

- Continuous monitoring and reporting: Offers ongoing regulatory monitoring and multi-country reporting, helping enterprises keep pace with frequent rule changes.

- Scalable enterprise architecture: Supports large, decentralised organisations with high transaction volumes and many entities, without sacrificing performance.

- Industry-specific solutions: Provides specialised capabilities for sectors that live under constant audit pressure, such as financial services and healthcare.

- Strategic tax technology fit: Best suited for larger groups that treat tax and e-invoicing technology as a long-term strategic programme rather than a small IT project.

Avalara

- Unified tax and e invoicing stack: Combines tax calculation, filing, and e invoicing in a single platform, reducing data silos and reconciliation pain between tools.

- Broad tech stack coverage: Supports diverse client ERPs and commerce platforms, widening the range of customers and systems you can serve efficiently.

- Deep ERP integrations: Certified connectors for SAP, Microsoft Dynamics, NetSuite, and others simplify the initial technical setup and reduce custom build work.

- Compliance automation at scale: Automates complex tax and e-invoicing workflows so accountants and finance teams can spend more time on higher-value advisory work.

- Firm-level scalability: Platform design and licensing can support growing client portfolios without an equivalent rise in operational overhead.

- Centralised reporting and analytics: Dashboards provide a unified view of tax exposure, invoice status, and compliance metrics across regions and entities.

- Market-trusted brand: Strong brand recognition in the compliance space can help firms build credibility when pitching to larger or more risk-averse clients.

For a full breakdown: The 5 Best UAE E-Invoicing Software in 2025

Conclusion: Choose a Partner, Not Just a Product

The UAE e-invoicing mandate is fixed, but how challenging or smooth your journey will be depends heavily on the partner you choose. If you:

- Lead an IT services or consulting practice

- Run a SaaS platform with UAE or global customers

- Own product or alliances for an ERP company

- Manage an accounting or audit firm that must guide clients through the change

Then your e-invoicing provider is not just another tool in your stack. They are a strategic ally touching revenue, risk, and reputation. By using:

- The MoF accreditation checklist

- The advanced feature list beyond compliance

- The four industry-specific checklists in this guide

You can filter out fragile, short-term options and focus on platforms that will still make sense when new countries and rules arrive.The next logical step is simple.

- Run your own readiness assessment

- Shortlist providers using the checklists above

- Test their sandboxes with your own data and workflows

From there, it becomes clear which providers truly treat UAE e-invoicing as core infrastructure your business can rely on.

Related posts

Frequently Asked Questions

The UAE Ministry of Finance requires vendors to meet five critical criteria: confirmed Peppol membership with UAE PINT AE format support, solid UAE legal presence with minimum paid-up capital and two years of operational history, proven live solutions with structured onboarding plans, ISO 27001 certification with encryption and multi-factor authentication, and clean legal status with cyber insurance and professional indemnity coverage. Verifying these checkpoints ensures your provider is legally authorized and operationally stable.

AI-powered auto-field mapping engines, unique to Complyance, eliminate the manual, error-prone process of mapping ERP fields to PINT AE schemas. This reduces integration time from weeks to days by automatically suggesting mappings based on your ERP schema and UAE requirements. IT services firms report 10x faster client onboarding when using platforms with this capability.

Complyance ranks highest for IT services due to its unified multi-country API, automatic regulatory updates, expert e-invoicing support, auto-mapping tools, and proven multi-ERP/multi-client environments. Pagero is a strong alternative for firms focused on supply chain automation, while EDICOM suits those needing EDI-e-invoicing hybrids.

SaaS firms must prioritize sandbox environments mirroring production, webhook support, multi-language SDKs (Java, Node, Python), pre-built ERP connectors, clear error handling, comprehensive documentation, built-in security with SOC 2 Type 2 certification, and implementation timelines under four weeks. Complyance delivers on all these criteria, offering a developer-first experience with interactive "try it now" docs.

Choose Complyance for rapid developer-first integration, AI auto-mapping, 10x faster go-live for partners, and cost-effective global rollouts with 24/7 UAE support. Select Pagero for supply chain-focused automation, superior network effects, and large trading community stickiness, particularly if your business model relies on B2B network-driven transactions.

The leading platforms are:

1) Complyance – best for fast implementation with one API and developer experience;

2) Pagero – optimal for supply chain automation and network effects;

3) EDICOM – ideal for EDI-first organizations;

4) Sovos – suited for large enterprises with complex VAT rules;

5) Avalara – perfect for unified tax and e-invoicing stacks.

Subscribe to our Newsletter

Get the latest compliance updates, e-invoicing news, and expert tips delivered to your inbox.

ABOUT COMPLYANCE

Empowering businesses to automate e-invoicing and stay compliant in 100+ countries. Our platform simplifies regulatory complexity for enterprises and fast-growing companies.