UAE E-Invoicing Compliance: Full Readiness Checklist for Businesses

A simple, complete guide to help UAE businesses get ready for e-invoicing. Learn how tax, IT, finance, and product teams can prepare early and stay compliant with the FTA.

Table of Contents

E-invoicing in the UAE is a big shift for every business. It changes how your business creates invoices, checks them, fixes errors, sends them to the buyer, and reports them to the FTA. Many companies know the rule is coming. But most do not know how to prepare properly. This guide gives you one clear path. It brings together the work of:

- tax teams,

- IT and ERP teams,

- finance teams,

- product teams.

Let's break this down in detail so every team knows how to get prepared.

What UAE E-Invoicing Really Means

E-invoicing in the UAE is a government-mandated process that requires businesses to issue, receive, and store invoices electronically in a structured XML format.

Regulated by the Federal Tax Authority, this system ensures real-time tax reporting, reduces invoice fraud, and improves compliance across sectors.

Instead of sending PDF or paper invoices, companies use FTA-approved Access Point providers to generate and transmit machine-readable e-invoices. These invoices are automatically validated and routed to both the buyer and the FTA through a five-corner model.

The UAE’s e-invoicing rollout will start in phases from 2025 and will be mandatory for large enterprises by January 2027. The system follows global digital tax trends and helps businesses streamline business transactions while staying audit-ready.

Why You Should Start Preparing Now

Many businesses think, “We still have time.”But e-invoicing readiness is not one small task. It touches many parts of your company. If you wait too long, several problems will appear.

- The IT team will feel the pressure.

- The tax team will not have enough time to verify the rules.

- The finance team will rush to clean the data.

- Your testing window becomes shorter.

- Errors show up at the last moment.

Starting now gives you space to fix things slowly and properly.

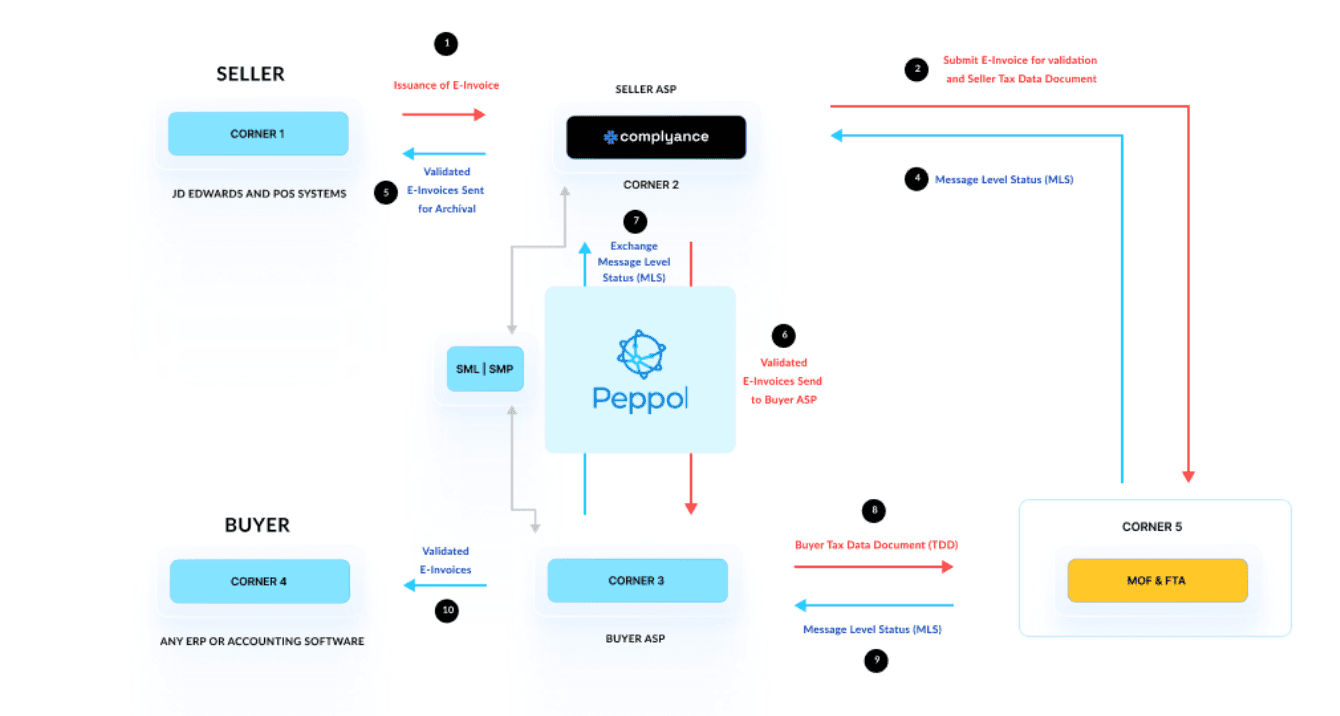

How Does the 5 Corner e-Invoicing Model Work?

The UAE uses a Peppol-based five-corner model (DCTCE) for e-invoicing. This model helps invoices move safely and correctly between your system, your buyer, and the FTA.

Here is how it works in simple words.

- Supplier Generates the Invoice: The supplier creates an invoice in their ERP or billing system in a standard format (not yet an e-invoice).

- Supplier’s Accredited Service Provider (ASP) Validates and Converts: The supplier’s ASP checks the invoice against UAE requirements and converts it into the PINT-AE XML format.

- At this point, the invoice becomes a valid e-invoice.

- Service Metadata Locator (SML) Identifies the Participant’s SMP: The SML acts as the global index of all Peppol participants. When an invoice needs to be sent, the network first queries the SML to locate the correct Service Metadata Publisher for the buyer. This step ensures the system knows exactly where the buyer’s metadata is stored.

- Service Metadata Publisher (SMP) Provides Routing Information: Once the SMP is identified through the SML, the SMP returns the buyer’s metadata, including Peppol ID, supported document types, and their Access Point details. This ensures the e-invoice is routed to the correct destination and that all participants have the information required to process it.

- Transmission to Buyer’s ASP: Using the Peppol network and SMP data, the e-invoice is securely delivered to the buyer’s ASP.

- Buyer Receives and Processes the Invoice: The buyer’s ASP delivers the e-invoice to the buyer’s ERP/accounting system, where it can be accepted, reconciled, or processed further.

- Reporting to the Federal Tax Authority (FTA): Both ASPs generate the Tax Data Document (TDD) and send it to the FTA via the Central Data Platform (CDP).

- FTA Validates and Accepts the TDD: The FTA validates the TDD in real time. Once accepted, the invoice is officially recorded as compliant and audit-ready.

For a detailed, step-by-step explanation of the 5 Corner Model, sign up for a free UAE E-Invoicing consultation with one of our tax experts

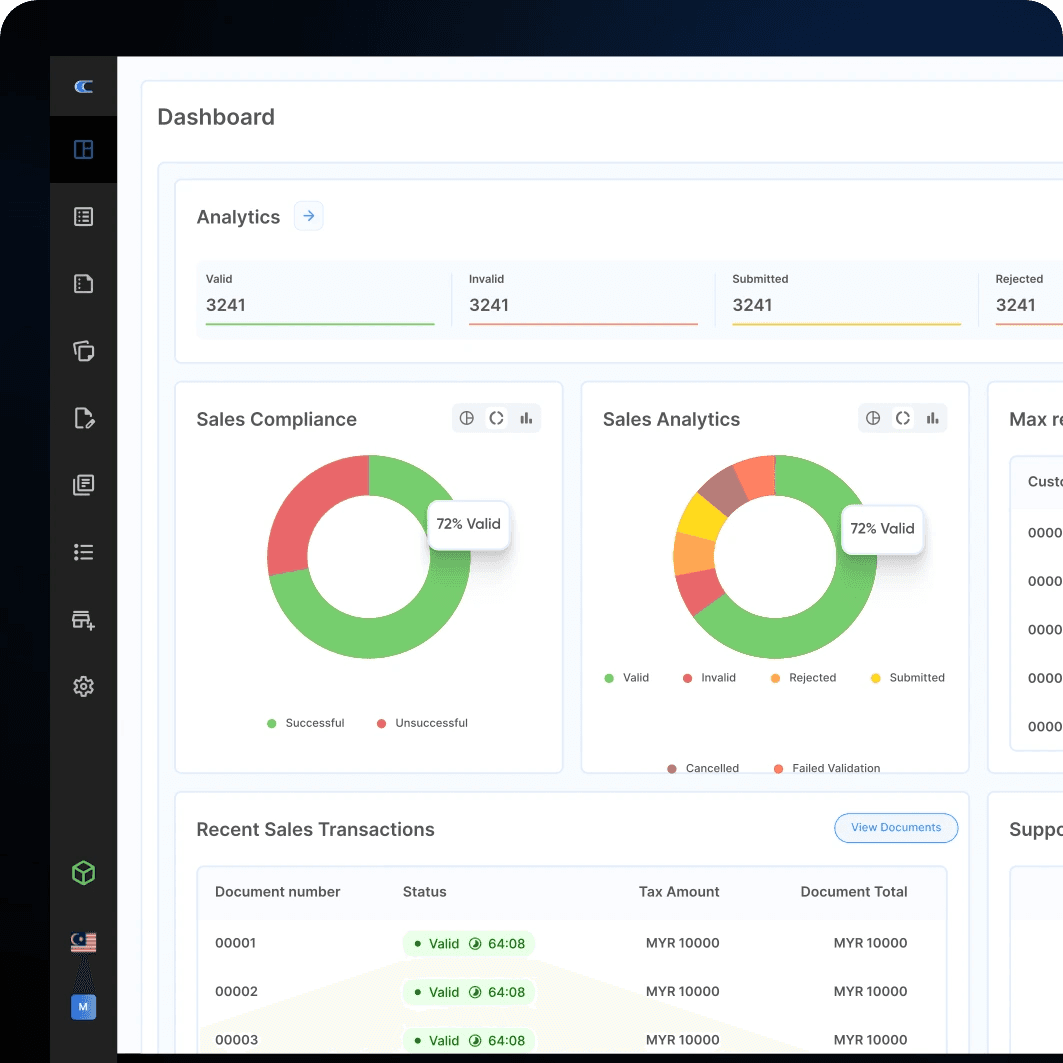

Go-live in a week using Complyance Platform

Why Businesses Must Prepare Long Before the Mandate Starts

To send your invoice through the UAE’s five-step model, every step must be followed clearly. Once you understand how the five corner model works, the next question becomes simple.

How can your business prepare so that your invoices move through the model smoothly and get validated by the FTA without any problems?

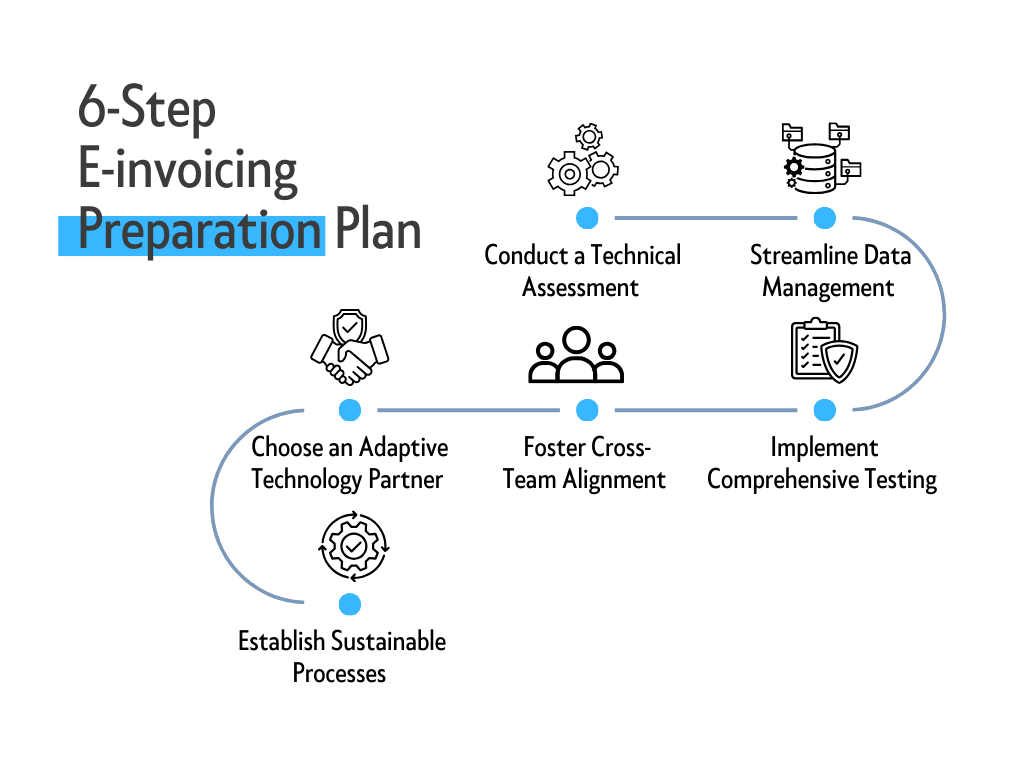

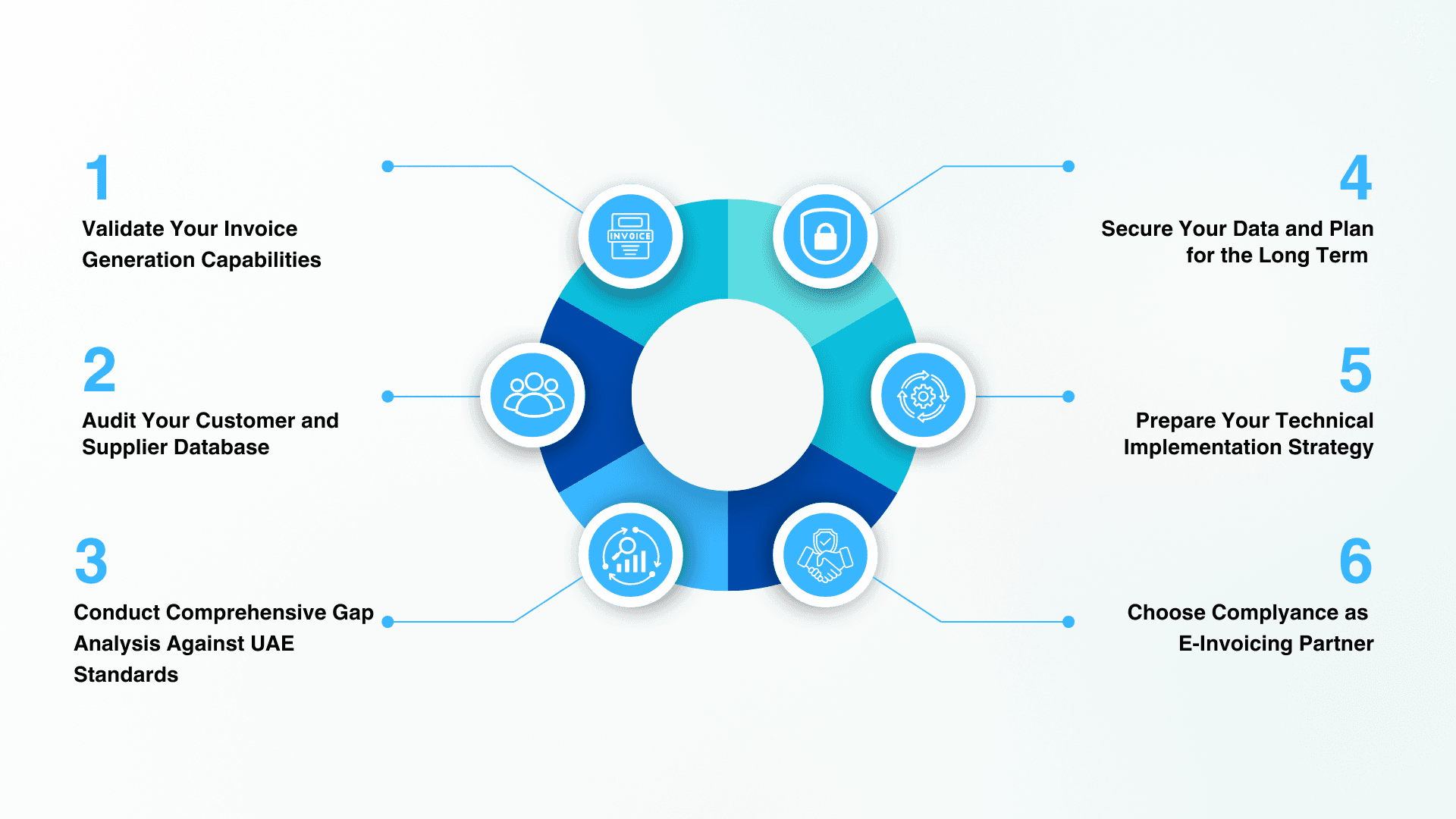

The good news is that getting ready does not have to be stressful or confusing. Your business can follow six simple steps to get everything in place. These steps help you clean your data, fix your systems, align your teams, and choose the right ASP so every e-invoice gets created, sent, and accepted without delays.

Let's break down each step in detail.

Conduct a Technical Assessment

Start by checking if your billing system or ERP can create an FTA-compliant e-invoice. Your system must be able to maintain clean data according to the PINT AE requirements. If some fields are missing or stored incorrectly, your team should fix them now. This early check helps you understand what your system can already do and what needs to be added or corrected before you move to the next steps.

Streamline Data Management

Clean and correct data is the heart of e-invoicing. If your TRNs are wrong, addresses are incomplete, or VAT values do not match, your invoice can fail before it even becomes an e-invoice. Your team should review customer and supplier details, fix missing fields, and make sure every record is accurate. This helps your invoices move smoothly from ERP to ASP to FTA without errors.

Choose an Adaptive Technology Partner

Your ASP is the bridge between your ERP and the FTA. This partner converts your invoice into PINT AE, validates it, and sends it to the FTA. Choose an ASP that grows with you, that updates its system when FTA rules change, and that supports your team through testing and fixing data issues. The right ASP makes your transition easier and keeps you compliant in the long run.

Complyance is a pre-approved Accredited Service Provider under the UAE Ministry of Finance framework, aligned with the Peppol-based five-corner model. This ensures invoices are validated, transmitted, and reported to the FTA in full accordance with official UAE e-invoicing requirements.

Foster Cross Team Alignment

E-invoicing is not a project for just one team. It needs teamwork across finance, tax, IT, and product. Each group has a clear role.

- Finance checks the numbers.

- Tax understands the rules.

- IT manages the systems.

- Product updates billing logic.

When everyone works together, your e-invoicing flow becomes stable, faster, and easier to manage.

Implement Comprehensive Testing

Before going live, test everything. Use your ASP’s sandbox to create sample invoices, credit notes, returns, and other real cases. See how your system reacts to FTA errors, missing fields, and wrong TRNs.Testing early helps your team catch mistakes and fix them while there is still time. This makes your actual go-live stress-free.

Establish Sustainable Processes

Once the e-invoicing mandate starts, your business must adapt to it to stay compliant. So you need clear, simple steps for:

- How to create invoices

- How to fix errors

- Who handles what

- What to do if the FTA is down

- How to report issues.

These processes help your team stay organised, avoid confusion, and keep your business compliant long after go-live.

Read the complete article: How to prepare for the UAE E-invoicing in 6 simple steps

How to Prepare Your ERP for UAE E-Invoicing

Once your teams understand the five-corner model and the six steps to get ready, the next part of preparation is your ERP. Your ERP is the place where every invoice starts. If the information in your ERP is not clean or complete, your ASP cannot create the PINT AE e-invoice, and the FTA will not validate it. This is why ERP readiness is one of the most important parts of your e-invoicing journey. Let us break down what your ERP team must do so your invoices move smoothly from your system to the ASP and then to the FTA.

Bridging the Gap Between Your ERP and the FTA

Your ERP, whether it is SAP, Oracle, Microsoft Dynamics, NetSuite, or a regional accounting tool, was not originally built for UAE e-invoicing. Most systems can create invoices, but they cannot create the exact PINT AE structure that the UAE requires. They also do not have built-in logic for things like digital signatures, XML creation, routing information, or validation rules. Because of this, your ERP needs extra preparation so the data it creates can be converted into a clean, compliant e-invoice. Without this preparation, your invoices may get rejected by the FTA.

Validate Your Invoice Generation Capabilities

The first thing your ERP team must check is whether the system can generate all the invoice details that the UAE requires. There are more than fifty mandatory fields in PINT AE, and your ERP must store each one correctly. This includes TRN, VAT values, invoice numbers, dates, totals, line items, and currency formats. Your ERP must also support special cases like credit notes, exemption codes, and reverse charge transactions. This step helps you see exactly what your ERP is missing and what needs to be added or fixed.

Audit Your Customer and Supplier Data

Most invoice failures happen because the data stored in the system is wrong or incomplete. Your team should check TRNs, addresses, emirate details, legal names, and all other customer or supplier information. If this data is incorrect, the ASP cannot convert your invoice properly, and the FTA may reject it. Cleaning this data early makes your e-invoicing journey much smoother.

Conduct a Gap Analysis Against UAE Standards

After checking your data, your IT team must compare your ERP output with the UAE e-invoicing standards. This means checking if your ERP can produce XML, if it can generate a UUID, if it supports digital signatures, and if it aligns with all PINT AE tagging rules. This gap analysis shows what must be built, fixed, or added before you can connect to an ASP.

Secure Your Data and Plan for Long-Term Compliance

E-invoicing involves sending financial data across multiple systems. Because of this, your business must follow strong security rules, including encryption, access control, and audit logging. Your team should also set up a long-term plan to keep up with any FTA updates or schema changes. This includes regular system reviews, update cycles, and clear steps for handling submission failures. Planning early protects your business from penalties and keeps your invoice flow stable.

Prepare Your Technical Implementation Strategy

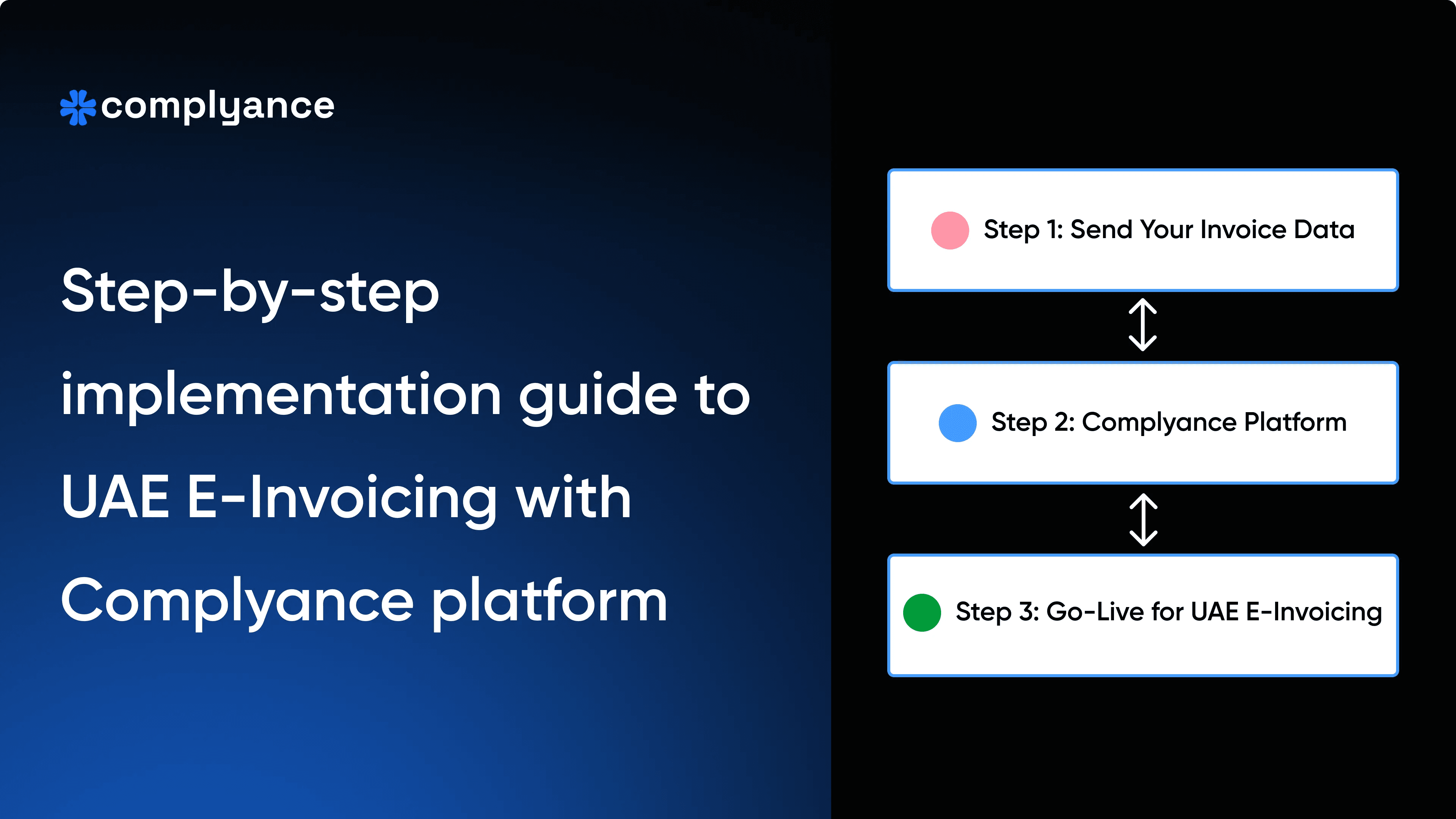

Once your ERP is clean and your data is ready, you must decide how your system will connect to the FTA. One option is to build a direct integration in-house, but this requires heavy development, constant updates, and technical expertise that many teams may not have. The other option is to connect to an Accredited Service Provider, where your ERP only needs to send a simple data payload, and the ASP handles the rest. Using an ASP reduces your workload because it takes care of XML formatting, signing, UUID creation, and FTA communication. This makes your go-live much faster and easier to maintain over time.

How Complyance Supports ERP Integration for UAE E-invoicing

Many companies choose Complyance because it removes the complexity of handling e-invoicing inside their ERP. The platform provides pre-built connectors for SAP, Oracle, Dynamics, and other major systems, so you do not need to rebuild your architecture. It checks your data against more than one hundred validation rules before sending anything to the FTA. It also reconciles your ERP invoice data with FTA responses so your finance and tax teams always stay aligned. With one clean API, businesses can go live in weeks instead of months.

Read the full guide: Step-by-Step Guide to Preparing ERP Systems for E-Invoicing in the UAE.

How Every Team in Your Company Should Prepare

Preparing for UAE e-invoicing is not something one team can handle alone. Every department plays a key part in making sure invoices move cleanly from your ERP to your ASP and then to the FTA. When all teams work together, your company becomes ready long before the mandate begins. Let us look at how each team can get prepared simply and clearly.

Finance Teams: What Is Their Role in UAE E‑Invoicing?

Finance teams make sure every number on an invoice is correct. They must check if the system is applying tax rules the right way and handling discounts, rounding, and credit notes properly. The invoice will be created by the system, but finance teams must set the logic behind how numbers are calculated and stored. They also need to confirm that customer and supplier information, such as TRNs and addresses, is complete and correct. When the new system goes live, finance teams will compare what was sent to the FTA against what was accepted every day.

IT Teams: What Is Their Role in UAE E‑Invoicing?

IT teams make sure the technology behind e-invoicing works smoothly. They need to check if the ERP or billing tool can produce the correct e-invoice file, usually in XML or UBL. They must set up safe connections that allow invoices to move from your ERP to your ASP and then to the FTA.IT teams should plan for situations where an invoice is rejected and ensure the system captures these errors clearly. They must also make these new changes work without disrupting finance, sales, or operations.

Product Managers: What Is Their Role in UAE E‑Invoicing?

If your product creates invoices for customers, then e-invoicing becomes a major update for your product team. Product managers must understand what the FTA expects and plan updates before the deadline. They need to check if refunds, discounts, price changes, or credit notes follow the new rules correctly. If your customers generate invoices using your product, you must explain what will change and when. Your product should be flexible so it can adapt when new rules or formats come from the FTA.

Tax Professionals: What Is Their Role in UAE E‑Invoicing?

Tax teams understand the rules better than anyone else. Their role is to stay updated with every change the FTA announces and translate complex rules into simple steps for other teams. They must guide finance, IT, and product teams on what must be checked before sending an invoice. Tax teams will help design new workflows so that every step follows UAE regulations. They also protect the company from penalties by spotting risks early and fixing them before invoices reach the FTA.

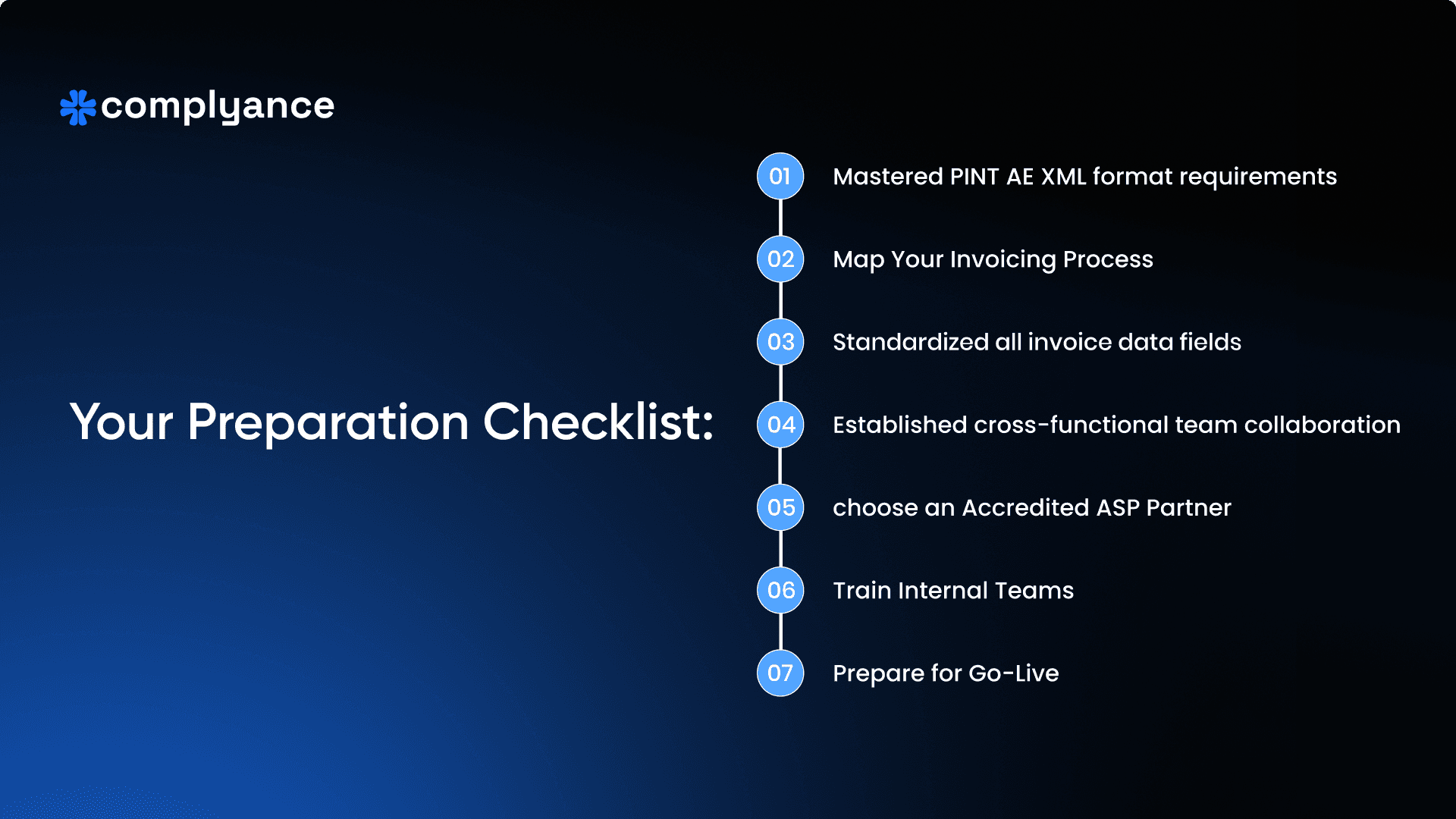

How should Indirect Tax Teams Prepare for UAE e-Invoicing: A Simple Seven-Step Roadmap

Tax teams play a central role in ensuring every part of e-invoicing is correct. Here is a simple way for them to get ready.

Learn the PINT AE XML Requirements

Tax teams must understand the PINT AE format and the UAE data dictionary. They need to know which fields are mandatory and which are conditional. This helps them guide IT and finance teams correctly. When tax teams know the rules well, the entire company is prepared for compliance.

Map Your Invoicing Process End to End

Every company creates invoices differently. Tax teams must sit with IT and finance to understand how invoices move from ERP to approval and then to dispatch. They should identify where each field comes from and who owns it. This makes it easier to fix gaps early in the project.

Standardize All Invoice Fields

Invoices often fail because of inconsistent invoice data, such as missing TRNs and wrong VAT codes. Tax teams must ensure all fields follow the same format across every system. Standardization reduces errors and helps the ASP convert the invoice to PINT AE without problems. This makes the whole process smooth from the start.

Build Strong Cross-Team Collaboration

Tax teams cannot prepare alone. They must work with finance to ensure numbers are correct and with IT to ensure systems support the logic. Regular meetings help all teams stay aligned. Collaboration removes bottlenecks and makes the project faster.

Choose an Accredited ASP Partner

The ASP is the link between your ERP and the government. Tax teams must help select the right partner so that your invoices move safely and accurately. A strong ASP supports your ERP setup, handles large volumes, and updates rules automatically. Choosing the right ASP saves time and reduces risk.

Train All Internal Teams

Internal training is important for long-term success. Finance, operations, tax, and IT must understand systems, errors, and how to fix problems. Workshops help everyone feel confident and reduce mistakes during go-live. Well-trained teams make the system work smoothly every day.

Prepare for Go-Live and Monitoring

Before going live, your company needs dashboards, alerts, and logs. These tools help tax teams monitor what is happening and fix issues quickly. Good monitoring builds trust within the company and with the FTA. It also turns your team from reactive to proactive.

Read the full blog: 7 Steps for the UAE E-Invoicing Roadmap for Tax Teams.

Conclusion: Turn UAE E-Invoicing Into an Advantage

The UAE e-invoicing mandate is more than a rule. It is a chance for your company to clean its data, fix old system gaps, and build stronger links between tax, finance, IT, and product teams. If you start early, you can test calmly, train your teams, choose the right ASP, and go live without panic. Your invoices will move smoothly from ERP to ASP to FTA, and your business will stay audit-ready in every cycle. Use this guide as your main roadmap. Then go deeper with the linked blogs on ERP readiness, tax team roadmaps, and six-step preparation plans. With the right planning and the right partner, UAE e-invoicing can move from a stressful deadline to a clear advantage for your business.

Related posts

Frequently Asked Questions

All businesses registered for VAT in the UAE are required to prepare e-invoices for B2B and B2G transactions. This obligation extends even to micro businesses with an annual turnover below AED 3 million, meaning size does not exempt a company from compliance. Non-resident businesses that supply taxable goods or services in the UAE are also included under the mandate. The only current exception applies to B2C transactions, which remain out of scope for now but may be brought under the e-invoicing framework in the future.

In the UAE, there is no specific turnover threshold exclusively for e-invoicing. Instead, the e-invoicing mandate applies to all VAT-registered businesses. Businesses with an annual taxable turnover exceeding AED 375,000 are required to register for VAT and must comply with e-invoicing rules. Additionally, businesses with a turnover between AED 187,500 and AED 375,000 can opt for voluntary VAT registration, making them subject to e-invoicing as well.

The most commonly recommended UAE E-invoicing solution, known for supporting Peppol/PINT-AE and local FTA compliance, includes

- Complyance

- Pagero (part of Thomson Reuters)

- EDICOM

- Sovose

- Avalara

These providers help with integration, XML/PINT‑AE formatting, validation, and real‑time reporting to the FTA

Subscribe to our Newsletter

Get the latest compliance updates, e-invoicing news, and expert tips delivered to your inbox.

ABOUT COMPLYANCE

Empowering businesses to automate e-invoicing and stay compliant in 100+ countries. Our platform simplifies regulatory complexity for enterprises and fast-growing companies.